In the dynamic non-alcoholic beverage sector, Monster Beverage Corporation and Coca-Cola Europacific Partners PLC stand out as leading competitors shaping consumer preferences globally. Both companies excel in innovation and market reach, with overlapping product lines in energy drinks and ready-to-drink beverages. This article explores their strategic strengths and financial health to help you decide which stock deserves a place in your investment portfolio. Let’s uncover which company offers the most compelling opportunity for investors today.

Table of contents

Companies Overview

I will begin the comparison between Monster Beverage Corporation and Coca-Cola Europacific Partners PLC by providing an overview of these two companies and their main differences.

Monster Beverage Corporation Overview

Monster Beverage Corporation focuses on the development, marketing, sale, and distribution of energy drink beverages and concentrates primarily in the US and internationally. It operates through three segments offering a broad portfolio including carbonated and non-carbonated energy drinks, iced teas, juices, sports drinks, and other beverages. Founded in 1985 and headquartered in Corona, California, Monster holds a leading position in the energy drink market with a market cap of approximately 75.7B USD.

Coca-Cola Europacific Partners PLC Overview

Coca-Cola Europacific Partners PLC produces, distributes, and sells a wide range of non-alcoholic ready-to-drink beverages, including soft drinks, energy drinks, waters, teas, coffees, and juices. It serves around 600M consumers, operating primarily in Europe and the Asia-Pacific region. Founded in 1986 and based in Uxbridge, UK, Coca-Cola Europacific Partners employs about 41,000 people and has a market cap of roughly 40.4B USD.

Key similarities and differences

Both companies operate in the non-alcoholic beverages sector with significant portfolios including energy drinks. Monster Beverage is more specialized in energy drinks and related products, whereas Coca-Cola Europacific Partners offers a broader range of beverage categories including soft drinks and ready-to-drink teas and coffees. Additionally, Monster’s operations are US-centric with international reach, while Coca-Cola Europacific Partners focuses on Europe and Asia-Pacific markets with a substantially larger workforce.

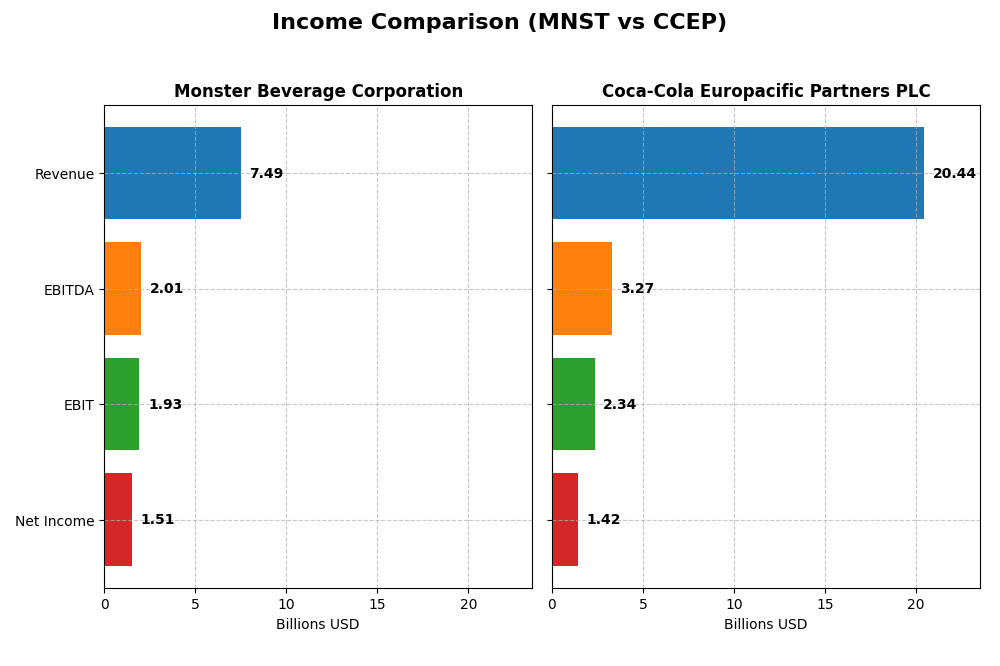

Income Statement Comparison

The following table compares key income statement metrics for Monster Beverage Corporation and Coca-Cola Europacific Partners PLC for the fiscal year 2024.

| Metric | Monster Beverage Corporation | Coca-Cola Europacific Partners PLC |

|---|---|---|

| Market Cap | 75.7B USD | 40.4B USD |

| Revenue | 7.49B USD | 20.4B EUR |

| EBITDA | 2.01B USD | 3.27B EUR |

| EBIT | 1.93B USD | 2.34B EUR |

| Net Income | 1.51B USD | 1.42B EUR |

| EPS | 1.50 USD | 3.08 EUR |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Monster Beverage Corporation

Monster Beverage’s revenue increased steadily from 4.6B in 2020 to 7.5B in 2024, reflecting a strong overall growth trend. Net income showed more modest gains, peaking in 2023 before declining slightly in 2024. Margins remained robust, with a gross margin above 54% in 2024, though net margin contracted by nearly 12% last year, indicating some pressure on profitability despite stable revenue growth.

Coca-Cola Europacific Partners PLC

Coca-Cola Europacific Partners experienced significant revenue growth, jumping from 10.6B EUR in 2020 to 20.4B EUR in 2024. Net income rose sharply as well, more than tripling over the period. Margins improved notably, with a gross margin near 36% and net margin around 7% in 2024. However, net margin and EPS both fell in the most recent year, signaling short-term margin compression despite strong top-line expansion.

Which one has the stronger fundamentals?

Both companies display favorable income statement fundamentals, but Coca-Cola Europacific Partners shows stronger overall growth in revenue and net income, alongside improving margin trends over the full period. Monster Beverage has higher margins but faces recent margin declines and slower net income growth. The choice depends on prioritizing margin stability versus accelerated growth and margin improvement.

Financial Ratios Comparison

The following table presents key financial ratios for Monster Beverage Corporation and Coca-Cola Europacific Partners PLC based on their most recent fiscal year data, facilitating a straightforward comparison.

| Ratios | Monster Beverage Corporation (MNST) | Coca-Cola Europacific Partners PLC (CCEP) |

|---|---|---|

| ROE | 25.33% | 16.70% |

| ROIC | 22.11% | 6.53% |

| P/E | 34.99 | 24.08 |

| P/B | 8.86 | 4.02 |

| Current Ratio | 3.32 | 0.81 |

| Quick Ratio | 2.65 | 0.62 |

| D/E | 0.06 | 1.33 |

| Debt-to-Assets | 4.84% | 36.43% |

| Interest Coverage | 69.19 | 8.81 |

| Asset Turnover | 0.97 | 0.66 |

| Fixed Asset Turnover | 7.16 | 3.18 |

| Payout ratio | 0% | 64.17% |

| Dividend yield | 0% | 2.66% |

Interpretation of the Ratios

Monster Beverage Corporation

Monster Beverage shows strong profitability ratios, with a net margin of 20.14% and ROE at 25.33%, indicating efficient earnings generation. Its leverage and coverage ratios are favorable, but high valuation multiples like a P/E of 34.99 and a PB of 8.86 raise caution. The company does not pay dividends, likely due to reinvestment priorities or growth focus, as no dividend payouts are reported.

Coca-Cola Europacific Partners PLC

Coca-Cola Europacific Partners presents moderate profitability with a net margin of 6.94% and ROE at 16.7%, reflecting steady returns. However, its leverage is high with a debt-to-equity of 1.33 and a low current ratio of 0.81, indicating liquidity concerns. The company pays dividends with a yield of 2.66%, supported by positive free cash flow, balancing shareholder returns with financial stability.

Which one has the best ratios?

Monster Beverage demonstrates overall more favorable financial ratios, particularly in profitability and leverage, despite some valuation concerns. Coca-Cola Europacific Partners shows mixed results with moderate profitability and higher leverage, though it supports dividend payouts. Based purely on ratio strength and risk indicators, Monster Beverage holds a more robust profile in this comparison.

Strategic Positioning

This section compares the strategic positioning of Monster Beverage Corporation and Coca-Cola Europacific Partners PLC, including market position, key segments, and exposure to technological disruption:

Monster Beverage Corporation

- Leading energy drink producer with strong market presence and moderate competitive pressure.

- Focused on energy drinks and strategic brands driving majority of revenue; limited alcohol segment exposure.

- Moderate exposure through energy drink innovation; traditional beverage formats dominate.

Coca-Cola Europacific Partners PLC

- Large bottler and distributor with significant market share and broad competitive landscape.

- Diversified beverage portfolio including soft drinks, energy drinks, waters, and ready-to-drink products.

- Exposure via broad product range including energy and ready-to-drink tea/coffee, adapting to consumer trends.

Monster Beverage Corporation vs Coca-Cola Europacific Partners PLC Positioning

Monster Beverage is concentrated predominantly on energy drinks and related brands, delivering focused expertise and brand strength. Coca-Cola Europacific Partners operates a diversified portfolio across many beverage categories, offering broader market coverage but facing more complex operational challenges.

Which has the best competitive advantage?

Both companies hold a slightly favorable moat status. Monster Beverage creates value with a higher ROIC than WACC but faces declining profitability, while Coca-Cola Europacific Partners has growing profitability but currently sheds value, reflecting differing stages of competitive advantage development.

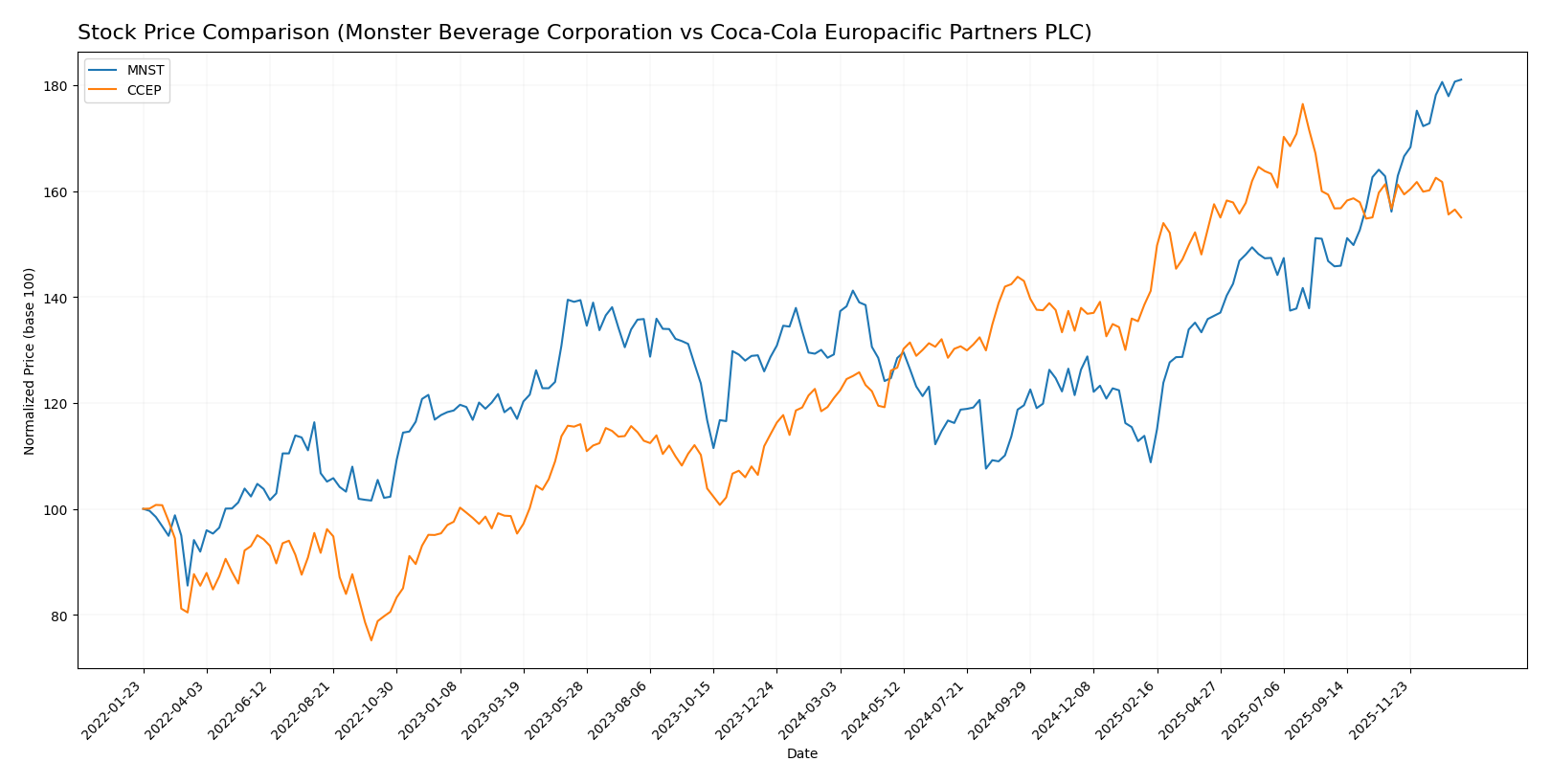

Stock Comparison

The past year has seen Monster Beverage Corporation (MNST) and Coca-Cola Europacific Partners PLC (CCEP) both exhibit bullish trends, with MNST showing notable acceleration and higher volatility, while CCEP’s price increase has decelerated recently.

Trend Analysis

Monster Beverage Corporation’s stock price rose 40.17% over the past 12 months, indicating a bullish trend with acceleration and a high of 77.5. Recent months show continued positive momentum with a 15.97% gain.

Coca-Cola Europacific Partners PLC’s stock gained 28.19% over the last year, also bullish but with deceleration. Its price peaked at 100.04. Recently, the trend turned slightly negative with a -1.06% change.

Comparing trends, MNST outperformed CCEP with a stronger overall price increase and recent acceleration, delivering the highest market performance in the analyzed period.

Target Prices

Here is the current consensus on target prices for these beverage companies from recognized analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Monster Beverage Corporation | 87 | 70 | 79.44 |

| Coca-Cola Europacific Partners PLC | 114 | 114 | 114 |

Analysts expect Monster Beverage’s price to rise modestly above the current 77.5 USD, while Coca-Cola Europacific Partners shows a strong consensus target significantly above its current 87.89 USD price, indicating a bullish outlook.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Monster Beverage Corporation and Coca-Cola Europacific Partners PLC:

Rating Comparison

MNST Rating

- Rating: B, classified as Very Favorable.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation outlook.

- ROE Score: 5, representing very efficient profit generation from equity.

- ROA Score: 5, showing excellent asset utilization to generate earnings.

- Debt To Equity Score: 1, reflecting very unfavorable financial risk profile.

- Overall Score: 3, assessed as Moderate overall financial standing.

CCEP Rating

- Rating: B, classified as Very Favorable.

- Discounted Cash Flow Score: 5, indicating a Very Favorable valuation outlook.

- ROE Score: 5, representing very efficient profit generation from equity.

- ROA Score: 3, showing moderate asset utilization to generate earnings.

- Debt To Equity Score: 1, reflecting very unfavorable financial risk profile.

- Overall Score: 3, assessed as Moderate overall financial standing.

Which one is the best rated?

Both companies share the same overall rating of B and an identical overall score of 3, indicating a moderate position. CCEP scores higher on discounted cash flow but lower on return on assets compared to MNST, which has stronger asset efficiency.

Scores Comparison

Here is a comparison of the financial scores for Monster Beverage Corporation and Coca-Cola Europacific Partners PLC:

MNST Scores

- Altman Z-Score: 25.33, indicating a safe zone, very low bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

CCEP Scores

- Altman Z-Score: 3.17, in safe zone, suggesting low bankruptcy risk.

- Piotroski Score: 5, indicating average financial strength.

Which company has the best scores?

Based strictly on the provided data, MNST has higher scores with a much stronger Altman Z-Score and a very strong Piotroski Score compared to CCEP’s moderate scores. MNST shows stronger financial stability and health in this comparison.

Grades Comparison

The following is a comparison of recent grades assigned to Monster Beverage Corporation and Coca-Cola Europacific Partners PLC by reputable grading companies:

Monster Beverage Corporation Grades

This table summarizes recent grades from recognized financial institutions for Monster Beverage Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-23 |

| Citigroup | Maintain | Buy | 2025-12-17 |

| Stifel | Maintain | Buy | 2025-12-12 |

| Wells Fargo | Maintain | Overweight | 2025-12-03 |

| Piper Sandler | Maintain | Overweight | 2025-12-03 |

| BMO Capital | Maintain | Market Perform | 2025-12-03 |

| RBC Capital | Maintain | Outperform | 2025-12-01 |

| Piper Sandler | Maintain | Overweight | 2025-12-01 |

Overall, Monster Beverage Corporation’s grades reflect a generally positive outlook with a majority maintaining “Buy” or “Overweight” ratings, indicating moderate confidence among analysts.

Coca-Cola Europacific Partners PLC Grades

This table presents recent grades from established grading firms for Coca-Cola Europacific Partners PLC:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-08 |

| Barclays | Maintain | Overweight | 2025-08-08 |

| Barclays | Maintain | Overweight | 2025-07-15 |

| UBS | Maintain | Buy | 2025-07-02 |

| Barclays | Maintain | Overweight | 2025-05-01 |

| UBS | Maintain | Buy | 2025-04-30 |

| Barclays | Maintain | Overweight | 2025-04-11 |

| Barclays | Maintain | Overweight | 2025-03-27 |

| Barclays | Maintain | Overweight | 2025-03-06 |

| Evercore ISI Group | Maintain | Outperform | 2025-02-18 |

Coca-Cola Europacific Partners PLC’s ratings consistently show “Buy” and “Overweight” grades, indicating strong analyst confidence with no recent downgrades.

Which company has the best grades?

Both Monster Beverage Corporation and Coca-Cola Europacific Partners PLC hold predominantly positive grades, with consensus ratings of “Buy.” However, Coca-Cola Europacific Partners shows a consistent pattern of “Overweight” and “Buy” ratings from Barclays and UBS, while Monster Beverage displays a slightly wider spread including “Hold” and “Market Perform” grades. Investors might interpret Coca-Cola Europacific Partners’ stronger uniformity in positive grades as signaling steadier analyst confidence.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Monster Beverage Corporation (MNST) and Coca-Cola Europacific Partners PLC (CCEP) based on recent financial and operational data.

| Criterion | Monster Beverage Corporation (MNST) | Coca-Cola Europacific Partners PLC (CCEP) |

|---|---|---|

| Diversification | Moderate; mainly energy drinks with emerging alcohol and strategic brands segments | Moderate; broad beverage portfolio but less diversified in product segments |

| Profitability | High net margin (20.14%), strong ROE (25.33%), ROIC 22.11% but declining | Moderate net margin (6.94%), solid ROE (16.7%), improving ROIC (6.53%) |

| Innovation | Focused innovation in energy drinks and brand expansion | Incremental innovation, focusing on portfolio and sustainability |

| Global presence | Strong presence in North America and growing internationally | Extensive European and Asia-Pacific distribution network |

| Market Share | Leading position in energy drinks market | Large market share in carbonated soft drinks and other beverages |

Key takeaways: Monster Beverage shows strong profitability and value creation despite some decline in ROIC, driven largely by its dominant energy drinks segment. Coca-Cola Europacific Partners is improving profitability with a broad international presence but currently generates less excess return on capital. Investors should weigh MNST’s focused innovation and high margins against CCEP’s growing efficiency and global reach.

Risk Analysis

Below is a comparative table highlighting key risk factors for Monster Beverage Corporation (MNST) and Coca-Cola Europacific Partners PLC (CCEP) based on the latest data available for 2024-2026.

| Metric | Monster Beverage Corporation (MNST) | Coca-Cola Europacific Partners PLC (CCEP) |

|---|---|---|

| Market Risk | Low beta of 0.46 indicates lower volatility compared to the market. | Low beta of 0.362 shows even less volatility, indicating defensive stock behavior. |

| Debt level | Very low debt-to-equity ratio at 0.06; strong interest coverage (69.19); very low financial leverage. | High debt-to-equity ratio at 1.33; moderate interest coverage (9.67); higher leverage risk. |

| Regulatory Risk | Moderate, US-focused beverage regulations; exposure to international markets. | Moderate, diverse regulatory environments in Europe and Pacific regions; compliance complexity. |

| Operational Risk | Medium, reliance on energy drink market trends and supply chain continuity. | Medium to high, large-scale bottling and distribution operations exposed to logistics disruptions. |

| Environmental Risk | Low to medium, increasing pressure on sustainability and packaging regulations. | Medium, European operations face stricter environmental regulations and sustainability demands. |

| Geopolitical Risk | Low, primarily US-centric with some international exposure. | Medium, exposure to Europe-Pacific geopolitical tensions and trade uncertainties. |

Synthesis: Monster Beverage’s most impactful risk lies in market concentration and product trends but benefits from very low debt and strong financial stability. Coca-Cola Europacific Partners faces higher financial risk due to elevated debt levels and operational complexity across multiple regions, with geopolitical tensions posing a moderate threat. Investors should weigh Monster’s lower leverage against CCEP’s broader geographic exposure and dividend yield.

Which Stock to Choose?

Monster Beverage Corporation (MNST) shows favorable income evolution with a 4.94% revenue growth in 2024 and strong profitability metrics, including a 20.14% net margin and 25.33% ROE. Its financial ratios are largely favorable, reflecting low debt and high interest coverage, though its valuation ratios are less attractive. The company maintains a very favorable rating and strong financial scores, with a slightly favorable moat despite a declining ROIC trend.

Coca-Cola Europacific Partners PLC (CCEP) demonstrates strong income growth, with 11.67% revenue growth in 2024 and a favorable income statement overall. Its profitability is moderate with a 6.94% net margin and 16.7% ROE. Financial ratios are slightly favorable but show higher leverage and weaker liquidity. CCEP holds a very favorable rating and stable financial scores, with a slightly favorable moat supported by an improving ROIC trend.

For investors valuing strong profitability and financial stability, MNST might appear more favorable due to its high ROE and low debt levels. Conversely, those prioritizing growth potential and improving profitability could find CCEP appealing, given its robust revenue growth and positive ROIC trajectory. The choice could depend on the investor’s risk tolerance and investment focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Monster Beverage Corporation and Coca-Cola Europacific Partners PLC to enhance your investment decisions: