In the fast-evolving world of cloud security, Cloudflare, Inc. (NET) and Zscaler, Inc. (ZS) stand out as leading innovators in software infrastructure. Both companies offer advanced cloud-based security solutions that protect businesses from cyber threats while enhancing performance and reliability. As they compete for market share and push innovation boundaries, this article will help you decide which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Cloudflare and Zscaler by providing an overview of these two companies and their main differences.

Cloudflare Overview

Cloudflare, Inc. operates as a cloud services provider delivering integrated security, performance, and reliability solutions worldwide. Its offerings include cloud firewalls, DDoS protection, content delivery, and developer tools. The company serves diverse industries such as technology, healthcare, financial services, and government, positioning itself as a comprehensive infrastructure security and performance platform since its founding in 2009.

Zscaler Overview

Zscaler, Inc. is a cloud security company specializing in secure access to externally managed and internal applications via its Internet Access and Private Access solutions. It also provides digital experience monitoring and workload segmentation to enhance security compliance and reduce risks. Founded in 2007, Zscaler serves a broad range of industries including financial services, healthcare, manufacturing, and public sector, focusing on cloud-native security platforms.

Key similarities and differences

Both Cloudflare and Zscaler operate in the Software – Infrastructure industry, focusing on cloud security solutions. While Cloudflare combines security with performance and reliability services, Zscaler concentrates on secure access and workload segmentation. Cloudflare is headquartered in San Francisco with 4,400 employees, whereas Zscaler is based in San Jose with a larger workforce of 7,348. Their market caps differ significantly, with Cloudflare at approximately 68.7B and Zscaler at 34.4B.

Income Statement Comparison

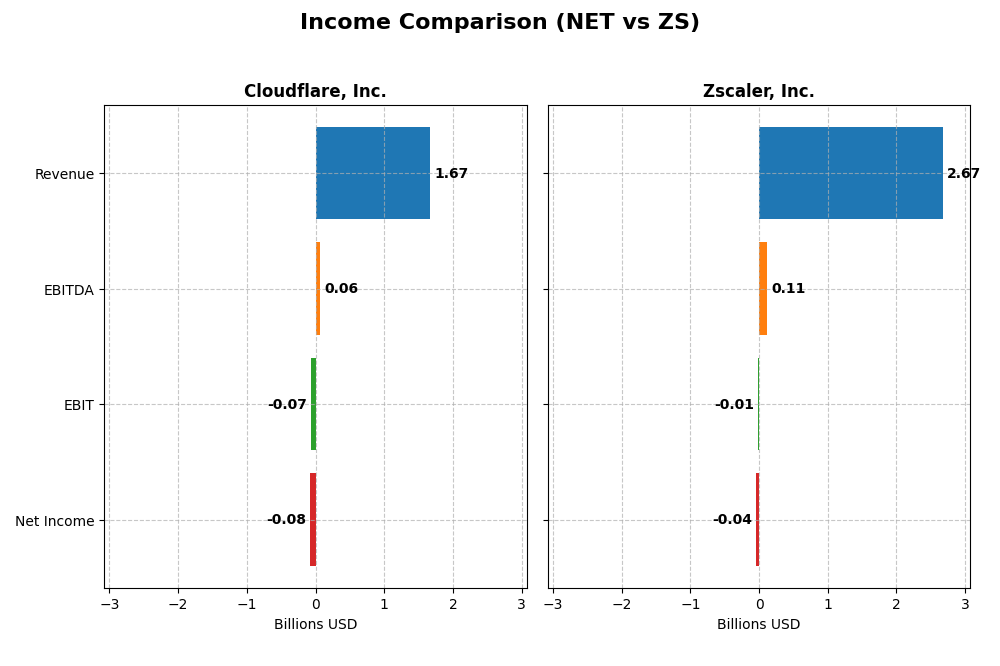

This table presents the latest fiscal year income statement metrics for Cloudflare, Inc. and Zscaler, Inc., offering a side-by-side view of key financial figures.

| Metric | Cloudflare, Inc. (NET) | Zscaler, Inc. (ZS) |

|---|---|---|

| Market Cap | 68.7B | 34.4B |

| Revenue | 1.67B | 2.67B |

| EBITDA | 62.0M | 112.4M |

| EBIT | -65.7M | -8.8M |

| Net Income | -78.8M | -41.5M |

| EPS | -0.23 | -0.27 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Cloudflare, Inc.

Cloudflare showed strong revenue growth from 2020 to 2024, reaching $1.67B in 2024 with a 287% increase overall. Net income losses narrowed substantially, improving from -$260M in 2021 to -$79M in 2024. Gross margins remained robust near 77%, but EBIT and net margins stayed negative despite significant improvement in 2024, reflecting ongoing investment needs.

Zscaler, Inc.

Zscaler’s revenue expanded steadily from $673M in 2021 to $2.67B in 2025, a 297% growth over the period. Net losses also reduced markedly, from -$262M in 2021 to -$41M in 2025. Gross margin held favorably around 77%, while EBIT margin improved close to break-even but remained slightly negative. Operational efficiencies contributed to margin and EPS growth in the latest year.

Which one has the stronger fundamentals?

Both companies exhibit favorable revenue and margin improvements with significant growth in gross profit and EPS. Cloudflare’s larger revenue base and improved net margin contrast with Zscaler’s closer-to-break-even EBIT margin and faster net income reduction. Each shows strong fundamentals but balances growth and profitability differently within the software infrastructure sector.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Cloudflare, Inc. (NET) and Zscaler, Inc. (ZS) based on their most recent fiscal year data.

| Ratios | Cloudflare, Inc. (NET) 2024 | Zscaler, Inc. (ZS) 2025 |

|---|---|---|

| ROE | -7.53% | -2.31% |

| ROIC | -6.06% | -3.18% |

| P/E | -466.5 | -1063.0 |

| P/B | 35.1 | 24.5 |

| Current Ratio | 2.86 | 2.01 |

| Quick Ratio | 2.86 | 2.01 |

| D/E | 1.40 | 1.00 |

| Debt-to-Assets | 44.3% | 28.0% |

| Interest Coverage | -29.8 | -13.5 |

| Asset Turnover | 0.51 | 0.42 |

| Fixed Asset Turnover | 2.63 | 4.22 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Cloudflare, Inc.

Cloudflare shows mostly unfavorable financial ratios, including negative net margin (-4.72%) and return on equity (-7.53%), signaling profitability challenges. Its valuation metrics like a high price-to-book ratio (35.14) also raise concerns. However, liquidity ratios such as current and quick ratios at 2.86 are favorable. The company does not pay dividends, likely due to ongoing reinvestment and growth priorities.

Zscaler, Inc.

Zscaler presents a mixed ratio profile with some strengths in liquidity (current and quick ratios at 2.01) and debt management (debt-to-assets at 27.98% favorable). Profitability remains weak with negative net margin (-1.55%) and return on equity (-2.31%). Valuation ratios like price-to-book (24.51) are unfavorable. Similar to Cloudflare, Zscaler does not distribute dividends, probably reflecting its focus on reinvestment and expansion.

Which one has the best ratios?

Comparing both, Zscaler’s ratios are slightly more favorable overall with a lower proportion of unfavorable metrics (50% vs. 57.14% for Cloudflare) and better debt levels. Yet both companies face profitability challenges and lack dividend payouts, reflecting growth-stage firms prioritizing reinvestment over returns to shareholders.

Strategic Positioning

This section compares the strategic positioning of Cloudflare, Inc. and Zscaler, Inc., focusing on market position, key segments, and exposure to technological disruption:

Cloudflare, Inc.

- Large market cap of 68.7B with competitive pressure in cloud services and integrated security solutions.

- Key segments include cloud firewall, DDoS protection, content delivery, and developer solutions across industries.

- Exposure to disruption through diverse cloud-based security and performance offerings across multiple platforms.

Zscaler, Inc.

- Market cap of 34.4B, competing in cloud security with a focus on secure access and digital experience solutions.

- Focused on secure access to SaaS, private clouds, workload segmentation, and digital experience across sectors.

- Exposure to disruption via innovative cloud security posture management and workload segmentation in public clouds.

Cloudflare, Inc. vs Zscaler, Inc. Positioning

Cloudflare has a more diversified portfolio covering broad cloud services and security, serving multiple industries, while Zscaler concentrates on cloud security access and segmentation. Cloudflare’s wider scope offers varied business drivers; Zscaler’s focused approach targets specialized security niches.

Which has the best competitive advantage?

Both companies have slightly unfavorable MOAT evaluations, shedding value despite growing ROIC trends. Neither currently demonstrates a strong sustainable competitive advantage based on ROIC versus WACC comparison.

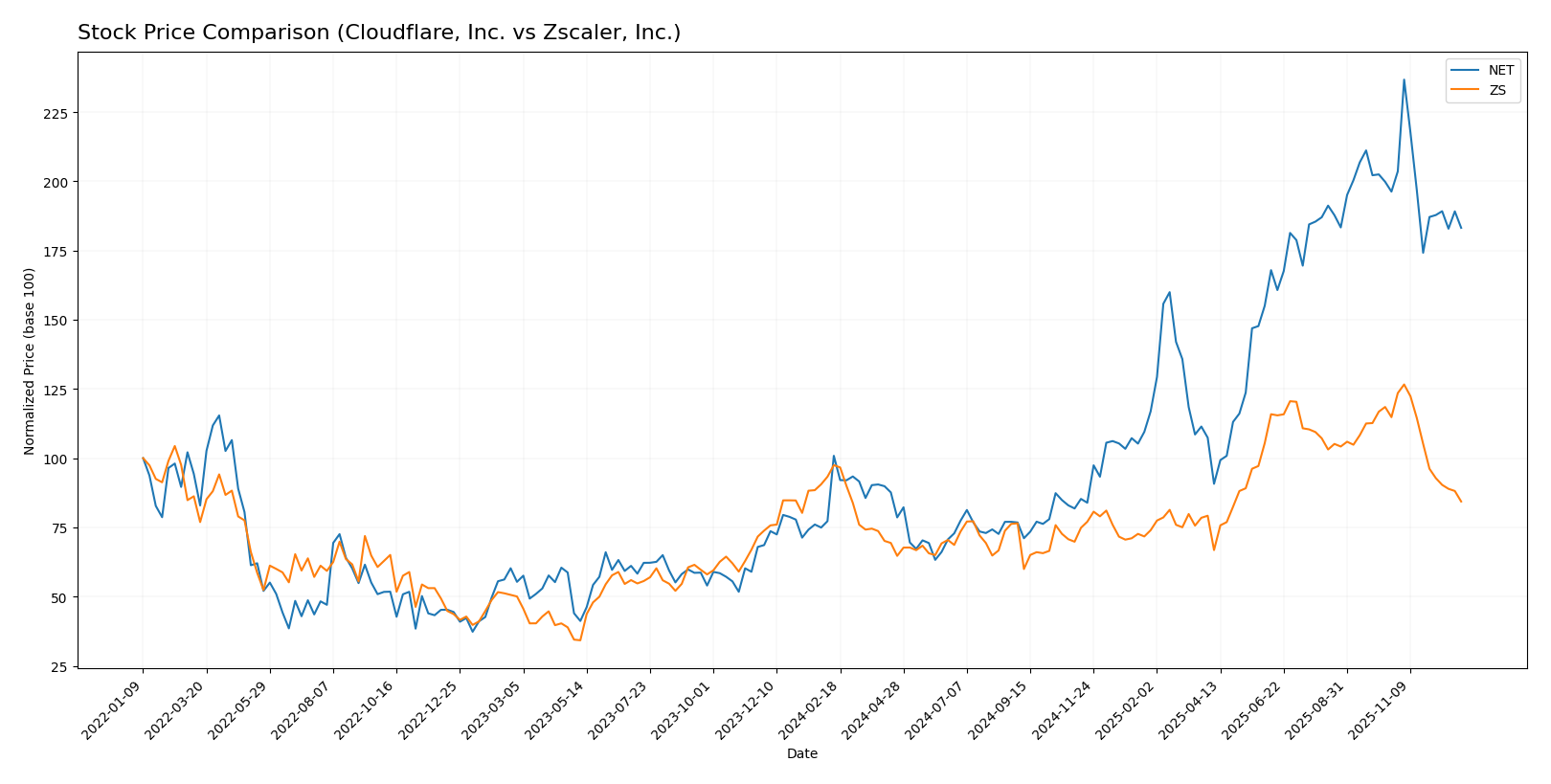

Stock Comparison

The stock price movements over the past 12 months reveal contrasting dynamics between Cloudflare, Inc. and Zscaler, Inc., with Cloudflare showing strong gains despite recent deceleration, while Zscaler exhibits a sustained decline and increased seller dominance.

Trend Analysis

Cloudflare, Inc. (NET) experienced a bullish trend over the past year with an 81.63% price increase, though the trend shows deceleration and a recent 6.66% decline between October 2025 and January 2026. Volatility remains high with a 52.46 std deviation.

Zscaler, Inc. (ZS) displayed a bearish trend with a 13.48% price decrease over the last 12 months, accelerating its decline recently with a 26.54% drop since October 2025, accompanied by a standard deviation of 47.29.

Comparing these trends, Cloudflare, Inc. clearly outperformed Zscaler, Inc. in market performance over the last year, delivering substantial gains while Zscaler’s stock declined significantly.

Target Prices

Analysts present a bullish consensus for both Cloudflare, Inc. and Zscaler, Inc., indicating notable upside potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 300 | 224 | 253.43 |

| Zscaler, Inc. | 360 | 264 | 319.6 |

The target consensus prices for Cloudflare and Zscaler suggest expected appreciation of approximately 29% and 45%, respectively, compared to their current prices of $196.02 and $220.57. This reflects strong analyst confidence in their growth prospects.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cloudflare, Inc. and Zscaler, Inc.:

Rating Comparison

Cloudflare, Inc. Rating

- Rating: D+; rated Very Favorable

- Discounted Cash Flow Score: 1, Very Unfavorable

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 1, Very Unfavorable

Zscaler, Inc. Rating

- Rating: C-; rated Very Favorable

- Discounted Cash Flow Score: 4, Favorable

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 1, Very Unfavorable

Which one is the best rated?

Zscaler holds a higher letter rating of C- compared to Cloudflare’s D+, reflecting a marginally better analyst rating. However, both companies share similarly low scores in overall financial metrics, except Zscaler’s more favorable discounted cash flow score.

Scores Comparison

The scores comparison between Cloudflare, Inc. and Zscaler, Inc. is as follows:

Cloudflare, Inc. Scores

- Altman Z-Score: 9.94, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 2, categorized as very weak financial strength.

Zscaler, Inc. Scores

- Altman Z-Score: 5.24, also in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 3, also considered very weak financial strength.

Which company has the best scores?

Both companies have Altman Z-Scores placing them safely away from bankruptcy risk, with Cloudflare scoring higher. Their Piotroski Scores remain very weak, with Zscaler slightly ahead. Overall, Cloudflare has a stronger Altman Z-Score, while Zscaler has a marginally better Piotroski Score.

Grades Comparison

The following tables present the latest reliable grades for Cloudflare, Inc. and Zscaler, Inc.:

Cloudflare, Inc. Grades

This table summarizes recent grades and rating actions from established grading companies for Cloudflare, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Maintain | Buy | 2025-11-10 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Susquehanna | Maintain | Neutral | 2025-11-03 |

| Mizuho | Maintain | Outperform | 2025-10-31 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-31 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

| Wells Fargo | Maintain | Overweight | 2025-10-31 |

| Piper Sandler | Maintain | Neutral | 2025-10-31 |

Cloudflare’s grades show a consistent pattern of Buy and Outperform ratings, with several Neutral assessments, indicating stable confidence among analysts.

Zscaler, Inc. Grades

This table shows recent grades and rating changes from reputable grading companies for Zscaler, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Upgrade | Outperform | 2025-12-16 |

| Bernstein | Downgrade | Market Perform | 2025-12-01 |

| Citigroup | Maintain | Buy | 2025-12-01 |

| UBS | Maintain | Buy | 2025-11-26 |

| Bernstein | Maintain | Outperform | 2025-11-26 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-26 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Stifel | Maintain | Buy | 2025-11-26 |

| Needham | Maintain | Buy | 2025-11-26 |

| Mizuho | Maintain | Neutral | 2025-11-26 |

Zscaler’s ratings reflect some recent volatility, with an upgrade to Outperform balanced by a downgrade to Market Perform, but mostly Buy and Outperform ratings are maintained.

Which company has the best grades?

Both companies receive predominantly positive grades, but Cloudflare, Inc. shows a steadier pattern of Buy and Outperform ratings without recent downgrades. This stability could suggest a more consistent analyst confidence, which may influence investor perceptions regarding risk and potential reward.

Strengths and Weaknesses

Below is a comparative table outlining key strengths and weaknesses of Cloudflare, Inc. (NET) and Zscaler, Inc. (ZS) based on their latest financial and operational data.

| Criterion | Cloudflare, Inc. (NET) | Zscaler, Inc. (ZS) |

|---|---|---|

| Diversification | Moderate product focus on cloud security and CDN with $1.67B revenue in 2024 | Focused on cloud security with $2.67B revenue in 2025; more concentrated product line |

| Profitability | Negative net margin (-4.72%), ROIC -6.06%, shedding value but ROIC improving | Negative net margin (-1.55%), ROIC -3.18%, also shedding value but with stronger ROIC growth |

| Innovation | Strong innovation with growing ROIC trend (22.1%) despite current losses | Stronger innovation trend with 76.1% ROIC growth, indicating improving efficiency |

| Global presence | Large global reach with high market visibility | Also global but with smaller current asset turnover (0.42) versus NET (0.51) |

| Market Share | Significant market share in CDN and cybersecurity sectors | Growing market share in cloud security but less diversified than NET |

Key takeaways: Both companies are currently unprofitable and shedding value, yet they demonstrate promising ROIC growth, signaling improving operational efficiency. Zscaler shows stronger profitability trends, while Cloudflare benefits from broader diversification and higher asset turnover. Investors should weigh growth potential against current profitability risks.

Risk Analysis

Below is a comparison of key risk factors for Cloudflare, Inc. (NET) and Zscaler, Inc. (ZS) based on the most recent data available.

| Metric | Cloudflare, Inc. (NET) | Zscaler, Inc. (ZS) |

|---|---|---|

| Market Risk | High beta 1.95, volatile stock price range (89.42-260) | Moderate beta 1.07, less volatile |

| Debt level | Debt-to-Equity 1.4 (unfavorable), Debt-to-Assets 44.3% (neutral) | Debt-to-Equity 1.0 (neutral), Debt-to-Assets 28.0% (favorable) |

| Regulatory Risk | Moderate, operates globally with cloud and security services | Moderate, global cloud security provider |

| Operational Risk | High, negative net margin (-4.72%) and ROE (-7.53%) | Moderate, negative net margin (-1.55%) and ROE (-2.31%) |

| Environmental Risk | Low to moderate, tech sector with limited direct impact | Low to moderate, similar sector profile |

| Geopolitical Risk | Moderate, exposure to US and global markets | Moderate, US-based with global operations |

Cloudflare faces higher market and debt risks with significant profitability challenges. Zscaler shows a slightly better debt profile and lower volatility but still incurs operational losses. Market and operational risks are the most impactful for both companies in 2026.

Which Stock to Choose?

Cloudflare, Inc. (NET) shows strong revenue growth of 287% over five years with favorable income statement metrics despite negative profitability ratios. Its leverage is relatively high with a debt-to-equity ratio of 1.4, and the company carries an unfavorable overall financial ratio profile. The rating is very favorable at D+, but key financial scores remain very unfavorable.

Zscaler, Inc. (ZS) exhibits 297% revenue growth over five years and positive income trends, with slightly better profitability ratios than NET. Its debt levels are lower with a debt-to-equity ratio of 1.0, and it holds a slightly unfavorable global ratio evaluation. The rating is very favorable at C-, though most financial scores are also very unfavorable.

Investors prioritizing growth might find both companies appealing due to strong revenue increases and improving profitability trends. Risk-averse investors could interpret Zscaler’s lower debt and slightly more favorable financial ratios as a more stable option, while those tolerant of higher leverage may see Cloudflare’s rapid income growth and strong rating as attractive. Both firms are currently shedding value but show signs of improving profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cloudflare, Inc. and Zscaler, Inc. to enhance your investment decisions: