In the rapidly evolving technology sector, Cloudflare, Inc. (NET) and Veritone, Inc. (VERI) stand out as innovative players in software infrastructure. Cloudflare focuses on cloud security and performance solutions, while Veritone specializes in AI-driven data insights and cognitive computing. Both companies cater to diverse industries, making their strategies and growth prospects compelling for investors. This article will help you decide which company aligns best with your investment goals.

Table of contents

Companies Overview

I will begin the comparison between Cloudflare and Veritone by providing an overview of these two companies and their main differences.

Cloudflare Overview

Cloudflare, Inc. is a cloud services provider focused on delivering integrated security, performance, and reliability solutions globally. Its offerings cover cloud firewall, DDoS protection, content delivery, and developer tools, serving sectors like technology, healthcare, finance, and government. Founded in 2009 and headquartered in San Francisco, Cloudflare operates with 4,400 employees and commands a market cap of approximately 64.5B USD.

Veritone Overview

Veritone, Inc. delivers AI computing solutions primarily in the US and UK, operating the aiWARE platform that applies machine learning and cognitive processes to extract insights from data. It also offers media advertising services targeting media, government, legal, and energy sectors. Established in 2014 and based in Denver, Veritone employs 469 people with a market cap near 225M USD.

Key similarities and differences

Both companies operate in the technology sector within software infrastructure, but their core focuses differ: Cloudflare emphasizes cloud-based security and performance solutions, while Veritone specializes in AI-driven data analytics and media services. Cloudflare is substantially larger in scale and market capitalization, whereas Veritone concentrates on AI platform development and advertising services. Both serve diverse industries but leverage distinct technological approaches.

Income Statement Comparison

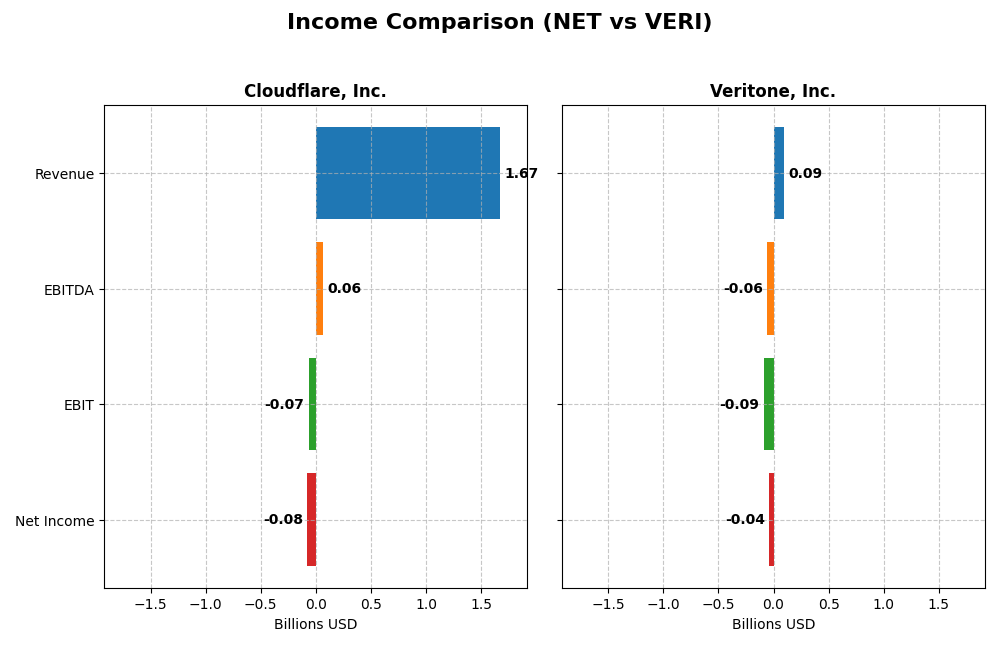

The table below presents a side-by-side comparison of key income statement metrics for Cloudflare, Inc. and Veritone, Inc. for the fiscal year 2024.

| Metric | Cloudflare, Inc. (NET) | Veritone, Inc. (VERI) |

|---|---|---|

| Market Cap | 64.5B | 225M |

| Revenue | 1.67B | 93M |

| EBITDA | 62M | -59M |

| EBIT | -66M | -88M |

| Net Income | -79M | -37M |

| EPS | -0.23 | -0.98 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Cloudflare, Inc.

Cloudflare’s revenue increased significantly from 431M in 2020 to 1.67B in 2024, with net income losses narrowing from -119M to -78.8M. The gross margin remained strong around 77%, while operating and net margins were negative but improving. In 2024, revenue growth accelerated by 28.8%, and net margin improved by 66.7%, indicating a positive trend despite persistent losses.

Veritone, Inc.

Veritone’s revenue rose from 57.7M in 2020 to a peak of 150M in 2022 but declined to 92.6M in 2024. Net income improved from -47.9M in 2020 to -37.4M in 2024, with net margin remaining deeply negative around -40%. Gross margin stayed favorable near 71%, but EBIT margin worsened significantly. The recent year saw a 7.4% revenue decline, though net margin and EPS showed positive growth.

Which one has the stronger fundamentals?

Cloudflare exhibits stronger fundamentals with robust revenue and gross profit growth, improving profitability margins, and a higher percentage of favorable income statement metrics. Veritone shows mixed signals with declining recent revenue and high interest expenses, though some margin improvements occurred. Overall, Cloudflare’s income statement trends suggest a more stable and growth-oriented financial profile.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Cloudflare, Inc. (NET) and Veritone, Inc. (VERI) based on their most recent fiscal year 2024 data.

| Ratios | Cloudflare, Inc. (NET) | Veritone, Inc. (VERI) |

|---|---|---|

| ROE | -7.53% | -277.91% |

| ROIC | -6.06% | -58.27% |

| P/E | -466.5 | -3.34 |

| P/B | 35.14 | 9.27 |

| Current Ratio | 2.86 | 0.97 |

| Quick Ratio | 2.86 | 0.97 |

| D/E (Debt-to-Equity) | 1.40 | 8.91 |

| Debt-to-Assets | 44.3% | 60.5% |

| Interest Coverage | -29.78 | -7.31 |

| Asset Turnover | 0.51 | 0.47 |

| Fixed Asset Turnover | 2.63 | 8.51 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Cloudflare, Inc.

Cloudflare’s financial ratios show several weaknesses, including negative net margin (-4.72%) and return on equity (-7.53%), indicating unprofitable operations and inefficient use of equity. The company has a strong current ratio (2.86), suggesting good short-term liquidity, but high debt-to-equity (1.4) and poor interest coverage (-12.64) raise concerns about leverage. Cloudflare does not pay dividends, reflecting a reinvestment focus during growth phases.

Veritone, Inc.

Veritone displays predominantly weak ratios, with a deeply negative net margin (-40.36%) and return on equity (-277.91%), signaling significant losses and poor profitability. Liquidity is weak, with a current ratio below 1 (0.97), and debt levels are high, as seen in debt-to-equity (8.91) and debt to assets (60.54%). Like Cloudflare, Veritone does not pay dividends, likely prioritizing reinvestment and growth over shareholder payouts.

Which one has the best ratios?

Between the two, Cloudflare presents a less unfavorable financial profile with stronger liquidity and somewhat lower leverage compared to Veritone. Both companies face considerable profitability challenges, but Veritone’s ratios are more severely negative and its liquidity is weaker. Overall, Cloudflare’s ratios are comparatively more stable though still unfavorable.

Strategic Positioning

This section compares the strategic positioning of Cloudflare, Inc. and Veritone, Inc., focusing on market position, key segments, and exposure to technological disruption:

Cloudflare, Inc.

- Leading cloud services provider with significant market cap; faces competitive pressure in software infrastructure.

- Focus on integrated cloud security, performance, reliability, and developer solutions across diverse industries.

- Operates in cloud security and performance, with exposure to evolving cloud and cybersecurity technologies.

Veritone, Inc.

- Smaller market cap AI computing solutions provider with high beta; competes in niche AI markets.

- Revenues segmented in AI platform licenses, managed services, software products, and advertising.

- AI operating system and media advertising services face risks from rapid AI technology changes.

Cloudflare vs Veritone Positioning

Cloudflare’s diversified cloud security and infrastructure services contrast with Veritone’s concentrated AI-driven software and media segments. Cloudflare benefits from broader industry reach, while Veritone’s niche focus limits scale but targets specialized AI applications.

Which has the best competitive advantage?

Both companies are shedding value with ROIC below WACC; however, Cloudflare shows improving profitability, whereas Veritone’s returns are declining, indicating a slightly stronger competitive advantage for Cloudflare based on MOAT evaluation.

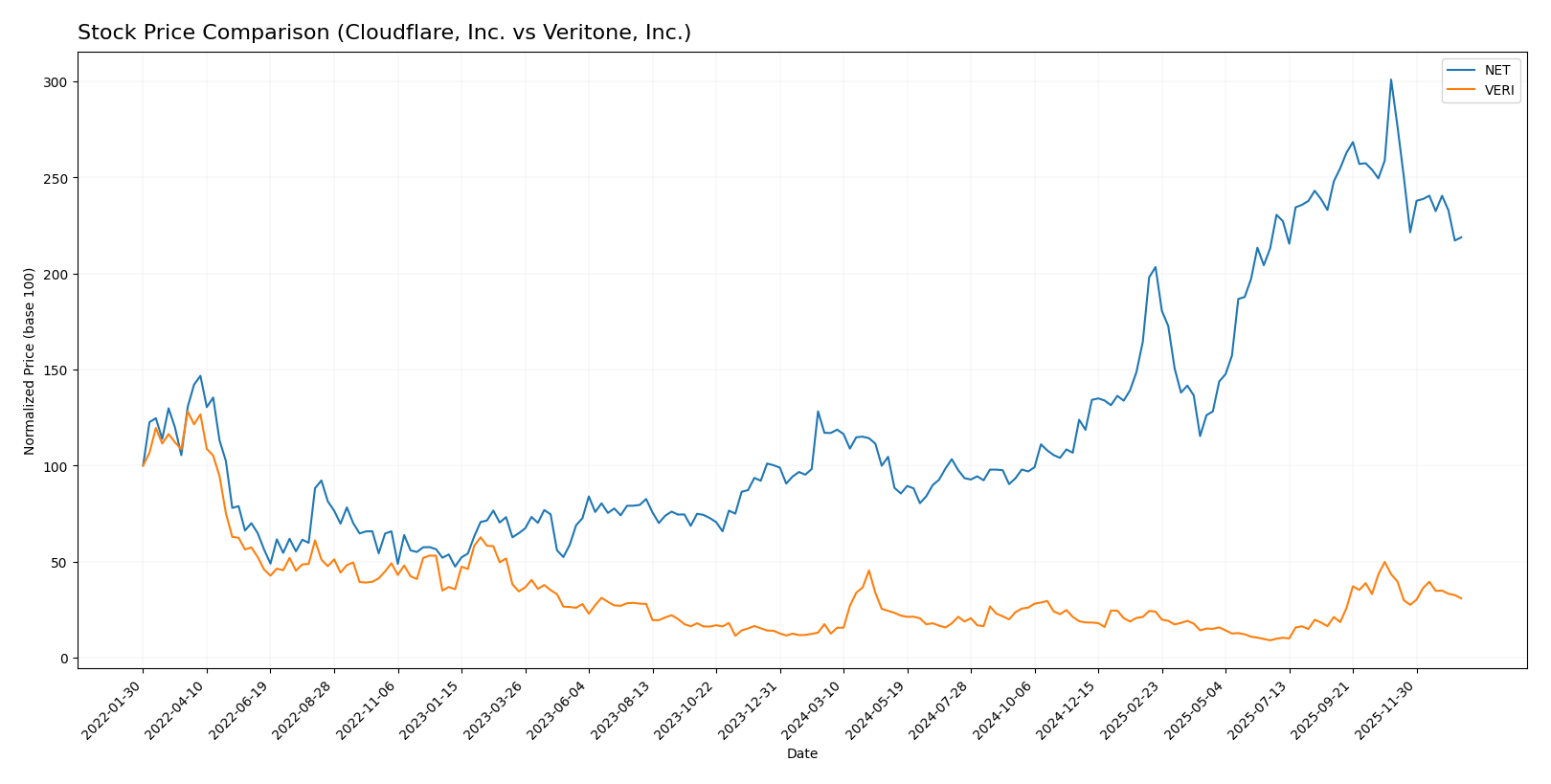

Stock Comparison

The past year saw Cloudflare, Inc. (NET) and Veritone, Inc. (VERI) display strong overall bullish trends with notable price gains, though both experienced recent declines in stock prices accompanied by shifts in buyer-seller dynamics.

Trend Analysis

Cloudflare, Inc. (NET) showed an 87.07% price increase over the past 12 months, indicating a bullish trend with deceleration. The stock peaked at 253.3 and bottomed at 67.69, with recent weeks showing a -27.29% decline.

Veritone, Inc. (VERI) recorded a 147.22% price rise in the same period, also bullish with deceleration. Its highest price was 7.18, lowest 1.3, followed by a recent -28.91% drop.

Comparing both, VERI outperformed NET in total price appreciation over the past year, despite similar recent downward pressure.

Target Prices

Here is the current consensus on target prices from verified analysts for the selected companies:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 300 | 210 | 248.86 |

| Veritone, Inc. | 10 | 9 | 9.5 |

Analysts expect Cloudflare’s stock to appreciate significantly from its current 184.17 USD price, reflecting strong growth potential. Veritone’s target consensus is more modest but indicates upside from its current 4.45 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cloudflare, Inc. and Veritone, Inc.:

Rating Comparison

Cloudflare, Inc. Rating

- Rating: D+, considered very favorable overall.

- Discounted Cash Flow Score: 1, rated very unfavorable.

- ROE Score: 1, rated very unfavorable.

- ROA Score: 1, rated very unfavorable.

- Debt To Equity Score: 1, rated very unfavorable.

- Overall Score: 1, rated very unfavorable.

Veritone, Inc. Rating

- Rating: C, considered very favorable overall.

- Discounted Cash Flow Score: 5, rated very favorable.

- ROE Score: 1, rated very unfavorable.

- ROA Score: 1, rated very unfavorable.

- Debt To Equity Score: 1, rated very unfavorable.

- Overall Score: 2, rated moderate.

Which one is the best rated?

Veritone, Inc. holds a better overall rating (C) and scores higher on discounted cash flow and overall score compared to Cloudflare, Inc., which has lower scores across all categories.

Scores Comparison

Here is a comparison of the financial scores for Cloudflare, Inc. (NET) and Veritone, Inc. (VERI):

NET Scores

- Altman Z-Score: 9.47, indicating a safe zone, low risk of bankruptcy.

- Piotroski Score: 2, classified as very weak financial strength.

VERI Scores

- Altman Z-Score: -0.07, indicating distress zone, high risk of bankruptcy.

- Piotroski Score: 3, classified as very weak financial strength.

Which company has the best scores?

Based on the provided data, NET has a much stronger Altman Z-Score, signaling financial stability, while both companies have very weak Piotroski Scores, with VERI slightly higher at 3 versus 2 for NET.

Grades Comparison

Below is the detailed comparison of grades assigned to Cloudflare, Inc. and Veritone, Inc. by reputable grading companies:

Cloudflare, Inc. Grades

This table shows recent grades and actions from recognized financial institutions for Cloudflare, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-11-10 |

| Susquehanna | Maintain | Neutral | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Cloudflare’s grades show a mixed but generally positive trend with multiple Buy and Neutral ratings, indicating stable analyst confidence.

Veritone, Inc. Grades

This table summarizes recent grades for Veritone, Inc. from a single grading entity:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| D. Boral Capital | Maintain | Buy | 2025-12-09 |

| D. Boral Capital | Maintain | Buy | 2025-12-04 |

| Needham | Maintain | Buy | 2025-12-02 |

| D. Boral Capital | Maintain | Buy | 2025-12-02 |

| D. Boral Capital | Maintain | Buy | 2025-11-07 |

| D. Boral Capital | Maintain | Buy | 2025-10-28 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-20 |

| D. Boral Capital | Maintain | Buy | 2025-10-15 |

| D. Boral Capital | Maintain | Buy | 2025-09-24 |

| D. Boral Capital | Maintain | Buy | 2025-09-09 |

Veritone’s grades are consistently Buy, reflecting strong and steady analyst endorsement.

Which company has the best grades?

Veritone, Inc. has received uniformly Buy ratings from its grading companies, whereas Cloudflare, Inc. shows a mix of Buy, Neutral, and Overweight grades. This suggests Veritone’s analyst consensus is more consistently positive, which may influence investor sentiment toward confidence and perceived growth potential.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of Cloudflare, Inc. (NET) and Veritone, Inc. (VERI) based on the most recent financial and operational data.

| Criterion | Cloudflare, Inc. (NET) | Veritone, Inc. (VERI) |

|---|---|---|

| Diversification | High revenue from a broad cloud services portfolio ($1.67B in 2024) | Moderate diversification across AI licensing, managed services, and software products ($111M total in 2024) |

| Profitability | Negative net margin (-4.72%) and ROIC (-6.06%), but improving ROIC trend (+22%) | Deeply negative margins (-40.36% net margin, -58.27% ROIC) with declining profitability trend (-9%) |

| Innovation | Strong innovation in cloud security and edge computing | Focus on AI-driven services but struggling to convert R&D into profit |

| Global presence | Established global footprint supporting diverse clients | Smaller scale with niche AI and media markets focus |

| Market Share | Significant presence in cloud infrastructure market | Limited market share in AI service segments |

Cloudflare shows resilience with growing profitability trends despite current losses, benefiting from a strong global presence and diversified cloud services. Veritone faces greater challenges with steep losses and declining efficiency, reflecting higher investment risk. Investors should weigh Cloudflare’s improving fundamentals against Veritone’s volatile outlook.

Risk Analysis

Below is a comparison table highlighting key risks for Cloudflare, Inc. (NET) and Veritone, Inc. (VERI) based on the latest available data for 2024.

| Metric | Cloudflare, Inc. (NET) | Veritone, Inc. (VERI) |

|---|---|---|

| Market Risk | High beta of 1.968 indicates elevated market volatility exposure | Very high beta of 2.052 signals significant sensitivity to market swings |

| Debt level | Moderate debt-to-equity ratio of 1.4; interest coverage negative at -12.64 | Very high debt-to-equity ratio of 8.91; poor interest coverage at -7.3 |

| Regulatory Risk | Moderate, operates globally in cloud security with evolving data laws | Moderate, AI sector faces increasing regulatory scrutiny especially on data use |

| Operational Risk | Complex cloud infrastructure; risk of service outages | AI model accuracy and platform reliability are operational challenges |

| Environmental Risk | Low direct impact; mainly data center energy consumption | Low direct impact; technology-driven but with some energy use concerns |

| Geopolitical Risk | Exposure to US and global markets; potential supply chain issues | US and UK focus; geopolitical tensions may affect international contracts |

The most impactful risks are financial instability for Veritone, reflected by its distress-level Altman Z-score and very unfavorable financial ratios, especially high debt and negative profitability. Cloudflare shows better financial health with a safe Altman Z-score but remains exposed to market volatility and operational complexity inherent in cloud infrastructure services. Investors should weigh Veritone’s high leverage and distress signals against Cloudflare’s growth potential tempered by market risks.

Which Stock to Choose?

Cloudflare, Inc. (NET) shows a favorable income evolution with strong revenue and profit growth, despite persistent negative profitability ratios. Its financial ratios are mostly unfavorable, with high debt levels and weak returns, yet it maintains a very favorable overall rating. The company is shedding value but shows improving profitability trends.

Veritone, Inc. (VERI) presents a less favorable income evolution marked by declining revenues and significant losses. Its financial ratios are predominantly very unfavorable, with high leverage and poor liquidity. VERI’s rating is very favorable overall but with a moderate score, reflecting persistent value destruction and declining profitability.

For investors prioritizing growth and improving profitability, NET might appear more favorable due to its strong income growth and slight improvement in value creation. Conversely, investors with a tolerance for higher risk and seeking potential turnaround opportunities could interpret VERI’s profile as worth monitoring given its moderate rating but ongoing value decline.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cloudflare, Inc. and Veritone, Inc. to enhance your investment decisions: