Home > Comparison > Consumer Defensive > CL vs IPAR

The strategic rivalry between Colgate-Palmolive Company and Inter Parfums, Inc. shapes the competitive landscape of the consumer defensive sector. Colgate-Palmolive operates as a diversified household and personal products giant with broad global reach. In contrast, Inter Parfums focuses on high-margin fragrance and cosmetic brands with niche market appeal. This analysis will evaluate which company presents the superior risk-adjusted investment opportunity in this evolving industry.

Table of contents

Companies Overview

Colgate-Palmolive and Inter Parfums are key players in the Household & Personal Products market with distinct scale and focus.

Colgate-Palmolive Company: Consumer Products Powerhouse

Colgate-Palmolive dominates the global consumer products space with a diversified portfolio spanning oral care, personal care, and pet nutrition. It generates revenue through mass-market sales of trusted brands like Colgate and Hill’s Science Diet. In 2026, it emphasizes expanding eCommerce channels and innovation in health-oriented personal care products.

Inter Parfums, Inc.: Niche Fragrance Specialist

Inter Parfums excels in the fragrance and cosmetic segment with a focus on premium, licensed brands such as Jimmy Choo and Coach. Its revenue engine relies on wholesale and specialty retail distribution internationally. The company prioritizes brand portfolio expansion and strengthening luxury retail partnerships to boost market presence.

Strategic Collision: Similarities & Divergences

Both firms operate in personal care but diverge in breadth—Colgate pursues a broad consumer staples strategy, while Inter Parfums targets luxury fragrance niches. Their battleground is consumer loyalty within differentiated product categories. Investors face contrasting profiles: Colgate offers scale and stability, Inter Parfums delivers focused exposure to high-margin luxury segments.

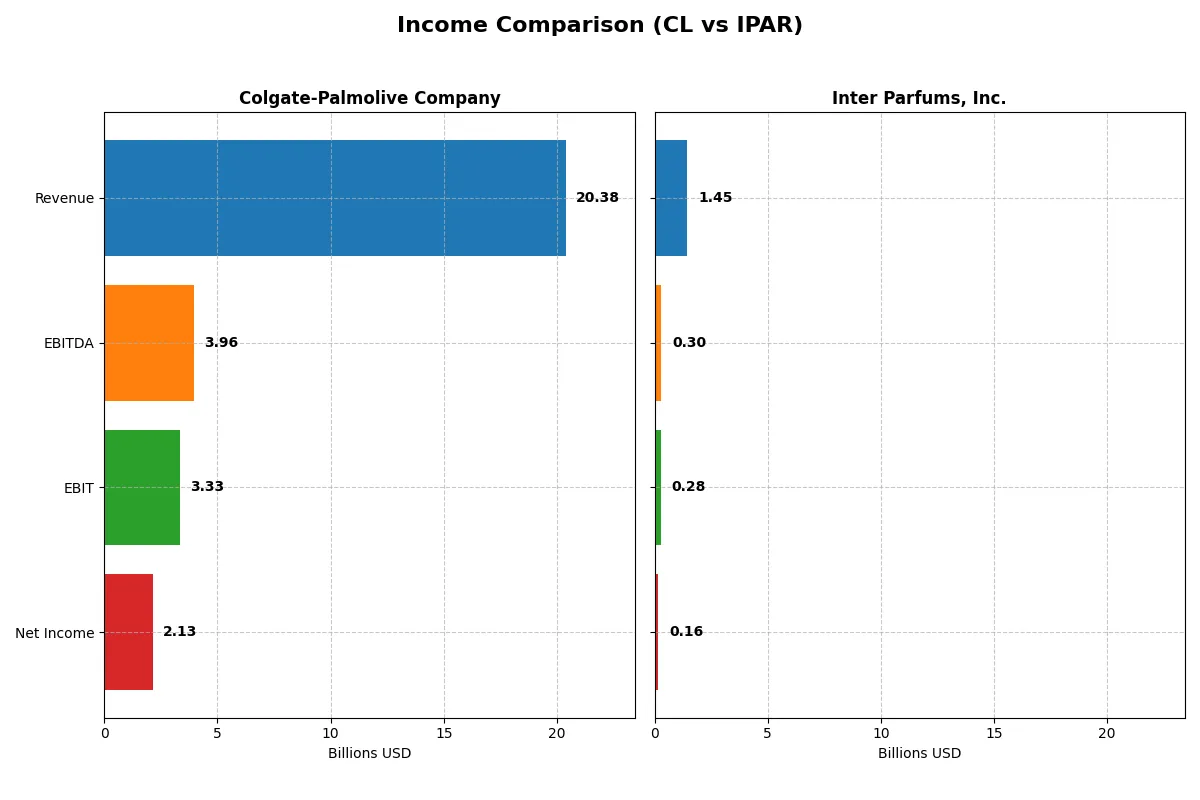

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Colgate-Palmolive Company (CL) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| Revenue | 20.38B | 1.45B |

| Cost of Revenue | 8.13B | 525M |

| Operating Expenses | 7.90B | 653M |

| Gross Profit | 12.25B | 927M |

| EBITDA | 3.96B | 305M |

| EBIT | 3.33B | 276M |

| Interest Expense | 267M | 7.83M |

| Net Income | 2.13B | 164M |

| EPS | 2.64 | 5.13 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This Income Statement comparison reveals which company delivers greater operational efficiency and sustainable profit growth over recent years.

Colgate-Palmolive Company Analysis

Colgate-Palmolive’s revenue steadily climbed from $17.4B in 2021 to $20.4B in 2025, showing moderate growth. Net income, however, declined from $2.17B in 2021 to $2.13B in 2025, signaling pressure on profitability. Gross and net margins remain healthy at 60.1% and 10.5%, respectively, but recent EBIT and net margin contraction highlight waning momentum in 2025.

Inter Parfums, Inc. Analysis

Inter Parfums grew revenue sharply from $540M in 2020 to $1.45B in 2024, with net income soaring from $38M to $164M. Superior gross margin at nearly 64% and a strong net margin above 11% reflect solid cost control. EBIT expanded 5.9% year-over-year in 2024, while EPS grew 7.8%, underscoring robust operational efficiency and upward momentum.

Growth Momentum vs. Margin Stability

Inter Parfums outpaces Colgate-Palmolive in growth and margin expansion, delivering a stronger income statement trajectory. Colgate’s scale is impressive but marred by recent profitability declines. For investors, Inter Parfums’ dynamic growth profile offers a more compelling earnings story than Colgate’s stable yet pressured margins.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | Colgate-Palmolive Company (CL) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| ROE | 13.63% | 22.07% |

| ROIC | 30.56% | 18.35% |

| P/E | 25.73 | 25.63 |

| P/B | 350.65 | 5.66 |

| Current Ratio | 0.92 | 2.75 |

| Quick Ratio | 0.58 | 1.63 |

| D/E | 40.15 | 0.26 |

| Debt-to-Assets | 53.05% | 13.62% |

| Interest Coverage | 15.01 | 35.12 |

| Asset Turnover | 1.25 | 1.03 |

| Fixed Asset Turnover | 4.55 | 8.14 |

| Payout ratio | 61.92% | 58.42% |

| Dividend yield | 2.41% | 2.28% |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and operational strengths critical for investment decisions.

Colgate-Palmolive Company

Colgate-Palmolive boasts a robust ROE of 13.6% and a strong net margin of 14.4%, signaling solid profitability. However, its P/E ratio of 25.7 marks the stock as somewhat expensive versus industry norms. The company supports shareholders with a 2.41% dividend yield, reflecting steady returns despite a stretched valuation.

Inter Parfums, Inc.

Inter Parfums shows moderate profitability with an 11.3% net margin and a 22.1% ROE, indicating effective capital use. Its P/E ratio of 25.6 suggests a similarly stretched valuation. The firm maintains a 2.28% dividend yield and a very favorable liquidity profile, underpinned by a strong current ratio of 2.75, enhancing operational safety.

Premium Valuation vs. Operational Safety

Both companies trade at comparable premium valuations around P/E 25. Inter Parfums offers superior liquidity and lower leverage, reducing financial risk. Colgate-Palmolive delivers higher profitability but with weaker current ratios. Investors prioritizing operational stability may prefer Inter Parfums, while those seeking consistent profitability might lean toward Colgate-Palmolive.

Which one offers the Superior Shareholder Reward?

I compare Colgate-Palmolive Company (CL) and Inter Parfums, Inc. (IPAR) by their dividend yields, payout ratios, and buyback intensity to identify the superior shareholder reward. CL yields 2.41% with a payout ratio around 62%, maintaining sustainable dividends well covered by free cash flow (FCF). Its buyback program is steady but modest, supporting total returns conservatively. IPAR yields 2.28% with a lower payout ratio near 58%, signaling room for growth or reinvestment. IPAR’s free cash flow coverage of dividends is solid, aided by a robust buyback pace, enhancing returns dynamically. CL’s distribution is stable and well-covered, suiting income-focused investors. IPAR blends income with aggressive capital allocation, favoring growth and buybacks. I conclude IPAR offers a more attractive total return profile in 2026, balancing dividend safety with stronger buyback-driven share appreciation.

Comparative Score Analysis: The Strategic Profile

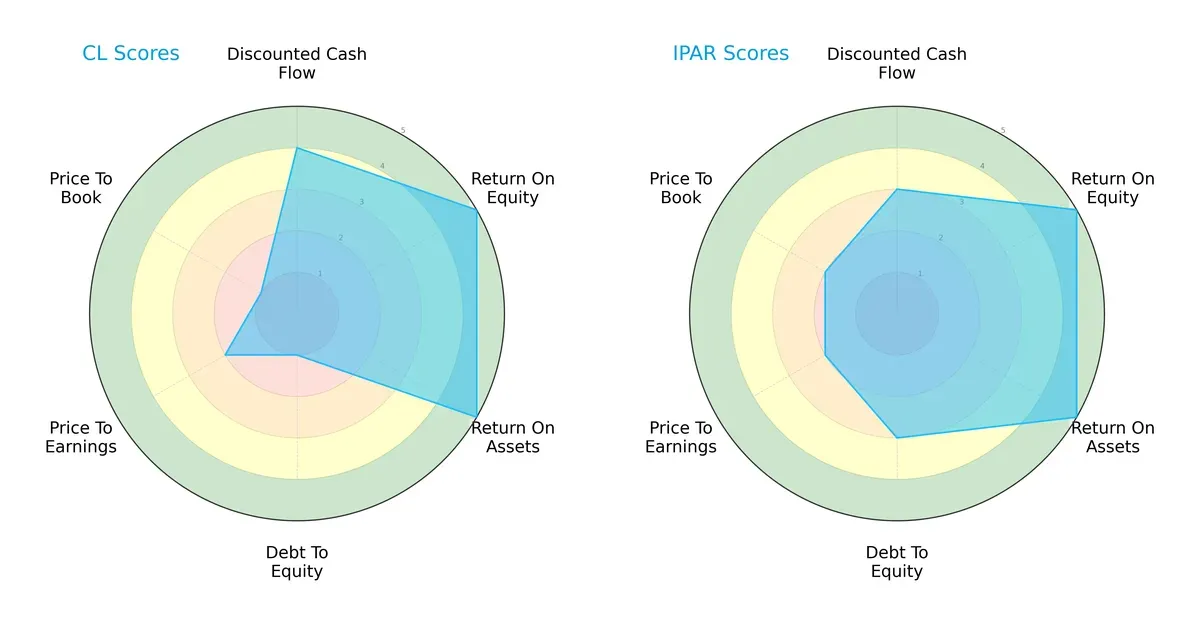

The radar chart reveals the fundamental DNA and trade-offs of Colgate-Palmolive and Inter Parfums, highlighting key financial strengths and vulnerabilities:

Colgate-Palmolive excels in discounted cash flow and profitability metrics (ROE and ROA scoring 5), but its balance sheet is heavily leveraged, reflected by a weak debt-to-equity score (1). Inter Parfums shows a more balanced profile with moderate leverage and slightly lower DCF (3) but better debt management (3). Valuation metrics indicate both firms face moderate to unfavorable pricing, with Colgate showing deeper discounting risk (P/B score 1). I see Inter Parfums as the more balanced choice, while Colgate relies on operational efficiency despite financial risk.

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores for both companies place them securely in the safe zone, indicating strong solvency and low bankruptcy risk in this cycle:

Colgate-Palmolive’s score of 6.75 and Inter Parfums’ 6.80 signal robust financial health. Historically, firms with such high Z-scores withstand economic downturns well, confirming both companies’ durability.

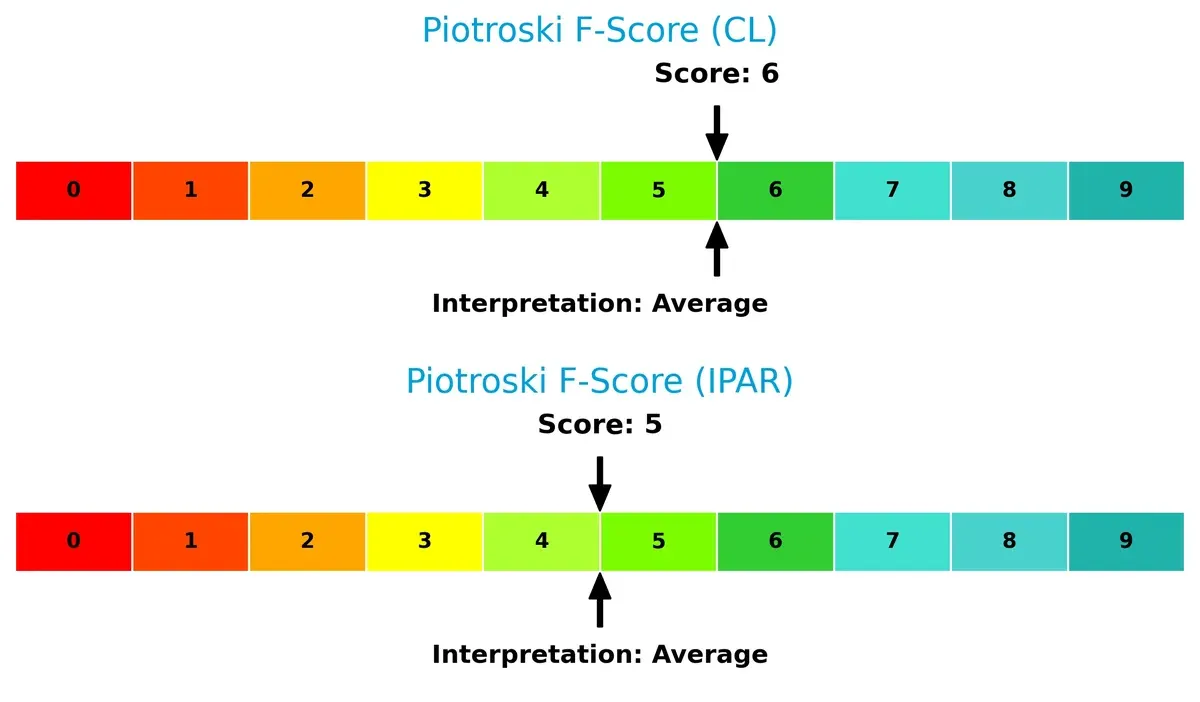

Financial Health: Quality of Operations

Piotroski F-Scores reveal that both firms maintain average financial health, with no glaring red flags in operational quality:

Colgate’s score of 6 and Inter Parfums’ 5 indicate solid but not peak internal metrics. Neither company currently displays significant distress signals, but Colgate edges slightly ahead in operational quality. I remain cautious, watching these scores for any decline signaling weakening fundamentals.

How are the two companies positioned?

This section dissects the operational DNA of CL and IPAR by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable advantage today.

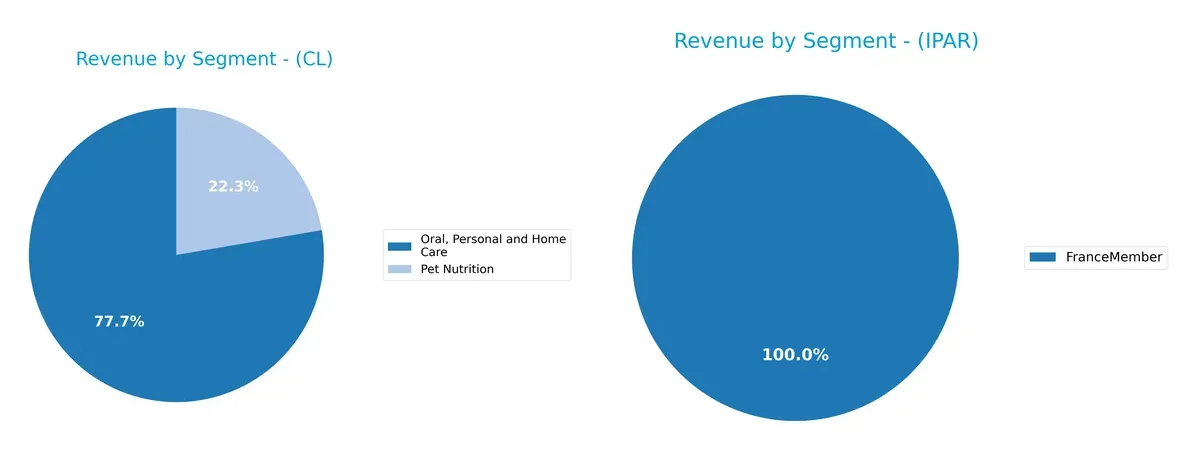

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Colgate-Palmolive and Inter Parfums diversify their income streams and where their primary sector bets lie:

Colgate-Palmolive anchors its revenue in Oral, Personal and Home Care with $15.6B in 2024, complemented by $4.5B from Pet Nutrition, showing a balanced diversification. Inter Parfums relies exclusively on the FranceMember segment with $37.6M, reflecting a concentrated revenue base. Colgate’s diversified mix reduces concentration risk and leverages ecosystem lock-in, while Inter Parfums faces higher vulnerability to single-market shifts.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Colgate-Palmolive Company (CL) and Inter Parfums, Inc. (IPAR):

CL Strengths

- High profitability with net margin 14.37%

- ROIC 30.56% well above WACC 4.89%

- Strong asset and fixed asset turnover

- Diverse product segments in oral care and pet nutrition

- Solid dividend yield 2.41%

IPAR Strengths

- Strong financial health with high current and quick ratios

- Favorable low debt levels and high interest coverage

- ROIC 18.35% exceeds cost of capital

- Diverse geographic presence across multiple continents

- High fixed asset turnover 8.14 and consistent profitability

CL Weaknesses

- Current and quick ratios below 1 signal liquidity risk

- High debt to assets ratio 53.05%

- Elevated price-to-book ratio 350.65

- PE ratio high at 25.73 indicating possible overvaluation

IPAR Weaknesses

- Moderate net margin 11.32%, lower than CL

- PE ratio also high at 25.63

- WACC higher at 9.24%, limiting profitability spread

- Limited product diversification compared to CL

Colgate-Palmolive’s strengths lie in profitability and product diversification but its liquidity and leverage ratios pose financial risks. Inter Parfums shows stronger balance sheet health and geographic reach but faces challenges in valuation and narrower product scope. The differences suggest distinct strategic focuses: CL on scale and profitability, IPAR on financial stability and international expansion.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only shield protecting long-term profits from relentless competitive erosion. Let’s examine how two companies defend their turf:

Colgate-Palmolive Company: Brand Power and Cost Efficiency

Colgate’s moat stems from strong brand loyalty and cost advantages. This manifests in a robust 60% gross margin and a very favorable 25.7% ROIC premium over WACC. Despite recent margin compression, its diversified product lines and global reach support moat durability in 2026.

Inter Parfums, Inc.: Niche Luxury Brand Moat

Inter Parfums relies on intangible assets—prestigious brand portfolios and licensing deals. Its 63.9% gross margin and growing ROIC trend (+174%) confirm effective capital use. Unlike Colgate, IPAR’s smaller scale fuels faster growth but exposes it to luxury market volatility in 2026.

Moat Strength: Scale Efficiency vs. Brand Exclusivity

Colgate’s wider moat combines scale and cost leadership, creating stable cash flows. Inter Parfums’ deeper but narrower moat hinges on luxury brand prestige and licensing agility. I see Colgate better equipped to defend mass-market share, while IPAR thrives on niche expansion risks.

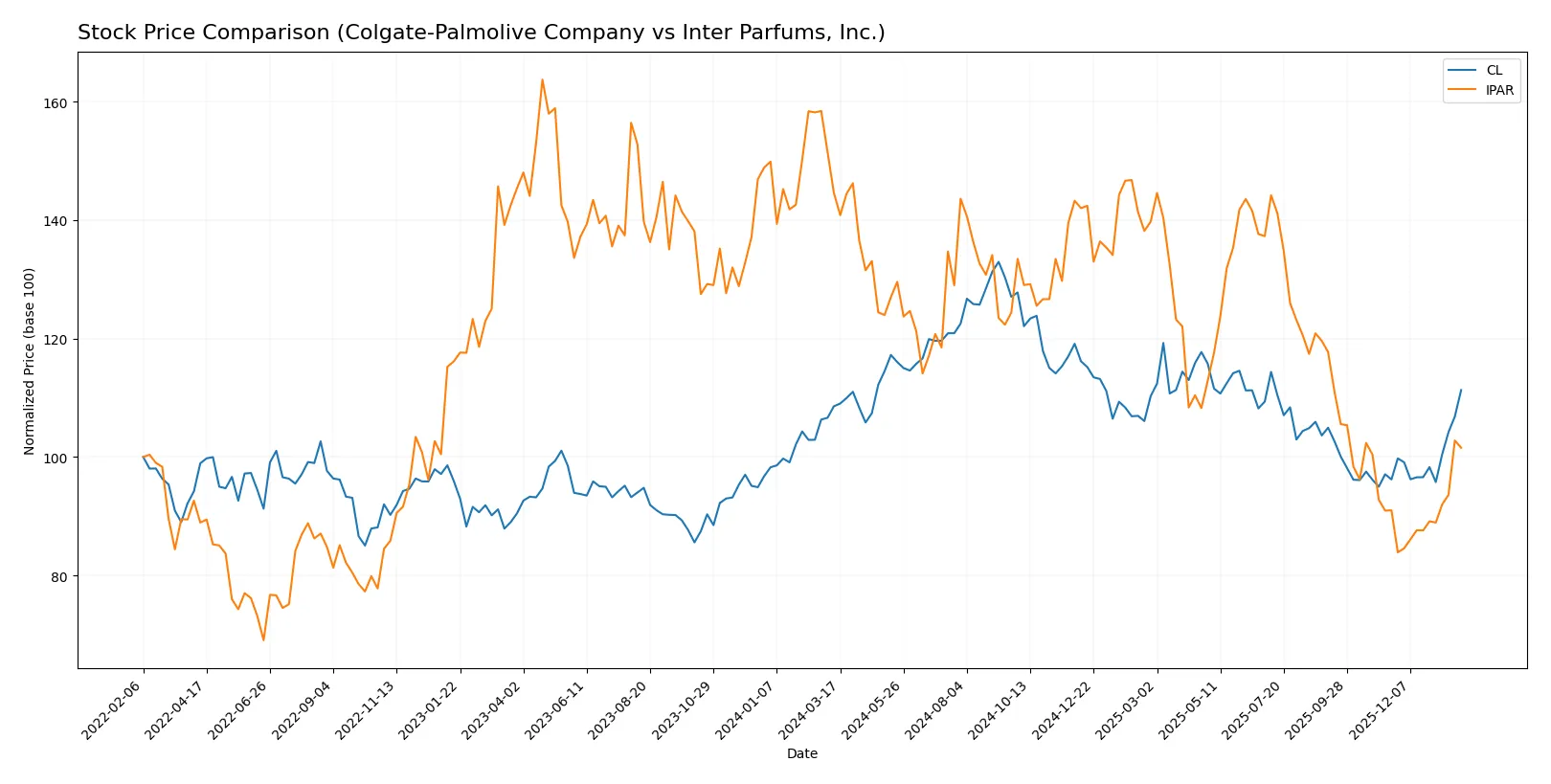

Which stock offers better returns?

The past year’s stock price movements reveal a bullish acceleration for Colgate-Palmolive, contrasting with a sharply bearish trend for Inter Parfums, despite recent short-term gains in both.

Trend Comparison

Colgate-Palmolive’s stock rose 2.52% over the past 12 months, marking a bullish trend with accelerating momentum and a price range between 77.05 and 107.86.

Inter Parfums declined 29.78% over the same period, showing a bearish trend with accelerating downward pressure and wider volatility, hitting a high of 141.02 and a low of 80.61.

Comparing both, Colgate-Palmolive delivered the highest market performance with sustained bullish momentum, while Inter Parfums faced significant losses despite recent recovery attempts.

Target Prices

Analysts show a positive outlook with well-defined target ranges for both companies.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Colgate-Palmolive Company | 83 | 96 | 89.2 |

| Inter Parfums, Inc. | 103 | 112 | 107.5 |

Colgate-Palmolive’s consensus target slightly exceeds its current price of 90.29, suggesting modest upside. Inter Parfums’ target consensus of 107.5 is notably above its 97.57 price, signaling stronger expected growth.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Colgate-Palmolive Company Grades

The following table summarizes recent institutional grades for Colgate-Palmolive Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2026-01-16 |

| UBS | Maintain | Buy | 2026-01-14 |

| Wells Fargo | Upgrade | Equal Weight | 2026-01-13 |

| TD Cowen | Maintain | Buy | 2026-01-08 |

| Piper Sandler | Upgrade | Overweight | 2026-01-07 |

| JP Morgan | Maintain | Overweight | 2025-12-18 |

| Argus Research | Downgrade | Hold | 2025-12-11 |

| RBC Capital | Upgrade | Outperform | 2025-12-09 |

| Barclays | Maintain | Equal Weight | 2025-11-04 |

| Citigroup | Maintain | Buy | 2025-11-03 |

Inter Parfums, Inc. Grades

The following table summarizes recent institutional grades for Inter Parfums, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BWS Financial | Maintain | Neutral | 2026-01-29 |

| BWS Financial | Downgrade | Neutral | 2025-11-21 |

| Canaccord Genuity | Maintain | Buy | 2025-11-19 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Jefferies | Maintain | Buy | 2025-10-28 |

| BWS Financial | Maintain | Buy | 2025-10-22 |

| Canaccord Genuity | Maintain | Buy | 2025-10-21 |

| BWS Financial | Maintain | Buy | 2025-05-07 |

| Piper Sandler | Maintain | Overweight | 2025-04-24 |

| DA Davidson | Maintain | Buy | 2025-03-25 |

Which company has the best grades?

Colgate-Palmolive has a broader range of recent institutional upgrades and mostly favorable grades like Overweight and Buy. Inter Parfums shows consistent Buy ratings but also recent Neutral grades, indicating more cautious sentiment. Investors might view Colgate’s diverse upgrades as a stronger signal of institutional confidence.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Colgate-Palmolive Company and Inter Parfums, Inc. in the 2026 market environment:

1. Market & Competition

Colgate-Palmolive Company

- Faces intense competition in household and personal products with established global brands.

Inter Parfums, Inc.

- Operates in a niche fragrance market with strong brand portfolios but higher exposure to luxury market volatility.

2. Capital Structure & Debt

Colgate-Palmolive Company

- Elevated debt-to-assets ratio at 53%, signaling higher leverage risk and weak liquidity ratios.

Inter Parfums, Inc.

- Low leverage with debt-to-assets at 14%, reflecting strong balance sheet and safer credit profile.

3. Stock Volatility

Colgate-Palmolive Company

- Beta of 0.28 indicates low stock volatility and defensive positioning in market downturns.

Inter Parfums, Inc.

- Higher beta of 1.24 suggests greater share price volatility and sensitivity to market swings.

4. Regulatory & Legal

Colgate-Palmolive Company

- Subject to strict consumer product regulations globally, with ongoing compliance costs.

Inter Parfums, Inc.

- Faces regulatory scrutiny mainly in cosmetics and fragrance ingredients, with moderate legal risk.

5. Supply Chain & Operations

Colgate-Palmolive Company

- Large global supply chain vulnerable to raw material cost inflation and logistics disruptions.

Inter Parfums, Inc.

- Smaller scale supply chain but exposed to specialty ingredient scarcity and luxury packaging supply risks.

6. ESG & Climate Transition

Colgate-Palmolive Company

- Increasing pressure to reduce environmental footprint across broad product lines and packaging.

Inter Parfums, Inc.

- Faces challenges integrating ESG standards without compromising luxury brand image and product integrity.

7. Geopolitical Exposure

Colgate-Palmolive Company

- Significant global footprint exposes it to currency fluctuations and trade tensions.

Inter Parfums, Inc.

- More concentrated regional operations, reducing but not eliminating geopolitical risks.

Which company shows a better risk-adjusted profile?

Inter Parfums’ lower leverage and stronger liquidity ratios provide a more stable capital structure than Colgate-Palmolive’s elevated debt levels. However, Colgate’s low stock volatility and diversified global presence mitigate some operational and market risks. The most impactful risk for Colgate is its high financial leverage, raising solvency concerns despite solid profitability. For Inter Parfums, market volatility tied to luxury consumer demand stands out. Overall, Inter Parfums offers a better risk-adjusted profile, supported by a very favorable ratio evaluation and safer balance sheet, while Colgate’s financial structure calls for cautious scrutiny.

Final Verdict: Which stock to choose?

Colgate-Palmolive’s superpower lies in its durable competitive advantage and exceptional capital efficiency. Its robust ROIC well above WACC signals consistent value creation. A point of vigilance remains its stretched liquidity ratios, which could pressure short-term operations. This stock suits portfolios focused on steady, long-term income and defensive growth.

Inter Parfums offers a strategic moat through strong margin expansion and rock-solid balance sheet safety. Its low leverage and high current ratio provide a cushion against volatility, contrasting favorably with Colgate’s tighter liquidity. This makes it appealing for investors seeking growth combined with a margin of safety, fitting well within GARP (Growth at a Reasonable Price) strategies.

If you prioritize reliable value creation with proven operational leverage, Colgate-Palmolive outshines due to its established moat and resilient cash flow. However, if you seek faster growth with better balance sheet stability, Inter Parfums offers superior safety and margin expansion potential. Both present compelling but distinct analytical scenarios aligned with different investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Colgate-Palmolive Company and Inter Parfums, Inc. to enhance your investment decisions: