Cloudflare, Inc. (NET) and GoDaddy Inc. (GDDY) both operate in the software infrastructure industry, each driving innovation in cloud services and online presence solutions. While Cloudflare focuses on advanced security and performance optimization, GoDaddy excels in domain registration and web hosting for small businesses. This comparison explores their market strategies and growth potential to help you identify which company could be the smarter choice for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Cloudflare and GoDaddy by providing an overview of these two companies and their main differences.

Cloudflare Overview

Cloudflare, Inc. operates as a cloud services provider delivering integrated cloud-based security solutions worldwide. Its offerings include cloud firewall, bot management, DDoS protection, and performance optimization for various platforms like public and private clouds, SaaS, and IoT devices. Founded in 2009 and based in San Francisco, Cloudflare serves sectors such as technology, healthcare, finance, and government with a market cap of 64.5B USD.

GoDaddy Overview

GoDaddy Inc. designs and develops cloud-based technology products, focusing on domain registration and website hosting services. Its portfolio includes shared and managed hosting, security tools, online marketing, e-commerce, and business applications such as Microsoft Office 365. Headquartered in Tempe since 2014, GoDaddy targets small businesses and individuals, holding a market cap of 14.5B USD.

Key similarities and differences

Both Cloudflare and GoDaddy operate within the software infrastructure industry, providing cloud-based solutions to enhance online presence and security. Cloudflare emphasizes integrated security and performance services across multiple platforms, while GoDaddy focuses more on domain registration, website hosting, marketing, and business productivity tools. Cloudflare’s larger market cap and emphasis on security contrast with GoDaddy’s broader suite of small business web services.

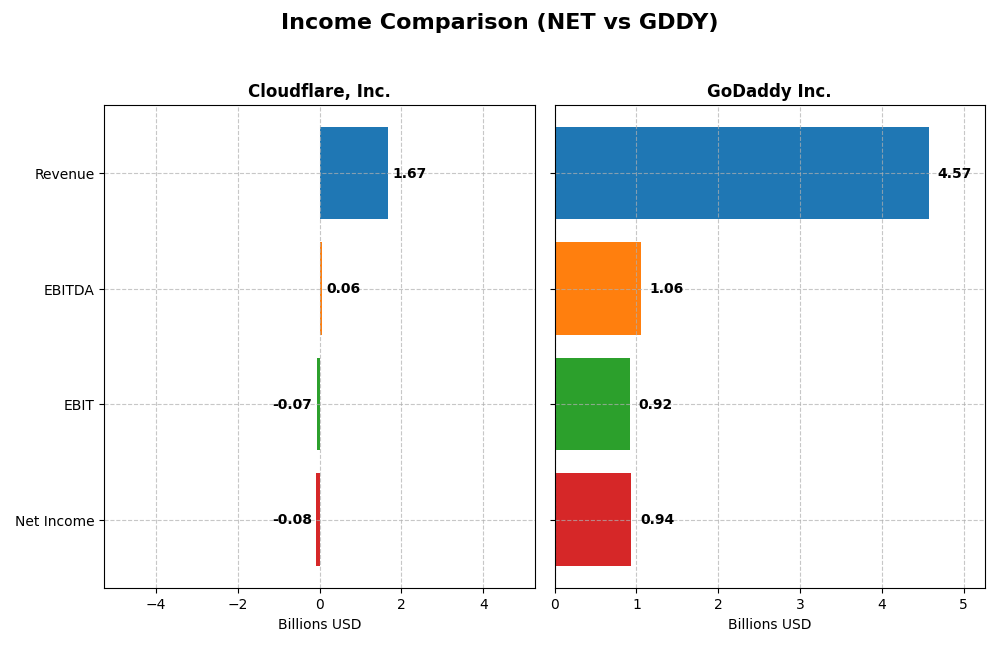

Income Statement Comparison

Below is a side-by-side comparison of key income statement metrics for Cloudflare, Inc. and GoDaddy Inc. based on their most recent fiscal year 2024 results.

| Metric | Cloudflare, Inc. (NET) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Cap | 64.5B | 14.5B |

| Revenue | 1.67B | 4.57B |

| EBITDA | 62M | 1.06B |

| EBIT | -66M | 924M |

| Net Income | -79M | 937M |

| EPS | -0.23 | 6.63 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Cloudflare, Inc.

Cloudflare’s revenue showed strong growth from 2020 to 2024, rising from $431M to $1.67B, with net income losses narrowing from -$119M to -$78.8M. Gross margins remained robust around 77%, but EBIT and net margins stayed negative, though improving. In 2024, the company posted a 28.8% revenue increase and significant margin improvements, signaling operational progress despite ongoing losses.

GoDaddy Inc.

GoDaddy’s revenue grew steadily from $3.32B in 2020 to $4.57B in 2024, accompanied by strong net income growth from a loss of -$495M to a profit of $937M. Margins improved with a stable gross margin near 64%, and EBIT and net margins remained positive and healthy. The latest year saw moderate revenue growth of 7.5%, with some margin contraction but sustained profitability.

Which one has the stronger fundamentals?

GoDaddy demonstrates stronger fundamentals with consistent profitability, positive EBIT and net margins, and significant net income growth over the period. Cloudflare exhibits rapid revenue expansion and margin improvements but continues to report net losses and negative operating income. Thus, GoDaddy’s stable earnings and margin profile contrast with Cloudflare’s growth-focused yet unprofitable performance.

Financial Ratios Comparison

The table below presents key financial ratios for Cloudflare, Inc. and GoDaddy Inc. based on their latest fiscal year data from 2024, facilitating a straightforward comparison for investors.

| Ratios | Cloudflare, Inc. (NET) | GoDaddy Inc. (GDDY) |

|---|---|---|

| ROE | -7.53% | 135.37% |

| ROIC | -6.06% | 16.02% |

| P/E | -466.54 | 29.76 |

| P/B | 35.14 | 40.28 |

| Current Ratio | 2.86 | 0.72 |

| Quick Ratio | 2.86 | 0.72 |

| D/E | 1.40 | 5.63 |

| Debt-to-Assets | 44.32% | 47.29% |

| Interest Coverage | -29.78 | 5.64 |

| Asset Turnover | 0.51 | 0.56 |

| Fixed Asset Turnover | 2.63 | 22.22 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Cloudflare, Inc.

Cloudflare exhibits mostly unfavorable financial ratios, with negative net margin (-4.72%) and return on equity (-7.53%), alongside a high price-to-book ratio (35.14). However, liquidity ratios like the current and quick ratios at 2.86 are strong. The company does not pay dividends, likely due to ongoing losses and a focus on reinvestment and growth.

GoDaddy Inc.

GoDaddy shows favorable profitability ratios, including a strong net margin of 20.49% and an exceptionally high return on equity of 135.37%. However, liquidity ratios are weak, with a current ratio of 0.72, and debt levels are relatively high (debt-to-equity of 5.63). The company also does not distribute dividends, probably prioritizing growth and internal investments.

Which one has the best ratios?

GoDaddy presents a more favorable profitability profile and interest coverage than Cloudflare, but weaker liquidity and higher leverage. Cloudflare has better liquidity but struggles with profitability and returns. Overall, GoDaddy’s ratios suggest stronger operational efficiency, while Cloudflare’s indicate caution due to persistent losses and financial stress.

Strategic Positioning

This section compares the strategic positioning of Cloudflare, Inc. and GoDaddy Inc., focusing on Market position, Key segments, and exposure to technological disruption:

Cloudflare, Inc.

- Holds a strong market cap of 64.5B in cloud services facing high competition in software infrastructure.

- Focuses on integrated cloud security, performance, reliability, and developer solutions across various industries.

- Faces disruption risks in cloud security and network infrastructure but offers diverse cloud-based products.

GoDaddy Inc.

- Market cap of 14.5B, competing in domain registration and hosting with moderate competitive pressure.

- Operates in domain registration, web hosting, marketing tools, and business applications targeting small businesses.

- Exposure to disruption mainly in web hosting and digital presence services with evolving marketing technologies.

Cloudflare, Inc. vs GoDaddy Inc. Positioning

Cloudflare’s strategy is diversified across cloud security, performance, and developer tools, while GoDaddy concentrates on domain registration, hosting, and marketing services. Cloudflare’s broader product scope offers varied revenue streams; GoDaddy’s focus targets small businesses with integrated digital presence solutions.

Which has the best competitive advantage?

GoDaddy shows a very favorable MOAT with growing ROIC above WACC, indicating durable competitive advantage and increasing profitability. Cloudflare has a slightly unfavorable MOAT with ROIC below WACC but improving profitability trends.

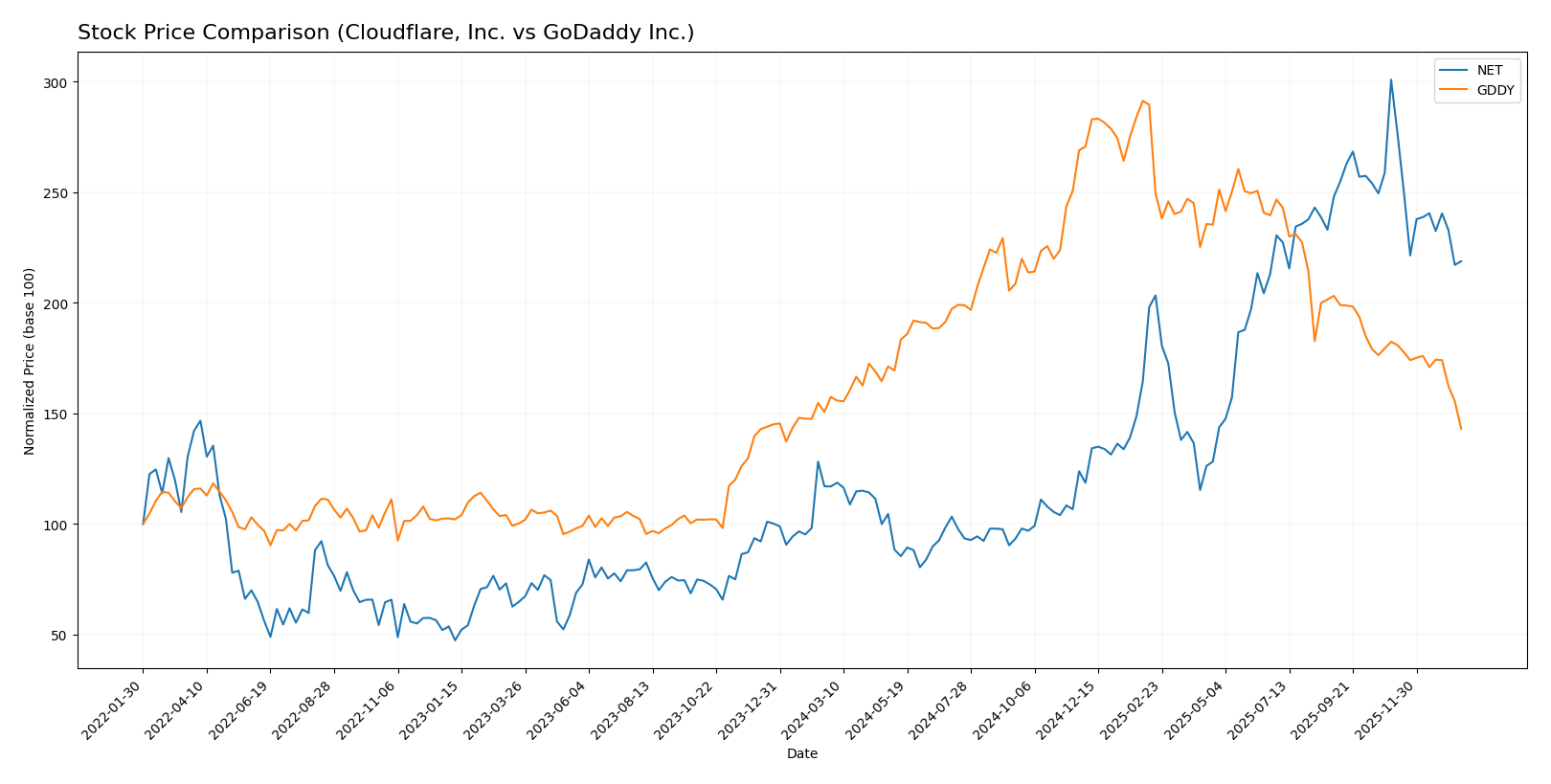

Stock Comparison

The stock price movements over the past 12 months reveal a strong bullish run for Cloudflare, Inc., contrasted by a sustained bearish trend for GoDaddy Inc., with both stocks experiencing deceleration in their trend momentum.

Trend Analysis

Cloudflare, Inc. (NET) exhibited an 87.07% price increase over the past year, indicating a bullish trend with decelerating momentum. The stock ranged from a low of 67.69 to a high of 253.3, showing significant volatility with a standard deviation of 52.73.

GoDaddy Inc. (GDDY) showed a -9.09% price change, reflecting a bearish trend and deceleration. The price fluctuated between 104.46 and 212.65 with a standard deviation of 27.35, signaling moderate volatility.

Comparing both, Cloudflare delivered the highest market performance with a strong positive return, while GoDaddy experienced a negative return over the same period.

Target Prices

The current analyst consensus suggests promising upside potential for these technology infrastructure companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 300 | 210 | 248.86 |

| GoDaddy Inc. | 182 | 70 | 143.33 |

Analysts expect Cloudflare’s stock to trade significantly above its current price of 184.17 USD, reflecting confidence in growth. GoDaddy’s consensus target at 143.33 USD also indicates potential appreciation from its current price of 104.46 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial grades for Cloudflare, Inc. and GoDaddy Inc.:

Rating Comparison

Cloudflare, Inc. Rating

- Rating: D+ indicating a very unfavorable outlook by analysts.

- Discounted Cash Flow Score: 1, considered very unfavorable.

- ROE Score: 1, indicating very unfavorable profitability from equity.

- ROA Score: 1, showing very unfavorable asset utilization.

- Debt To Equity Score: 1, marked as very unfavorable financial risk.

- Overall Score: 1, rated very unfavorable overall financial standing.

GoDaddy Inc. Rating

- Rating: B+ reflecting a very favorable outlook by analysts.

- Discounted Cash Flow Score: 5, considered very favorable.

- ROE Score: 5, indicating very favorable profitability from equity.

- ROA Score: 4, showing favorable asset utilization.

- Debt To Equity Score: 1, marked as very unfavorable financial risk.

- Overall Score: 3, rated as moderate overall financial standing.

Which one is the best rated?

Based on the provided data, GoDaddy holds a higher rating (B+) and superior scores in discounted cash flow, ROE, and ROA compared to Cloudflare’s D+ rating and uniformly low scores. However, both have the same low debt to equity score, reflecting similar financial risk levels.

Scores Comparison

The scores comparison between Cloudflare, Inc. and GoDaddy Inc. is as follows:

Cloudflare, Inc. Scores

- Altman Z-Score: 9.47, indicating a safe zone status.

- Piotroski Score: 2, categorized as very weak financial strength.

GoDaddy Inc. Scores

- Altman Z-Score: 1.53, indicating a distress zone.

- Piotroski Score: 8, categorized as very strong financial strength.

Which company has the best scores?

Cloudflare shows a very strong Altman Z-Score in the safe zone, while GoDaddy’s Altman score is in distress. Conversely, GoDaddy has a very strong Piotroski Score, compared to Cloudflare’s very weak Piotroski rating.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Cloudflare, Inc. and GoDaddy Inc.:

Cloudflare, Inc. Grades

The table below summarizes recent grades from reputable financial institutions for Cloudflare, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-11-10 |

| Susquehanna | Maintain | Neutral | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Cloudflare shows a balanced trend with multiple “Buy” and “Neutral” ratings, indicating moderate confidence from analysts.

GoDaddy Inc. Grades

The following table presents recent grades from established grading firms for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

GoDaddy’s ratings range from “Hold” to “Buy” with some “Equal Weight” and “Neutral,” reflecting cautious but generally positive analyst views.

Which company has the best grades?

Both Cloudflare and GoDaddy carry a consensus “Buy” rating, but Cloudflare has a higher concentration of “Buy” grades from top firms, while GoDaddy includes more “Hold” and “Neutral” ratings. This difference may impact investor perception of growth potential and risk tolerance.

Strengths and Weaknesses

Below is a comparison table highlighting the main strengths and weaknesses of Cloudflare, Inc. (NET) and GoDaddy Inc. (GDDY) based on recent financial and operational data:

| Criterion | Cloudflare, Inc. (NET) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Diversification | Moderate: Single main segment with $1.67B revenue | High: Multiple segments with $4.57B total revenue (Core Platform $2.92B, Applications & Commerce $1.65B) |

| Profitability | Weak: Negative net margin (-4.72%), ROIC -6.06% | Strong: Net margin 20.49%, ROIC 16.02% |

| Innovation | Growing ROIC trend (+22%), indicating improving efficiency | Strong innovation with very favorable moat and ROIC growth (+147%) |

| Global presence | Solid but less diversified internationally | Large global presence with diverse product offerings |

| Market Share | Challenged: Shedding value, slightly unfavorable moat | Strong: Creating value, very favorable moat rating |

In summary, GoDaddy exhibits stronger profitability, diversification, and a durable competitive advantage, while Cloudflare shows improving innovation but continues to struggle with profitability and value creation. Investors should weigh GoDaddy’s robust financials against Cloudflare’s growth potential and ongoing operational improvements.

Risk Analysis

Below is a comparative table of key risks for Cloudflare, Inc. (NET) and GoDaddy Inc. (GDDY) based on 2024 financial and operational data:

| Metric | Cloudflare, Inc. (NET) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Risk | High (Beta 1.97, volatile price range $89-$260) | Moderate (Beta 0.95, price range $104-$216) |

| Debt level | Moderate (Debt-to-Equity 1.4, Interest coverage negative) | High (Debt-to-Equity 5.63, Interest coverage positive) |

| Regulatory Risk | Moderate (Tech sector, global data security regulations) | Moderate (Domain and hosting services, data privacy laws) |

| Operational Risk | Moderate (Cloud infrastructure, security threats) | Moderate (Platform reliability, customer service) |

| Environmental Risk | Low (Technology sector, limited direct exposure) | Low (Technology sector, limited direct exposure) |

| Geopolitical Risk | Moderate (Global cloud services exposure) | Moderate (International customer base) |

The most impactful risks are Cloudflare’s high market volatility and negative interest coverage, signaling financial strain despite solid liquidity. GoDaddy carries high debt burden but maintains positive interest coverage. Both face regulatory and geopolitical risks typical of global tech firms. Investors should weigh Cloudflare’s financial weakness against GoDaddy’s leverage risk.

Which Stock to Choose?

Cloudflare, Inc. (NET) shows strong revenue growth of 287% over 2020-2024 with favorable income statement metrics despite negative profitability ratios. Its financial ratios are mostly unfavorable, including a negative return on equity and high debt levels. The company’s rating is very unfavorable, though it maintains a safe Altman Z-Score and a slightly unfavorable moat due to value destruction but improving profitability.

GoDaddy Inc. (GDDY) presents moderate revenue growth of 38% and generally favorable profitability with strong return on equity and return on invested capital. Financial ratios are mixed, balancing favorable returns and interest coverage against high debt and weak liquidity ratios. Its rating is moderate, with a distress zone Altman Z-Score but a strong Piotroski Score and a very favorable moat reflecting durable competitive advantage.

Investors focused on growth may find Cloudflare’s rapid income expansion and improving profitability appealing despite risks, while those prioritizing financial stability and value creation might view GoDaddy’s solid returns and competitive moat as more favorable. The contrasting financial profiles suggest the choice could depend on an investor’s risk tolerance and strategic emphasis.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cloudflare, Inc. and GoDaddy Inc. to enhance your investment decisions: