Home > Comparison > Consumer Defensive > CL vs COTY

The strategic rivalry between Colgate-Palmolive Company and Coty Inc. shapes the Consumer Defensive sector’s competitive landscape. Colgate-Palmolive operates as a diversified household and personal products giant with broad global reach. Coty Inc. focuses on prestige and mass beauty products, relying heavily on brand portfolio management. This analysis will assess which company presents a superior risk-adjusted profile for investors seeking durable growth within the evolving consumer market.

Table of contents

Companies Overview

The battle for global household and personal care dominance unfolds between two New York-based giants with distinct market footprints.

Colgate-Palmolive Company: Global Consumer Staples Powerhouse

Colgate-Palmolive anchors its market leadership in oral, personal, and home care products. It generates revenues through a broad portfolio including toothpaste, soaps, and pet nutrition under trusted brands like Colgate and Hill’s Science Diet. In 2026, its strategic focus continues on innovation and expanding eCommerce channels to solidify its consumer defensive moat.

Coty Inc.: Prestige and Mass Beauty Innovator

Coty operates primarily in the beauty industry, driving revenue through prestige fragrances, skincare, and mass cosmetics sold globally via department stores and e-commerce. The company’s 2026 strategy emphasizes broadening its brand portfolio and strengthening digital direct-to-consumer sales to capture evolving beauty market trends and consumer preferences.

Strategic Collision: Similarities & Divergences

Colgate-Palmolive and Coty both compete in household and personal products but diverge in their business models: Colgate emphasizes a diversified consumer staples approach while Coty targets premium and mass beauty segments. Their primary battleground lies in global retail presence and digital commerce innovation. These differences create distinct investment profiles—Colgate offers stability and scale, Coty pursues growth through brand revitalization and market penetration.

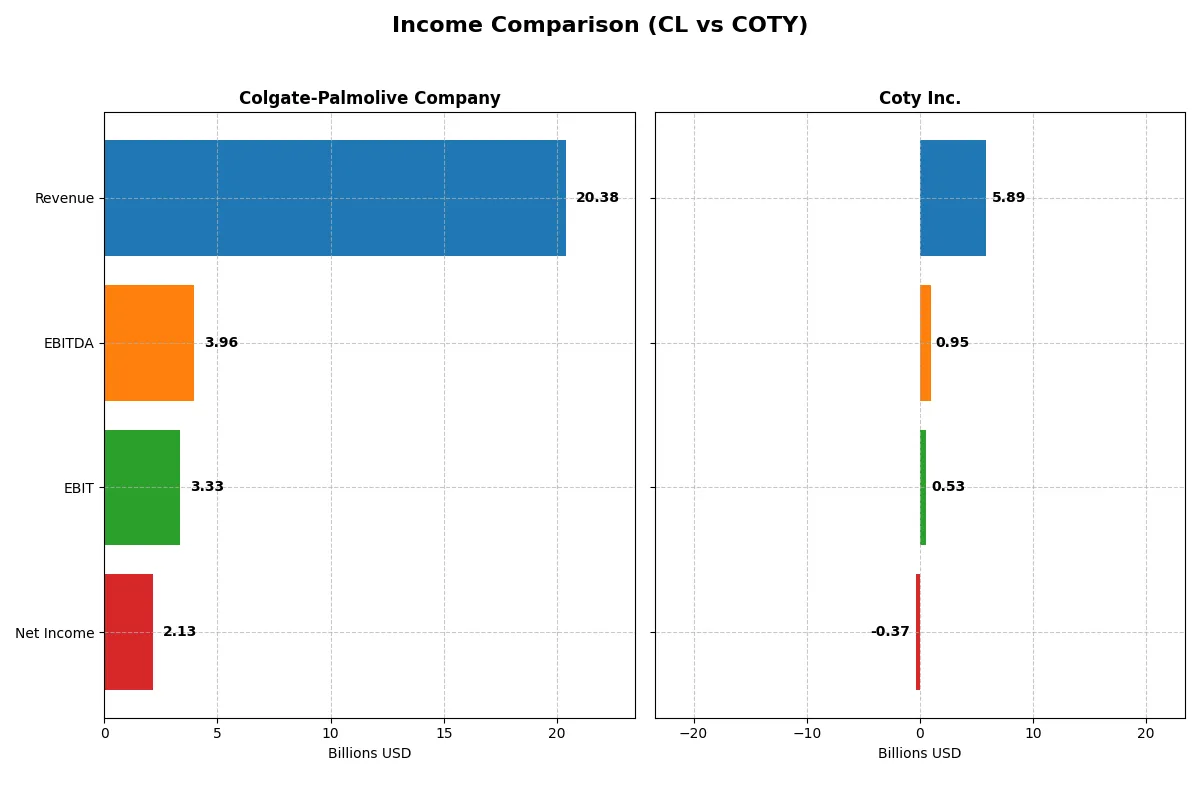

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Colgate-Palmolive Company (CL) | Coty Inc. (COTY) |

|---|---|---|

| Revenue | 20.38B | 5.89B |

| Cost of Revenue | 8.13B | 2.07B |

| Operating Expenses | 7.90B | 3.58B |

| Gross Profit | 12.25B | 3.82B |

| EBITDA | 3.96B | 950M |

| EBIT | 3.33B | 530M |

| Interest Expense | 267M | 227M |

| Net Income | 2.13B | -368M |

| EPS | 2.64 | -0.44 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes which company runs its business more efficiently and delivers stronger shareholder returns.

Colgate-Palmolive Company Analysis

Colgate shows steady revenue growth, reaching $20.4B in 2025, but net income declined to $2.13B, signaling margin pressure. Gross margin remains robust at 60%, while net margin slipped to 10.5%, reflecting rising operating expenses. The 2025 drop in EBIT by 21.7% signals a loss of momentum, despite favorable long-term revenue expansion.

Coty Inc. Analysis

Coty’s revenue slipped to $5.9B in 2025 with a persistent net loss of $368M, highlighting ongoing profitability challenges. Its gross margin of 64.8% is healthy, but the net margin stands negative at -6.2%. EBIT fell 9.1% year-over-year, showing weak operational leverage and deteriorating bottom-line performance over the period.

Margin Strength vs. Profitability Challenges

Colgate leads with a solid gross margin and positive net income, despite recent margin compression. Coty maintains a higher gross margin but struggles with consistent net losses and negative margins. For investors prioritizing profitability and operational efficiency, Colgate’s profile is more compelling, while Coty’s volatile earnings pose significant risks.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Colgate-Palmolive Company (CL) | Coty Inc. (COTY) |

|---|---|---|

| ROE | 13.63% | -9.98% |

| ROIC | 30.56% | 2.55% |

| P/E | 25.73 | -11.02 |

| P/B | 350.65 | 1.10 |

| Current Ratio | 0.92 | 0.77 |

| Quick Ratio | 0.58 | 0.46 |

| D/E | 40.15 | 1.15 |

| Debt-to-Assets | 53.05% | 35.65% |

| Interest Coverage | 15.01 | 1.06 |

| Asset Turnover | 1.25 | 0.49 |

| Fixed Asset Turnover | 4.55 | 6.04 |

| Payout Ratio | 62% | -3.6% |

| Dividend Yield | 2.41% | 0.33% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios serve as a company’s DNA, uncovering hidden risks and revealing operational strengths that numbers alone can obscure.

Colgate-Palmolive Company

Colgate exhibits strong profitability with a 13.6% ROE and a solid 14.4% net margin, signaling operational efficiency. Its valuation appears stretched, reflected by a high P/E of 25.7 and a steep P/B at 350.7. The company returns value through a 2.41% dividend yield, balancing investor income with steady growth.

Coty Inc.

Coty struggles with negative profitability metrics, including a -10% ROE and -6.2% net margin, indicating operational challenges. Its valuation is attractive, with a low P/E (negative but favorable) and a modest P/B of 1.1, suggesting undervaluation. Coty’s minimal 0.33% dividend yield highlights limited shareholder returns amid ongoing restructuring.

Profitability Strength vs. Valuation Opportunity

Colgate offers a robust operational profile but trades at a premium, increasing risk for valuation-sensitive investors. Coty presents a value play with operational headwinds and weaker profitability. Investors seeking quality and steady returns may prefer Colgate, while those targeting turnaround potential might consider Coty’s discounted valuation.

Which one offers the Superior Shareholder Reward?

I compare Colgate-Palmolive (CL) and Coty Inc. (COTY) by their dividend and buyback strategies. CL yields 2.4% with a payout ratio near 62%, supported by strong free cash flow (4.3/share). Its buyback program consistently returns capital, enhancing shareholder value. COTY pays a minimal 0.33% dividend with a negative payout ratio, reflecting losses, yet reinvests heavily in growth and cost control. Coty’s buybacks are modest and less reliable. Given CL’s robust free cash flow coverage and steady dividends plus buybacks, I find CL’s shareholder rewards more sustainable and attractive in 2026.

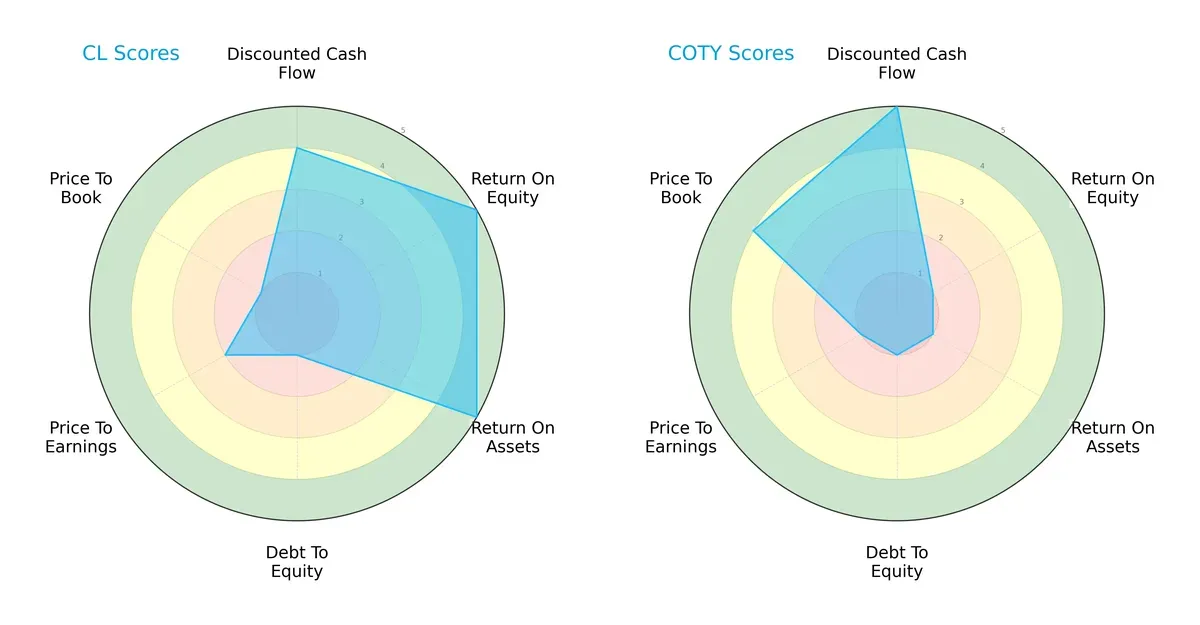

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Colgate-Palmolive and Coty Inc., highlighting their core financial strengths and vulnerabilities:

Colgate-Palmolive shows a balanced profile with strong ROE and ROA scores (5 each), signaling efficient asset use and profitability. Coty leans heavily on discounted cash flow (5) and price-to-book (4), reflecting potential undervaluation but weak operational returns (ROE and ROA at 1). Both suffer from poor debt-to-equity scores (1), indicating leverage risks, but Colgate’s overall financial strength appears more stable.

—

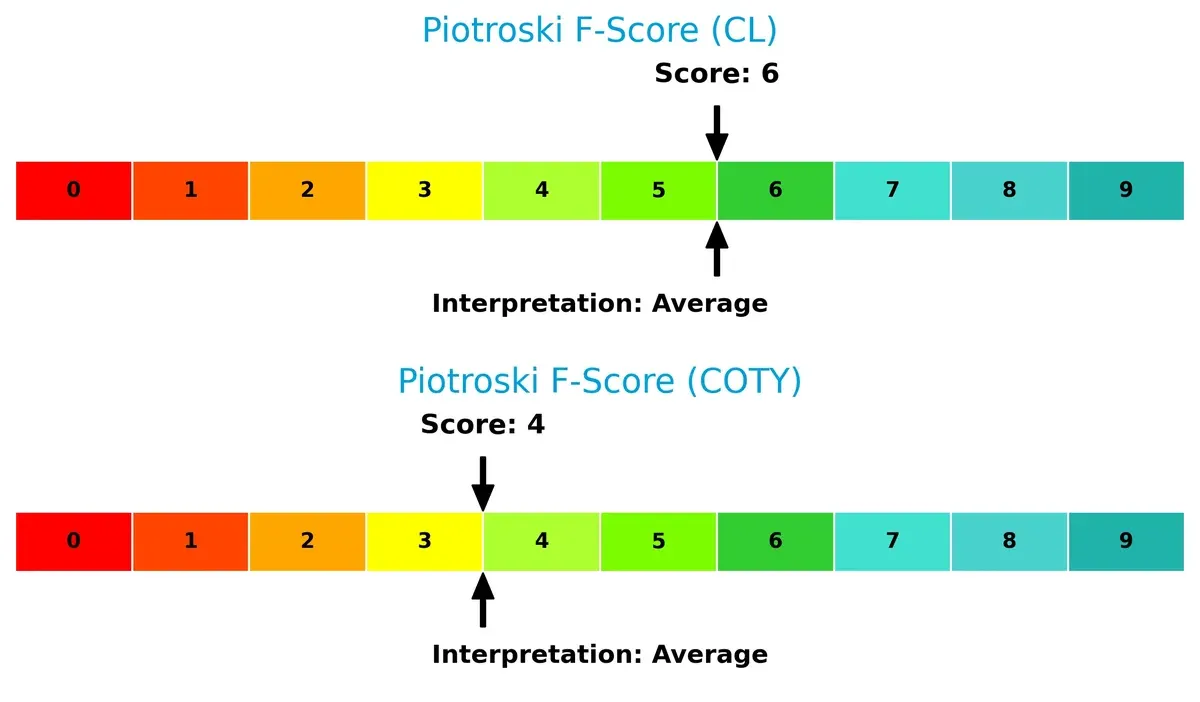

Bankruptcy Risk: Solvency Showdown

Colgate-Palmolive’s Altman Z-Score of 6.75 places it securely in the safe zone, while Coty’s near-zero score signals distress, implying a significant survival risk in this cycle:

—

Financial Health: Quality of Operations

Both companies exhibit average Piotroski F-Scores—Colgate at 6 and Coty at 4—indicating moderate financial health, but Coty’s lower score suggests more internal weaknesses and operational red flags:

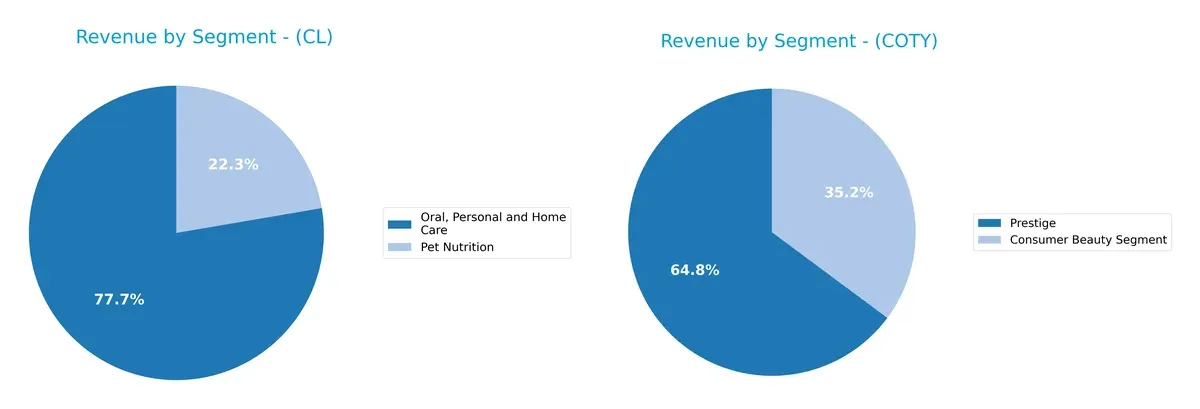

How are the two companies positioned?

This section dissects the operational DNA of Colgate-Palmolive and Coty by comparing their revenue distribution and internal dynamics of strengths and weaknesses. The objective is to confront their economic moats to identify which business model delivers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Colgate-Palmolive and Coty diversify their income streams and where their primary sector bets lie:

Colgate-Palmolive anchors revenue in Oral, Personal and Home Care with $15.6B in 2024, complemented by a $4.5B Pet Nutrition segment. Coty shows a more fragmented mix, with Prestige at $3.8B and Consumer Beauty around $2.1B. Colgate’s focus reduces risk via a strong core, while Coty’s spread across beauty sub-segments suggests a pivot toward capturing diverse market niches but also exposes it to volatility.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Colgate-Palmolive Company and Coty Inc.:

Colgate-Palmolive Company Strengths

- Strong profitability with 14.37% net margin and 30.56% ROIC

- Favorable interest coverage at 12.46

- High fixed asset turnover of 4.55

- Significant diversification in Oral Care and Pet Nutrition segments

- Consistent dividend yield of 2.41%

Coty Inc. Strengths

- Favorable weighted average cost of capital at 5.61%

- Low price-to-book ratio at 1.1 indicating potential undervaluation

- High fixed asset turnover at 6.04

- Diverse product lines including Consumer Beauty, Prestige, and Luxury segments

- Global geographic presence across Americas, EMEA, and Asia Pacific

Colgate-Palmolive Company Weaknesses

- Unfavorable liquidity with current ratio 0.92 and quick ratio 0.58 below 1

- High debt-to-assets ratio at 53.05% and debt-to-equity of 40.15

- Elevated price-to-book ratio at 350.65

- Price-to-earnings ratio at 25.73 is unfavorable

Coty Inc. Weaknesses

- Negative profitability with net margin -6.24% and ROE -9.98%

- Low current and quick ratios at 0.77 and 0.46 respectively

- Weak asset turnover of 0.49

- Low dividend yield at 0.33%

- Interest coverage ratio at 2.33 is marginally neutral

- Moderate debt-to-assets ratio at 35.65%

Colgate-Palmolive demonstrates robust profitability and solid asset efficiency but faces liquidity and leverage concerns. Coty shows strengths in asset utilization and product diversity but struggles with profitability and liquidity, signaling strategic challenges ahead.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole barrier protecting long-term profits from relentless competition erosion. Let’s dissect the competitive moats of two major players:

Colgate-Palmolive Company: Durable Brand and Scale Moat

Colgate’s moat stems from strong brand loyalty and extensive distribution networks. This manifests in a high ROIC exceeding WACC by 25.7%, signaling efficient capital use. In 2026, new product innovation and pet nutrition expansion could deepen this moat further.

Coty Inc.: Emerging Turnaround with Prestige Brand Portfolio

Coty’s moat relies on intangible assets, notably its prestige fragrance brands, contrasting with Colgate’s broad consumer base. Despite a negative ROIC vs. WACC, its improving profitability signals a nascent moat. Growth in emerging markets offers expansion potential but also competitive risks.

Brand Strength vs. Profit Efficiency: The Moat Verdict

Colgate holds a wider, more durable moat with consistent value creation and scale advantages. Coty shows promise through margin recovery but remains vulnerable. Colgate is better positioned to defend and grow its market share in 2026.

Which stock offers better returns?

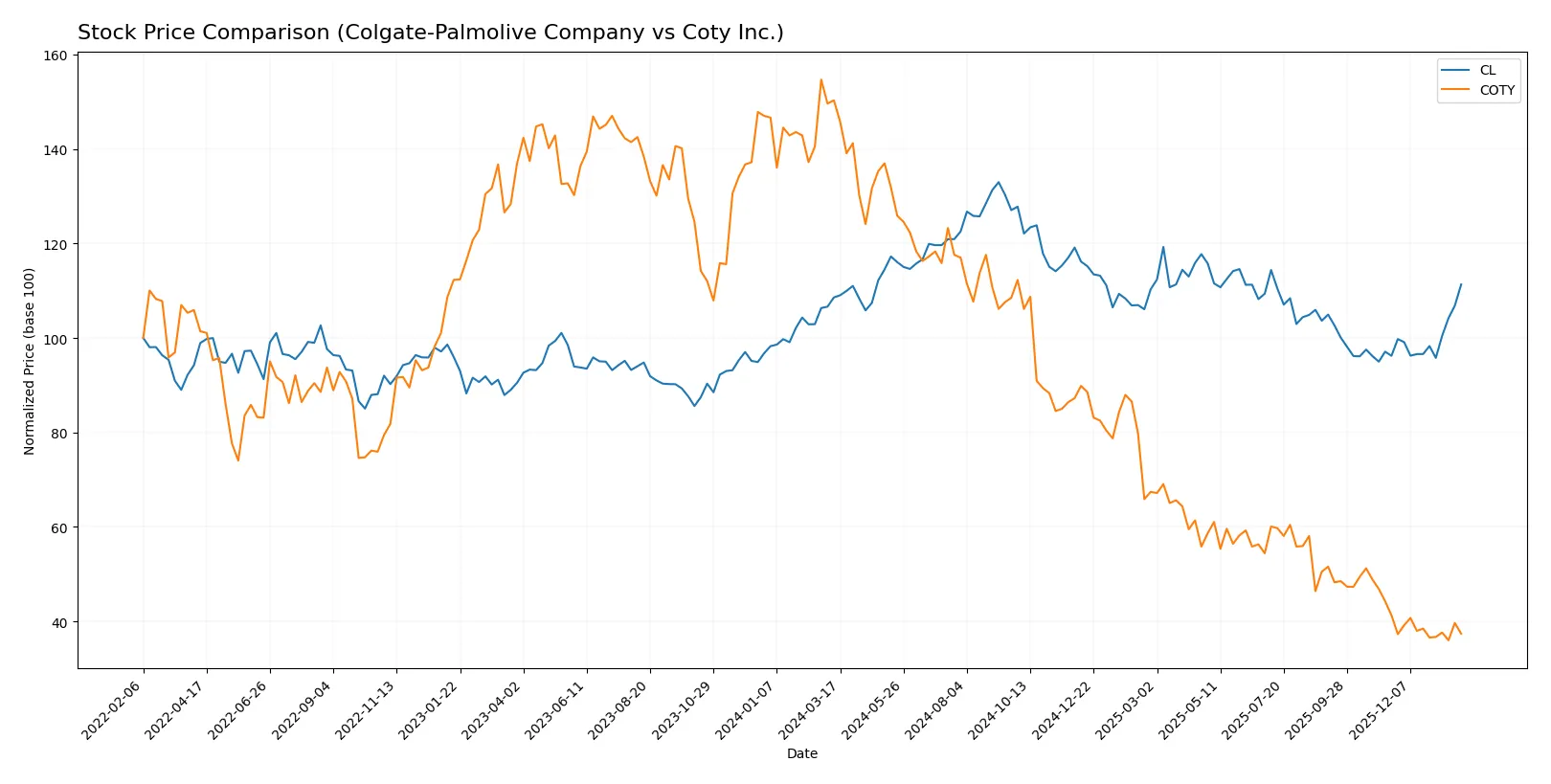

The past year shows divergent stock price trajectories, with Colgate-Palmolive gaining steadily while Coty faced sharp declines and growing selling pressure.

Trend Comparison

Colgate-Palmolive’s stock rose 2.52% over the last 12 months, signaling a bullish trend with accelerating momentum and a high near 108. Volatility is moderate, with a 7.34 std deviation.

Coty’s stock plunged 75.1% in 12 months, reflecting a bearish trend with accelerating decline. The price hit a low of 3.05, with relatively low volatility at 2.74 std deviation.

Colgate-Palmolive delivered the highest market performance with positive gains and strong buyer dominance, while Coty suffered substantial losses and weak buyer activity.

Target Prices

Analysts present mixed but clear target price ranges for Colgate-Palmolive and Coty, reflecting varied growth expectations.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Colgate-Palmolive Company | 83 | 96 | 89.2 |

| Coty Inc. | 3 | 10 | 4.83 |

Colgate-Palmolive’s consensus target of 89.2 sits slightly below its current price of 90.29, indicating modest downside risk. Coty’s 4.83 target exceeds its 3.17 stock price, suggesting potential upside amid market uncertainty.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Colgate-Palmolive Company and Coty Inc.:

Colgate-Palmolive Company Grades

This table lists recent grades from well-known financial institutions for Colgate-Palmolive Company.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Overweight | 2026-01-16 |

| UBS | maintain | Buy | 2026-01-14 |

| Wells Fargo | upgrade | Equal Weight | 2026-01-13 |

| TD Cowen | maintain | Buy | 2026-01-08 |

| Piper Sandler | upgrade | Overweight | 2026-01-07 |

| JP Morgan | maintain | Overweight | 2025-12-18 |

| Argus Research | downgrade | Hold | 2025-12-11 |

| RBC Capital | upgrade | Outperform | 2025-12-09 |

| Barclays | maintain | Equal Weight | 2025-11-04 |

| Citigroup | maintain | Buy | 2025-11-03 |

Coty Inc. Grades

This table shows recent grades from recognized institutions for Coty Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | maintain | Hold | 2026-01-21 |

| Evercore ISI Group | downgrade | In Line | 2025-12-23 |

| Citigroup | maintain | Neutral | 2025-12-17 |

| TD Cowen | maintain | Hold | 2025-12-12 |

| Berenberg | downgrade | Hold | 2025-09-10 |

| Morgan Stanley | maintain | Equal Weight | 2025-08-25 |

| RBC Capital | maintain | Outperform | 2025-08-22 |

| Wells Fargo | maintain | Equal Weight | 2025-08-22 |

| Barclays | maintain | Underweight | 2025-08-22 |

| B of A Securities | maintain | Underperform | 2025-08-22 |

Which company has the best grades?

Colgate-Palmolive consistently receives stronger grades, including multiple Buy and Overweight ratings. Coty’s grades cluster around Hold, Neutral, and Underperform. This disparity suggests greater institutional confidence in Colgate-Palmolive’s prospects, potentially impacting investor sentiment and portfolio allocation.

Risks specific to each company

The following categories highlight the critical pressure points and systemic threats facing Colgate-Palmolive Company and Coty Inc. in the 2026 market environment:

1. Market & Competition

Colgate-Palmolive Company

- Strong global brand portfolio supports stable market position.

Coty Inc.

- Faces intense competition in prestige and mass beauty segments.

2. Capital Structure & Debt

Colgate-Palmolive Company

- High debt-to-equity ratio (40.15) signals financial leverage risk.

Coty Inc.

- Debt-to-equity is very high (1.15), raising solvency concerns.

3. Stock Volatility

Colgate-Palmolive Company

- Low beta (0.28) indicates defensive, stable stock behavior.

Coty Inc.

- Higher beta (0.96) implies elevated price volatility risk.

4. Regulatory & Legal

Colgate-Palmolive Company

- Operates in highly regulated consumer products sector with steady compliance.

Coty Inc.

- Exposure to evolving regulations in cosmetics and fragrance markets.

5. Supply Chain & Operations

Colgate-Palmolive Company

- Diversified supply chain reduces disruption risks.

Coty Inc.

- More vulnerable to supply chain disruptions due to complex global distribution.

6. ESG & Climate Transition

Colgate-Palmolive Company

- Increasing ESG initiatives strengthen brand and reduce transition risks.

Coty Inc.

- ESG efforts less visible, potentially risking investor scrutiny.

7. Geopolitical Exposure

Colgate-Palmolive Company

- Broad global presence mitigates risks from any single region.

Coty Inc.

- Significant exposure to emerging markets with geopolitical volatility.

Which company shows a better risk-adjusted profile?

Colgate-Palmolive’s key risk lies in its high leverage despite strong operational metrics. Coty struggles with poor profitability and financial distress signals. Colgate’s stable stock volatility and safer Altman Z-Score (6.75 in safe zone) contrast with Coty’s distress zone score (0.01). I see Colgate’s risk-adjusted profile as clearly superior given its robust returns on capital and market resilience. Coty’s negative margins and weak debt coverage highlight critical financial fragility in 2026.

Final Verdict: Which stock to choose?

Colgate-Palmolive Company wields the superpower of a durable competitive moat, evidenced by a robust ROIC well above its WACC. Its consistent value creation and efficient capital use position it as a reliable cash machine. The main point of vigilance is its tight liquidity ratios, which might stress short-term flexibility. It suits portfolios focused on steady, long-term growth.

Coty Inc. offers a strategic moat centered on potential operational turnaround, supported by a recent rebound in ROIC despite ongoing value destruction. Its lower valuation multiples and modest price-to-book ratio present an intriguing value proposition. Compared to Colgate, Coty carries higher risk but could fit portfolios aiming for speculative recovery plays or deep-value opportunities.

If you prioritize capital preservation and proven economic moats, Colgate-Palmolive outshines as the compelling choice due to its consistent profitability and strong financial health. However, if you seek contrarian growth with a higher risk appetite, Coty offers better potential upside through its improving operational metrics, albeit with financial instability and an ongoing recovery challenge.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Colgate-Palmolive Company and Coty Inc. to enhance your investment decisions: