In the competitive world of non-alcoholic beverages, Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP) stand out as major players with overlapping market footprints and strong innovation strategies. Both companies command significant consumer loyalty through diverse product portfolios spanning soft drinks, coffee, and energy drinks. This article will explore their strengths and risks to help you decide which company is the more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Coca-Cola Europacific Partners PLC and Keurig Dr Pepper Inc. by providing an overview of these two companies and their main differences.

Coca-Cola Europacific Partners PLC Overview

Coca-Cola Europacific Partners PLC produces, distributes, and sells a wide range of non-alcoholic ready-to-drink beverages. Its portfolio includes soft drinks, energy drinks, waters, teas, coffees, and juices under globally recognized brands such as Coca-Cola, Fanta, Sprite, and Monster Energy. The company serves approximately 600M consumers and operates primarily in Europe and the Asia-Pacific region, employing 41,000 people with a market cap of $40.4B.

Keurig Dr Pepper Inc. Overview

Keurig Dr Pepper Inc. operates mainly in the U.S. and internationally, focusing on coffee systems, packaged beverages, beverage concentrates, and Latin America beverages. It owns notable brands like Dr Pepper, Canada Dry, 7UP, and Snapple, and sells coffee brewers and pods under its Coffee Systems segment. The company employs 29,000 people, with a market cap of $37.6B, serving a diverse range of retail and foodservice customers.

Key similarities and differences

Both companies operate in the non-alcoholic beverages industry, offering a broad portfolio of consumer brands and serving global markets. Coca-Cola Europacific Partners focuses heavily on bottling and distribution in Europe and Asia-Pacific, while Keurig Dr Pepper emphasizes coffee systems and beverage concentrates alongside packaged drinks, with a strong U.S. presence. Their business models differ in product segmentation and geographic reach, reflecting distinct strategic priorities within the consumer defensive sector.

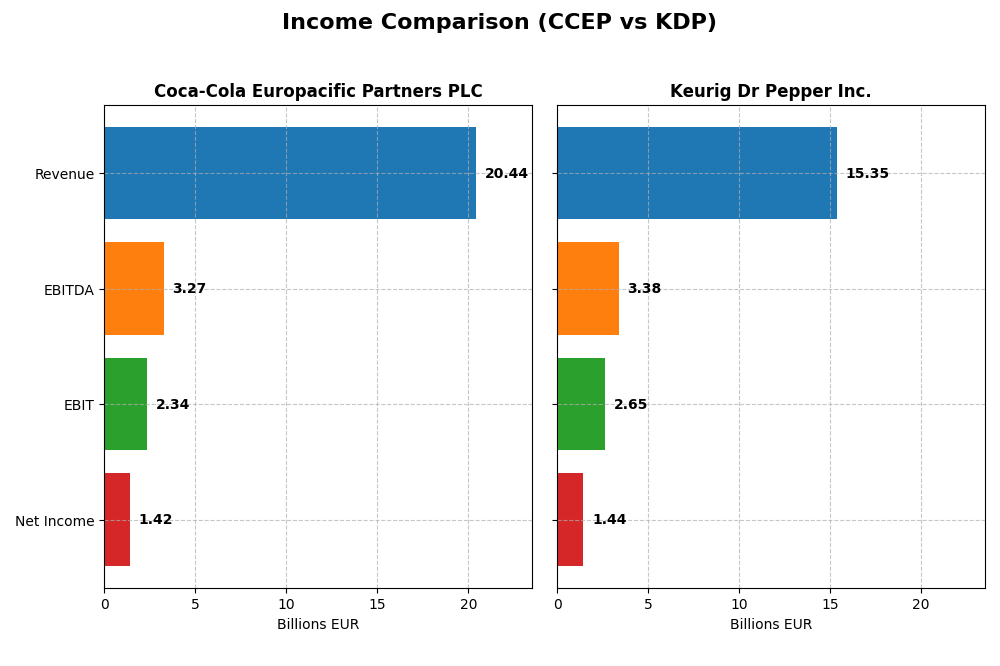

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Coca-Cola Europacific Partners PLC and Keurig Dr Pepper Inc. for the fiscal year 2024.

| Metric | Coca-Cola Europacific Partners PLC (CCEP) | Keurig Dr Pepper Inc. (KDP) |

|---|---|---|

| Market Cap | 40.4B EUR | 37.6B USD |

| Revenue | 20.4B EUR | 15.4B USD |

| EBITDA | 3.27B EUR | 3.38B USD |

| EBIT | 2.34B EUR | 2.65B USD |

| Net Income | 1.42B EUR | 1.44B USD |

| EPS | 3.08 EUR | 1.06 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Coca-Cola Europacific Partners PLC

Coca-Cola Europacific Partners showed strong revenue growth over 2020-2024, nearly doubling to 20.4B EUR in 2024. Net income more than tripled to 1.42B EUR, supported by improving net margins reaching 6.94%. However, in 2024, net income and EBIT slightly declined despite revenue growth, indicating margin pressure from rising operating expenses.

Keurig Dr Pepper Inc.

Keurig Dr Pepper’s revenue increased steadily to 15.35B USD in 2024, with net income rising moderately to 1.44B USD. Its gross margin remained robust above 55%, but EBIT and net margin both contracted notably in 2024. The company faced margin compression and a drop in earnings per share despite continued top-line growth.

Which one has the stronger fundamentals?

Both companies show favorable income statement fundamentals overall, but Coca-Cola Europacific Partners exhibits stronger long-term net income and margin growth. Keurig Dr Pepper maintains higher gross margins but experienced greater recent margin declines. The balance of sustained revenue and income growth versus margin volatility shapes their differing fundamental profiles.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP) based on their most recent fiscal year 2024 data.

| Ratios | Coca-Cola Europacific Partners PLC (CCEP) | Keurig Dr Pepper Inc. (KDP) |

|---|---|---|

| ROE | 16.7% | 5.9% |

| ROIC | 6.5% | 4.0% |

| P/E | 24.1 | 30.4 |

| P/B | 4.02 | 1.80 |

| Current Ratio | 0.81 | 0.49 |

| Quick Ratio | 0.62 | 0.33 |

| D/E (Debt-to-Equity) | 1.33 | 0.71 |

| Debt-to-Assets | 36.4% | 32.3% |

| Interest Coverage | 8.81 | 3.79 |

| Asset Turnover | 0.66 | 0.29 |

| Fixed Asset Turnover | 3.18 | 3.99 |

| Payout Ratio | 64.2% | 82.9% |

| Dividend Yield | 2.7% | 2.7% |

Interpretation of the Ratios

Coca-Cola Europacific Partners PLC

Coca-Cola Europacific Partners shows a slightly favorable ratio profile with strong return on equity (16.7%) and interest coverage (9.67) but faces challenges in liquidity, indicated by a current ratio of 0.81 and a debt-to-equity ratio of 1.33. Its dividend yield is attractive at 2.66%, supported by a manageable payout and free cash flow coverage, though high leverage and weak liquidity warrant attention.

Keurig Dr Pepper Inc.

Keurig Dr Pepper presents a slightly unfavorable ratio profile with a lower return on equity (5.94%) and weak asset turnover (0.29). The company’s liquidity is strained, evidenced by a current ratio of 0.49 and quick ratio of 0.33. Its dividend yield of 2.73% is comparable to peers but comes with less favorable coverage and higher valuation multiples, suggesting cautious monitoring of financial health.

Which one has the best ratios?

Coca-Cola Europacific Partners holds a more balanced and slightly favorable ratio set compared to Keurig Dr Pepper’s more unfavorable readings. Stronger returns on equity and interest coverage alongside a better liquidity stance position Coca-Cola Europacific Partners more favorably, despite some concerns. Keurig Dr Pepper’s weaker profitability and liquidity metrics weigh on its overall ratio strength.

Strategic Positioning

This section compares the strategic positioning of Coca-Cola Europacific Partners (CCEP) and Keurig Dr Pepper (KDP) including market position, key segments, and exposure to disruption:

Coca-Cola Europacific Partners (CCEP)

- Large market cap of 40B USD with moderate competitive pressure

- Diverse beverage portfolio including soft drinks, waters, teas, coffees, and energy drinks

- No explicit data on technological disruption exposure

Keurig Dr Pepper (KDP)

- Market cap of 37.6B USD facing competitive pressure in beverage sector

- Segmented business: Coffee Systems, Packaged Beverages, Beverage Concentrates, Latin America Beverages

- Exposure through Coffee Systems segment with K-Cup pods and brewers

Coca-Cola Europacific Partners vs Keurig Dr Pepper Positioning

CCEP pursues a diversified strategy with a broad beverage portfolio, while KDP concentrates on coffee systems and beverage concentrates. CCEP’s approach offers wider market coverage; KDP’s focus may allow specialization but increases segment reliance.

Which has the best competitive advantage?

CCEP shows a slightly favorable moat with growing ROIC, indicating improving profitability. KDP has a very unfavorable moat with declining ROIC, reflecting value destruction and weakening competitive advantage.

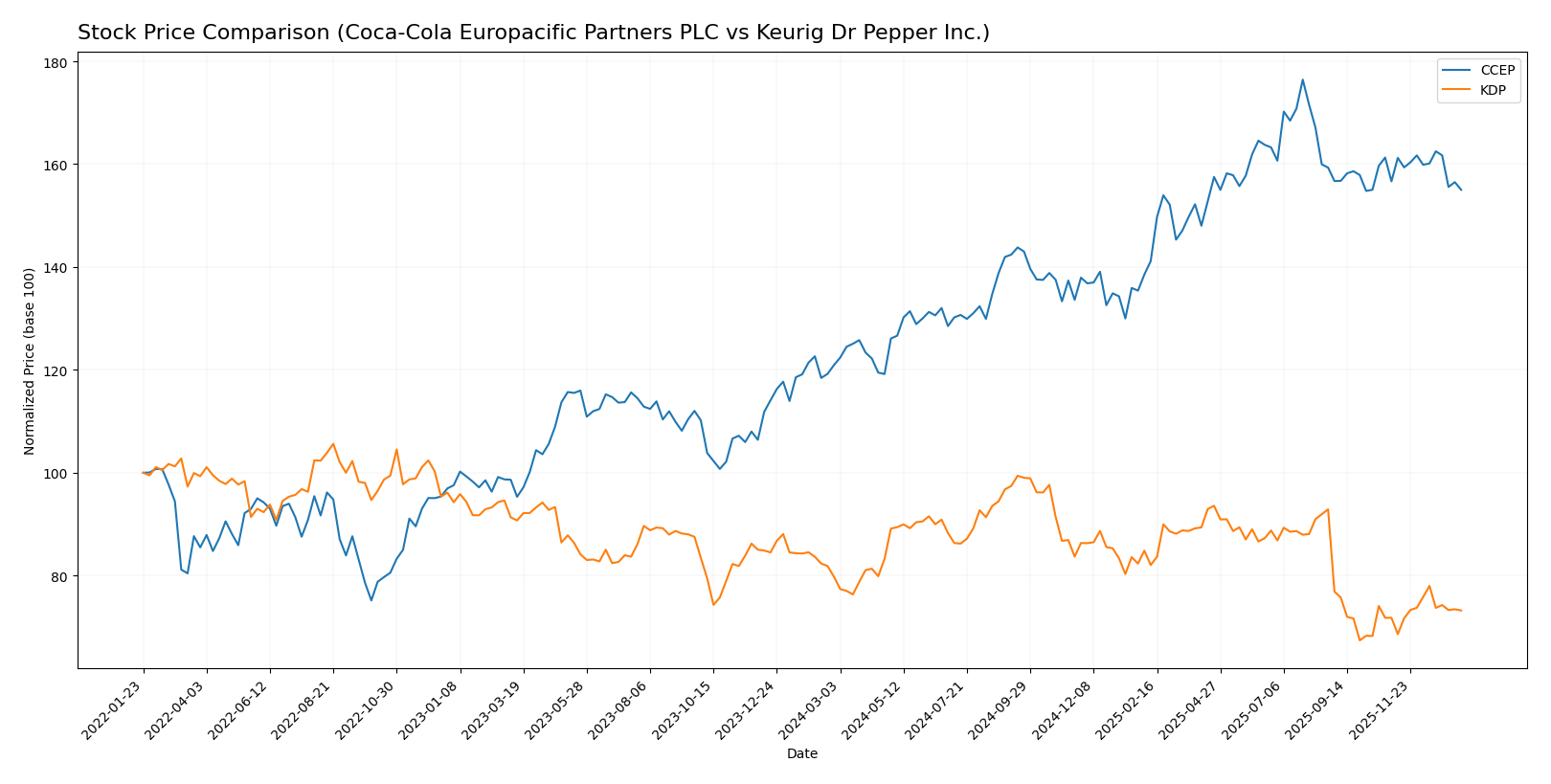

Stock Comparison

The past year has seen divergent price movements between Coca-Cola Europacific Partners PLC and Keurig Dr Pepper Inc., with CCEP showing a strong bullish trend despite recent deceleration, while KDP experienced an overall bearish trajectory but recent signs of mild recovery.

Trend Analysis

Coca-Cola Europacific Partners PLC’s stock gained 28.19% over the past 12 months, indicating a bullish trend with price deceleration. The stock exhibited notable volatility with an 8.26 std deviation, ranging from 67.58 to 100.04.

Keurig Dr Pepper Inc. showed an 8.25% decline over the same period, marking a bearish trend with accelerating downward momentum. Volatility was lower at a 2.98 std deviation, with prices fluctuating between 25.5 and 37.61.

Comparing both stocks, Coca-Cola Europacific Partners PLC delivered the highest market performance over the last year, outperforming Keurig Dr Pepper Inc. despite recent slight downward pressure.

Target Prices

Analysts present a clear consensus on target prices for Coca-Cola Europacific Partners PLC and Keurig Dr Pepper Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Coca-Cola Europacific Partners PLC | 114 | 114 | 114 |

| Keurig Dr Pepper Inc. | 38 | 24 | 32 |

The consensus target for Coca-Cola Europacific Partners at 114 is significantly above its current price of 87.89, indicating potential upside. Keurig Dr Pepper’s target consensus of 32 suggests moderate growth compared to its current price near 27.7.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Coca-Cola Europacific Partners PLC and Keurig Dr Pepper Inc.:

Rating Comparison

CCEP Rating

- Rating: B, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 5, indicating a Very Favorable valuation outlook.

- ROE Score: 5, showing very efficient profit generation from equity.

- ROA Score: 3, a moderate level of asset utilization effectiveness.

- Debt To Equity Score: 1, considered Very Unfavorable, highlighting higher risk.

KDP Rating

- Rating: B, also rated Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation outlook.

- ROE Score: 3, reflecting moderate efficiency in profit generation.

- ROA Score: 3, similarly showing moderate asset utilization effectiveness.

- Debt To Equity Score: 2, Moderate risk with somewhat better financial stability.

Which one is the best rated?

Both companies share the same overall rating of B and an overall score of 3, indicating moderate standing. CCEP scores higher in discounted cash flow and return on equity, but has weaker debt-to-equity metrics than KDP.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

CCEP Scores

- Altman Z-Score: 3.17, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength.

KDP Scores

- Altman Z-Score: 1.33, indicating a distress zone with high bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

Which company has the best scores?

Based on the provided data, CCEP has a significantly better Altman Z-Score, placing it in a safer financial zone than KDP. Both have similar Piotroski Scores, indicating comparable average financial strength.

Grades Comparison

The following sections present the latest reliable grades for Coca-Cola Europacific Partners PLC and Keurig Dr Pepper Inc.:

Coca-Cola Europacific Partners PLC Grades

This table summarizes recent grades assigned by reputable financial institutions for Coca-Cola Europacific Partners PLC.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-08 |

| Barclays | Maintain | Overweight | 2025-08-08 |

| Barclays | Maintain | Overweight | 2025-07-15 |

| UBS | Maintain | Buy | 2025-07-02 |

| Barclays | Maintain | Overweight | 2025-05-01 |

| UBS | Maintain | Buy | 2025-04-30 |

| Barclays | Maintain | Overweight | 2025-04-11 |

| Barclays | Maintain | Overweight | 2025-03-27 |

| Barclays | Maintain | Overweight | 2025-03-06 |

| Evercore ISI Group | Maintain | Outperform | 2025-02-18 |

Overall, Coca-Cola Europacific Partners PLC maintains a consistently positive outlook, predominantly rated as Buy or Overweight by major firms.

Keurig Dr Pepper Inc. Grades

This table summarizes recent grades assigned by reputable financial institutions for Keurig Dr Pepper Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Downgrade | Hold | 2025-12-17 |

| Piper Sandler | Maintain | Overweight | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-10-28 |

| Wells Fargo | Maintain | Overweight | 2025-10-28 |

| JP Morgan | Maintain | Overweight | 2025-10-20 |

| B of A Securities | Maintain | Buy | 2025-10-08 |

| Goldman Sachs | Maintain | Neutral | 2025-10-02 |

| Wells Fargo | Maintain | Overweight | 2025-09-25 |

| Barclays | Downgrade | Equal Weight | 2025-09-24 |

| BNP Paribas | Downgrade | Underperform | 2025-09-22 |

Keurig Dr Pepper Inc. shows a more mixed trend with several downgrades and a range of ratings from Buy to Underperform.

Which company has the best grades?

Coca-Cola Europacific Partners PLC has received consistently stronger grades, mostly Buy and Overweight, compared to Keurig Dr Pepper Inc.’s mixed ratings and recent downgrades. This suggests a more favorable analyst sentiment around Coca-Cola Europacific Partners, potentially impacting investor confidence and perceived risk.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP) based on their recent financial and operational data.

| Criterion | Coca-Cola Europacific Partners PLC (CCEP) | Keurig Dr Pepper Inc. (KDP) |

|---|---|---|

| Diversification | Moderate product range focused on beverages; solid geographic reach in Europe and Pacific regions | Diversified beverage portfolio including coffee systems, concentrates, and regional beverages in North America |

| Profitability | ROIC of 6.53% with improving trend; net margin 6.94%, ROE 16.7% (favorable) | Lower profitability with ROIC 4.04%, net margin 9.39%, ROE 5.94% (unfavorable) and declining ROIC trend |

| Innovation | Steady innovation in packaging and product variants; moderate asset turnover (0.66) | Strong innovation in coffee systems and K-Cup pods; high fixed asset turnover (3.99) |

| Global presence | Strong presence in Europe and Pacific markets; stable global distribution | Primarily North American focus with growing product lines but less global diversification |

| Market Share | Solid market share in European beverage sector, supported by brand strength | Leading position in single-serve coffee market with significant share in regional beverages |

Key takeaways: CCEP shows a slightly favorable moat with growing profitability and efficient capital use, while KDP faces challenges with declining profitability and a very unfavorable moat despite strong innovation in its core products. Investors should weigh CCEP’s stable growth against KDP’s innovation-driven but riskier profile.

Risk Analysis

Below is a comparative table of key risks for Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP) based on the most recent fiscal year 2024 data:

| Metric | Coca-Cola Europacific Partners PLC (CCEP) | Keurig Dr Pepper Inc. (KDP) |

|---|---|---|

| Market Risk | Moderate (Beta 0.36, stable brand presence) | Moderate (Beta 0.35, competitive US market) |

| Debt Level | Elevated (Debt/Equity 1.33, unfavorable) | Moderate (Debt/Equity 0.71, neutral) |

| Regulatory Risk | Moderate (Global beverage regulations) | Moderate (US and Latin America regulations) |

| Operational Risk | Moderate (Large global operations) | Moderate (Complex supply chains) |

| Environmental Risk | Moderate (Sustainability initiatives ongoing) | Moderate (Focus on sustainable packaging) |

| Geopolitical Risk | Moderate (Exposure to European and Pacific markets) | Moderate (US and Latin America exposure) |

The most impactful risks are CCEP’s higher debt level, which raises financial leverage concerns despite stable profitability, and KDP’s lower Altman Z-score placing it in a distress zone, signaling potential financial instability. Market and regulatory risks remain moderate for both due to global beverage industry dynamics. Investors should monitor debt management and financial health closely.

Which Stock to Choose?

Coca-Cola Europacific Partners PLC (CCEP) shows a favorable income statement with strong revenue and net income growth over 2020-2024. Its financial ratios are slightly favorable, highlighted by a 16.7% ROE and good interest coverage, despite unfavorable liquidity and leverage ratios. The company’s rating is very favorable, supported by a safe-zone Altman Z-Score and moderate Piotroski Score.

Keurig Dr Pepper Inc. (KDP) presents a favorable income statement with moderate revenue growth but weaker net margin trends. Its financial ratios are slightly unfavorable overall, with low ROE at 5.94%, moderate debt levels, and weaker asset turnover. Ratings are very favorable but tempered by a distress-zone Altman Z-Score and an average Piotroski Score.

Investors seeking growth and improving profitability might view CCEP’s improving ROIC and slightly favorable financial ratios as attractive, while those more tolerant of risk might consider KDP’s stable income but weaker profitability metrics. The choice could depend on whether the focus is on quality and value creation or on other investment objectives.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Coca-Cola Europacific Partners PLC and Keurig Dr Pepper Inc. to enhance your investment decisions: