In the dynamic industrial sector, Hyster-Yale Materials Handling, Inc. (HY) and Columbus McKinnon Corporation (CMCO) stand out as key players specializing in material handling and machinery. Both companies innovate to meet evolving market demands, with HY focusing on lift trucks and hydrogen fuel-cell technology, while CMCO excels in intelligent motion solutions and crane systems. This comparison will help investors identify which company offers the most compelling opportunity in this competitive space.

Table of contents

Companies Overview

I will begin the comparison between Hyster-Yale Materials Handling, Inc. and Columbus McKinnon Corporation by providing an overview of these two companies and their main differences.

Hyster-Yale Materials Handling Overview

Hyster-Yale Materials Handling, Inc. designs, engineers, manufactures, sells, and services lift trucks, attachments, and aftermarket parts worldwide. It operates primarily under the Hyster and Yale brand names, serving various sectors including manufacturing, trucking, and government agencies. Headquartered in Cleveland, Ohio, the company focuses on both light and heavy machinery markets, including hydrogen fuel-cell technology, with a workforce of 8,500 employees.

Columbus McKinnon Corporation Overview

Columbus McKinnon Corporation specializes in intelligent motion solutions for material handling, including hoists, cranes, rigging equipment, and power and motion technology products. Serving diverse industries such as transportation, energy, and e-commerce, it distributes products directly and through various partners. Founded in 1875 and based in Buffalo, New York, Columbus McKinnon employs approximately 3,515 people and emphasizes ergonomic and automated lifting technologies.

Key similarities and differences

Both companies operate within the industrial sector, focusing on material handling and agricultural machinery, but with distinct product ranges and market approaches. Hyster-Yale emphasizes lift trucks and attachments with a strong aftermarket presence, while Columbus McKinnon offers a broader spectrum of motion and lifting solutions, including automation components. Despite similar sector exposure, their customer bases and specific technologies reflect different strategic priorities and operational scales.

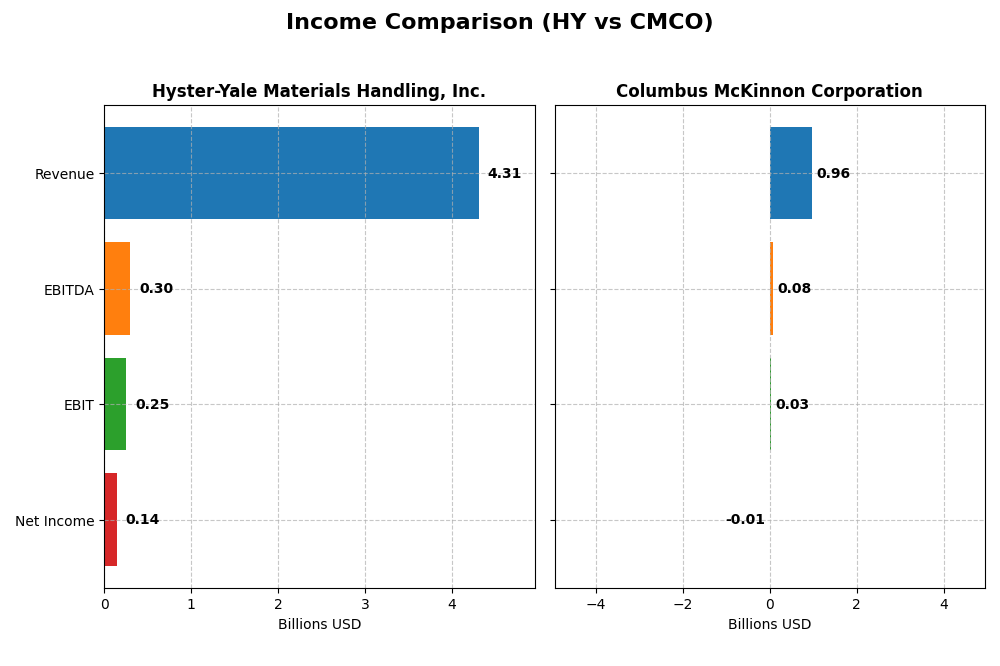

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Hyster-Yale Materials Handling, Inc. and Columbus McKinnon Corporation based on their most recent fiscal year data.

| Metric | Hyster-Yale Materials Handling, Inc. (HY) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Market Cap | 579M | 554M |

| Revenue | 4.31B | 963M |

| EBITDA | 300M | 75M |

| EBIT | 253M | 27M |

| Net Income | 142M | -5.14M |

| EPS | 8.16 | -0.18 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Hyster-Yale Materials Handling, Inc.

Hyster-Yale demonstrated a strong upward trend in revenue, increasing by 53.2% from 2020 to 2024, with net income surging 283.56%. Gross and net margins improved significantly, reflecting operational efficiency gains. In 2024, revenue grew 4.61% and net margin increased 8.04%, while EBIT advanced 15.8%, signaling solid profitability enhancement despite slightly higher operating expenses.

Columbus McKinnon Corporation

Columbus McKinnon showed a 48.24% revenue increase over the period but suffered net income decline of 156.42%, with net margins turning negative. The latest year saw a 4.98% revenue drop and sharp deteriorations in gross profit (-13.11%) and EBIT (-72.94%). Net margin and EPS also declined substantially, reflecting profitability challenges and higher interest burdens relative to revenues.

Which one has the stronger fundamentals?

Hyster-Yale’s income statement reveals favorable growth and margin improvements, supported by positive EPS trends and controlled interest expenses. In contrast, Columbus McKinnon faces unfavorable profitability metrics, declining net income, and negative net margins despite revenue growth. Thus, Hyster-Yale exhibits stronger fundamentals in terms of income statement performance and stability.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Hyster-Yale Materials Handling, Inc. (HY) and Columbus McKinnon Corporation (CMCO) based on the most recent fiscal year data available.

| Ratios | Hyster-Yale Materials Handling, Inc. (HY) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| ROE | 29.95% | -0.58% |

| ROIC | 13.59% | 3.30% |

| P/E | 6.24 | -94.69 |

| P/B | 1.87 | 0.55 |

| Current Ratio | 1.35 | 1.81 |

| Quick Ratio | 0.64 | 1.04 |

| D/E (Debt to Equity) | 1.14 | 0.61 |

| Debt-to-Assets | 26.70% | 31.09% |

| Interest Coverage | 7.24 | 1.68 |

| Asset Turnover | 2.12 | 0.55 |

| Fixed Asset Turnover | 14.05 | 9.07 |

| Payout Ratio | 16.87% | -156.52% |

| Dividend Yield | 2.70% | 1.65% |

Interpretation of the Ratios

Hyster-Yale Materials Handling, Inc.

Hyster-Yale shows a generally favorable ratio profile with strong returns on equity (29.95%) and invested capital (13.59%), supported by a low weighted average cost of capital (7.99%). However, concerns arise from a weak net margin (3.3%) and unfavorable leverage ratios like debt to equity at 1.14. The company pays a dividend with a 2.7% yield, reflecting sustainable shareholder returns without excessive payout risk.

Columbus McKinnon Corporation

Columbus McKinnon presents mixed ratios, with unfavorable net margin (-0.53%) and return on equity (-0.58%), indicating operational challenges. Positive points include a strong current ratio (1.81) and a price-to-book ratio of 0.55. The dividend yield stands at 1.65%, but coverage may be a concern given negative profitability and interest coverage below 1, signaling financial strain.

Which one has the best ratios?

Hyster-Yale exhibits a more favorable ratio set overall, with stronger profitability and return metrics, despite some leverage concerns. Columbus McKinnon’s ratios are less robust, weighed down by negative returns and weak interest coverage. Consequently, Hyster-Yale’s financial ratios appear relatively stronger in this comparison based on the provided data.

Strategic Positioning

This section compares the strategic positioning of Hyster-Yale (HY) and Columbus McKinnon (CMCO) in terms of market position, key segments, and exposure to technological disruption:

Hyster-Yale (HY)

- Mid-sized player with 578M market cap facing industrial competition.

- Focuses on lift trucks, attachments, aftermarket parts, and hydrogen fuel-cell technology.

- Invests in hydrogen fuel-cell stacks and rough terrain forklifts, indicating some tech innovation.

Columbus McKinnon (CMCO)

- Similar market cap at 554M, competing in industrial machinery.

- Diverse product lines including hoists, cranes, conveyors, and power control systems.

- Offers automation and diagnostics in power/motion technology, with some custom engineered products.

Hyster-Yale vs Columbus McKinnon Positioning

HY has a more concentrated focus on lift trucks and related equipment, with added emphasis on hydrogen fuel cells, while CMCO pursues a diversified portfolio across motion solutions, hoists, and conveyor systems catering to various industrial sectors. HY’s approach centers on specialized products, CMCO spreads risk across broader markets.

Which has the best competitive advantage?

HY demonstrates a very favorable moat with growing ROIC above WACC, indicating durable competitive advantage and value creation. CMCO shows a slightly unfavorable moat with ROIC below WACC despite improving profitability, suggesting weaker competitive positioning.

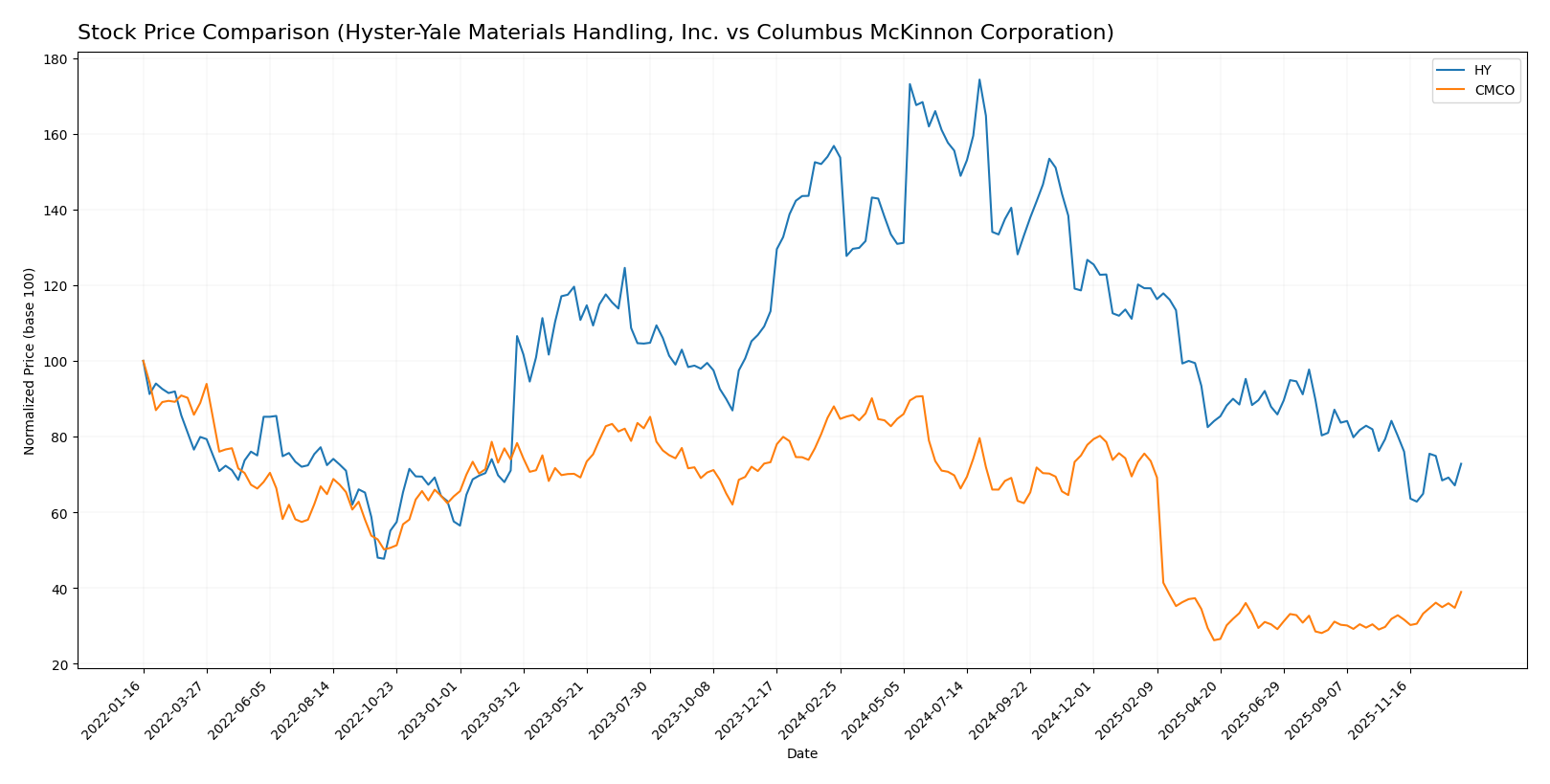

Stock Comparison

The past year has seen both Hyster-Yale Materials Handling, Inc. and Columbus McKinnon Corporation experience significant price declines, with recent divergent trading dynamics indicating differing short-term momentum.

Trend Analysis

Hyster-Yale Materials Handling, Inc. shows a bearish trend over the past 12 months with a price decline of -53.58%, marked by accelerating downside and a volatility measure (std deviation) of 13.78. The stock reached a high of 78.14 and a low of 28.15.

Columbus McKinnon Corporation also displays a bearish trend for the year with a -55.75% price drop and accelerating negative momentum. Its volatility is slightly lower at 11.22, with price extremes between 44.9 and 12.96. However, recent months show a bullish momentum with a 22.41% gain.

Comparing both stocks, Columbus McKinnon Corporation delivered the highest recent market performance, reversing the longer-term downtrend, unlike Hyster-Yale, which continues to decline.

Target Prices

Analysts present clear target price consensus for Hyster-Yale Materials Handling, Inc. and Columbus McKinnon Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Hyster-Yale Materials Handling, Inc. | 40 | 40 | 40 |

| Columbus McKinnon Corporation | 50 | 48 | 49 |

The consensus target prices for HY and CMCO are above their current stock prices of $32.63 and $19.28, indicating moderate upside potential according to analysts’ estimates.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Hyster-Yale Materials Handling, Inc. (HY) and Columbus McKinnon Corporation (CMCO):

Rating Comparison

HY Rating

- Rating: C, considered Very Favorable

- Discounted Cash Flow Score: 1, rated Very Unfavorable

- ROE Score: 1, rated Very Unfavorable

- ROA Score: 2, rated Moderate

- Debt To Equity Score: 2, rated Moderate

- Overall Score: 2, rated Moderate

CMCO Rating

- Rating: B, considered Very Favorable

- Discounted Cash Flow Score: 5, rated Very Favorable

- ROE Score: 1, rated Very Unfavorable

- ROA Score: 2, rated Moderate

- Debt To Equity Score: 2, rated Moderate

- Overall Score: 3, rated Moderate

Which one is the best rated?

Based strictly on the data, CMCO holds a higher rating (B) and a better overall score (3) compared to HY’s rating (C) and overall score (2). CMCO notably outperforms HY in discounted cash flow, indicating a stronger valuation perspective.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

HY Scores

- Altman Z-Score: 2.70, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 5, classified as average financial strength.

CMCO Scores

- Altman Z-Score: 1.40, in the distress zone signaling high bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial strength.

Which company has the best scores?

HY has a higher Altman Z-Score suggesting lower bankruptcy risk, while CMCO shows a much stronger Piotroski Score indicating superior financial strength. Each excels in a different metric based on the provided data.

Grades Comparison

The following is a comparison of recent reliable grades for Hyster-Yale Materials Handling, Inc. and Columbus McKinnon Corporation:

Hyster-Yale Materials Handling, Inc. Grades

Summary of recent grades from verified grading companies for Hyster-Yale Materials Handling, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth MKM | Maintain | Buy | 2024-11-06 |

| Roth MKM | Maintain | Buy | 2024-08-08 |

| Roth MKM | Maintain | Buy | 2024-06-07 |

| Northland Capital Markets | Upgrade | Outperform | 2024-06-05 |

| Northland Capital Markets | Downgrade | Market Perform | 2024-05-10 |

| Roth MKM | Maintain | Buy | 2024-05-09 |

| EF Hutton | Maintain | Buy | 2023-05-04 |

| EF Hutton | Maintain | Buy | 2023-05-03 |

| EF Hutton | Maintain | Buy | 2023-03-01 |

| EF Hutton | Maintain | Buy | 2022-03-02 |

The grades for Hyster-Yale show a consistent Buy rating from Roth MKM and EF Hutton, with some fluctuations between Market Perform and Outperform from Northland Capital Markets.

Columbus McKinnon Corporation Grades

Summary of recent grades from verified grading companies for Columbus McKinnon Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Downgrade | Neutral | 2025-02-11 |

| DA Davidson | Maintain | Buy | 2024-02-05 |

| DA Davidson | Maintain | Buy | 2022-10-04 |

| DA Davidson | Maintain | Buy | 2022-10-03 |

| Barrington Research | Maintain | Outperform | 2022-07-29 |

| Barrington Research | Maintain | Outperform | 2022-07-28 |

| JP Morgan | Downgrade | Neutral | 2022-05-26 |

| Barrington Research | Maintain | Outperform | 2022-05-26 |

| Barrington Research | Maintain | Outperform | 2022-05-25 |

| JP Morgan | Downgrade | Neutral | 2022-05-25 |

Columbus McKinnon has seen multiple downgrades to Neutral from DA Davidson and JP Morgan since 2022, though Barrington Research has consistently maintained Outperform ratings.

Which company has the best grades?

Both companies have a consensus Buy rating; however, Hyster-Yale’s grades show greater stability with consistent Buy ratings and fewer downgrades. Columbus McKinnon’s grades display more volatility, with recent downgrades to Neutral potentially indicating increased caution among analysts. This difference could affect investor sentiment and risk assessment.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Hyster-Yale Materials Handling, Inc. (HY) and Columbus McKinnon Corporation (CMCO), based on recent financial and operational data.

| Criterion | Hyster-Yale Materials Handling, Inc. (HY) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Diversification | Moderate product range centered on lift trucks and attachments; steady growth in other segments | More diversified product portfolio across hoists, conveyors, cranes, and power control systems |

| Profitability | Favorable ROIC of 13.6%, strong ROE near 30%, but low net margin (3.3%) | Low profitability with negative net margin (-0.53%) and negative ROE; ROIC below WACC indicating value destruction |

| Innovation | Demonstrates durable competitive advantage with growing ROIC and investment in technology segments like Bolzoni and Nuvera | ROIC improving but still below cost of capital; innovation impact moderate with focus on engineered products and digital controls |

| Global presence | Strong presence globally with significant revenue from lift truck business and international segments like JAPIC and Bolzoni | Global footprint with varied industrial product lines, but less dominant market share internationally |

| Market Share | Solid market share in material handling equipment, supported by high asset turnover | Smaller market share in niche industrial lifting and conveyor markets; lower asset turnover |

Key takeaways: Hyster-Yale (HY) stands out with a durable competitive advantage supported by strong profitability and asset efficiency, despite some margin pressure. Columbus McKinnon (CMCO) shows improving trends but remains a riskier choice with negative profitability metrics and slower growth in capital returns. Caution is advised when considering CMCO for investment.

Risk Analysis

Below is a comparative risk assessment for Hyster-Yale Materials Handling, Inc. (HY) and Columbus McKinnon Corporation (CMCO) based on the most recent 2024 data.

| Metric | Hyster-Yale Materials Handling, Inc. (HY) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Market Risk | Beta 1.44 indicates higher volatility | Beta 1.29, moderately volatile |

| Debt level | Debt-to-Equity 1.14 (unfavorable) | Debt-to-Equity 0.61 (neutral) |

| Regulatory Risk | Moderate; industrial sector compliance | Moderate; industrial manufacturing |

| Operational Risk | Moderate; diverse product lines and global supply chains | Moderate; complex product range and global presence |

| Environmental Risk | Growing pressure for cleaner energy solutions, some hydrogen fuel-cell production exposure | Moderate; manufacturing impact and energy use |

| Geopolitical Risk | Exposure to international markets and trade policies | Similar exposure to global markets and supply chains |

The most impactful risks center on operational complexity and market volatility. HY’s higher beta and debt-to-equity ratio pose greater market and financial risks, while CMCO’s distress zone Altman Z-score signals potential financial instability despite a strong Piotroski score. Investors should weigh HY’s financial leverage cautiously and monitor CMCO’s bankruptcy risk indicators closely.

Which Stock to Choose?

Hyster-Yale Materials Handling, Inc. (HY) shows a favorable income evolution with 53.2% revenue growth over 2020-2024 and strong profitability metrics, including a 29.95% ROE and 13.59% ROIC above WACC. Debt levels are moderate and financial ratios are mostly favorable, supporting a very favorable rating.

Columbus McKinnon Corporation (CMCO) exhibits an unfavorable income trend with declining net income and margins, despite 48.24% revenue growth overall. Financial ratios reveal weaker profitability, a higher net debt to EBITDA, and mixed ratings, resulting in a slightly favorable moat status and a very favorable overall rating.

Investors seeking durable value creation and strong profitability might find HY’s metrics and growing ROIC more compelling, while those focused on potential turnaround opportunities or with higher risk tolerance could view CMCO’s improving ROIC trend and recent price recovery as noteworthy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Hyster-Yale Materials Handling, Inc. and Columbus McKinnon Corporation to enhance your investment decisions: