Home > Comparison > Financial Services > ICE vs COIN

The strategic rivalry between Intercontinental Exchange, Inc. (ICE) and Coinbase Global, Inc. (COIN) shapes the evolving landscape of financial data and stock exchanges. ICE operates as a diversified capital-intensive exchange operator with a broad asset class footprint. In contrast, Coinbase functions as a high-growth, technology-driven crypto marketplace. This analysis evaluates which business model offers a superior risk-adjusted return, guiding investors seeking durable leadership in the dynamic financial services sector.

Table of contents

Companies Overview

Intercontinental Exchange and Coinbase represent two giants shaping the future of financial markets and digital assets.

Intercontinental Exchange, Inc.: Global Market Infrastructure Leader

Intercontinental Exchange dominates as a regulated exchange operator spanning commodities, equities, and fixed income markets globally. It generates revenue through trading, clearing houses, and data services across 13 exchanges and 6 clearing venues. In 2026, its strategic focus sharpens on expanding mortgage technology platforms and enhancing data analytics to drive recurring revenue and deepen market integration.

Coinbase Global, Inc.: Cryptocurrency Financial Infrastructure Innovator

Coinbase stands as a leading cryptoeconomy infrastructure provider, offering retail and institutional access to digital assets. Its revenue engine revolves around transaction fees from crypto trading and technology services enabling crypto payments. In 2026, Coinbase prioritizes scaling its marketplace liquidity and developer tools, aiming to cement its position as the primary financial account in the evolving crypto ecosystem.

Strategic Collision: Similarities & Divergences

Both firms operate in financial services but differ fundamentally: Intercontinental Exchange builds on a regulated, multi-asset trading ecosystem, while Coinbase pioneers an open, blockchain-based infrastructure. Their battleground centers on market share in emerging digital assets versus traditional securities trading. Investors face distinct profiles—Intercontinental Exchange offers stable cash flows from diversified assets, whereas Coinbase presents higher volatility tied to crypto market cycles.

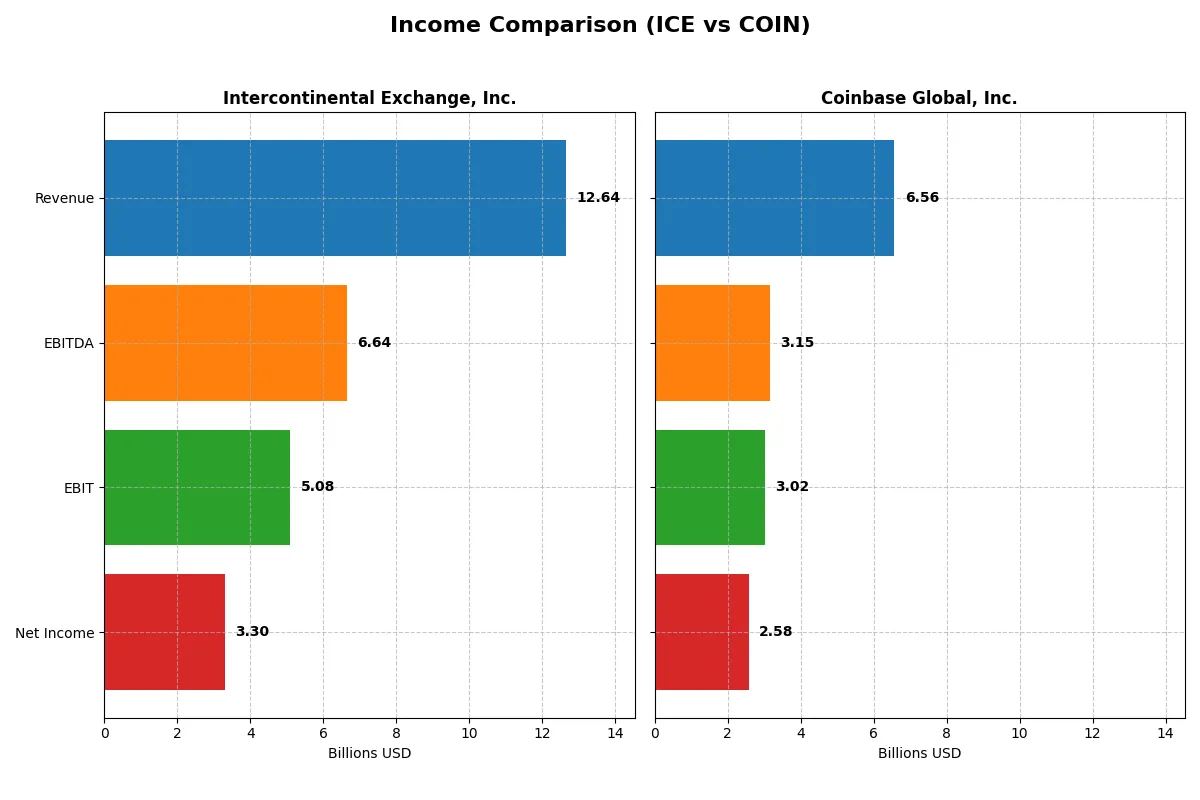

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Intercontinental Exchange (ICE) | Coinbase Global (COIN) |

|---|---|---|

| Revenue | 12.6B | 6.56B |

| Cost of Revenue | 4.82B | 1.66B |

| Operating Expenses | 2.93B | 2.60B |

| Gross Profit | 7.82B | 4.91B |

| EBITDA | 6.64B | 3.15B |

| EBIT | 5.08B | 3.02B |

| Interest Expense | 781M | 81M |

| Net Income | 3.30B | 2.59B |

| EPS | 5.8 | 10.42 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company drives superior profitability and operational efficiency through recent market cycles.

Intercontinental Exchange, Inc. Analysis

ICE’s revenue climbed steadily from 9.17B in 2021 to 12.64B in 2025, a 38% growth over five years. Net income, however, peaked in 2021 at 4.06B before dipping to 3.30B in 2025, reflecting margin pressure. Gross and net margins remain healthy at 62% and 26%, respectively, signaling resilient cost control despite a modest 7.5% revenue growth in the latest year.

Coinbase Global, Inc. Analysis

Coinbase’s revenue surged from 1.28B in 2020 to 6.56B in 2024, a remarkable 414% increase. Net income rebounded strongly to 2.59B in 2024 after losses in prior years, with net margin hitting 39%. Its gross margin of 75% and ebit margin of 46% demonstrate robust profitability. The latest year’s 111% revenue growth and massive earnings expansion underscore strong momentum and operating leverage.

Momentum Surge vs. Margin Resilience

Coinbase outpaces ICE in revenue and earnings growth, showcasing explosive momentum and expanding profitability. ICE delivers steadier, mature margin profiles with less volatile net income. Investors seeking rapid growth and improving earnings might favor Coinbase’s profile, while those valuing stable margin power may lean toward ICE’s consistent financial engine.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency for the companies compared below:

| Ratios | Intercontinental Exchange (ICE) | Coinbase Global (COIN) |

|---|---|---|

| ROE | 11.40% | 25.10% |

| ROIC | 7.02% | 13.56% |

| P/E | 28.00 | 23.82 |

| P/B | 3.19 | 5.98 |

| Current Ratio | 1.02 | 2.28 |

| Quick Ratio | 1.02 | 2.28 |

| D/E | 0.72 | 0.45 |

| Debt-to-Assets | 15.31% | 20.54% |

| Interest Coverage | 6.27 | 28.61 |

| Asset Turnover | 0.09 | 0.29 |

| Fixed Asset Turnover | 4.70 | 23.34 |

| Payout ratio | 33.44% | 0% |

| Dividend yield | 1.19% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s financial DNA, exposing hidden risks and operational strengths essential for investor insight.

Intercontinental Exchange, Inc.

ICE shows solid profitability with an 11.4% ROE and a strong 26.14% net margin, signaling operational efficiency. Its P/E ratio at 28.0 suggests the stock trades at a premium, while a 1.19% dividend yield offers modest shareholder returns. The company balances reinvestment and steady payouts, reflecting a cautious capital allocation strategy.

Coinbase Global, Inc.

COIN delivers high profitability with a 25.1% ROE and a 39.29% net margin, outperforming many peers. Its P/E ratio of 23.82 appears more reasonable, though a high P/B at 5.98 indicates a stretched valuation. Coinbase does not pay dividends, instead reinvesting heavily in R&D and growth initiatives, aligning with its tech-driven expansion.

Premium Valuation vs. Growth Efficiency

ICE trades at a higher multiple with moderate returns and steady dividends, reflecting stability but stretched valuation. COIN offers superior profitability and growth reinvestment but carries valuation risks and no dividend income. Investors seeking growth may favor COIN’s profile, while those prioritizing income and operational consistency might lean toward ICE.

Which one offers the Superior Shareholder Reward?

I see Intercontinental Exchange, Inc. (ICE) pays a consistent dividend with a 1.2% yield and a 33% payout ratio, covered comfortably by 92% FCF. ICE also executes steady buybacks, enhancing shareholder returns sustainably. Coinbase Global, Inc. (COIN), by contrast, pays no dividend but invests aggressively in growth and maintains a robust buyback program supported by strong free cash flow and a 39% net margin. Historically, I’ve observed that ICE’s balanced distribution suits income-focused investors, while COIN’s reinvestment can fuel higher long-term capital gains. In 2026, ICE offers more stable, income-driven rewards, but COIN’s growth-centric buybacks present superior total return potential for risk-tolerant investors.

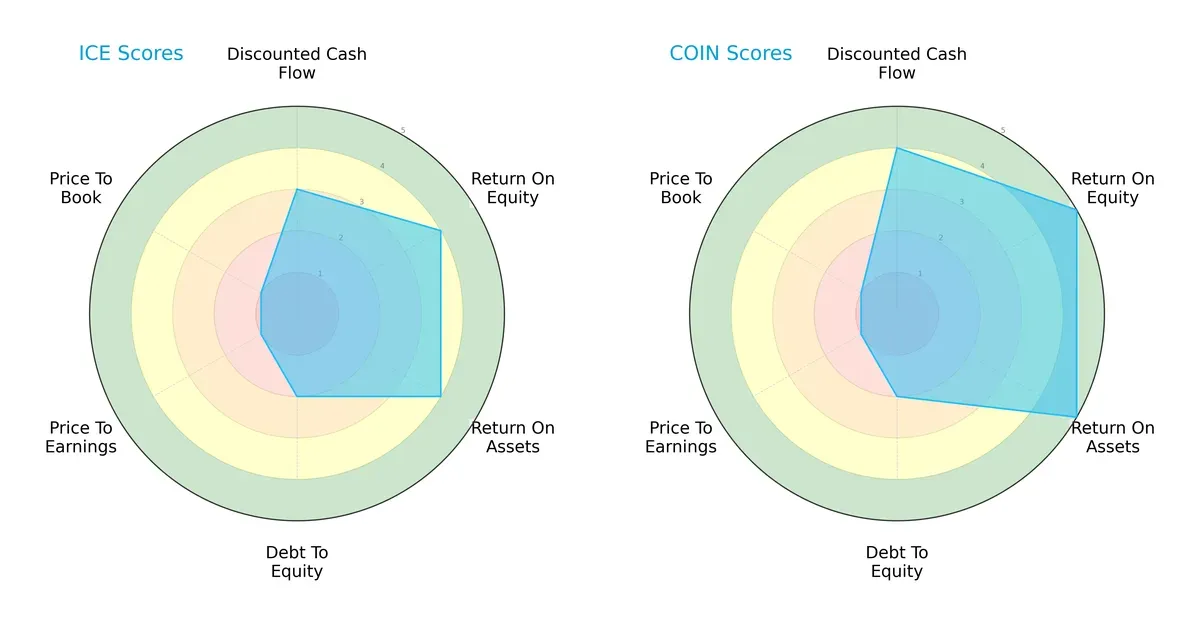

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Intercontinental Exchange, Inc. and Coinbase Global, Inc., highlighting their financial strengths and weaknesses:

Coinbase leads in discounted cash flow, return on equity, and return on assets, signaling superior profitability and asset use. Both firms share a weak debt-to-equity profile, implying higher financial risk. Intercontinental Exchange displays a more balanced valuation approach, while Coinbase relies heavily on operational efficiency for its edge.

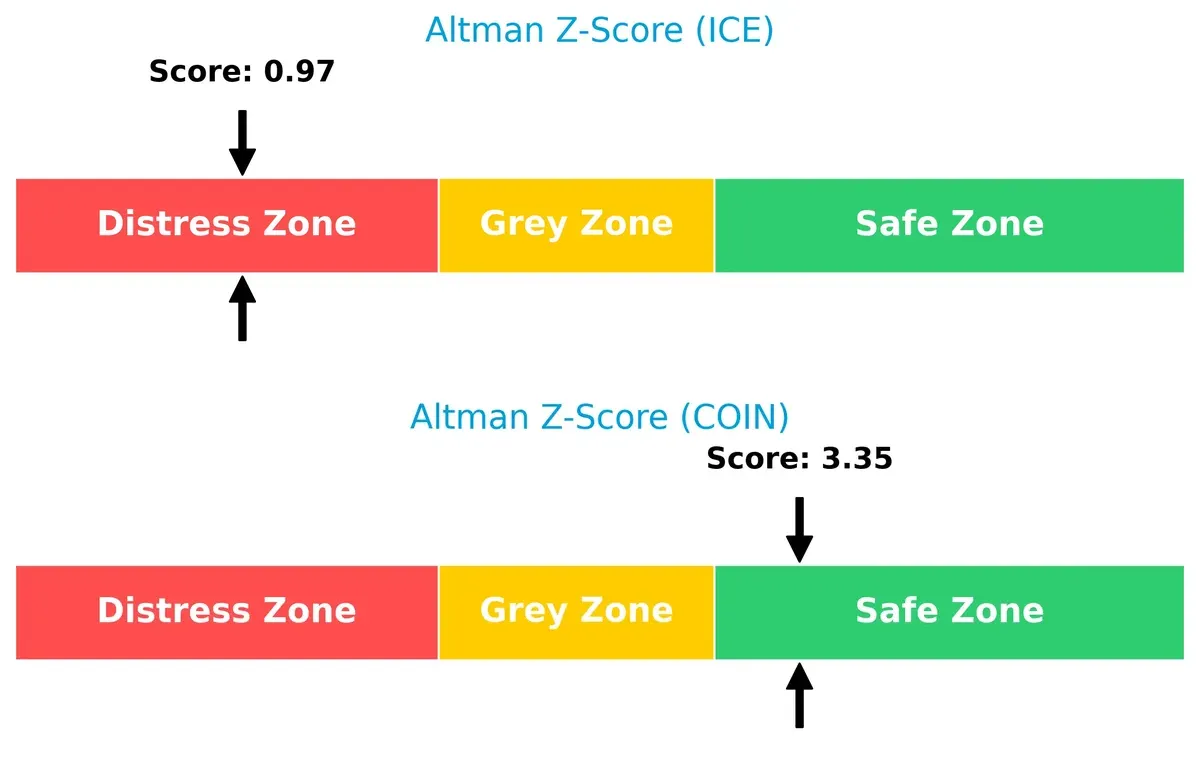

Bankruptcy Risk: Solvency Showdown

Intercontinental Exchange’s Altman Z-Score of 0.97 places it in distress, suggesting high bankruptcy risk. Coinbase’s score of 3.35 sits safely above, indicating robust solvency and long-term survival prospects:

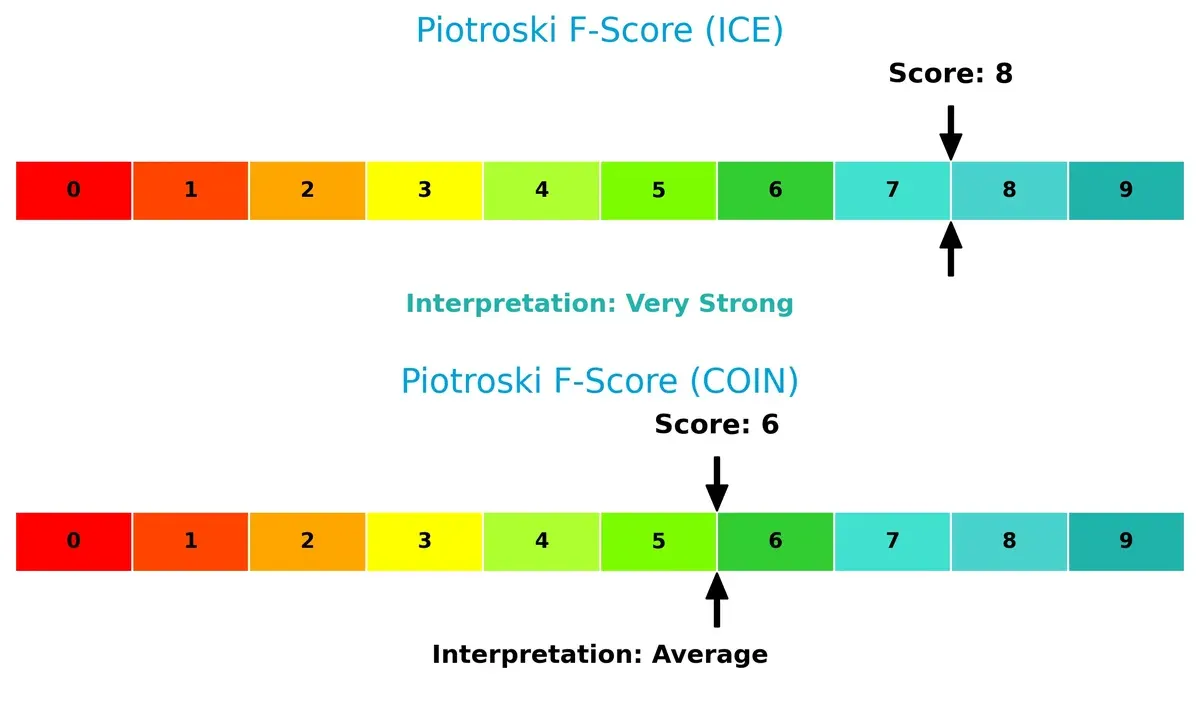

Financial Health: Quality of Operations

Intercontinental Exchange scores an 8 on the Piotroski F-Score, reflecting very strong financial health. Coinbase’s 6 is respectable but signals some internal weaknesses relative to ICE:

How are the two companies positioned?

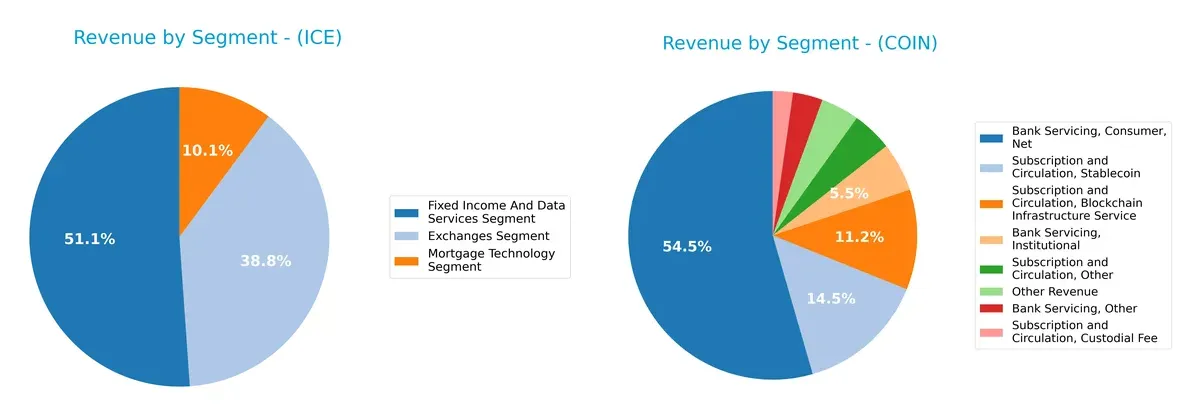

This section dissects the operational DNA of ICE and COIN by comparing their revenue distribution by segment and internal dynamics. The final objective is to confront their economic moats and identify which model offers the most resilient, sustainable advantage today.

Revenue Segmentation: The Strategic Mix

This comparison dissects how Intercontinental Exchange and Coinbase diversify their income streams and where their primary sector bets lie:

Intercontinental Exchange (ICE) balances revenue between Fixed Income and Data Services ($1.36B) and Exchanges ($1.03B), plus a smaller Mortgage Tech segment ($269M). Coinbase (COIN) relies heavily on Bank Servicing Consumer ($3.43B), dwarfing other segments like Blockchain Infrastructure ($706M). ICE’s diversified mix suggests ecosystem lock-in and infrastructure dominance, while COIN faces concentration risk anchored on consumer banking services.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Intercontinental Exchange, Inc. and Coinbase Global, Inc.:

ICE Strengths

- Diversified revenue across exchanges, fixed income, and mortgage technology

- Favorable net margin at 26.14%

- Strong quick ratio at 1.02

- Low debt-to-assets ratio at 15.31%

- Solid interest coverage at 6.51x

- Global presence with significant US and Europe revenues

COIN Strengths

- High net margin at 39.29%

- Strong ROE at 25.1%

- Favorable liquidity ratios with current and quick ratios at 2.28

- Very high interest coverage at 37.49x

- Impressive fixed asset turnover at 23.34

- Concentrated US market exposure with growing international revenues

ICE Weaknesses

- Unfavorable high PE (28.0) and PB (3.19) ratios

- Neutral ROIC below WACC (7.02% vs. 7.61%)

- Low asset turnover at 0.09

- Moderate current ratio at 1.02 limits liquidity buffer

- Dividend yield at 1.19% may limit reinvestment

COIN Weaknesses

- Unfavorable high WACC at 19.51%

- Unfavorable PB ratio at 5.98

- Unfavorable ROIC at 13.56% below WACC

- No dividend yield limits income return

- Asset turnover remains low at 0.29 despite growth

- Higher debt-to-assets ratio at 20.54% increases leverage risk

Both ICE and COIN exhibit strong profitability and liquidity metrics, though ICE shows a more diversified revenue base and conservative leverage. COIN’s higher profitability contrasts with elevated cost of capital and leverage, which could pressure future returns. Each company’s strategic focus is reflected in its financial structure and market footprint.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield preserving long-term profits from relentless competitive pressure. Let’s dissect the moats of two financial market leaders:

Intercontinental Exchange, Inc. (ICE): Network Effects and Regulatory Barriers

ICE’s moat stems from network effects and regulatory licensing across multiple global exchanges. Its stable 26% net margin and 40% EBIT margin reflect this durable advantage. Expansion into mortgage technology deepens its competitive edge in 2026.

Coinbase Global, Inc. (COIN): Platform Scale in the Cryptoeconomy

Coinbase’s moat relies on platform liquidity and brand trust in crypto markets, contrasting ICE’s regulated exchanges. Despite a higher gross margin (75%) and explosive revenue growth, COIN faces margin pressure with a weakening ROIC trend. Innovation in crypto services could disrupt or expand its moat.

Network Effects vs. Platform Scale: Who Holds the Stronger Moat?

ICE’s growing ROIC and consistent profitability reveal a more sustainable moat than COIN’s declining ROIC and value destruction. ICE’s regulatory entrenchment better shields market share against competition in 2026.

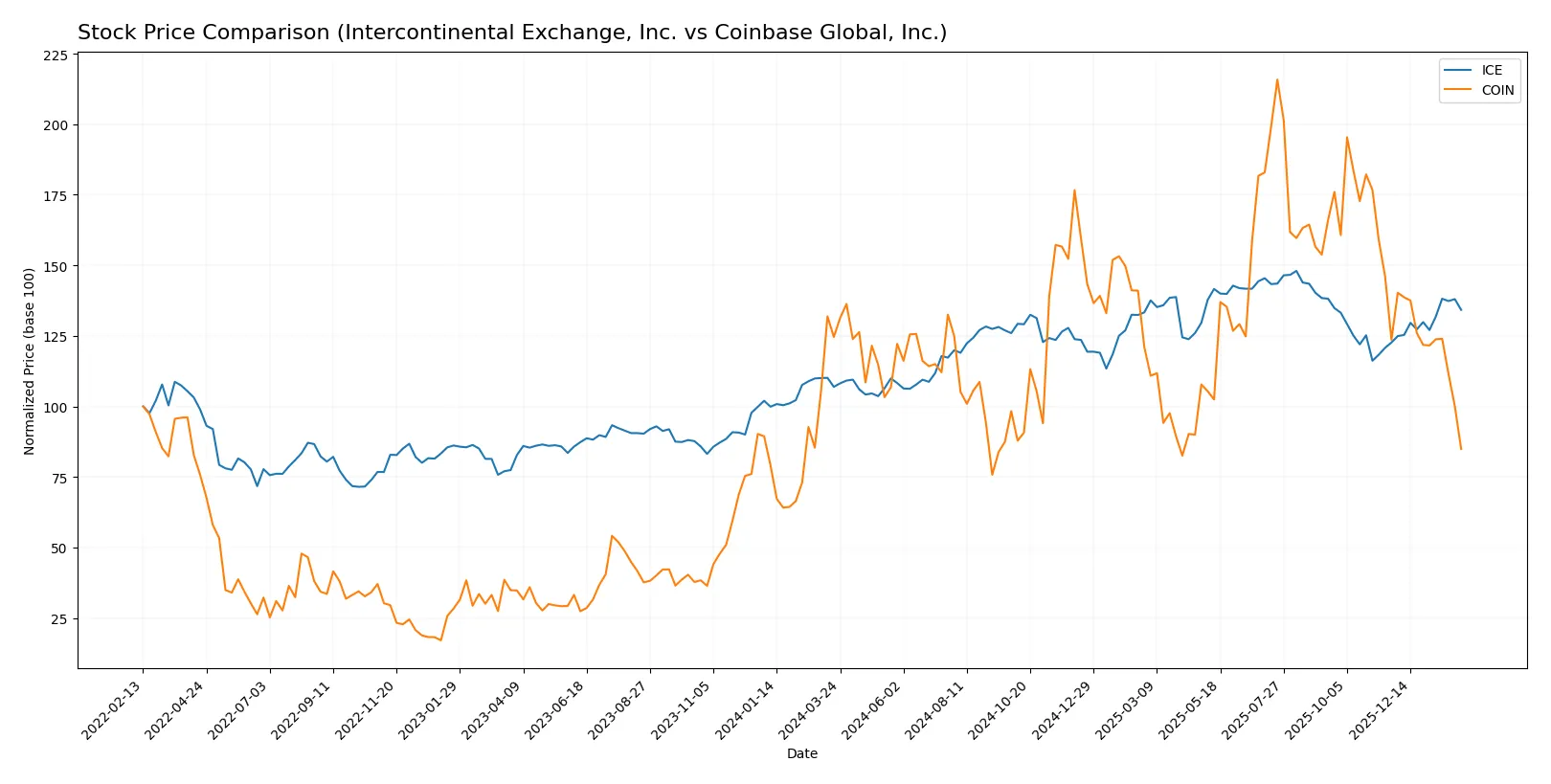

Which stock offers better returns?

Over the past year, Intercontinental Exchange, Inc. (ICE) surged 25.5%, showing accelerating bullish momentum. Coinbase Global, Inc. (COIN) declined 31.9%, with decelerating bearish pressure dominating trading activity.

Trend Comparison

ICE’s stock price rose 25.5% over the last 12 months, marking a bullish trend with accelerating gains and a high price range between 130.5 and 186.4. Volatility measured by a 14.83 standard deviation.

COIN’s stock price fell 31.9% over the same period, confirming a bearish trend with deceleration. The stock exhibited extreme volatility, with a 58.94 standard deviation, and prices ranged from 147.35 to 419.78.

ICE outperformed COIN in market returns, delivering strong positive growth while COIN experienced a significant decline over the past year.

Target Prices

Analysts present a bullish consensus for both Intercontinental Exchange, Inc. and Coinbase Global, Inc. with substantial upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Intercontinental Exchange, Inc. | 180 | 211 | 192.33 |

| Coinbase Global, Inc. | 230 | 440 | 336.44 |

The consensus target for ICE stands about 14% above its current 169 price, reflecting moderate growth expectations. COIN’s consensus target exceeds its 165 current price by over 100%, indicating high optimism despite its volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the recent institutional grades assigned to Intercontinental Exchange, Inc. and Coinbase Global, Inc.:

Intercontinental Exchange, Inc. Grades

The table below summarizes recent grades from leading financial institutions for ICE:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-02-06 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Piper Sandler | Maintain | Overweight | 2026-01-14 |

| TD Cowen | Maintain | Buy | 2026-01-14 |

| Barclays | Maintain | Overweight | 2026-01-08 |

| UBS | Maintain | Buy | 2026-01-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-22 |

| UBS | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Barclays | Maintain | Overweight | 2025-10-31 |

Coinbase Global, Inc. Grades

The table below summarizes recent grades from recognized financial firms for COIN:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-02-05 |

| Piper Sandler | Maintain | Neutral | 2026-01-14 |

| Oppenheimer | Maintain | Outperform | 2026-01-12 |

| B of A Securities | Upgrade | Buy | 2026-01-08 |

| Barclays | Maintain | Equal Weight | 2026-01-08 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-18 |

| BTIG | Maintain | Buy | 2025-12-18 |

| Compass Point | Maintain | Sell | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-12-12 |

| Argus Research | Downgrade | Hold | 2025-11-25 |

Which company has the best grades?

Intercontinental Exchange, Inc. consistently receives positive grades with multiple “Buy” and “Overweight” ratings. Coinbase Global, Inc. shows more mixed grades ranging from “Buy” and “Outperform” to “Sell.” ICE’s stronger consensus may suggest greater institutional confidence, potentially impacting investor sentiment and valuation stability.

Risks specific to each company

In 2026’s volatile market, these categories highlight the critical pressure points and systemic threats facing Intercontinental Exchange, Inc. (ICE) and Coinbase Global, Inc. (COIN):

1. Market & Competition

Intercontinental Exchange, Inc. (ICE)

- Operates in mature, regulated markets with stable competition but faces pressure from fintech innovation.

Coinbase Global, Inc. (COIN)

- Faces intense competition in a rapidly evolving crypto market with high volatility and new entrants.

2. Capital Structure & Debt

ICE

- Moderate debt-to-equity ratio (0.72) with favorable interest coverage (6.51), signaling manageable leverage.

COIN

- Lower debt-to-equity (0.45) and very strong interest coverage (37.49) indicate a conservative balance sheet.

3. Stock Volatility

ICE

- Beta near 1.03 reflects market-level volatility, typical for financial service firms.

COIN

- High beta of 3.70 signals extreme sensitivity to market swings and elevated risk.

4. Regulatory & Legal

ICE

- Subject to well-established financial regulations across multiple jurisdictions, providing some predictability.

COIN

- Faces regulatory uncertainty due to the evolving legal framework around cryptocurrencies and digital assets.

5. Supply Chain & Operations

ICE

- Robust, diversified operations in exchanges and data services minimize operational disruptions.

COIN

- Dependent on digital infrastructure and crypto network stability, which are vulnerable to cyber risks.

6. ESG & Climate Transition

ICE

- Established ESG policies typical of legacy financial firms, with ongoing climate transition initiatives.

COIN

- Emerging ESG focus but faces scrutiny on energy use and environmental impact of crypto mining and transactions.

7. Geopolitical Exposure

ICE

- Operations span multiple developed markets, mitigating single-region geopolitical risk.

COIN

- Global crypto exposure includes markets with uncertain regulatory or political environments, increasing geopolitical risk.

Which company shows a better risk-adjusted profile?

ICE’s primary risk is its middling financial distress signals and regulatory complexity in traditional markets. COIN’s biggest threat is extreme stock volatility amplified by regulatory uncertainty. Despite COIN’s superior liquidity and Altman Z-Score in the safe zone, ICE’s steadier market position and ESG progress offer a more balanced risk-adjusted profile. COIN’s beta of 3.7 and recent 13% price surge underscore its volatility risk. I favor ICE for investors seeking stable exposure with moderate growth potential amid 2026’s choppy financial landscape.

Final Verdict: Which stock to choose?

Intercontinental Exchange, Inc. (ICE) stands out as a cash-generating powerhouse with a steadily improving profitability trend. Its main point of vigilance lies in a modest margin between ROIC and WACC, signaling some value destruction. ICE suits portfolios seeking stable, slightly conservative growth with moderate risk tolerance.

Coinbase Global, Inc. (COIN) commands a strategic moat through its robust revenue growth and high return on equity, supported by a strong market position in digital assets. It offers greater liquidity and balance sheet safety than ICE but faces challenges with declining ROIC and volatile earnings. COIN fits growth-oriented portfolios willing to accept higher volatility.

If you prioritize consistent cash flow and improving profitability, ICE is the compelling choice due to its operational resilience and steady income profile. However, if you seek aggressive growth fueled by market dominance and rapid expansion, COIN offers superior upside potential despite its higher risk. Both present contrasting analytical scenarios for distinct investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Intercontinental Exchange, Inc. and Coinbase Global, Inc. to enhance your investment decisions: