In today’s evolving financial landscape, Coinbase Global, Inc. (COIN) and FactSet Research Systems Inc. (FDS) stand out as pivotal players in the financial data and stock exchanges industry. Coinbase leads in crypto infrastructure and innovation, while FactSet excels in traditional financial analytics and integrated data solutions. This comparison explores their strategies and market positions to help you identify which company holds the greatest potential for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Coinbase Global, Inc. and FactSet Research Systems Inc. by providing an overview of these two companies and their main differences.

Coinbase Global, Inc. Overview

Coinbase Global, Inc. operates as a financial infrastructure and technology provider for the cryptoeconomy both in the US and internationally. Founded in 2012, it offers primary financial accounts for consumers, a liquidity marketplace for institutions, and technology enabling developers to build crypto applications and accept crypto payments. The company is headquartered in Wilmington, Delaware.

FactSet Research Systems Inc. Overview

FactSet Research Systems Inc. delivers integrated financial data and analytics to the investment community worldwide. Established in 1978 and based in Norwalk, Connecticut, it serves portfolio managers, investment banks, asset managers, and wealth advisors through workflow solutions spanning research, analytics, trading, and content technology. FactSet focuses on providing insight and information for diverse financial services entities.

Key similarities and differences

Both companies operate within the financial services sector, specifically in financial data and stock exchanges, serving professional and institutional clients. Coinbase focuses on the cryptoeconomy and blockchain-based financial technology, while FactSet emphasizes traditional financial data, analytics, and workflow solutions for investment professionals. Their customer bases and product offerings reflect these distinct market niches.

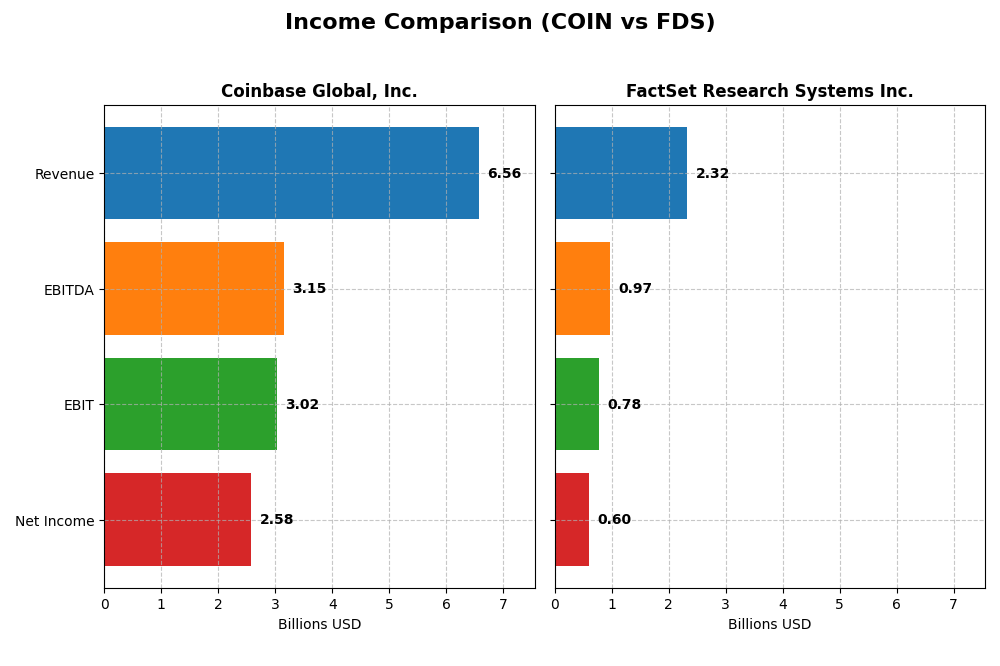

Income Statement Comparison

This table compares the key income statement metrics for Coinbase Global, Inc. and FactSet Research Systems Inc. for their most recent fiscal years.

| Metric | Coinbase Global, Inc. (COIN) | FactSet Research Systems Inc. (FDS) |

|---|---|---|

| Market Cap | 62.4B | 11.2B |

| Revenue | 6.56B | 2.32B |

| EBITDA | 3.15B | 966M |

| EBIT | 3.02B | 777M |

| Net Income | 2.59B | 597M |

| EPS | 10.42 | 15.74 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Coinbase Global, Inc.

Coinbase exhibited robust revenue growth from 2020 to 2024, surging over 400% overall, with net income rebounding sharply from a loss in 2022 to a 2.6B net income in 2024. Margins improved notably, with a gross margin of 74.75% and net margin at 39.29%, both favorable. The 2024 year showed exceptional growth acceleration and margin expansion after prior volatility.

FactSet Research Systems Inc.

FactSet’s revenue increased steadily by nearly 46% over 2021-2025, accompanied by a consistent net income rise of about 49%. Margins remained stable and favorable, with a 52.72% gross margin and 25.72% net margin in 2025. The latest fiscal year saw moderate revenue growth of 5.4%, with slight improvements in net margin and earnings per share, indicating steady operational performance.

Which one has the stronger fundamentals?

Coinbase demonstrates stronger fundamentals from a growth and margin perspective, with much higher revenue and net income expansion and superior margins, reflecting dynamic industry positioning. FactSet shows stable, consistent growth and solid profitability, but at a slower pace and with lower margin levels. Both companies present favorable income statements, yet Coinbase’s metrics indicate a more pronounced growth trajectory and margin improvement.

Financial Ratios Comparison

This table presents the most recent financial ratios for Coinbase Global, Inc. (COIN) and FactSet Research Systems Inc. (FDS) as of their latest fiscal year-end, facilitating a side-by-side comparison.

| Ratios | Coinbase Global, Inc. (2024) | FactSet Research Systems Inc. (2025) |

|---|---|---|

| ROE | 25.10% | 27.31% |

| ROIC | 13.56% | 16.10% |

| P/E | 23.82 | 23.71 |

| P/B | 5.98 | 6.48 |

| Current Ratio | 2.28 | 1.40 |

| Quick Ratio | 2.28 | 1.40 |

| D/E (Debt-to-Equity) | 0.45 | 0.71 |

| Debt-to-Assets | 20.54% | 36.21% |

| Interest Coverage | 28.61 | 13.29 |

| Asset Turnover | 0.29 | 0.54 |

| Fixed Asset Turnover | 23.34 | 11.22 |

| Payout ratio | 0% | 26.79% |

| Dividend yield | 0% | 1.13% |

Interpretation of the Ratios

Coinbase Global, Inc.

Coinbase shows a generally favorable profile with strong net margin at 39.29% and ROE at 25.1%, though its ROIC at 13.56% and WACC at 20.04% are unfavorable. Liquidity and solvency ratios are robust, including a current ratio of 2.28 and debt-to-equity at 0.45. The company does not pay dividends, likely reflecting a reinvestment strategy or growth phase in crypto infrastructure.

FactSet Research Systems Inc.

FactSet’s ratios are mostly favorable, highlighted by a net margin of 25.72% and ROE of 27.31%, with ROIC at a solid 16.1% and a low WACC of 6.76%. Its liquidity ratios are moderate, with a current ratio of 1.4 and debt-to-equity neutral at 0.71. FactSet pays dividends, with a 1.13% yield and moderate payout, suggesting balanced shareholder returns with controlled risk.

Which one has the best ratios?

Coinbase has more favorable ratios overall, especially in profitability and liquidity, despite concerns about ROIC and WACC. FactSet presents a steadier risk profile with consistent returns and dividend payments but has more neutral ratings on liquidity and leverage. The choice depends on investor preference for growth versus income stability.

Strategic Positioning

This section compares the strategic positioning of Coinbase Global, Inc. and FactSet Research Systems Inc., focusing on market position, key segments, and exposure to technological disruption:

Coinbase Global, Inc. (COIN)

- Leading crypto financial infrastructure provider facing high volatility and competition in digital assets.

- Core business driven by crypto consumer accounts, institutional liquidity pools, and blockchain infrastructure services.

- High exposure to crypto technology shifts and evolving blockchain applications impacting business model dynamics.

FactSet Research Systems Inc. (FDS)

- Established financial data and analytics provider with stable competitive presence in global markets.

- Key segments include financial data, analytics, and workflow solutions serving diversified investment clients worldwide.

- Moderate exposure to technology changes, focusing on integrated financial information and analytical applications.

Coinbase vs FactSet Positioning

Coinbase’s strategy centers on the rapidly evolving cryptoeconomy with focused segments in consumer and institutional crypto services, while FactSet offers diversified financial data and analytics across global markets. Coinbase faces higher technological disruption risk, whereas FactSet benefits from established workflows but with slower growth potential.

Which has the best competitive advantage?

FactSet displays a slightly favorable moat with value creation despite declining ROIC, indicating efficient capital use. Coinbase shows a very unfavorable moat with declining ROIC and value destruction, reflecting weaker competitive advantage under current conditions.

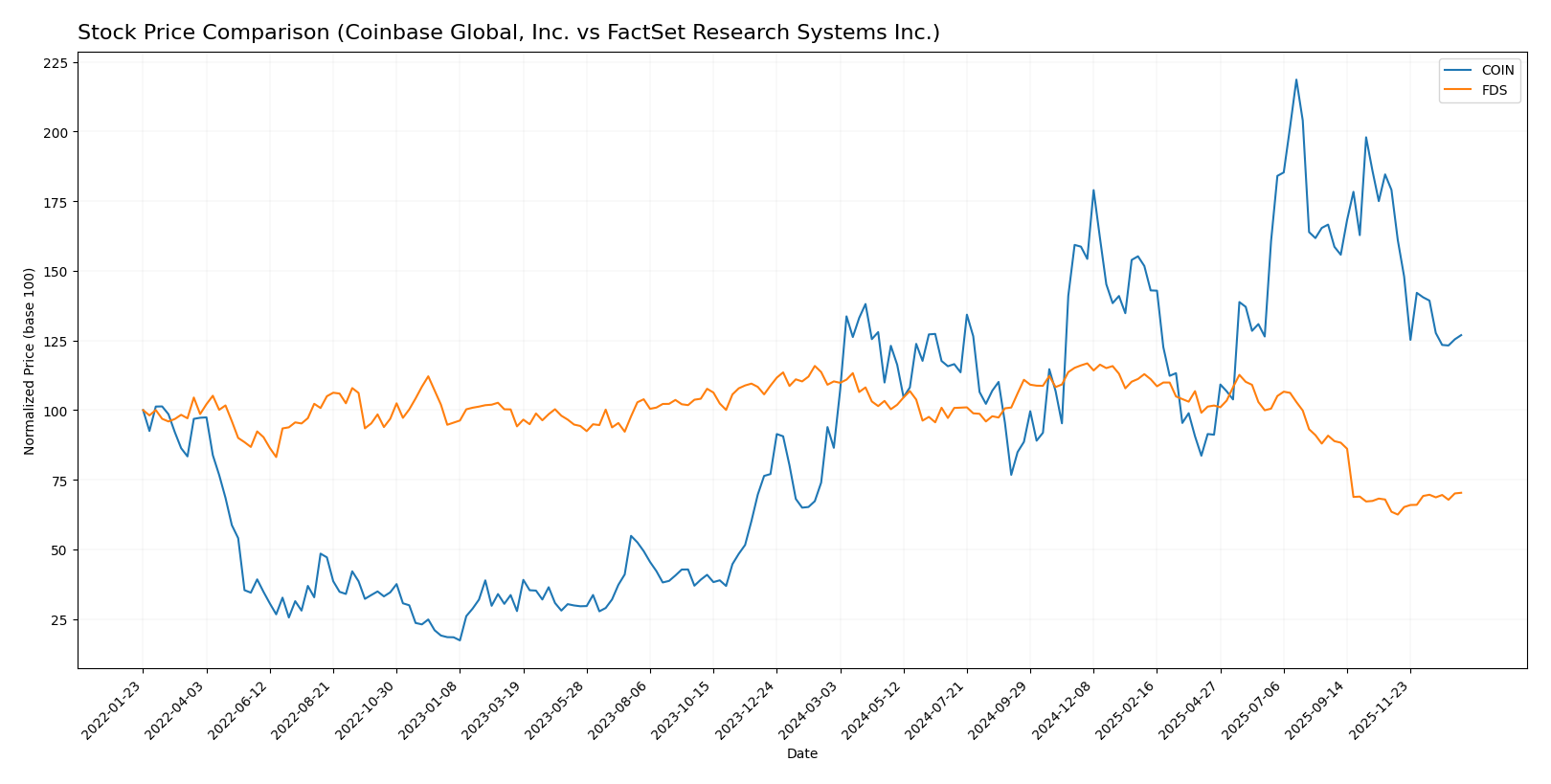

Stock Comparison

The stock price chart highlights significant movements over the past 12 months, with Coinbase Global, Inc. showing a strong overall upward trend despite recent weakening, while FactSet Research Systems Inc. displays a general decline with some recent recovery.

Trend Analysis

Coinbase Global, Inc. experienced a bullish trend over the past year with a 46.8% price increase, though the trend shows deceleration. Recently, the stock declined by 29.12%, indicating a short-term bearish shift.

FactSet Research Systems Inc. had a bearish trend over the past year with a 36.25% price drop, but the trend accelerated downward. Recently, it reversed slightly, gaining 10.73%, indicating a minor bullish correction.

Comparing both, Coinbase delivered the highest market performance with a 46.8% gain over the year, while FactSet’s stock declined overall despite recent gains.

Target Prices

Analysts present a clear consensus on target prices for Coinbase Global, Inc. and FactSet Research Systems Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Coinbase Global, Inc. | 440 | 230 | 362.5 |

| FactSet Research Systems Inc. | 321 | 253 | 296.89 |

The target consensus for Coinbase is significantly above its current price of $243.93, indicating potential upside. FactSet’s consensus target price closely matches its current price of $295.84, suggesting limited near-term price movement.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial grades for Coinbase Global, Inc. and FactSet Research Systems Inc.:

Rating Comparison

Coinbase Global, Inc. Rating

- Rating: B+ with a very favorable status.

- Discounted Cash Flow Score: 4, classified as favorable.

- ROE Score: 5, considered very favorable.

- ROA Score: 5, considered very favorable.

- Debt To Equity Score: 3, rated moderate risk.

FactSet Research Systems Inc. Rating

- Rating: A- with a very favorable status.

- Discounted Cash Flow Score: 5, classified as very favorable.

- ROE Score: 5, considered very favorable.

- ROA Score: 5, considered very favorable.

- Debt To Equity Score: 2, rated moderate risk but lower than COIN.

| Overall Score: 3, moderate rating. | Overall Score: 4, favorable rating. |

Which one is the best rated?

FactSet holds a higher overall rating of A- compared to Coinbase’s B+, with stronger discounted cash flow and overall scores. Both have equally high ROE and ROA scores, but FactSet shows a slight edge in financial standing based on the provided data.

Scores Comparison

Here is a comparison of the financial health scores for Coinbase and FactSet:

COIN Scores

- Altman Z-Score: 3.90, indicating safe zone with low bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

FDS Scores

- Altman Z-Score: 5.20, indicating safe zone with very low bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

Which company has the best scores?

Both companies are in the Altman Z-Score safe zone, but FDS has a higher score indicating stronger financial stability. Piotroski scores for both are equal, showing similar average financial health.

Grades Comparison

The following presents the latest grades and ratings for Coinbase Global, Inc. and FactSet Research Systems Inc.:

Coinbase Global, Inc. Grades

The table below summarizes recent grades assigned to Coinbase by reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-08 |

| B of A Securities | Upgrade | Buy | 2026-01-08 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-18 |

| BTIG | Maintain | Buy | 2025-12-18 |

| Compass Point | Maintain | Sell | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-12-12 |

| Argus Research | Downgrade | Hold | 2025-11-25 |

| Goldman Sachs | Maintain | Neutral | 2025-11-21 |

| Monness, Crespi, Hardt | Upgrade | Buy | 2025-11-10 |

| Mizuho | Maintain | Neutral | 2025-11-03 |

Coinbase’s grades show a mix of Buy and Hold ratings, with some equal weight and a few Sell opinions, indicating moderate analyst confidence.

FactSet Research Systems Inc. Grades

The table below summarizes recent grades assigned to FactSet by reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | In Line | 2026-01-08 |

| BMO Capital | Maintain | Market Perform | 2025-12-22 |

| Goldman Sachs | Maintain | Sell | 2025-12-19 |

| Stifel | Maintain | Hold | 2025-12-19 |

| RBC Capital | Maintain | Sector Perform | 2025-12-19 |

| Morgan Stanley | Upgrade | Equal Weight | 2025-12-17 |

| Wells Fargo | Maintain | Underweight | 2025-12-05 |

| UBS | Upgrade | Buy | 2025-09-22 |

| BMO Capital | Maintain | Market Perform | 2025-09-19 |

| Wells Fargo | Maintain | Underweight | 2025-09-19 |

FactSet’s grades predominantly range from Hold to Market Perform, with some downgrades and a few upgrades to Buy or Equal Weight, reflecting more cautious analyst views.

Which company has the best grades?

Coinbase Global, Inc. has received more Buy ratings and a higher consensus grade compared to FactSet Research Systems Inc., which has a majority of Hold and Market Perform ratings. This suggests stronger analyst optimism for Coinbase, potentially influencing investor sentiment toward growth prospects.

Strengths and Weaknesses

Below is a comparative table highlighting key strengths and weaknesses of Coinbase Global, Inc. (COIN) and FactSet Research Systems Inc. (FDS) based on recent financial and strategic data:

| Criterion | Coinbase Global, Inc. (COIN) | FactSet Research Systems Inc. (FDS) |

|---|---|---|

| Diversification | Moderate – revenue mainly from crypto-related bank servicing and subscription services, growing but concentrated | Limited geographic diversification but steady product focus in financial data services |

| Profitability | High net margin (39.3%) and ROE (25.1%) but ROIC below WACC indicates value destruction | Solid profitability with net margin (25.7%), ROE (27.3%), and ROIC above WACC, creating value |

| Innovation | Strong in blockchain infrastructure and stablecoin services, growing revenue streams | Steady innovation in data analytics and financial research, less volatile but incremental |

| Global presence | Expanding but largely US-focused with emerging institutional clients | Established presence in US and UK markets, consistent client base |

| Market Share | Leading in crypto exchange space but vulnerable due to regulatory and market volatility | Niche leader in financial data services, stable market position |

Key takeaways: Coinbase shows strong profitability and innovation in a high-growth, volatile sector but faces value destruction risks with declining ROIC. FactSet demonstrates stable value creation and consistent profitability, with lower volatility but less diversification. Investors should weigh growth potential against risk tolerance accordingly.

Risk Analysis

Below is a summary table highlighting key risks for Coinbase Global, Inc. (COIN) and FactSet Research Systems Inc. (FDS) based on the latest available data from 2025-2026.

| Metric | Coinbase Global, Inc. (COIN) | FactSet Research Systems Inc. (FDS) |

|---|---|---|

| Market Risk | High beta (3.7) indicates strong volatility and sensitivity to market swings. | Low beta (0.74) shows relative stability versus the market. |

| Debt level | Low debt-to-equity ratio (0.45), favorable leverage. | Moderate debt-to-equity (0.71), neutral leverage risk. |

| Regulatory Risk | Elevated due to crypto market regulations and legal scrutiny. | Moderate, as financial data sector faces evolving compliance demands. |

| Operational Risk | Moderate, dependent on crypto market infrastructure and technology reliability. | Low, with established workflow and analytics platforms. |

| Environmental Risk | Low, limited direct environmental impact. | Low, mostly digital services with minor environmental footprint. |

| Geopolitical Risk | Moderate, crypto markets impacted by international regulations and sanctions. | Low to moderate, global presence but less exposed to volatile sectors. |

In synthesis, Coinbase’s most impactful risks are high market volatility and regulatory uncertainty, driven by the evolving crypto landscape. FactSet shows moderate debt and regulatory risks but benefits from more stable market exposure and operational resilience. Investors should weigh Coinbase’s higher growth potential against its elevated risk profile and consider FactSet for a more stable, lower-volatility investment.

Which Stock to Choose?

Coinbase Global, Inc. (COIN) shows a strong income evolution with significant revenue and net income growth, coupled with favorable profitability ratios such as a 39.29% net margin and 25.1% ROE. Its debt levels are well-managed, and it holds a very favorable B+ rating despite some unfavorable ROIC versus WACC metrics.

FactSet Research Systems Inc. (FDS) presents steady income growth with favorable margins, including a 25.72% net margin and 27.31% ROE. It has moderate debt levels and a slightly favorable A- rating, supported by a positive ROIC over WACC, although profitability trends show some decline.

For investors prioritizing rapid growth and high profitability metrics, COIN might appear attractive due to its robust income improvements and favorable ratios. Conversely, FDS could be seen as more suitable for those valuing consistent value creation and a slightly better risk profile, despite its declining profitability trend.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Coinbase Global, Inc. and FactSet Research Systems Inc. to enhance your investment decisions: