In the rapidly evolving software infrastructure sector, Cloudflare, Inc. (NET) and MongoDB, Inc. (MDB) stand out as innovative leaders shaping the future of cloud services and database management. Both companies operate at the intersection of cloud technology and enterprise solutions, catering to global businesses with cutting-edge platforms. This article will analyze their strengths and market positions to help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Cloudflare and MongoDB by providing an overview of these two companies and their main differences.

Cloudflare Overview

Cloudflare, Inc. operates as a cloud services provider focused on delivering integrated cloud-based security solutions and performance enhancements. Its offerings include cloud firewall, bot management, DDoS protection, and content delivery services, catering to a diverse range of industries such as technology, healthcare, financial services, and government. Founded in 2009, Cloudflare is headquartered in San Francisco and has a market capitalization of approximately 64.5B USD.

MongoDB Overview

MongoDB, Inc. provides a general-purpose database platform, including MongoDB Enterprise Advanced for enterprise use, MongoDB Atlas as a multi-cloud database-as-a-service, and a free Community Server version. The company also offers consulting and training services. Established in 2007 and based in New York City, MongoDB serves global customers and has a market capitalization near 32.5B USD, positioning itself as a leader in database infrastructure.

Key similarities and differences

Both Cloudflare and MongoDB operate in the software infrastructure industry, offering cloud-related technology solutions. While Cloudflare focuses on cloud security and network performance services, MongoDB specializes in database platforms and management. Each company serves enterprise clients with scalable cloud solutions but differs in their core offerings: Cloudflare emphasizes security and content delivery, whereas MongoDB centers on database technology and services.

Income Statement Comparison

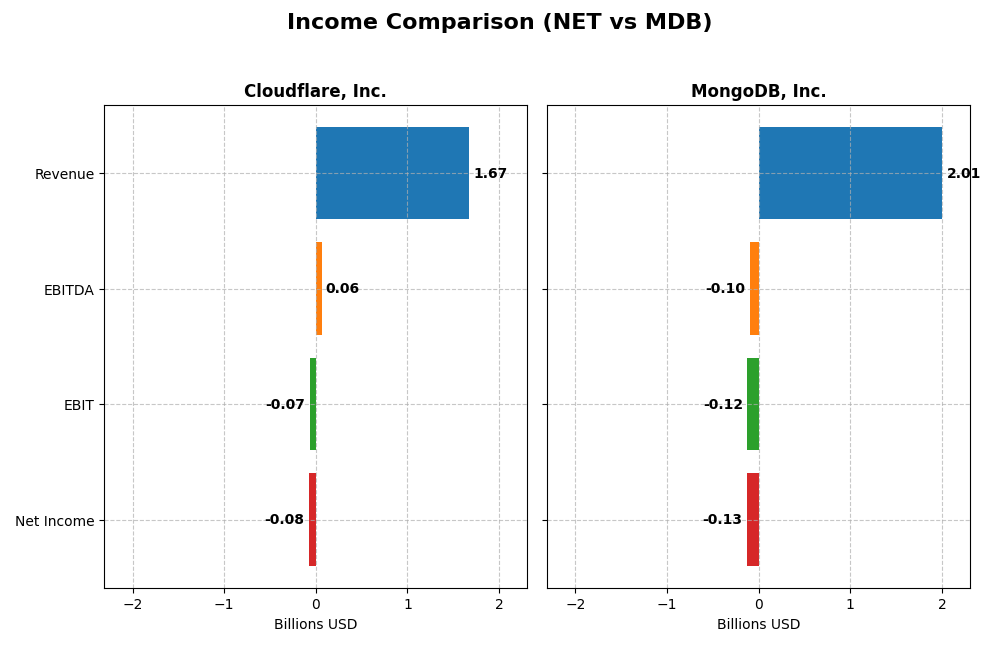

This table compares key income statement metrics for Cloudflare, Inc. and MongoDB, Inc. based on their most recent reported fiscal years.

| Metric | Cloudflare, Inc. (NET) | MongoDB, Inc. (MDB) |

|---|---|---|

| Market Cap | 64.5B | 32.5B |

| Revenue | 1.67B | 2.01B |

| EBITDA | 62.0M | -96.5M |

| EBIT | -65.7M | -123.5M |

| Net Income | -78.8M | -129.1M |

| EPS | -0.23 | -1.73 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Cloudflare, Inc.

Cloudflare experienced strong revenue growth from 2020 to 2024, increasing from $431M to $1.67B, with net income losses narrowing from -$119M to -$79M. Gross margins remained robust at 77.32%, while net and EBIT margins stayed negative but improved significantly in 2024. The latest year showed marked margin expansion and a revenue surge of almost 29%, reflecting operational progress.

MongoDB, Inc.

MongoDB’s revenue rose impressively from $590M in 2021 to $2.01B in 2025, with net losses decreasing from -$267M to -$129M. Gross margin held favorably at 73.32%, while EBIT and net margins were negative but improved in 2025. The company posted a 19% revenue increase in the last year, alongside better profitability metrics, indicating positive growth momentum and margin recovery.

Which one has the stronger fundamentals?

Both companies display favorable revenue growth and improving margins, with Cloudflare showing a higher gross margin and a sharper net income improvement in 2024. MongoDB, while growing its top line faster overall, maintains slightly lower margins and larger net losses. Each exhibits strengths in margin trends and growth, reflecting solid but still developing fundamentals for investors to consider.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Cloudflare, Inc. and MongoDB, Inc. based on the most recent fiscal year data available.

| Ratios | Cloudflare, Inc. (NET) 2024 | MongoDB, Inc. (MDB) 2025 |

|---|---|---|

| ROE | -7.53% | -4.64% |

| ROIC | -6.06% | -7.36% |

| P/E | -466.54 | -157.88 |

| P/B | 35.14 | 7.32 |

| Current Ratio | 2.86 | 5.20 |

| Quick Ratio | 2.86 | 5.20 |

| D/E (Debt-to-Equity) | 1.40 | 0.01 |

| Debt-to-Assets | 44.32% | 1.06% |

| Interest Coverage | -29.78 | -26.70 |

| Asset Turnover | 0.51 | 0.58 |

| Fixed Asset Turnover | 2.63 | 24.78 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Cloudflare, Inc.

Cloudflare shows predominantly unfavorable ratios, with negative net margin (-4.72%), ROE (-7.53%), and ROIC (-6.06%), indicating profitability and capital efficiency challenges. The current and quick ratios are favorable at 2.86, reflecting good short-term liquidity, but debt-to-equity at 1.4 is concerning. The firm does not pay dividends, likely due to ongoing losses and reinvestment strategies.

MongoDB, Inc.

MongoDB’s ratios also reflect financial strain, with negative net margin (-6.43%), ROE (-4.64%), and ROIC (-7.36%). The quick ratio is favorable at 5.2, and debt-to-equity is very low at 0.01, suggesting minimal leverage. However, the current ratio is considered unfavorable. MongoDB does not pay dividends, consistent with its reinvestment focus amid losses and growth initiatives.

Which one has the best ratios?

Both companies exhibit unfavorable overall ratio profiles, with MongoDB having a slightly better balance of favorable metrics, including lower leverage and stronger fixed asset turnover, while Cloudflare maintains better liquidity ratios. Neither company generates positive net income or pays dividends, reflecting ongoing investment and profitability challenges in this sector.

Strategic Positioning

This section compares the strategic positioning of Cloudflare, Inc. and MongoDB, Inc. focusing on Market position, Key segments, and disruption:

Cloudflare, Inc.

- Market position and competitive pressure

- Key segments and business drivers

- Exposure to technological disruption

MongoDB, Inc.

- Large cloud services provider with diversified cloud security and performance solutions worldwide.

- Integrated cloud-based security, performance, reliability, and developer solutions across multiple industries.

- Operates in evolving cloud infrastructure with security and network innovations; faces intense competition.

Cloudflare, Inc. vs MongoDB, Inc. Positioning

Cloudflare’s approach is diversified across security, performance, and developer tools serving multiple sectors, while MongoDB concentrates on database solutions with growing cloud service revenue. Cloudflare benefits from broad industry reach; MongoDB leverages focused product innovation.

Which has the best competitive advantage?

Both companies are currently shedding value despite growing profitability. Their ROIC remains below WACC, indicating slightly unfavorable economic moats, but improving trends suggest potential future strengthening of competitive advantages.

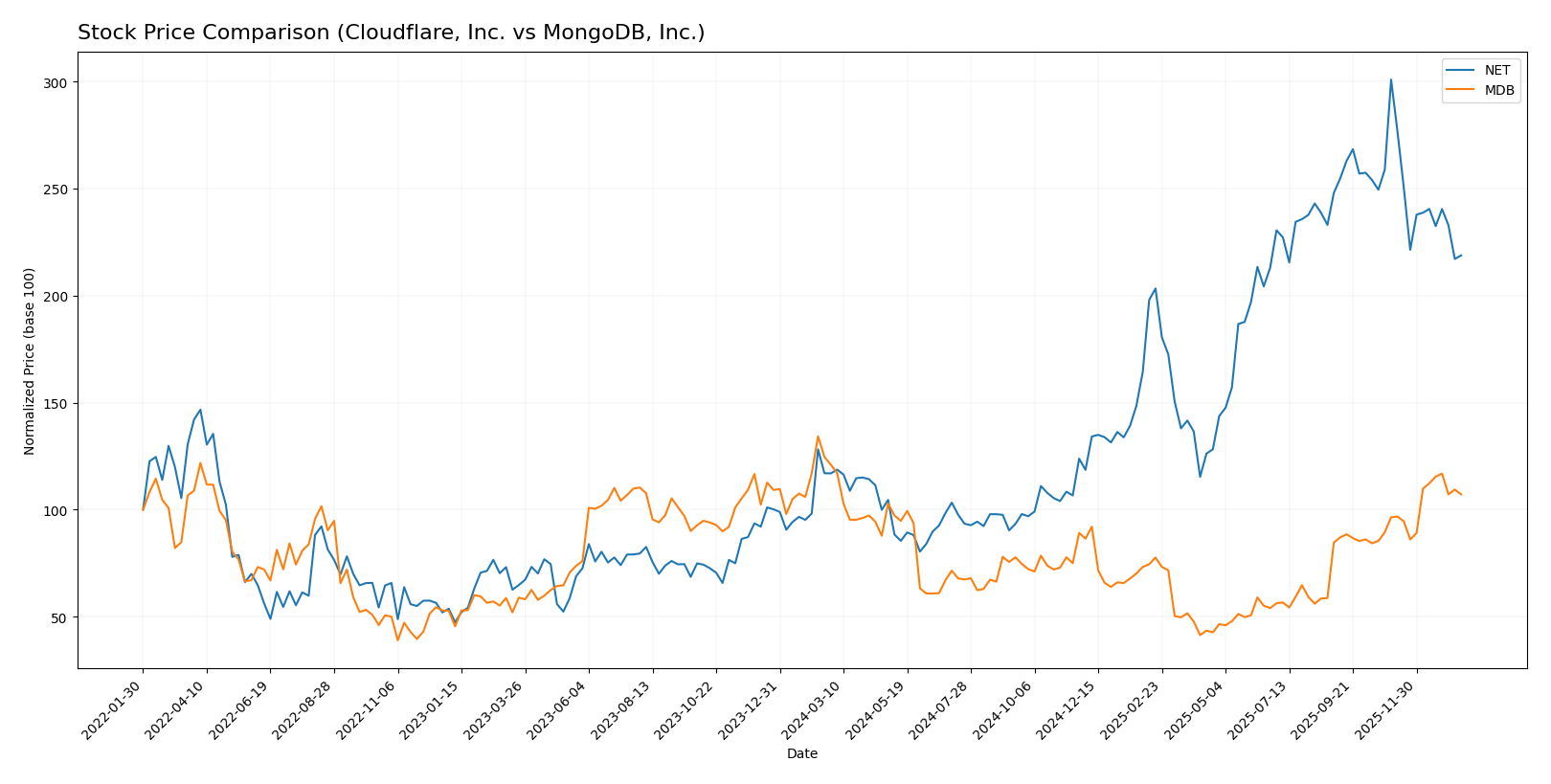

Stock Comparison

The stock price movements of Cloudflare, Inc. and MongoDB, Inc. over the past 12 months reveal contrasting trajectories, with Cloudflare showing strong gains despite recent pullbacks and MongoDB experiencing an overall decline but recent recovery signs.

Trend Analysis

Cloudflare, Inc. (NET) recorded an 87.07% price increase over the past year, indicating a bullish trend with deceleration. The stock ranged from 67.69 to 253.3, with recent months showing a -27.29% pullback.

MongoDB, Inc. (MDB) saw an 11.46% decline over the same period, marking a bearish trend with acceleration. Prices fluctuated between 154.39 and 451.52, though the recent trend is positive with an 11.1% rise.

Comparing both, Cloudflare delivered the highest market performance with a strong overall gain, whereas MongoDB’s year-long performance remains negative despite recent upward momentum.

Target Prices

Analysts present optimistic target prices for both Cloudflare, Inc. and MongoDB, Inc., indicating potential upside from current levels.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 300 | 210 | 248.86 |

| MongoDB, Inc. | 500 | 375 | 445.2 |

The consensus target prices for Cloudflare and MongoDB suggest expected gains of approximately 35% and 11%, respectively, compared to their current prices of 184.17 and 399.76 USD. Overall, analysts show confidence in both stocks’ growth potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cloudflare, Inc. and MongoDB, Inc.:

Rating Comparison

Cloudflare, Inc. Rating

- Rating: D+ indicating a very favorable overall rating despite low scores

- Discounted Cash Flow Score: 1, very unfavorable, indicating potential overvaluation or weak cash flow projections

- ROE Score: 1, very unfavorable, showing low efficiency in generating profits from equity

- ROA Score: 1, very unfavorable, indicating poor asset utilization

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk

- Overall Score: 1, very unfavorable, summarizing weak financial standing

MongoDB, Inc. Rating

- Rating: C reflecting a very favorable overall rating with moderate scores

- Discounted Cash Flow Score: 2, moderate, suggesting a fairer valuation based on cash flow

- ROE Score: 1, very unfavorable, also showing low efficiency in equity profit generation

- ROA Score: 1, very unfavorable, indicating similarly poor asset utilization

- Debt To Equity Score: 4, favorable, reflecting stronger financial stability and lower debt risk

- Overall Score: 2, moderate, indicating a somewhat better financial position

Which one is the best rated?

Based solely on the provided data, MongoDB, Inc. holds a better rating with a C versus Cloudflare’s D+, and outperforms notably in debt-to-equity and overall scores, suggesting comparatively stronger financial stability.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Cloudflare and MongoDB:

Cloudflare Scores

- Altman Z-Score: 9.47, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 2, classified as very weak financial strength.

MongoDB Scores

- Altman Z-Score: 30.24, well into the safe zone, showing very low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

Which company has the best scores?

MongoDB has a significantly higher Altman Z-Score and a better Piotroski Score, indicating stronger overall financial health compared to Cloudflare based on the provided data.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Cloudflare, Inc. and MongoDB, Inc.:

Cloudflare, Inc. Grades

The table below shows recent grades from established grading companies for Cloudflare, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-11-10 |

| Susquehanna | Maintain | Neutral | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Cloudflare’s grades predominantly indicate a stable Buy to Neutral consensus with multiple firms maintaining Buy ratings.

MongoDB, Inc. Grades

Below are the recent grades from credible grading firms for MongoDB, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

MongoDB’s grades largely reflect strong Buy and Overweight ratings, with an Outperform grade also evident, indicating robust confidence from analysts.

Which company has the best grades?

MongoDB, Inc. has received consistently stronger grades such as Buy, Overweight, and Outperform compared to Cloudflare’s mix of Buy and Neutral ratings. This pattern may suggest higher analyst confidence in MongoDB’s outlook, potentially impacting investor sentiment accordingly.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Cloudflare, Inc. (NET) and MongoDB, Inc. (MDB) based on the latest available data.

| Criterion | Cloudflare, Inc. (NET) | MongoDB, Inc. (MDB) |

|---|---|---|

| Diversification | Primarily focused on cloud security and CDN services, moderate product range | Broad product segmentation with MongoDB Atlas, other subscriptions, and services |

| Profitability | Negative net margin (-4.72%) and ROIC (-6.06%), indicating current unprofitability | Negative net margin (-6.43%) and ROIC (-7.36%), also currently unprofitable |

| Innovation | Continual growth in ROIC suggests improving efficiency despite value loss | Strong ROIC growth (62.87%), reflecting innovation and increasing profitability potential |

| Global presence | Significant global footprint with 1.67B USD revenue in FY 2024 | Global reach with 2.0B USD total revenue across segments in FY 2025 |

| Market Share | Established player in CDN and security markets but with value destruction | Growing market share in database services, especially cloud-based solutions |

Key takeaways: Both companies are currently shedding value but show promising ROIC growth, indicating improving operational efficiency. MongoDB’s diversified revenue streams and strong innovation edge position it well for future growth, while Cloudflare’s focus remains narrower with ongoing profitability challenges.

Risk Analysis

Below is a comparative table summarizing key risks for Cloudflare, Inc. (NET) and MongoDB, Inc. (MDB) based on the most recent data available (2024 for NET and 2025 for MDB):

| Metric | Cloudflare, Inc. (NET) | MongoDB, Inc. (MDB) |

|---|---|---|

| Market Risk | High beta at 1.97 increases volatility risk | Moderate beta at 1.38, less volatile than NET |

| Debt level | Debt-to-equity ratio of 1.4 indicates higher leverage risk | Very low debt-to-equity ratio at 0.01, low leverage risk |

| Regulatory Risk | Moderate, technology sector faces evolving data/privacy laws | Moderate, with cloud services subject to regulatory scrutiny |

| Operational Risk | Complex cloud infrastructure may face service disruptions | Cloud database service dependent on uptime and security |

| Environmental Risk | Low direct impact, but energy use in data centers may attract scrutiny | Similar to NET, limited direct exposure but energy consumption relevant |

| Geopolitical Risk | Moderate, global cloud network exposed to international tensions | Moderate, reliance on multi-cloud environments affected by geopolitical issues |

The most likely and impactful risks for these companies center on market volatility and operational challenges, especially given Cloudflare’s higher beta and significant leverage. Both firms face evolving regulatory landscapes in data security and privacy, which could impact compliance costs and operations. Cloudflare’s debt level and negative profitability metrics warrant cautious risk management. MongoDB shows stronger balance sheet stability but still struggles with negative margins and operational efficiency.

Which Stock to Choose?

Cloudflare, Inc. (NET) has shown strong revenue growth of 28.76% in 2024 with an 85.71% favorable income statement evaluation. However, its profitability ratios remain unfavorable, with a negative ROE of -7.53% and a net margin of -4.72%. The company carries moderate debt (debt-to-equity 1.4) and has a very favorable rating of D+ but poor financial ratio status overall.

MongoDB, Inc. (MDB) reported 19.22% revenue growth in 2025 and also achieved an 85.71% favorable income statement evaluation. Profitability ratios are slightly better than NET’s but still negative, with ROE at -4.64% and net margin at -6.43%. MDB demonstrates low debt levels (debt-to-equity 0.01) and holds a favorable rating of C, though financial ratios are generally unfavorable.

For investors prioritizing growth, both companies exhibit improving profitability trends despite current negative returns. NET’s higher revenue growth and very favorable rating might appeal to those seeking aggressive expansion, while MDB’s stronger balance sheet and moderate rating could attract risk-conscious investors valuing financial stability. Ultimately, the choice might depend on tolerance for financial risks amid ongoing value destruction.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cloudflare, Inc. and MongoDB, Inc. to enhance your investment decisions: