Home > Comparison > Technology > NET vs TDC

The strategic rivalry between Cloudflare, Inc. and Teradata Corporation shapes innovation in the software infrastructure sector. Cloudflare operates as a high-growth cloud services provider focusing on integrated security and performance solutions. Teradata delivers a multi-cloud data platform emphasizing enterprise analytics and ecosystem simplification. This analysis weighs their contrasting operational models to determine which offers superior risk-adjusted returns for a diversified portfolio amid evolving technological demands.

Table of contents

Companies Overview

Cloudflare, Inc. and Teradata Corporation stand as pivotal players in the evolving software infrastructure landscape.

Cloudflare, Inc.: Integrated Cloud Security and Performance Leader

Cloudflare dominates as a cloud services provider delivering integrated security and performance solutions. Its core revenue derives from cloud-based security products like firewalls, DDoS protection, and bot management, alongside performance tools such as content delivery and intelligent routing. In 2026, Cloudflare focuses on expanding its multi-platform security reach, enhancing developer tools, and scaling consumer VPN services.

Teradata Corporation: Enterprise Analytics and Multi-Cloud Data Platform Innovator

Teradata specializes in connected multi-cloud data platforms enabling enterprise analytics. Its revenues come primarily from Teradata Vantage, a data platform that integrates diverse data sources for ecosystem simplification and cloud migration. The 2026 strategy emphasizes consulting services to build analytic visions and operationalize cloud ecosystems across sectors like finance, healthcare, and telecommunications.

Strategic Collision: Similarities & Divergences

Both companies operate in software infrastructure but diverge in approach: Cloudflare prioritizes a security-driven, integrated cloud ecosystem, while Teradata focuses on enterprise data analytics and multi-cloud platform integration. Their primary battleground lies in cloud platform dominance, targeting overlapping enterprise clients. This results in distinct investment profiles—Cloudflare as a high-growth innovator in security and performance, Teradata as a steady player in analytic infrastructure and consulting.

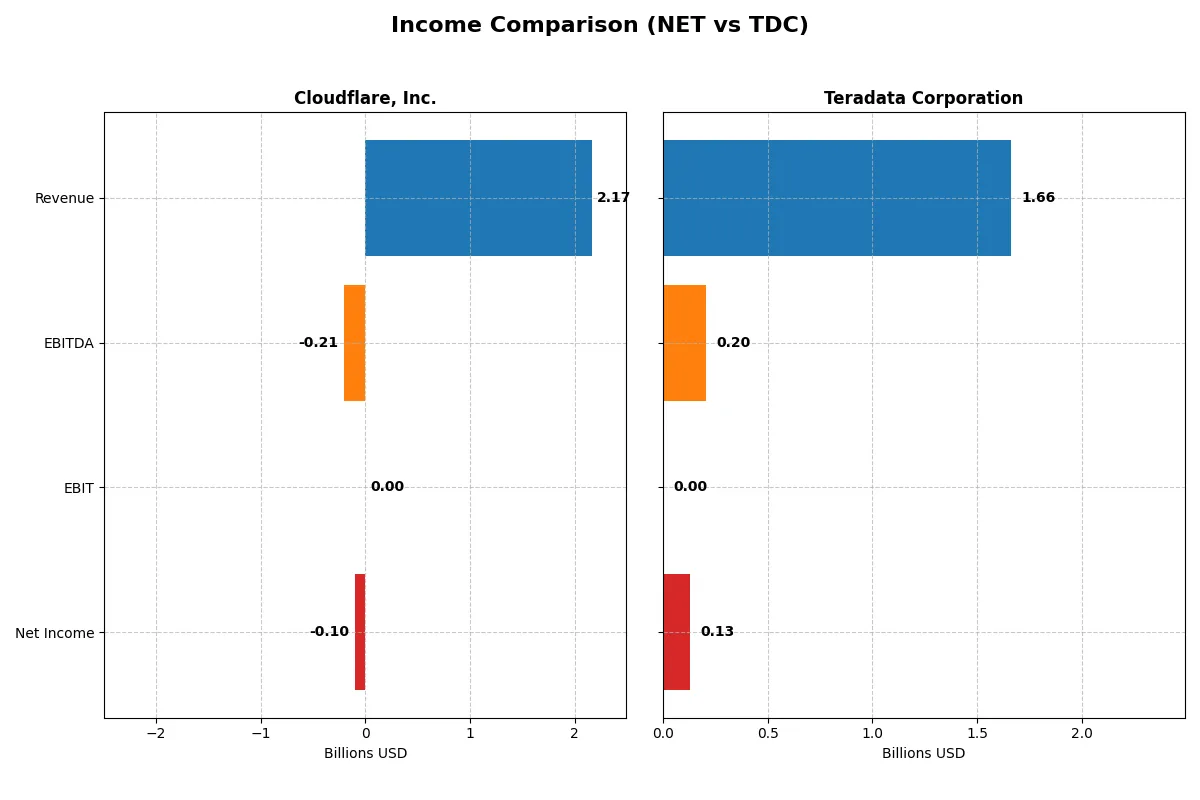

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Cloudflare, Inc. (NET) | Teradata Corporation (TDC) |

|---|---|---|

| Revenue | 2.17B | 1.66B |

| Cost of Revenue | 553M | 676M |

| Operating Expenses | 1.82B | 782M |

| Gross Profit | 1.62B | 987M |

| EBITDA | -207M | 205M |

| EBIT | 0 | 0 |

| Interest Expense | -8.8M | 0 |

| Net Income | -102M | 130M |

| EPS | -0.29 | 1.38 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with greater financial efficiency and growth momentum through recent market cycles.

Cloudflare, Inc. Analysis

Cloudflare’s revenue surged from 656M in 2021 to 2.17B in 2025, reflecting strong top-line growth. However, net income remains negative, though losses narrowed from -260M to -102M. The gross margin stays robust around 74.5%, but negative net margins highlight ongoing operational challenges despite improving EBIT trends.

Teradata Corporation Analysis

Teradata’s revenue declined modestly from 1.92B in 2021 to 1.66B in 2025. Net income improved from 147M to 130M, supported by a solid 59.4% gross margin and positive net margin of 7.8%. However, the 2025 EBIT margin dropped to zero, signaling margin compression despite stable profitability.

Verdict: Growth Engine vs. Margin Resilience

Cloudflare drives rapid revenue expansion with improving operational efficiency but struggles to turn profitable. Teradata delivers consistent profitability and respectable margins amid slight revenue contraction. For investors, Cloudflare offers growth potential while Teradata presents a steadier income profile with healthier net margins.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Cloudflare, Inc. (NET) | Teradata Corporation (TDC) |

|---|---|---|

| ROE | N/A | N/A |

| ROIC | N/A | N/A |

| P/E | -467 (2024) | 22.1 (2025) |

| P/B | 35.1 (2024) | N/A |

| Current Ratio | 2.86 (2024) | 0.81 (2024) |

| Quick Ratio | 2.86 (2024) | 0.79 (2024) |

| D/E | 1.40 (2024) | 0 (2025) |

| Debt-to-Assets | 44.3% (2024) | 0 (2025) |

| Interest Coverage | -29.8 (2024) | 0 (2025) |

| Asset Turnover | 0.51 (2024) | 0 (2025) |

| Fixed Asset Turnover | 2.63 (2024) | 0 (2025) |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and exposing operational strengths vital for investors’ decisions.

Cloudflare, Inc.

Cloudflare displays negative profitability with a net margin of -4.72% and zero ROE, signaling operational challenges. The stock trades at a stretched P/E of -671.68, indicating market skepticism. It offers no dividends, instead plowing resources into R&D at over 23% of revenue, aiming to fuel future growth despite current losses.

Teradata Corporation

Teradata posts a modest net margin of 7.82%, but zero ROE highlights some profitability concerns. Its P/E of 22.1 suggests a neutral valuation relative to peers. The company pays no dividend but reinvests moderately in R&D at about 16.8% of revenue, seeking steady improvement. Debt metrics appear favorable, yet liquidity ratios remain weak.

Balanced Growth vs. Stretched Innovation

Teradata offers a more balanced profile with modest profitability and neutral valuation, whereas Cloudflare’s stretched valuation contrasts with negative margins. Teradata fits investors favoring operational stability. Cloudflare suits those prioritizing aggressive growth through reinvestment despite current financial strain.

Which one offers the Superior Shareholder Reward?

I compare Cloudflare, Inc. (NET) and Teradata Corporation (TDC) on distribution strategies and shareholder rewards. Neither pays dividends, so total return relies on reinvestment and buybacks. NET posts zero dividend yield and payout ratio. TDC also pays no dividends but shows solid free cash flow (3.2/sh) fully covering operations. NET’s buyback activity is limited by negative net margins and high price-to-FCF (189x), raising sustainability concerns. TDC delivers consistent operating margins (~12%), modest valuation (P/FCF ~9.4x), and robust free cash flow generation supporting buybacks. I see TDC’s disciplined capital allocation and positive cash flow as superior for long-term shareholder value in 2026.

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Cloudflare, Inc. and Teradata Corporation, highlighting their financial strengths and weaknesses side by side:

Teradata excels in cash flow generation and profitability, scoring 4 and 5 in DCF and ROE respectively, compared to Cloudflare’s uniformly low scores of 1. Teradata’s ROA also outperforms at 4 versus 1, indicating better asset utilization. However, both companies share weaknesses in debt management and valuation metrics, with Teradata’s debt-to-equity and price-to-book scores as unfavorable as Cloudflare’s. Teradata presents a more balanced profile driven by operational efficiency, while Cloudflare relies on neither profitability nor valuation strengths.

Bankruptcy Risk: Solvency Showdown

Teradata’s Altman Z-Score of 0.95 places it in the distress zone, signaling high bankruptcy risk, whereas Cloudflare’s score of 9.38 indicates a robust solvency position. This stark contrast implies Cloudflare is far better positioned to survive the current market cycle’s volatility:

Financial Health: Quality of Operations

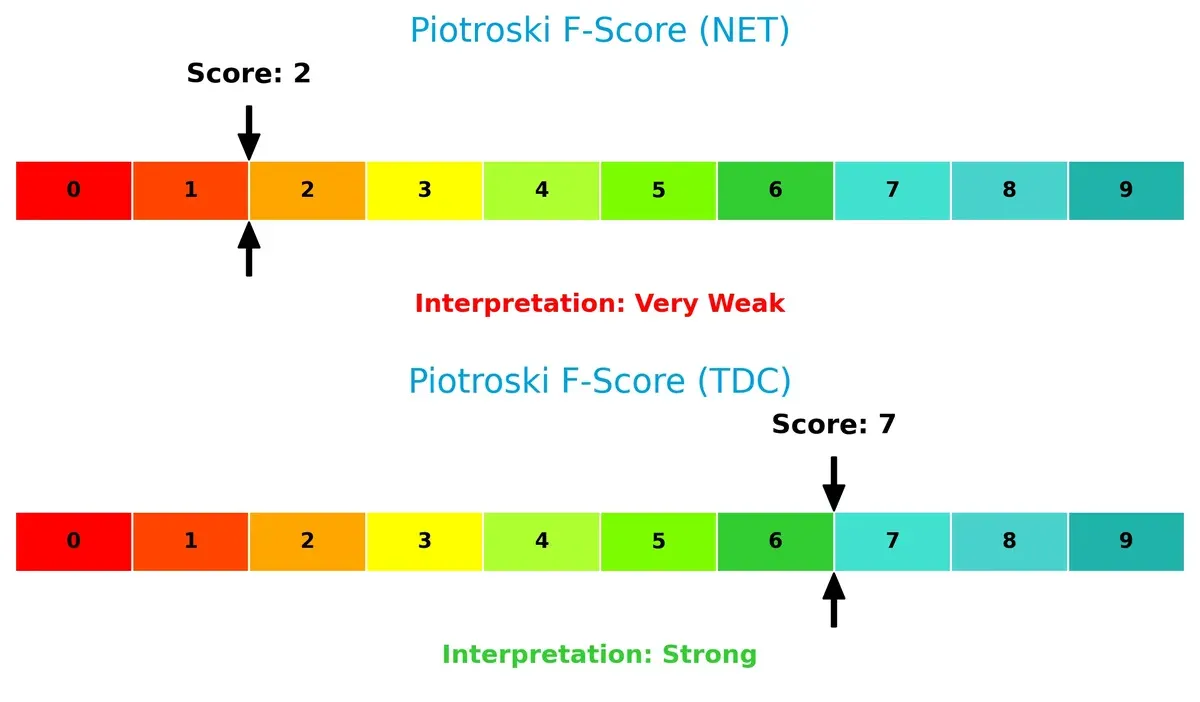

Teradata’s Piotroski F-Score of 7 reflects strong financial health and operational quality, while Cloudflare’s weak score of 2 raises red flags about its internal financial stability. Investors should be cautious about Cloudflare’s underlying fundamentals:

How are the two companies positioned?

This section dissects the operational DNA of Cloudflare and Teradata by comparing their revenue distribution by segment and internal dynamics. The objective is to confront their economic moats to identify which model offers the most resilient advantage in today’s market.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Cloudflare, Inc. and Teradata Corporation diversify their income streams and where their primary sector bets lie:

Cloudflare anchors its revenue entirely in one reportable segment totaling $1.67B, reflecting a focused business model. Teradata diversifies across consulting ($248M), recurring products ($1.48B), recurring services ($1.19B), subscription software ($289M), and perpetual licenses ($23M). Teradata’s broad mix reduces concentration risk and signals a multifaceted ecosystem. Cloudflare’s reliance on a single segment exposes it to higher sector-specific volatility but may reflect infrastructure dominance.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Cloudflare, Inc. and Teradata Corporation:

Cloudflare Strengths

- Zero debt levels and debt-to-assets ratio support strong balance sheet

- Favorable price-to-earnings and price-to-book ratios indicate positive market valuation

Teradata Strengths

- Diverse revenue streams across consulting, recurring products, and subscriptions

- Favorable price-to-book ratio and manageable debt levels support financial stability

Cloudflare Weaknesses

- Negative net margin and return on equity reflect unprofitability

- Poor liquidity ratios and interest coverage raise financial risk concerns

- Asset turnover ratios indicate weak operational efficiency

Teradata Weaknesses

- Low return on equity and invested capital indicate suboptimal profitability

- Weak liquidity and interest coverage ratios highlight financial constraints

- Unfavorable asset turnover suggests operational inefficiencies

Both companies show financial challenges in profitability and liquidity metrics. Cloudflare benefits from a debt-free structure, while Teradata’s diversified revenues provide some resilience. Each faces operational efficiency and profitability pressures that will affect strategic priorities.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole shield protecting long-term profits from relentless competitive erosion. Let’s dissect how Cloudflare and Teradata defend their turf:

Cloudflare, Inc.: Network Effects and Integrated Security Moat

Cloudflare’s primary advantage stems from its vast, integrated cloud network combining security and performance. This moat reflects in rapid revenue growth (30% YoY) and expanding gross margins near 75%. Their push into edge computing and IoT security could deepen this lead in 2026.

Teradata Corporation: Data Ecosystem and Analytical Platform Moat

Teradata’s moat centers on its connected multi-cloud data platform, offering ecosystem simplification. Unlike Cloudflare’s growth trajectory, Teradata shows shrinking revenues and a declining ROIC trend, though it maintains healthy net margins near 8%. Expansion into AI-driven analytics could revive its positioning.

Network Effects vs. Data Ecosystem: The Moat Showdown

Cloudflare’s expanding network effects and innovation-driven growth create a wider, more resilient moat than Teradata’s contracting data platform advantage. Cloudflare is better positioned to defend and grow market share through scalable integration and security breadth.

Which stock offers better returns?

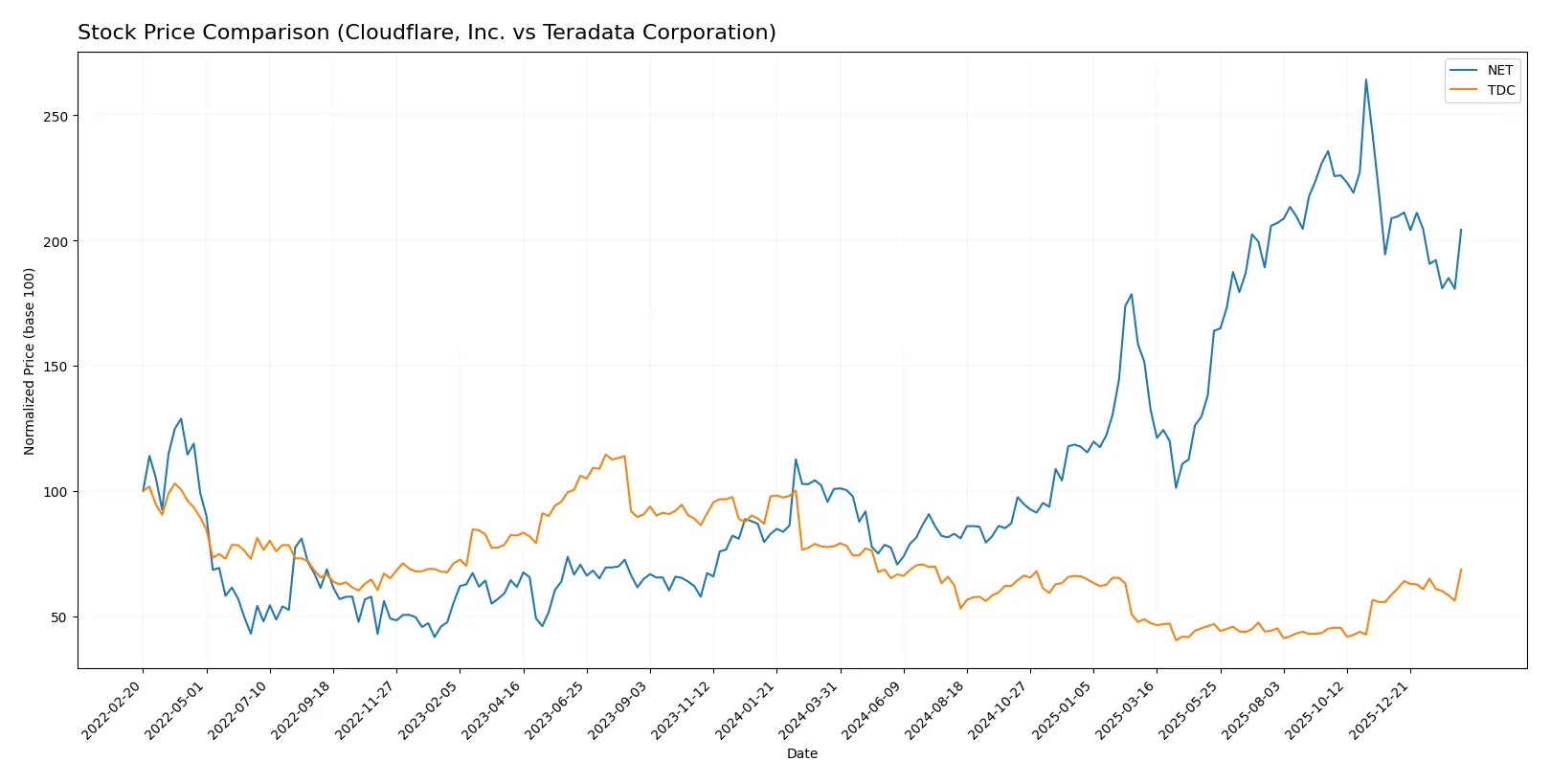

Over the past 12 months, Cloudflare, Inc. and Teradata Corporation showed contrasting price trends, with notable volatility and shifts in buyer dominance shaping their trading dynamics.

Trend Comparison

Cloudflare, Inc. gained 102.81% over the last year, displaying a bullish trend but with decelerating momentum. Its price ranged from 67.69 to 253.3, showing significant volatility (std dev 52.86).

Teradata Corporation fell 11.87% over the past year, marking a bearish trend but with accelerating downward momentum. The stock price fluctuated between 19.73 and 38.67, with lower volatility (std dev 5.29).

Cloudflare’s stock outperformed Teradata significantly, delivering stronger overall market returns despite recent short-term weakness.

Target Prices

Analysts offer constructive optimism with solid upside potential for both Cloudflare and Teradata.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 140 | 300 | 230.2 |

| Teradata Corporation | 27 | 40 | 35 |

Cloudflare’s consensus target of 230.2 implies a 17.5% premium over its current 195.85 price, signaling strong growth expectations. Teradata’s 35 consensus target values the stock slightly above its 33.56 price, reflecting moderate upside confidence.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Cloudflare, Inc. Grades

The table below summarizes recent institutional grades for Cloudflare, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-12 |

| Piper Sandler | Maintain | Neutral | 2026-02-11 |

| Guggenheim | Maintain | Sell | 2026-02-11 |

| Wells Fargo | Maintain | Overweight | 2026-02-11 |

| Jefferies | Maintain | Hold | 2026-02-11 |

| Barclays | Maintain | Overweight | 2026-02-11 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-02-11 |

| Scotiabank | Maintain | Sector Perform | 2026-02-11 |

| RBC Capital | Maintain | Outperform | 2026-02-11 |

| BTIG | Maintain | Buy | 2026-02-11 |

Teradata Corporation Grades

The table below summarizes recent institutional grades for Teradata Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-12 |

| RBC Capital | Maintain | Sector Perform | 2026-02-11 |

| Citizens | Maintain | Market Outperform | 2026-02-11 |

| Barclays | Maintain | Underweight | 2026-02-11 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-11 |

| Citigroup | Maintain | Buy | 2026-02-04 |

| Barclays | Maintain | Underweight | 2026-01-12 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Citizens | Upgrade | Market Outperform | 2025-11-10 |

Which company has the best grades?

Cloudflare, Inc. holds a broader range of positive grades, including multiple Buy and Outperform ratings. Teradata shows mixed signals with some Underweight grades despite a few Outperform ratings. This disparity may influence investor confidence differently.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Cloudflare, Inc.

- Operates in a highly competitive, fast-evolving cloud security market; faces pressure from large cloud providers and startups.

Teradata Corporation

- Competes in multi-cloud data analytics; faces competition from established cloud vendors and niche analytics firms.

2. Capital Structure & Debt

Cloudflare, Inc.

- Favorable debt metrics but zero liquidity ratios raise red flags on short-term financial flexibility.

Teradata Corporation

- Also shows favorable debt ratios but suffers from poor liquidity, indicating potential operational strain.

3. Stock Volatility

Cloudflare, Inc.

- High beta of 1.98 signals elevated stock price volatility and market sensitivity.

Teradata Corporation

- Low beta of 0.54 suggests defensive stock behavior with limited price swings.

4. Regulatory & Legal

Cloudflare, Inc.

- Must navigate complex cybersecurity and data privacy regulations globally; risks of compliance costs.

Teradata Corporation

- Faces regulatory scrutiny in data handling and cross-border cloud operations, but less exposed than Cloudflare.

5. Supply Chain & Operations

Cloudflare, Inc.

- Relies on global data centers and network infrastructure; operational risks from outages or cyber threats.

Teradata Corporation

- Depends on cloud partnerships and software development; operational risks tied to integration and service continuity.

6. ESG & Climate Transition

Cloudflare, Inc.

- Increasing pressure to reduce carbon footprint in energy-intensive data centers; ESG disclosures under investor scrutiny.

Teradata Corporation

- Faces similar ESG pressures; transitioning legacy infrastructure to greener cloud solutions poses challenges.

7. Geopolitical Exposure

Cloudflare, Inc.

- Global operations expose it to US-China tensions, data sovereignty laws, and cross-border restrictions.

Teradata Corporation

- Also exposed globally but with less direct infrastructure footprint, mitigating some geopolitical risks.

Which company shows a better risk-adjusted profile?

Cloudflare’s most impactful risk lies in market volatility and liquidity concerns, threatening its operational agility. Teradata’s biggest risk is its distressed financial health as indicated by the Altman Z-score, despite stronger profitability metrics. Teradata’s lower volatility and stronger recent profitability point to a better risk-adjusted profile, but its balance sheet weakness demands caution. The stark contrast in Altman Z-scores—Cloudflare safely above 9 versus Teradata below 1—justifies my heightened concern for Teradata’s solvency risk.

Final Verdict: Which stock to choose?

Cloudflare, Inc. (NET) wields unmatched growth momentum fueled by robust revenue expansion and a powerful gross margin. Its core strength lies in innovation and scale within cybersecurity and cloud services. A point of vigilance remains its persistent negative profitability and cash flow challenges. NET suits aggressive growth seekers willing to endure volatility for market leadership.

Teradata Corporation (TDC) offers a strategic moat rooted in data analytics expertise and steady cash generation. Its disciplined capital allocation supports a more conservative risk profile than NET. While facing revenue headwinds, TDC’s stable free cash flow and improving earnings yield appeal to GARP investors favoring moderate growth with valuation discipline.

If you prioritize rapid expansion and market dominance, Cloudflare outshines as a high-growth, innovation-driven scenario despite near-term profitability risks. However, if you seek better stability and cash flow with a value tilt, Teradata offers a compelling profile for those balancing growth with financial prudence. Each reflects distinct investor archetypes navigating growth versus stability trade-offs.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cloudflare, Inc. and Teradata Corporation to enhance your investment decisions: