Dominion Energy, Inc. and Consolidated Edison, Inc. are two leading players in the regulated electric utility sector, serving millions of customers across different U.S. regions. Both companies focus on energy distribution while investing in innovative renewable projects to meet evolving market demands. Comparing their operational scale, financial health, and growth strategies provides valuable insights. Join me as we explore which company offers the most compelling opportunity for investors today.

Table of contents

Companies Overview

I will begin the comparison between Dominion Energy and Consolidated Edison by providing an overview of these two companies and their main differences.

Dominion Energy Overview

Dominion Energy, Inc. is a major player in the U.S. regulated electric industry, focusing on producing and distributing energy primarily in Virginia, North Carolina, South Carolina, and several other states. The company operates through four segments covering electric generation, gas distribution, and renewable energy assets. With a diversified portfolio that includes 30.2GW of electric capacity and extensive transmission and distribution networks, Dominion serves millions of residential, commercial, and industrial customers.

Consolidated Edison Overview

Consolidated Edison, Inc. operates in the regulated electric, gas, and steam delivery markets, mainly serving New York City, Westchester County, and parts of New Jersey. It provides electricity to about 3.5M customers, gas to 1.2M customers, and steam services to over 1,500 customers. The company also invests in renewable energy and energy infrastructure projects, managing a comprehensive network of transmission lines, substations, and distribution facilities. Founded in 1823, it remains a key energy provider in its region.

Key similarities and differences

Both Dominion Energy and Consolidated Edison operate in the regulated electric utility sector and serve millions of customers with electricity and gas services. They maintain extensive infrastructure and invest in renewable energy projects. However, Dominion has a broader geographical footprint across multiple states with a larger electric generating capacity, while Consolidated Edison focuses on a densely populated urban region with additional steam services, highlighting a more localized but diversified utility model.

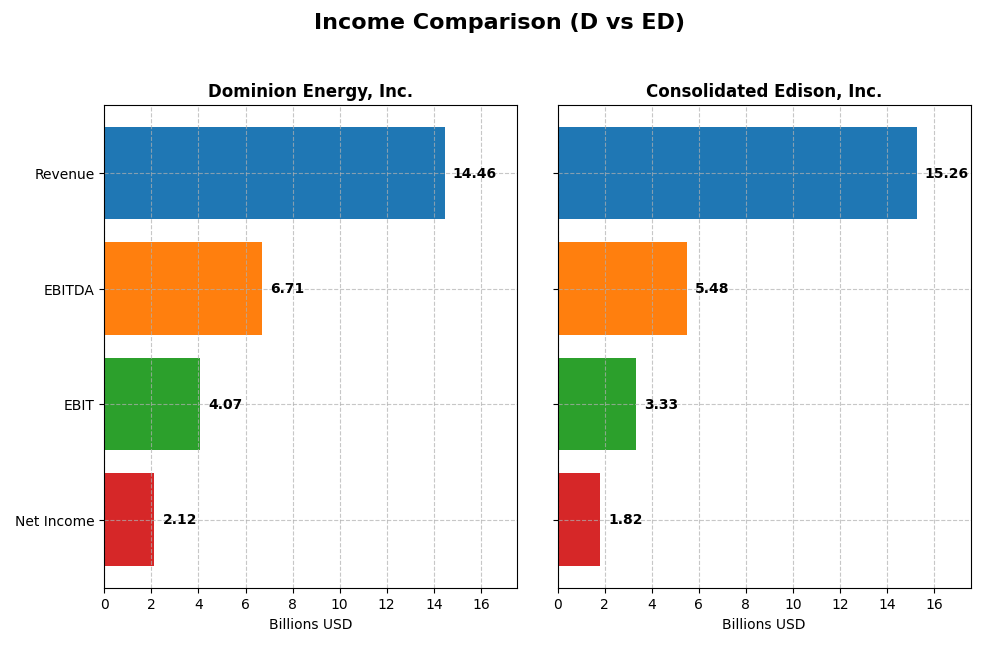

Income Statement Comparison

This table compares key income statement metrics for Dominion Energy, Inc. and Consolidated Edison, Inc. for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | Dominion Energy, Inc. | Consolidated Edison, Inc. |

|---|---|---|

| Market Cap | 49.5B | 35.8B |

| Revenue | 14.46B | 15.26B |

| EBITDA | 6.71B | 5.48B |

| EBIT | 4.07B | 3.33B |

| Net Income | 2.12B | 1.82B |

| EPS | 2.44 | 5.26 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Dominion Energy, Inc.

Dominion Energy’s revenue showed modest growth from 2020 to 2024, rising from $14.2B to $14.5B, while net income surged significantly over the same period. The company maintained favorable gross and EBIT margins around 48% and 28%, respectively, though interest expenses remain a concern at 13%. In 2024, revenue growth slowed to 0.46%, but EBIT and net margin improved, reflecting operational efficiency gains.

Consolidated Edison, Inc.

Consolidated Edison demonstrated solid revenue growth from $12.2B in 2020 to $15.3B in 2024, with net income also increasing notably. Gross margin was strong at nearly 64%, though EBIT margin was lower at 21.8%. The company faced a decline in EBIT and net margin in 2024, with EPS falling by over 27%, indicating recent margin pressures despite overall favorable long-term trends.

Which one has the stronger fundamentals?

Dominion Energy exhibits stronger margin stability and more robust net income growth, despite some pressure from interest expenses and slower revenue growth in the latest year. Consolidated Edison shows higher revenue growth and gross margin but faced recent declines in profitability and EPS. Both companies have favorable income statement evaluations, though Dominion’s margin improvements and earnings growth suggest comparatively stronger fundamentals.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Dominion Energy, Inc. (D) and Consolidated Edison, Inc. (ED) based on their most recent 2024 fiscal year data.

| Ratios | Dominion Energy, Inc. (D) | Consolidated Edison, Inc. (ED) |

|---|---|---|

| ROE | 7.79% | 8.29% |

| ROIC | 2.86% | 3.48% |

| P/E | 21.3 | 16.96 |

| P/B | 1.66 | 1.41 |

| Current Ratio | 0.71 | 1.04 |

| Quick Ratio | 0.52 | 0.96 |

| D/E (Debt-to-Equity) | 1.53 | 1.27 |

| Debt-to-Assets | 40.8% | 39.4% |

| Interest Coverage | 1.72 | 2.30 |

| Asset Turnover | 0.14 | 0.22 |

| Fixed Asset Turnover | 0.21 | 0.29 |

| Payout ratio | 105.4% | 60.4% |

| Dividend yield | 4.95% | 3.56% |

Interpretation of the Ratios

Dominion Energy, Inc.

Dominion Energy shows a mixed ratio profile with a favorable net margin of 14.69% and dividend yield at 4.95%, but weak returns on equity (7.79%) and invested capital (2.86%) raise concerns. The liquidity ratios are low, with a current ratio of 0.71 and quick ratio of 0.52, indicating potential short-term solvency challenges. Dividend payments appear solid, supported by stable yields, though coverage by free cash flow is negative, suggesting caution on sustainability.

Consolidated Edison, Inc.

Consolidated Edison exhibits solid net margin (11.93%) and a decent dividend yield of 3.56%, alongside favorable price-to-book and stable liquidity ratios near 1.0. However, returns on equity (8.29%) and invested capital (3.48%) remain below ideal levels, and debt-to-equity is somewhat high at 1.27. Dividend payments are supported but free cash flow yields are negative, indicating potential pressure on payout sustainability despite ongoing share buybacks.

Which one has the best ratios?

Both companies present slightly unfavorable overall ratio profiles, but Consolidated Edison holds a higher proportion of favorable metrics (28.57%) compared to Dominion Energy (21.43%), with better liquidity and valuation ratios. Dominion’s weaker liquidity and negative free cash flow coverage contrast with Con Edison’s stronger balance sheet, although both face challenges in profitability and capital returns.

Strategic Positioning

This section compares the strategic positioning of Dominion Energy, Inc. and Consolidated Edison, Inc. across Market position, Key segments, and Exposure to technological disruption:

Dominion Energy, Inc.

- Large regulated utility with 4 segments serving multiple states, facing moderate competitive pressure.

- Key revenue from Dominion Energy Virginia, South Carolina, Gas Distribution, and Contracted Energy segments.

- Operates regulated and nonregulated renewable energy assets; involved in LNG import, storage, and solar development.

Consolidated Edison, Inc.

- Regulated electric, gas, and steam delivery primarily in New York, with focused geographic exposure.

- Main drivers are electricity sales, oil and gas purchases, steam, plus non-utility products and services.

- Owns and develops renewable and energy infrastructure projects; invests in electric and gas transmission.

Dominion Energy, Inc. vs Consolidated Edison, Inc. Positioning

Dominion Energy exhibits a diversified utility portfolio across multiple states and energy types, while Consolidated Edison focuses on a concentrated metropolitan market with diverse product lines. Dominion’s broader asset base contrasts with Con Edison’s urban-centric operations, implying different scale and regional risk profiles.

Which has the best competitive advantage?

Both companies are currently shedding value relative to their cost of capital. Dominion Energy shows a slightly unfavorable moat with improving ROIC, while Consolidated Edison has a very unfavorable moat and declining profitability, indicating Dominion’s competitive advantage is marginally stronger.

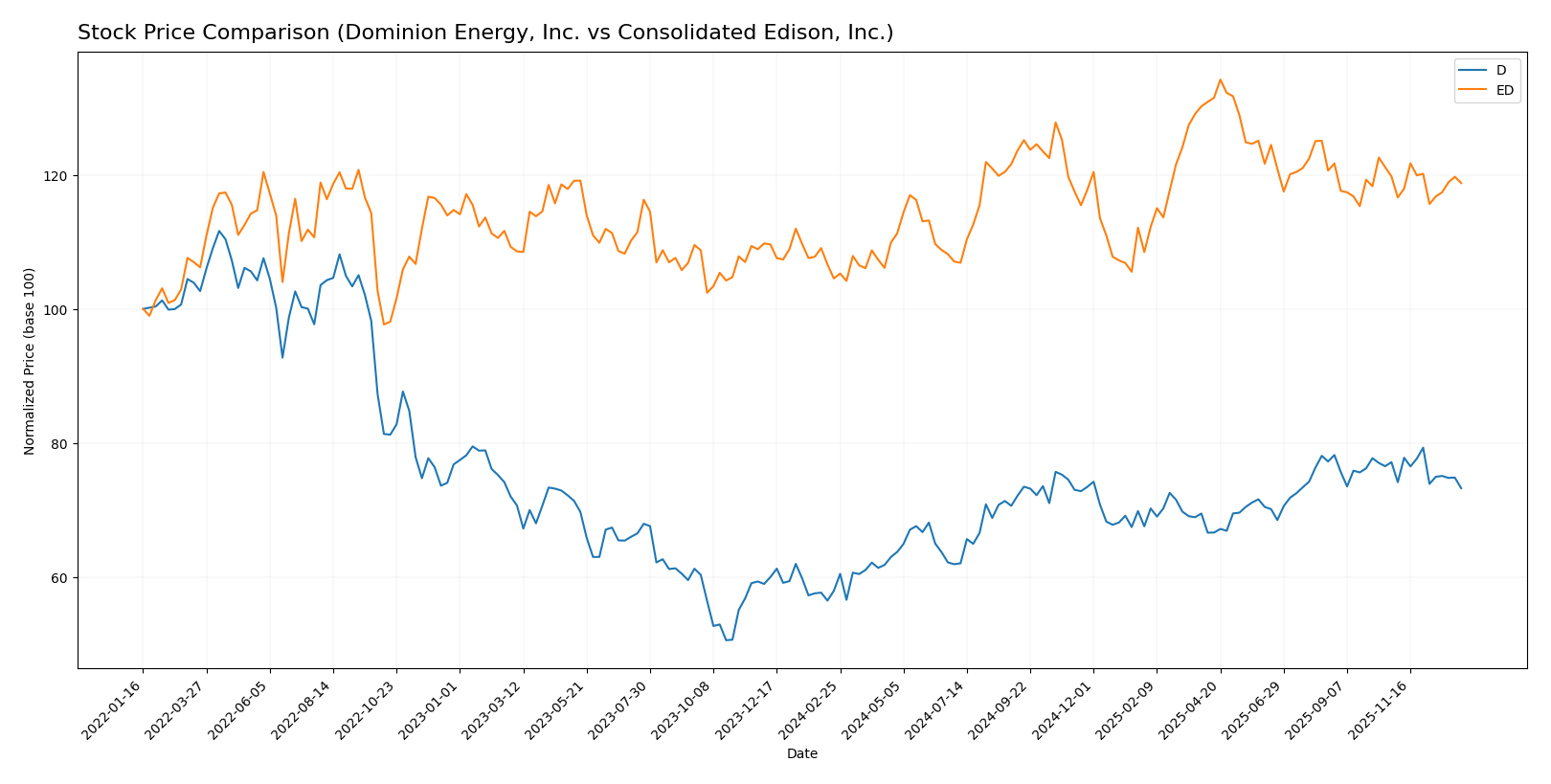

Stock Comparison

The stock price chart highlights significant gains for Dominion Energy, Inc. and Consolidated Edison, Inc. over the past year, with both exhibiting bullish trends but showing recent deceleration and slight downward corrections.

Trend Analysis

Dominion Energy, Inc. displayed a bullish trend over the past 12 months with a 26.43% price increase, though momentum slowed down. The stock ranged between 44.79 and 62.77, showing deceleration in its upward trajectory.

Consolidated Edison, Inc. also followed a bullish trend with a 13.62% rise over the year, accompanied by higher volatility (6.0 std dev). It experienced deceleration and a mild recent decline of 0.83%.

Dominion Energy outperformed Consolidated Edison with a stronger overall price gain, although both stocks showed decelerating growth and slight recent pullbacks.

Target Prices

The consensus target prices from recognized analysts indicate potential upside for both Dominion Energy, Inc. and Consolidated Edison, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Dominion Energy, Inc. | 70 | 63 | 66 |

| Consolidated Edison, Inc. | 106 | 86 | 99.86 |

Analysts expect Dominion Energy’s stock to rise approximately 14% from the current price of 57.98, while Consolidated Edison’s consensus target suggests a slight upside of about 0.65% from its current price of 99.21.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Dominion Energy, Inc. (D) and Consolidated Edison, Inc. (ED):

Rating Comparison

D Rating

- Rating: C+, considered Very Favorable overall by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation outlook.

- ROE Score: 3, a Moderate level of efficiency in generating profit from equity.

- ROA Score: 1, marked as Very Unfavorable for asset utilization efficiency.

- Debt To Equity Score: 3, Moderate financial risk with balanced debt levels.

- Overall Score: 2, reflecting a Moderate overall financial standing.

ED Rating

- Rating: B-, also rated Very Favorable overall by analysts.

- Discounted Cash Flow Score: 1, suggesting a Very Unfavorable valuation.

- ROE Score: 3, showing a similar Moderate efficiency in profit generation.

- ROA Score: 3, Moderate asset utilization efficiency.

- Debt To Equity Score: 2, also Moderate but slightly lower than D’s score.

- Overall Score: 2, equally Moderate overall financial standing.

Which one is the best rated?

Based strictly on the data, ED holds a higher rating of B- versus D’s C+, and shows better return on assets and a slightly better debt-to-equity score. However, D outperforms ED significantly in discounted cash flow score. Both have moderate overall scores.

Scores Comparison

Here is a comparison of the financial scores for Dominion Energy, Inc. and Consolidated Edison, Inc.:

Dominion Energy, Inc. Scores

- Altman Z-Score: Unavailable, no data provided.

- Piotroski Score: 7, indicating strong financial health.

Consolidated Edison, Inc. Scores

- Altman Z-Score: 1.19, in distress zone indicating high risk.

- Piotroski Score: 7, indicating strong financial health.

Which company has the best scores?

Consolidated Edison has a reported Altman Z-Score indicating financial distress, while Dominion Energy’s Altman Z-Score is unavailable. Both companies have an identical Piotroski Score of 7, reflecting strong financial health.

Grades Comparison

Here is a comparison of recent reliable grades from established grading companies for Dominion Energy, Inc. and Consolidated Edison, Inc.:

Dominion Energy, Inc. Grades

The table below summarizes Dominion Energy’s latest grades from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-12-17 |

| JP Morgan | Maintain | Underweight | 2025-12-11 |

| BMO Capital | Maintain | Market Perform | 2025-11-03 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-25 |

| JP Morgan | Maintain | Underweight | 2025-08-21 |

| JP Morgan | Maintain | Underweight | 2025-07-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-06-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-05-22 |

Dominion Energy’s grades show a mix of “Overweight,” “Equal Weight,” and “Underweight” ratings, with a consensus tending toward a “Hold” stance from analysts.

Consolidated Edison, Inc. Grades

The table below displays Consolidated Edison’s latest grades from recognized financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-07 |

| UBS | Maintain | Neutral | 2025-12-17 |

| Keybanc | Maintain | Underweight | 2025-12-12 |

| JP Morgan | Maintain | Underweight | 2025-12-12 |

| Barclays | Maintain | Underweight | 2025-11-10 |

| Barclays | Maintain | Underweight | 2025-10-22 |

| Morgan Stanley | Maintain | Underweight | 2025-10-22 |

| Barclays | Maintain | Underweight | 2025-10-21 |

| Keybanc | Maintain | Underweight | 2025-10-15 |

| Morgan Stanley | Maintain | Underweight | 2025-09-25 |

Consolidated Edison’s grades consistently lean toward “Underweight” or “Neutral,” with a consensus rating of “Hold” among analysts.

Which company has the best grades?

Dominion Energy has generally received more favorable grades, including several “Overweight” ratings, compared to Consolidated Edison’s persistent “Underweight” and “Neutral” grades. This difference may indicate relatively stronger analyst confidence in Dominion Energy’s outlook, potentially impacting investor sentiment and portfolio positioning.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Dominion Energy, Inc. (D) and Consolidated Edison, Inc. (ED) based on their latest financial and strategic data.

| Criterion | Dominion Energy, Inc. (D) | Consolidated Edison, Inc. (ED) |

|---|---|---|

| Diversification | Moderate: Focus on Virginia & South Carolina energy markets with some contracted energy | Moderate: Mainly electricity with oil, gas purchases, steam, and non-utility products |

| Profitability | Net margin 14.7% (favorable), but ROIC 2.9% below WACC, indicating value destruction | Net margin 11.9% (favorable), ROIC 3.5% also below WACC, with declining profitability |

| Innovation | Limited data on innovation; improving ROIC trend suggests operational improvements | Limited innovation, declining ROIC trend signals challenges in profitability growth |

| Global presence | Primarily regional US utility with no significant global footprint | Primarily regional US utility, limited global presence |

| Market Share | Strong presence in Virginia energy market, generating over $10B revenue | Leading in electricity segment with $10.8B revenue, diversified within utility-related services |

Key takeaways: Both companies operate largely in regional US utility markets with moderate diversification. Dominion Energy shows improving profitability trends despite value destruction, while Consolidated Edison faces declining profitability. Investors should weigh the slightly unfavorable moat and financial ratios carefully, focusing on risk management.

Risk Analysis

Below is a comparative risk table for Dominion Energy, Inc. (D) and Consolidated Edison, Inc. (ED) based on the most recent 2024 data:

| Metric | Dominion Energy, Inc. (D) | Consolidated Edison, Inc. (ED) |

|---|---|---|

| Market Risk | Beta 0.70 (moderate volatility) | Beta 0.38 (low volatility) |

| Debt level | Debt-to-Equity 1.53 (elevated) | Debt-to-Equity 1.27 (high but lower) |

| Regulatory Risk | High, due to extensive regulated operations in multiple states | High, with large NYC and NY metro exposure |

| Operational Risk | Moderate; large infrastructure with diverse assets | Moderate; aging urban infrastructure challenges |

| Environmental Risk | Growing, due to transition to renewables and gas operations | Significant, urban environmental regulations and transition risks |

| Geopolitical Risk | Low, primarily US operations | Low, primarily US operations |

Dominion Energy faces higher debt levels and operational complexity across several states, increasing financial and regulatory risk exposure. Consolidated Edison benefits from lower market volatility but must manage significant urban regulatory and environmental challenges. Both companies show moderate operational risks, with Dominion’s debt requiring cautious monitoring.

Which Stock to Choose?

Dominion Energy, Inc. (D) shows a slightly unfavorable financial ratios profile with 50% unfavorable indicators, including weak liquidity and asset turnover. Its income statement is favorable, with strong net margin growth and profitability, but it carries a moderate debt level and a growing yet value-destroying ROIC compared to WACC. The company holds a very favorable rating of C+.

Consolidated Edison, Inc. (ED) displays a slightly unfavorable ratios evaluation but with fewer negatives (35.7%) and more favorable metrics, including better liquidity and valuation ratios. The income statement is also favorable, though with recent margin and earnings declines. Its ROIC is declining and below WACC, indicating value destruction. The rating stands at a very favorable B-.

Investors prioritizing growth and improving profitability might find Dominion Energy’s improving income trends and rising ROIC appealing, despite its financial weaknesses. Conversely, more risk-averse or value-focused investors could perceive Consolidated Edison’s steadier ratios and stronger rating as preferable, notwithstanding its declining ROIC trend.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Dominion Energy, Inc. and Consolidated Edison, Inc. to enhance your investment decisions: