In the dynamic world of technology infrastructure, Oracle Corporation and CoreWeave, Inc. stand out as influential players, each with unique strategies and market approaches. Oracle, a titan with decades of enterprise software expertise, contrasts sharply with CoreWeave, a young innovator specializing in scalable cloud compute tailored for AI workloads. Comparing these companies reveals insights into established dominance versus cutting-edge growth potential. Join me as we explore which offers the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Oracle and CoreWeave by providing an overview of these two companies and their main differences.

Oracle Overview

Oracle Corporation, founded in 1977 and headquartered in Austin, Texas, is a global leader in enterprise information technology. It offers a broad range of cloud software applications, database technologies, and hardware products. Oracle serves various industries with cloud ERP, performance management, and industry-specific solutions, supported by a workforce of 159K employees and a market cap of $549B.

CoreWeave Overview

CoreWeave, Inc., based in Livingston, New Jersey, was incorporated in 2017 and focuses on cloud infrastructure tailored for GenAI and high-performance computing workloads. Its platform provides GPU and CPU compute, storage, networking, and managed services to support AI training, inference, and rendering. With 881 employees and a market cap of $5B, CoreWeave is a newer, specialized player in the software infrastructure sector.

Key similarities and differences

Both Oracle and CoreWeave operate in the software infrastructure industry, providing cloud-based solutions and services. Oracle offers a broad portfolio across enterprise IT, including databases and hardware, targeting a wide range of sectors. In contrast, CoreWeave specializes in scalable cloud platforms optimized for AI and compute-intensive applications, reflecting its focus on emerging technologies and a smaller scale of operations.

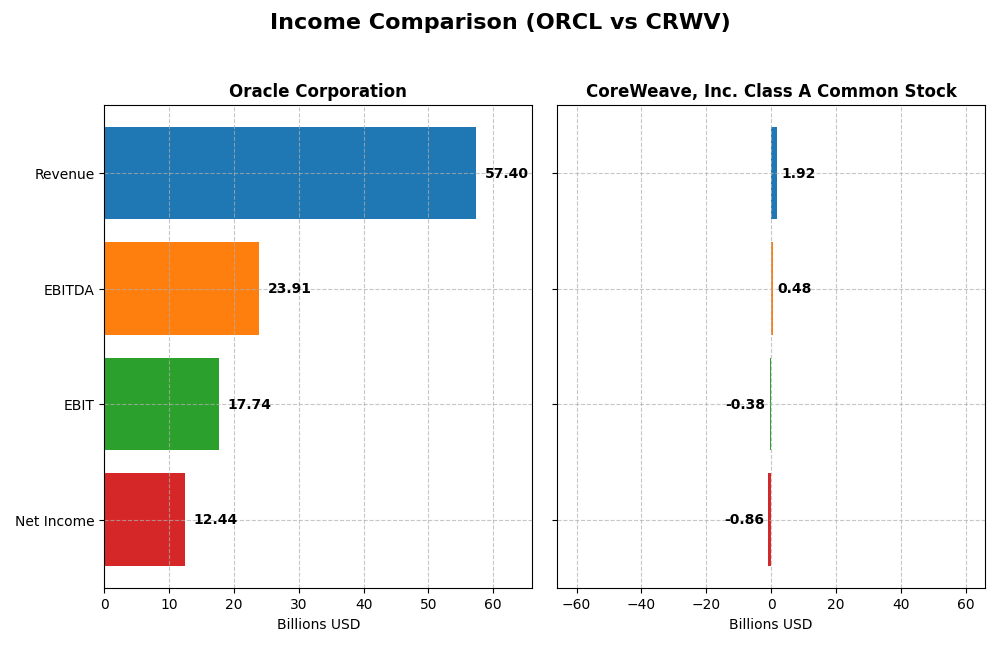

Income Statement Comparison

This table presents a side-by-side comparison of the most recent fiscal year income statement metrics for Oracle Corporation and CoreWeave, Inc. Class A Common Stock.

| Metric | Oracle Corporation (ORCL) | CoreWeave, Inc. Class A (CRWV) |

|---|---|---|

| Market Cap | 549B | 50B |

| Revenue | 57.4B | 1.92B |

| EBITDA | 23.9B | 480M |

| EBIT | 17.7B | -383M |

| Net Income | 12.4B | -863M |

| EPS | 4.46 | -2.33 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Oracle Corporation

Oracle’s revenue steadily increased from 40.5B in 2021 to 57.4B in 2025, showing a favorable 41.8% growth over five years. Net income fluctuated, peaking at 13.7B in 2021 before declining to 12.4B in 2025, reflecting some margin pressure. In 2025, Oracle reported improved operational efficiency with an EBIT margin of 30.9%, supporting solid profitability despite a slight net income decrease.

CoreWeave, Inc. Class A Common Stock

CoreWeave’s revenue surged from 15.8M in 2022 to 1.92B in 2024, representing extraordinary growth of nearly 12,000%. However, net income remains negative, widening from -31M in 2022 to -863M in 2024, with unfavorable EBIT and net margins. The 2024 results indicate strong top-line momentum but persistent challenges in profitability and high interest expenses.

Which one has the stronger fundamentals?

Oracle demonstrates more stable fundamentals with consistent revenue growth, positive net income, and favorable margins. CoreWeave shows remarkable revenue expansion but suffers from significant losses and negative margins, reflecting its early-stage status and operational challenges. Oracle’s mature profitability contrasts with CoreWeave’s growth-focused but unprofitable profile.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Oracle Corporation and CoreWeave, Inc., providing a snapshot of their financial health and performance metrics.

| Ratios | Oracle Corporation (2025) | CoreWeave, Inc. Class A (2024) |

|---|---|---|

| ROE | 60.8% | 2.1% |

| ROIC | 10.9% | 2.1% |

| P/E | 37.1 | -18.7 |

| P/B | 22.6 | -39.1 |

| Current Ratio | 0.75 | 0.39 |

| Quick Ratio | 0.75 | 0.39 |

| D/E (Debt-to-Equity) | 5.09 | -25.68 |

| Debt-to-Assets | 61.8% | 59.6% |

| Interest Coverage | 4.94 | 0.90 |

| Asset Turnover | 0.34 | 0.11 |

| Fixed Asset Turnover | 1.32 | 0.13 |

| Payout ratio | 38.1% | -6.7% |

| Dividend yield | 1.03% | 0.36% |

Interpretation of the Ratios

Oracle Corporation

Oracle shows strong profitability ratios with a net margin of 21.68% and a return on equity of 60.84%, indicating efficient profit generation and shareholder value. However, the company faces concerns such as a low current ratio of 0.75 and a high debt-to-equity ratio of 5.09, suggesting liquidity and leverage risks. Oracle pays dividends, yielding 1.03%, supported moderately by free cash flow, though payout sustainability should be monitored.

CoreWeave, Inc. Class A Common Stock

CoreWeave presents a mixed profile with a favorable return on equity of 208.77% but a negative net margin of -45.08%, reflecting operational losses. The company’s liquidity is weak with a current ratio of 0.39, and it carries high debt levels relative to assets. CoreWeave does not pay dividends, likely due to its negative net income and reinvestment focus during rapid growth, prioritizing infrastructure expansion over shareholder payouts.

Which one has the best ratios?

Both companies have unfavorable global ratio opinions, but Oracle offers stronger profitability and more balanced leverage, despite liquidity concerns. CoreWeave’s high volatility, significant operational losses, and low liquidity present greater risk, making Oracle’s ratios comparatively better grounded for evaluation despite some financial weaknesses.

Strategic Positioning

This section compares the strategic positioning of Oracle Corporation and CoreWeave, Inc. Class A Common Stock in terms of Market position, Key segments, and disruption:

Oracle Corporation

- Large market cap of $549B, facing competitive pressure in software infrastructure.

- Key segments include cloud and license business ($49B), services ($5.2B), and hardware ($2.9B).

- Exposure includes established cloud software, databases, and middleware technologies.

CoreWeave, Inc. Class A Common Stock

- Smaller market cap of $50B, operating in a niche cloud computing segment.

- Focused on GPU and CPU compute cloud services, AI model training, and VFX rendering.

- Highly exposed to technological disruption through GenAI infrastructure and acceleration.

Oracle Corporation vs CoreWeave, Inc. Positioning

Oracle shows a diversified business model across cloud, hardware, and services with a large scale, while CoreWeave concentrates on advanced cloud infrastructure for AI workloads. Oracle’s broad offering contrasts with CoreWeave’s specialized platform focus and smaller workforce.

Which has the best competitive advantage?

Both companies are shedding value based on MOAT evaluation; Oracle is slightly unfavorable with declining ROIC, while CoreWeave is unfavorable despite stable profitability, indicating neither currently holds a strong competitive advantage.

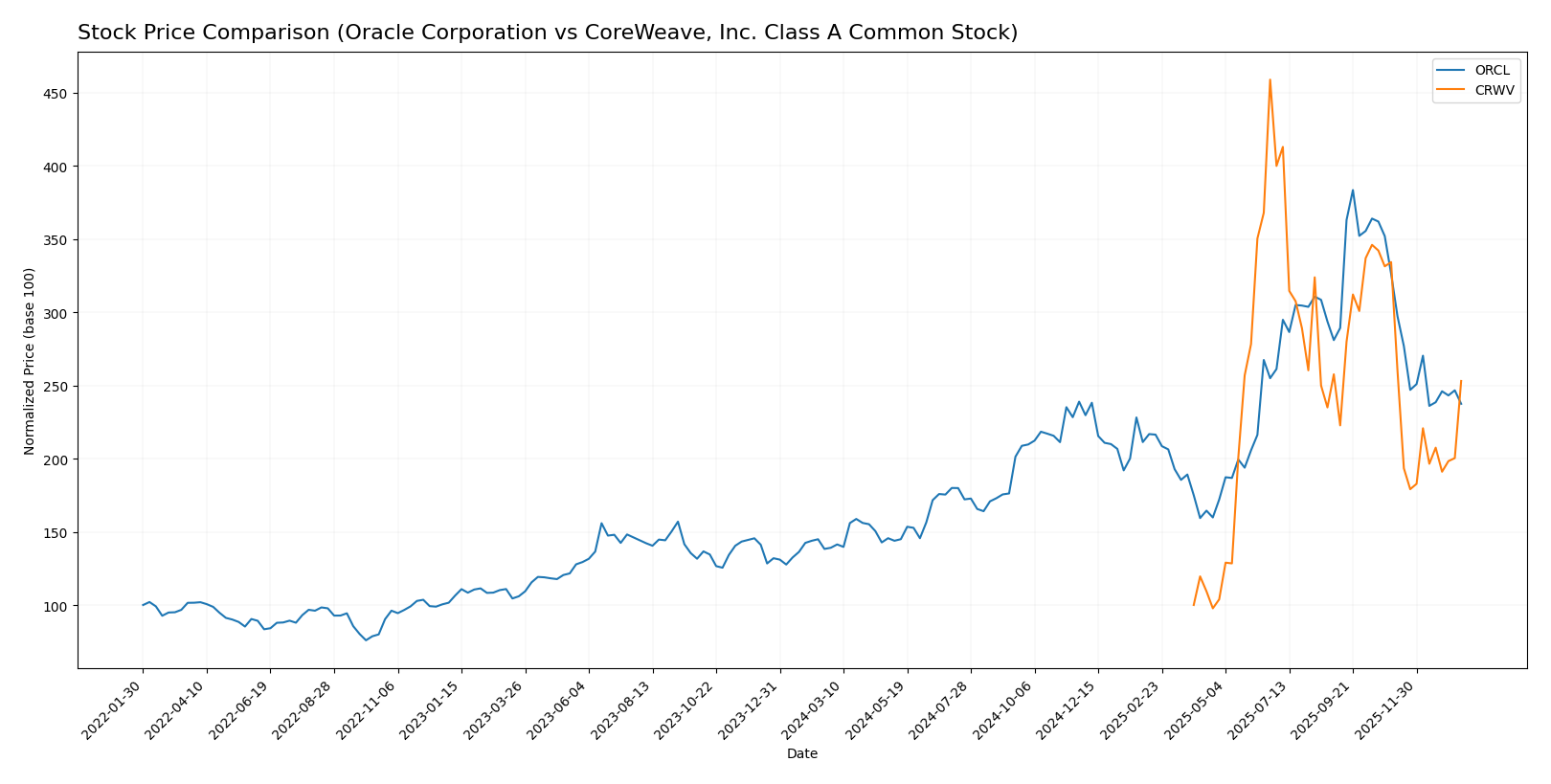

Stock Comparison

The past year shows marked bullish trends for both Oracle Corporation and CoreWeave, Inc. Class A Common Stock, with CoreWeave exhibiting stronger overall gains and both experiencing recent downward corrections amid differing buyer-seller dynamics.

Trend Analysis

Oracle Corporation’s stock rose 70.69% over the last 12 months, signaling a bullish trend with decelerating momentum and significant price volatility (std deviation 49.0). The recent period saw a 27.23% decline, reflecting a short-term bearish correction.

CoreWeave, Inc. Class A Common Stock increased 153.08% over the same timeframe, also bullish with decelerating acceleration and moderate volatility (std deviation 35.67). Recently, it experienced a 24.29% drop, indicating a mild short-term downturn.

Comparing both, CoreWeave outperformed Oracle with a higher overall price increase, despite similar deceleration and recent corrections, delivering the strongest market performance from the analyzed data.

Target Prices

The current analyst consensus reveals a promising upside potential for Oracle Corporation and CoreWeave, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Oracle Corporation | 400 | 175 | 314.08 |

| CoreWeave, Inc. Class A Common Stock | 175 | 68 | 115.79 |

Oracle’s target consensus at 314.08 USD suggests significant appreciation from the current price of 191.09 USD, indicating strong confidence in its growth. CoreWeave’s consensus target of 115.79 USD also implies a notable upside from its present price of 101.23 USD, reflecting optimism despite its higher volatility.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Oracle Corporation and CoreWeave, Inc. Class A Common Stock:

Rating Comparison

Oracle Corporation Rating

- Rating: B, considered Very Favorable

- Discounted Cash Flow Score: 3, Moderate

- ROE Score: 5, Very Favorable

- ROA Score: 4, Favorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 3, Moderate

CoreWeave, Inc. Class A Common Stock Rating

- Rating: D+, status Very Favorable

- Discounted Cash Flow Score: 1, Very Unfavorable

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 1, Very Unfavorable

Which one is the best rated?

Oracle Corporation holds a higher rating (B) with stronger financial scores in discounted cash flow, ROE, and ROA compared to CoreWeave’s lower scores and D+ rating. Oracle’s debt to equity score is equally low for both.

Scores Comparison

The scores comparison between Oracle Corporation and CoreWeave, Inc. Class A Common Stock is as follows:

ORCL Scores

- Altman Z-Score: 2.43, in the grey zone, moderate bankruptcy risk.

- Piotroski Score: 5, average financial strength.

CRWV Scores

- Altman Z-Score: 0.80, in the distress zone, high bankruptcy risk.

- Piotroski Score: 3, very weak financial strength.

Which company has the best scores?

Based on the provided data, Oracle (ORCL) has better scores than CoreWeave (CRWV), with a higher Altman Z-Score in the grey zone versus distress zone and a stronger Piotroski Score indicating better financial health.

Grades Comparison

The grades from multiple reputable grading companies for Oracle Corporation and CoreWeave, Inc. Class A Common Stock are as follows:

Oracle Corporation Grades

The following table presents recent analyst grades from major financial institutions for Oracle Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-05 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-12-12 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| UBS | Maintain | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-11 |

| JP Morgan | Maintain | Neutral | 2025-12-11 |

| DA Davidson | Maintain | Neutral | 2025-12-11 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-11 |

Oracle’s grades predominantly indicate a “Buy” or equivalent positive stance, with some “Neutral” and “Sector Perform” ratings, reflecting generally favorable analyst sentiment.

CoreWeave, Inc. Class A Common Stock Grades

The recent analyst grades for CoreWeave, Inc. Class A Common Stock from recognized financial firms are summarized below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| DA Davidson | Upgrade | Neutral | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-11-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| Barclays | Maintain | Equal Weight | 2025-11-12 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| B of A Securities | Maintain | Neutral | 2025-11-11 |

CoreWeave’s grades show a mix of “Buy,” “Overweight,” and “Neutral” ratings, indicating moderate optimism from analysts with some cautious positions.

Which company has the best grades?

Oracle Corporation has received a higher number of “Buy” and equivalent ratings compared to CoreWeave, which has more mixed “Buy” and “Neutral” grades. This suggests Oracle is viewed more favorably by analysts, potentially reflecting stronger confidence in its near-term performance and stability for investors.

Strengths and Weaknesses

Below is a comparison of Oracle Corporation (ORCL) and CoreWeave, Inc. Class A Common Stock (CRWV) based on key business and financial criteria.

| Criterion | Oracle Corporation (ORCL) | CoreWeave, Inc. (CRWV) |

|---|---|---|

| Diversification | Strong diversification with Cloud & License ($49.23B), Services ($5.23B), Hardware ($2.94B) | Limited diversification; primarily focused on niche cloud infrastructure |

| Profitability | High net margin (21.68%), ROE (60.84%), ROIC (10.86%) but declining ROIC trend | Negative net margin (-45.08%), positive ROE (208.77%) but very low ROIC (2.08%) and high WACC (84.93%) |

| Innovation | Moderate innovation with steady cloud growth; hardware business shrinking | Early-stage innovation focus but financial metrics reflect challenges |

| Global presence | Extensive global footprint as a mature enterprise software company | Smaller global presence, focused on emerging cloud market segments |

| Market Share | Leading player in enterprise software and cloud services | Emerging player with limited market share and scale |

In summary, Oracle shows stable diversification and strong profitability metrics despite a slightly unfavorable declining ROIC trend. CoreWeave remains an early-stage company with significant financial challenges but high ROE, reflecting potential growth risks and rewards. Investors should weigh Oracle’s stability against CoreWeave’s growth potential and risk profile carefully.

Risk Analysis

Below is a comparison of key risks for Oracle Corporation (ORCL) and CoreWeave, Inc. Class A Common Stock (CRWV) based on the most recent data available.

| Metric | Oracle Corporation (ORCL) | CoreWeave, Inc. Class A (CRWV) |

|---|---|---|

| Market Risk | Beta 1.65 (moderate volatility) | Beta 21.65 (extremely high volatility) |

| Debt level | High debt-to-assets 61.8%, D/E 5.09 (unfavorable) | High debt-to-assets 59.6%, negative D/E (favorable but unstable) |

| Regulatory Risk | Moderate, typical for large US tech firms | Elevated due to younger company and evolving AI/cloud regulations |

| Operational Risk | Large, complex operations with 159K employees, risk of integration challenges | Smaller scale (881 employees), but rapid growth may strain resources |

| Environmental Risk | Moderate, standard for tech hardware/data centers | Moderate, with cloud infrastructure footprint |

| Geopolitical Risk | US-based, exposed to trade tensions and data privacy laws | US-based, exposed to similar risks but less diversified globally |

Oracle’s moderate market volatility contrasts sharply with CoreWeave’s extreme beta, reflecting CoreWeave’s high sensitivity to market swings. Both companies carry significant leverage, but Oracle’s large debt burden poses a cautionary note. CoreWeave’s financial distress signals and low Altman Z-score highlight higher bankruptcy risk, while Oracle remains in a grey zone. Regulatory and operational risks are more pronounced for CoreWeave due to its rapid growth phase and niche AI infrastructure focus.

Which Stock to Choose?

Oracle Corporation (ORCL) shows a favorable income evolution with 8.38% revenue growth in 2025, strong profitability indicated by a 21.68% net margin, but mixed financial ratios with high debt levels and an unfavorable overall ratio evaluation. Its rating is very favorable (B), supported by strong ROE and ROA scores despite some weaknesses in valuation ratios and liquidity.

CoreWeave, Inc. Class A Common Stock (CRWV) reports a highly volatile income evolution with exceptional revenue growth but negative net margin and profitability. Financial ratios are largely unfavorable, reflecting high leverage and weak liquidity, while its overall rating is very favorable (D+) but with poor scores on most financial stability metrics.

Investors seeking stability and consistent profitability might find ORCL’s financial profile more reassuring given its favorable income statement and strong rating, while those focused on high growth potential but accepting greater risk could interpret CRWV’s explosive revenue growth as attractive despite its weaker financial health and valuation concerns.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Oracle Corporation and CoreWeave, Inc. Class A Common Stock to enhance your investment decisions: