Home > Comparison > Technology > PLTR vs NET

The strategic rivalry between Palantir Technologies Inc. and Cloudflare, Inc. defines the current trajectory of the technology sector’s software infrastructure landscape. Palantir operates as a data analytics powerhouse focused on complex, mission-critical intelligence solutions. In contrast, Cloudflare specializes in cloud-based security and performance services for diverse digital environments. This analysis evaluates which business model delivers the superior risk-adjusted potential for a diversified portfolio amid evolving technological demands.

Table of contents

Companies Overview

Palantir Technologies and Cloudflare stand as pivotal players in the software infrastructure space, shaping data and security landscapes.

Palantir Technologies Inc.: Advanced Data Integration Specialist

Palantir excels as a software infrastructure leader focused on large-scale data integration. It generates revenue through platforms like Palantir Gotham and Foundry, which empower governments and corporations to analyze complex datasets. In 2026, Palantir emphasizes expanding its AI capabilities and enhancing cross-sector data collaboration for operational efficiency.

Cloudflare, Inc.: Comprehensive Cloud Security Provider

Cloudflare serves as a top-tier cloud services provider delivering integrated security and performance solutions worldwide. Its revenue streams stem from cloud-based firewalls, bot management, and content delivery networks that secure and accelerate internet applications. The company’s 2026 strategy prioritizes strengthening its global network reliability and expanding developer-centric programmable services.

Strategic Collision: Similarities & Divergences

Both firms compete in software infrastructure but pursue distinct philosophies: Palantir’s strength lies in deep data analytics and AI integration, while Cloudflare focuses on broad cloud security and network performance. The primary battleground is enterprise digital transformation, where data insights meet secure connectivity. Their investment profiles diverge sharply—Palantir targets high-impact data operations, Cloudflare bets on scalable cloud ecosystems.

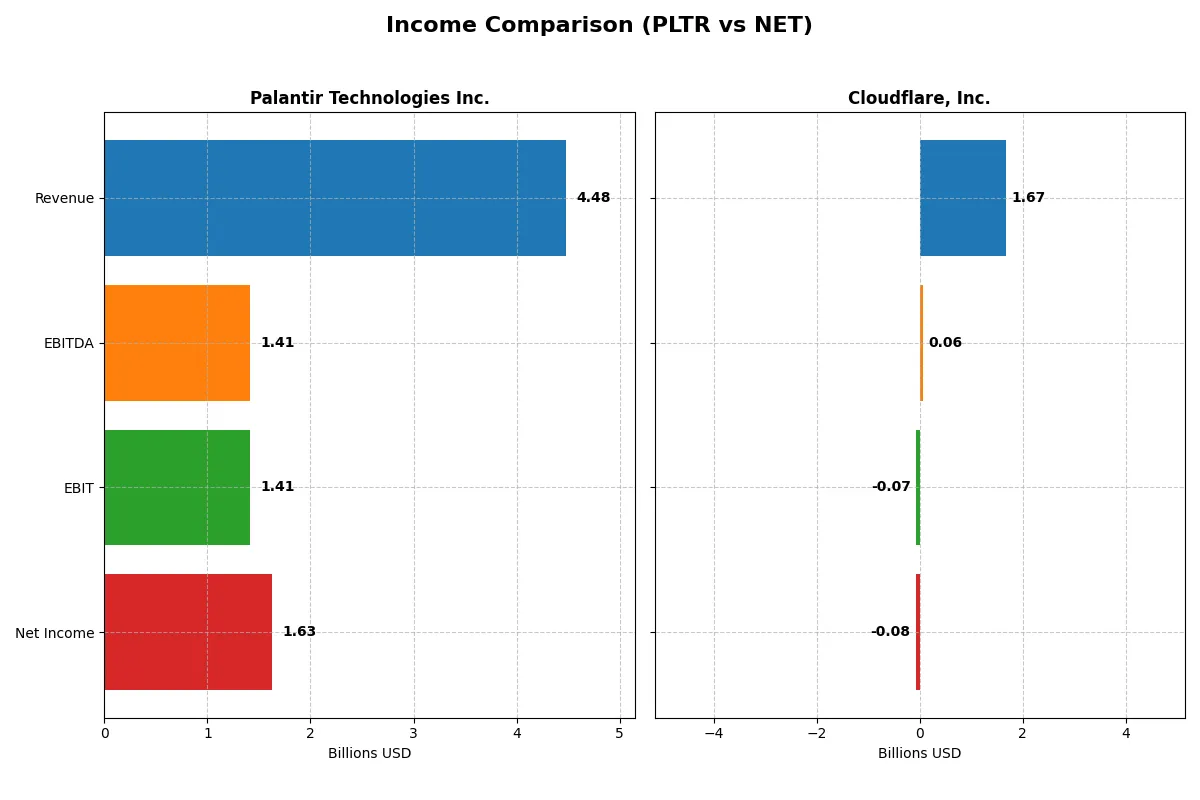

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Palantir Technologies Inc. (PLTR) | Cloudflare, Inc. (NET) |

|---|---|---|

| Revenue | 4.48B | 1.67B |

| Cost of Revenue | 789M | 379M |

| Operating Expenses | 2.27B | 1.45B |

| Gross Profit | 3.69B | 1.29B |

| EBITDA | 1.41B | 62M |

| EBIT | 1.41B | -66M |

| Interest Expense | 0 | 5.2M |

| Net Income | 1.63B | -79M |

| EPS | 0.69 | -0.23 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable corporate engine in the evolving tech landscape.

Palantir Technologies Inc. Analysis

Palantir’s revenue surged from 1.54B in 2021 to 4.48B in 2025, showing strong growth momentum. Net income flipped from a -520M loss in 2021 to a 1.63B profit in 2025, reflecting robust operational leverage. Its gross margin at 82.4% and net margin at 36.3% highlight exceptional profitability and efficient cost control in 2025.

Cloudflare, Inc. Analysis

Cloudflare’s revenue climbed steadily from 431M in 2020 to 1.67B in 2024, demonstrating consistent expansion. Despite revenue growth, it reported net losses across the period, with -79M net income in 2024. Its 77.3% gross margin shows solid core business efficiency, but a negative net margin of -4.7% indicates challenges in scaling profitability.

Margin Dominance vs. Growth Resilience

Palantir outpaces Cloudflare on profitability, delivering superior margins and a strong net income turnaround. Cloudflare excels in steady revenue growth but struggles to convert scale into profits. For investors, Palantir’s high-margin profile offers a clearer path to sustainable earnings compared to Cloudflare’s growth-at-a-losses model.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Palantir Technologies Inc. (PLTR) | Cloudflare, Inc. (NET) |

|---|---|---|

| ROE | 9.24% | -7.53% |

| ROIC | 5.51% | -6.06% |

| P/E | 368.2x | -466.5x |

| P/B | 34.01x | 35.14x |

| Current Ratio | 5.96 | 2.86 |

| Quick Ratio | 5.96 | 2.86 |

| D/E | 0.048 | 1.40 |

| Debt-to-Assets | 3.77% | 44.32% |

| Interest Coverage | 0 (no coverage) | -29.78x (negative) |

| Asset Turnover | 0.45 | 0.51 |

| Fixed Asset Turnover | 11.92 | 2.63 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, unveiling hidden risks and operational strengths that shape investment decisions.

Palantir Technologies Inc.

Palantir shows moderate profitability with a 9.24% ROE and a strong 16.13% net margin, reflecting operational efficiency. The stock’s valuation is stretched, with a P/E of 368.2 and P/B of 34.01, indicating high growth expectations. Palantir returns no dividends, instead heavily reinvesting in R&D to fuel future expansion.

Cloudflare, Inc.

Cloudflare posts negative returns on equity and invested capital, with a net margin of -4.72%, signaling operational challenges. Its P/E is negative but the P/B at 35.14 remains high, suggesting a stretched valuation. The company pays no dividend and shows high leverage, focusing on growth through continued investment rather than shareholder payouts.

Premium Valuation vs. Operational Safety

Palantir balances elevated valuation with better profitability and operational metrics, while Cloudflare’s ratios point to higher risk and weaker returns. Investors prioritizing growth with operational discipline may lean toward Palantir. Those accepting higher risk for potential turnaround may consider Cloudflare’s profile.

Which one offers the Superior Shareholder Reward?

Palantir Technologies Inc. (PLTR) and Cloudflare, Inc. (NET) both forego dividends, focusing on reinvestment and buybacks. PLTR delivers a stronger free cash flow per share ($0.51 in 2024) and a higher operating cash flow ratio (~1.16), signaling robust cash generation. It aggressively repurchases shares, supporting shareholder value despite a zero dividend yield. NET, with weaker free cash flow per share ($0.57) and a lower free cash flow operating cash flow ratio (~0.51), shows less buyback intensity. NET’s heavy debt load (debt-to-equity ~1.4) raises sustainability concerns. I find PLTR’s capital allocation more disciplined and sustainable, making it the superior total return choice in 2026.

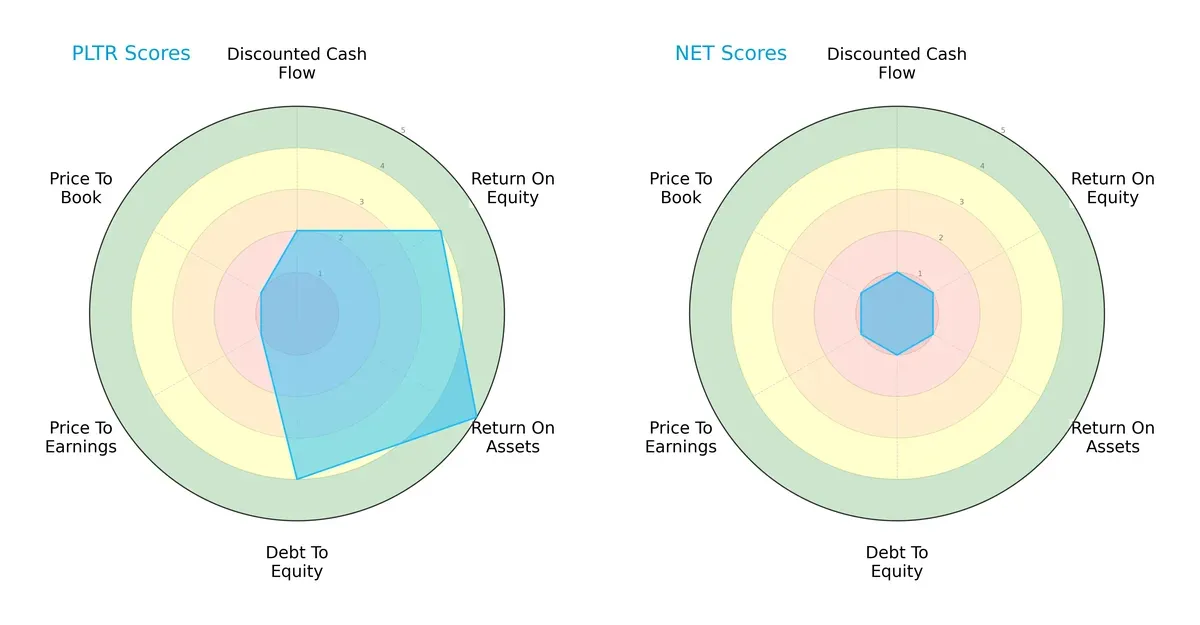

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Palantir Technologies Inc. and Cloudflare, Inc., highlighting their financial and valuation contrasts:

Palantir shows a balanced strength in ROE (4) and ROA (5), signaling efficient profit and asset use. Its debt-to-equity score (4) indicates prudent leverage management. However, Palantir’s valuation scores (PE and PB at 1) suggest it trades at a premium or faces market skepticism. Cloudflare scores uniformly low (all 1s), reflecting weaknesses across profitability, leverage, and valuation metrics. Palantir clearly has the more robust and balanced profile, while Cloudflare relies on less favorable fundamentals.

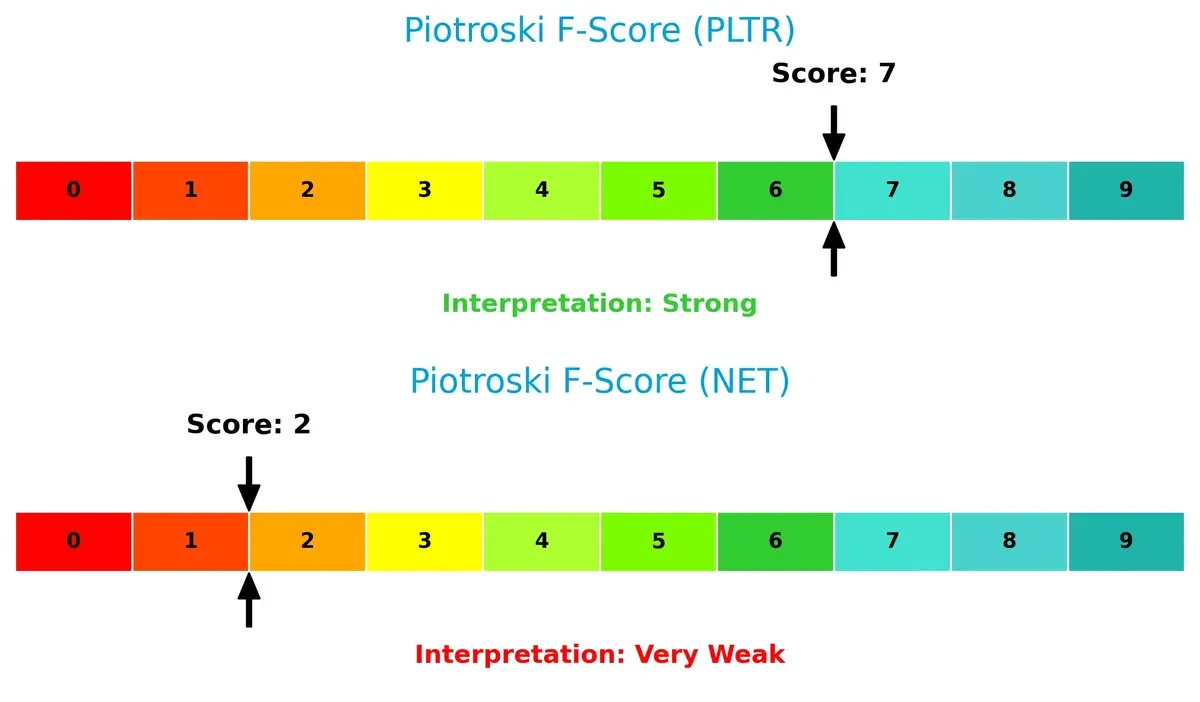

Bankruptcy Risk: Solvency Showdown

Palantir’s Altman Z-Score (145.6) far exceeds Cloudflare’s (9.2), confirming both firms remain in the safe zone but Palantir’s solvency is exceptionally strong. This gap implies Palantir is structurally more resilient for long-term survival in volatile market cycles:

Financial Health: Quality of Operations

Palantir’s Piotroski F-Score of 7 indicates strong financial health, showing solid profitability and operational efficiency. In contrast, Cloudflare’s score of 2 signals red flags in internal metrics, cautioning investors on its operational risks and weaker fundamentals:

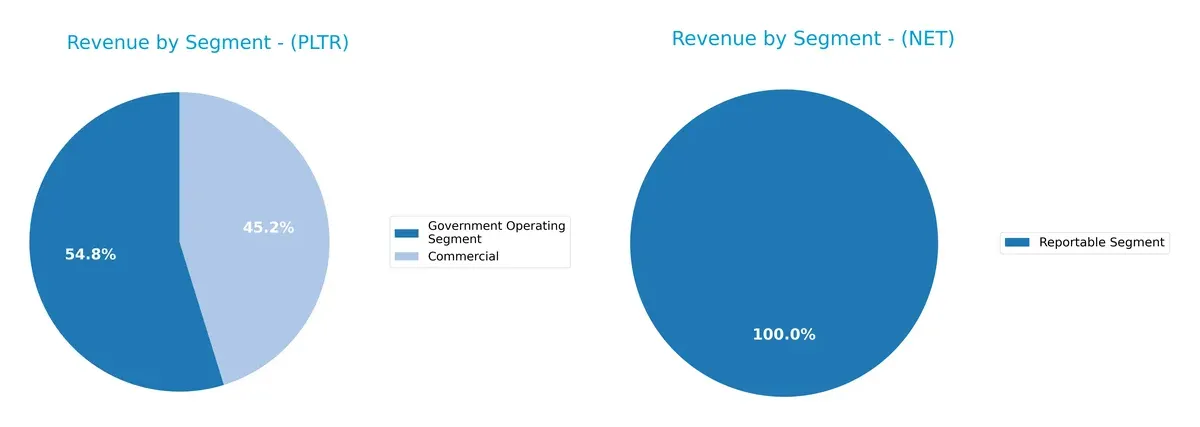

How are the two companies positioned?

This section dissects the operational DNA of Palantir and Cloudflare by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and reveal which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This comparison breaks down how Palantir Technologies and Cloudflare diversify their revenues and highlights their primary sector dependencies:

Palantir shows a clear two-segment split, with $1.57B from Government and $1.30B from Commercial in 2024. This mix reflects a strategic balance between stable government contracts and growing commercial ventures. Cloudflare reports a single $1.67B segment, indicating reliance on one core business line. Palantir’s diversification reduces concentration risk, while Cloudflare’s focus may yield scale advantages but invites vulnerability to market shifts.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Palantir Technologies Inc. (PLTR) and Cloudflare, Inc. (NET):

PLTR Strengths

- Strong net margin at 16.13%

- Very low debt-to-equity at 0.05

- High quick ratio at 5.96

- Growing diversified revenue from government and commercial segments

- Significant US and UK revenue base

NET Strengths

- Favorable P/E ratio despite losses

- Balanced geographic revenue including US, EMEA, and Asia Pacific

- Current and quick ratios at 2.86 support liquidity

- Neutral asset turnover indicates efficient asset use

- Diversified global footprint

PLTR Weaknesses

- Unfavorable ROE at 9.24%

- Very high P/E at 368.2 and P/B at 34.01

- Unavailable WACC hinders cost of capital assessment

- Unfavorable asset turnover at 0.45

- No dividend yield

- Revenue concentrated in two segments and mainly US

NET Weaknesses

- Negative net margin (-4.72%), ROE (-7.53%), ROIC (-6.06%)

- High debt-to-equity at 1.4

- Unfavorable interest coverage (-12.64)

- Unfavorable P/B at 35.14

- No dividend yield

- Single reportable segment limits diversification

Both companies show distinct profiles: PLTR benefits from strong profitability and low leverage but faces valuation and diversification limits. NET demonstrates global reach and liquidity but struggles with consistent profitability and high leverage. These contrasts highlight differing strategic priorities and risk exposures.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only barrier guarding long-term profits from relentless competition. Let’s dissect how these two tech firms defend their turf:

Palantir Technologies Inc.: Data Integration Switching Costs

Palantir’s moat stems from high switching costs embedded in its data integration platforms. Its 36% net margin and soaring revenue growth confirm robust profitability. Ongoing AI enhancements in 2026 promise to deepen this advantage.

Cloudflare, Inc.: Network Effects & Security Ecosystem

Cloudflare’s competitive edge lies in its expansive cloud security network, benefiting from powerful network effects. Despite current negative margins, improving EBIT signals strengthening economics. Expansion into new security domains could disrupt markets further.

The Verdict: Switching Costs vs. Network Effects Battle

Palantir’s deep switching cost moat outmatches Cloudflare’s still-maturing network effects. Palantir’s superior margins and explosive growth better equip it to defend market share against rising competition.

Which stock offers better returns?

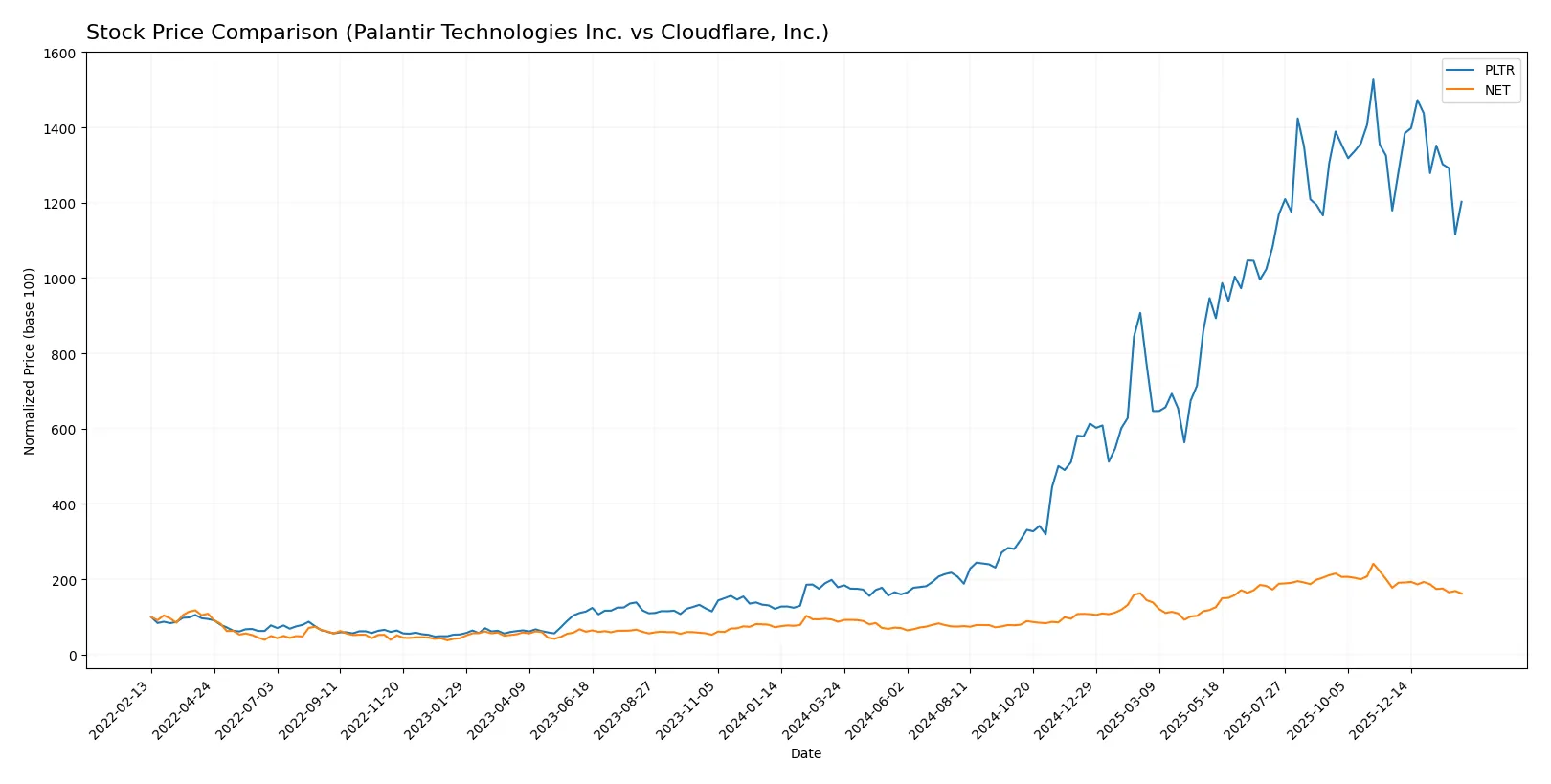

Over the past 12 months, Palantir Technologies and Cloudflare exhibited strong bullish trends, with Palantir showing a more pronounced price surge and decelerating momentum.

Trend Comparison

Palantir Technologies gained 572.12% over the last year, marking a bullish trend with decelerating acceleration. Its price ranged from 20.47 to a high of 200.47.

Cloudflare’s stock rose 85.93% in the same period, also bullish but with deceleration. Its highest and lowest prices were 253.3 and 67.69, respectively.

Palantir outperformed Cloudflare with significantly higher returns over 12 months, despite both showing decelerating upward trends.

Target Prices

Analysts present a bullish consensus for Palantir Technologies Inc. and Cloudflare, Inc., indicating strong upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Palantir Technologies Inc. | 180 | 230 | 198.8 |

| Cloudflare, Inc. | 210 | 300 | 247.75 |

Both stocks trade well below consensus targets, suggesting room for price appreciation based on current analyst expectations. Palantir’s target is about 26% above its $158 price, while Cloudflare’s consensus target exceeds its $170 price by 45%.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Palantir Technologies Inc. Grades

The following table summarizes recent institutional grades for Palantir Technologies Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-03 |

| DA Davidson | Maintain | Neutral | 2026-02-03 |

| UBS | Maintain | Neutral | 2026-02-03 |

| Citigroup | Upgrade | Buy | 2026-01-12 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

| Piper Sandler | Maintain | Overweight | 2025-11-04 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-04 |

| UBS | Maintain | Neutral | 2025-11-04 |

| Goldman Sachs | Maintain | Neutral | 2025-11-04 |

| Mizuho | Maintain | Neutral | 2025-11-04 |

Cloudflare, Inc. Grades

The following table summarizes recent institutional grades for Cloudflare, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2026-01-21 |

| Citigroup | Maintain | Buy | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-11-10 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Susquehanna | Maintain | Neutral | 2025-11-03 |

| Citizens | Maintain | Market Outperform | 2025-10-31 |

| Scotiabank | Maintain | Sector Perform | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Which company has the best grades?

Cloudflare holds generally stronger grades, including multiple Buy and Outperform ratings from reputable firms. Palantir’s ratings lean neutral with fewer Buy endorsements. This suggests investors may view Cloudflare as having better near-term growth prospects.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Palantir Technologies Inc. and Cloudflare, Inc. in the 2026 market environment:

1. Market & Competition

Palantir Technologies Inc.

- Faces intense competition in software infrastructure with a strong foothold in government contracts.

Cloudflare, Inc.

- Competes aggressively in cloud security and performance, battling larger cloud providers and niche startups.

2. Capital Structure & Debt

Palantir Technologies Inc.

- Maintains a very low debt-to-equity ratio (0.05), indicating strong balance sheet discipline.

Cloudflare, Inc.

- Carries high leverage (debt-to-equity 1.4), increasing financial risk and interest expenses.

3. Stock Volatility

Palantir Technologies Inc.

- Exhibits beta of 1.687, reflecting moderate stock volatility relative to the market.

Cloudflare, Inc.

- Shows higher beta at 1.98, indicating greater price swings and investor risk.

4. Regulatory & Legal

Palantir Technologies Inc.

- Subject to scrutiny over data privacy and government surveillance contracts.

Cloudflare, Inc.

- Faces regulatory challenges related to cybersecurity standards and data protection laws globally.

5. Supply Chain & Operations

Palantir Technologies Inc.

- Operates primarily software platforms with limited physical supply chain risks.

Cloudflare, Inc.

- Relies on global data center networks, vulnerable to hardware shortages and infrastructure disruptions.

6. ESG & Climate Transition

Palantir Technologies Inc.

- ESG initiatives less prominent; government contracts may attract scrutiny on ethical grounds.

Cloudflare, Inc.

- Increasing focus on sustainable cloud infrastructure but still exposed to energy consumption concerns.

7. Geopolitical Exposure

Palantir Technologies Inc.

- High exposure due to international intelligence and defense contracts.

Cloudflare, Inc.

- Moderate geopolitical risks linked to global internet infrastructure and cross-border data flows.

Which company shows a better risk-adjusted profile?

Palantir’s strongest risk is geopolitical exposure due to its deep ties with government intelligence, which can invite volatility but benefits from long-term contracts. Cloudflare’s largest risk lies in its stretched capital structure and high leverage, heightening bankruptcy risk. Palantir’s Altman Z-score (145.6) and Piotroski score (7) confirm robust financial health, while Cloudflare’s weaker scores (Altman Z 9.2; Piotroski 2) signal vulnerability. Palantir thus offers a superior risk-adjusted profile, bolstered by conservative debt levels and stable cash flow, despite regulatory and market pressures.

Final Verdict: Which stock to choose?

Palantir’s superpower lies in its ability to generate rapid revenue and profit growth, fueled by strong operational efficiency and a robust cash conversion cycle. Its high valuation multiples and stretched current ratio are points of vigilance. This stock suits portfolios aiming for aggressive growth with tolerance for premium pricing.

Cloudflare boasts a strategic moat through its entrenched cloud security and network services platform, offering recurring revenue safety. Compared to Palantir, it presents a more cautious financial profile but carries elevated debt levels and margin pressures. It fits best in GARP portfolios seeking steady growth with moderate risk.

If you prioritize high growth and can stomach valuation premiums, Palantir outshines with accelerating profitability and cash flow. However, if you seek more stability and a defensible market position, Cloudflare offers better resilience despite current profitability challenges. Both require careful risk management, aligned with your growth tolerance and portfolio strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Palantir Technologies Inc. and Cloudflare, Inc. to enhance your investment decisions: