In the competitive non-alcoholic beverage sector, Monster Beverage Corporation and Coca-Cola Consolidated, Inc. stand out as influential players with overlapping markets and distinct innovation strategies. While Monster focuses on energy drinks and dynamic brand expansion, Coca-Cola Consolidated leads in distribution and a broad product portfolio including iconic sparkling beverages. This article will analyze both companies to help you identify the most promising investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Monster Beverage Corporation and Coca-Cola Consolidated, Inc. by providing an overview of these two companies and their main differences.

Monster Beverage Corporation Overview

Monster Beverage Corporation focuses on the development, marketing, sale, and distribution of energy drink beverages and concentrates globally. Operating through segments like Monster Energy Drinks and Strategic Brands, it offers a wide range of products including carbonated and non-carbonated energy drinks, iced teas, juices, and flavored sparkling beverages. Founded in 1985 and headquartered in Corona, California, Monster is a key player in the non-alcoholic beverage industry with a market cap of approximately 75.7B USD.

Coca-Cola Consolidated, Inc. Overview

Coca-Cola Consolidated, Inc. primarily manufactures, markets, and distributes nonalcoholic beverages in the US, focusing on products from The Coca-Cola Company. Its portfolio includes sparkling and still beverages, energy products, and post-mix fountain syrups. The company serves a broad customer base from grocery stores to restaurants and vending outlets. Founded in 1980 and based in Charlotte, North Carolina, Coca-Cola Consolidated has a market cap near 13.1B USD and employs around 15,000 people.

Key similarities and differences

Both companies operate within the non-alcoholic beverage sector and distribute a variety of drinks including energy and sparkling beverages. However, Monster Beverage Corporation is more concentrated on energy drinks and related products with a strong global presence, whereas Coca-Cola Consolidated emphasizes distribution of Coca-Cola products alongside other beverage brands primarily within the US market. Their business models differ with Monster focusing on brand-driven product development, while Coca-Cola Consolidated acts largely as a bottler and distributor.

Income Statement Comparison

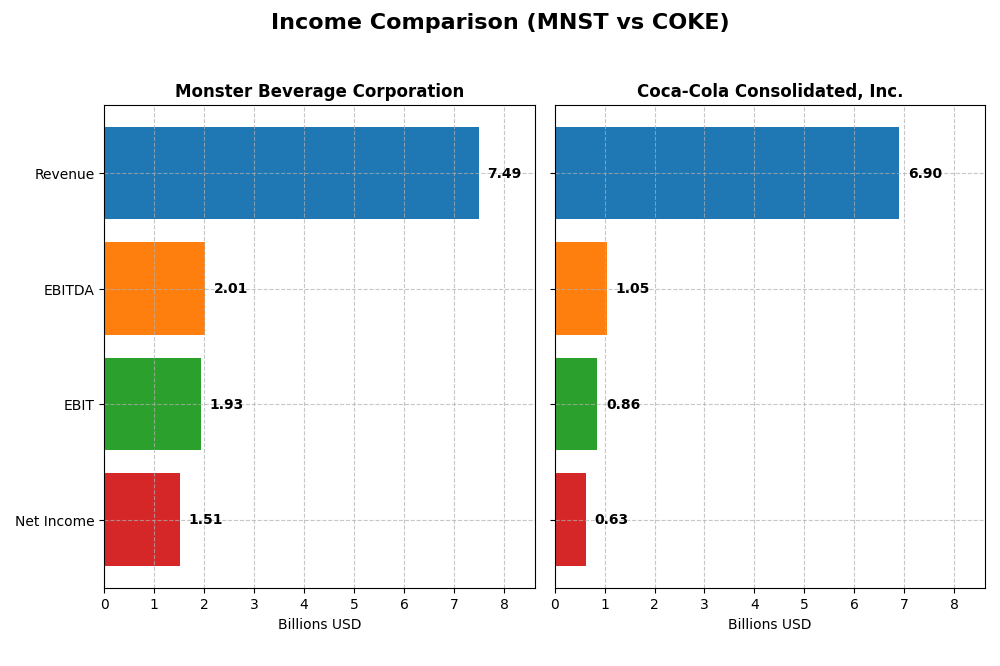

The following table presents a side-by-side comparison of key income statement metrics for Monster Beverage Corporation and Coca-Cola Consolidated, Inc. for the fiscal year 2024.

| Metric | Monster Beverage Corporation | Coca-Cola Consolidated, Inc. |

|---|---|---|

| Market Cap | 75.7B | 13.1B |

| Revenue | 7.49B | 6.90B |

| EBITDA | 2.01B | 1.05B |

| EBIT | 1.93B | 859M |

| Net Income | 1.51B | 633M |

| EPS | 1.50 | 7.01 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Monster Beverage Corporation

Monster Beverage’s revenue grew steadily from 4.6B in 2020 to 7.5B in 2024, with net income rising modestly to 1.5B in 2024. Gross and EBIT margins remain strong at 54.04% and 25.76%, though net margin declined by 11.83% last year. The latest year showed slower EBIT growth (-1.18%) and EPS decline (-3.25%), signaling some margin pressure despite solid top-line gains.

Coca-Cola Consolidated, Inc.

Coca-Cola Consolidated’s revenue increased from 5.0B in 2020 to 6.9B in 2024, with net income surging from 172M to 633M. Margins improved notably, with gross margin at 39.9% and EBIT margin at 12.44%. The 2024 year saw a 49.51% net margin increase and a remarkable 60.69% EPS growth, indicating enhanced profitability and efficient expense management over the period.

Which one has the stronger fundamentals?

Both companies show favorable income statement evaluations, but Coca-Cola Consolidated exhibits more pronounced improvements in net income growth (267% vs. 7%) and margin expansions, reflected in significantly higher EPS growth. Monster Beverage holds higher margins overall but faced some recent margin contractions. Coca-Cola Consolidated’s broader margin and profit growth suggest stronger recent fundamental momentum.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Monster Beverage Corporation (MNST) and Coca-Cola Consolidated, Inc. (COKE) based on their most recent fiscal year 2024 data.

| Ratios | Monster Beverage Corporation (MNST) | Coca-Cola Consolidated, Inc. (COKE) |

|---|---|---|

| ROE | 25.3% | 44.7% |

| ROIC | 22.1% | 15.5% |

| P/E | 35.0 | 18.0 |

| P/B | 8.86 | 8.03 |

| Current Ratio | 3.32 | 1.94 |

| Quick Ratio | 2.65 | 1.69 |

| D/E (Debt-to-Equity) | 0.063 | 1.35 |

| Debt-to-Assets | 4.8% | 35.9% |

| Interest Coverage | 69.2 | 498.0 |

| Asset Turnover | 0.97 | 1.30 |

| Fixed Asset Turnover | 7.16 | 4.26 |

| Payout Ratio | 0% | 29.3% |

| Dividend Yield | 0% | 1.63% |

Interpretation of the Ratios

Monster Beverage Corporation

Monster Beverage shows strong profitability with favorable net margin (20.14%), ROE (25.33%), and ROIC (22.11%), indicating efficient capital use. However, its high PE (34.99) and PB (8.86) ratios suggest a premium valuation, while the current ratio (3.32) is considered weak. The company does not pay dividends, likely reinvesting for growth, as indicated by zero dividend yield and no payout activity.

Coca-Cola Consolidated, Inc.

Coca-Cola Consolidated has a solid ROE (44.66%) and ROIC (15.55%), reflecting effective returns on equity and invested capital, though net margin is moderate at 9.18%. The debt-to-equity ratio (1.35) is unfavorable, raising leverage concerns. The company pays dividends with a 1.63% yield, supported by cash flow, but payout stability and buybacks require monitoring given moderate profitability.

Which one has the best ratios?

Both companies present a favorable overall ratio profile, but Monster Beverage edges ahead with stronger profitability and lower leverage. Coca-Cola Consolidated’s higher dividend yield and asset turnover are positive, yet its greater debt levels and mixed margin performance temper the outlook. The evaluation depends on investor preference for growth versus income and risk tolerance.

Strategic Positioning

This section compares the strategic positioning of Monster Beverage Corporation and Coca-Cola Consolidated, Inc., including market position, key segments, and exposure to technological disruption:

Monster Beverage Corporation

- Leading energy drink company with significant market cap and low beta, facing competitive beverage market.

- Dominates energy drinks segment; also offers strategic brands and alcohol products driving revenue growth.

- Limited explicit information on technological disruption exposure in the data provided.

Coca-Cola Consolidated, Inc.

- Regional bottler and distributor for Coca-Cola products with moderate market cap and beta.

- Focuses on nonalcoholic beverages including sparkling and still drinks, distributing Coca-Cola and others.

- No direct data on technological disruption exposure available in the dataset.

Monster Beverage Corporation vs Coca-Cola Consolidated, Inc. Positioning

Monster Beverage has a concentrated focus on energy drinks and related brands, while Coca-Cola Consolidated operates a more diversified portfolio in nonalcoholic beverages and distribution. Monster’s specialization may offer growth in niche markets, whereas Coca-Cola Consolidated benefits from broad product and distribution channels.

Which has the best competitive advantage?

Based on MOAT evaluation, Coca-Cola Consolidated holds a very favorable competitive advantage with growing ROIC and increasing profitability, while Monster Beverage shows a slightly favorable moat with value creation but declining ROIC over recent years.

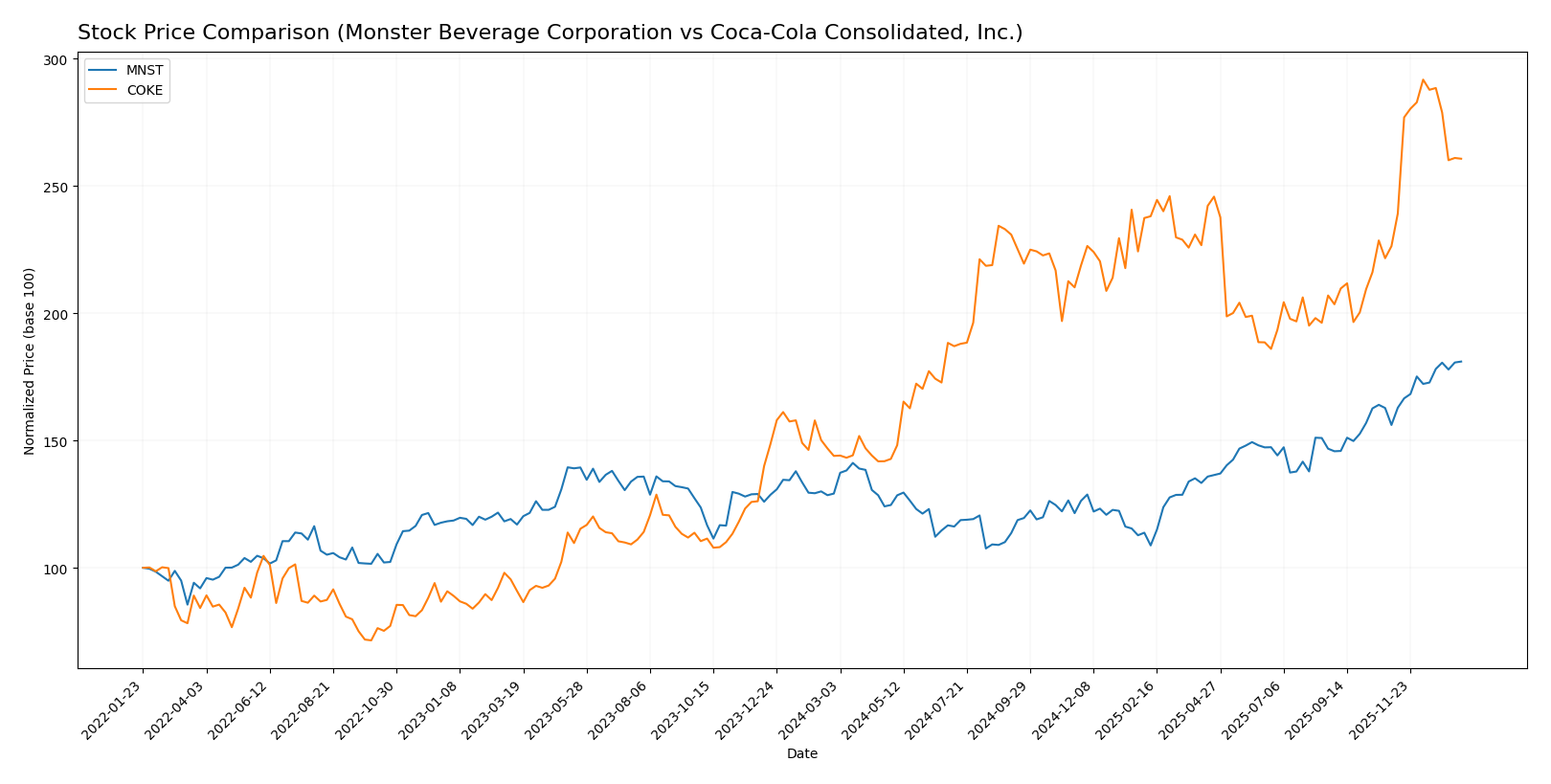

Stock Comparison

The stock prices of Monster Beverage Corporation and Coca-Cola Consolidated, Inc. have both shown significant bullish trends with accelerating momentum and strong buyer dominance over the past year, reflecting dynamic trading activity and notable price appreciation.

Trend Analysis

Monster Beverage Corporation’s stock price rose by 40.17% over the past 12 months, indicating a bullish trend with acceleration. The price fluctuated between 46.06 and 77.5, with a standard deviation of 8.13, reflecting moderate volatility.

Coca-Cola Consolidated, Inc. exhibited an 81.11% increase in stock price over the same period, confirming a bullish trend with accelerating gains. The stock showed higher volatility, with a standard deviation of 20.47 and prices ranging from 81.69 to 168.08.

Comparing both, Coca-Cola Consolidated delivered the highest market performance, nearly doubling Monster Beverage’s price increase, supported by stronger recent bullish momentum and greater price volatility.

Target Prices

The target price consensus for Monster Beverage Corporation reflects a moderately bullish outlook from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Monster Beverage Corporation | 87 | 70 | 79.44 |

Analysts expect Monster Beverage’s stock to trade slightly above its current price of $77.50, indicating moderate upside potential. No verified target price data is available from recognized analysts for Coca-Cola Consolidated, Inc.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Monster Beverage Corporation and Coca-Cola Consolidated, Inc.:

Rating Comparison

MNST Rating

- Rating: B, considered Very Favorable overall.

- Discounted Cash Flow Score: 4, rated Favorable.

- ROE Score: 5, rated Very Favorable for profit generation.

- ROA Score: 5, rated Very Favorable for asset utilization.

- Debt To Equity Score: 1, rated Very Unfavorable for financial risk.

- Overall Score: 3, rated Moderate.

COKE Rating

- Rating: B+, considered Very Favorable overall.

- Discounted Cash Flow Score: 3, rated Moderate.

- ROE Score: 5, rated Very Favorable for profit generation.

- ROA Score: 5, rated Very Favorable for asset utilization.

- Debt To Equity Score: 1, rated Very Unfavorable for financial risk.

- Overall Score: 3, rated Moderate.

Which one is the best rated?

COKE holds a slightly higher overall rating of B+ compared to MNST’s B, despite both having the same moderate overall score and very favorable ROE and ROA scores. MNST scores better on discounted cash flow, but both share the same unfavorable debt to equity score.

Scores Comparison

Below is a comparison of the Altman Z-Score and Piotroski Score for Monster Beverage Corporation and Coca-Cola Consolidated, Inc.:

MNST Scores

- Altman Z-Score: 25.33, indicating a safe zone.

- Piotroski Score: 8, classified as very strong.

COKE Scores

- Altman Z-Score: 4.33, indicating a safe zone.

- Piotroski Score: 7, classified as strong.

Which company has the best scores?

Based on the provided data, MNST has higher scores in both Altman Z-Score and Piotroski Score compared to COKE, suggesting comparatively stronger financial stability and health.

Grades Comparison

Here is a comparison of the latest available grades from recognized grading companies for the two companies:

Monster Beverage Corporation Grades

The following table summarizes recent grades issued by reputable financial institutions for Monster Beverage Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Hold | Hold | 2026-01-08 |

| Wells Fargo | Overweight | Overweight | 2026-01-05 |

| Morgan Stanley | Overweight | Overweight | 2025-12-23 |

| Citigroup | Buy | Buy | 2025-12-17 |

| Stifel | Buy | Buy | 2025-12-12 |

| Wells Fargo | Overweight | Overweight | 2025-12-03 |

| Piper Sandler | Overweight | Overweight | 2025-12-03 |

| BMO Capital | Hold | Market Perform | 2025-12-03 |

| RBC Capital | Outperform | Outperform | 2025-12-01 |

| Piper Sandler | Overweight | Overweight | 2025-12-01 |

Monster Beverage Corporation’s grades show a strong inclination towards buy and overweight recommendations, with consistent maintenance of these ratings.

Coca-Cola Consolidated, Inc. Grades

The following table shows the latest grades from a single grading company, though dated, for Coca-Cola Consolidated, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Hold | Neutral | 2016-05-20 |

| Citigroup | Hold | Neutral | 2016-05-19 |

| Citigroup | Hold | Neutral | 2015-07-27 |

| Citigroup | Hold | Neutral | 2015-07-26 |

| Citigroup | Hold | Neutral | 2015-05-07 |

| Citigroup | Hold | Neutral | 2015-05-06 |

| Citigroup | Hold | Neutral | 2015-03-06 |

| Citigroup | Hold | Neutral | 2015-03-05 |

| Citigroup | Hold | Neutral | 2014-11-13 |

| Citigroup | Hold | Neutral | 2014-11-12 |

Coca-Cola Consolidated, Inc. grades are uniformly neutral with no recent updates, indicating a stable but unremarkable outlook from the grading entity.

Which company has the best grades?

Monster Beverage Corporation consistently receives positive grades such as Buy and Overweight from multiple reputable firms, indicating stronger analyst confidence compared to the older, neutral ratings for Coca-Cola Consolidated, Inc. This disparity in grading could impact investor sentiment and portfolio positioning.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Monster Beverage Corporation (MNST) and Coca-Cola Consolidated, Inc. (COKE) based on the most recent financial and operational data.

| Criterion | Monster Beverage Corporation (MNST) | Coca-Cola Consolidated, Inc. (COKE) |

|---|---|---|

| Diversification | Moderate; heavily reliant on Monster Energy Drinks (~$6.86B in 2024) with smaller alcohol and strategic brand segments | More diversified in nonalcoholic beverages (~$6.84B in 2024) plus other operating segments |

| Profitability | High net margin (20.14%) and ROE (25.33%) but declining ROIC trend | Moderate net margin (9.18%) with very strong ROE (44.66%) and growing ROIC trend |

| Innovation | Strong in energy drink market innovation but limited outside this niche | Innovation focused on beverage distribution and product variety across segments |

| Global presence | Strong global brand recognition but less extensive distribution network | Extensive distribution network as a major Coca-Cola bottler, strong U.S. presence |

| Market Share | Leading in energy drinks segment globally | Significant share in U.S. nonalcoholic beverage bottling market |

Key takeaways: Monster Beverage shows strong profitability and brand dominance in energy drinks but faces risks from a declining return on invested capital and limited diversification. Coca-Cola Consolidated benefits from a durable competitive advantage with increasing profitability and broader beverage portfolio, though its net margin is more moderate. Investors should weigh MNST’s growth potential against COKE’s stable, diversified cash flows.

Risk Analysis

Below is a comparative table summarizing the key risks for Monster Beverage Corporation (MNST) and Coca-Cola Consolidated, Inc. (COKE) as of 2024:

| Metric | Monster Beverage Corporation (MNST) | Coca-Cola Consolidated, Inc. (COKE) |

|---|---|---|

| Market Risk | Moderate (Beta 0.46, stable demand in energy drinks) | Moderate (Beta 0.64, exposure to beverage market volatility) |

| Debt level | Low (Debt-to-Equity 0.06, very favorable) | High (Debt-to-Equity 1.35, unfavorable) |

| Regulatory Risk | Moderate (Health regulations on energy drinks) | Moderate (Beverage and distribution regulations) |

| Operational Risk | Low (Strong operational efficiency, asset turnover favorable) | Moderate (Larger operational scale, higher employee count) |

| Environmental Risk | Low to Moderate (Industry-wide sustainability pressure) | Moderate (Sustainability initiatives ongoing, larger footprint) |

| Geopolitical Risk | Low (Primarily US and international markets) | Moderate (US-focused but impacted by global supply chains) |

In synthesis, the most impactful risks include Coca-Cola Consolidated’s elevated debt level, which increases financial vulnerability despite strong operational scores. Monster Beverage shows low financial leverage and operational risk but faces regulatory scrutiny typical for energy drink producers. Both companies maintain a safe financial position per Altman Z-Scores, but careful monitoring of debt and regulatory environments remains essential.

Which Stock to Choose?

Monster Beverage Corporation (MNST) shows favorable income quality with a 20.14% net margin and strong profitability ratios such as a 25.33% ROE and 22.11% ROIC. It carries very low debt, reflected in a 0.06 debt-to-equity ratio, and has a very favorable overall rating despite some valuation concerns.

Coca-Cola Consolidated, Inc. (COKE) presents a favorable income evolution with a 9.18% net margin and very high ROE at 44.66%. Its debt is more significant, with a debt-to-equity of 1.35, yet it maintains a very favorable rating supported by solid cash flows and improving profitability metrics.

Considering ratings, income, and financial ratios, MNST might appeal to growth-oriented investors valuing strong profitability and low leverage, while COKE could be more suitable for those prioritizing durable competitive advantage and improving returns amid moderate debt levels.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Monster Beverage Corporation and Coca-Cola Consolidated, Inc. to enhance your investment decisions: