In the evolving landscape of renewable utilities, Constellation Energy Corporation (CEG) and NuScale Power Corporation (SMR) stand out with distinct approaches to clean energy. While CEG boasts a diverse portfolio including nuclear, wind, and solar assets, SMR focuses on innovative modular nuclear reactors. Their shared commitment to sustainable energy and market presence makes this comparison compelling. Join me as we explore which company offers the most promising investment potential in 2026.

Table of contents

Companies Overview

I will begin the comparison between Constellation Energy Corporation and NuScale Power Corporation by providing an overview of these two companies and their main differences.

Constellation Energy Corporation Overview

Constellation Energy Corporation, headquartered in Baltimore, Maryland, operates in the renewable utilities sector. The company generates and sells electricity across the United States through diverse segments, including Mid-Atlantic and Midwest regions. It manages 32,400 megawatts of generating capacity from nuclear, wind, solar, natural gas, and hydroelectric sources, serving a broad customer base from municipalities to commercial entities.

NuScale Power Corporation Overview

NuScale Power Corporation, based in Portland, Oregon, specializes in developing modular light water reactor nuclear power plants. Its products include the NuScale Power Module and VOYGR series plants with varying output capacities tailored to customer needs. Operating as a subsidiary of Fluor Enterprises, Inc., NuScale focuses on supplying energy for electricity generation and other industrial applications within the renewable utilities sector.

Key similarities and differences

Both companies operate within the renewable utilities industry in the US but differ significantly in scale and business models. Constellation Energy has a large, diversified portfolio with 32,400 MW capacity spanning multiple energy sources, while NuScale concentrates on innovative modular nuclear reactors. Constellation serves various customer types, whereas NuScale targets infrastructure projects with specialized nuclear technology, reflecting contrasting approaches to energy production and market engagement.

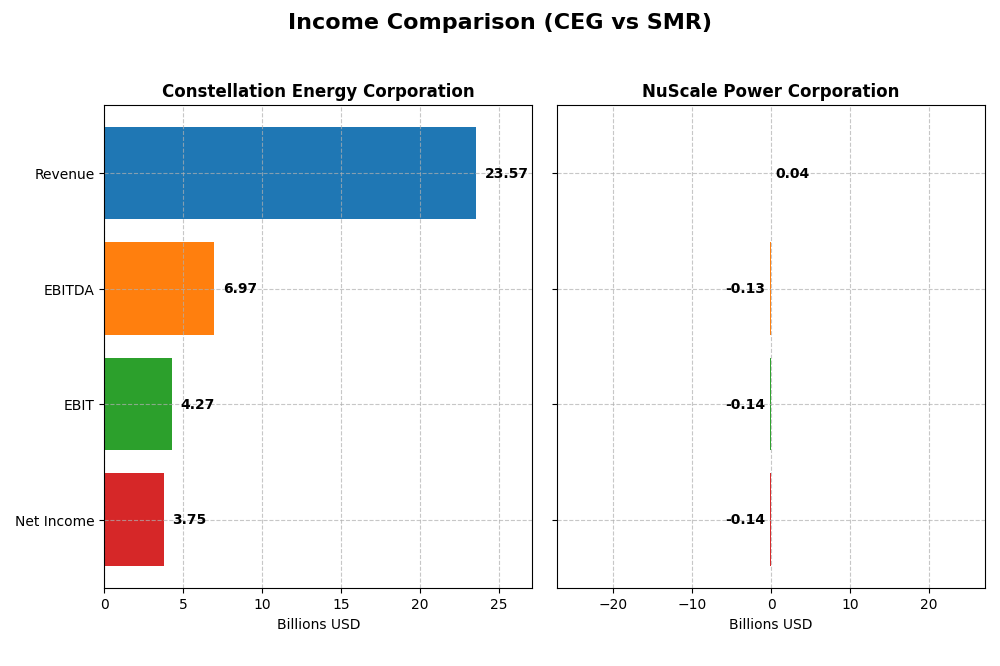

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Constellation Energy Corporation and NuScale Power Corporation for the fiscal year 2024.

| Metric | Constellation Energy Corporation (CEG) | NuScale Power Corporation (SMR) |

|---|---|---|

| Market Cap | 107B | 6.1B |

| Revenue | 23.6B | 37M |

| EBITDA | 6.97B | -134M |

| EBIT | 4.27B | -135M |

| Net Income | 3.75B | -137M |

| EPS | 11.9 | -1.47 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Constellation Energy Corporation

Constellation Energy saw revenue growth of 33.9% over the 2020-2024 period, though revenue declined by 5.4% in 2024. Net income grew substantially by 536.5% overall, with a 144.2% rise in net margin in the last year. Margins improved significantly, with a 25.4% gross margin and 15.9% net margin in 2024, reflecting enhanced profitability despite slower top-line growth.

NuScale Power Corporation

NuScale Power experienced a remarkable 6074% revenue increase over the overall period, with a 62.4% rise in 2024 alone. However, net income declined by 54.6% overall and dropped further in 2024, resulting in negative net margins of -368.8%. Despite a strong gross margin of 86.7%, EBIT and net margins remain deeply negative, indicating ongoing operational losses amid rapid growth.

Which one has the stronger fundamentals?

Constellation Energy exhibits stronger fundamentals with consistent profitability, favorable margins, and robust net income growth, despite a recent revenue dip. NuScale Power shows rapid revenue expansion but operates at significant losses with negative margins. The contrast in profitability and margin stability favors Constellation’s financial health over NuScale’s growth-oriented but riskier profile.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Constellation Energy Corporation (CEG) and NuScale Power Corporation (SMR) for the fiscal year 2024.

| Ratios | Constellation Energy Corporation (CEG) | NuScale Power Corporation (SMR) |

|---|---|---|

| ROE | 28.5% | -22.1% |

| ROIC | 7.7% | -30.7% |

| P/E | 18.8 | -12.2 |

| P/B | 5.35 | 2.70 |

| Current Ratio | 1.57 | 5.25 |

| Quick Ratio | 1.34 | 5.25 |

| D/E | 0.64 | 0 |

| Debt-to-Assets | 15.9% | 0 |

| Interest Coverage | 8.6 | 0 |

| Asset Turnover | 0.45 | 0.068 |

| Fixed Asset Turnover | 1.11 | 15.30 |

| Payout Ratio | 11.8% | 0 |

| Dividend Yield | 0.63% | 0 |

Interpretation of the Ratios

Constellation Energy Corporation

Constellation Energy shows a slightly favorable ratio profile with strong net margin (15.91%) and ROE (28.47%), indicating efficient profitability. However, a high PB ratio (5.35) and low asset turnover (0.45) pose concerns about valuation and asset utilization. The company pays dividends with a modest yield of 0.63%, supported by stable free cash flow, though the yield is somewhat low.

NuScale Power Corporation

NuScale exhibits an unfavorable ratio profile with deeply negative profitability metrics: net margin at -368.8% and ROE at -22.08%. The company holds no dividends, reflecting its ongoing development phase and reinvestment in R&D. Strong fixed asset turnover (15.3) contrasts with weak cash flow and interest coverage, highlighting operational and financial risks.

Which one has the best ratios?

Constellation Energy outperforms NuScale in profitability, financial stability, and dividend returns, offering a more balanced risk-reward profile. NuScale’s negative margins and lack of dividends reflect its early-stage status and high risk, despite some operational strengths. Overall, Constellation’s ratios are more favorable for investors seeking established performance.

Strategic Positioning

This section compares the strategic positioning of Constellation Energy Corporation and NuScale Power Corporation, including market position, key segments, and exposure to disruption:

Constellation Energy Corporation

- Large market cap of 107B USD in renewable utilities, facing typical sector competition.

- Diversified revenue streams across multiple U.S. regions and energy types, including nuclear, wind, solar, and natural gas.

- Moderate exposure to disruption through renewable energy technologies and gas; legacy assets balanced with innovation.

NuScale Power Corporation

- Smaller market cap of 6.1B USD, operating in niche modular nuclear power market.

- Focused on modular light water nuclear reactors for power generation and industrial uses.

- High exposure to technological disruption as a developer of new modular nuclear reactor technology.

Constellation Energy Corporation vs NuScale Power Corporation Positioning

Constellation is diversified across multiple energy segments and regions, offering stability through scale and variety. NuScale is concentrated on innovative modular nuclear technology, which carries higher technological risk but potential for breakthrough impact. Each approach presents distinct operational scopes and market challenges.

Which has the best competitive advantage?

Both companies currently have slightly unfavorable MOAT evaluations, shedding value despite growing ROIC trends. Constellation’s scale and diversification offer broader stability, while NuScale’s focused innovation entails greater risk and opportunity in competitive advantage.

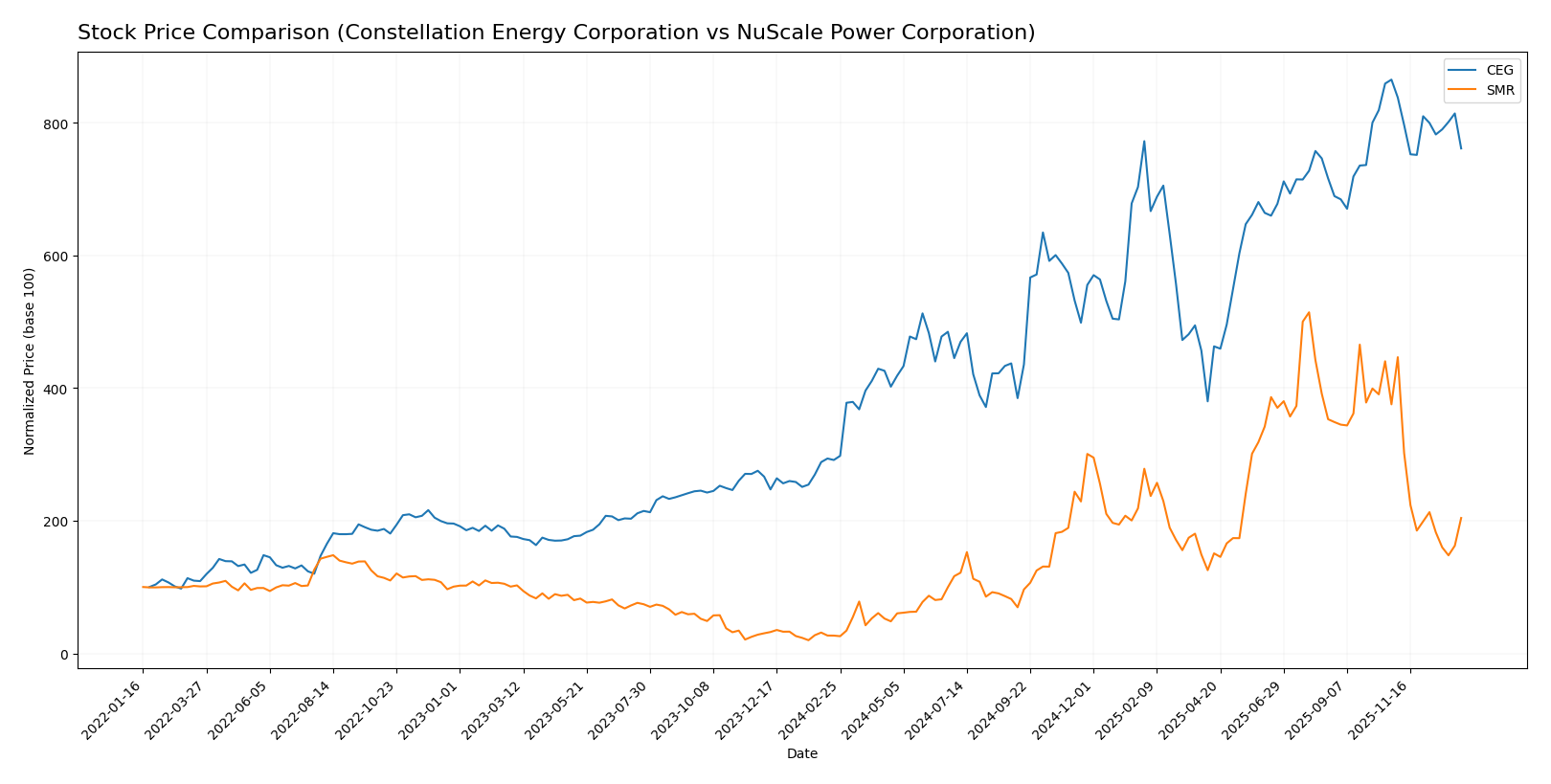

Stock Comparison

The stock price chart reveals significant upward movements over the past 12 months for both companies, with notable deceleration in growth and recent downward corrections in trading dynamics.

Trend Analysis

Constellation Energy Corporation (CEG) exhibited a strong bullish trend over the past year with a 161.15% price increase, though momentum has decelerated. Recent months show an 11.99% decline, indicating a short-term bearish correction.

NuScale Power Corporation (SMR) recorded an even more pronounced bullish trend with a 662.45% gain over the same period, also experiencing deceleration. Its recent 45.64% drop points to a sharper short-term bearish movement compared to CEG.

Comparing both, SMR outperformed CEG substantially over the past year, despite greater recent volatility and a more significant short-term decline.

Target Prices

Analysts present a cautiously optimistic consensus on target prices for Constellation Energy Corporation and NuScale Power Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Constellation Energy Corporation | 478 | 375 | 407.88 |

| NuScale Power Corporation | 55 | 20 | 33.83 |

The target consensus for Constellation Energy at 407.88 exceeds the current price of 342.52, indicating moderate upside potential. NuScale’s consensus target of 33.83 also suggests significant growth compared to its current price of 20.51.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Constellation Energy Corporation (CEG) and NuScale Power Corporation (SMR):

Rating Comparison

CEG Rating

- Rating: B- indicates a very favorable assessment of the company’s financials.

- Discounted Cash Flow Score: 1, rated very unfavorable, signaling valuation concerns.

- ROE Score: 5, very favorable, reflecting strong profit generation from equity.

- ROA Score: 4, favorable, indicating effective use of assets to generate earnings.

- Debt To Equity Score: 3, moderate, reflecting balanced financial risk.

- Overall Score: 3, moderate overall financial standing.

SMR Rating

- Rating: D+ also noted as very favorable, despite the letter grade.

- Discounted Cash Flow Score: 1, very unfavorable, indicating similar concerns.

- ROE Score: 1, very unfavorable, showing weak efficiency in generating returns.

- ROA Score: 1, very unfavorable, suggesting poor asset utilization.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk.

- Overall Score: 1, very unfavorable overall financial position.

Which one is the best rated?

Based strictly on the provided data, CEG is better rated with a B- rating and higher scores in ROE, ROA, and debt-to-equity metrics. SMR’s scores are consistently very unfavorable, resulting in a weaker overall score.

Scores Comparison

Here is a comparison of the key financial scores for Constellation Energy Corporation (CEG) and NuScale Power Corporation (SMR):

CEG Scores

- Altman Z-Score: 2.55, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 5, classified as average financial strength.

SMR Scores

- Altman Z-Score: 7.92, in the safe zone indicating very low bankruptcy risk.

- Piotroski Score: 2, classified as very weak financial strength.

Which company has the best scores?

SMR has a significantly higher Altman Z-Score, placing it in the safe zone, while CEG is in the grey zone. However, CEG’s Piotroski Score is average, outperforming SMR’s very weak Piotroski Score.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Constellation Energy Corporation and NuScale Power Corporation:

Constellation Energy Corporation Grades

The table below summarizes recent grades assigned by multiple reliable grading companies to Constellation Energy Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2025-12-17 |

| JP Morgan | Maintain | Overweight | 2025-12-16 |

| Citigroup | Maintain | Neutral | 2025-11-10 |

| Mizuho | Maintain | Neutral | 2025-10-27 |

| JP Morgan | Maintain | Overweight | 2025-10-20 |

| Keybanc | Maintain | Overweight | 2025-10-15 |

| Seaport Global | Upgrade | Buy | 2025-10-08 |

| Jefferies | Maintain | Hold | 2025-09-09 |

| Raymond James | Maintain | Outperform | 2025-08-11 |

| BMO Capital | Maintain | Outperform | 2025-08-11 |

Overall, Constellation Energy Corporation’s grades show a positive trend with a dominant consensus of Buy and Overweight ratings, reflecting sustained confidence from analysts.

NuScale Power Corporation Grades

The table below summarizes recent grades assigned by multiple reliable grading companies to NuScale Power Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Buy | 2025-12-22 |

| Goldman Sachs | Maintain | Neutral | 2025-12-12 |

| UBS | Maintain | Neutral | 2025-11-25 |

| RBC Capital | Maintain | Sector Perform | 2025-11-10 |

| Citigroup | Downgrade | Sell | 2025-10-21 |

| B of A Securities | Downgrade | Underperform | 2025-09-30 |

| Canaccord Genuity | Maintain | Buy | 2025-09-03 |

| UBS | Maintain | Neutral | 2025-08-11 |

| Canaccord Genuity | Maintain | Buy | 2025-08-11 |

| BTIG | Downgrade | Neutral | 2025-06-25 |

NuScale Power Corporation’s grades indicate mixed sentiment with several downgrades to Sell and Underperform, balanced by Buy and Neutral ratings, suggesting cautious analyst views.

Which company has the best grades?

Constellation Energy Corporation has received consistently stronger grades, with multiple Buy, Overweight, and Outperform ratings compared to NuScale Power Corporation’s more mixed grades including several downgrades. This difference may influence investors by reflecting higher analyst confidence and potentially lower perceived risk in Constellation Energy’s outlook.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of Constellation Energy Corporation (CEG) and NuScale Power Corporation (SMR) based on their recent financial and operational data:

| Criterion | Constellation Energy Corporation (CEG) | NuScale Power Corporation (SMR) |

|---|---|---|

| Diversification | Strong regional diversification with significant revenue streams across multiple U.S. regions | Very limited revenue base, mostly in early-stage or niche markets |

| Profitability | Positive net margin (15.91%) and strong ROE (28.47%), but ROIC slightly below WACC, indicating slight value destruction | Negative profitability ratios with large net losses and negative ROIC, showing financial challenges |

| Innovation | Moderate asset turnover and consistent investment in infrastructure | High fixed asset turnover indicating efficient use of assets, but lack of profitability limits innovation impact |

| Global presence | Large U.S. presence with diverse regional operations | Limited global footprint, small revenue scale |

| Market Share | Significant in energy commodities and public utilities in the U.S. | Very small market share with minimal current revenues |

In summary, CEG benefits from strong regional diversification and solid profitability metrics but faces slight value destruction as ROIC is below WACC. SMR is still in a developmental phase with poor profitability and limited market presence, though it shows efficient asset use. Investors should weigh CEG’s stable but slightly challenged value creation against SMR’s growth potential and financial risks.

Risk Analysis

Below is a comparison table of key risks for Constellation Energy Corporation (CEG) and NuScale Power Corporation (SMR) based on the latest 2024 data:

| Metric | Constellation Energy Corporation (CEG) | NuScale Power Corporation (SMR) |

|---|---|---|

| Market Risk | Moderate (Beta 1.145; exposure to energy markets) | High (Beta 2.132; volatile stock price) |

| Debt level | Moderate (Debt/Equity 0.64; manageable leverage) | Low (Debt/Equity 0; no debt) |

| Regulatory Risk | Moderate (Utility sector regulations, nuclear oversight) | High (Nuclear technology development, licensing challenges) |

| Operational Risk | Moderate (Diverse energy assets, operational complexity) | High (Early-stage technology, project execution risks) |

| Environmental Risk | Moderate (Nuclear and renewables; regulatory scrutiny) | Moderate to High (Nuclear safety and waste management) |

| Geopolitical Risk | Low (US-focused operations) | Low (US-focused operations) |

The most impactful risks are SMR’s high regulatory and operational challenges due to its nascent modular nuclear technology, posing execution and licensing uncertainties. CEG faces moderate market and regulatory risks typical for diversified utilities but benefits from stable operating cash flows and manageable debt. Investors should weigh SMR’s growth potential against its higher risk profile, while CEG offers more stability with moderate downside.

Which Stock to Choose?

Constellation Energy Corporation (CEG) shows a favorable income evolution with strong profitability metrics, including a 28.5% ROE and a 15.9% net margin. Its financial ratios are slightly favorable overall, supported by moderate debt levels and a very favorable rating.

NuScale Power Corporation (SMR) exhibits rapid revenue growth but negative profitability with a -22.1% ROE and -368.8% net margin. Its financial ratios are mostly unfavorable, though it maintains low debt and a very favorable rating despite financial challenges.

Investors focused on stable profitability and moderate risk might find CEG more favorable due to its solid income and financial ratios, while those with a tolerance for volatility and growth potential might view SMR’s improving but currently negative metrics as indicative of future opportunity.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Constellation Energy Corporation and NuScale Power Corporation to enhance your investment decisions: