In the rapidly evolving software infrastructure sector, CrowdStrike Holdings, Inc. (CRWD) and Cloudflare, Inc. (NET) stand out as two influential players driving innovation in cybersecurity and cloud services. Both companies serve global markets with advanced cloud-delivered security solutions, yet they approach their strategies differently, from endpoint protection to integrated cloud networks. This article will explore their strengths and risks to help you identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike and Cloudflare by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. focuses on cloud-delivered protection for endpoints, cloud workloads, identity, and data. Its Falcon platform offers threat intelligence, managed security services, IT operations management, and Zero Trust identity protection. Founded in 2011 and based in Austin, Texas, CrowdStrike primarily sells subscriptions through a direct sales team and channel partners, serving customers globally in the software infrastructure industry.

Cloudflare Overview

Cloudflare, Inc. operates as a cloud services provider delivering integrated security solutions for public, private, and hybrid clouds, as well as SaaS and IoT devices. Its offerings include cloud firewall, DDoS protection, content delivery, and developer tools. Founded in 2009 and headquartered in San Francisco, Cloudflare serves diverse industries worldwide, emphasizing both security and performance under its software infrastructure segment.

Key similarities and differences

Both CrowdStrike and Cloudflare operate in the software infrastructure sector, focusing on cloud-based security solutions for a global customer base. While CrowdStrike specializes in endpoint and identity protection through its Falcon platform, Cloudflare provides a broader suite of services including security, performance optimization, and developer tools. CrowdStrike employs over 10K staff, more than twice Cloudflare’s workforce of 4.4K, reflecting different scale and operational focuses.

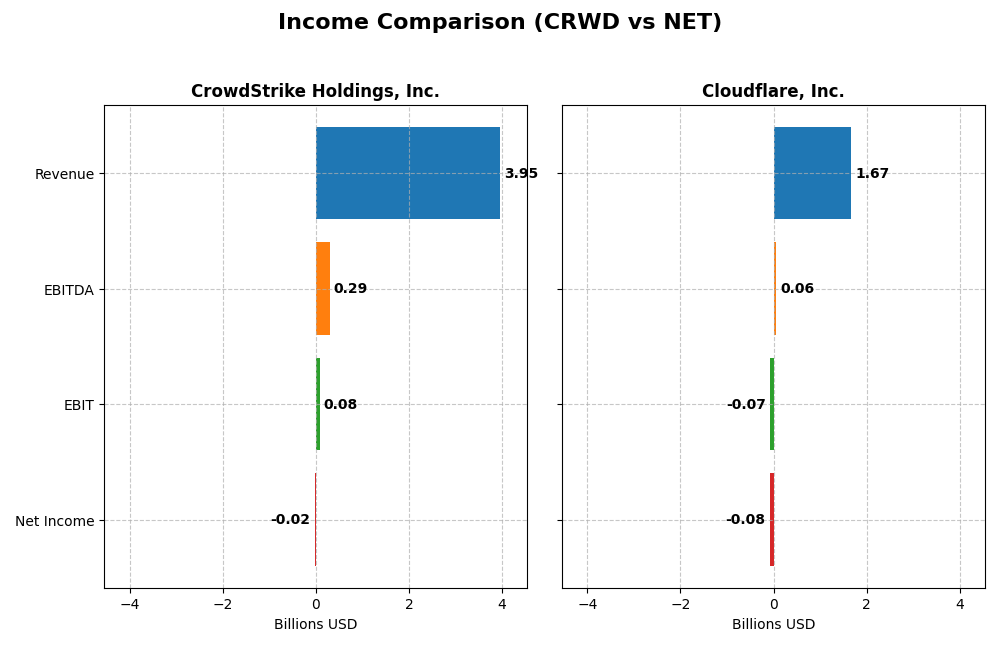

Income Statement Comparison

The table below compares the most recent fiscal year income statement metrics for CrowdStrike Holdings, Inc. and Cloudflare, Inc., providing a snapshot of their financial performance.

| Metric | CrowdStrike Holdings, Inc. | Cloudflare, Inc. |

|---|---|---|

| Market Cap | 114.4B | 64.5B |

| Revenue | 3.95B | 1.67B |

| EBITDA | 295M | 62M |

| EBIT | 81M | -66M |

| Net Income | -19M | -79M |

| EPS | -0.08 | -0.23 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

CrowdStrike experienced strong revenue growth, rising 352% over 2021–2025, with gross margins steady near 75%. However, net income showed volatility, swinging from losses to profits and back negative in 2025. Despite a favorable gross margin and revenue growth, operating expenses grew in line with revenue, leading to a decline in EBIT margin and a negative net margin in the latest fiscal year.

Cloudflare, Inc.

Cloudflare’s revenue grew 287% from 2020 to 2024, supported by consistently favorable gross margins above 77%. The company improved EBIT and net margin notably in the last year, with EBIT growth of 72% and net margin growth of 67%, though margins remain negative. Operating expenses scaled efficiently relative to revenue, contributing to overall positive trends in profitability metrics.

Which one has the stronger fundamentals?

Both companies exhibit favorable revenue expansion and gross margin strength. CrowdStrike shows higher revenue growth but struggles with operating costs impacting net income negatively in 2025. Cloudflare presents more consistent margin improvements and positive growth in EBIT and net income metrics over the latest year. Cloudflare’s income statement reflects a stronger alignment between expense management and profitability growth.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for CrowdStrike Holdings, Inc. and Cloudflare, Inc. based on their most recent fiscal year data.

| Ratios | CrowdStrike Holdings, Inc. (2025) | Cloudflare, Inc. (2024) |

|---|---|---|

| ROE | -0.59% | -7.53% |

| ROIC | 0.70% | -6.06% |

| P/E | -5056 | -467 |

| P/B | 29.71 | 35.14 |

| Current Ratio | 1.67 | 2.86 |

| Quick Ratio | 1.67 | 2.86 |

| D/E (Debt-to-Equity) | 0.24 | 1.40 |

| Debt-to-Assets | 9.07% | 44.32% |

| Interest Coverage | -4.58 | -29.78 |

| Asset Turnover | 0.45 | 0.51 |

| Fixed Asset Turnover | 4.76 | 2.63 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike presents a balanced mix of strong and weak ratios, with a current ratio of 1.67 indicating good short-term liquidity, yet a negative net margin and return on equity highlight profitability challenges. The company does not pay dividends, likely prioritizing growth and reinvestment in R&D, as suggested by high research and development expenses and no share buybacks.

Cloudflare, Inc.

Cloudflare shows more unfavorable ratios, including a negative net margin of -4.72% and a poor return on equity of -7.53%, alongside high debt-to-equity at 1.4, indicating potential financial leverage risks. With no dividend payments, the firm likely focuses on reinvestment and innovation, consistent with its substantial R&D spending and absence of shareholder returns via dividends or buybacks.

Which one has the best ratios?

Based on the ratio evaluations, CrowdStrike holds a more neutral stance with balanced favorable and unfavorable metrics, while Cloudflare’s ratios lean more toward unfavorable, particularly in profitability and leverage. Overall, CrowdStrike’s liquidity and lower debt levels represent comparatively stronger financial health.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and Cloudflare, focusing on Market position, Key segments, and exposure to technological disruption:

CrowdStrike Holdings, Inc.

- Market leader in cloud-delivered endpoint and identity security, facing competitive pressure in cybersecurity.

- Key revenue driven by subscriptions to Falcon platform and cloud modules; professional services contribute less.

- Exposure to technological disruption through evolving cloud security needs and Zero Trust models.

Cloudflare, Inc.

- Provides integrated cloud security and performance services, competing broadly in cloud infrastructure market.

- Diverse cloud services including security, performance, reliability, and developer solutions across industries.

- Faces disruption risks linked to rapid cloud service innovation and expanding IoT device security requirements.

CrowdStrike vs Cloudflare Positioning

CrowdStrike focuses on a concentrated cybersecurity subscription model, leveraging direct sales and channel partners, while Cloudflare pursues a diversified cloud services approach addressing security, performance, and developer tools. CrowdStrike’s specialization contrasts with Cloudflare’s broader product scope.

Which has the best competitive advantage?

Both companies exhibit slightly unfavorable MOAT status, shedding value despite growing ROIC trends. CrowdStrike’s higher ROIC growth rate suggests improving efficiency, but neither currently sustains a definitive competitive advantage based on MOAT evaluation.

Stock Comparison

The stock prices of CrowdStrike Holdings, Inc. and Cloudflare, Inc. have exhibited significant bullish trends over the past 12 months, with both showing deceleration in momentum and notable recent declines in price.

Trend Analysis

CrowdStrike’s stock price rose 45.71% over the past year, indicating a bullish trend with decelerating momentum. It experienced a high of 543.01 and a low of 217.89, with recent weeks showing a 16.41% decline.

Cloudflare’s stock price increased 87.07% over the same period, also reflecting a bullish trend with deceleration. Its price ranged between 67.69 and 253.3, but it faced a sharper recent drop of 27.29%.

Comparing both, Cloudflare delivered the highest market performance over the past year despite stronger recent price declines, outperforming CrowdStrike in overall price appreciation.

Target Prices

Analysts present a cautiously optimistic target consensus for CrowdStrike Holdings, Inc. and Cloudflare, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

| Cloudflare, Inc. | 300 | 210 | 248.86 |

The target consensus for CrowdStrike at 553.47 USD suggests upside potential compared to its current price of 453.88 USD, while Cloudflare’s consensus of 248.86 USD also indicates expected gains above its current 184.17 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for CrowdStrike Holdings, Inc. (CRWD) and Cloudflare, Inc. (NET):

Rating Comparison

CRWD Rating

- Rating: C, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, favorable indication of valuation.

- ROE Score: 1, very unfavorable, indicating low efficiency in generating profit from equity.

- ROA Score: 1, very unfavorable, reflecting poor asset utilization.

- Debt To Equity Score: 3, moderate, indicating moderate financial risk.

- Overall Score: 2, moderate overall financial standing.

NET Rating

- Rating: D+, also considered very favorable by analysts.

- Discounted Cash Flow Score: 1, very unfavorable, signaling potential overvaluation.

- ROE Score: 1, very unfavorable, indicating low efficiency in profit generation from equity.

- ROA Score: 1, very unfavorable, reflecting poor asset utilization.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk.

- Overall Score: 1, very unfavorable overall financial standing.

Which one is the best rated?

Based solely on the provided data, CRWD holds a better overall rating and higher discounted cash flow and debt-to-equity scores compared to NET, which scores very unfavorable across most financial metrics.

Scores Comparison

This table compares the Altman Z-Score and Piotroski Score of CrowdStrike Holdings, Inc. and Cloudflare, Inc.:

CRWD Scores

- Altman Z-Score: 12.38, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

NET Scores

- Altman Z-Score: 9.47, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 2, reflecting very weak financial strength.

Which company has the best scores?

Based on the provided scores, CRWD has a higher Altman Z-Score and a stronger Piotroski Score than NET. Both are in the safe zone for bankruptcy risk, but CRWD shows better financial health per the Piotroski metric.

Grades Comparison

The following tables present the latest reliable grades for CrowdStrike Holdings, Inc. and Cloudflare, Inc.:

CrowdStrike Holdings, Inc. Grades

This table shows recent analyst grades and actions from verified grading firms for CrowdStrike Holdings, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

CrowdStrike’s grades mostly indicate a positive outlook, with several buy ratings and some recent upgrades, though there is a slight downgrade from Keybanc.

Cloudflare, Inc. Grades

This table displays recent analyst grades and actions from recognized grading companies for Cloudflare, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-11-10 |

| Susquehanna | Maintain | Neutral | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Cloudflare’s grades show a mix of buy and neutral ratings with no recent upgrades or downgrades, reflecting a stable but more cautious analyst sentiment.

Which company has the best grades?

CrowdStrike Holdings, Inc. has received generally stronger and more frequent buy ratings with recent upgrades, suggesting more robust analyst confidence compared to Cloudflare, Inc., which has more neutral ratings. This disparity may influence investor perception of growth potential and risk profile between the two.

Strengths and Weaknesses

Below is a comparative table summarizing the key strengths and weaknesses of CrowdStrike Holdings, Inc. (CRWD) and Cloudflare, Inc. (NET) based on their recent financial and operational data.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | Cloudflare, Inc. (NET) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from subscriptions (3.76B in 2025) with growing professional services (192M) | Low: Single reportable segment with 1.67B revenue (2024) |

| Profitability | Unfavorable: Negative net margin (-0.49%), ROIC slightly positive (0.7%), but shedding value overall | Unfavorable: Larger negative net margin (-4.72%), negative ROIC (-6.06%), shedding value |

| Innovation | Strong: ROIC trend growing 114%, indicating improving profitability | Moderate: ROIC trend growing 22%, some profitability improvement |

| Global presence | Significant: Broad market presence implied by large subscription base | Strong: Global web infrastructure presence, but financials weaker |

| Market Share | Large and growing subscription revenues suggest strong market position | Solid but challenged by financial performance and higher debt levels |

Key takeaways: Both CRWD and NET are currently shedding value with negative profitability ratios, but their improving ROIC trends indicate potential for future growth. CRWD shows stronger diversification and a larger revenue base, while NET faces more financial challenges, including higher debt and weaker margins. Investors should weigh growth potential against current profitability risks.

Risk Analysis

Below is a comparative table outlining key risk factors for CrowdStrike Holdings, Inc. (CRWD) and Cloudflare, Inc. (NET) based on the most recent fiscal data:

| Metric | CrowdStrike Holdings, Inc. (CRWD) | Cloudflare, Inc. (NET) |

|---|---|---|

| Market Risk | Beta 1.03, moderate volatility | Beta 1.97, higher volatility |

| Debt Level | Low (D/E 0.24), favorable | High (D/E 1.40), unfavorable |

| Regulatory Risk | Moderate, cybersecurity sector | Moderate, cloud services sector |

| Operational Risk | Moderate, reliance on subscription model | Moderate, wide product integration complexity |

| Environmental Risk | Low, primarily software provider | Low, primarily software provider |

| Geopolitical Risk | Moderate, global customer base | Moderate, global customer base |

The most impactful and likely risks center on Cloudflare’s higher financial leverage and greater market volatility, which raise solvency and valuation concerns. CrowdStrike shows more financial stability but faces operational risks due to intense competition in cybersecurity. Both companies carry typical regulatory and geopolitical exposures inherent in global tech firms.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) shows strong revenue growth of 29.39% in 2025 with a favorable overall income statement. Despite a slightly unfavorable profitability and some negative returns on equity and assets, its debt levels remain low and financial ratios are balanced, leading to a neutral global ratio opinion and a very favorable rating.

Cloudflare, Inc. (NET) posted 28.76% revenue growth in 2024 and an overall favorable income statement, though profitability metrics remain negative. Its financial ratios are mostly unfavorable, reflecting higher debt and weaker returns, resulting in an unfavorable global ratio opinion despite a very favorable rating status.

Investors focused on growth might find CRWD’s improving profitability and moderate financial risk more appealing, while those prioritizing strong income growth and market momentum could see potential value in NET despite its higher financial risk and weaker ratio profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and Cloudflare, Inc. to enhance your investment decisions: