In the evolving landscape of financial services, Moody’s Corporation and Coinbase Global, Inc. stand out as influential players driving innovation and market dynamics. Moody’s, a century-old risk assessment leader, contrasts sharply with Coinbase, a pioneering force in cryptocurrency infrastructure. Both operate within the financial data and exchange industry but target distinct market niches. This article will explore their strengths and risks to identify which company holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Moody’s Corporation and Coinbase Global, Inc. by providing an overview of these two companies and their main differences.

Moody’s Corporation Overview

Moody’s Corporation operates as a global integrated risk assessment firm, providing credit ratings and risk management services. Its two segments, Moody’s Investors Service and Moody’s Analytics, cover credit ratings across approximately 140 countries and offer subscription-based research and analytical tools. Founded in 1900 and headquartered in New York, Moody’s serves a wide range of clients including corporates, financial institutions, and governments.

Coinbase Global, Inc. Overview

Coinbase Global, Inc. offers financial infrastructure and technology dedicated to the cryptoeconomy. It provides consumers with primary crypto accounts, liquidity pools for institutions, and developer tools for crypto-based applications. Founded in 2012 and based in Wilmington, Delaware, Coinbase focuses on enabling secure crypto asset transactions and payment acceptance worldwide.

Key similarities and differences

Both companies operate in the financial services sector within the data and stock exchanges industry, serving institutional and retail clients. Moody’s specializes in traditional credit rating and risk management, while Coinbase focuses on cryptocurrency infrastructure and technology. Moody’s long-established global presence contrasts with Coinbase’s newer, crypto-centric business model, reflecting different approaches to financial data and market participation.

Income Statement Comparison

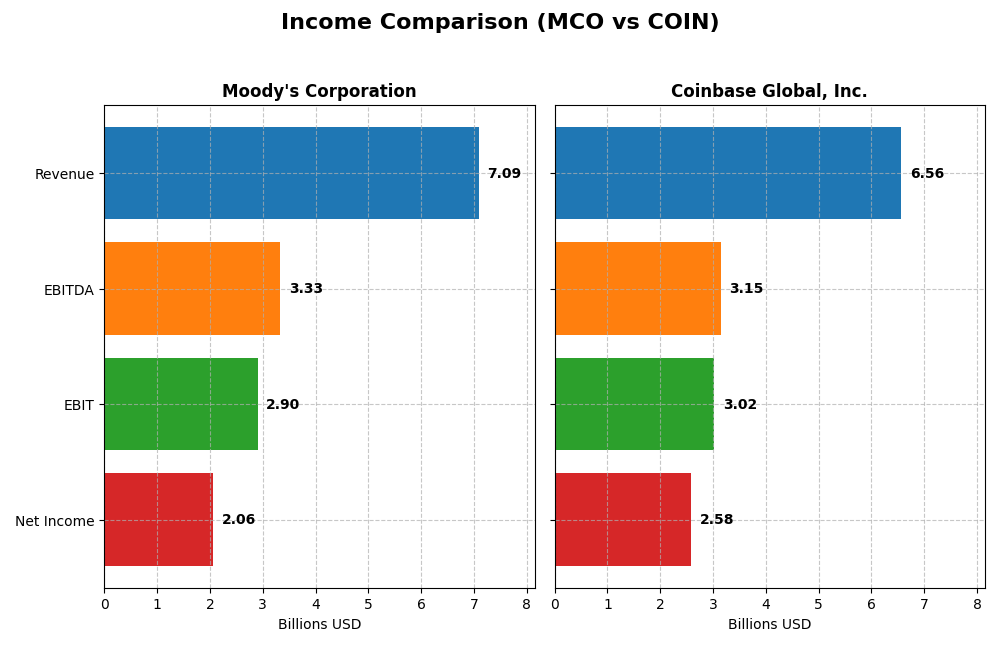

The table below compares the key income statement metrics for Moody’s Corporation and Coinbase Global, Inc. for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | Moody’s Corporation | Coinbase Global, Inc. |

|---|---|---|

| Market Cap | 95.5B | 62.6B |

| Revenue | 7.09B | 6.56B |

| EBITDA | 3.33B | 3.15B |

| EBIT | 2.90B | 3.02B |

| Net Income | 2.06B | 2.59B |

| EPS | 11.32 | 10.42 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Moody’s Corporation

Moody’s Corporation exhibited consistent revenue growth from $5.37B in 2020 to $7.09B in 2024, with net income rising from $1.78B to $2.06B over the same period. Margins remained stable, with a favorable gross margin of 66.41% and net margin near 29%. In 2024, revenue growth slowed to 19.81%, but EBIT margin improved, signaling operational efficiency gains.

Coinbase Global, Inc.

Coinbase showed volatile but substantial revenue growth, jumping from $1.28B in 2020 to $6.56B in 2024, with net income recovering from a $2.63B loss in 2022 to a $2.59B profit in 2024. Margins improved significantly, with a gross margin of 74.75% and net margin at 39.29% in 2024. The latest year saw exceptional growth rates, reflecting a strong operational rebound.

Which one has the stronger fundamentals?

Both companies demonstrate favorable income statement evaluations, but Coinbase’s extraordinary growth rates and margin improvements suggest more dynamic fundamentals. Moody’s shows steady, reliable growth with high profitability, while Coinbase’s recent performance indicates rapid expansion and margin recovery. The choice depends on preference for stability versus growth potential.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Moody’s Corporation and Coinbase Global, Inc. based on their most recent fiscal year data ending 2024.

| Ratios | Moody’s Corporation (MCO) | Coinbase Global, Inc. (COIN) |

|---|---|---|

| ROE | 57.7% | 25.1% |

| ROIC | 17.8% | 13.6% |

| P/E | 41.8 | 23.8 |

| P/B | 24.1 | 6.0 |

| Current Ratio | 1.43 | 2.28 |

| Quick Ratio | 1.43 | 2.28 |

| D/E | 2.17 | 0.45 |

| Debt-to-Assets | 50.0% | 20.5% |

| Interest Coverage | 14.6 | 28.6 |

| Asset Turnover | 0.46 | 0.29 |

| Fixed Asset Turnover | 8.13 | 23.34 |

| Payout Ratio | 30.1% | 0% |

| Dividend Yield | 0.72% | 0% |

Interpretation of the Ratios

Moody’s Corporation

Moody’s presents a mixed ratio profile with strong profitability indicators, including a high ROE of 57.73% and ROIC of 17.84%, but faces challenges with a high PE of 41.82 and a debt-to-equity ratio of 2.17, which is unfavorable. The dividend yield is modest at 0.72%, with regular payouts supported by stable cash flows, though the payout ratio and free cash flow coverage suggest a need for caution.

Coinbase Global, Inc.

Coinbase shows generally favorable ratios, notably a strong net margin of 39.29% and robust liquidity with a current ratio of 2.28. However, its ROIC of 13.56% is flagged as unfavorable, and its price-to-book ratio of 5.98 raises some concerns. Coinbase does not pay dividends, reflecting its focus on reinvestment and growth in the evolving crypto market.

Which one has the best ratios?

Coinbase holds a more favorable overall ratio profile with 57.14% favorable metrics compared to Moody’s 42.86%, driven by superior liquidity, lower leverage, and growth orientation. Moody’s, while strong in profitability, faces more unfavorable valuations and leverage metrics, resulting in a neutral global ratio assessment versus Coinbase’s favorable stance.

Strategic Positioning

This section compares the strategic positioning of Moody’s Corporation and Coinbase Global, Inc. in terms of market position, key segments, and exposure to technological disruption:

Moody’s Corporation

- Leading integrated risk assessment firm with global reach; faces competition in financial data services.

- Operates two segments: Investors Service (credit ratings) and Analytics (risk management solutions).

- Moderate exposure through analytics software; traditional finance focus limits disruption risk.

Coinbase Global, Inc.

- Key player in crypto financial infrastructure; operates in a highly competitive and evolving market.

- Diverse revenue from consumer/institutional crypto services and blockchain infrastructure subscriptions.

- High exposure to blockchain and crypto innovation; technological shifts directly impact business model.

Moody’s Corporation vs Coinbase Global, Inc. Positioning

Moody’s shows a diversified model across credit ratings and analytics, providing stable, broad-based financial services. Coinbase concentrates on crypto infrastructure with rapid innovation but higher volatility and disruption risk.

Which has the best competitive advantage?

Moody’s maintains a slightly favorable moat with consistent value creation despite declining ROIC. Coinbase has a very unfavorable moat, shedding value with a steeply declining profitability trend, indicating weaker competitive advantage.

Stock Comparison

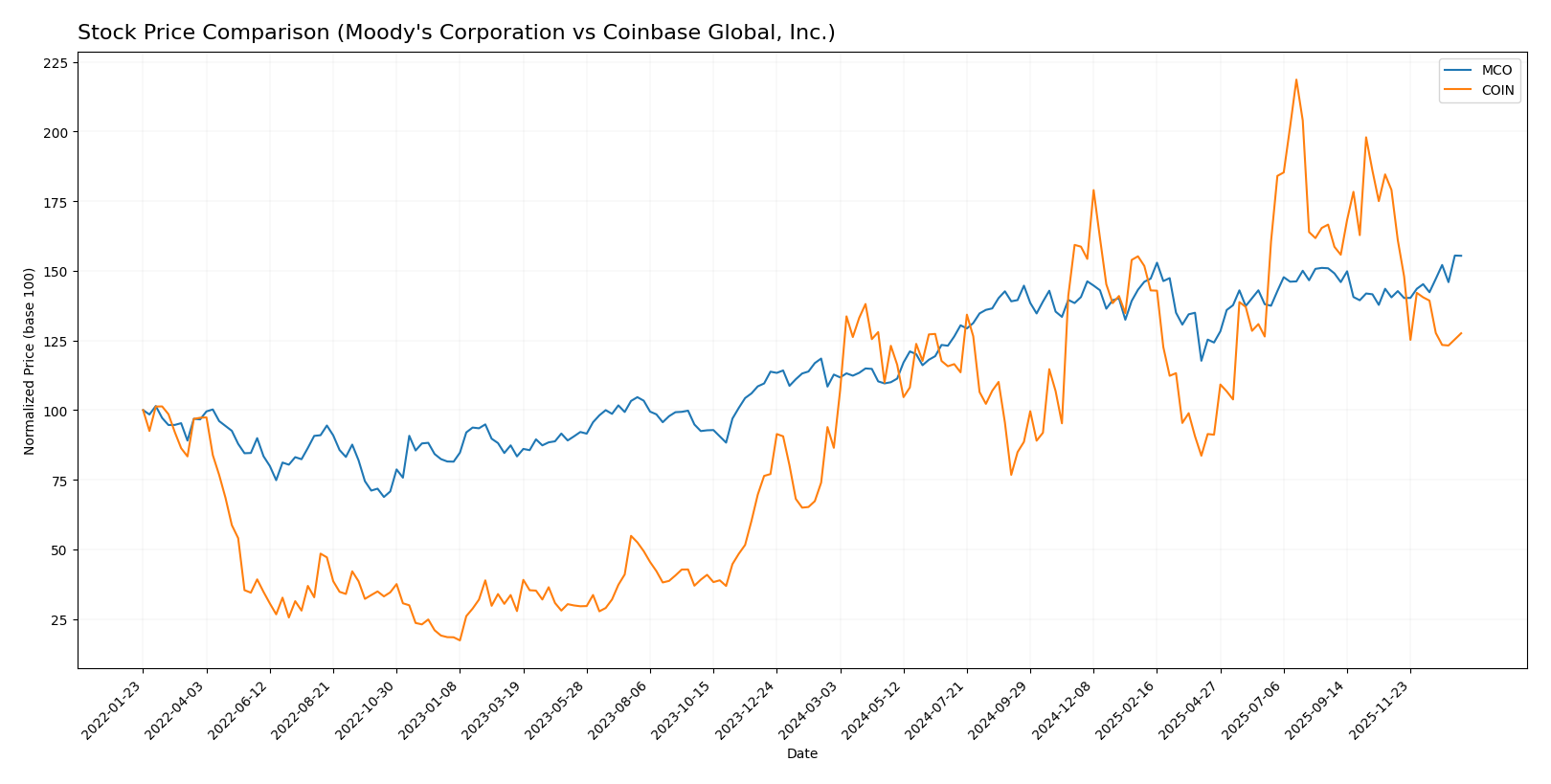

The stock price dynamics over the past 12 months reveal notable bullish trends for both Moody’s Corporation and Coinbase Global, Inc., with contrasting recent movements and distinct trading volumes shaping their market profiles.

Trend Analysis

Moody’s Corporation (MCO) exhibited a strong bullish trend over the past year with a 37.83% price increase and accelerating momentum, reaching a high of 531.61 and a low of 374.67, supported by a decreasing volume trend and buyer dominance.

Coinbase Global, Inc. (COIN) showed a higher overall bullish trend with a 47.57% gain but experienced deceleration and a sharp recent decline of -28.75%, with significant volatility and a shift to seller dominance in recent trading weeks.

Comparing these trends, Coinbase delivered the highest total market performance over the full year despite recent weakness, whereas Moody’s maintained steadier gains with accelerating strength.

Target Prices

The current analyst consensus presents clear target price ranges for both Moody’s Corporation and Coinbase Global, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Moody’s Corporation | 620 | 507 | 557.44 |

| Coinbase Global, Inc. | 440 | 230 | 362.5 |

Analysts expect Moody’s stock to trade moderately above its current price of $531.39, while Coinbase shows potential for significant upside from its current $244.57 price, reflecting higher volatility and growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Moody’s Corporation and Coinbase Global, Inc.:

Rating Comparison

MCO Rating

- Rating: B, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: Moderate at 3, indicating average valuation.

- ROE Score: Very Favorable at 5, showing efficient profit generation.

- ROA Score: Very Favorable at 5, demonstrating effective asset use.

- Debt To Equity Score: Very Unfavorable at 1, indicating high financial risk.

- Overall Score: Moderate at 3, a balanced summary of financial standing.

COIN Rating

- Rating: B+, also classified as Very Favorable by analysts.

- Discounted Cash Flow Score: Favorable at 4, suggesting undervaluation signs.

- ROE Score: Very Favorable at 5, equally strong in profit generation.

- ROA Score: Very Favorable at 5, similarly effective in asset utilization.

- Debt To Equity Score: Moderate at 3, reflecting better financial stability.

- Overall Score: Moderate at 3, matching Moody’s in overall assessment.

Which one is the best rated?

Based strictly on the provided data, Coinbase holds a slightly better rating with a B+ and a more favorable discounted cash flow and debt-to-equity score compared to Moody’s B rating and weaker debt management score. Both share equally strong ROE and ROA scores.

Scores Comparison

Here is a comparison of the financial scores for Moody’s Corporation and Coinbase Global, Inc.:

MCO Scores

- Altman Z-Score: 7.47, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

COIN Scores

- Altman Z-Score: 3.90, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 6, classified as average financial health.

Which company has the best scores?

Moody’s Corporation shows stronger financial health with a higher Altman Z-Score and a very strong Piotroski Score compared to Coinbase’s lower Piotroski Score and safer but less robust Altman Z-Score.

Grades Comparison

Here is a comparison of the recent grades assigned to Moody’s Corporation and Coinbase Global, Inc.:

Moody’s Corporation Grades

The following table summarizes recent grades from reputable grading companies for Moody’s Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | Outperform | 2026-01-08 |

| Stifel | Upgrade | Buy | 2026-01-05 |

| Goldman Sachs | Upgrade | Buy | 2025-12-16 |

| Mizuho | Maintain | Neutral | 2025-10-28 |

| Stifel | Maintain | Hold | 2025-10-23 |

| JP Morgan | Maintain | Overweight | 2025-10-23 |

| Wells Fargo | Maintain | Overweight | 2025-10-23 |

| BMO Capital | Maintain | Market Perform | 2025-10-23 |

| Raymond James | Upgrade | Market Perform | 2025-10-17 |

| BMO Capital | Maintain | Market Perform | 2025-10-16 |

Moody’s grades show a clear bullish trend, with multiple upgrades to “Buy” and consistent “Overweight” or “Outperform” ratings from top-tier firms.

Coinbase Global, Inc. Grades

The following table presents recent grades from established grading firms for Coinbase Global, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-08 |

| B of A Securities | Upgrade | Buy | 2026-01-08 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-18 |

| BTIG | Maintain | Buy | 2025-12-18 |

| Compass Point | Maintain | Sell | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-12-12 |

| Argus Research | Downgrade | Hold | 2025-11-25 |

| Goldman Sachs | Maintain | Neutral | 2025-11-21 |

| Monness, Crespi, Hardt | Upgrade | Buy | 2025-11-10 |

| Mizuho | Maintain | Neutral | 2025-11-03 |

Coinbase’s grades depict a more mixed picture, with some buy ratings but also notable hold and sell designations, reflecting varied analyst sentiment.

Which company has the best grades?

Moody’s Corporation has received generally stronger and more consistent buy and outperform ratings compared to Coinbase Global, Inc., which shows a broader range of opinions including hold and sell grades. This disparity may influence investors differently based on risk tolerance and confidence in analyst consensus.

Strengths and Weaknesses

Here is a comparative overview of key strengths and weaknesses for Moody’s Corporation (MCO) and Coinbase Global, Inc. (COIN) based on the latest data:

| Criterion | Moody’s Corporation (MCO) | Coinbase Global, Inc. (COIN) |

|---|---|---|

| Diversification | Strong, with two main segments: Moodys Analytics ($4.41B) and Moodys Investors Service ($2.68B) contributing significant revenues | Moderate diversification with multiple revenue streams: Bank servicing consumer ($3.43B), stablecoin ($0.91B), blockchain services, and others |

| Profitability | High net margin (29.03%) and ROIC (17.84%), but declining trend in ROIC; creates value but profitability is slightly weakening | High net margin (39.29%) but ROIC (13.56%) below WACC and declining sharply; currently destroying value |

| Innovation | Established financial analytics and credit rating innovations; steady but limited growth in ROIC suggests room for enhanced innovation | Focus on blockchain and crypto innovations, with strong growth potential but also high risk and volatility |

| Global presence | Significant; Moody’s services are recognized worldwide in financial markets | Growing global footprint in crypto markets but facing regulatory and competitive challenges |

| Market Share | Leading market share in credit rating and analytics sectors | Significant share in crypto exchange market but highly competitive and rapidly evolving |

Key takeaways: Moody’s demonstrates solid profitability and strong diversification with a slight decline in efficiency, indicating a mature, value-creating business. Coinbase, while innovative and profitable by margin, faces challenges with declining capital efficiency and value destruction, reflecting higher risk and volatility in its sector.

Risk Analysis

The following table summarizes key risk factors for Moody’s Corporation (MCO) and Coinbase Global, Inc. (COIN) based on the most recent data from 2024:

| Metric | Moody’s Corporation (MCO) | Coinbase Global, Inc. (COIN) |

|---|---|---|

| Market Risk | Beta 1.45, moderate volatility | Beta 3.71, high volatility |

| Debt Level | Debt-to-Equity 2.17 (unfavorable) | Debt-to-Equity 0.45 (favorable) |

| Regulatory Risk | Moderate, financial regulations | High, evolving crypto regulations |

| Operational Risk | Stable, diversified segments | Medium, dependent on crypto market infrastructure |

| Environmental Risk | Low impact | Low impact |

| Geopolitical Risk | Moderate, global exposure | Moderate, international crypto policies |

Moody’s faces elevated debt levels and market sensitivity but benefits from strong operational stability. Coinbase carries higher market and regulatory risks due to crypto volatility and uncertain legal frameworks. Both remain financially solvent, with Moody’s showing very strong bankruptcy safety scores.

Which Stock to Choose?

Moody’s Corporation (MCO) has shown steady income growth with a 19.81% revenue increase in 2024 and favorable profitability metrics, including a 29.03% net margin and a high 57.73% ROE. Its debt level is moderate with a net debt to EBITDA of 1.6, and the overall rating stands at very favorable with a “B” grade.

Coinbase Global, Inc. (COIN) exhibits rapid income expansion, with a 111.17% revenue growth in 2024 and a higher net margin of 39.29%. Financial ratios reveal a generally favorable profile, including a low debt to equity of 0.45 and a “B+” rating. However, its ROIC is below WACC, signaling value destruction despite solid profitability.

For investors prioritizing stable value creation and consistent profitability, Moody’s might appear more favorable due to its strong economic moat and very favorable rating. Conversely, risk-tolerant investors focusing on growth could see Coinbase’s exceptional income growth and favorable ratios as attractive, despite its declining ROIC and recent price volatility.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Moody’s Corporation and Coinbase Global, Inc. to enhance your investment decisions: