In the dynamic world of non-alcoholic beverages, two giants stand out: Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP). Both companies share a similar industry focus and compete for market share, but they diverge in their innovation strategies and product offerings. This article will delve into their strengths and weaknesses, helping you, the investor, determine which of these companies offers the most compelling opportunity for your portfolio.

Table of contents

Company Overview

Coca-Cola Europacific Partners PLC Overview

Coca-Cola Europacific Partners PLC (CCEP) is a leading beverage company that produces, distributes, and sells a diverse range of non-alcoholic ready-to-drink beverages. Founded in 1986 and headquartered in Uxbridge, UK, CCEP operates within the Consumer Defensive sector. The company’s mission revolves around refreshing consumers with a variety of brands, including Coca-Cola, Sprite, and Monster Energy, reaching approximately 600 million consumers globally. CCEP is committed to sustainability and innovation, continuously adapting to changing consumer preferences with new product offerings across multiple beverage categories.

Keurig Dr Pepper Inc. Overview

Keurig Dr Pepper Inc. (KDP) operates as a significant player in the beverage industry, focusing on both coffee and non-alcoholic drinks. Established in 1981 and based in Burlington, Massachusetts, KDP’s mission is to deliver high-quality beverage experiences through its diverse portfolio, including Dr Pepper, Canada Dry, and various coffee systems. The company serves a wide array of customers, from retailers to restaurants, and emphasizes innovation in both product development and distribution channels. With a strategic focus on growth, KDP has made significant strides in the packaged beverages market.

Key similarities and differences

Both CCEP and KDP operate in the non-alcoholic beverage industry and share a commitment to product diversity and consumer satisfaction. However, CCEP is primarily focused on a wide range of soft drinks and energy beverages, while KDP has a notable emphasis on coffee systems and packaged beverages. This distinction highlights their unique business models and market approaches.

Income Statement Comparison

The following table outlines the key financial metrics for Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP) for their most recent fiscal years, allowing for a clear comparison of their performance.

| Metric | CCEP | KDP |

|---|---|---|

| Market Cap | 42.13B | 37.90B |

| Revenue | 20.44B | 15.35B |

| EBITDA | 3.27B | 3.38B |

| EBIT | 2.34B | 2.65B |

| Net Income | 1.42B | 1.44B |

| EPS | 3.08 | 1.06 |

| Fiscal Year | 2024 | 2024 |

Interpretation of Income Statement

In the most recent fiscal year, Coca-Cola Europacific Partners (CCEP) saw its revenue increase to 20.44B, up from 18.30B the previous year, while Keurig Dr Pepper (KDP) reported a more modest rise to 15.35B from 14.81B. CCEP’s net income decreased to 1.42B from 1.67B, reflecting tighter margins amid rising costs. Conversely, KDP’s net income remained stable at 1.44B, indicating effective cost management despite a slight revenue increase. Overall, while both companies showed growth, CCEP’s declining margins warrant caution for investors.

Financial Ratios Comparison

The following table presents a comparative analysis of the most recent financial metrics for Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP).

| Metric | CCEP | KDP |

|---|---|---|

| ROE | 16.70% | 5.94% |

| ROIC | 6.53% | 4.04% |

| P/E | 24.08 | 30.36 |

| P/B | 4.02 | 1.80 |

| Current Ratio | 0.81 | 0.49 |

| Quick Ratio | 0.62 | 0.33 |

| D/E | 1.33 | 0.71 |

| Debt-to-Assets | 36.43% | 28.44% |

| Interest Coverage | 8.81 | 3.79 |

| Asset Turnover | 0.66 | 0.29 |

| Fixed Asset Turnover | 3.18 | 3.99 |

| Payout Ratio | 64.17% | 82.86% |

| Dividend Yield | 2.66% | 2.73% |

Interpretation of Financial Ratios

CCEP shows stronger performance with a higher ROE and asset turnover, indicating efficient use of equity and assets. However, its higher P/E and P/B ratios suggest it may be overvalued compared to KDP. KDP’s lower ratios in profitability and liquidity highlight potential concerns regarding financial health, especially with a current ratio below 1. Both companies have manageable debt levels, but CCEP’s higher interest coverage ratio suggests it can comfortably meet its debt obligations, which is a positive sign for investors.

Dividend and Shareholder Returns

Coca-Cola Europacific Partners PLC (CCEP) maintains a robust dividend policy with a payout ratio of 64.2% and a dividend yield of approximately 2.66%. This indicates a commitment to returning value to shareholders, supported by healthy free cash flow coverage. However, potential risks include unsustainable distributions if profit margins decline.

On the other hand, Keurig Dr Pepper Inc. (KDP) also pays dividends, with a payout ratio of 82.9% and a yield of 2.73%. While this suggests a strong shareholder return strategy, the high payout could be a concern if profitability falters. Both companies’ distributions reflect a focus on long-term shareholder value, albeit with associated risks.

Strategic Positioning

Coca-Cola Europacific Partners PLC (CCEP) holds a strong market share in the non-alcoholic beverage sector, leveraging its extensive portfolio of well-known brands. With a market cap of $42.1B, CCEP faces competitive pressure from Keurig Dr Pepper Inc. (KDP), which has a market cap of $37.9B and a diverse product line, including coffee systems and packaged beverages. Both companies must navigate technological disruptions and changing consumer preferences, which can impact their market positions significantly.

Stock Comparison

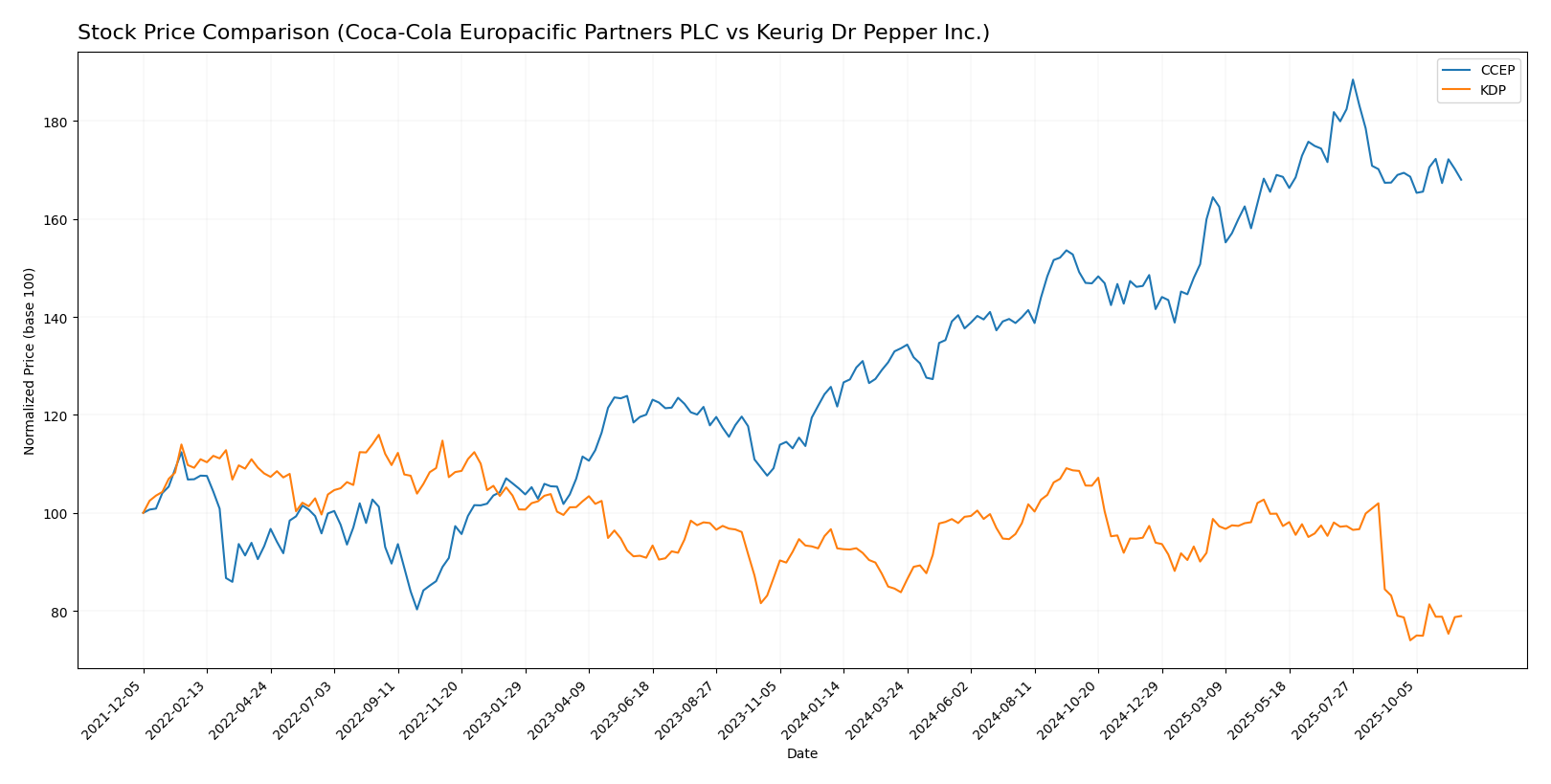

In analyzing the stock performance of Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP) over the past year, we observe significant price movements and trading dynamics that reflect the broader market trends and company-specific developments.

Trend Analysis

For Coca-Cola Europacific Partners PLC (CCEP), the stock has experienced a notable price change of +41.91% over the past year. This strong upward movement indicates a bullish trend, although it is currently showing signs of deceleration. The stock reached a high of 100.04 and a low of 64.61, with a standard deviation of 8.79, indicating some volatility in its price movements. More recently, from September 14, 2025, to November 30, 2025, the stock has seen a +2.21% increase, with a standard deviation of 1.27, suggesting a stable yet cautious upward trajectory.

In contrast, Keurig Dr Pepper Inc. (KDP) has faced a -12.73% decline over the past year, marking a bearish trend. The stock has shown acceleration in its downward movement, with a high of 37.61 and a low of 25.50, and a standard deviation of 2.78, reflecting increased volatility. Despite a recent uptick of +2.46% from September 14, 2025, to November 30, 2025, accompanied by a lower standard deviation of 0.84, the overall trend remains concerning for investors.

Analyst Opinions

Recent analyst recommendations for Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP) indicate a consensus rating of “B+”. Analysts highlight CCEP’s strong discounted cash flow score (5) and solid return metrics, suggesting it is well-positioned for growth, although its price-to-earnings and price-to-book scores are moderate. For KDP, the overall assessment remains positive, with good return on assets but similar concerns about valuation metrics. Both companies are viewed as “hold” investments for the current year, reflecting cautious optimism in a competitive market.

Stock Grades

In this section, I will present the latest stock grades for Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP), based on credible grading from well-known financial institutions.

Coca-Cola Europacific Partners PLC Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Overweight | 2025-08-08 |

| Barclays | maintain | Overweight | 2025-07-15 |

| UBS | maintain | Buy | 2025-07-02 |

| Barclays | maintain | Overweight | 2025-05-01 |

| UBS | maintain | Buy | 2025-04-30 |

| Barclays | maintain | Overweight | 2025-04-11 |

| Barclays | maintain | Overweight | 2025-03-27 |

| Barclays | maintain | Overweight | 2025-03-06 |

| Evercore ISI Group | maintain | Outperform | 2025-02-18 |

| UBS | maintain | Buy | 2025-02-17 |

Keurig Dr Pepper Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | maintain | Overweight | 2025-10-28 |

| Barclays | maintain | Equal Weight | 2025-10-28 |

| JP Morgan | maintain | Overweight | 2025-10-20 |

| B of A Securities | maintain | Buy | 2025-10-08 |

| Goldman Sachs | maintain | Neutral | 2025-10-02 |

| Wells Fargo | maintain | Overweight | 2025-09-25 |

| Barclays | downgrade | Equal Weight | 2025-09-24 |

| BNP Paribas | downgrade | Underperform | 2025-09-22 |

| Piper Sandler | maintain | Overweight | 2025-09-17 |

| Citigroup | maintain | Buy | 2025-09-16 |

Overall, both CCEP and KDP maintain strong positions, with CCEP consistently graded as “Overweight” and KDP showing a mix of grades, including recent downgrades but also maintaining “Overweight” by some analysts. This indicates a generally positive outlook for CCEP while KDP faces some challenges that investors should consider carefully.

Target Prices

The current consensus target prices from analysts indicate a positive outlook for both Coca-Cola Europacific Partners PLC and Keurig Dr Pepper Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Coca-Cola Europacific Partners | 98 | 46.22 | 74.69 |

| Keurig Dr Pepper Inc. | 41 | 24 | 32.5 |

Coca-Cola Europacific Partners has a consensus target price of 74.69, which suggests potential upside compared to its current price of 91.69. In contrast, Keurig Dr Pepper’s consensus of 32.5 indicates room for growth from its current price of 27.90.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP) based on the most recent data.

| Criterion | CCEP | KDP |

|---|---|---|

| Diversification | Moderate (variety of brands) | High (coffee and beverages) |

| Profitability | Net margin: 6.9% | Net margin: 9.4% |

| Innovation | Moderate (traditional brands) | High (coffee systems) |

| Global presence | Strong (600M consumers) | Moderate (mainly USA) |

| Market Share | 20% in Europe | 14% in USA |

| Debt level | Moderate (debt/equity: 1.43) | Moderate (debt/equity: 0.71) |

Key takeaways indicate that while both companies have their strengths and moderate debt levels, KDP exhibits higher profitability and innovation, making it a potentially more attractive option for investors focused on growth.

Risk Analysis

The table below outlines the key risks associated with Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP).

| Metric | CCEP | KDP |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | High | High |

| Environmental Risk | High | Moderate |

| Geopolitical Risk | Moderate | High |

In summary, both companies face significant operational and environmental risks, particularly in light of recent supply chain disruptions and increasing regulatory scrutiny in the beverage industry. The geopolitical landscape also poses a potential threat to their operations.

Which one to choose?

In comparing Coca-Cola Europacific Partners PLC (CCEP) and Keurig Dr Pepper Inc. (KDP), both companies show solid fundamentals with a B+ rating from analysts. CCEP has a higher gross profit margin of 35.6% and a net income of €1.418B, while KDP’s gross profit margin stands at 55.6% with a net income of $1.441B. However, CCEP has demonstrated a bullish stock trend with a price change of +41.91%, while KDP is currently in a bearish trend at -12.73%.

For growth-focused investors, CCEP may appear favorable due to its strong price momentum and operating metrics. Conversely, KDP could attract those seeking value with its significant gross margins, despite recent price declines. Risks include competitive pressures and market dependence for both entities.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Coca-Cola Europacific Partners PLC and Keurig Dr Pepper Inc. to enhance your investment decisions: