In the dynamic world of technology hardware, selecting the right company to invest in requires careful comparison. Coherent, Inc. (COHR) and Mesa Laboratories, Inc. (MLAB) both operate in the hardware, equipment, and parts industry, yet serve distinct yet overlapping markets with innovative product lines. This article will explore their strategies and financial profiles to help you identify which company might be the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Coherent, Inc. and Mesa Laboratories, Inc. by providing an overview of these two companies and their main differences.

Coherent, Inc. Overview

Coherent, Inc. specializes in lasers and laser-based technologies, serving commercial, industrial, and scientific research markets. The company operates through two segments: OEM Laser Sources and Industrial Lasers & Systems. Founded in 1966 and now a subsidiary of II-VI Incorporated, Coherent designs and manufactures laser tools, precision optics, and measurement products globally, with a market cap of approximately 29.5B USD.

Mesa Laboratories, Inc. Overview

Mesa Laboratories, Inc. develops and sells life sciences tools and quality control products internationally. Its operations span four segments: Sterilization and Disinfection Control, Biopharmaceutical Development, Calibration Solutions, and Clinical Genomics. Founded in 1982, the company focuses on healthcare and laboratory environments, with a market cap near 466M USD and a workforce of 736 employees.

Key similarities and differences

Both companies operate in the Technology sector within the Hardware, Equipment & Parts industry, focusing on specialized equipment for scientific and industrial applications. Coherent emphasizes laser technologies for research and manufacturing, while Mesa targets life sciences and healthcare quality control tools. Coherent is significantly larger in market capitalization and workforce, reflecting broader global reach and product scope compared to Mesa’s niche focus.

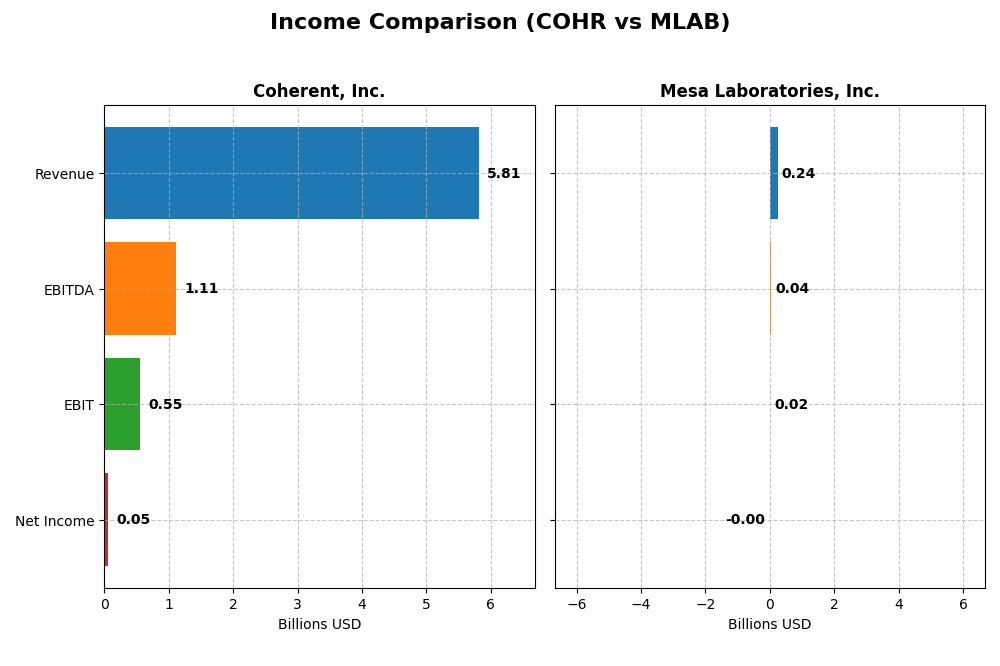

Income Statement Comparison

This table compares the latest full fiscal year income statement metrics for Coherent, Inc. and Mesa Laboratories, Inc., providing a snapshot of their financial performance.

| Metric | Coherent, Inc. (COHR) | Mesa Laboratories, Inc. (MLAB) |

|---|---|---|

| Market Cap | 29.5B | 466M |

| Revenue | 5.81B | 241M |

| EBITDA | 1.11B | 42.3M |

| EBIT | 552M | 17.8M |

| Net Income | 49.4M | -1.97M |

| EPS | -0.52 | -0.36 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Coherent, Inc.

Coherent, Inc. exhibited strong revenue growth of 87% from 2021 to 2025, with a 23% increase in the most recent year, accompanied by a gross margin of 35.4%, which is favorable. However, net income declined overall by 83%, though it improved significantly in the last year. EBIT margins remained stable, showing neutral change, while net margin growth was positive recently, reflecting a recovery phase.

Mesa Laboratories, Inc.

Mesa Laboratories showed revenue growth of nearly 80% over the period, with an 11.5% rise in the latest year, supported by a high gross margin of 62.6%. EBIT margin was neutral, but net margin stayed negative overall, despite a nearly 100% improvement in the last year. Net income fell sharply by 160% over five years, signaling challenges despite recent margin improvements.

Which one has the stronger fundamentals?

Both companies demonstrate favorable revenue and gross margin trends with stable EBIT margins. Coherent presents a more robust recent turnaround in net income and margin growth, though its overall net income declined less drastically than Mesa’s. Mesa has higher gross margins but faces deeper net margin and net income declines, offset somewhat by recent gains. Overall, both show favorable income statement dynamics but with contrasting net profitability trends.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Coherent, Inc. and Mesa Laboratories, Inc., enabling a clear side-by-side comparison of key performance metrics as of their latest fiscal years.

| Ratios | Coherent, Inc. (2025 FY) | Mesa Laboratories, Inc. (2025 FY) |

|---|---|---|

| ROE | 0.61% | -1.24% |

| ROIC | 1.31% | -1.45% |

| P/E | 279.75 | -326.35 |

| P/B | 1.70 | 4.03 |

| Current Ratio | 2.19 | 0.63 |

| Quick Ratio | 1.39 | 0.47 |

| D/E | 0.48 | 1.14 |

| Debt-to-Assets | 26.1% | 41.9% |

| Interest Coverage | 2.26 | 1.38 |

| Asset Turnover | 0.39 | 0.56 |

| Fixed Asset Turnover | 3.09 | 7.45 |

| Payout ratio | 23.2% | -175.7% |

| Dividend yield | 0.08% | 0.54% |

Interpretation of the Ratios

Coherent, Inc.

Coherent, Inc. shows mixed financial ratios with favorable liquidity and leverage metrics, including a strong current ratio of 2.19 and a manageable debt-to-equity of 0.48. However, profitability ratios like net margin (0.85%), ROE (0.61%), and ROIC (1.31%) are weak, signaling low returns. The company pays no dividends, likely prioritizing reinvestment or growth given the unfavorable profitability metrics and negative free cash flow to equity.

Mesa Laboratories, Inc.

Mesa Laboratories, Inc. faces significant challenges, reflected in unfavorable profitability ratios such as a negative net margin of -0.82% and ROE at -1.24%. The company’s liquidity is weak, with a current ratio of 0.63, and a high debt-to-equity ratio of 1.14, indicating financial risk. Despite a dividend yield of 0.54%, the payout appears risky given poor earnings and negative returns, pointing to potential sustainability issues.

Which one has the best ratios?

Coherent, Inc. holds a slight advantage with more favorable liquidity and leverage ratios, though profitability remains weak for both companies. Mesa Laboratories struggles with deeper profitability and liquidity issues, alongside a higher risk debt profile. Overall, Coherent’s ratios appear less unfavorable, but both companies exhibit significant financial challenges at present.

Strategic Positioning

This section compares the strategic positioning of Coherent, Inc. and Mesa Laboratories, Inc. in terms of market position, key segments, and exposure to technological disruption:

Coherent, Inc.

- Large market cap with significant competition in hardware and equipment sectors.

- Focus on lasers and materials segments, serving industrial, scientific, and OEM applications.

- Exposure to laser technology and system innovation, with potential disruption from new laser technologies.

Mesa Laboratories, Inc.

- Much smaller market cap, operating in specialized life sciences tools and quality control.

- Diversified segments including biopharmaceutical, calibration, sterilization, and clinical genomics.

- Exposure to biotech and health safety tech, facing disruption from evolving clinical and genomic testing methods.

Coherent, Inc. vs Mesa Laboratories, Inc. Positioning

Coherent’s strategy is concentrated on laser and materials hardware, leveraging scale but facing intense competition. Mesa employs a more diversified approach across multiple life sciences and calibration markets, balancing risk but with smaller scale and niche focus.

Which has the best competitive advantage?

Both companies show very unfavorable MOAT status with declining ROIC trends, indicating value destruction and weak competitive advantages based on recent capital efficiency and profitability data.

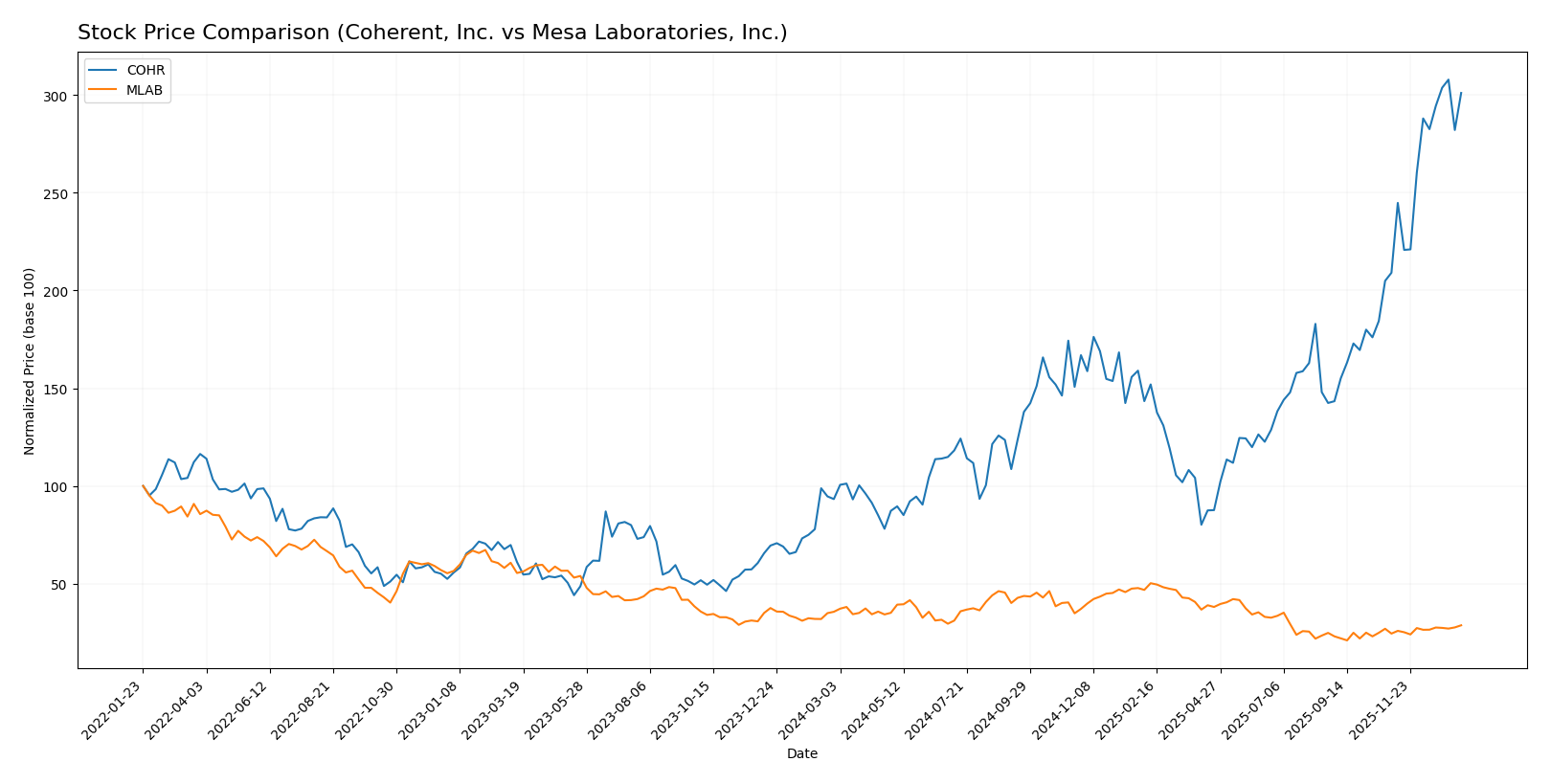

Stock Comparison

The past year showed marked divergence in stock performance for Coherent, Inc. and Mesa Laboratories, Inc., with Coherent demonstrating strong bullish momentum and Mesa experiencing a bearish trend, reflecting contrasting trading dynamics.

Trend Analysis

Coherent, Inc. (COHR) exhibited a robust bullish trend over the past 12 months, with a 223% price increase and accelerating momentum. The stock ranged from a low of 49.26 to a high of 194.33, with high volatility (std deviation 34.26).

Mesa Laboratories, Inc. (MLAB) recorded a 19.46% decline over the same period, indicating a bearish trend with accelerating downward pressure. Its price fluctuated between 61.66 and 147.79, with moderate volatility (std deviation 23.27).

Comparing both, Coherent’s stock significantly outperformed Mesa’s, delivering the highest market return and stronger upward momentum during the last year.

Target Prices

Analysts provide a clear consensus on target prices for Coherent, Inc. and Mesa Laboratories, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Coherent, Inc. | 210 | 135 | 175 |

| Mesa Laboratories, Inc. | 83 | 83 | 83 |

For Coherent, the consensus target price of 175 is below the current stock price of 190.03, suggesting some downside potential. Mesa Laboratories’ consensus target price of 83 is slightly below its current price of 84.36, indicating a neutral to slightly bearish outlook.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Coherent, Inc. and Mesa Laboratories, Inc.:

Rating Comparison

Coherent, Inc. Rating

- Rating: B- indicating a very favorable overall status.

- Discounted Cash Flow Score: Moderate at 3 out of 5.

- ROE Score: Moderate efficiency at 2 out of 5.

- ROA Score: Moderate asset use at 3 out of 5.

- Debt To Equity Score: Moderate financial risk at 2/5.

- Overall Score: Moderate at 2 out of 5.

Mesa Laboratories, Inc. Rating

- Rating: C+ also marked as very favorable overall.

- Discounted Cash Flow Score: Very favorable at 5 out of 5.

- ROE Score: Very unfavorable efficiency at 1 out of 5.

- ROA Score: Very unfavorable asset use at 1 out of 5.

- Debt To Equity Score: Very unfavorable risk at 1 out of 5.

- Overall Score: Moderate at 2 out of 5.

Which one is the best rated?

Based strictly on the provided data, Coherent, Inc. holds a higher rating grade (B-) with more balanced moderate scores across key metrics. Mesa Laboratories, Inc. shows strengths in discounted cash flow but weaker performance on profitability and financial risk metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for each company:

Coherent, Inc. Scores

- Altman Z-Score: 3.70, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health and value.

Mesa Laboratories, Inc. Scores

- Altman Z-Score: 1.36, indicating a distress zone with high bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength.

Which company has the best scores?

Coherent, Inc. shows stronger financial health with a safe zone Altman Z-Score and a strong Piotroski Score. Mesa Laboratories, Inc. falls in the distress zone with an average Piotroski Score, indicating weaker financial stability.

Grades Comparison

I compare the recent grades and ratings of Coherent, Inc. and Mesa Laboratories, Inc. below:

Coherent, Inc. Grades

The following table shows recent analyst grades and actions for Coherent, Inc. from reputable firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2025-12-17 |

| JP Morgan | Maintain | Overweight | 2025-12-05 |

| Barclays | Maintain | Overweight | 2025-11-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-06 |

| Stifel | Maintain | Buy | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-11-06 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-20 |

| Rosenblatt | Maintain | Buy | 2025-10-14 |

Coherent’s grades show a mix of “Buy” and “Overweight” ratings with several “Equal Weight” assessments, indicating a broadly favorable analyst view.

Mesa Laboratories, Inc. Grades

Below are recent credible analyst grades and actions for Mesa Laboratories, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2025-12-15 |

| Wells Fargo | Upgrade | Equal Weight | 2025-08-08 |

| Wells Fargo | Maintain | Underweight | 2025-05-30 |

| Evercore ISI Group | Maintain | Outperform | 2024-10-01 |

| Evercore ISI Group | Maintain | Outperform | 2024-08-06 |

| Evercore ISI Group | Maintain | Outperform | 2024-07-02 |

| Evercore ISI Group | Maintain | Outperform | 2024-04-04 |

| Evercore ISI Group | Upgrade | Outperform | 2024-01-04 |

| Evercore ISI Group | Downgrade | In Line | 2021-01-04 |

| Evercore ISI Group | Downgrade | In Line | 2021-01-03 |

Mesa Laboratories’ ratings include several “Outperform” grades from Evercore ISI Group, but recent Wells Fargo grades are mostly “Equal Weight,” reflecting mixed analyst sentiment.

Which company has the best grades?

Coherent, Inc. has predominantly “Buy” and “Overweight” ratings with a consensus “Buy,” while Mesa Laboratories, Inc. shows more “Equal Weight” and “Hold” ratings with a consensus “Hold.” This suggests Coherent currently enjoys more favorable analyst sentiment, which could influence investor confidence and potential portfolio positioning.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Coherent, Inc. (COHR) and Mesa Laboratories, Inc. (MLAB) based on the latest financial and operational data.

| Criterion | Coherent, Inc. (COHR) | Mesa Laboratories, Inc. (MLAB) |

|---|---|---|

| Diversification | Moderate; Lasers and Materials segments with $1.43B and $954M revenue respectively (2025) | Limited; mainly Products ($198M) and Services ($43M) segments with less variety |

| Profitability | Very low net margin (0.85%), ROIC (1.31%) below WACC (11.53%), value destroying | Negative net margin (-0.82%), negative ROIC (-1.45%), also shedding value |

| Innovation | Moderate; operates in advanced laser technology but declining profitability | Niche biopharmaceutical & calibration tech, but financials indicate challenges |

| Global presence | Strong global footprint, supported by sizeable diversified revenue bases | Smaller scale, focused markets with less global reach evident |

| Market Share | Significant in laser and materials markets but under pressure due to declining ROIC | Smaller market share, struggling to maintain profitability and growth |

Key takeaways: Both companies are currently experiencing declining profitability and are value destroyers as per ROIC vs. WACC. Coherent shows more diversification and stronger global presence, while Mesa Laboratories faces more pronounced financial challenges and limited diversification. Caution is advised for investors considering these stocks.

Risk Analysis

Below is a comparative table highlighting key risks for Coherent, Inc. (COHR) and Mesa Laboratories, Inc. (MLAB) based on their 2025 financial and operational data:

| Metric | Coherent, Inc. (COHR) | Mesa Laboratories, Inc. (MLAB) |

|---|---|---|

| Market Risk | High beta (1.835) indicates greater volatility | Moderate beta (0.889) suggests lower volatility |

| Debt level | Moderate debt-to-equity (0.48), favorable | High debt-to-equity (1.14), unfavorable |

| Regulatory Risk | Moderate, tech sector exposure | Moderate, healthcare & life sciences sector |

| Operational Risk | Large workforce (26K+), complex production | Smaller scale (736 employees), niche products |

| Environmental Risk | Moderate, manufacturing impacts | Moderate, lab and biotech manufacturing |

| Geopolitical Risk | Global sales exposure, moderate risk | International sales, moderate risk |

The most impactful risks are Coherent’s market volatility due to a high beta and Mesa Laboratories’ high leverage and financial distress indicated by a low Altman Z-Score (1.36). Mesa’s financial instability and weaker liquidity ratios raise concerns, despite its favorable discounted cash flow score. Coherent shows better financial stability but with some operational and market risks to monitor.

Which Stock to Choose?

Coherent, Inc. (COHR) shows a favorable income statement with strong revenue and gross profit growth in 2025, though profitability ratios remain slightly unfavorable. Its debt levels are moderate, liquidity ratios are strong, and it holds a very favorable overall rating despite a declining ROIC trend indicating value destruction.

Mesa Laboratories, Inc. (MLAB) exhibits favorable income growth and a high gross margin but suffers from negative net margins and returns. The company’s financial ratios are largely unfavorable with high leverage and weak liquidity, paired with a very unfavorable rating on key profitability metrics and a distress-level Altman Z-Score.

Investors focused on stability and financial health might find Coherent’s stronger liquidity and more favorable rating appealing, while those tolerant of higher risk could see potential in Mesa’s recent income growth despite its financial challenges. Both companies display declining profitability trends and value destruction, suggesting cautious evaluation aligned with individual risk profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Coherent, Inc. and Mesa Laboratories, Inc. to enhance your investment decisions: