In the dynamic world of technology infrastructure, CoreWeave, Inc. (CRWV) and GoDaddy Inc. (GDDY) stand out as influential players shaping cloud computing services. Both companies operate within the software infrastructure industry but target distinct yet overlapping markets—from GenAI compute acceleration to domain registration and web hosting. This comparison will help you, as an investor, identify which company aligns best with your portfolio goals and risk appetite.

Table of contents

Companies Overview

I will begin the comparison between CoreWeave and GoDaddy by providing an overview of these two companies and their main differences.

CoreWeave Overview

CoreWeave, Inc. operates a cloud platform specializing in scaling, support, and acceleration for GenAI workloads. Positioned in the technology sector, it provides infrastructure services including GPU and CPU compute, storage, networking, and managed virtual and bare metal servers. Founded in 2017 and headquartered in Livingston, NJ, CoreWeave focuses on supporting enterprise compute demands such as AI model training and VFX rendering.

GoDaddy Overview

GoDaddy Inc. designs and develops cloud-based technology products aimed primarily at small businesses and individuals. Its offerings include domain registration, website hosting, security services, marketing tools, and business applications like Microsoft Office 365. Established in 2014 and based in Tempe, AZ, GoDaddy serves a broad customer base with a comprehensive suite of digital identity and online presence management solutions.

Key similarities and differences

Both CoreWeave and GoDaddy operate in the software infrastructure industry, providing cloud-related services. However, CoreWeave concentrates on high-performance computing infrastructure for AI and rendering workloads, while GoDaddy focuses on enabling digital presence through domains, hosting, and marketing tools. CoreWeave is a younger company with a smaller workforce, whereas GoDaddy has a broader product portfolio targeting small businesses and individuals.

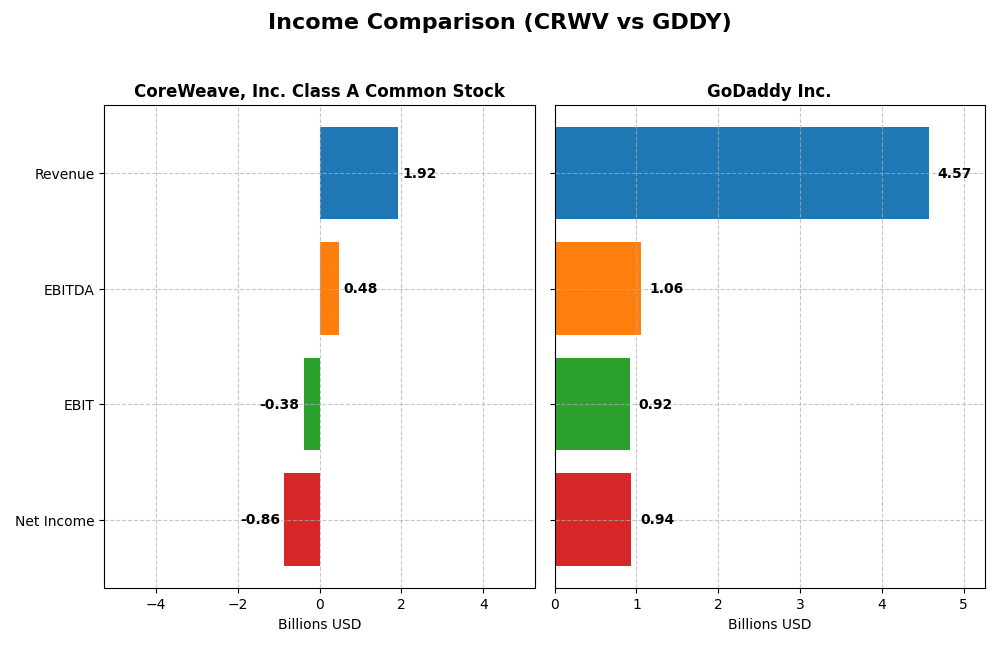

Income Statement Comparison

The table below compares key income statement metrics for CoreWeave, Inc. Class A Common Stock and GoDaddy Inc. for the fiscal year 2024.

| Metric | CoreWeave, Inc. Class A Common Stock | GoDaddy Inc. |

|---|---|---|

| Market Cap | 50.4B | 14.5B |

| Revenue | 1.92B | 4.57B |

| EBITDA | 480M | 1.06B |

| EBIT | -383M | 924M |

| Net Income | -863M | 937M |

| EPS | -2.33 | 6.63 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

CoreWeave, Inc. Class A Common Stock

CoreWeave’s revenue surged dramatically from $16M in 2022 to $1.9B in 2024, reflecting rapid growth. Despite a strong gross margin of 74.24%, the company reported a net loss of -$937M in 2024, with negative net and EBIT margins. The latest year showed improved EBIT and net margin growth, but EPS declined, indicating profitability challenges.

GoDaddy Inc.

GoDaddy exhibited steady revenue growth from $3.3B in 2020 to $4.6B in 2024, with a stable gross margin near 64%. Net income rose overall, reaching $937M in 2024, but net margin dropped slightly that year. EBIT margin remained positive at 20.2%, and while EPS decreased recently, overall profitability and margin improvements over the period support solid fundamentals.

Which one has the stronger fundamentals?

GoDaddy presents stronger fundamentals with consistent revenue and net income growth, positive EBIT and net margins, and manageable interest expenses. CoreWeave shows impressive revenue expansion but suffers from sustained losses, negative margins, and high interest costs, leading to weaker profitability despite favorable growth metrics.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for CoreWeave, Inc. Class A Common Stock (CRWV) and GoDaddy Inc. (GDDY) for the fiscal year ended 2024.

| Ratios | CoreWeave, Inc. (CRWV) | GoDaddy Inc. (GDDY) |

|---|---|---|

| ROE | 2.09% | 135.37% |

| ROIC | 2.08% | 16.02% |

| P/E | -18.73 | 29.76 |

| P/B | -39.11 | 40.28 |

| Current Ratio | 0.39 | 0.72 |

| Quick Ratio | 0.39 | 0.72 |

| D/E (Debt-to-Equity) | -25.68 | 5.63 |

| Debt-to-Assets | 59.56% | 47.29% |

| Interest Coverage | 0.90 | 5.64 |

| Asset Turnover | 0.11 | 0.56 |

| Fixed Asset Turnover | 0.13 | 22.22 |

| Payout ratio | -6.69% | 0% |

| Dividend yield | 0.36% | 0% |

Interpretation of the Ratios

CoreWeave, Inc. Class A Common Stock

CoreWeave shows mostly unfavorable financial ratios with only about 29% favorable metrics. Key concerns include a very low current and quick ratio at 0.39, indicating liquidity issues, and a high debt-to-assets ratio of 59.56%. Despite this, the company reports a strong return on equity at 208.77%. CoreWeave currently does not pay dividends, likely reflecting its negative net income and focus on reinvestment in infrastructure and growth.

GoDaddy Inc.

GoDaddy presents a more balanced ratio profile with roughly 43% favorable and 43% unfavorable metrics. The company’s net margin of 20.49% and return on equity of 135.37% are strong, though its price-to-earnings and price-to-book ratios are considered unfavorable. Liquidity ratios remain below 1, indicating some short-term financial pressure. GoDaddy does not pay dividends, possibly prioritizing investments in R&D and market expansion.

Which one has the best ratios?

GoDaddy holds a more neutral stance overall with nearly equal favorable and unfavorable ratios, including solid profitability and coverage ratios. CoreWeave’s ratios are predominantly unfavorable, especially regarding liquidity and debt metrics, despite a high return on equity. Thus, GoDaddy shows a comparatively better financial ratio profile based on the available data.

Strategic Positioning

This section compares the strategic positioning of CoreWeave, Inc. Class A Common Stock (CRWV) and GoDaddy Inc. (GDDY) in terms of market position, key segments, and exposure to technological disruption:

CoreWeave, Inc. Class A Common Stock (CRWV)

- Operates in cloud infrastructure with a $50B market cap and high competitive pressure.

- Key segments include GPU/CPU compute, storage, networking, managed and bare metal servers.

- Exposure to disruption through GenAI infrastructure and compute workload innovation.

GoDaddy Inc. (GDDY)

- $14.5B market cap focusing on cloud-based technology with moderate competitive pressure.

- Key segments are Core Platform ($2.9B) and Applications and Commerce ($1.65B), driving business growth.

- Exposed to disruption via evolving cloud hosting, security, marketing tools, and e-commerce capabilities.

CoreWeave, Inc. Class A Common Stock vs GoDaddy Inc. Positioning

CoreWeave concentrates on advanced cloud infrastructure and AI compute workloads, while GoDaddy has a more diversified approach with domain registration, hosting, marketing, and business applications. CoreWeave’s niche focus contrasts with GoDaddy’s broader service portfolio.

Which has the best competitive advantage?

GoDaddy exhibits a very favorable moat with growing ROIC and value creation, indicating a durable competitive advantage. CoreWeave shows an unfavorable moat, currently shedding value despite stable profitability.

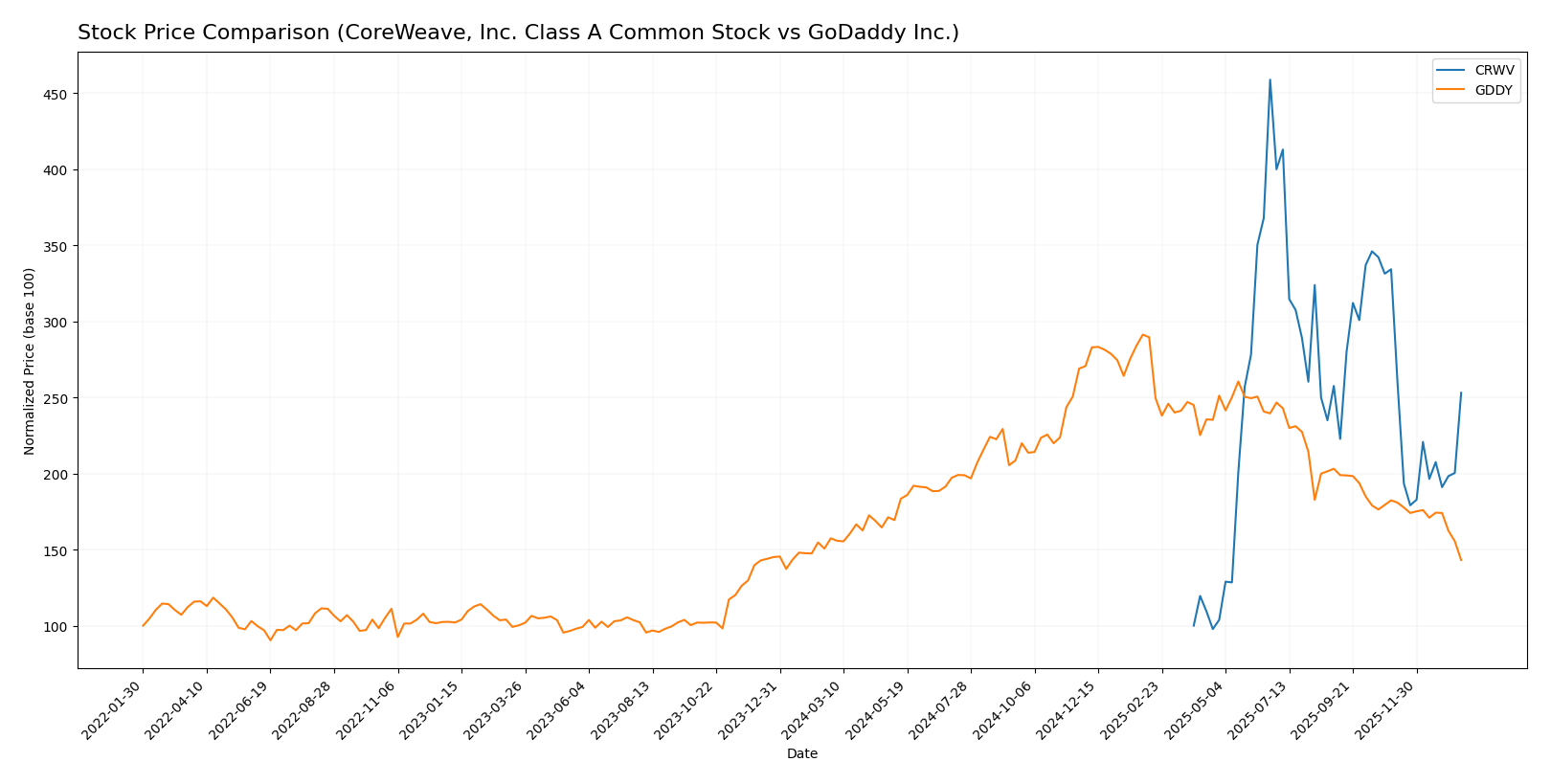

Stock Comparison

The stock price movements over the past 12 months reveal CoreWeave’s strong bullish momentum contrasted by GoDaddy’s bearish performance, with significant price swings and volume shifts shaping the trading landscape.

Trend Analysis

CoreWeave, Inc. Class A Common Stock (CRWV) posted a 153.08% price increase over the past year, indicating a bullish trend with decelerating acceleration. The stock reached a high of 183.58 and a low of 39.09, with notable volatility (std deviation 35.67).

GoDaddy Inc. (GDDY) experienced a -9.09% price change over the past year, marking a bearish trend with deceleration. It traded between 104.46 and 212.65, showing moderate volatility (std deviation 27.35).

Comparing the two, CoreWeave delivered substantially higher market performance over the past 12 months, outperforming GoDaddy by a wide margin in price appreciation.

Target Prices

The consensus target prices reflect a positive outlook from analysts for both CoreWeave, Inc. and GoDaddy Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CoreWeave, Inc. Class A Common Stock | 175 | 68 | 115.79 |

| GoDaddy Inc. | 182 | 70 | 143.33 |

Analysts expect CoreWeave’s stock to appreciate moderately above its current price of $101.23, while GoDaddy’s consensus target suggests a stronger upside from its current $104.46 level.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial grades for CoreWeave, Inc. Class A Common Stock (CRWV) and GoDaddy Inc. (GDDY):

Rating Comparison

CRWV Rating

- Rating: D+, categorized as Very Favorable

- Discounted Cash Flow Score: 1, Very Unfavorable

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 1, Very Unfavorable

GDDY Rating

- Rating: B+, categorized as Very Favorable

- Discounted Cash Flow Score: 5, Very Favorable

- ROE Score: 5, Very Favorable

- ROA Score: 4, Favorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 3, Moderate

Which one is the best rated?

Based strictly on the data, GDDY holds a higher rating (B+) and better scores in discounted cash flow, ROE, ROA, and overall metrics. CRWV has uniformly low scores, placing it behind GDDY in analyst evaluations.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score for CoreWeave and GoDaddy:

CoreWeave Scores

- Altman Z-Score: 0.80, in distress zone indicating high bankruptcy risk.

- Piotroski Score: 3, categorized as very weak financial strength.

GoDaddy Scores

- Altman Z-Score: 1.53, in distress zone with moderate bankruptcy risk.

- Piotroski Score: 8, categorized as very strong financial strength.

Which company has the best scores?

GoDaddy shows better financial strength with a very strong Piotroski Score of 8, compared to CoreWeave’s very weak score of 3. Both are in the distress zone for Altman Z-Score, but GoDaddy’s score is closer to the grey zone, indicating relatively lower bankruptcy risk.

Grades Comparison

Here is a comparison of the recent grades assigned to CoreWeave, Inc. Class A Common Stock and GoDaddy Inc.:

CoreWeave, Inc. Class A Common Stock Grades

This table summarizes the latest grades from major grading companies for CoreWeave:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| DA Davidson | Upgrade | Neutral | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-11-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| Barclays | Maintain | Equal Weight | 2025-11-12 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| B of A Securities | Maintain | Neutral | 2025-11-11 |

CoreWeave exhibits a generally positive outlook with multiple “Buy” and “Overweight” grades, alongside some “Neutral” and “Equal Weight” ratings, indicating moderate optimism among analysts.

GoDaddy Inc. Grades

This table presents the recent grading actions for GoDaddy:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

GoDaddy’s ratings show a mixed but generally favorable stance, with several “Buy” and “Overweight” grades balanced by multiple “Neutral,” “Hold,” and “Equal Weight” assessments.

Which company has the best grades?

Both CoreWeave and GoDaddy have received predominantly positive grades, with CoreWeave showing a slightly higher proportion of “Buy” and “Overweight” ratings. This suggests a marginally stronger analyst confidence in CoreWeave, which may influence investor sentiment towards potential growth prospects.

Strengths and Weaknesses

Below is a comparison of the key strengths and weaknesses of CoreWeave, Inc. (CRWV) and GoDaddy Inc. (GDDY) based on recent financial and operational data.

| Criterion | CoreWeave, Inc. Class A Common Stock (CRWV) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Diversification | Limited product range, focused on cloud infrastructure | Broad product portfolio with Core Platform and Applications & Commerce segments |

| Profitability | Negative net margin (-45.08%), value destroying (ROIC < WACC) | Positive net margin (20.49%), value creating (ROIC > WACC) |

| Innovation | ROE very high (208.77%), but unfavorable operational ratios suggest inefficiencies | Strong innovation reflected in growing ROIC (+147%) and durable competitive advantage |

| Global presence | Smaller scale with limited global footprint | Extensive global presence supporting diverse customer base |

| Market Share | Niche market player with lower asset turnover (0.11) | Larger market share with higher asset turnover (0.56) and fixed asset turnover (22.22) |

In summary, GoDaddy exhibits a durable competitive advantage with strong profitability, diversification, and global reach, making it a more stable investment. CoreWeave, while showing some financial strength in ROE, struggles with profitability and operational efficiency, signaling higher risk for investors.

Risk Analysis

Below is a comparative overview of key risks for CoreWeave, Inc. Class A Common Stock (CRWV) and GoDaddy Inc. (GDDY) based on the most recent 2024 data.

| Metric | CoreWeave, Inc. (CRWV) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Risk | Very high beta (21.65), volatile stock price | Moderate beta (0.95), more stable price |

| Debt Level | High debt-to-assets (59.56%), weak interest coverage | Moderate debt-to-assets (47.29%), good interest coverage (5.84) |

| Regulatory Risk | Moderate, tech/cloud industry compliance | Moderate, domain and hosting regulations |

| Operational Risk | High, low current and quick ratios (0.39), operational inefficiencies | Moderate, current ratio 0.72, stable operations |

| Environmental Risk | Low, typical for tech infrastructure | Low, primarily digital services |

| Geopolitical Risk | Moderate, US-based but reliant on global AI/cloud demand | Moderate, US-based with international presence |

CoreWeave carries the most significant market and financial risks, with extreme volatility and weak liquidity, placing it in financial distress. GoDaddy shows moderate risks with stronger profitability and financial health but must manage debt prudently. Market volatility and financial leverage are the most impactful risks for investors in these stocks.

Which Stock to Choose?

CoreWeave, Inc. Class A Common Stock (CRWV) shows remarkable revenue growth of nearly 12,000% over 2022-2024, yet suffers from negative net margins and weak profitability metrics. Its financial ratios reveal mostly unfavorable figures, including high debt and poor liquidity, resulting in an unfavorable global ratios opinion and a very favorable rating of D+ with distress signals in financial health scores.

GoDaddy Inc. (GDDY) presents steady income growth with positive net and EBIT margins, supported by favorable profitability metrics and a balanced capital structure. Its financial ratios are mixed but lean towards neutral with some favorable indicators, accompanied by a very favorable B+ rating. The company demonstrates durable value creation with a growing ROIC and strong financial health scores despite some concerns in debt ratios.

Investors prioritizing growth might find CoreWeave’s explosive revenue expansion appealing despite its financial challenges, while those valuing stability and durable profitability could see GoDaddy as a more balanced option with a solid competitive advantage and healthier financial fundamentals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CoreWeave, Inc. Class A Common Stock and GoDaddy Inc. to enhance your investment decisions: