Home > Comparison > Technology > NET vs VRSN

The strategic rivalry between Cloudflare, Inc. and VeriSign, Inc. defines the current trajectory of the technology sector’s software infrastructure industry. Cloudflare operates a broad, integrated cloud security and performance platform, while VeriSign specializes in domain name registry and internet infrastructure services. This analysis pits Cloudflare’s growth-driven, expansive model against VeriSign’s stable, niche dominance. I will determine which offers a superior risk-adjusted outlook for a diversified portfolio.

Table of contents

Companies Overview

Cloudflare and VeriSign occupy pivotal roles in the software infrastructure landscape, shaping internet security and navigation.

Cloudflare, Inc.: Integrated Cloud Security Leader

Cloudflare dominates as a cloud services provider focused on internet security and performance. It generates revenue through a diverse suite of cloud-based products, including firewalls, bot management, and content delivery. In 2026, its strategic emphasis lies in expanding integrated security solutions across public and private clouds, IoT, and SaaS platforms, reinforcing its role in enterprise digital transformation.

VeriSign, Inc.: Domain Name Registry Authority

VeriSign commands a unique position as the operator of critical internet infrastructure with domain registry services for .com and .net domains. Its core income derives from domain registration fees and authoritative resolution services that underpin global e-commerce. The company’s 2026 strategy focuses on maintaining internet stability and security through root zone management and distributed server operations.

Strategic Collision: Similarities & Divergences

Both companies secure internet functionality but diverge in approach: Cloudflare offers a broad, integrated cloud security stack, while VeriSign centers on domain registry and root server stewardship. Their primary battleground is internet trust and reliability, with Cloudflare pushing performance and security layers atop the web, and VeriSign safeguarding foundational DNS infrastructure. These distinct moats shape contrasting investment profiles—one driven by innovation and scale, the other by regulatory-backed monopoly and consistency.

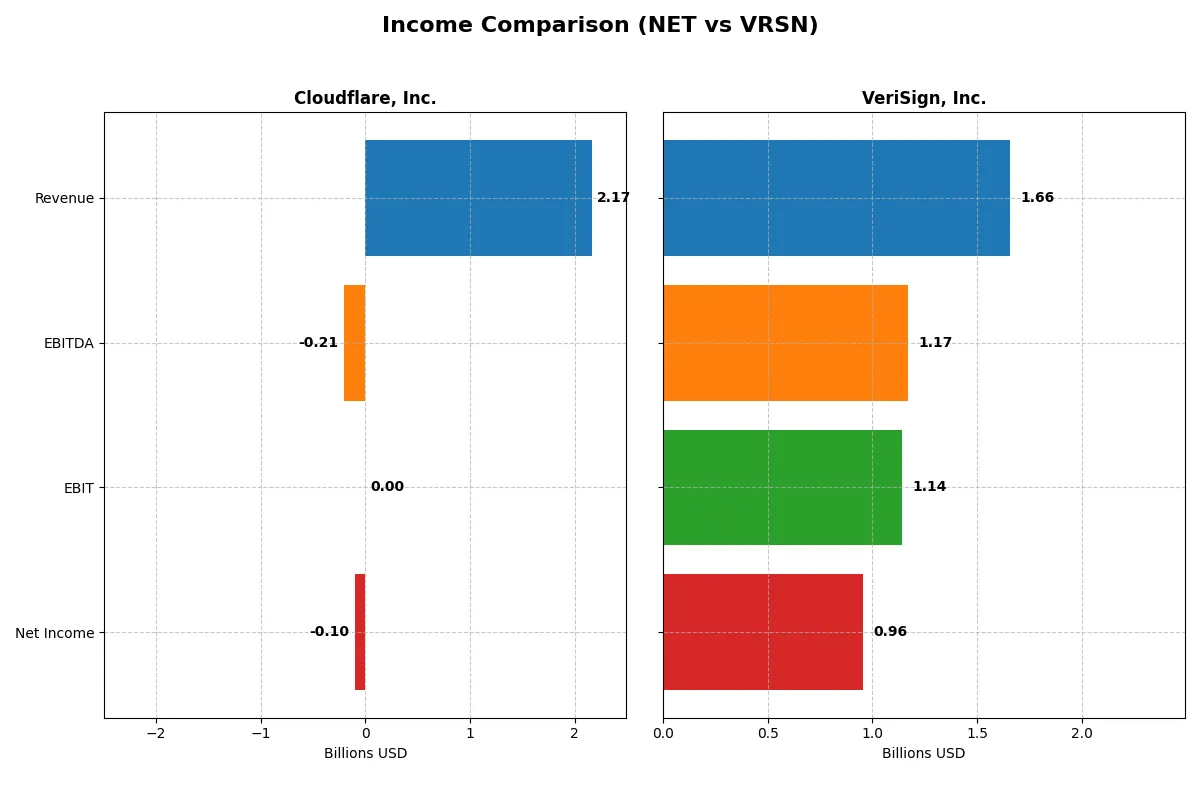

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Cloudflare, Inc. (NET) | VeriSign, Inc. (VRSN) |

|---|---|---|

| Revenue | 2.17B | 1.66B |

| Cost of Revenue | 553M | 196M |

| Operating Expenses | 1.82B | 339M |

| Gross Profit | 1.62B | 1.46B |

| EBITDA | -207M | 1.17B |

| EBIT | 0 | 1.14B |

| Interest Expense | -9M | 77M |

| Net Income | -102M | 956M |

| EPS | -0.29 | 8.83 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs the more efficient and profitable corporate engine in the current market landscape.

Cloudflare, Inc. Analysis

Cloudflare’s revenue surged from 656M in 2021 to 2.17B in 2025, showing strong growth momentum. However, it posts consistent net losses, with a slight improvement to -102M in 2025. Its gross margin remains healthy at 74.5%, but net margin stays negative at -4.7%, indicating ongoing challenges in converting sales into profits despite expanding scale.

VeriSign, Inc. Analysis

VeriSign’s revenue grew steadily from 1.33B in 2021 to 1.66B in 2025. It boasts a robust gross margin of 88.1% and an impressive net margin of 57.7%, reflecting exceptional profitability. Its net income reached 955M in 2025, reinforcing operational efficiency and strong capital allocation. VeriSign maintains consistent earnings growth, demonstrating resilience and margin power.

Margin Power vs. Revenue Scale

VeriSign dominates with superior margins and consistent profitability, generating substantial net income on stable revenue growth. Cloudflare impresses with rapid revenue expansion but struggles to reach profitability. For investors, VeriSign’s profile appeals for stable earnings and strong cash conversion, while Cloudflare suits those prioritizing growth potential amid higher risk.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | Cloudflare, Inc. (NET) | VeriSign, Inc. (VRSN) |

|---|---|---|

| ROE | 0 | -44.36% |

| ROIC | 0 | -716.03% |

| P/E | -467 (2024) | 23.49 |

| P/B | 35.14 (2024) | -10.42 |

| Current Ratio | 2.86 (2024) | 0.49 |

| Quick Ratio | 2.86 (2024) | 0.49 |

| D/E (Debt-to-Equity) | 1.40 (2024) | -0.83 |

| Debt-to-Assets | 44.32% (2024) | 135.61% |

| Interest Coverage | -29.78 (2024) | 14.56 |

| Asset Turnover | 0.51 (2024) | 1.25 |

| Fixed Asset Turnover | 2.63 (2024) | 7.41 |

| Payout ratio | 0 | 22.52% |

| Dividend yield | 0 | 0.96% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and revealing operational strengths essential for investors’ decisions.

Cloudflare, Inc.

Cloudflare shows weak profitability with a negative net margin of -4.72% and zero ROE, signaling operational struggles. Its P/E ratio is negative yet marked favorable, likely due to losses. The absence of dividends highlights a growth-focused reinvestment strategy, mainly in R&D, reflecting a long-term innovation bet despite current inefficiencies.

VeriSign, Inc.

VeriSign boasts a strong net margin of 57.68%, demonstrating operational efficiency, but suffers a negative ROE of -44.36%, indicating shareholder return challenges. Its P/E of 23.49 sits at a moderate valuation. The modest 0.96% dividend yield suggests some shareholder returns, balanced with ongoing investments maintaining stable cash flow metrics.

Profitability vs. Stability: Balancing Growth and Returns

VeriSign offers superior operational profitability and a balanced valuation, while Cloudflare struggles with losses despite growth investments. VeriSign fits investors seeking steady cash flows, whereas Cloudflare appeals to those prioritizing aggressive growth despite near-term risks.

Which one offers the Superior Shareholder Reward?

Cloudflare (NET) pays no dividends and generates negative net income but preserves moderate free cash flow of $0.83/share in 2025. Its buyback program is negligible, limiting shareholder returns. VeriSign (VRSN) offers a 0.96% dividend yield with a 22.5% payout ratio, supported by strong FCF of $11.56/share and consistent buybacks. VeriSign’s model balances steady dividends and buybacks, backed by robust margins and cash flow. I find VeriSign’s distribution strategy more sustainable and rewarding for 2026 investors seeking total return.

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Cloudflare, Inc. and VeriSign, Inc., highlighting their financial strengths and vulnerabilities:

Cloudflare shows a uniformly weak profile, scoring very low across DCF, ROE, ROA, Debt/Equity, and valuation metrics. VeriSign, however, leverages a strong asset efficiency (ROA score 5) and favorable DCF score (4), but struggles with equity returns and balance sheet leverage. VeriSign’s profile is more balanced, relying on operational efficiency, while Cloudflare depends on none and shows broad financial fragility.

Bankruptcy Risk: Solvency Showdown

VeriSign’s Altman Z-Score plunges into the distress zone (-5.49), signaling severe bankruptcy risk. Cloudflare’s score (9.38) places it comfortably in the safe zone, implying strong long-term survival potential:

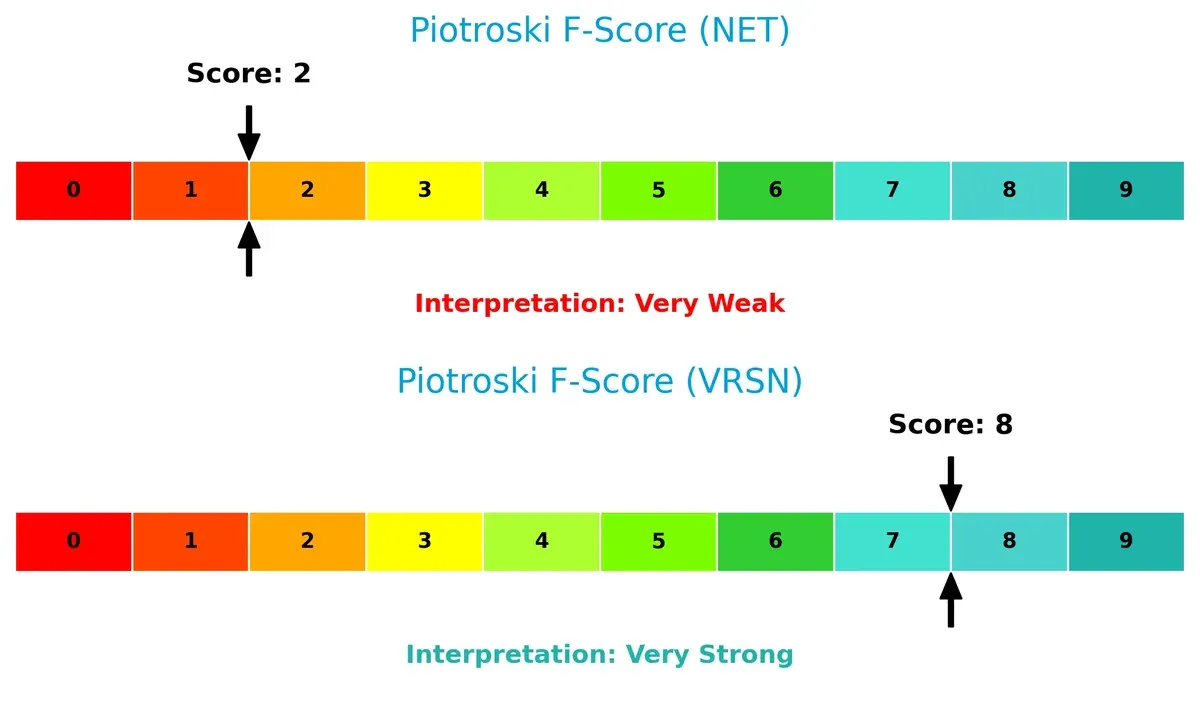

Financial Health: Quality of Operations

Cloudflare’s Piotroski F-Score of 2 signals very weak financial health, raising red flags in profitability and efficiency. VeriSign’s score of 8 indicates very strong operational quality and internal robustness, marking a significant divergence:

How are the two companies positioned?

This section dissects Cloudflare and VeriSign’s operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats to reveal which model delivers the most resilient competitive advantage today.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Cloudflare, Inc. and VeriSign, Inc.:

Cloudflare Strengths

- Diversified global revenue across US, EMEA, Asia Pacific, and other regions

- Favorable price-to-earnings and price-to-book ratios

- Low debt-to-equity and debt-to-assets ratios indicating strong financial structure

VeriSign Strengths

- High net margin at 57.68% demonstrating strong profitability

- Favorable weighted average cost of capital at 6.88%

- Strong asset turnover and fixed asset turnover ratios indicating operational efficiency

- High interest coverage ratio

Cloudflare Weaknesses

- Negative net margin at -4.72% showing unprofitability

- Zero return on equity and return on invested capital

- Unfavorable liquidity ratios and interest coverage

- Unfavorable asset turnover ratios limiting operational leverage

VeriSign Weaknesses

- Negative return on equity at -44.36% and extremely negative ROIC

- High debt-to-assets ratio at 135.61% indicating elevated leverage

- Low current and quick ratios below 1 signaling liquidity concerns

- Dividend yield unfavorable despite profitability

Cloudflare shows strengths in geographic diversification and conservative leverage but struggles with profitability and liquidity. VeriSign excels in profitability and asset efficiency but faces challenges with leverage and returns on capital. These contrasts highlight differing strategic focuses and financial health profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from relentless competition erosion. Let’s dissect how Cloudflare and VeriSign defend their turf:

Cloudflare, Inc.: Network Effects and Integrated Security Moat

Cloudflare leverages network effects with its vast, interconnected cloud security and performance platform. Its gross margin at 74.5% signals efficient scale. Continued innovation in IoT and edge computing could deepen this moat through 2026.

VeriSign, Inc.: Intangible Assets and Registry Dominance

VeriSign’s moat stems from intangible assets—exclusive control over .com and .net domains. Its stellar 88% gross margin and 57.7% net margin reflect pricing power unlike Cloudflare’s broader but more competitive scope. Expansion risks exist but registry monopoly remains a fortress.

Registry Monopoly vs. Network Scale: Who Guards the Castle Better?

VeriSign’s moat is narrower but deeper, driven by regulatory-backed domain registry rights. Cloudflare’s network moat is broader, fueled by rapid innovation but faces more competition. VeriSign is better equipped to defend market share against entrants.

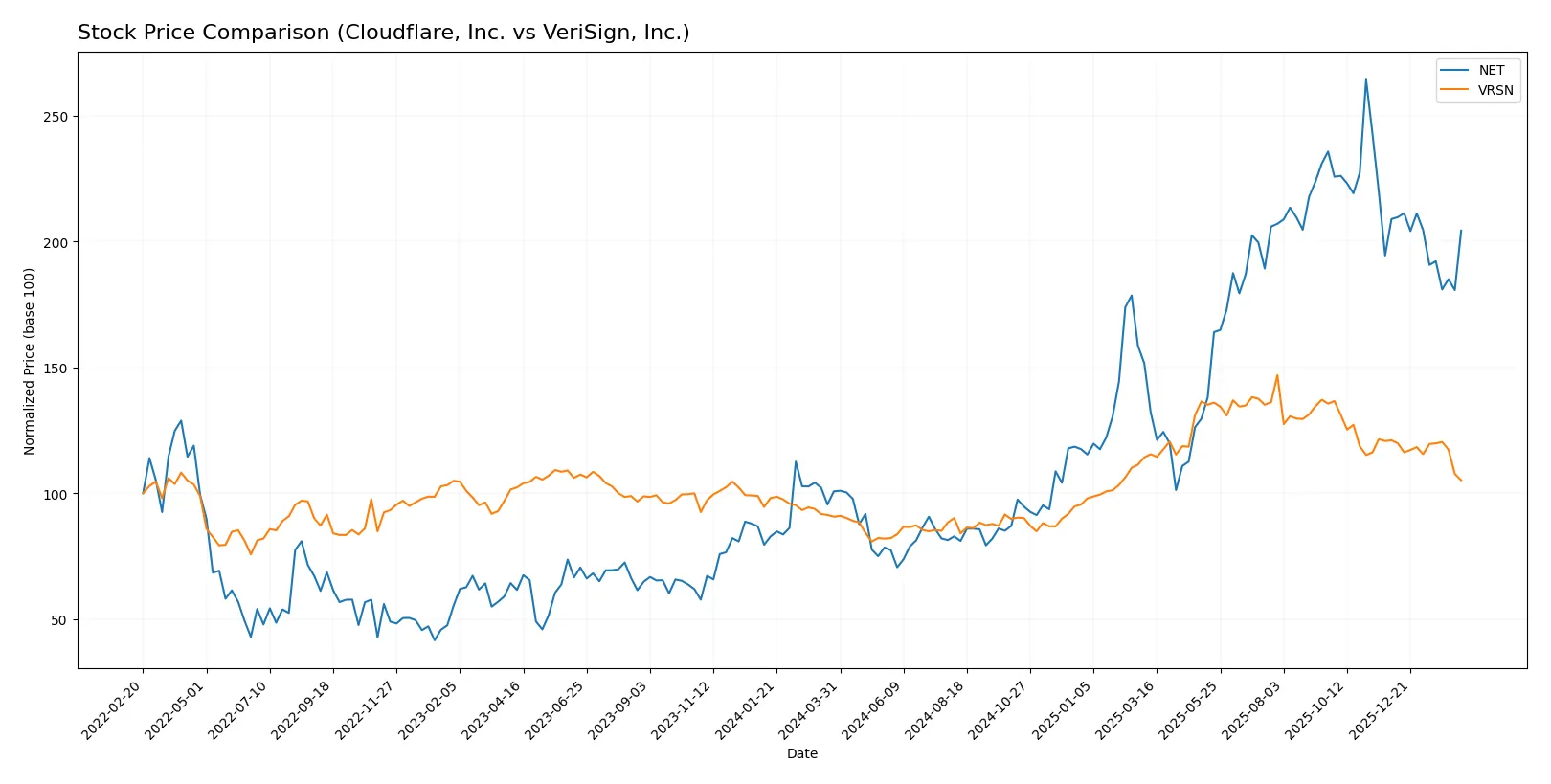

Which stock offers better returns?

Over the past year, both stocks exhibited bullish trends with notable price gains but showed deceleration and recent negative momentum in the final months. Trading volumes reveal contrasting buyer dominance dynamics.

Trend Comparison

Cloudflare, Inc. (NET) achieved a strong 102.81% price increase over 12 months, marking a bullish trend with decelerating growth and high volatility. The stock peaked at 253.3 and bottomed at 67.69.

VeriSign, Inc. (VRSN) recorded a 15.98% gain over the same period, also bullish with deceleration and less volatility. Its price ranged between 168.32 and 305.79, showing less dramatic movement than NET.

NET’s performance clearly outpaced VRSN’s in market returns, despite both experiencing recent downward corrections and slowing momentum.

Target Prices

Analysts maintain a bullish consensus on Cloudflare, Inc. and VeriSign, Inc., reflecting strong growth expectations.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 140 | 300 | 230.2 |

| VeriSign, Inc. | 325 | 325 | 325 |

Cloudflare’s target consensus of 230.2 exceeds its current 196 price, signaling upside potential. VeriSign’s consensus target at 325 implies a substantial premium over its 219 current price.

How do institutions grade them?

Cloudflare, Inc. Grades

The following table summarizes recent institutional grades for Cloudflare, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-12 |

| Piper Sandler | Maintain | Neutral | 2026-02-11 |

| Guggenheim | Maintain | Sell | 2026-02-11 |

| Wells Fargo | Maintain | Overweight | 2026-02-11 |

| Jefferies | Maintain | Hold | 2026-02-11 |

| Barclays | Maintain | Overweight | 2026-02-11 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-02-11 |

| Scotiabank | Maintain | Sector Perform | 2026-02-11 |

| RBC Capital | Maintain | Outperform | 2026-02-11 |

| BTIG | Maintain | Buy | 2026-02-11 |

VeriSign, Inc. Grades

Below are the recent institutional grades assigned to VeriSign, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-09 |

| JP Morgan | Maintain | Neutral | 2026-01-06 |

| Baird | Maintain | Outperform | 2025-07-01 |

| Baird | Maintain | Outperform | 2025-04-25 |

| Baird | Maintain | Outperform | 2025-04-01 |

| Citigroup | Maintain | Buy | 2025-02-04 |

| Citigroup | Maintain | Buy | 2025-01-03 |

| Baird | Upgrade | Outperform | 2024-12-09 |

| Baird | Maintain | Neutral | 2024-06-27 |

| Baird | Maintain | Neutral | 2024-04-26 |

Which company has the best grades?

VeriSign, Inc. holds consistently strong grades, including multiple Outperform ratings and Buy recommendations. Cloudflare, Inc. shows a wider range from Sell to Buy, reflecting mixed institutional views. Investors may interpret VeriSign’s steadier grades as a signal of greater confidence from analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Cloudflare, Inc.

- Faces intense competition in cloud security and performance sectors with rapid innovation cycles.

VeriSign, Inc.

- Holds dominant position in domain registry but faces risks from alternative naming systems and evolving internet protocols.

2. Capital Structure & Debt

Cloudflare, Inc.

- Maintains a favorable debt-to-equity ratio with low leverage, reducing financial risk.

VeriSign, Inc.

- Exhibits high debt-to-assets ratio (135.6%), indicating heavy leverage pressure and potential liquidity risk.

3. Stock Volatility

Cloudflare, Inc.

- High beta (1.98) signals significant stock price volatility relative to the market.

VeriSign, Inc.

- Lower beta (0.75) reflects more stable stock price behavior and lower market sensitivity.

4. Regulatory & Legal

Cloudflare, Inc.

- Operates under complex global data privacy and cybersecurity regulations with compliance costs.

VeriSign, Inc.

- Subject to regulatory scrutiny over domain registry operations and internet infrastructure oversight.

5. Supply Chain & Operations

Cloudflare, Inc.

- Relies on global cloud infrastructure with risk of service disruptions and hardware failures.

VeriSign, Inc.

- Operates critical internet root servers, requiring robust operational continuity and redundancy.

6. ESG & Climate Transition

Cloudflare, Inc.

- Faces pressure to reduce data center energy consumption and improve sustainable cloud services.

VeriSign, Inc.

- Needs to ensure sustainable operations of data centers and align with evolving ESG standards.

7. Geopolitical Exposure

Cloudflare, Inc.

- Exposure to geopolitical tensions impacting global internet access and cybersecurity policies.

VeriSign, Inc.

- Vulnerable to geopolitical risks affecting internet governance and cross-border data flow regulations.

Which company shows a better risk-adjusted profile?

Cloudflare’s biggest risk is market competition and high stock volatility reflecting growth uncertainties. VeriSign’s most impactful risk is its heavy debt load, raising financial distress concerns despite stable market positioning. Cloudflare’s low leverage and safe Altman Z-Score suggest a better risk-adjusted profile. VeriSign’s distress zone Altman Z-Score and high debt-to-assets ratio justify caution despite strong operational moat.

Final Verdict: Which stock to choose?

Cloudflare, Inc. (NET) stands out for its rapid revenue growth and strong gross margins, showcasing its superpower as a scalable cloud security platform. However, its persistent negative profitability and weak cash flow generation remain points of vigilance. NET suits investors targeting aggressive growth in emerging tech.

VeriSign, Inc. (VRSN) commands a strategic moat with its entrenched domain name registry dominance and robust free cash flow yield. It offers better income quality and operational efficiency compared to NET, though its balance sheet shows liquidity concerns. VRSN fits portfolios focused on GARP—growth at a reasonable price.

If you prioritize high growth potential and market expansion, Cloudflare might be the compelling choice due to its accelerating top-line and innovation focus. However, if you seek better stability and a durable competitive advantage, VeriSign offers superior cash flow reliability and margin strength despite some financial leverage risks. Each represents a distinct risk-reward profile within the tech sector’s evolving landscape.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cloudflare, Inc. and VeriSign, Inc. to enhance your investment decisions: