Home > Comparison > Technology > CTSH vs PANW

The strategic rivalry between Cognizant Technology Solutions Corporation and Palo Alto Networks, Inc. defines the trajectory of the technology sector. Cognizant operates as a capital-intensive IT services giant, focusing on consulting and outsourcing, while Palo Alto Networks excels as a high-margin cybersecurity software provider. This head-to-head pits scale and diversification against innovation and specialization. This analysis aims to identify which corporate path offers superior risk-adjusted returns for a diversified portfolio in 2026.

Table of contents

Companies Overview

Cognizant and Palo Alto Networks stand as pivotal players reshaping enterprise technology landscapes.

Cognizant Technology Solutions Corporation: Global IT Services Powerhouse

Cognizant dominates the Information Technology Services sector with consulting, technology, and outsourcing solutions. Its revenue stems from diverse verticals like financial services, healthcare, and communications. In 2026, Cognizant’s strategic focus sharpens on digital transformation, AI-driven automation, and omni-channel customer experience, reinforcing its competitive edge in operational efficiency and client integration.

Palo Alto Networks, Inc.: Cybersecurity Infrastructure Leader

Palo Alto Networks commands the cybersecurity software space, specializing in firewall appliances and security management solutions. Its core revenue derives from subscription services covering threat prevention and cloud security. In 2026, the company prioritizes expanding cloud-native security and threat intelligence capabilities, targeting medium to large enterprises and government sectors to combat evolving cyber threats.

Strategic Collision: Similarities & Divergences

Both companies emphasize technology-driven solutions but diverge in business philosophy: Cognizant offers broad, integrated IT services while Palo Alto Networks champions a specialized, security-first approach. Their primary battleground is enterprise digital infrastructure, where trust and innovation govern market share. Cognizant appeals through scale and service breadth; Palo Alto Networks stands out with a focused, cutting-edge cybersecurity moat.

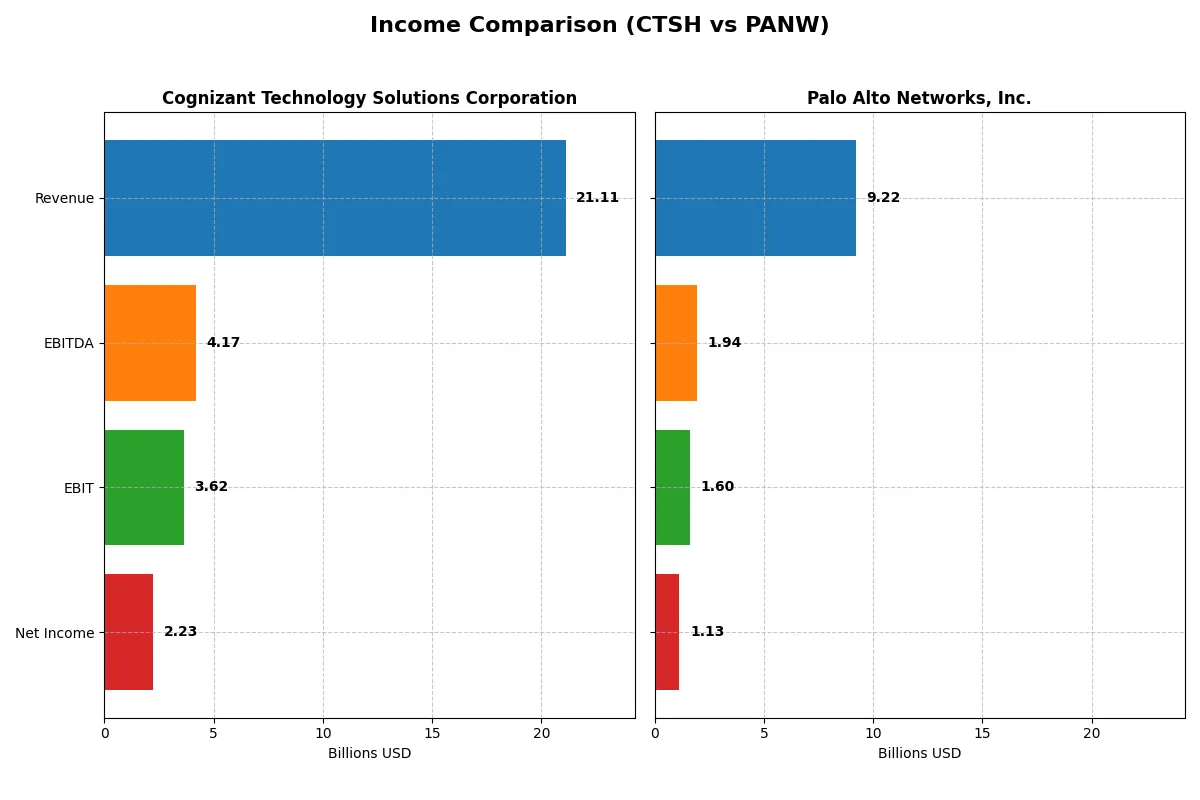

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Cognizant Technology Solutions Corporation (CTSH) | Palo Alto Networks, Inc. (PANW) |

|---|---|---|

| Revenue | 21.1B | 9.2B |

| Cost of Revenue | 14.0B | 2.5B |

| Operating Expenses | 3.6B | 5.5B |

| Gross Profit | 7.1B | 6.8B |

| EBITDA | 4.2B | 1.9B |

| EBIT | 3.6B | 1.6B |

| Interest Expense | 37M | 3M |

| Net Income | 2.2B | 1.1B |

| EPS | 4.56 | 1.71 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and momentum behind each company’s profit engine in a competitive tech landscape.

Cognizant Technology Solutions Corporation Analysis

Cognizant’s revenue climbed steadily from 18.5B in 2021 to 21.1B in 2025, reflecting moderate growth. Gross margin holds firm near 33.7%, while net margin stands at a solid 10.6%. The 2025 year shows strong operating income expansion (+21% EBIT growth), indicating improved operational efficiency despite a slight net margin decline.

Palo Alto Networks, Inc. Analysis

Palo Alto Networks surged revenue from 4.3B in 2021 to 9.2B in 2025, more than doubling in five years. Their gross margin impresses at 73.4%, with net margin at 12.3%. The latest fiscal year delivered a 61% EBIT jump, signaling rapid scale and margin expansion, though net margin and EPS declined sharply year-over-year, highlighting volatility in profitability.

Margin Strength vs. Growth Velocity

Palo Alto Networks dominates in revenue growth and gross margin, driven by aggressive expansion and scale advantages. Cognizant exhibits steadier, more consistent profitability with a resilient margin profile. For investors, Palo Alto offers high momentum but with profit swings, while Cognizant presents a stable, efficient income stream with prudent margin control.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Cognizant Technology Solutions Corporation (CTSH) | Palo Alto Networks, Inc. (PANW) |

|---|---|---|

| ROE | 14.85% | 14.49% |

| ROIC | 12.31% | 5.67% |

| P/E | 17.90 | 101.43 |

| P/B | 2.66 | 14.70 |

| Current Ratio | 2.34 | 0.89 |

| Quick Ratio | 2.34 | 0.89 |

| D/E | 0.10 | 0.04 |

| Debt-to-Assets | 7.61% | 1.43% |

| Interest Coverage | 95.38 | 414.30 |

| Asset Turnover | 1.02 | 0.39 |

| Fixed Asset Turnover | 14.02 | 12.56 |

| Payout ratio | 27.35% | 0% |

| Dividend yield | 1.53% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as the company’s DNA, exposing hidden risks and operational excellence that define long-term value and market positioning.

Cognizant Technology Solutions Corporation

Cognizant delivers solid profitability with a 14.85% ROE and favorable net margin of 10.56%. Its valuation remains reasonable, featuring a neutral P/E of 17.9 and P/B of 2.66. The company balances shareholder returns with a 1.53% dividend yield, reflecting steady income and capital discipline.

Palo Alto Networks, Inc.

Palo Alto shows a comparable ROE of 14.49% but outperforms in net margin at 12.3%. However, its valuation is stretched, with a P/E exceeding 100 and P/B at 14.7. It pays no dividend, focusing instead on aggressive growth and R&D, which weighs on liquidity with a sub-1 current ratio.

Valuation Discipline vs. Growth Aggression

Cognizant offers a more balanced risk-reward profile with attractive valuation and stable dividends. Palo Alto’s premium multiples signal high growth expectations but come with greater operational and liquidity risks. Value seekers may prefer Cognizant’s prudence, while growth investors might lean toward Palo Alto’s ambitious expansion.

Which one offers the Superior Shareholder Reward?

I see Cognizant (CTSH) pays a steady 1.5% dividend yield with a sustainable ~27% payout, backed by robust free cash flow coverage above 90%. Its consistent buybacks add to total returns. Palo Alto Networks (PANW) skips dividends, focusing on reinvestment and aggressive buybacks funded by strong free cash flow, despite a high valuation and leverage. I judge CTSH’s balanced dividend and buyback mix more sustainable for long-term reward, while PANW’s growth strategy carries higher risk in 2026. Overall, CTSH offers the superior shareholder return profile today.

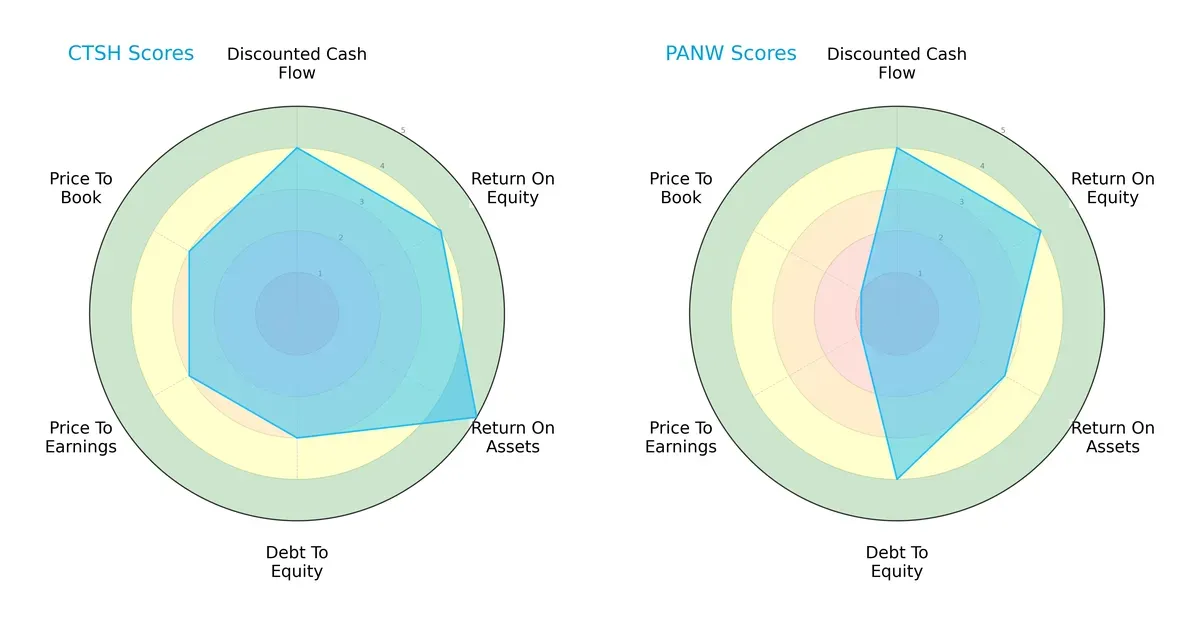

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their financial strengths and valuation contrasts:

Cognizant Technology Solutions (CTSH) shows a balanced profile with very favorable ROA (5) and solid ROE (4), moderate leverage (3), and reasonable valuation scores (3). Palo Alto Networks (PANW) matches CTSH on DCF and ROE but depends heavily on debt management strength (4) and trades at less attractive valuation multiples (P/E and P/B scores of 1). CTSH offers a more consistent financial foundation, while PANW leverages a niche edge in capital structure but faces valuation headwinds.

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores place both firms safely above distress thresholds, with CTSH scoring 6.85 and PANW at 5.40, signaling robust solvency and low bankruptcy risk in the current cycle:

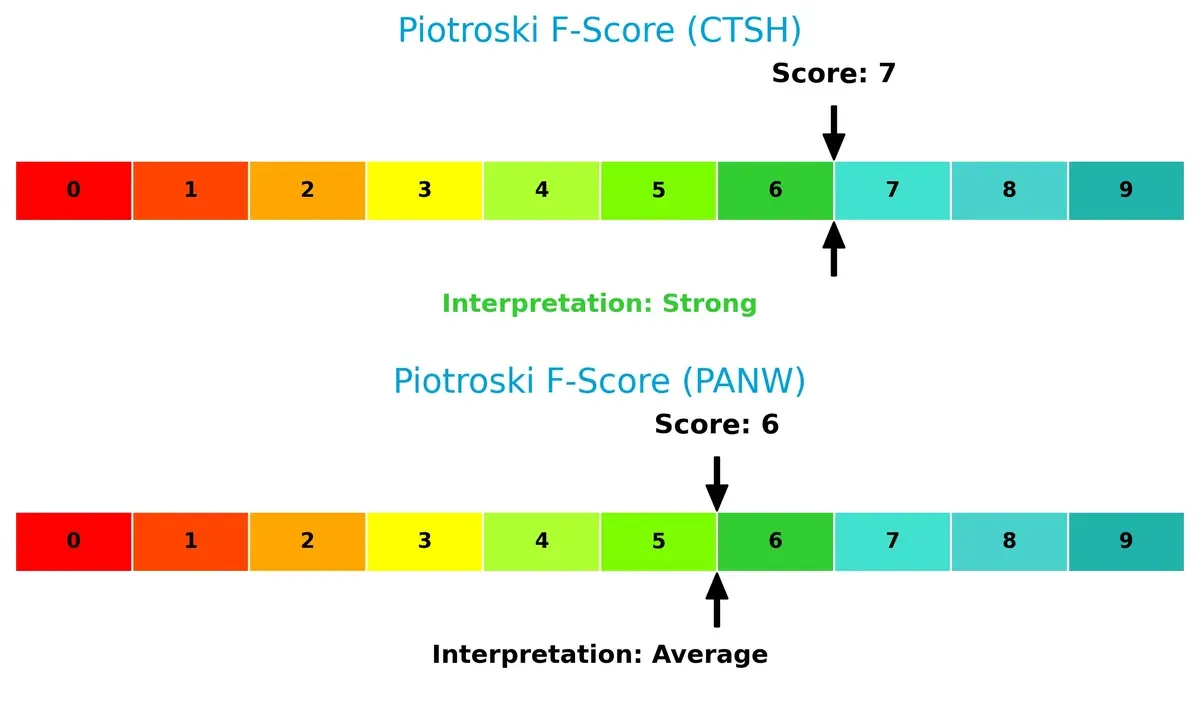

Financial Health: Quality of Operations

CTSH leads with a Piotroski F-Score of 7, indicating strong operational health, while PANW’s score of 6 suggests average financial quality and minor red flags in internal metrics:

How are the two companies positioned?

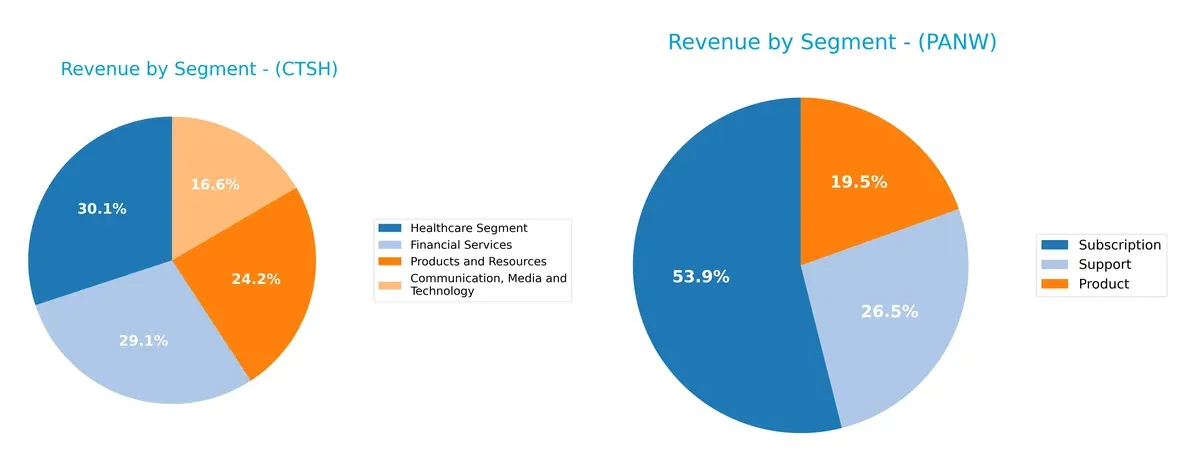

This section dissects the operational DNA of Cognizant and Palo Alto Networks by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Cognizant Technology Solutions Corporation and Palo Alto Networks, Inc. diversify their income streams and where their primary sector bets lie:

Cognizant shows a balanced revenue mix with Healthcare ($5.9B), Financial Services ($5.7B), and Products & Resources ($4.8B) anchoring its portfolio. Palo Alto Networks pivots heavily on Subscription revenue ($5.0B), dwarfing Product ($1.8B) and Support ($2.4B). Cognizant’s diversification mitigates concentration risk, while Palo Alto’s subscription focus signals strong ecosystem lock-in but higher dependency on recurring sales.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Cognizant Technology Solutions Corporation and Palo Alto Networks, Inc.:

CTSH Strengths

- Diversified revenue across four large segments

- Favorable net margin at 10.56%

- Strong liquidity with current and quick ratios at 2.34

- Very low debt-to-equity at 0.1

- High interest coverage at 97.92

- Global presence with dominant North America and Europe sales

PANW Strengths

- Higher net margin at 12.3%

- Favorable cost of capital at 7.29% WACC

- Low debt-to-equity at 0.04

- Exceptional interest coverage at 532.53

- Strong subscription revenue growth

- Expanding global footprint in Americas, EMEA, and Asia Pacific

CTSH Weaknesses

- ROE is only neutral at 14.85%

- Price multiples are neutral (PE 17.9, PB 2.66)

- No clear innovation metric provided

- Moderate dividend yield at 1.53%

- Market share details not specified

PANW Weaknesses

- ROIC low and neutral at 5.67%

- High valuation multiples (PE 101.43, PB 14.7) considered unfavorable

- Current ratio below 1 at 0.89 signals liquidity risk

- Asset turnover weak at 0.39

- No dividend yield reduces income appeal

Both companies demonstrate strong financial health but differ in valuation and operational efficiency. CTSH shows robust liquidity and diversification, while PANW excels in profitability and capital structure but faces valuation and liquidity concerns. These contrasts highlight differing strategic priorities and risk profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only shield protecting long-term profits from relentless competition erosion. Let’s dissect two tech giants’ moats:

Cognizant Technology Solutions Corporation: Intangible Assets and Scale Moat

Cognizant’s competitive edge stems from its deep industry expertise and scale in IT services. Its steady 17% EBIT margin reflects margin resilience. Yet, declining ROIC signals rising pressure on capital efficiency in 2026.

Palo Alto Networks, Inc.: Innovation-Driven Network Effect Moat

Palo Alto’s moat is built on cutting-edge cybersecurity software and strong network effects. Rapid revenue growth and expanding gross margins underscore its market grip. Despite current value destruction, soaring ROIC trend suggests improving capital returns ahead.

Margin Stability vs. Growth Potential: The Moat Face-off

Cognizant offers a wider moat with stable profitability and value creation despite declining ROIC. Palo Alto boasts a deeper moat driven by innovation but currently sheds value. I see Palo Alto better positioned to defend and expand market share long term.

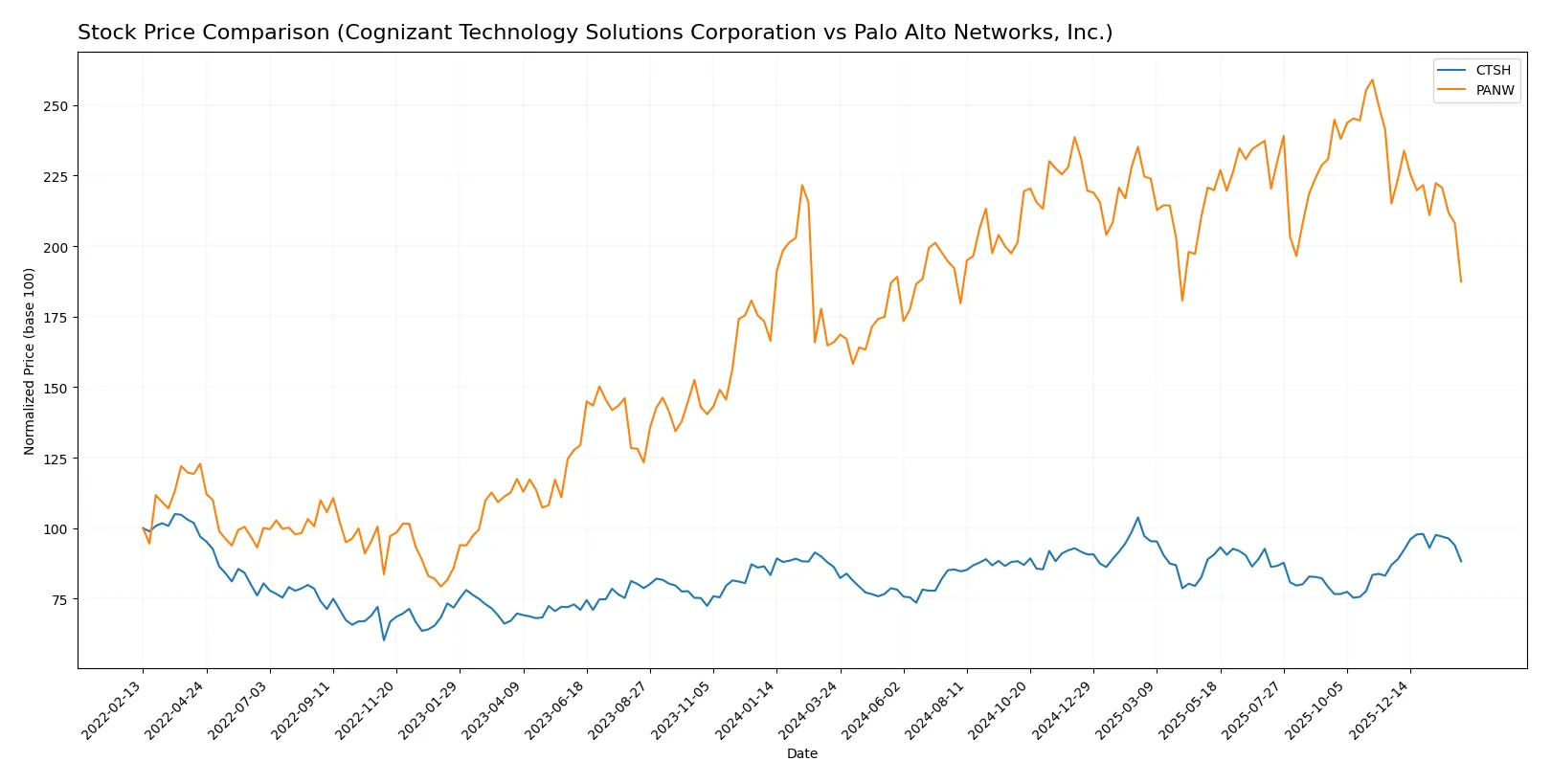

Which stock offers better returns?

The past year showed distinct trajectories for Cognizant Technology Solutions and Palo Alto Networks, with strong price gains and contrasting recent trading dynamics.

Trend Comparison

Cognizant Technology Solutions (CTSH) posted a 12-month price gain of 2.32%, signaling a bullish trend with accelerating momentum and moderate volatility around a 5.77% standard deviation.

Palo Alto Networks (PANW) delivered a 12.93% gain over the same period, indicating a bullish trend despite decelerating momentum and higher volatility at 19.06%. Recent months show a sharp reversal.

Comparing both, PANW achieved the highest market performance over the last year, though its recent downtrend contrasts with CTSH’s steady, accelerating advance.

Target Prices

Analysts present a cautiously optimistic target consensus for Cognizant and Palo Alto Networks.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Cognizant Technology Solutions Corporation | 82 | 107 | 93.2 |

| Palo Alto Networks, Inc. | 157 | 265 | 231.07 |

The consensus targets imply upside potential of roughly 21% for Cognizant and 45% for Palo Alto Networks versus current prices. Analysts expect solid growth despite recent market volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Cognizant Technology Solutions Corporation Grades

Below are recent grades assigned by major financial institutions for Cognizant Technology Solutions Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2026-02-05 |

| Morgan Stanley | Maintain | Equal Weight | 2026-02-05 |

| RBC Capital | Maintain | Sector Perform | 2026-02-05 |

| Guggenheim | Maintain | Buy | 2026-01-28 |

| Citigroup | Maintain | Neutral | 2026-01-22 |

| Wells Fargo | Maintain | Overweight | 2026-01-14 |

| TD Cowen | Maintain | Hold | 2026-01-09 |

| UBS | Maintain | Neutral | 2025-12-08 |

| William Blair | Upgrade | Outperform | 2025-11-21 |

| UBS | Maintain | Neutral | 2025-10-30 |

Palo Alto Networks, Inc. Grades

These are the latest grades issued by respected financial firms for Palo Alto Networks, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-28 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Guggenheim | Upgrade | Neutral | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-18 |

| HSBC | Downgrade | Reduce | 2025-11-21 |

| Goldman Sachs | Maintain | Buy | 2025-11-21 |

| Rosenblatt | Maintain | Buy | 2025-11-20 |

| Oppenheimer | Maintain | Outperform | 2025-11-20 |

| BTIG | Maintain | Buy | 2025-11-20 |

Which company has the best grades?

Cognizant shows a mix of Hold to Buy ratings with one recent upgrade to Outperform, indicating moderate confidence. Palo Alto Networks exhibits more Buy and Overweight ratings but includes a downgrade. Investors might view Palo Alto’s generally higher grades as stronger institutional enthusiasm, albeit with some caution.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Cognizant Technology Solutions Corporation

- Faces intense competition in IT services with pressure on margins from digital transformation demands.

Palo Alto Networks, Inc.

- Operates in a highly competitive cybersecurity sector with rapid innovation cycles and strong rivals like CrowdStrike and Fortinet.

2. Capital Structure & Debt

Cognizant Technology Solutions Corporation

- Maintains a conservative debt profile with low debt-to-equity (0.1) and high interest coverage (97.9), supporting financial stability.

Palo Alto Networks, Inc.

- Also enjoys low leverage (debt-to-equity 0.04) and excellent interest coverage (532.5), but weaker liquidity ratios raise concerns.

3. Stock Volatility

Cognizant Technology Solutions Corporation

- Beta near 0.96 suggests average market volatility, aligned with S&P 500 norms.

Palo Alto Networks, Inc.

- Lower beta at 0.75 indicates less sensitivity to market swings, offering defensive characteristics in volatile markets.

4. Regulatory & Legal

Cognizant Technology Solutions Corporation

- Subject to compliance risks in international data privacy and outsourcing regulations across multiple jurisdictions.

Palo Alto Networks, Inc.

- Faces stringent cybersecurity regulations and scrutiny over data protection compliance, with potential for costly legal challenges.

5. Supply Chain & Operations

Cognizant Technology Solutions Corporation

- Risks stem from reliance on global IT talent and offshore delivery centers, vulnerable to geopolitical and labor market disruptions.

Palo Alto Networks, Inc.

- Operational risks include dependency on hardware suppliers and cloud infrastructure stability critical for service delivery.

6. ESG & Climate Transition

Cognizant Technology Solutions Corporation

- Increasing pressure to enhance ESG practices amid investor focus on sustainability and social governance in tech services.

Palo Alto Networks, Inc.

- Advancing ESG integration, but must manage energy-intensive data centers and evolving regulatory expectations in climate-related disclosures.

7. Geopolitical Exposure

Cognizant Technology Solutions Corporation

- Exposure to geopolitical tensions affecting outsourcing hubs in Asia, potentially disrupting service continuity.

Palo Alto Networks, Inc.

- Limited direct exposure but must navigate US-China tech tensions impacting supply chains and international sales.

Which company shows a better risk-adjusted profile?

Cognizant’s strongest risk remains its operational exposure to offshore talent markets vulnerable to geopolitical shifts. Palo Alto Networks faces significant valuation and liquidity risks amid a high P/E ratio and suboptimal current ratio. Cognizant’s conservative capital structure and solid liquidity give it the edge on risk-adjusted stability. Notably, Palo Alto’s sky-high valuation multiples (P/E ~101) amplify downside risk despite strong market positioning.

Final Verdict: Which stock to choose?

Cognizant Technology Solutions Corporation (CTSH) shines as a reliable cash generator with solid capital efficiency. Its superpower lies in consistently creating value while maintaining a strong balance sheet. A point of vigilance is the slightly declining ROIC trend, signaling the need for monitoring long-term profitability. It suits portfolios focused on steady, moderate growth.

Palo Alto Networks, Inc. (PANW) boasts a strategic moat in cloud security dominance, driving impressive revenue and earnings growth. Its rapid profitability improvement contrasts with a weaker balance sheet and stretched valuation. Compared to CTSH, PANW offers higher growth potential but with more volatility and risk. It fits well in GARP (Growth at a Reasonable Price) or growth-oriented portfolios willing to accept premium multiples.

If you prioritize stable value creation and financial resilience, CTSH is the compelling choice due to its efficient capital use and balance sheet strength. However, if you seek aggressive growth with exposure to cutting-edge cybersecurity, PANW offers superior growth trajectories despite valuation and liquidity concerns. Each stock serves distinct investor profiles, demanding careful alignment with risk tolerance and investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cognizant Technology Solutions Corporation and Palo Alto Networks, Inc. to enhance your investment decisions: