Home > Comparison > Consumer Defensive > CL vs CLX

The strategic rivalry between Colgate-Palmolive Company and The Clorox Company shapes the competitive landscape of the Household & Personal Products sector. Colgate-Palmolive operates as a diversified consumer products manufacturer with a focus on oral care and pet nutrition. In contrast, Clorox emphasizes health, wellness, and lifestyle segments with a leaner operational footprint. This analysis aims to identify which company presents a superior risk-adjusted return, guiding portfolio decisions in the defensive consumer space.

Table of contents

Companies Overview

Colgate-Palmolive and The Clorox Company stand as key players in the global household and personal products market.

Colgate-Palmolive Company: Global Consumer Products Leader

Colgate-Palmolive dominates through its Oral, Personal, and Home Care segment, offering toothpaste, soaps, and shampoos under iconic brands like Colgate and Palmolive. Its Pet Nutrition segment adds a strategic diversification with Hill’s Science Diet. In 2026, it focuses on expanding eCommerce and strengthening its oral health pharmaceutical lines to drive growth.

The Clorox Company: Diversified Household & Wellness Innovator

Clorox operates across four segments—Health and Wellness, Household, Lifestyle, and International—marketing cleaning, food, and personal care products under brands like Clorox, Glad, and Burt’s Bees. Its strategy in 2026 centers on innovation in health products and international expansion, leveraging a broad portfolio to capture multiple consumer needs globally.

Strategic Collision: Similarities & Divergences

Both companies compete in the household and personal products space but diverge sharply in business philosophy. Colgate-Palmolive leans on a focused brand portfolio with deep market penetration, while Clorox pursues a diversified, multi-segment approach. Their battleground is innovation and global retail presence. Investors face distinct profiles: Colgate offers scale and stability; Clorox provides diversity with growth potential.

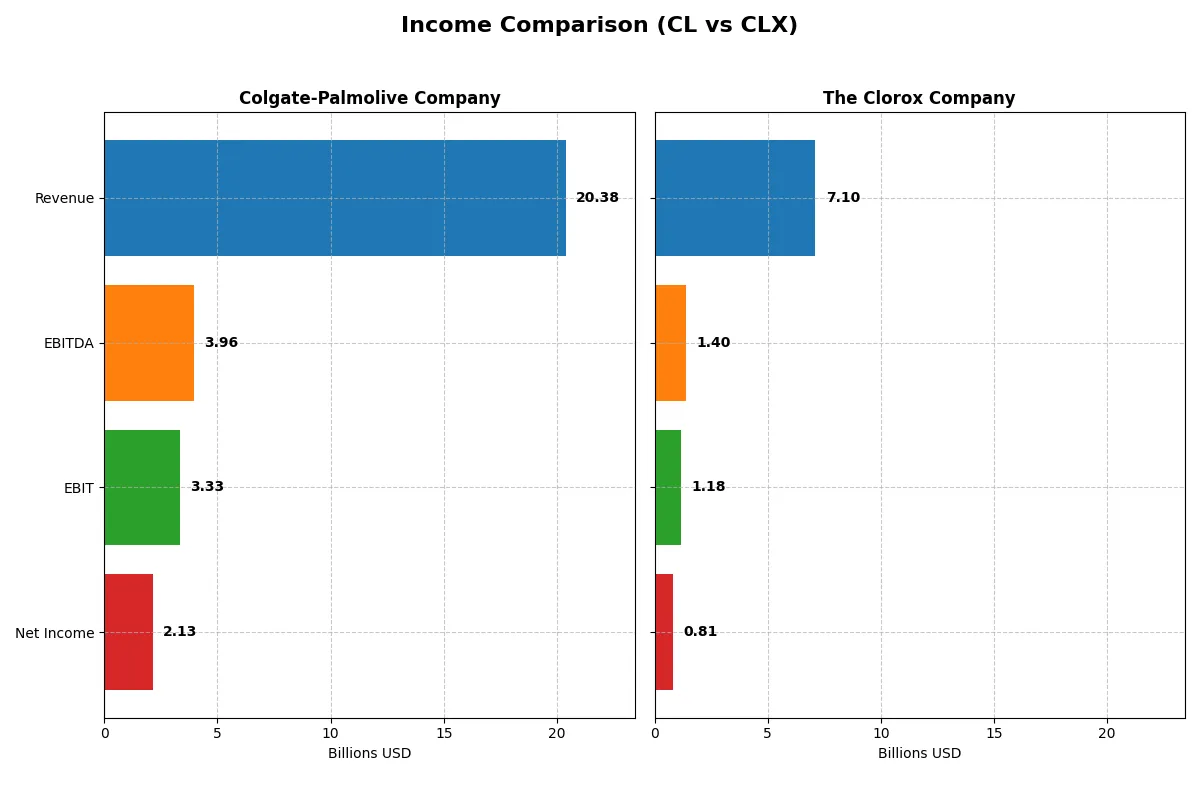

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Colgate-Palmolive Company (CL) | The Clorox Company (CLX) |

|---|---|---|

| Revenue | 20.4B | 7.1B |

| Cost of Revenue | 8.1B | 3.9B |

| Operating Expenses | 7.9B | 2.0B |

| Gross Profit | 12.3B | 3.2B |

| EBITDA | 4.0B | 1.4B |

| EBIT | 3.3B | 1.2B |

| Interest Expense | 0.3B | 0.1B |

| Net Income | 2.1B | 0.8B |

| EPS | 2.64 | 6.56 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with greater efficiency and profitability in their core business engines.

Colgate-Palmolive Company Analysis

Colgate-Palmolive’s revenue grew steadily to $20.4B in 2025 but net income declined to $2.13B. Its gross margin remains strong at 60.1%, yet net margin dropped to 10.5%. The latest year shows weakening profitability and shrinking EBIT by 21.7%, signaling margin pressure despite stable top-line growth.

The Clorox Company Analysis

Clorox’s revenue held flat near $7.1B in 2025 while net income surged to $810M. Its gross margin at 45.0% is lower than Colgate’s but EBIT margin improved to 16.6%. Clorox posted remarkable net margin growth of 188.8% last year, reflecting improved operational leverage and a sharp rebound in bottom-line momentum.

Margin Resilience vs. Earnings Momentum

Colgate-Palmolive commands higher gross margins but faces declining net income and deteriorating profitability trends. Clorox operates with slimmer margins but demonstrates robust earnings growth and improving net margin. Clorox’s profile offers stronger recent momentum, while Colgate’s scale and margin base appeal to investors prioritizing steady cash flow.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | Colgate-Palmolive Company (CL) | The Clorox Company (CLX) |

|---|---|---|

| ROE | 13.63% | 2.52% |

| ROIC | 30.56% | 24.14% |

| P/E | 25.73 | 18.31 |

| P/B | 350.65 | 46.20 |

| Current Ratio | 0.92 | 0.84 |

| Quick Ratio | 0.58 | 0.57 |

| D/E (Debt-to-Equity) | 40.15 | 8.97 |

| Debt-to-Assets | 53.05% | 51.79% |

| Interest Coverage | 15.01 | 11.67 |

| Asset Turnover | 1.25 | 1.28 |

| Fixed Asset Turnover | 4.55 | 4.44 |

| Payout Ratio | 61.92% | 74.32% |

| Dividend Yield | 2.41% | 4.06% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and highlighting operational excellence essential for investment decisions.

Colgate-Palmolive Company

Colgate delivers robust profitability with a 13.6% ROE and a strong 14.37% net margin, signaling operational efficiency. However, its valuation appears stretched, with a 25.7 P/E and an unusually high 350.7 P/B, indicating premium pricing. The 2.41% dividend yield supports steady shareholder returns amid disciplined capital allocation.

The Clorox Company

Clorox shows moderate profitability, with a 2.5% ROE and an 11.4% net margin, reflecting solid but less efficient earnings. Its P/E of 18.3 is more reasonable, though a 46.2 P/B suggests some valuation pressure. Clorox offers a higher dividend yield of 4.06%, emphasizing income-focused shareholder returns with steady operational metrics.

Premium Valuation vs. Income Stability

Colgate exhibits superior profitability but trades at a premium, heightening valuation risk. Clorox balances reasonable valuation with stronger dividend income, offering a more defensive profile. Investors seeking growth and efficiency may favor Colgate, while income-oriented investors might prefer Clorox’s steady yield.

Which one offers the Superior Shareholder Reward?

I compare Colgate-Palmolive Company (CL) and The Clorox Company (CLX) on dividend yield, payout ratios, and buyback intensity. CL yields ~2.4% with a 62% payout, backed by strong free cash flow coverage (1.75x). CLX pays a higher yield near 3.6%, but with a payout ratio over 100%, signaling risk. CL maintains consistent buybacks supporting total return; CLX’s buybacks are less pronounced amid stretched dividend payout. CL’s distribution strategy balances income and reinvestment sustainably. I conclude CL offers a superior total shareholder reward for 2026 investors due to healthier cash flow coverage and disciplined capital allocation.

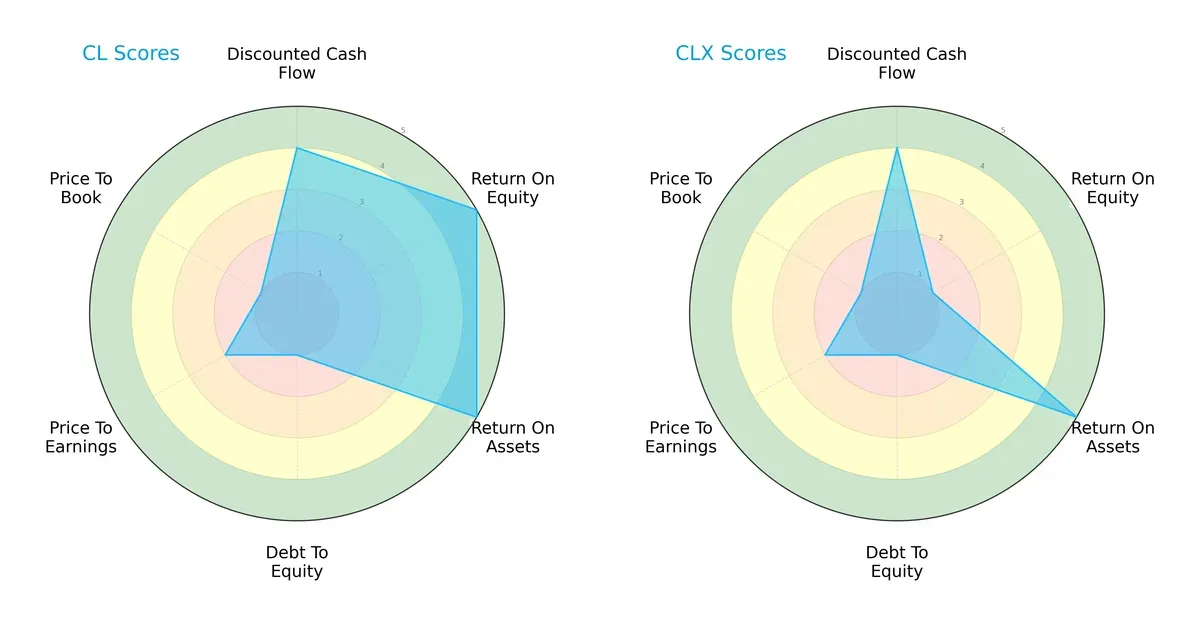

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their financial strengths and valuation nuances:

Colgate-Palmolive Company (CL) shows a balanced profile with very favorable ROE and ROA scores, signaling efficient profit generation and asset use. Its discounted cash flow score is strong at 4, but it struggles with debt-to-equity and price-to-book metrics, indicating leverage risk and potential overvaluation. The Clorox Company (CLX) relies heavily on asset efficiency (ROA of 5) but has a very unfavorable ROE score of 1, reflecting weaker shareholder returns. Both firms share poor debt-to-equity and price-to-book scores. Overall, CL presents a more balanced strategic profile, whereas CLX depends on specific operational efficiency.

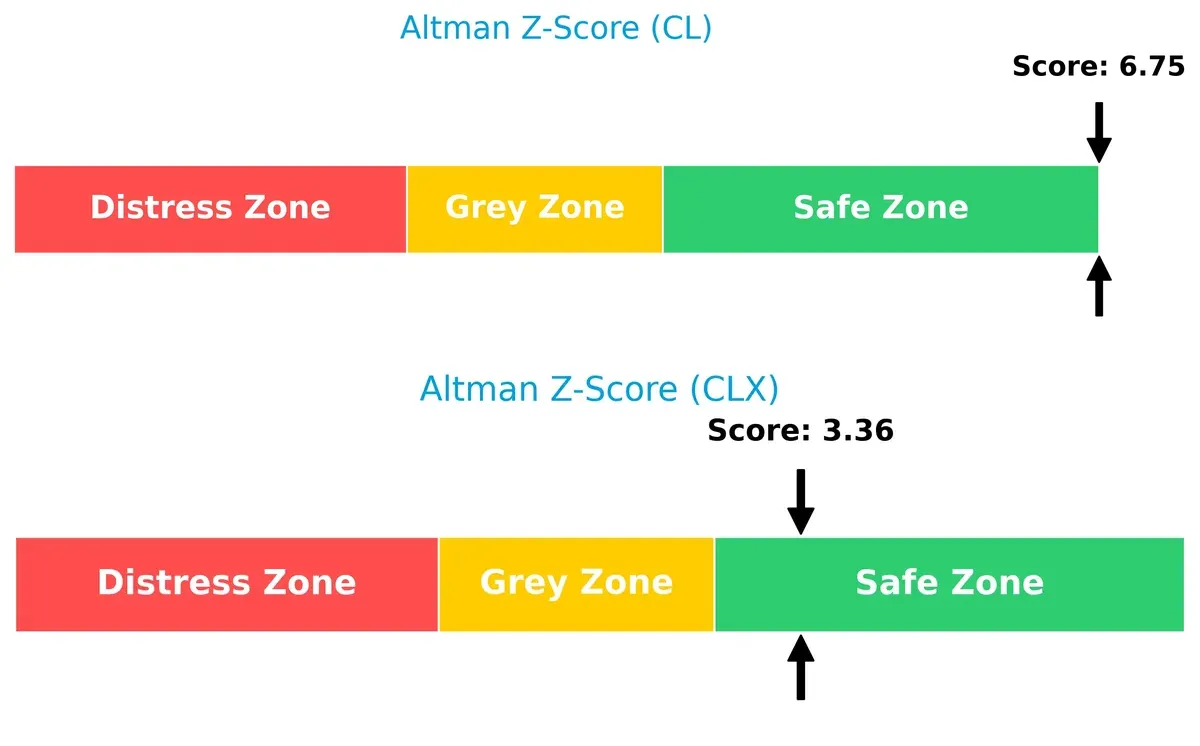

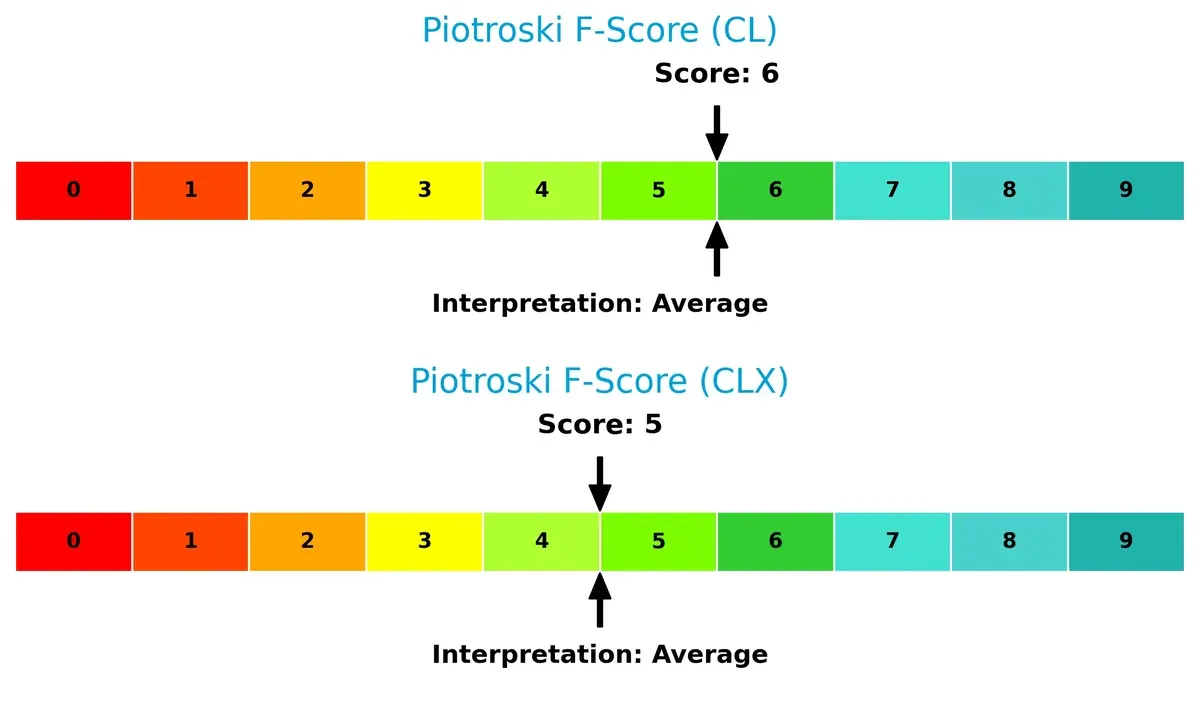

Bankruptcy Risk: Solvency Showdown

Colgate-Palmolive’s Altman Z-Score of 6.75 versus Clorox’s 3.36 places both in the safe zone, but CL’s higher score implies greater resilience against bankruptcy risks in this cycle:

Financial Health: Quality of Operations

Both companies have average Piotroski F-Scores, with CL at 6 and CLX at 5. This suggests similar financial health, though CL slightly outperforms, indicating marginally stronger internal metrics without clear red flags:

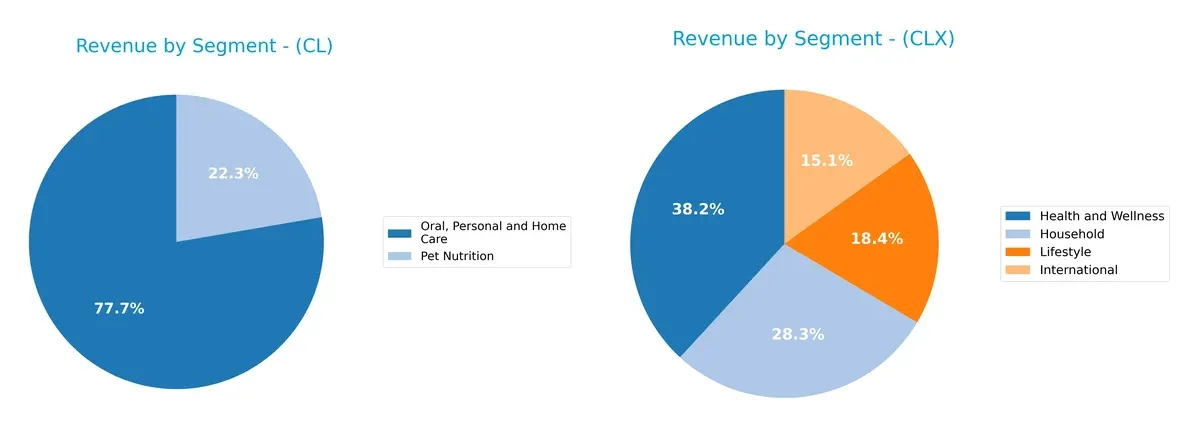

How are the two companies positioned?

This section dissects the operational DNA of Colgate-Palmolive and Clorox by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which business model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Colgate-Palmolive and The Clorox Company diversify their income streams and where their primary sector bets lie:

Colgate-Palmolive anchors its revenue heavily in Oral, Personal and Home Care, generating $15.6B in 2024, with Pet Nutrition contributing a smaller $4.5B. The Clorox Company, by contrast, displays a more balanced mix across Health and Wellness ($2.7B), Household ($2.0B), Lifestyle ($1.3B), and International ($1.1B). Colgate’s concentration signals strong ecosystem lock-in but exposes it to segment-specific risks. Clorox’s diversified segments reduce volatility, supporting infrastructure dominance across multiple consumer categories.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Colgate-Palmolive Company and The Clorox Company:

Colgate-Palmolive Company Strengths

- Strong profitability with 14.37% net margin and 30.56% ROIC

- High ROE at 1362.74% indicates efficient capital use

- Favorable interest coverage of 12.46

- Solid asset turnover at 1.25 and fixed asset turnover at 4.55

- Stable dividend yield of 2.41%

- Diverse product segmentation including Oral Care and Pet Nutrition

The Clorox Company Strengths

- Favorable profitability with 11.4% net margin and 24.14% ROIC

- Healthy ROE of 252.34% reflects good capital returns

- Strong dividend yield at 4.06%

- Good asset turnover of 1.28 and fixed asset turnover of 4.44

- Balanced product portfolio across Health, Household, Lifestyle, and International segments

- Notable US and international revenue diversification

Colgate-Palmolive Company Weaknesses

- Valuation concerns with high P/E of 25.73 and extremely high P/B of 350.65

- Weak liquidity ratios: current ratio 0.92, quick ratio 0.58

- Elevated debt-to-equity at 40.15 and debt-to-assets at 53.05%

- Slightly higher financial leverage raises solvency risk

The Clorox Company Weaknesses

- Lower current ratio at 0.84 and quick ratio at 0.57 signal liquidity constraints

- Debt-to-equity at 8.97 and debt-to-assets 51.79% also indicate leverage risks

- P/B ratio of 46.2 is high but less extreme than CL

- P/E ratio neutral at 18.31

Both companies exhibit solid profitability and capital efficiency with favorable returns on invested capital. However, liquidity and leverage ratios highlight potential risks, especially for Colgate-Palmolive due to its higher financial leverage and valuation multiples. Clorox’s broader product and geographic diversification supports resilience but it faces similar liquidity challenges. These factors shape each firm’s strategic priorities in capital allocation and risk management.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat alone protects long-term profits from relentless competitive erosion. Here’s how Colgate-Palmolive and Clorox defend their turf:

Colgate-Palmolive Company: Brand Power and Efficiency Moat

Colgate’s moat stems from strong brand equity and exceptional capital efficiency, shown by a 26% ROIC above WACC. Margin stability supports durable profits. Innovation in pet nutrition and oral care could deepen this moat in 2026.

The Clorox Company: Diversified Product Portfolio Moat

Clorox’s moat relies on product diversification and category breadth, contrasting with Colgate’s brand focus. Its 18% ROIC above WACC confirms value creation. Expansion into health and wellness segments offers growth avenues and market disruption potential.

Verdict: Brand Equity vs. Portfolio Diversification

Colgate’s wider moat benefits from higher returns and stronger margin consistency. Clorox’s moat is robust but narrower. Colgate is better positioned to defend market share amid intensifying competition.

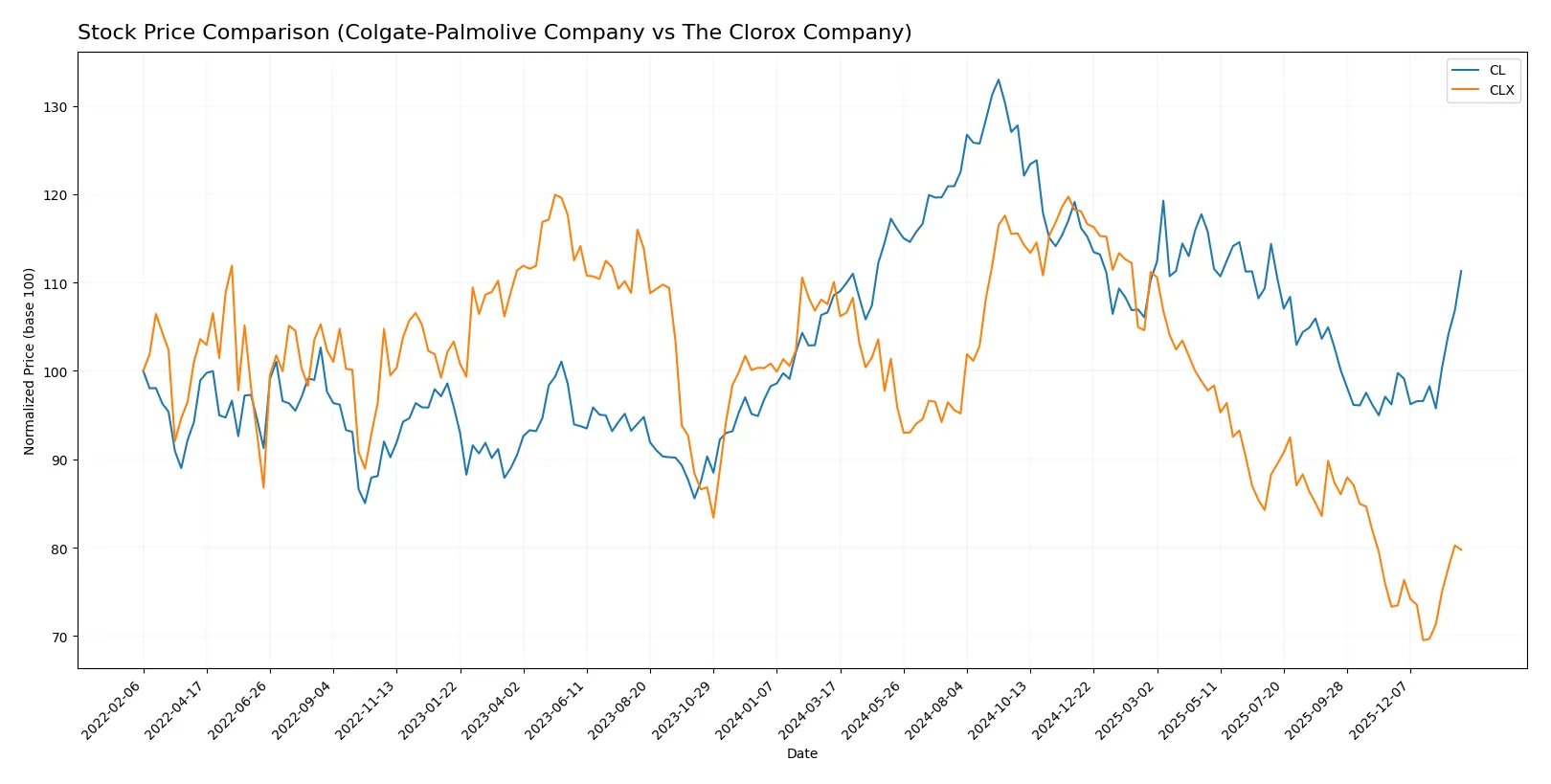

Which stock offers better returns?

The past year shows Colgate-Palmolive gaining 2.52%, signaling a bullish trend with accelerating momentum. Clorox declined 27.54%, reflecting a sharp bearish trend despite recent recovery signs.

Trend Comparison

Colgate-Palmolive’s stock rose 2.52% over 12 months, confirming a bullish trend with acceleration and moderate volatility (7.34 std deviation). The price peaked at 107.86 and bottomed at 77.05.

The Clorox Company’s stock fell 27.54% in the same period, showing a bearish trend with accelerating decline and high volatility (19.27 std deviation). The highest price reached 169.3, the lowest 98.31.

Colgate-Palmolive outperformed Clorox by a wide margin, delivering positive returns while Clorox suffered significant value erosion over the past year.

Target Prices

Analysts present a clear consensus on target prices for Colgate-Palmolive and The Clorox Company.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Colgate-Palmolive Company | 83 | 96 | 89.2 |

| The Clorox Company | 94 | 152 | 117.71 |

The consensus target for Colgate-Palmolive is slightly below its current price of 90.29, suggesting modest downside risk. Clorox’s consensus target sits above its current 112.79 price, indicating potential upside.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize the latest institutional grades for Colgate-Palmolive Company and The Clorox Company:

Colgate-Palmolive Company Grades

This table lists recent grades and rating actions from major financial institutions for Colgate-Palmolive:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2026-01-16 |

| UBS | Maintain | Buy | 2026-01-14 |

| Wells Fargo | Upgrade | Equal Weight | 2026-01-13 |

| TD Cowen | Maintain | Buy | 2026-01-08 |

| Piper Sandler | Upgrade | Overweight | 2026-01-07 |

| JP Morgan | Maintain | Overweight | 2025-12-18 |

| Argus Research | Downgrade | Hold | 2025-12-11 |

| RBC Capital | Upgrade | Outperform | 2025-12-09 |

| Barclays | Maintain | Equal Weight | 2025-11-04 |

| Citigroup | Maintain | Buy | 2025-11-03 |

The Clorox Company Grades

This table presents recent grades and rating actions from key financial institutions for The Clorox Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-23 |

| JP Morgan | Maintain | Neutral | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-14 |

| TD Cowen | Maintain | Hold | 2026-01-08 |

| Goldman Sachs | Maintain | Sell | 2026-01-07 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-17 |

| Citigroup | Maintain | Neutral | 2025-11-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

Which company has the best grades?

Colgate-Palmolive consistently receives positive grades, including multiple “Buy” and “Overweight” ratings, with several upgrades. The Clorox Company holds mostly neutral or equal weight ratings, with a notable “Sell” from Goldman Sachs. Investors may view Colgate-Palmolive’s stronger institutional support as a signal of greater confidence relative to The Clorox Company.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Colgate-Palmolive Company and The Clorox Company in the 2026 market environment:

1. Market & Competition

Colgate-Palmolive Company

- Dominates with a broad product portfolio and global scale but faces intense sector rivalry.

The Clorox Company

- Smaller market cap limits scale; competes in niche segments with diverse product lines.

2. Capital Structure & Debt

Colgate-Palmolive Company

- Leverage is a concern with 53% debt-to-assets and unfavorable debt/equity ratios.

The Clorox Company

- Also highly leveraged at 52% debt-to-assets, though debt/equity ratio is lower but still flagged.

3. Stock Volatility

Colgate-Palmolive Company

- Very low beta (~0.28) indicates stable stock with minimal market sensitivity.

The Clorox Company

- Higher beta (~0.58) suggests more volatility and risk compared to Colgate.

4. Regulatory & Legal

Colgate-Palmolive Company

- Global operations expose it to multiple regulatory frameworks; compliance costs are significant.

The Clorox Company

- Similar exposure but smaller scale may limit regulatory burden; product safety remains key risk.

5. Supply Chain & Operations

Colgate-Palmolive Company

- Extensive supply chain complexity risks, but strong asset turnover reflects operational efficiency.

The Clorox Company

- Less complex but dependent on specialized suppliers; operational flexibility is moderate.

6. ESG & Climate Transition

Colgate-Palmolive Company

- Faces pressure to innovate sustainable products amid consumer demand and regulatory shifts.

The Clorox Company

- ESG initiatives progressing but lag larger peers; climate transition costs could affect margins.

7. Geopolitical Exposure

Colgate-Palmolive Company

- Broad geographic footprint increases exposure to trade tensions and currency fluctuations.

The Clorox Company

- More concentrated US focus reduces direct geopolitical risks but limits diversification benefits.

Which company shows a better risk-adjusted profile?

Colgate-Palmolive’s major risk lies in its high leverage and related financial strain despite operational strength. Clorox’s key risk is greater stock volatility and a weaker return on equity. Colgate’s lower beta and superior Altman Z-Score (6.75 vs. 3.36) signal a more stable risk-adjusted profile. However, both firms carry significant debt risks that investors must monitor closely.

Final Verdict: Which stock to choose?

Colgate-Palmolive’s superpower lies in its durable competitive moat, demonstrated by consistently strong returns on invested capital well above its cost of capital. Its efficient capital allocation and solid profitability make it a reliable cash generator. However, a low current ratio signals a point of vigilance regarding short-term liquidity. It suits portfolios targeting steady, long-term growth with moderate risk tolerance.

The Clorox Company boasts a strategic moat rooted in steady operating margins and a robust free cash flow yield, supported by disciplined capital spending. Its higher dividend yield enhances its appeal as an income-generating asset. Relative to Colgate, Clorox offers a more cautious risk profile, though its recent price trend has been weaker. It fits well within GARP (Growth at a Reasonable Price) portfolios seeking income plus moderate growth.

If you prioritize durable competitive advantages and superior capital efficiency, Colgate stands out due to its superior ROIC-WACC spread and accelerating bullish momentum. However, if you seek a more income-focused, stable investment with reasonable valuation and solid cash flow reliability, Clorox offers better stability despite its recent headwinds. Both present viable analytical scenarios depending on your portfolio’s risk appetite and investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Colgate-Palmolive Company and The Clorox Company to enhance your investment decisions: