In the dynamic world of cloud-based software infrastructure, Cloudflare, Inc. (NET) and Wix.com Ltd. (WIX) stand out as innovative leaders shaping the digital landscape. Both companies operate in overlapping markets focused on empowering businesses through advanced cloud solutions, yet they adopt distinct innovation strategies to capture market share. This article will analyze their strengths and risks to help you decide which company deserves a place in your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Cloudflare and Wix by providing an overview of these two companies and their main differences.

Cloudflare Overview

Cloudflare, Inc. is a cloud services provider focused on delivering integrated security, performance, and reliability solutions for a variety of platforms including public and private clouds, on-premise, SaaS, and IoT devices. The company serves diverse sectors such as technology, healthcare, financial services, and government. Headquartered in San Francisco and incorporated in 2009, Cloudflare has a strong presence in the software infrastructure industry.

Wix Overview

Wix.com Ltd. develops and markets a cloud-based platform that enables users globally to create websites and web applications with ease through drag-and-drop tools and AI-driven features. The company also offers business management tools, payment solutions, and an app marketplace. Founded in 2006 and based in Tel Aviv, Wix operates primarily in the software infrastructure sector and supports millions of users worldwide with a broad range of digital services.

Key similarities and differences

Both Cloudflare and Wix operate in the software infrastructure industry and provide cloud-based platforms, but their core offerings differ significantly. Cloudflare emphasizes security, performance, and network reliability services, while Wix focuses on website creation and business management tools. Each serves a global customer base, but Cloudflare targets enterprise and institutional clients, whereas Wix caters primarily to individual users and small businesses. Both companies have similar employee counts and maintain active listings on major stock exchanges.

Income Statement Comparison

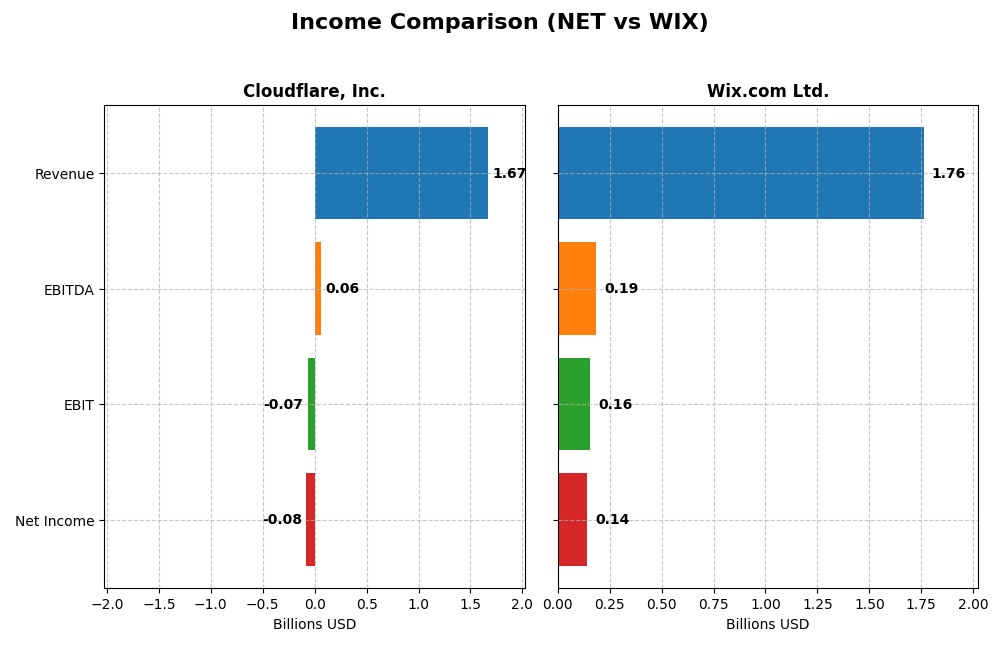

This table presents a side-by-side comparison of key income statement metrics for Cloudflare, Inc. and Wix.com Ltd. for the fiscal year 2024, highlighting their financial performance.

| Metric | Cloudflare, Inc. (NET) | Wix.com Ltd. (WIX) |

|---|---|---|

| Market Cap | 64.5B | 4.5B |

| Revenue | 1.67B | 1.76B |

| EBITDA | 62.0M | 186.2M |

| EBIT | -65.7M | 155.1M |

| Net Income | -78.8M | 138.3M |

| EPS | -0.23 | 2.49 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Cloudflare, Inc.

Cloudflare’s revenue grew significantly from 2020 to 2024, reaching $1.67B in 2024 with a 28.76% increase from the prior year. Despite this growth, net income remained negative at -$78.8M, though improving compared to earlier losses. Gross margin was strong at 77.32%, while net margin stayed negative at -4.72%, showing margin improvements but ongoing profitability challenges in the latest year.

Wix.com Ltd.

Wix’s revenue also rose steadily, hitting $1.76B in 2024, up 12.74% year-over-year. Net income improved markedly to $138M, reflecting a solid net margin of 7.86%. Gross margin was favorable at 67.93%, with EBIT margin positive at 8.81%, indicating healthier profitability and operational efficiency gains in the recent fiscal year compared to prior periods.

Which one has the stronger fundamentals?

Wix demonstrates stronger fundamentals with positive net income, consistent profitability, and favorable margins, including a solid EBIT margin. Cloudflare, despite robust revenue growth and high gross margins, continues to report net losses and negative net margins, reflecting ongoing challenges in profitability. Both companies show favorable revenue growth, but Wix’s profitability metrics present a more favorable income statement profile.

Financial Ratios Comparison

The table below presents key financial ratios for Cloudflare, Inc. and Wix.com Ltd. for the fiscal year ending 2024, enabling a straightforward side-by-side comparison of their financial performance and stability.

| Ratios | Cloudflare, Inc. (NET) | Wix.com Ltd. (WIX) |

|---|---|---|

| ROE | -7.53% | -175.57% |

| ROIC | -6.06% | 9.13% |

| P/E | -466.54 | 86.21 |

| P/B | 35.14 | -151.35 |

| Current Ratio | 2.86 | 0.84 |

| Quick Ratio | 2.86 | 0.84 |

| D/E | 1.40 | -12.31 |

| Debt-to-Assets | 44.32% | 50.70% |

| Interest Coverage | -29.78 | 25.92 |

| Asset Turnover | 0.51 | 0.92 |

| Fixed Asset Turnover | 2.63 | 3.33 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Cloudflare, Inc.

Cloudflare exhibits mostly unfavorable financial ratios, including negative net margin (-4.72%) and return on equity (-7.53%), reflecting profitability challenges. Its current and quick ratios at 2.86 are favorable, indicating solid liquidity, but high price-to-book (35.14) and debt-to-equity (1.4) raise concerns. The company does not pay dividends, likely focusing on reinvestment or growth.

Wix.com Ltd.

Wix.com shows a mixed ratio profile with neutral net margin (7.86%) and return on invested capital (9.13%), but an unfavorable return on equity (-175.57%) and current ratio (0.84), suggesting liquidity risk. Positive interest coverage (40.14) and fixed asset turnover (3.33) rates are favorable. Wix also does not distribute dividends, likely prioritizing reinvestment or expansion.

Which one has the best ratios?

Wix.com has a more balanced ratio profile with a higher percentage of favorable and neutral ratios, including strong interest coverage and asset turnover, despite liquidity concerns. Cloudflare, however, faces more pronounced profitability and leverage weaknesses. Overall, Wix’s ratios appear slightly more favorable compared to Cloudflare’s predominantly unfavorable metrics.

Strategic Positioning

This section compares the strategic positioning of Cloudflare, Inc. and Wix.com Ltd. in terms of Market position, Key segments, and Exposure to technological disruption:

Cloudflare, Inc.

- Market position and competitive pressure

- Key segments and business drivers

- Exposure to technological disruption

Wix.com Ltd.

- Large market cap of 64.5B, operating globally in cloud infrastructure.

- Integrated cloud security, performance, reliability, developer solutions.

- Positioned in evolving cloud security and infrastructure services.

Cloudflare, Inc. vs Wix.com Ltd. Positioning

Cloudflare adopts a diversified approach with broad cloud infrastructure and security solutions, serving multiple industries globally. Wix concentrates on website creation and business growth tools, relying on subscription models and a large user base. Each faces distinct competitive dynamics based on their market focus.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC but show growing profitability trends. Their economic moats are slightly unfavorable, indicating limited but improving competitive advantages in their respective markets.

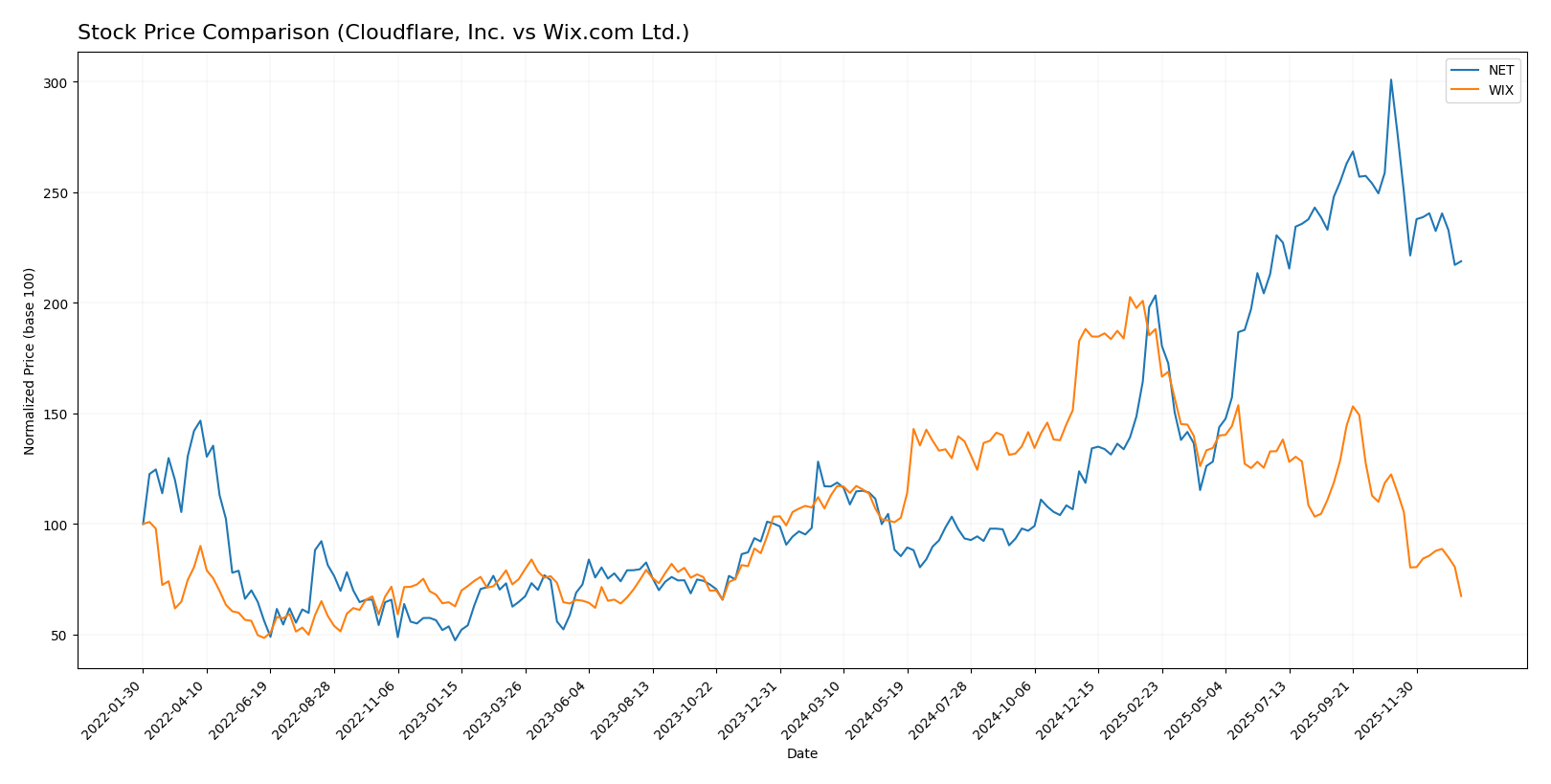

Stock Comparison

The past year showed significant divergence in stock price movements between Cloudflare, Inc. (NET) and Wix.com Ltd. (WIX), with NET exhibiting strong gains despite recent pullbacks and WIX facing sustained declines amid shifting trading volumes.

Trend Analysis

Cloudflare, Inc. (NET) experienced a bullish trend over the past 12 months with an 87.07% price increase, showing deceleration in momentum and high volatility (std deviation 52.73). The stock reached a high of 253.3 and a low of 67.69.

Wix.com Ltd. (WIX) showed a bearish trend with a -40.28% price change over the same period. The trend also decelerated, with moderate volatility (std deviation 34.39). The stock peaked at 240.89 and bottomed at 80.16.

Comparing both, Cloudflare delivered the highest market performance with a robust upward trend, while Wix suffered a notable downtrend, indicating divergent investor sentiment and market dynamics.

Target Prices

Here is the current target price consensus for Cloudflare, Inc. and Wix.com Ltd., reflecting analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 300 | 210 | 248.86 |

| Wix.com Ltd. | 210 | 70 | 160.27 |

Analysts anticipate significant upside for both stocks, with Cloudflare’s consensus target about 35% above its current price of 184.17 USD, and Wix’s target nearly double its current price of 80.16 USD. This suggests bullish sentiment overall, but investors should consider the wide ranges and inherent risks.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cloudflare, Inc. and Wix.com Ltd.:

Rating Comparison

Cloudflare, Inc. Rating

- Rating: D+ indicating a very favorable overall status.

- Discounted Cash Flow Score: 1, rated very unfavorable.

- ROE Score: 1, rated very unfavorable.

- ROA Score: 1, rated very unfavorable.

- Debt To Equity Score: 1, rated very unfavorable.

- Overall Score: 1, rated very unfavorable.

Wix.com Ltd. Rating

- Rating: C indicating a very favorable overall status.

- Discounted Cash Flow Score: 3, rated moderate.

- ROE Score: 1, rated very unfavorable.

- ROA Score: 4, rated favorable.

- Debt To Equity Score: 1, rated very unfavorable.

- Overall Score: 2, rated moderate.

Which one is the best rated?

Wix.com Ltd. holds a higher overall score and a better discounted cash flow and ROA score than Cloudflare, Inc., indicating a relatively stronger rating based on the provided metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Cloudflare, Inc. and Wix.com Ltd.:

Cloudflare, Inc. Scores

- Altman Z-Score: 9.47 indicates a safe zone with low bankruptcy risk.

- Piotroski Score: 2, considered very weak financial strength.

Wix.com Ltd. Scores

- Altman Z-Score: 1.83 places the company in the grey zone, moderate bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

Which company has the best scores?

Based on the provided data, Cloudflare shows a stronger Altman Z-Score indicating lower bankruptcy risk, while Wix.com has a higher Piotroski Score implying better financial health. Each company leads in a different score category.

Grades Comparison

Here is a comparison of the latest available grades from reputable grading companies for Cloudflare, Inc. and Wix.com Ltd.:

Cloudflare, Inc. Grades

This table shows recent grade updates from recognized financial institutions for Cloudflare, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-11-10 |

| Susquehanna | Maintain | Neutral | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Overall, Cloudflare’s grades predominantly show a mix of Buy and Neutral ratings, reflecting a cautiously optimistic outlook from analysts.

Wix.com Ltd. Grades

Below are the recent grades assigned to Wix.com Ltd. by established grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-15 |

| Wells Fargo | Maintain | Overweight | 2025-12-19 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-11-20 |

| Citizens | Maintain | Market Outperform | 2025-11-20 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-20 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-20 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-20 |

| Needham | Maintain | Buy | 2025-11-20 |

| B. Riley Securities | Maintain | Buy | 2025-11-20 |

Wix.com shows consistently positive grades with multiple Buy, Overweight, and Outperform ratings, suggesting strong confidence among analysts.

Which company has the best grades?

Wix.com Ltd. has received generally stronger grades, including more Overweight and Outperform ratings, compared to Cloudflare’s mix of Buy and Neutral grades. This difference may influence investors seeking more bullish analyst sentiment.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Cloudflare, Inc. (NET) and Wix.com Ltd. (WIX) based on the latest available data.

| Criterion | Cloudflare, Inc. (NET) | Wix.com Ltd. (WIX) |

|---|---|---|

| Diversification | Primarily focused on cloud security and CDN with 1.67B USD revenue; limited product diversification | More diversified with Business Solutions (496M USD) and Creative Subscription (1.26B USD) |

| Profitability | Negative net margin (-4.72%) and ROIC (-6.06%), shedding value but improving ROIC trend | Positive net margin (7.86%), neutral ROIC (9.13%), slightly unfavorable overall profitability |

| Innovation | Strong innovation in cybersecurity and edge computing | Innovation focused on web development and creative tools |

| Global presence | Extensive global network infrastructure | Global reach but smaller scale in cloud and security markets |

| Market Share | Significant player in cloud security and performance | Leading in DIY website building and creative platforms |

Key takeaways: Both companies are currently shedding economic value but show improving profitability trends. Cloudflare excels in innovation and global infrastructure but lacks diversification. Wix offers more product variety and positive margins but faces challenges in financial efficiency. Investors should weigh growth potential against current profitability and risk.

Risk Analysis

Below is a comparative overview of the key risks faced by Cloudflare, Inc. (NET) and Wix.com Ltd. (WIX) based on the most recent financial and market data from 2024.

| Metric | Cloudflare, Inc. (NET) | Wix.com Ltd. (WIX) |

|---|---|---|

| Market Risk | High beta at 1.97 indicates elevated stock volatility and sensitivity to market swings. | Moderate beta at 1.42, less volatile but still susceptible to market fluctuations. |

| Debt Level | Debt-to-equity ratio of 1.4, indicating significant leverage and financial risk. | Negative debt-to-equity (-12.31) suggests net cash position; however, debt-to-assets at 50.7% is relatively high, potentially impacting liquidity. |

| Regulatory Risk | U.S.-based with exposure to stringent data security and privacy regulations impacting cloud services. | Israeli headquarters with international operations; faces diverse regulatory environments and compliance costs. |

| Operational Risk | Heavy reliance on cloud infrastructure and security products; any downtime or breach could severely impact reputation. | Dependent on platform stability and user growth; competition from other website builders poses operational challenges. |

| Environmental Risk | Moderate, given data center energy usage and sustainability commitments typical in tech infrastructure. | Moderate environmental impact due to cloud operations and global server usage, with increasing pressure for sustainable practices. |

| Geopolitical Risk | Exposure mainly to U.S. market; moderate risk from international trade tensions affecting tech sector. | Higher geopolitical risk due to Israel base and broader international customer footprint, including markets with political instability. |

In synthesis, Cloudflare’s most impactful risks stem from high market volatility and significant financial leverage, raising concerns about its ability to absorb shocks. Wix’s risks are more balanced but include geopolitical exposure and moderate leverage. Investors should carefully weigh Cloudflare’s operational and market risks against Wix’s geopolitical and regulatory challenges when considering portfolio inclusion.

Which Stock to Choose?

Cloudflare, Inc. (NET) shows strong income growth with a 28.76% revenue increase in 2024 and a favorable gross margin of 77.32%. However, profitability ratios such as ROE and net margin remain negative, and the company carries considerable debt with a debt-to-equity ratio of 1.4. Its overall financial ratios are mostly unfavorable, reflected in a very low rating of D+.

Wix.com Ltd. (WIX) has a more moderate revenue growth of 12.74% in 2024 and a positive net margin of 7.86%, indicating profitability. Financial ratios present a mixed picture with some favorable metrics like interest coverage, yet with a low current ratio and a higher debt-to-assets ratio. Wix holds a better overall rating of C but with some moderate to unfavorable individual scores.

Considering the ratings and financial evaluations, Cloudflare’s rapid income growth contrasts with its weak profitability and financial ratios, while Wix offers steadier profitability but with financial stability concerns. Investors seeking growth exposure might find Cloudflare’s profile more aligned with their strategy, whereas those favoring moderate profitability with mixed financial health might lean toward Wix. Both companies show signs of value destruction despite improving profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cloudflare, Inc. and Wix.com Ltd. to enhance your investment decisions: