In today’s fast-evolving technology landscape, Cloudflare, Inc. and StoneCo Ltd. stand out as influential players in the software infrastructure sector. Cloudflare focuses on global cloud security and performance services, while StoneCo drives fintech innovation in Brazil’s electronic commerce space. Their overlapping commitment to technological advancement and digital transformation makes them compelling candidates for comparison. Join me as we explore which company offers the most attractive investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Cloudflare and StoneCo by providing an overview of these two companies and their main differences.

Cloudflare Overview

Cloudflare, Inc. operates as a cloud services provider focused on delivering integrated cloud-based security and performance solutions globally. Its offerings include cloud firewall, bot management, content delivery, and developer tools designed to secure and optimize various platforms such as public and private clouds, SaaS applications, and IoT devices. Headquartered in San Francisco, Cloudflare serves diverse sectors including technology, healthcare, and financial services.

StoneCo Overview

StoneCo Ltd. provides financial technology solutions to merchants and partners for electronic commerce across in-store, online, and mobile channels primarily in Brazil. It distributes its solutions through proprietary Stone Hubs and a sales team targeting small- and medium-sized businesses, digital merchants, and software vendors. Founded in 2000 and based in George Town, Cayman Islands, StoneCo operates as a subsidiary of HR Holdings, LLC, focusing on payment and commerce technology.

Key similarities and differences

Both companies operate in the technology sector and focus on software infrastructure but serve different markets and client bases. Cloudflare emphasizes cloud security, performance, and networking solutions globally, while StoneCo specializes in fintech solutions for commerce primarily in Brazil. Cloudflare’s product range includes developer and consumer services, whereas StoneCo concentrates on payment platforms and merchant services. Their geographic focus and core business models distinguish their market positioning.

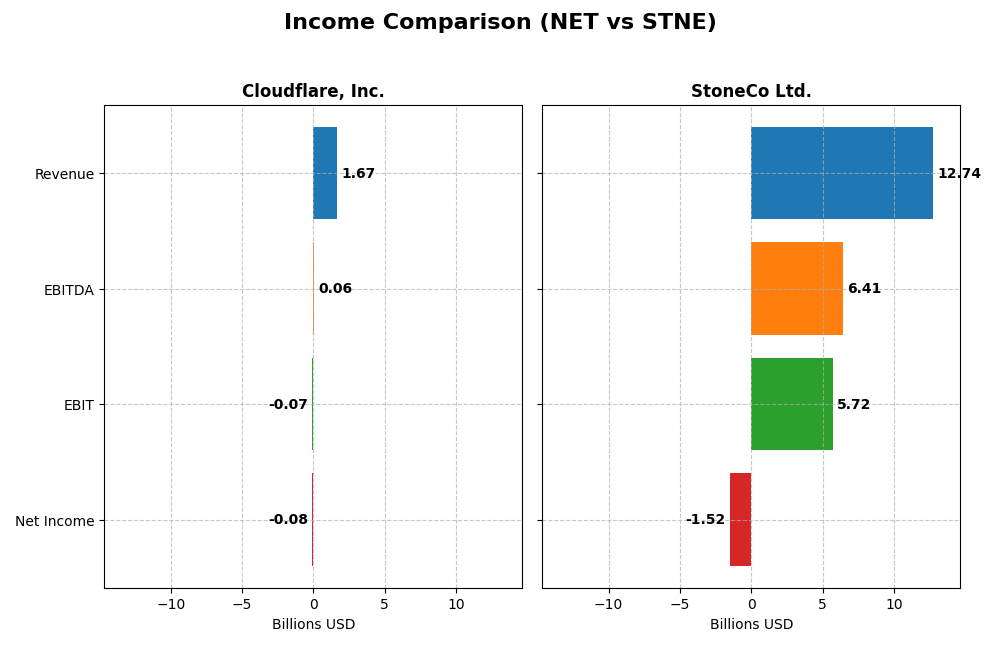

Income Statement Comparison

The table below compares key income statement metrics for Cloudflare, Inc. and StoneCo Ltd. for the fiscal year 2024, reflecting their most recent financial results.

| Metric | Cloudflare, Inc. (NET) | StoneCo Ltd. (STNE) |

|---|---|---|

| Market Cap | 64.5B | 3.9B |

| Revenue | 1.67B | 12.7B BRL |

| EBITDA | 62M | 6.41B BRL |

| EBIT | -66M | 5.72B BRL |

| Net Income | -79M | -1.52B BRL |

| EPS | -0.23 | -5.02 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Cloudflare, Inc.

Cloudflare’s revenue demonstrated strong growth from 2020 to 2024, increasing from $431M to $1.67B, with net income losses narrowing significantly from -$119M to -$79M. Gross margin remained robust around 77%, while net margins stayed negative but improved by over 80%. The 2024 fiscal year showed accelerated revenue growth of 29%, with improved profitability metrics and a rising EBITDA, indicating operational progress despite ongoing losses.

StoneCo Ltd.

StoneCo’s revenue expanded substantially from BRL 3.2B in 2020 to BRL 12.7B in 2024, while net income declined from a positive BRL 854M to a loss of BRL 1.52B. Gross margin held strong near 73%, and EBIT margin was favorable at 44.9%, but net margin deteriorated to -11.9%. In 2024, revenue growth slowed to 12%, and net income worsened sharply, reflecting increased challenges in converting operational gains into profitability.

Which one has the stronger fundamentals?

Cloudflare exhibits stronger fundamentals with favorable trends in revenue growth, margin improvements, and a meaningful reduction in net losses over five years, supported by a consistent gross margin around 77%. StoneCo shows impressive revenue growth and EBIT margin but faces significant net income deterioration and negative net margin trends, indicating profitability pressures despite operational strength. Overall, Cloudflare’s income statement reflects more consistent progress toward profitability.

Financial Ratios Comparison

The table below compares key financial ratios for Cloudflare, Inc. (NET) and StoneCo Ltd. (STNE) based on their most recent fiscal year data, highlighting profitability, liquidity, leverage, and efficiency metrics.

| Ratios | Cloudflare, Inc. (NET) | StoneCo Ltd. (STNE) |

|---|---|---|

| ROE | -7.53% | -12.87% |

| ROIC | -6.06% | 22.41% |

| P/E | -466.5 | -9.84 |

| P/B | 35.1 | 1.27 |

| Current Ratio | 2.86 | 1.37 |

| Quick Ratio | 2.86 | 1.37 |

| D/E (Debt to Equity) | 1.40 | 1.10 |

| Debt-to-Assets | 44.3% | 23.5% |

| Interest Coverage | -29.8 | 5.57 |

| Asset Turnover | 0.51 | 0.23 |

| Fixed Asset Turnover | 2.63 | 6.95 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Cloudflare, Inc.

Cloudflare exhibits several unfavorable ratios, including negative net margin (-4.72%), return on equity (-7.53%), and return on invested capital (-6.06%), indicating weak profitability and capital efficiency. Its strong liquidity ratios, with a current and quick ratio of 2.86, provide some financial stability. The company does not pay dividends, likely reflecting a reinvestment strategy during its growth phase.

StoneCo Ltd.

StoneCo shows a mixed profile with unfavorable net margin (-11.89%) and return on equity (-12.87%), but a favorable return on invested capital (22.41%) and a solid interest coverage ratio (5.41). Its liquidity is moderate with a current ratio of 1.37. StoneCo also does not pay dividends, possibly focusing on growth and operational investments instead of shareholder distributions.

Which one has the best ratios?

StoneCo has a more balanced ratio profile with 50% favorable metrics compared to Cloudflare’s 21.43%, including stronger capital returns and better debt management. However, both companies face profitability challenges and do not issue dividends, reflecting ongoing reinvestment or restructuring efforts. Overall, StoneCo’s ratios appear slightly more favorable for investors.

Strategic Positioning

This section compares the strategic positioning of Cloudflare, Inc. and StoneCo Ltd., covering market position, key segments, and exposure to technological disruption:

Cloudflare, Inc.

- Large market cap of 64.5B in cloud infrastructure with high competitive pressure globally.

- Serves diverse sectors including technology, healthcare, finance, retail, and government with cloud security and performance solutions.

- High exposure to evolving cloud security technologies and Internet infrastructure innovations.

StoneCo Ltd.

- Smaller 3.9B market cap focused on Brazil’s fintech market with regional competitive pressure.

- Primarily targets small and medium merchants, marketplaces, and e-commerce platforms in Brazil via fintech solutions.

- Exposure tied to fintech innovation and digital payment technologies in Brazilian market.

Cloudflare, Inc. vs StoneCo Ltd. Positioning

Cloudflare pursues a diversified strategy across multiple industries and cloud services, offering broad security and performance solutions. StoneCo concentrates on Brazilian fintech for SMBs and digital merchants, focusing on localized electronic commerce solutions, reflecting more market concentration.

Which has the best competitive advantage?

StoneCo shows a very favorable MOAT with ROIC above WACC and strong ROIC growth, indicating durable competitive advantage. Cloudflare has a slightly unfavorable MOAT, currently shedding value despite growing profitability.

Stock Comparison

The stock price movements of Cloudflare, Inc. (NET) and StoneCo Ltd. (STNE) over the past 12 months reveal contrasting trends, with NET showing strong gains despite recent pullbacks, while STNE has experienced sustained declines amid shifting trading volumes.

Trend Analysis

Cloudflare, Inc. (NET) posted an overall bullish trend over the past year with an 87.07% price increase, though the upward momentum decelerated. The recent period shows a -27.29% decline, indicating a short-term bearish reversal.

StoneCo Ltd. (STNE) exhibited a bearish trend over the past year, declining 13.9% with decelerating losses. Its recent trend remains negative with a -23.78% price change, consistent with a continued downtrend.

Comparing the two, Cloudflare delivered the highest market performance with a significant positive return, while StoneCo’s stock showed a sustained downward trend and weaker price appreciation.

Target Prices

The current analyst consensus on target prices indicates a positive outlook for both Cloudflare, Inc. and StoneCo Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 300 | 210 | 248.86 |

| StoneCo Ltd. | 20 | 20 | 20 |

Analysts expect Cloudflare’s stock to appreciate significantly from its current price of $184.17, while StoneCo’s target price of $20 suggests moderate upside from the current $14.49 level.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cloudflare, Inc. and StoneCo Ltd.:

Rating Comparison

Cloudflare, Inc. Rating

- Rating: D+ indicating a very favorable status.

- Discounted Cash Flow Score: 1, very unfavorable.

- ROE Score: 1, very unfavorable.

- ROA Score: 1, very unfavorable.

- Debt To Equity Score: 1, very unfavorable.

- Overall Score: 1, very unfavorable.

StoneCo Ltd. Rating

- Rating: C indicating a very favorable status.

- Discounted Cash Flow Score: 3, moderate status.

- ROE Score: 1, very unfavorable.

- ROA Score: 1, very unfavorable.

- Debt To Equity Score: 1, very unfavorable.

- Overall Score: 2, moderate status.

Which one is the best rated?

StoneCo Ltd. holds a better rating overall with a “C” compared to Cloudflare’s “D+”. StoneCo also scores higher in discounted cash flow and overall score, while both share very unfavorable scores in ROE, ROA, and debt to equity.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Cloudflare, Inc. and StoneCo Ltd.:

Cloudflare, Inc. Scores

- Altman Z-Score: 9.47, indicating a safe zone.

- Piotroski Score: 2, classified as very weak.

StoneCo Ltd. Scores

- Altman Z-Score: 1.02, indicating a distress zone.

- Piotroski Score: 5, classified as average.

Which company has the best scores?

Cloudflare, Inc. shows a strong Altman Z-Score indicating financial safety but a very weak Piotroski Score. StoneCo Ltd. has a distress-level Altman Z-Score but a better Piotroski Score in the average range. Each score reflects different aspects of financial health.

Grades Comparison

The following tables present the latest grades from reputable grading companies for both Cloudflare, Inc. and StoneCo Ltd.:

Cloudflare, Inc. Grades

This table summarizes the most recent grades from recognized financial institutions for Cloudflare, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-11-10 |

| Susquehanna | Maintain | Neutral | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Overall, Cloudflare’s grades show a consistent pattern of Buy and Neutral ratings, indicating moderate confidence from analysts.

StoneCo Ltd. Grades

This table presents the recent grades from established grading companies for StoneCo Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Maintain | Buy | 2025-10-14 |

| B of A Securities | Maintain | Buy | 2025-09-09 |

| UBS | Maintain | Buy | 2025-08-29 |

| JP Morgan | Maintain | Overweight | 2025-07-16 |

| Barclays | Maintain | Equal Weight | 2025-05-12 |

| Barclays | Maintain | Equal Weight | 2025-04-23 |

| Citigroup | Upgrade | Buy | 2025-04-22 |

| Barclays | Maintain | Equal Weight | 2025-03-21 |

| Morgan Stanley | Maintain | Underweight | 2025-03-21 |

| Goldman Sachs | Maintain | Buy | 2025-02-06 |

StoneCo’s grades are a mix of Buy and Equal Weight, with an Underweight rating from Morgan Stanley, reflecting a more varied analyst sentiment.

Which company has the best grades?

Cloudflare, Inc. has predominantly Buy and Neutral ratings with multiple analyst confirmations, whereas StoneCo Ltd. shows more variability including Equal Weight and Underweight grades. Investors may interpret Cloudflare’s more consistent Buy consensus as a sign of stronger analyst confidence compared to StoneCo.

Strengths and Weaknesses

Below is a comparative overview of Cloudflare, Inc. (NET) and StoneCo Ltd. (STNE) based on key financial and strategic criteria as of 2024.

| Criterion | Cloudflare, Inc. (NET) | StoneCo Ltd. (STNE) |

|---|---|---|

| Diversification | Moderate, focused on cloud services with a sizeable $1.67B revenue segment | Moderate, concentrated in fintech and payment solutions in Brazil |

| Profitability | Negative net margin (-4.72%) and ROIC (-6.06%), value destroying | Negative net margin (-11.89%), but strong ROIC (22.41%), creating value |

| Innovation | Growing ROIC trend (+22%), indicating improving operational efficiency | Very strong ROIC growth (+371%), indicating robust innovation and competitive edge |

| Global presence | Significant global cloud infrastructure | Mainly focused on Latin American markets, limited global footprint |

| Market Share | Strong in cloud security and performance sectors | Leading fintech player in Brazil with expanding market share |

Key takeaways: StoneCo exhibits a stronger economic moat with durable profitability growth and favorable financial ratios, despite current losses. Cloudflare shows improving operational trends but remains value destructive with weaker profitability metrics. Investors should weigh StoneCo’s growth potential against Cloudflare’s innovation trajectory and global reach.

Risk Analysis

Below is a comparative risk overview for Cloudflare, Inc. (NET) and StoneCo Ltd. (STNE) based on the most recent data from 2024:

| Metric | Cloudflare, Inc. (NET) | StoneCo Ltd. (STNE) |

|---|---|---|

| Market Risk | High beta at 1.97 indicates significant volatility. | Beta at 1.83 shows elevated market sensitivity. |

| Debt Level | Debt-to-equity ratio 1.4, unfavorable leverage level. | Debt-to-equity ratio 1.1, slightly better but still elevated. |

| Regulatory Risk | Medium, US-based but operates globally with data security regulations. | High, operates mainly in Brazil with complex fintech regulations. |

| Operational Risk | Moderate, cloud infrastructure dependency and cybersecurity threats. | Moderate, fintech services reliant on digital payment adoption and integration. |

| Environmental Risk | Low, limited direct environmental impact. | Low, primarily a technology service provider with minimal environmental footprint. |

| Geopolitical Risk | Moderate, US tech company subject to international trade policies. | High, exposure to Latin American political and economic instability. |

The most likely and impactful risks are market volatility and elevated debt levels for both companies. Cloudflare’s high beta signals susceptibility to market swings, while StoneCo’s operations face significant regulatory and geopolitical challenges in Brazil. Cloudflare’s unfavorable profitability and leverage ratios add caution, whereas StoneCo’s distressed Altman Z-score highlights bankruptcy risk despite some favorable operational metrics.

Which Stock to Choose?

Cloudflare, Inc. (NET) shows strong revenue growth of 287% from 2020 to 2024, with favorable gross margin and improving net margin. However, profitability ratios like ROE and ROIC remain negative, debt levels are high, and the rating is very unfavorable overall despite a strong current ratio.

StoneCo Ltd. (STNE) reports solid revenue growth of 302% over five years, with a favorable EBIT margin and a positive return on invested capital exceeding WACC, indicating value creation. Debt appears moderate, financial ratios are slightly favorable, and the rating is very favorable with some moderate scores.

Considering the ratings and income evaluations, NET’s improving income but unfavorable ratios suggest it might appeal to growth-oriented investors accepting higher risk. STNE’s positive ROIC and stable ratings could be seen as more suitable for investors seeking value and financial stability. The choice may depend on individual risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cloudflare, Inc. and StoneCo Ltd. to enhance your investment decisions: