In the competitive world of alcoholic beverages, Diageo plc (DEO) and Constellation Brands, Inc. (STZ) stand out as industry leaders with extensive portfolios spanning spirits, beer, and wine. Both companies innovate to capture diverse markets across multiple continents, making them direct rivals in the consumer defensive sector. This article will analyze their strengths and strategies to help you identify the more compelling investment opportunity. Let’s explore which company could best enhance your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Diageo and Constellation Brands by providing an overview of these two companies and their main differences.

Diageo Overview

Diageo plc is a global leader in alcoholic beverages, producing and marketing a diverse portfolio that includes scotch, whisky, vodka, rum, tequila, liqueurs, and beer. The company operates internationally across North America, Europe, Africa, Latin America, and Asia Pacific. Founded in 1886 and headquartered in London, Diageo holds iconic brands like Johnnie Walker, Smirnoff, and Guinness, positioning itself as a dominant player in the beverages industry.

Constellation Brands Overview

Constellation Brands, Inc. specializes in beer, wine, and spirits, primarily serving markets in the United States, Canada, Mexico, New Zealand, and Italy. Established in 1945 and based in Victor, New York, it markets well-known beer brands such as Corona and Modelo, alongside premium wines and spirits. The company distributes to wholesalers, retailers, and state agencies, focusing on North American and select international markets.

Key similarities and differences

Both companies operate in the beverages industry, focusing on alcoholic products and competing within the consumer defensive sector. While Diageo has a broader global footprint and a wider brand portfolio spanning spirits and beer, Constellation Brands concentrates on North American markets with strong beer offerings and a growing wine and spirits presence. Employee count and market capitalization also differ, reflecting Diageo’s larger scale and international reach compared to Constellation.

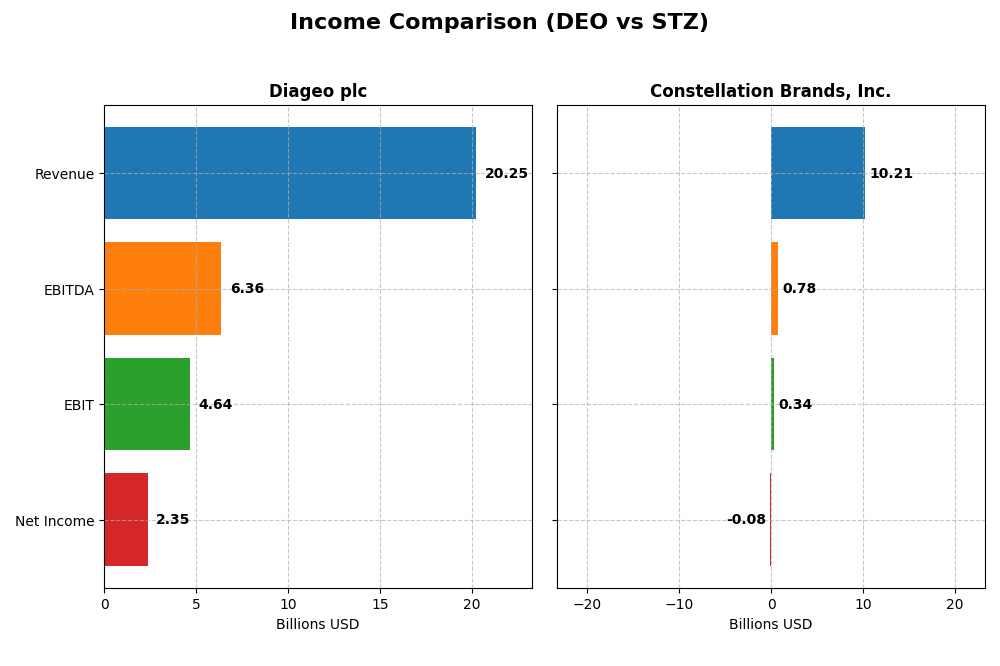

Income Statement Comparison

The table below presents a side-by-side comparison of the latest fiscal year income statement metrics for Diageo plc and Constellation Brands, Inc., highlighting key financial figures.

| Metric | Diageo plc (DEO) | Constellation Brands, Inc. (STZ) |

|---|---|---|

| Market Cap | 50.5B | 26.4B |

| Revenue | 20.2B | 10.2B |

| EBITDA | 6.36B | 783.0M |

| EBIT | 4.64B | 336.0M |

| Net Income | 2.35B | -81.4M |

| EPS | 4.24 | -0.45 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Diageo plc

Diageo’s revenue showed a favorable overall growth of 59% from 2021 to 2025, yet net income declined by 11.5% over the same period. Margins remain mostly favorable, with a strong gross margin of 60.13% and an EBIT margin of 22.92%. However, the latest fiscal year saw revenue and net margin decrease slightly, signaling a slowdown in growth and margin compression.

Constellation Brands, Inc.

Constellation Brands experienced a modest revenue increase of 18.51% over five years but faced a significant net income decline exceeding 100%, with net margins turning negative. While gross margin remained favorable at 50.96%, EBIT margin was neutral at 3.29%. The most recent year reflected a slight revenue rise but steep drops in EBIT and net margin, indicating profitability challenges.

Which one has the stronger fundamentals?

Both companies face profitability pressures, with unfavorable net margin trends and earnings declines. Diageo demonstrates stronger margin stability and higher absolute net income despite recent setbacks, while Constellation Brands struggles with negative net margins and deeper earnings deterioration. Overall, Diageo’s fundamentals appear more resilient amid the challenges noted.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Diageo plc (DEO) and Constellation Brands, Inc. (STZ) based on their most recent fiscal year data.

| Ratios | Diageo plc (DEO) FY 2025 | Constellation Brands (STZ) FY 2025 |

|---|---|---|

| ROE | 21.23% | -1.18% |

| ROIC | 7.47% | 6.83% |

| P/E | 23.80 | -391.27 |

| P/B | 5.05 | 4.63 |

| Current Ratio | 1.63 | 0.92 |

| Quick Ratio | 0.64 | 0.56 |

| D/E | 2.20 | 1.76 |

| Debt-to-Assets | 49.47% | 55.95% |

| Interest Coverage | 4.19 | 8.80 |

| Asset Turnover | 0.41 | 0.47 |

| Fixed Asset Turnover | 2.12 | 1.28 |

| Payout Ratio | 97.62% | -899.02% |

| Dividend Yield | 4.10% | 2.30% |

Interpretation of the Ratios

Diageo plc

Diageo plc shows mostly favorable to neutral ratios, with strong net margin at 11.63% and return on equity of 21.23%, indicating effective profitability. Concerns include a high price-to-book ratio of 5.05 and weak quick ratio of 0.64, suggesting liquidity risks. The company has a solid 4.1% dividend yield supported by consistent payouts and manageable buybacks.

Constellation Brands, Inc.

Constellation Brands presents several weak ratios, including a negative net margin (-0.8%) and return on equity (-1.18%), reflecting profitability challenges. Its debt levels and coverage ratios are unfavorable, with a current ratio below 1, signaling liquidity stress. Despite paying dividends with a 2.3% yield, the firm’s negative earnings and cash flow raise sustainability concerns.

Which one has the best ratios?

Diageo’s ratios are generally more favorable than Constellation Brands’, with better profitability, liquidity, and dividend metrics. Constellation struggles with negative profitability and weaker liquidity, leading to a predominantly unfavorable ratio profile. Overall, Diageo demonstrates stronger financial health and dividend coverage based on the available data.

Strategic Positioning

This section compares the strategic positioning of Diageo plc and Constellation Brands, including Market position, Key segments, and Exposure to technological disruption:

Diageo plc

- Large market cap of 50B USD with low beta, indicating stable competitive positioning.

- Diverse alcoholic beverages portfolio: spirits (22B GBP), beer (4.5B GBP), ready-to-drink and others.

- Exposure to technological disruption not explicitly detailed in provided data.

Constellation Brands, Inc.

- Market cap of 26B USD with moderate beta, facing moderate competitive pressure.

- Focus on beer (8.5B USD) and wines and spirits (1.7B USD), less diversified than Diageo.

- Exposure to technological disruption not explicitly detailed in provided data.

Diageo plc vs Constellation Brands, Inc. Positioning

Diageo shows a diversified product portfolio across many segments and geographies, offering broad exposure but possible complexity. Constellation is more concentrated on beer and wine/spirits, potentially simplifying focus but limiting diversification benefits.

Which has the best competitive advantage?

Both companies create value with ROIC above WACC and slightly favorable moats, but both face declining profitability trends, indicating caution in sustaining competitive advantage.

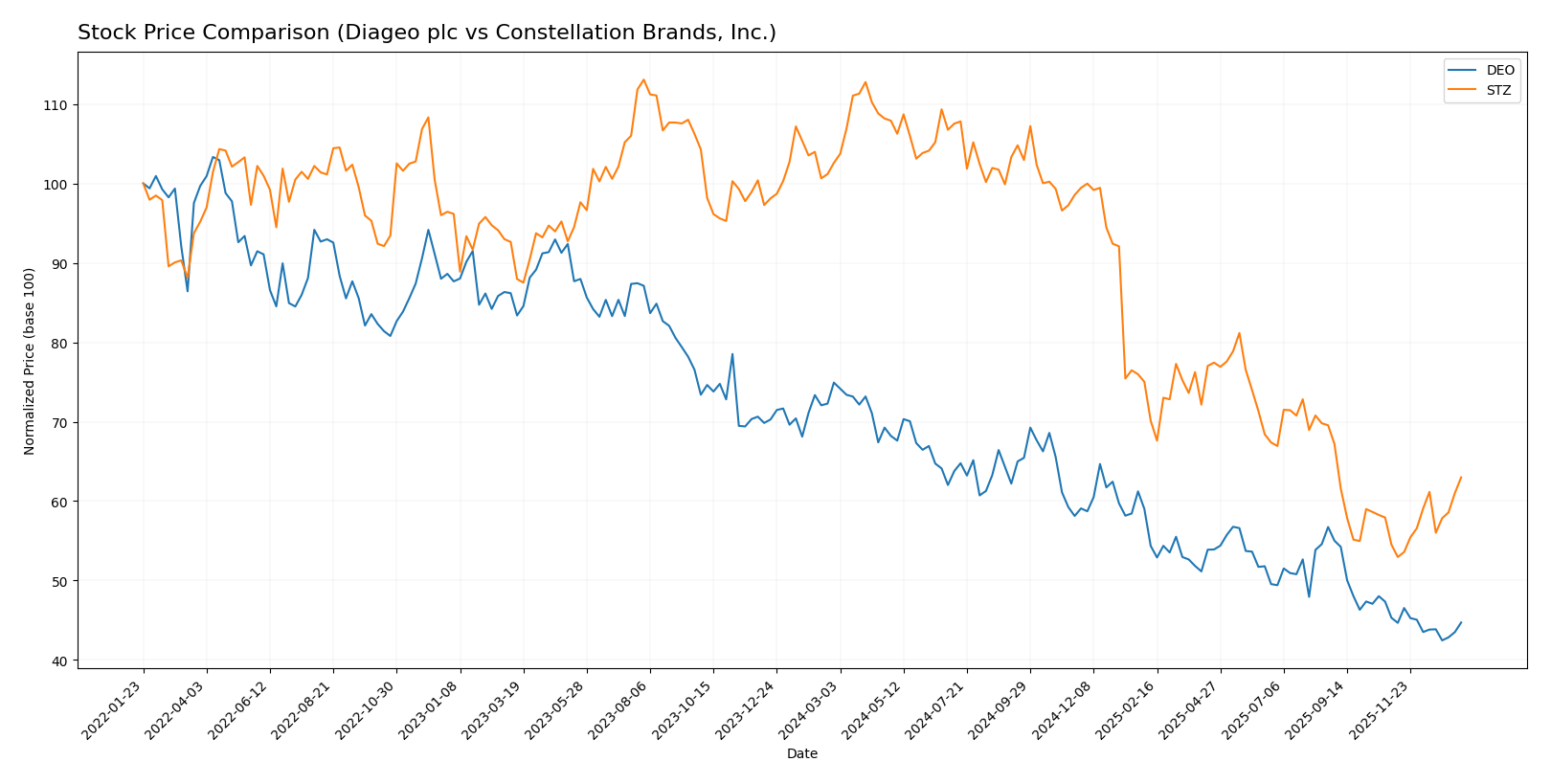

Stock Comparison

The stock price dynamics over the past 12 months reveal pronounced bearish trends for both Diageo plc and Constellation Brands, Inc., with recent divergent momentum and trading volume shifts marking distinct phases in their market performance.

Trend Analysis

Diageo plc’s stock exhibited a bearish trend over the past year, declining by 40.32% with accelerating downward momentum and a standard deviation of 17.64. The price ranged between a high of 152.29 and a low of 86.32, with a recent minor 1.3% drop signaling a deceleration phase.

Constellation Brands, Inc. also faced a bearish trend with a 38.59% fall and accelerating price movement, but with higher volatility reflected in a 46.23 standard deviation. The recent trend reversed positively, rising 15.56%, supported by a strong upward slope.

Comparing both, Constellation Brands delivered relatively better market performance in the recent period due to its notable price recovery, despite both stocks enduring substantial declines over the full year.

Target Prices

Here is the current analyst consensus on target prices for Diageo plc and Constellation Brands, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Diageo plc | 124 | 124 | 124 |

| Constellation Brands, Inc. | 209 | 135 | 172.91 |

Analysts expect Diageo’s stock to rise from $90.89 to $124, indicating potential upside. Constellation Brands shows a wider target range, with a consensus near $173 versus the current $151.82, suggesting moderate growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Diageo plc and Constellation Brands, Inc.:

Rating Comparison

Diageo plc Rating

- Rating: B-, categorized as Very Favorable

- Discounted Cash Flow Score: 3, indicating Moderate value

- ROE Score: 5, reflecting Very Favorable profitability

- ROA Score: 3, showing Moderate asset utilization

- Debt To Equity Score: 1, considered Very Unfavorable

- Overall Score: 3, representing Moderate overall rating

Constellation Brands Rating

- Rating: B+, categorized as Very Favorable

- Discounted Cash Flow Score: 5, indicating Very Favorable value

- ROE Score: 4, reflecting Favorable profitability

- ROA Score: 4, showing Favorable asset utilization

- Debt To Equity Score: 1, considered Very Unfavorable

- Overall Score: 3, representing Moderate overall rating

Which one is the best rated?

Based strictly on the provided data, Constellation Brands holds a higher overall rating (B+) compared to Diageo’s B-. It also scores better in discounted cash flow, ROE, and ROA, suggesting a stronger valuation and profitability profile.

Scores Comparison

The comparison of scores for Diageo plc and Constellation Brands, Inc. is as follows:

Diageo plc Scores

- Altman Z-Score of 2.80, placing it in the grey zone.

- Piotroski Score of 7, indicating strong financial health.

Constellation Brands, Inc. Scores

- Altman Z-Score of 2.79, also in the grey zone.

- Piotroski Score of 8, indicating very strong financial health.

Which company has the best scores?

Both companies are in the grey zone for Altman Z-Score, indicating moderate bankruptcy risk. Constellation Brands has a higher Piotroski Score (8) compared to Diageo (7), suggesting stronger financial health.

Grades Comparison

Here is a comparison of the recent grades assigned to Diageo plc and Constellation Brands, Inc.:

Diageo plc Grades

The table below summarizes recent grades from reputable grading companies for Diageo plc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Downgrade | Neutral | 2025-12-03 |

| B of A Securities | Maintain | Buy | 2025-09-26 |

| TD Cowen | Maintain | Hold | 2025-01-08 |

| Jefferies | Upgrade | Buy | 2024-12-04 |

| Citigroup | Upgrade | Buy | 2024-07-03 |

| Citigroup | Upgrade | Buy | 2024-07-02 |

| Argus Research | Downgrade | Hold | 2024-01-04 |

| Argus Research | Downgrade | Hold | 2024-01-03 |

| JP Morgan | Downgrade | Neutral | 2023-11-29 |

| JP Morgan | Downgrade | Neutral | 2023-11-28 |

Overall, Diageo’s grades show a mix of Buy, Hold, and Neutral ratings with recent downgrades, indicating a cautious sentiment among analysts.

Constellation Brands, Inc. Grades

The table below presents recent grades from recognized grading companies for Constellation Brands, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2026-01-09 |

| UBS | Maintain | Buy | 2026-01-09 |

| Needham | Maintain | Buy | 2026-01-09 |

| Citigroup | Maintain | Neutral | 2026-01-09 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Needham | Maintain | Buy | 2026-01-08 |

| Needham | Maintain | Buy | 2026-01-06 |

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Jefferies | Downgrade | Hold | 2025-12-17 |

| Piper Sandler | Maintain | Neutral | 2025-11-21 |

Constellation Brands has predominantly Buy, Outperform, and Overweight ratings, with very few downgrades, reflecting a generally positive analyst outlook.

Which company has the best grades?

Constellation Brands, Inc. holds the stronger overall analyst consensus with more Buy and Outperform ratings compared to Diageo plc’s mixed Hold and Neutral grades. This difference may influence investors towards Constellation Brands due to its more favorable market perception.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Diageo plc (DEO) and Constellation Brands, Inc. (STZ) based on the most recent financial and operational data.

| Criterion | Diageo plc (DEO) | Constellation Brands, Inc. (STZ) |

|---|---|---|

| Diversification | Broad portfolio: spirits dominate with £22.2B revenue, plus beer (£4.5B), ready-to-drink (£0.99B), and other products. | Focused on beer ($8.5B) and wines/spirits ($1.7B); less diversified product range. |

| Profitability | Positive net margin (11.6%), strong ROE (21.2%), ROIC 7.5%, creating value but with declining profitability. | Negative net margin (-0.8%) and ROE (-1.2%), ROIC 6.8%; value creation but profitability under pressure. |

| Innovation | Continues to invest in premium spirits and ready-to-drink segments; steady product development. | Innovation focused on core beer and wine markets; less emphasis on diversification. |

| Global presence | Strong global footprint with diverse markets, benefiting from international brand recognition. | Strong U.S. presence, less global reach compared to Diageo. |

| Market Share | Leading market shares in premium spirits globally; stable but facing margin pressures. | Significant share in U.S. beer market; challenged by declining profitability and liquidity ratios. |

Key takeaways: Diageo exhibits a well-diversified portfolio with solid profitability and global reach, though its margins are dipping. Constellation Brands shows value creation but struggles with profitability and liquidity, indicating higher investment risk despite strong U.S. market presence.

Risk Analysis

Below is a summary table outlining key risks for Diageo plc (DEO) and Constellation Brands, Inc. (STZ) based on the most recent 2025 data:

| Metric | Diageo plc (DEO) | Constellation Brands, Inc. (STZ) |

|---|---|---|

| Market Risk | Low beta (0.146) indicates low volatility | Moderate beta (0.444) suggests moderate volatility |

| Debt level | High debt-to-equity (2.2), debt-to-assets 49.5% (neutral) | High debt-to-equity (1.76), debt-to-assets 56% (unfavorable) |

| Regulatory Risk | Exposure to global regulatory regimes, mainly UK and US | Exposure to multi-national regulation including US, Canada, Mexico |

| Operational Risk | Large global footprint with 30K employees, moderate asset turnover (0.41) | Smaller workforce (10.6K), lower asset turnover (0.47) |

| Environmental Risk | Industry-wide risks related to sustainability and climate impact | Similar sector risks, with growing focus on sustainable packaging |

| Geopolitical Risk | Operations across Europe, Americas, Asia-Pacific, Africa | Significant North American focus, some exposure to Mexico, Italy, New Zealand |

Synthesis: Diageo’s low market volatility and strong profitability mitigate some risks, but its high leverage and slow asset turnover warrant caution. Constellation Brands faces higher financial stress with negative margins and weak liquidity, compounded by significant debt and operational inefficiencies. Both companies reside in the “grey zone” for bankruptcy risk, but Constellation’s unfavorable financial metrics pose more immediate concerns. Geopolitical and regulatory factors remain relevant but manageable with risk diversification.

Which Stock to Choose?

Diageo plc (DEO) shows a mixed income evolution with a slight decline in revenue and profitability over the past year, despite favorable net margin and ROE ratios. Its debt levels remain high with some unfavorable leverage ratios, but the overall rating is very favorable.

Constellation Brands, Inc. (STZ) exhibits weak income performance marked by negative net margin and ROE, alongside high debt and unfavorable liquidity ratios. However, it maintains a slightly favorable moat status and a very favorable rating driven by a strong discounted cash flow score.

For investors, DEO might appear more suitable for those prioritizing stable profitability and quality metrics, while STZ could be seen as appealing to risk-tolerant investors interested in potential value creation despite recent earnings challenges. The choice could depend on the investor’s risk profile and strategy focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Diageo plc and Constellation Brands, Inc. to enhance your investment decisions: