Cloudflare, Inc. (NET) and Rubrik, Inc. (RBRK) are two prominent players in the software infrastructure industry, each offering innovative cloud and data security solutions. While Cloudflare focuses on integrated cloud performance and security, Rubrik specializes in enterprise data protection and cyber recovery. Their market overlap and distinct innovation strategies make this comparison essential. Join me as we explore which company stands out as the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Cloudflare and Rubrik by providing an overview of these two companies and their main differences.

Cloudflare Overview

Cloudflare, Inc. is a cloud services provider offering integrated security and performance solutions for businesses worldwide. The company’s products cover cloud firewall, DDoS protection, IoT security, and content delivery, serving industries like technology, healthcare, and financial services. Founded in 2009 and based in San Francisco, Cloudflare operates a network that supports public and private clouds, on-premise systems, and SaaS applications.

Rubrik Overview

Rubrik, Inc. specializes in data security solutions including enterprise data protection, cloud and SaaS data security, threat analytics, and cyber recovery. It serves a broad range of sectors such as financial, retail, energy, healthcare, and education. Established in 2013 and headquartered in Palo Alto, Rubrik focuses on safeguarding unstructured data and improving security postures for businesses globally.

Key similarities and differences

Both Cloudflare and Rubrik operate in the software infrastructure industry, providing security-focused solutions to enterprises. Cloudflare emphasizes cloud-based performance and network security services, while Rubrik centers on data protection and cyber recovery. Cloudflare is larger with over 4,400 employees and a 64.5B market cap, whereas Rubrik is smaller with around 3,200 staff and a 13.4B market cap, reflecting different scale and market focus within the technology sector.

Income Statement Comparison

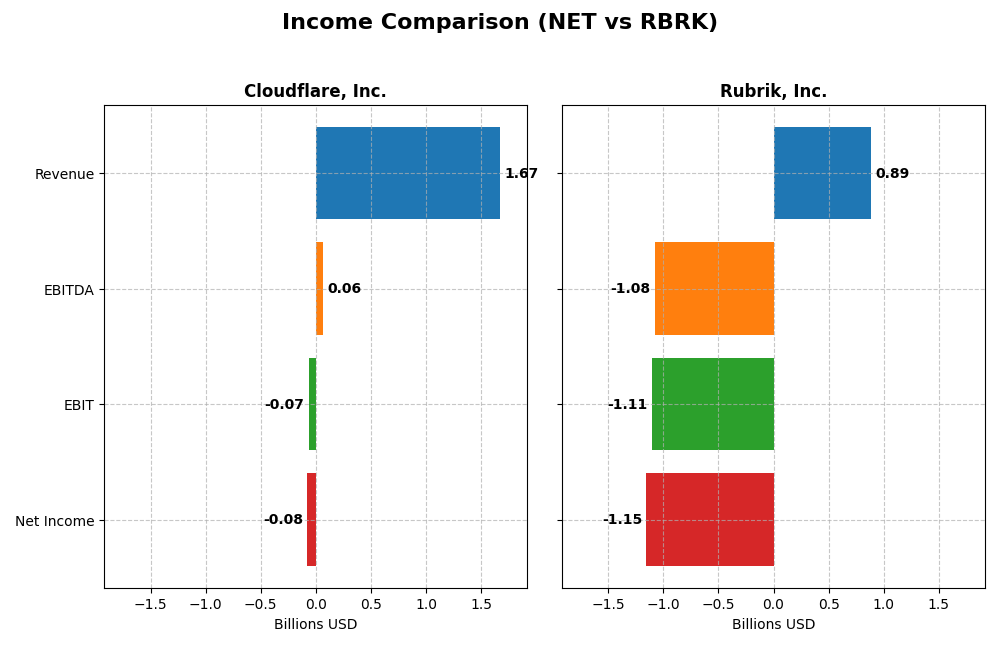

This table presents the most recent fiscal year income statement metrics for Cloudflare, Inc. and Rubrik, Inc., offering a snapshot of their financial performance.

| Metric | Cloudflare, Inc. (NET) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Market Cap | 64.5B | 13.4B |

| Revenue | 1.67B | 886.5M |

| EBITDA | 62.0M | -1.08B |

| EBIT | -65.7M | -1.11B |

| Net Income | -78.8M | -1.15B |

| EPS | -0.23 | -7.48 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Cloudflare, Inc.

Cloudflare’s revenue rose significantly from $431M in 2020 to $1.67B in 2024, showing strong growth. Net income losses narrowed from -$260M in 2021 to -$79M in 2024, reflecting improved profitability. Gross margins remained robust around 77%, while operating and net margins improved, indicating better cost control and operational leverage in the latest year.

Rubrik, Inc.

Rubrik’s revenue increased steadily from $388M in 2021 to $887M in 2025. However, net losses deepened, reaching -$1.15B in 2025 from -$213M in 2021, with deteriorating net and EBIT margins. Despite top-line growth, operating expenses expanded faster than revenue in 2025, contributing to worsening profitability and margin compression in the most recent period.

Which one has the stronger fundamentals?

Cloudflare displays stronger fundamentals, evidenced by sustained revenue growth, improving margins, and reduced net losses. Its gross margin is higher and more stable. Rubrik shows revenue growth but suffers from steeply rising losses and negative margin trends, indicating weaker income statement health over the evaluated period.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Cloudflare, Inc. (NET) and Rubrik, Inc. (RBRK) based on their most recent fiscal year data.

| Ratios | Cloudflare, Inc. (NET) 2024 | Rubrik, Inc. (RBRK) 2025 |

|---|---|---|

| ROE | -7.53% | 208.55% |

| ROIC | -6.06% | -234.85% |

| P/E | -466.54 | -9.79 |

| P/B | 35.14 | -20.42 |

| Current Ratio | 2.86 | 1.13 |

| Quick Ratio | 2.86 | 1.13 |

| D/E (Debt-to-Equity) | 1.40 | -0.63 |

| Debt-to-Assets | 44.32% | 24.65% |

| Interest Coverage | -29.78 | -27.49 |

| Asset Turnover | 0.51 | 0.62 |

| Fixed Asset Turnover | 2.63 | 16.67 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Cloudflare, Inc.

Cloudflare shows a generally weak financial position with unfavorable net margin (-4.72%), ROE (-7.53%), ROIC (-6.06%), and interest coverage (-12.64), though it benefits from a strong current and quick ratio (2.86). The dividend yield is zero, reflecting no dividend payments as the company likely reinvests earnings to support growth and innovation without share buybacks.

Rubrik, Inc.

Rubrik’s ratios present a mixed picture with a favorable ROE (208.55%) and WACC (5.34%), but negative net margin (-130.26%) and ROIC (-234.85%) indicate operational challenges. It maintains a neutral current ratio (1.13) but favorable quick ratio and debt metrics. Like Cloudflare, Rubrik pays no dividends, focusing on reinvestment and growth strategies without returning cash to shareholders.

Which one has the best ratios?

Rubrik holds a better overall ratio profile with 57.14% favorable metrics versus Cloudflare’s 21.43%, despite its poor profitability margins. Cloudflare has more unfavorable ratios and liquidity strength but struggles with returns and leverage. Thus, Rubrik’s financial ratios appear more favorable compared to Cloudflare’s in this comparison.

Strategic Positioning

This section compares the strategic positioning of Cloudflare and Rubrik, focusing on Market position, Key segments, and exposure to disruption:

Cloudflare, Inc.

- Large market cap of 64.5B with high beta, facing intense competition in cloud infrastructure.

- Focuses on integrated cloud-based security, performance, and reliability solutions across multiple platforms.

- Operates in cloud security and performance, exposed to rapid cloud technology evolution and IoT expansion.

Rubrik, Inc.

- Smaller market cap of 13.4B with low beta, competing in data security solutions.

- Specializes in enterprise data protection, threat analytics, and cyber recovery across diverse sectors.

- Concentrated in data security, facing risks from evolving cyber threats and cloud data protection shifts.

Cloudflare vs Rubrik Positioning

Cloudflare has a diversified offering spanning cloud security, performance, and reliability, benefiting from scale but facing intense competition. Rubrik concentrates on data security and cyber recovery, which may limit scale but focuses expertise in a specific niche.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC. Cloudflare’s growing ROIC trend signals improving profitability, while Rubrik’s declining ROIC trend indicates deteriorating returns and a weaker moat position.

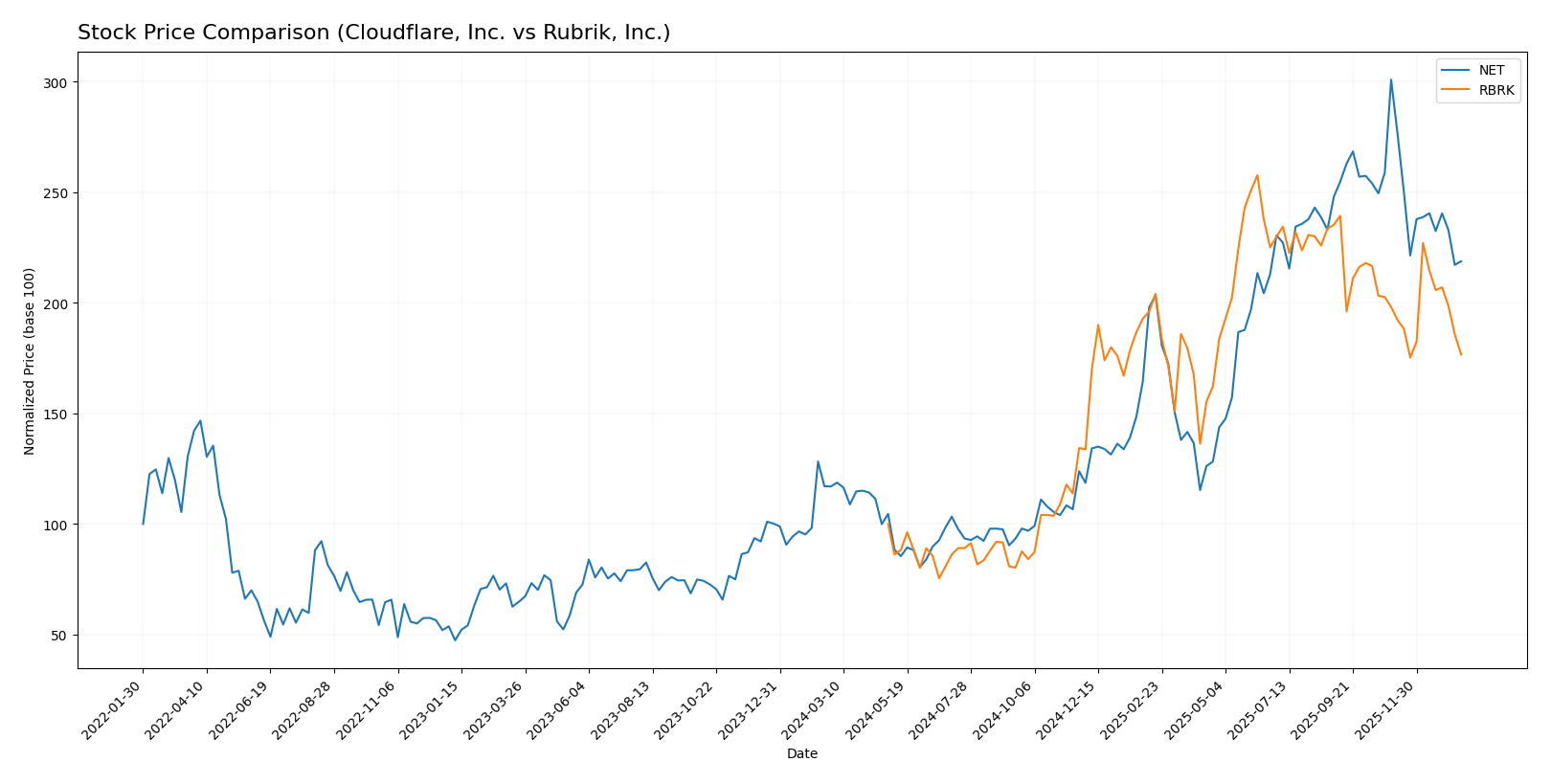

Stock Comparison

The stock price chart reveals significant bullish trends for both Cloudflare, Inc. (NET) and Rubrik, Inc. (RBRK) over the past 12 months, with notable deceleration and recent downward corrections affecting short-term trading dynamics.

Trend Analysis

Cloudflare, Inc. (NET) recorded an 87.07% price increase over the past year, indicating a strong bullish trend with deceleration. The stock showed high volatility, peaking at 253.3 and bottoming at 67.69, with a recent correction of -27.29%.

Rubrik, Inc. (RBRK) experienced a 76.58% price gain, also bullish with deceleration. The highest price reached 97.91, the lowest 28.65, and recent performance declined by -10.85%, reflecting milder volatility compared to NET.

Comparing both stocks, Cloudflare delivered the highest market performance over the 12-month period, outperforming Rubrik by approximately 10.5 percentage points despite recent short-term declines.

Target Prices

The current analyst target consensus suggests a positive outlook for Cloudflare, Inc. and Rubrik, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 300 | 210 | 248.86 |

| Rubrik, Inc. | 113 | 105 | 109.33 |

Analysts expect Cloudflare’s stock price to rise significantly above its current 184.17 USD, while Rubrik shows potential to reach nearly double its current 67.1 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cloudflare, Inc. and Rubrik, Inc.:

Rating Comparison

Cloudflare, Inc. Rating

- Rating: D+ indicating a very favorable evaluation overall.

- Discounted Cash Flow Score: 1, rated very unfavorable.

- ROE Score: 1, rated very unfavorable for profitability.

- ROA Score: 1, rated very unfavorable for asset efficiency.

- Debt To Equity Score: 1, indicating very unfavorable risk.

- Overall Score: 1, indicating very unfavorable financials.

Rubrik, Inc. Rating

- Rating: C indicating a very favorable evaluation overall.

- Discounted Cash Flow Score: 1, rated very unfavorable.

- ROE Score: 5, rated very favorable, showing strong profitability.

- ROA Score: 1, rated very unfavorable for asset efficiency.

- Debt To Equity Score: 1, indicating very unfavorable risk.

- Overall Score: 2, indicating moderate financial standing.

Which one is the best rated?

Rubrik holds a better overall rating with a C and a moderate overall score of 2, driven by a very favorable ROE score of 5, whereas Cloudflare’s scores are consistently very unfavorable with a D+ rating and overall score of 1.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Cloudflare, Inc. and Rubrik, Inc.:

Cloudflare, Inc. Scores

- Altman Z-Score: 9.47, indicating a safe zone status

- Piotroski Score: 2, categorized as very weak

Rubrik, Inc. Scores

- Altman Z-Score: 1.41, indicating distress zone

- Piotroski Score: 4, categorized as average

Which company has the best scores?

Cloudflare shows a much stronger Altman Z-Score, indicating financial safety, but a very weak Piotroski Score. Rubrik, while in financial distress per Altman, has a better Piotroski Score, suggesting average financial strength.

Grades Comparison

Below is a comparison of recent grades assigned to Cloudflare, Inc. and Rubrik, Inc. by recognized grading companies:

Cloudflare, Inc. Grades

This table summarizes Cloudflare, Inc.’s latest grades from established grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-11-10 |

| Susquehanna | Maintain | Neutral | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Cloudflare’s grades predominantly reflect a “Buy” or “Neutral” stance, with consistent maintenance of these ratings over recent months.

Rubrik, Inc. Grades

This table displays the most recent grades for Rubrik, Inc. from respected grading institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

Rubrik shows a strong pattern of “Overweight” and “Outperform” grades, including a recent upgrade, indicating generally favorable analyst sentiment.

Which company has the best grades?

Rubrik, Inc. holds a stronger consensus with multiple “Overweight” and “Outperform” ratings, while Cloudflare, Inc. mostly receives “Buy” and “Neutral” grades. This difference suggests Rubrik may be viewed as having better growth potential by analysts, which could impact investor sentiment and portfolio positioning accordingly.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Cloudflare, Inc. (NET) and Rubrik, Inc. (RBRK) based on the most recent financial and operational data.

| Criterion | Cloudflare, Inc. (NET) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Diversification | Moderate, with a single main segment ($1.67B in 2024) | High, with multiple revenue streams: subscriptions $829M, products & services $45M, maintenance $18M (2025) |

| Profitability | Negative net margin (-4.72%), ROIC -6.06%, losing value but improving profitability | Negative net margin (-130%), ROIC -235%, losing value with declining profitability |

| Innovation | Growing ROIC trend suggests improving operational efficiency | Declining ROIC trend signals challenges in innovation payoff |

| Global presence | Strong global cloud infrastructure presence | Expanding but less global scale compared to NET |

| Market Share | Significant in CDN and cloud security markets | Niche player in data management and backup markets |

Key takeaway: Cloudflare shows improving profitability and a strong global footprint despite current value destruction, while Rubrik faces deeper profitability challenges and declining returns, though it benefits from diversified revenue sources. Investors should weigh Cloudflare’s growth potential against Rubrik’s riskier profile.

Risk Analysis

The following table summarizes key risk factors for Cloudflare, Inc. (NET) and Rubrik, Inc. (RBRK) based on the most recent financial and market data available in 2026.

| Metric | Cloudflare, Inc. (NET) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Market Risk | High beta (1.97) indicating significant volatility | Low beta (0.28) indicating low volatility |

| Debt level | High debt-to-equity ratio (1.4), moderate debt-to-assets (44%) | Low debt-to-equity (-0.63), low debt-to-assets (25%) |

| Regulatory Risk | Moderate; operates globally in cloud and security, subject to data/privacy regulations | Moderate; data security focus with sectoral regulations |

| Operational Risk | Unfavorable profitability ratios; negative net margin (-4.72%) and ROE (-7.53%) | Mixed; negative net margin (-130%) but strong ROE (209%) |

| Environmental Risk | Low direct impact; tech infrastructure with minimal environmental footprint | Low direct impact; software-centric business model |

| Geopolitical Risk | Exposure due to global cloud infrastructure and clients | Moderate, with global client base in regulated sectors |

In synthesis, Cloudflare faces the most impactful risks from high market volatility and substantial leverage combined with weak profitability, raising financial distress concerns despite a healthy liquidity position. Rubrik shows a distressed Altman Z-score reflecting possible bankruptcy risk, mainly from operational losses despite strong ROE and low leverage. Investors should weigh Cloudflare’s market sensitivity and debt risks against Rubrik’s financial instability and operational challenges.

Which Stock to Choose?

Cloudflare, Inc. (NET) shows strong revenue growth of 287% over five years with improving profitability, despite negative returns on equity and invested capital. Its financial ratios are largely unfavorable, particularly high debt levels and poor interest coverage, although liquidity ratios are favorable. The company’s rating is very favorable overall, but underlying score metrics suggest caution.

Rubrik, Inc. (RBRK) presents a mixed picture with revenue growth of 129% but deteriorating profitability and negative returns on capital, indicating value destruction. Financial ratios are more favorable than NET’s, with lower leverage and better equity returns, yet the company is in financial distress per bankruptcy risk scores. Its rating is very favorable but overall scores are moderate.

Investors prioritizing growth and improving profitability might find NET’s favorable income trends and rating attractive despite financial risks. Conversely, those focused on stronger financial ratios and moderate risk could interpret RBRK’s metrics as more suitable, though its declining profitability and distress signals suggest caution. The choice depends on risk tolerance and strategic focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cloudflare, Inc. and Rubrik, Inc. to enhance your investment decisions: