In the rapidly evolving software infrastructure sector, CoreWeave, Inc. (CRWV) and Informatica Inc. (INFA) stand out as key players innovating in cloud and AI-driven data management solutions. While CoreWeave focuses on cutting-edge GPU-powered cloud platforms for AI workloads, Informatica excels in comprehensive data integration and governance. This article will analyze both companies to help you identify which offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between CoreWeave and Informatica by providing an overview of these two companies and their main differences.

CoreWeave Overview

CoreWeave, Inc. operates a cloud platform specializing in scaling, support, and acceleration for GenAI workloads. Focused on infrastructure software, it provides GPU and CPU compute, storage, networking, and managed services, along with solutions for VFX, AI model training, and mission control. Founded in 2017 and based in New Jersey, CoreWeave positions itself as a niche player in cloud infrastructure for compute-heavy applications.

Informatica Overview

Informatica Inc. develops an AI-powered platform designed to connect, manage, and unify enterprise data across multi-cloud and hybrid systems. Its offerings include data integration, API management, data quality, master data management, and governance products. Founded in 1993 and headquartered in California, Informatica targets large enterprises seeking comprehensive data management solutions.

Key similarities and differences

Both CoreWeave and Informatica operate in the software infrastructure industry, focusing on enterprise technology solutions. CoreWeave emphasizes cloud compute infrastructure for AI and rendering workloads, whereas Informatica concentrates on data management and integration across diverse environments. CoreWeave is a newer, smaller company with a more specialized product set, while Informatica is an established firm with a broader suite of data platform offerings.

Income Statement Comparison

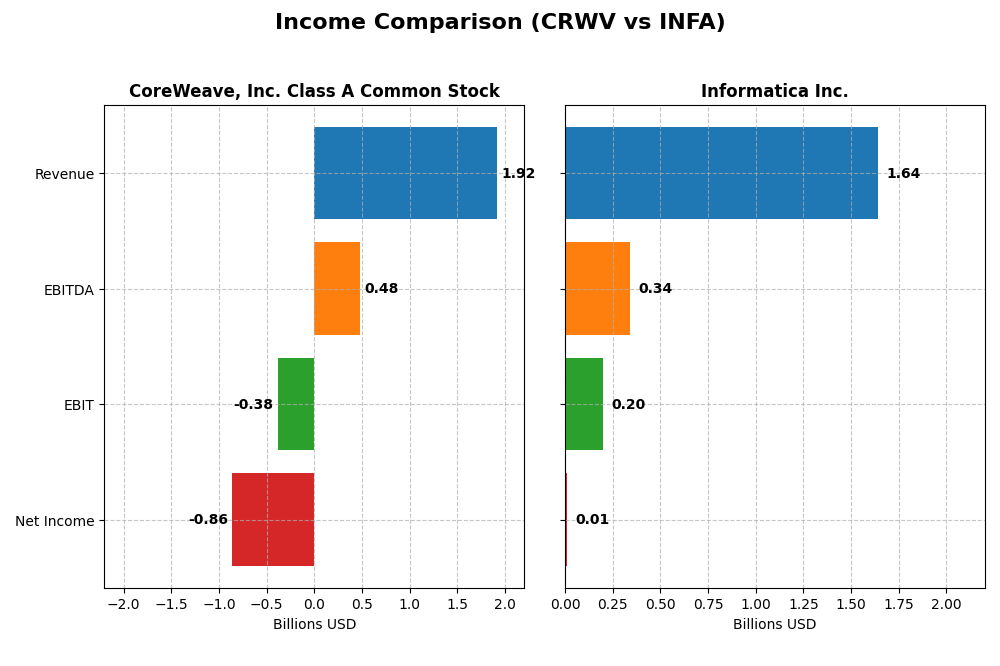

The table below compares the key income statement metrics for CoreWeave, Inc. Class A Common Stock and Informatica Inc. for the fiscal year 2024.

| Metric | CoreWeave, Inc. Class A Common Stock | Informatica Inc. |

|---|---|---|

| Market Cap | 50.4B | 7.54B |

| Revenue | 1.92B | 1.64B |

| EBITDA | 480M | 339M |

| EBIT | -383M | 199M |

| Net Income | -863M | 9.93M |

| EPS | -2.33 | 0.0329 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

CoreWeave, Inc. Class A Common Stock

CoreWeave’s revenue surged dramatically from $15.8M in 2022 to $1.92B in 2024, reflecting rapid expansion. However, net income remained negative, widening to -$937.8M in 2024 despite gross margin stability at 74.24%. The latest year showed improved operating income but persistent net losses, indicating ongoing investment and scaling challenges.

Informatica Inc.

Informatica’s revenue grew steadily from $1.32B in 2020 to $1.64B in 2024 with gross margins holding favorably at 80.11%. Net income turned positive in 2024 at $9.9M after years of losses, supported by a 12.15% EBIT margin. The recent year experienced moderate revenue growth but significant improvements in profitability metrics and earnings per share.

Which one has the stronger fundamentals?

Informatica demonstrates stronger fundamentals with consistent revenue growth, positive EBIT and net margins, and profitability improvements over the period. CoreWeave, despite impressive revenue gains and solid gross margins, continues to face substantial net losses and unfavorable EBIT margins. Informatica’s financial metrics suggest a more stable profitability trajectory.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for CoreWeave, Inc. Class A Common Stock (CRWV) and Informatica Inc. (INFA) for the fiscal year 2024, offering a snapshot of their recent financial performance and position.

| Ratios | CoreWeave, Inc. (CRWV) | Informatica Inc. (INFA) |

|---|---|---|

| ROE | 2.09% | 0.43% |

| ROIC | 2.08% | 0.56% |

| P/E | -18.73 | 787.95 |

| P/B | -39.11 | 3.39 |

| Current Ratio | 0.39 | 1.82 |

| Quick Ratio | 0.39 | 1.82 |

| D/E (Debt-to-Equity) | -25.68 | 0.81 |

| Debt-to-Assets | 59.56% | 35.24% |

| Interest Coverage | 0.90 | 0.87 |

| Asset Turnover | 0.11 | 0.31 |

| Fixed Asset Turnover | 0.13 | 8.75 |

| Payout Ratio | -6.69% | 0.12% |

| Dividend Yield | 0.36% | 0.00015% |

Interpretation of the Ratios

CoreWeave, Inc. Class A Common Stock

CoreWeave exhibits a generally unfavorable ratio profile, with 71% of key ratios marked as weak. The company shows a low current and quick ratio of 0.39, indicating liquidity concerns, and a high debt-to-assets ratio of 59.56%. Despite a strong ROE of 208.77% and favorable price multiples, net margin and interest coverage remain negative. CoreWeave does not pay dividends, likely reflecting its investment or growth phase.

Informatica Inc.

There is no available ratio data for Informatica Inc., preventing a detailed financial ratio assessment. The absence of dividend information suggests either no dividend payments or a lack of disclosed data. This lack of key metrics limits the ability to analyze liquidity, profitability, or leverage ratios, and thus restricts a comprehensive comparison with CoreWeave.

Which one has the best ratios?

Based on the available data, CoreWeave’s ratios show more unfavorable signs than favorable ones, especially regarding liquidity and profitability metrics. Informatica lacks disclosed ratios for 2024, making direct comparison impossible. Therefore, from a ratio standpoint, neither company clearly outperforms the other given the limited and partial data.

Strategic Positioning

This section compares the strategic positioning of CoreWeave and Informatica, focusing on market position, key segments, and exposure to technological disruption:

CoreWeave

- Large market cap $50B, high beta 21.65, faces volatile competitive pressure in cloud infrastructure.

- Focused on GPU/CPU cloud compute, AI model training, VFX rendering, and infrastructure services.

- Positioned in cloud infrastructure supporting GenAI workloads; potential risks from rapid tech changes.

Informatica

- Smaller market cap $7.5B, moderate beta 1.14, competes in enterprise data management software.

- Diverse AI-powered data integration, management, governance, and professional services.

- Platform integrates multi-cloud and hybrid data environments, exposed to evolving data tech.

CoreWeave vs Informatica Positioning

CoreWeave is concentrated in high-performance cloud infrastructure for AI workloads, offering specialized compute services. Informatica provides a diversified, broad AI-powered data management platform, balancing subscription and professional services revenues with enterprise-scale integration.

Which has the best competitive advantage?

CoreWeave shows an unfavorable moat with ROIC below WACC, indicating value destruction and no strong competitive advantage. Informatica’s moat evaluation data is missing, preventing a definitive comparison of competitive advantage.

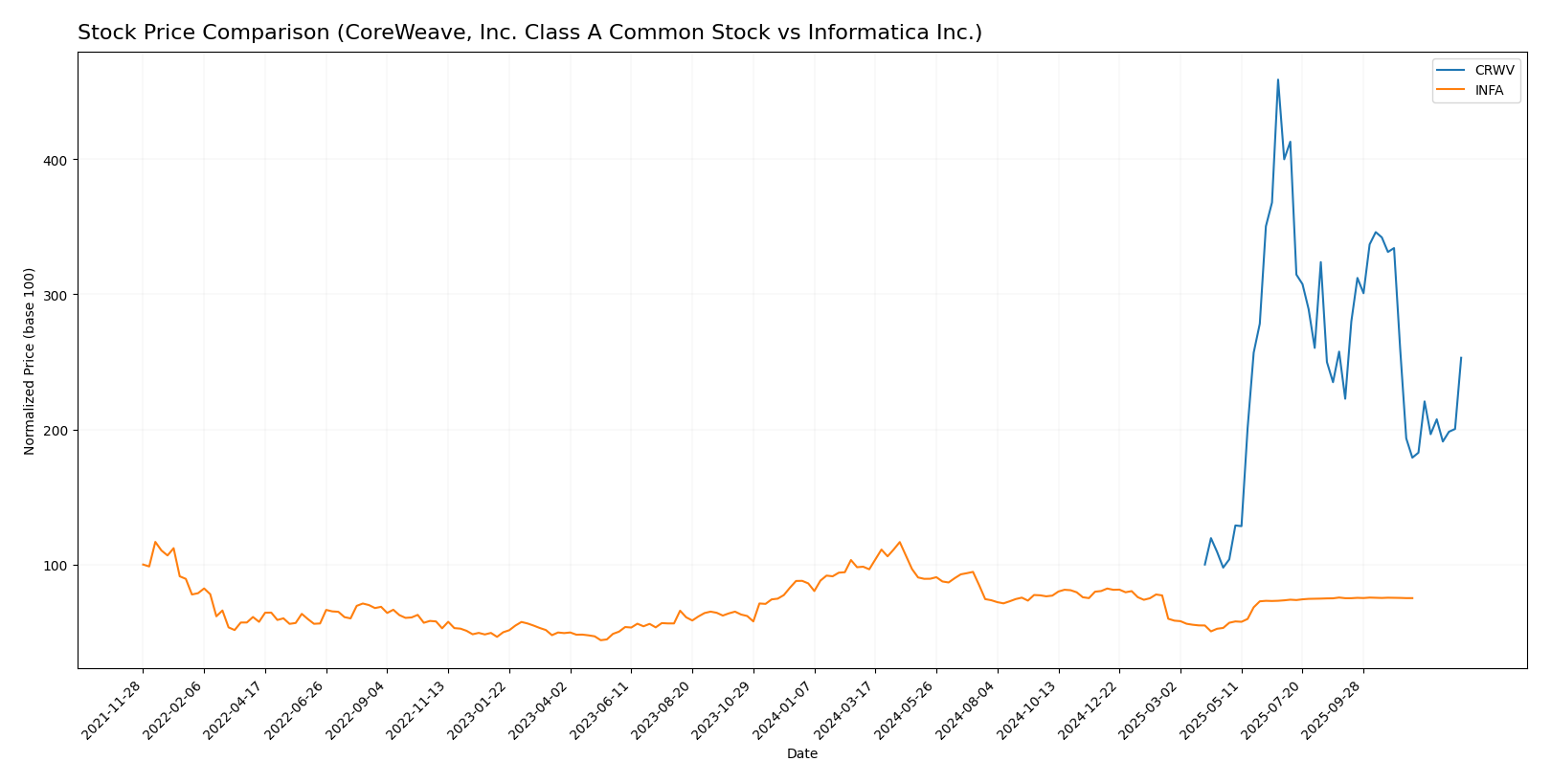

Stock Comparison

The stock prices of CoreWeave, Inc. Class A Common Stock (CRWV) and Informatica Inc. (INFA) have shown contrasting dynamics over the past 12 months, with CRWV exhibiting a strong overall uptrend despite recent declines, while INFA faced a steady downtrend with minimal recent recovery.

Trend Analysis

CoreWeave’s stock price surged 153.08% over the past year, indicating a clear bullish trend despite recent deceleration and a 24.29% drop since November 2025. Volatility remains elevated with a std deviation of 35.67.

Informatica’s stock declined 12.68% over the same period, confirming a bearish trend with accelerating losses. Recent price movements are neutral with virtually no change and very low volatility (std deviation 0.05).

Comparing both, CoreWeave delivered the highest market performance with a strong bullish trend overall, while Informatica experienced a sustained bearish trend and weaker price appreciation.

Target Prices

The current analyst consensus for target prices shows a positive outlook for both CoreWeave, Inc. and Informatica Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CoreWeave, Inc. Class A Common Stock | 175 | 68 | 115.79 |

| Informatica Inc. | 27 | 27 | 27 |

Analysts expect CoreWeave’s stock to appreciate above its current price of 101.23 USD, indicating potential upside. Informatica’s target consensus at 27 USD is moderately higher than its current 24.79 USD, suggesting limited but positive growth prospects.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CoreWeave, Inc. Class A Common Stock (CRWV) and Informatica Inc. (INFA):

Rating Comparison

CRWV Rating

- Rating: D+, assessed as Very Favorable by analysts.

- Discounted Cash Flow Score: 1, marked Very Unfavorable.

- ROE Score: 1, considered Very Unfavorable.

- ROA Score: 1, evaluated as Very Unfavorable.

- Debt To Equity Score: 1, rated Very Unfavorable.

- Overall Score: 1, classified as Very Unfavorable.

INFA Rating

- No rating data available.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

Which one is the best rated?

Based strictly on the available data, CoreWeave (CRWV) has a defined rating of D+ with several very unfavorable financial scores, while Informatica (INFA) lacks any rating or score data, making CRWV the only company with measurable analyst opinions in this comparison.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

CRWV Scores

- Altman Z-Score: 0.80, classified in the distress zone, indicating high bankruptcy risk.

- Piotroski Score: 3, rated very weak, signaling poor financial strength.

INFA Scores

- Altman Z-Score: 1.94, in the grey zone, suggesting moderate bankruptcy risk.

- Piotroski Score: 6, rated average, indicating moderate financial health.

Which company has the best scores?

INFA has higher Altman Z-Score and Piotroski Score than CRWV, indicating relatively lower bankruptcy risk and stronger financial health based on the provided data.

Grades Comparison

Here is a comparison of the most recent reliable grades for CoreWeave, Inc. Class A Common Stock and Informatica Inc.:

CoreWeave, Inc. Class A Common Stock Grades

The table below shows recent grades assigned by various reputable grading companies for CoreWeave:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| DA Davidson | Upgrade | Neutral | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-11-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| Barclays | Maintain | Equal Weight | 2025-11-12 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| B of A Securities | Maintain | Neutral | 2025-11-11 |

CoreWeave’s grades predominantly range from Neutral to Buy, with multiple Buy and Overweight ratings maintained, indicating a generally positive analyst sentiment.

Informatica Inc. Grades

The table below presents recent grades from recognized grading companies for Informatica:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Downgrade | Neutral | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-05-28 |

| JP Morgan | Downgrade | Neutral | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | Downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-28 |

| Truist Securities | Downgrade | Hold | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-27 |

| UBS | Maintain | Neutral | 2025-05-16 |

Informatica’s grades mostly cluster around Neutral and Hold, with several downgrades noted, reflecting a more cautious analyst stance.

Which company has the best grades?

CoreWeave has received generally more favorable grades, featuring multiple Buy and Overweight ratings, whereas Informatica’s consensus leans toward Neutral and Hold with downgrades. This disparity may influence investors’ perception of potential growth and risk between the two equities.

Strengths and Weaknesses

Below is a comparison table summarizing the strengths and weaknesses of CoreWeave, Inc. Class A Common Stock (CRWV) and Informatica Inc. (INFA) based on the most recent available data.

| Criterion | CoreWeave, Inc. (CRWV) | Informatica Inc. (INFA) |

|---|---|---|

| Diversification | Limited diversification; focus on specialized cloud infrastructure | Well diversified with strong subscription and professional services segments |

| Profitability | Unfavorable: negative net margin (-45.08%), ROIC below WACC, value destroying | Data not available; however, revenue streams show strong growth in subscription |

| Innovation | Emerging tech focus but financial instability limits execution | Implied steady innovation through growing cloud and subscription revenues |

| Global presence | Smaller, niche market exposure | Established global presence in data management solutions |

| Market Share | Niche market player | Significant player in enterprise data integration and cloud services |

Key takeaways: CoreWeave faces financial challenges despite strong ROE, indicating risk for investors, while Informatica shows robust revenue diversification and growth potential, though exact profitability metrics are missing. Caution is advised with CoreWeave; Informatica appears more stable for long-term investment.

Risk Analysis

Below is a comparative table of key risks for CoreWeave, Inc. (CRWV) and Informatica Inc. (INFA) based on the latest 2024 data:

| Metric | CoreWeave, Inc. (CRWV) | Informatica Inc. (INFA) |

|---|---|---|

| Market Risk | Very high beta (21.65) indicating extreme volatility | Moderate beta (1.14) showing average volatility |

| Debt level | High debt to assets (59.56%), weak interest coverage (-1.06) | Data unavailable for debt specifics |

| Regulatory Risk | Moderate – operates in tech cloud sector, subject to data and AI regulations | Moderate – data management and privacy regulations impact |

| Operational Risk | High – small workforce (881) with complex infrastructure operations | Moderate – larger workforce (5200) but complex integration systems |

| Environmental Risk | Low – primarily software services with minimal direct environmental impact | Low – software-focused with limited environmental footprint |

| Geopolitical Risk | Moderate – US-based but global cloud infrastructure exposure | Moderate – US-based with international data compliance challenges |

Synthesis: CoreWeave shows significant market and financial risk with very high stock volatility and precarious debt levels, raising concerns about financial distress. Informatica faces moderate operational and regulatory risks but benefits from greater stability and a more established market presence. Investors should weigh CoreWeave’s growth potential against its heightened risk exposure.

Which Stock to Choose?

CoreWeave, Inc. Class A Common Stock (CRWV) shows a strong revenue growth of 736.64% in 2024, with a favorable gross margin of 74.24%, but suffers from negative net margins and returns on invested capital. Its financial ratios are mostly unfavorable, with high debt levels and a very weak Altman Z-Score, resulting in an overall very unfavorable rating.

Informatica Inc. (INFA) presents stable income with favorable gross and EBIT margins, modest revenue growth of 2.81% in 2024, and net margin near zero. Its financial scores indicate moderate risk with an Altman Z-Score in the grey zone and an average Piotroski Score, though detailed ratio evaluations are unavailable.

For investors prioritizing high growth potential and willing to accept financial instability, CRWV might appear attractive due to its rapid revenue expansion despite unfavorable ratios. Conversely, those favoring stability and moderate profitability could view INFA as a more suitable option given its steady income and moderate risk profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CoreWeave, Inc. Class A Common Stock and Informatica Inc. to enhance your investment decisions: