The Magnum Ice Cream Company N.V. (MICC) and Conagra Brands, Inc. (CAG) are two prominent players in the packaged foods industry, each with a distinct footprint and innovation approach. While Magnum specializes in premium ice cream products with a strong European base, Conagra operates a diverse portfolio of grocery and snack brands across North America. This article will explore their market positions and growth strategies to help you decide which company holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between The Magnum Ice Cream Company N.V. and Conagra Brands, Inc. by providing an overview of these two companies and their main differences.

The Magnum Ice Cream Company N.V. Overview

The Magnum Ice Cream Company N.V., based in Amsterdam, focuses exclusively on the ice cream segment within the packaged foods industry. Established recently with an IPO in December 2025, it positions itself as a specialized player in consumer defensive goods. With a market cap of approximately 9.3B USD and around 18,582 employees, Magnum aims to strengthen its presence in the frozen dessert niche.

Conagra Brands, Inc. Overview

Conagra Brands, headquartered in Chicago, is a diversified consumer packaged goods company operating since 1861. It serves multiple segments including grocery and snacks, refrigerated and frozen foods, international markets, and foodservice in North America. With a market cap near 7.98B USD and about 18,500 employees, Conagra offers a broad portfolio of well-known brands across various food categories, emphasizing a comprehensive market approach.

Key similarities and differences

Both companies operate in the packaged foods sector under the consumer defensive umbrella with comparable workforce sizes. Magnum Ice Cream is niche-focused on frozen desserts, while Conagra operates a diversified food portfolio across several segments and geographic markets. Conagra’s longer history and wider product range contrast with Magnum’s recent market entry and specialization, reflecting different strategic scopes within the industry.

Income Statement Comparison

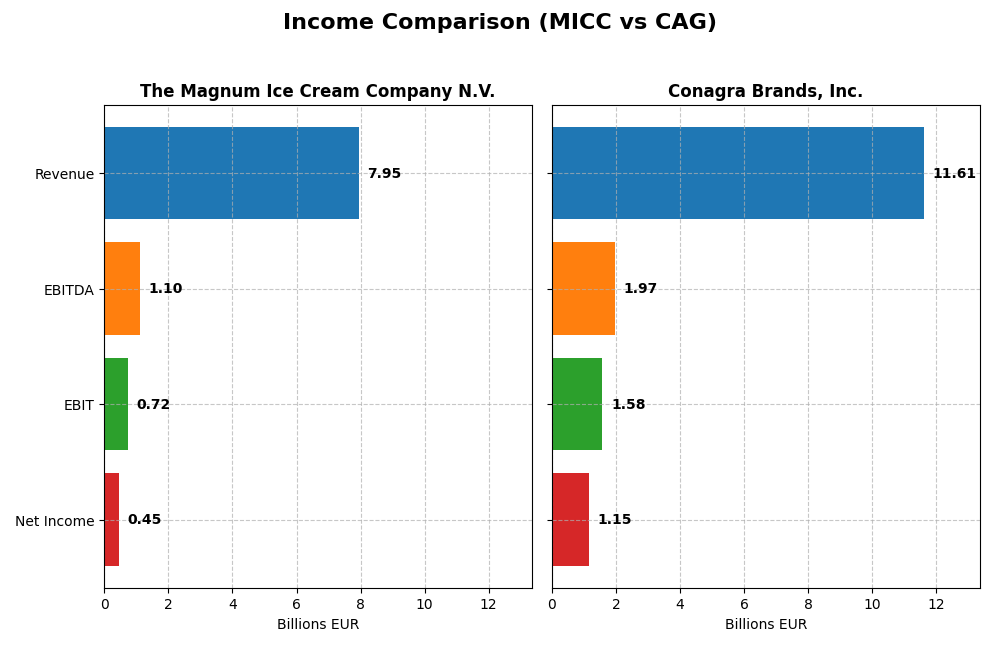

This table compares key income statement metrics for The Magnum Ice Cream Company N.V. (MICC) and Conagra Brands, Inc. (CAG) based on their most recent fiscal year data.

| Metric | The Magnum Ice Cream Company N.V. (MICC) | Conagra Brands, Inc. (CAG) |

|---|---|---|

| Market Cap | 9.3B EUR | 8.0B USD |

| Revenue | 7.95B EUR | 11.61B USD |

| EBITDA | 1.10B EUR | 1.97B USD |

| EBIT | 725M EUR | 1.58B USD |

| Net Income | 450M EUR | 1.15B USD |

| EPS | 0.74 EUR | 2.41 USD |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

The Magnum Ice Cream Company N.V.

The Magnum Ice Cream Company showed a moderate revenue increase of 4.32% in 2024, with overall revenue growth of 5.88% from 2022 to 2024. Despite a stable gross margin near 34.9%, net income declined by 11.59% over the period, pushing net margin down by 16.5%. The latest fiscal year saw slight EBIT growth but a negative trend in net margin and EPS, reflecting margin pressures and profitability challenges.

Conagra Brands, Inc.

Conagra experienced a slight revenue decrease of 3.64% in 2025, with a modest overall revenue growth of 3.83% since 2021. Gross margin remained favorable at 25.9%, while EBIT and net margins improved significantly in the last year, with EBIT growth of 50.55% and net margin growth exceeding 244%. Despite net income declining over the longer term, the recent performance indicates improved operational efficiency and earnings power.

Which one has the stronger fundamentals?

Conagra Brands displays stronger fundamentals with more favorable margin improvements and significant recent EBIT and net income growth, despite a slight revenue dip. The Magnum Ice Cream Company maintains a higher gross margin but faces declining net income and margin pressures. Overall, Conagra’s better margin expansion and earnings growth suggest more robust income statement fundamentals based on the current data.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for The Magnum Ice Cream Company N.V. (MICC) and Conagra Brands, Inc. (CAG), reflecting their fiscal year 2024 and 2025, respectively.

| Ratios | The Magnum Ice Cream Company N.V. (MICC) | Conagra Brands, Inc. (CAG) |

|---|---|---|

| ROE | 16.2% | 4.1% |

| ROIC | 16.4% | 2.6% |

| P/E | 19.6 | 41.7 |

| P/B | 3.18 | 1.72 |

| Current Ratio | 0.80 | 0.97 |

| Quick Ratio | 0.35 | 0.33 |

| D/E (Debt-to-Equity) | 0.068 | 1.03 |

| Debt-to-Assets | 3.4% | 41.5% |

| Interest Coverage | 5.18 | 1.96 |

| Asset Turnover | 1.44 | 0.58 |

| Fixed Asset Turnover | 3.37 | 4.16 |

| Payout Ratio | 2.4% | 190% |

| Dividend Yield | 0.12% | 4.5% |

Interpretation of the Ratios

The Magnum Ice Cream Company N.V.

The Magnum Ice Cream Company shows a favorable return on equity (16.2%) and return on invested capital (16.42%), indicating efficient capital use. However, its price-to-book ratio (3.18) and liquidity ratios are unfavorable, highlighting potential concerns in asset valuation and short-term liquidity. The company does not pay dividends, likely reflecting a reinvestment strategy or growth focus.

Conagra Brands, Inc.

Conagra Brands has a neutral net margin (9.92%) and return on equity (12.9%), with a favorable price-to-earnings ratio (9.3) and price-to-book ratio (1.2), suggesting reasonable valuation. Liquidity ratios are unfavorable, and debt levels are moderate with neutral coverage ratios. The company pays dividends, with a 6.25% yield, indicating shareholder returns supported but with some caution advised.

Which one has the best ratios?

The Magnum Ice Cream Company presents a higher proportion of favorable ratios (57.14%) compared to Conagra’s 28.57%, especially in profitability and capital efficiency metrics. Conagra benefits from better valuation ratios and dividend yield but has more neutral and unfavorable ratings overall. Therefore, Magnum’s ratios appear generally stronger, albeit with liquidity concerns for both.

Strategic Positioning

This section compares the strategic positioning of The Magnum Ice Cream Company N.V. (MICC) and Conagra Brands, Inc. (CAG) including market position, key segments, and exposure to technological disruption:

The Magnum Ice Cream Company N.V. (MICC)

- Focused ice cream business with a strong market presence in packaged foods, facing typical industry competition.

- Concentrates on ice cream products within the consumer defensive sector and packaged foods industry.

- No explicit data on technological disruption exposure or innovation impact provided.

Conagra Brands, Inc. (CAG)

- Diversified packaged foods company with multiple segments and broad competitive pressures in North America.

- Operates four key segments: Grocery & Snacks, Refrigerated & Frozen, International, and Foodservice.

- No explicit data on technological disruption exposure or innovation impact provided.

MICC vs CAG Positioning

MICC pursues a concentrated strategy focused exclusively on ice cream products, while CAG adopts a diversified approach across multiple food segments. MICC’s narrower focus may limit scale but enhances specialization. CAG’s diversity spreads risk but faces complexity in segment management.

Which has the best competitive advantage?

MICC shows a favorable moat with stable profitability and strong value creation, while CAG has a slightly favorable moat but a declining ROIC trend, indicating less sustainable competitive advantage over time.

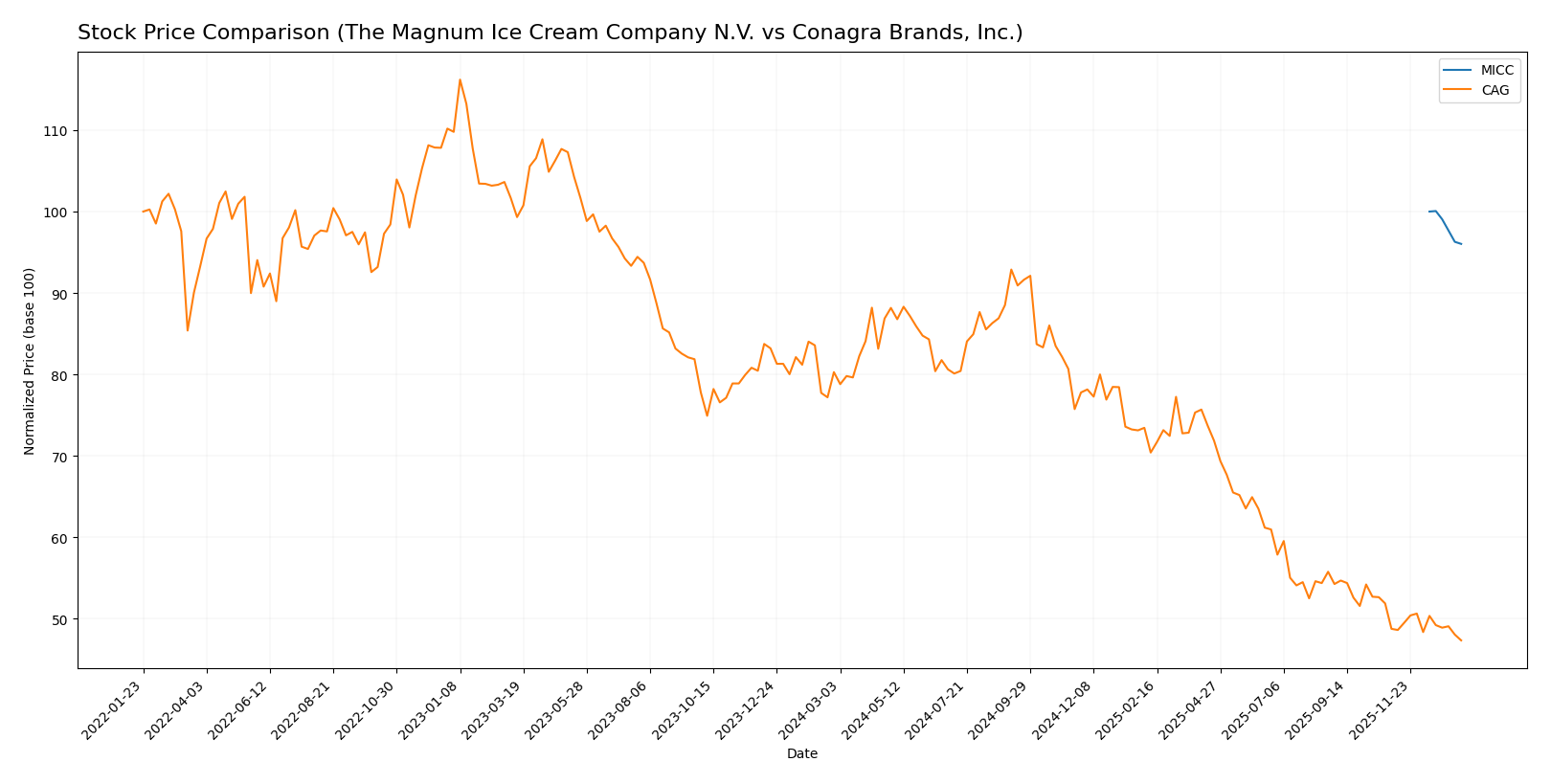

Stock Comparison

The stock price movements of The Magnum Ice Cream Company N.V. (MICC) and Conagra Brands, Inc. (CAG) over the past year reveal distinct bearish trends with differing volatility and trading volume dynamics.

Trend Analysis

The Magnum Ice Cream Company N.V. (MICC) experienced a -3.97% price decline over the past 12 months, indicating a bearish trend with stable acceleration and low volatility (0.26 std deviation). The stock traded between highs of 15.88 and lows of 15.24.

Conagra Brands, Inc. (CAG) showed a more pronounced bearish trend with a -41.02% price drop over the same period, accompanied by accelerating decline and higher volatility (4.93 std deviation). Price ranged from 32.74 down to 16.69.

Comparing the two, MICC delivered a less severe decline than CAG, marking it as the better-performing stock in terms of price retention during the analyzed period.

Target Prices

Here is the current target price consensus for The Magnum Ice Cream Company N.V. and Conagra Brands, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Magnum Ice Cream Company N.V. | 16 | 16 | 16 |

| Conagra Brands, Inc. | 22 | 16 | 18.6 |

Analysts expect The Magnum Ice Cream Company’s price to hold steady near $16, slightly above its current $15.24. Conagra’s consensus target of $18.6 indicates moderate upside from its $16.68 market price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for The Magnum Ice Cream Company N.V. (MICC) and Conagra Brands, Inc. (CAG):

Rating Comparison

MICC Rating

- Rating: B- indicating a very favorable overall financial standing.

- Discounted Cash Flow Score: 1, very unfavorable, suggesting potential overvaluation concerns.

- ROE Score: 5, very favorable, showing efficient profit generation from equity.

- ROA Score: 4, favorable, reflecting effective asset utilization.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk.

- Overall Score: 3, moderate overall financial health.

CAG Rating

- Rating: B- indicating a very favorable overall financial standing.

- Discounted Cash Flow Score: 5, very favorable, implying undervaluation potential.

- ROE Score: 1, very unfavorable, indicating low efficiency in profit generation from equity.

- ROA Score: 1, very unfavorable, showing poor asset utilization.

- Debt To Equity Score: 2, moderate, suggesting relatively better financial stability.

- Overall Score: 2, moderate overall financial health.

Which one is the best rated?

Both MICC and CAG share the same overall rating of B-, classified as very favorable. MICC excels in ROE and ROA, while CAG leads in discounted cash flow and debt-to-equity scores. Overall, MICC has stronger profitability metrics, whereas CAG shows better valuation and financial stability scores.

Scores Comparison

The scores comparison between The Magnum Ice Cream Company N.V. (MICC) and Conagra Brands, Inc. (CAG) is as follows:

MICC Scores

- Altman Z-Score: No data available

- Piotroski Score: No data available

CAG Scores

- Altman Z-Score: 1.48, in the distress zone indicating financial risk

- Piotroski Score: 3, classified as very weak financial strength

Which company has the best scores?

Based on the available data, only CAG’s scores are provided, showing financial distress and very weak strength. MICC’s scores are not available for comparison.

Grades Comparison

Here is a comparison of the latest available grades for The Magnum Ice Cream Company N.V. and Conagra Brands, Inc.:

The Magnum Ice Cream Company N.V. Grades

No reliable grades are available from verifiable grading companies for The Magnum Ice Cream Company N.V. This absence of data implies uncertainty and requires cautious risk management.

Conagra Brands, Inc. Grades

The table below summarizes recent grades from reputable financial institutions for Conagra Brands, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-05 |

| UBS | Maintain | Neutral | 2025-12-23 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-22 |

| Deutsche Bank | Maintain | Hold | 2025-12-22 |

| RBC Capital | Maintain | Sector Perform | 2025-12-22 |

| Evercore ISI Group | Maintain | In Line | 2025-12-22 |

| TD Cowen | Maintain | Hold | 2025-12-22 |

| B of A Securities | Maintain | Underperform | 2025-12-22 |

| JP Morgan | Maintain | Neutral | 2025-12-16 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-12 |

The overall consensus for Conagra Brands, Inc. is “Hold,” reflecting a mixed but generally cautious outlook among analysts.

Which company has the best grades?

Conagra Brands, Inc. has received multiple reliable grades mostly ranging from Hold to Equal Weight, indicating moderate confidence from analysts. The Magnum Ice Cream Company N.V. lacks publicly available grading data, which may increase uncertainty for investors considering its stock.

Strengths and Weaknesses

Below is a comparison of The Magnum Ice Cream Company N.V. (MICC) and Conagra Brands, Inc. (CAG) based on key criteria relevant for investors.

| Criterion | The Magnum Ice Cream Company N.V. (MICC) | Conagra Brands, Inc. (CAG) |

|---|---|---|

| Diversification | Focused on ice cream products; limited diversification | Broad product range: Foodservice, Grocery & Snacks, International, Refrigerated & Frozen segments |

| Profitability | ROIC 16.4%, ROE 16.2%, net margin 5.66% (favorable overall) | ROIC 7.36%, ROE 12.9%, net margin 9.92% (neutral to slightly favorable) |

| Innovation | Stable profitability with favorable ROIC vs WACC; moderate innovation implied | Slightly declining ROIC trend suggests innovation or efficiency challenges |

| Global presence | Limited international exposure | Significant global footprint with nearly $1B international revenue in 2025 |

| Market Share | Strong in its niche with stable returns | Large market share in multiple food segments, but competitive pressures affect margins |

Key takeaways: MICC excels in profitability and capital efficiency within a focused niche, offering stable but limited diversification. CAG provides broader market exposure and product diversification but faces challenges with declining profitability trends. Investors should weigh MICC’s strong value creation against CAG’s diversified but slightly less stable growth.

Risk Analysis

Below is a comparative table highlighting key risks for The Magnum Ice Cream Company N.V. (MICC) and Conagra Brands, Inc. (CAG) based on the most recent data from 2025–2026:

| Metric | The Magnum Ice Cream Company N.V. (MICC) | Conagra Brands, Inc. (CAG) |

|---|---|---|

| Market Risk | Moderate (Beta 0, niche ice cream market) | Moderate (Beta -0.014, diverse products) |

| Debt Level | Low (Debt-to-Equity 0.07, favorable) | High (Debt-to-Equity 0.93, neutral) |

| Regulatory Risk | Moderate (EU food regulations) | Moderate (US and international regulations) |

| Operational Risk | Moderate (new IPO, integration risks) | Moderate (complex supply chain) |

| Environmental Risk | Moderate (consumer pressure on sustainability) | Moderate (sustainability initiatives ongoing) |

| Geopolitical Risk | Moderate (European base, global supply) | Moderate to High (US base, international exposure) |

In synthesis, MICC’s main risks relate to its recent IPO and relatively weak liquidity ratios, despite low debt and solid profitability. CAG faces higher financial leverage and geopolitical exposure, with moderate operational risks due to its broad product segments. Investors should closely monitor debt management and regulatory developments for both companies, as these factors present the most likely and impactful risks for their financial stability and growth potential.

Which Stock to Choose?

The Magnum Ice Cream Company N.V. (MICC) shows a stable income with a 4.32% revenue growth in 2024, favorable profitability ratios such as a 16.2% ROE and 16.42% ROIC, low debt levels (net debt to EBITDA at 0.11), and a very favorable rating of B-. However, its income statement trend is mostly unfavorable due to declining net margin and EPS.

Conagra Brands, Inc. (CAG) reports a mixed income evolution with a slight revenue decline of -3.64% in 2025 but marked improvements in EBIT and net margin growth. Its financial ratios are slightly favorable overall with moderate debt levels (net debt to EBITDA at 4.19), a 12.9% ROE, and a slightly favorable rating of B-. The company’s MOAT is slightly favorable but shows a declining ROIC trend.

For investors prioritizing stable profitability and financial health, MICC’s favorable ROE, ROIC, and low leverage might appear more attractive. Conversely, those focused on growth potential and recent operational improvements may find CAG’s income growth and rating slightly favorable despite higher debt and declining ROIC. Each profile could interpret these metrics differently based on risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Magnum Ice Cream Company N.V. and Conagra Brands, Inc. to enhance your investment decisions: