In today’s fast-evolving technology landscape, CoreWeave, Inc. and Gen Digital Inc. stand out as key players in the software infrastructure sector. CoreWeave specializes in cloud computing solutions for AI workloads, while Gen Digital focuses on comprehensive cybersecurity services for consumers worldwide. Both companies innovate to address critical tech needs, making their comparison essential. Join me as we explore which company offers the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between CoreWeave and Gen Digital by providing an overview of these two companies and their main differences.

CoreWeave Overview

CoreWeave, Inc. operates a cloud platform focusing on scaling and accelerating GenAI workloads. The company builds infrastructure supporting compute tasks for enterprises, offering GPU and CPU compute, storage, networking, and managed services. Founded in 2017 and based in Livingston, New Jersey, CoreWeave targets advanced technology sectors with specialized cloud infrastructure solutions.

Gen Digital Overview

Gen Digital Inc. provides comprehensive cyber safety solutions for consumers across multiple regions including the US, Europe, and Asia Pacific. Its offerings include Norton 360, identity theft protection, VPN services, and privacy management tools. Established in 1982 and headquartered in Tempe, Arizona, Gen Digital serves a broad customer base with cybersecurity and privacy products.

Key similarities and differences

Both companies operate in the technology sector within software infrastructure but serve distinct markets: CoreWeave focuses on enterprise cloud computing and AI infrastructure, while Gen Digital targets consumer cybersecurity and privacy. CoreWeave’s services emphasize compute and storage for AI workloads, whereas Gen Digital offers security software and identity protection across devices and platforms. Their business models differ in customer focus and product specialization.

Income Statement Comparison

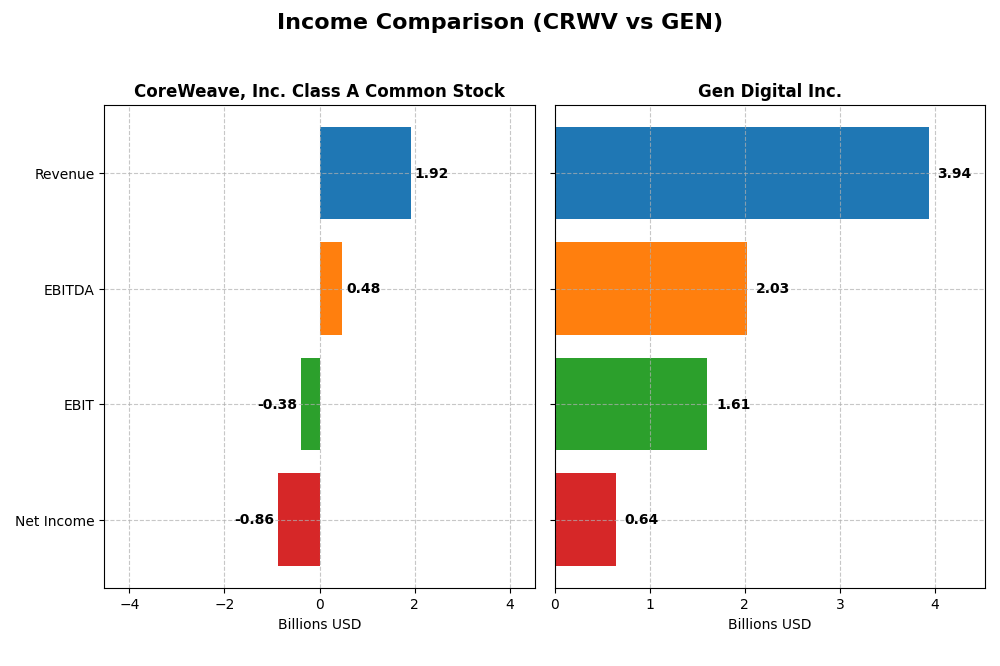

Below is a comparison of the most recent fiscal year income statement metrics for CoreWeave, Inc. Class A Common Stock and Gen Digital Inc.

| Metric | CoreWeave, Inc. Class A Common Stock | Gen Digital Inc. |

|---|---|---|

| Market Cap | 50.4B | 16.1B |

| Revenue | 1.92B | 3.94B |

| EBITDA | 480M | 2.03B |

| EBIT | -383M | 1.61B |

| Net Income | -863M | 643M |

| EPS | -2.33 | 1.04 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

CoreWeave, Inc. Class A Common Stock

CoreWeave’s revenue surged dramatically from $16M in 2022 to $1.92B in 2024, reflecting rapid growth in its cloud infrastructure services. Despite gross margins holding strong at 74.24%, net income remained deeply negative, with a net margin of -45.08% in 2024. The latest year showed improved EBIT by 27.62% but persistent losses due to high interest expenses.

Gen Digital Inc.

Gen Digital experienced steady revenue growth from $2.55B in 2021 to $3.94B in 2025, maintaining a high gross margin of 80.28%. EBIT margin improved to 40.84%, supporting a positive net margin of 16.34% in 2025. The recent year featured moderate revenue growth of 3.55%, with net income and EPS growing favorably, despite slightly increased interest costs.

Which one has the stronger fundamentals?

Gen Digital displays stronger fundamentals with consistent profitability, positive net margins, and stable growth in earnings per share. CoreWeave, while showing exceptional top-line growth and favorable gross margins, struggles with sustained net losses and high interest expenses. Overall, Gen Digital’s income statement reflects more balanced and sustainable financial health.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for CoreWeave, Inc. Class A Common Stock (CRWV) and Gen Digital Inc. (GEN) based on their most recent fiscal year data.

| Ratios | CoreWeave, Inc. (CRWV) 2024 | Gen Digital Inc. (GEN) 2025 |

|---|---|---|

| ROE | 2.09% | 28.34% |

| ROIC | 2.08% | 7.77% |

| P/E | -18.73 | 25.36 |

| P/B | -39.11 | 7.19 |

| Current Ratio | 0.39 | 0.51 |

| Quick Ratio | 0.39 | 0.51 |

| D/E | -25.68 | 3.66 |

| Debt-to-Assets | 59.56% | 53.66% |

| Interest Coverage | 0.90 | 2.79 |

| Asset Turnover | 0.11 | 0.25 |

| Fixed Asset Turnover | 0.13 | 36.10 |

| Payout ratio | -6.69% | 48.68% |

| Dividend yield | 0.36% | 1.92% |

Interpretation of the Ratios

CoreWeave, Inc. Class A Common Stock

CoreWeave exhibits a mixed performance with a strong return on equity (208.77%) but weak profitability indicated by a negative net margin (-45.08%) and return on invested capital (2.08%). Its liquidity ratios (current and quick) are low (0.39), signaling potential short-term financial stress. The company does not pay dividends, likely due to its negative net income and reinvestment focus in growth and infrastructure.

Gen Digital Inc.

Gen Digital shows solid profitability with a favorable net margin (16.34%) and return on equity (28.34%), though its price-to-earnings (PE) and price-to-book (PB) ratios appear elevated, suggesting valuation concerns. Liquidity ratios remain below 1 (0.51), which may affect short-term obligations. The company pays dividends with a 1.92% yield, reflecting a moderate shareholder return balance alongside ongoing investments.

Which one has the best ratios?

Gen Digital presents a more balanced financial profile with favorable profitability ratios and a sustainable dividend yield, despite some valuation and liquidity concerns. CoreWeave’s ratios reveal higher risk with negative margins and weak liquidity, though strong equity returns suggest potential. Overall, Gen Digital’s ratios are slightly more favorable in terms of stability and returns.

Strategic Positioning

This section compares the strategic positioning of CoreWeave and Gen Digital, focusing on Market position, Key segments, and Exposure to technological disruption:

CoreWeave, Inc. Class A Common Stock

- Emerging cloud platform in infrastructure with high market volatility and competitive pressure.

- Focus on GPU and CPU compute, storage, AI model training, and VFX rendering driving business growth.

- Cloud infrastructure services tailored to GenAI workloads, potentially sensitive to rapid tech changes.

Gen Digital Inc.

- Established cyber safety provider with moderate competitive pressure and broad geographic reach.

- Dominates consumer cyber safety with Norton 360, identity protection, VPN, and privacy management products.

- Cybersecurity solutions targeted at consumers, with evolving threats requiring continuous innovation.

CoreWeave vs Gen Digital Positioning

CoreWeave concentrates on cloud infrastructure for AI workloads, while Gen Digital has a diversified portfolio across cybersecurity and privacy. CoreWeave’s niche focus contrasts with Gen Digital’s broad consumer coverage and legacy product lines.

Which has the best competitive advantage?

Both companies are currently shedding value, but CoreWeave shows stable profitability while Gen Digital faces declining ROIC and profitability, indicating a weaker competitive advantage for Gen Digital based on MOAT evaluation.

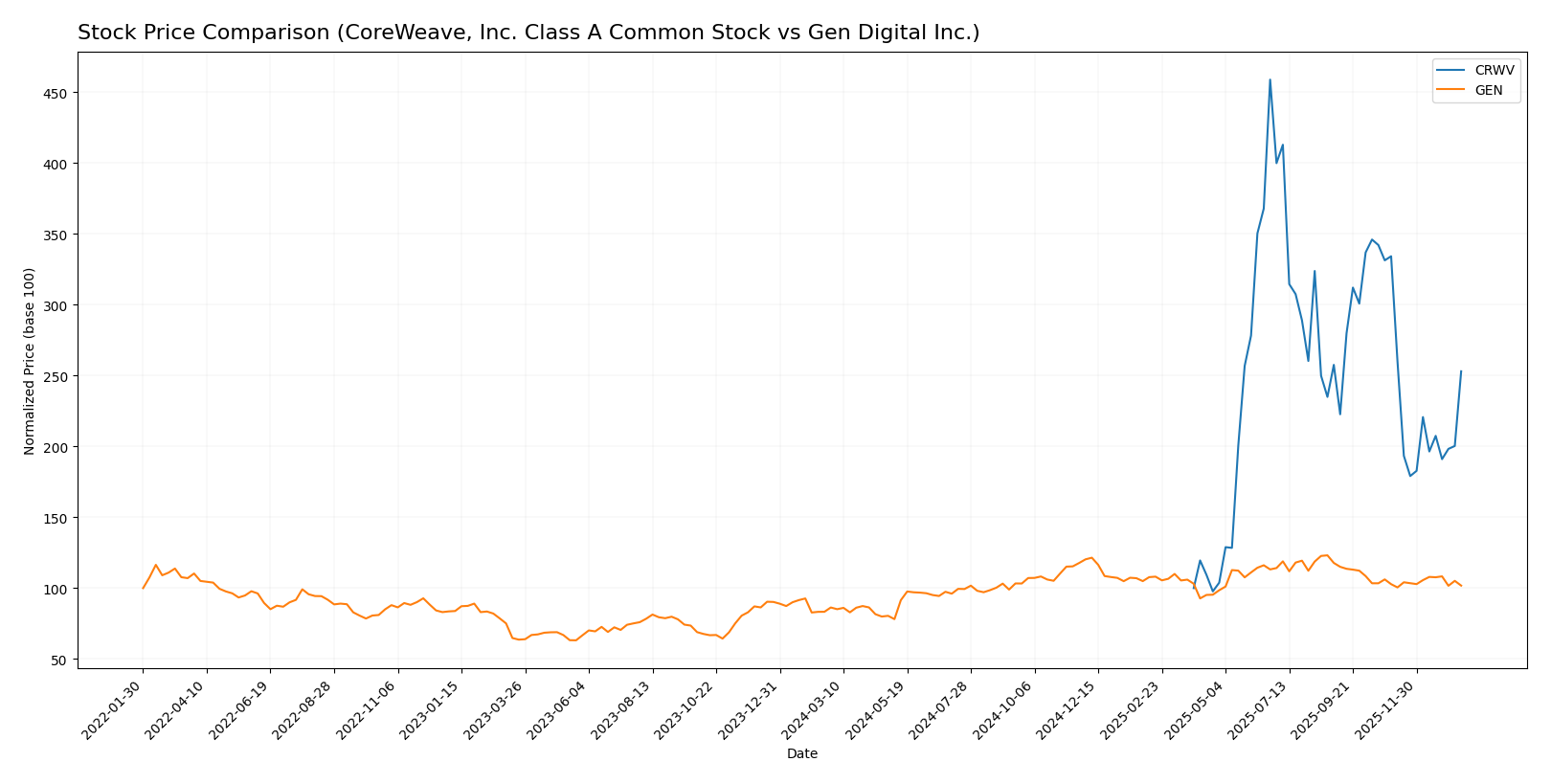

Stock Comparison

The stock price movements over the past 12 months reveal a strong bullish trend for CoreWeave, Inc. Class A Common Stock with significant growth, contrasted with a more moderate bullish trend for Gen Digital Inc., alongside differing volume dynamics and recent short-term fluctuations.

Trend Analysis

CoreWeave, Inc. Class A Common Stock (CRWV) experienced a 153.08% price increase over the past year, marking a bullish trend with decelerating momentum. The stock reached a high of 183.58 and a low of 39.09, with notable volatility (std deviation 35.67).

Gen Digital Inc. (GEN) showed a 17.89% price increase over the same period, also bullish but with deceleration and much lower volatility (std deviation 2.59). The stock’s price ranged from 20.03 to 31.58, with a near-neutral recent trend.

Comparing both, CRWV delivered a substantially higher market performance than GEN during the last 12 months, reflecting stronger price gains and increased trading volume despite recent short-term declines.

Target Prices

The current analyst consensus provides a clear target price range for CoreWeave, Inc. and Gen Digital Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CoreWeave, Inc. Class A Common Stock | 175 | 68 | 115.79 |

| Gen Digital Inc. | 32 | 31 | 31.5 |

Analysts expect CoreWeave’s stock to appreciate from its current price of 101.23 USD, with consensus well above the current market value. Gen Digital’s target consensus of 31.5 USD also suggests modest upside compared to its current price of 26.1 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for CoreWeave, Inc. Class A Common Stock (CRWV) and Gen Digital Inc. (GEN):

Rating Comparison

CRWV Rating

- Rating: D+, indicating a very unfavorable overall financial standing.

- Discounted Cash Flow Score: 1, very unfavorable valuation based on future cash flow.

- ROE Score: 1, very unfavorable efficiency in generating profit from equity.

- ROA Score: 1, very unfavorable asset utilization effectiveness.

- Debt To Equity Score: 1, very unfavorable financial risk profile.

- Overall Score: 1, very unfavorable summary of financial health.

GEN Rating

- Rating: B, reflecting a very favorable overall financial standing.

- Discounted Cash Flow Score: 5, very favorable valuation outlook.

- ROE Score: 5, very favorable efficiency in profit generation.

- ROA Score: 3, moderate asset utilization effectiveness.

- Debt To Equity Score: 1, very unfavorable financial risk profile.

- Overall Score: 3, moderate summary of financial health.

Which one is the best rated?

GEN is clearly better rated than CRWV, with a B rating and higher scores in discounted cash flow, ROE, ROA, and overall financial health. CRWV holds a D+ rating with uniformly very unfavorable scores.

Scores Comparison

The comparison of CoreWeave (CRWV) and Gen Digital (GEN) scores is as follows:

CRWV Scores

- Altman Z-Score: 0.80, in distress zone, high bankruptcy risk

- Piotroski Score: 3, very weak financial strength

GEN Scores

- Altman Z-Score: 1.25, also in distress zone, high bankruptcy risk

- Piotroski Score: 6, average financial strength

Which company has the best scores?

GEN shows higher scores than CRWV, with a better Piotroski Score (6 vs. 3) and a slightly higher Altman Z-Score, although both remain in the distress zone. GEN demonstrates relatively stronger financial health based on these measures.

Grades Comparison

Here is a comparison of the recent grades assigned to CoreWeave, Inc. Class A Common Stock and Gen Digital Inc.:

CoreWeave, Inc. Class A Common Stock Grades

The following table shows recent grades from reliable financial institutions for CoreWeave:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| DA Davidson | Upgrade | Neutral | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-11-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| Barclays | Maintain | Equal Weight | 2025-11-12 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| B of A Securities | Maintain | Neutral | 2025-11-11 |

CoreWeave’s grades range mostly between Buy, Overweight, and Neutral, with no Sell ratings, indicating a generally positive outlook with some caution.

Gen Digital Inc. Grades

The following table summarizes reliable grades for Gen Digital Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2025-11-07 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-02 |

| Barclays | Maintain | Equal Weight | 2025-08-08 |

| Wells Fargo | Maintain | Overweight | 2025-08-08 |

| RBC Capital | Maintain | Sector Perform | 2025-08-08 |

| Barclays | Maintain | Equal Weight | 2025-07-14 |

| RBC Capital | Maintain | Sector Perform | 2025-05-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-04-16 |

| RBC Capital | Maintain | Sector Perform | 2025-01-31 |

Gen Digital’s grades mostly range between Sector Perform, Equal Weight, Overweight, and Outperform, with a single Sell rating noted in consensus data, reflecting a generally stable but less consistently positive assessment compared to CoreWeave.

Which company has the best grades?

CoreWeave has received more Buy and Overweight ratings, indicating stronger bullish sentiment, while Gen Digital’s grades tend toward Sector Perform and Equal Weight. Investors might interpret CoreWeave’s grades as signaling higher growth potential but possibly with higher risk, whereas Gen Digital’s grades suggest steadier but more moderate expectations.

Strengths and Weaknesses

Below is a comparison of CoreWeave, Inc. Class A Common Stock (CRWV) and Gen Digital Inc. (GEN) across key investment criteria based on the most recent financial and operational data.

| Criterion | CoreWeave, Inc. (CRWV) | Gen Digital Inc. (GEN) |

|---|---|---|

| Diversification | Limited product/service range; focused on cloud GPU infrastructure | Broad cybersecurity portfolio with $3.885B Cyber Safety revenues and legacy products |

| Profitability | Negative net margin (-45.08%), high ROE (208.77%), but overall value destroying | Positive net margin (16.34%), solid ROE (28.34%), but declining ROIC trend |

| Innovation | Moderate innovation with stable ROIC but high cost of capital (WACC 84.93%) | Strong innovation in cybersecurity but pressure on profitability and market multiples |

| Global presence | Growing but limited global footprint in cloud infrastructure | Established global presence in cybersecurity markets |

| Market Share | Niche market player with limited scale | Significant market share in cybersecurity industry |

Key takeaways: CoreWeave shows high return on equity but struggles with profitability and value creation due to high capital costs. Gen Digital holds a strong market position with diversified cybersecurity offerings and positive margins, yet faces challenges from declining ROIC and valuation concerns. Investors should weigh CoreWeave’s growth potential against its financial risks, while Gen Digital offers stability with caution on its profitability trajectory.

Risk Analysis

Below is a comparative table of key risks for CoreWeave, Inc. Class A Common Stock (CRWV) and Gen Digital Inc. (GEN) based on the most recent financial and market evaluations:

| Metric | CoreWeave, Inc. (CRWV) | Gen Digital Inc. (GEN) |

|---|---|---|

| Market Risk | Extremely high beta (21.65) indicating very high volatility | Moderate beta (1.08), typical market risk for sector |

| Debt level | Moderate to high debt-to-assets (59.56%), poor interest coverage (-1.06) | High debt-to-assets (53.66%), moderate interest coverage (2.78) |

| Regulatory Risk | Moderate (technology/cloud sector, evolving regulations) | Moderate to high (cybersecurity, data privacy regulations worldwide) |

| Operational Risk | Low workforce size (881), early-stage IPO (2025) with infrastructure scaling risks | Larger workforce (3,400), mature operations but risks from cyber threats and product reliability |

| Environmental Risk | Low to moderate (technology sector, data center energy use) | Moderate (global operations with privacy compliance and data security concerns) |

| Geopolitical Risk | Low (US-based, cloud infrastructure focus) | Moderate (global presence across many regions with geopolitical tensions) |

Synthesis: CoreWeave faces the most impactful risk in extreme market volatility and weak financial stability, as indicated by its very high beta and financial distress scores. Gen Digital carries considerable debt risk and regulatory challenges due to its global cybersecurity operations but shows better operational stability. Investors should weigh CoreWeave’s growth potential against its financial fragility and Gen Digital’s steadier but leveraged profile.

Which Stock to Choose?

CoreWeave, Inc. Class A Common Stock (CRWV) shows a favorable income evolution with a 736.64% revenue growth in one year but suffers from negative profitability and high debt levels. Its financial ratios are mostly unfavorable, with a poor current ratio and high leverage, resulting in a very favorable rating of D+ but an overall unfavorable financial health assessment.

Gen Digital Inc. (GEN) presents stable income with moderate revenue growth around 3.55% and favorable profitability metrics, including a 16.34% net margin. Its financial ratios indicate a slightly unfavorable profile due to debt and liquidity concerns, yet it holds a better rating of B with moderate overall financial scores and average Piotroski strength.

For investors, GEN might appear more attractive for those prioritizing consistent profitability and moderate growth, while CRWV’s rapid income expansion but weaker financial stability could appeal to more risk-tolerant profiles focused on growth potential. Both companies show challenges in value creation, with CRWV shedding value steadily and GEN experiencing declining profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CoreWeave, Inc. Class A Common Stock and Gen Digital Inc. to enhance your investment decisions: