In the fast-evolving technology sector, Cloudflare, Inc. (NET) and CoreWeave, Inc. Class A Common Stock (CRWV) stand out as innovative players in cloud infrastructure. Both companies focus on providing cutting-edge solutions that power digital experiences, yet they approach the market with distinct strategies—Cloudflare emphasizes integrated security and performance, while CoreWeave specializes in GPU-accelerated computing for AI workloads. This article will help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Cloudflare and CoreWeave by providing an overview of these two companies and their main differences.

Cloudflare Overview

Cloudflare, Inc. is a cloud services provider focused on delivering integrated cloud-based security and performance solutions to businesses globally. Its offerings encompass cloud firewall, bot management, DDoS protection, and performance enhancements such as content delivery and intelligent routing. Founded in 2009 and headquartered in San Francisco, Cloudflare serves diverse sectors including technology, healthcare, and financial services, employing around 4,400 staff.

CoreWeave Overview

CoreWeave, Inc. operates a cloud platform specializing in scaling and accelerating compute workloads, particularly for GenAI. The company provides GPU and CPU compute, storage, networking, and managed services, along with solutions for VFX, AI training, and mission control. Incorporated in 2017 and based in Livingston, New Jersey, CoreWeave has a workforce of approximately 881 employees and focuses on enterprise infrastructure support.

Key similarities and differences

Both Cloudflare and CoreWeave operate in the software infrastructure sector, providing cloud-based services to enterprise clients. Cloudflare emphasizes security and performance products across a wide range of platforms, while CoreWeave concentrates on compute acceleration for AI and rendering workloads. Cloudflare is larger in terms of market cap and employee count, whereas CoreWeave shows a more specialized focus with a higher beta, reflecting greater volatility.

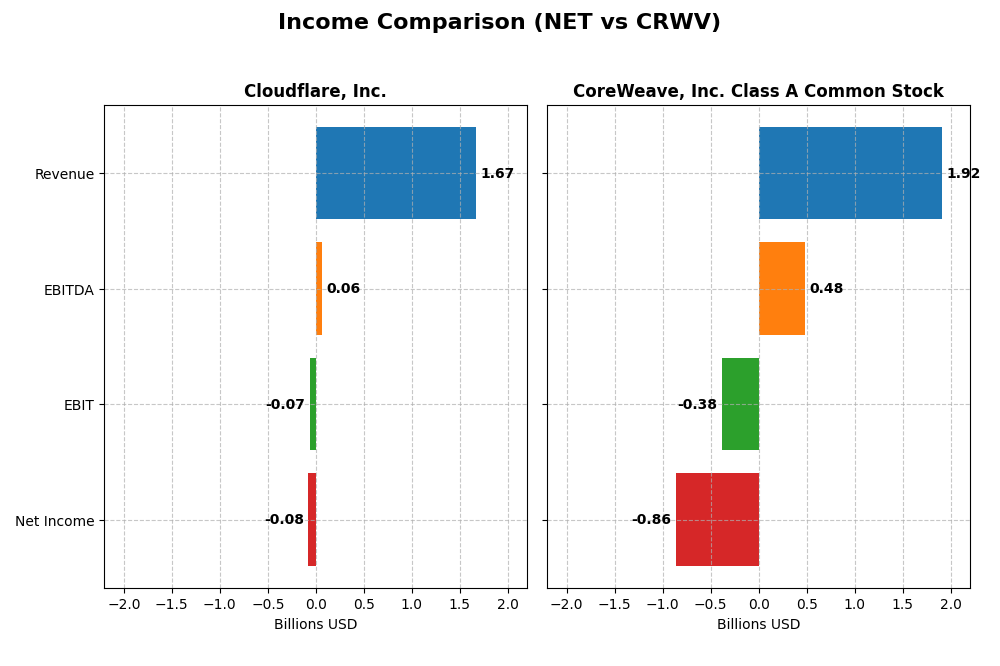

Income Statement Comparison

This table presents a direct comparison of key income statement metrics for Cloudflare, Inc. and CoreWeave, Inc. for the fiscal year 2024, highlighting their financial performance.

| Metric | Cloudflare, Inc. (NET) | CoreWeave, Inc. Class A Common Stock (CRWV) |

|---|---|---|

| Market Cap | 64.5B | 50.4B |

| Revenue | 1.67B | 1.92B |

| EBITDA | 62.0M | 480.0M |

| EBIT | -65.7M | -383.4M |

| Net Income | -78.8M | -863.4M |

| EPS | -0.23 | -2.33 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Cloudflare, Inc.

Cloudflare’s revenue grew steadily from 2020 to 2024, reaching $1.67B in 2024, with net income losses narrowing to -$78.8M. The gross margin remained strong at 77.3%, reflecting efficient cost control, although EBIT and net margins stayed negative. In 2024, revenue growth accelerated by 28.8%, and profitability metrics improved, signaling progress despite ongoing losses.

CoreWeave, Inc. Class A Common Stock

CoreWeave experienced explosive revenue growth from $15.8M in 2022 to $1.92B in 2024, yet net losses deepened to -$863M in 2024. Gross margin held favorably at 74.2%, but EBIT and net margins were significantly negative at -20.0% and -45.1%, respectively. The recent year showed strong revenue and gross profit expansion, though net income deterioration persisted.

Which one has the stronger fundamentals?

Cloudflare displays a more consistent margin profile with improving profitability indicators and controlled interest expenses, contributing to favorable overall income statement metrics. CoreWeave’s rapid revenue scale-up is impressive but accompanied by heavier losses and high interest burdens, offsetting some positive growth aspects. Thus, Cloudflare’s fundamentals appear more balanced and stable relative to CoreWeave’s high-growth, high-risk profile.

Financial Ratios Comparison

The table below compares key financial ratios for Cloudflare, Inc. and CoreWeave, Inc. Class A Common Stock as reported for fiscal year 2024.

| Ratios | Cloudflare, Inc. (NET) | CoreWeave, Inc. Class A (CRWV) |

|---|---|---|

| ROE | -7.53% | 208.77% |

| ROIC | -6.06% | 2.08% |

| P/E | -466.54 | -18.73 |

| P/B | 35.14 | -39.11 |

| Current Ratio | 2.86 | 0.39 |

| Quick Ratio | 2.86 | 0.39 |

| D/E | 1.40 | -25.68 |

| Debt-to-Assets | 44.32% | 59.56% |

| Interest Coverage | -29.78 | 0.90 |

| Asset Turnover | 0.51 | 0.11 |

| Fixed Asset Turnover | 2.63 | 0.13 |

| Payout ratio | 0 | -6.69% |

| Dividend yield | 0 | 0.36% |

Interpretation of the Ratios

Cloudflare, Inc.

Cloudflare shows a mixed financial profile with only 21.43% of its key ratios favorable, including a strong current and quick ratio around 2.86, indicating solid short-term liquidity. However, the majority of ratios are unfavorable, such as negative net margin (-4.72%) and ROE (-7.53%), alongside a high price-to-book ratio (35.14). The company does not pay dividends, reflecting reinvestment in growth and R&D, supported by no dividend yield and no share buybacks.

CoreWeave, Inc. Class A Common Stock

CoreWeave’s ratios also present challenges, with 71.43% unfavorable metrics, including a low current ratio of 0.39 and a deeply negative net margin of -45.08%. Favorable indicators like a very high ROE of 208.77% contrast with risks such as a high weighted average cost of capital (84.93%) and negative interest coverage. CoreWeave pays no dividends, likely prioritizing growth and capital expenditures over shareholder returns.

Which one has the best ratios?

Both companies have unfavorable overall ratio profiles, but Cloudflare displays better liquidity and less extreme financial instability than CoreWeave. Cloudflare’s current and quick ratios suggest it is better positioned to meet short-term obligations, whereas CoreWeave struggles with liquidity and higher financial leverage risks. Neither company provides dividend income, focusing instead on reinvestment or expansion.

Strategic Positioning

This section compares the strategic positioning of Cloudflare, Inc. and CoreWeave, Inc. in terms of Market position, Key segments, and Exposure to technological disruption:

Cloudflare, Inc.

- Established cloud services provider with 64.5B market cap, facing high competition in software infrastructure.

- Focuses on integrated cloud security, performance, and reliability solutions across multiple industries.

- Exposure to cloud security and performance tech disruption, integrating diverse solutions including IoT and SaaS.

CoreWeave, Inc. Class A Common Stock

- Newer cloud platform company with 50.4B market cap, high beta, in a competitive infrastructure market.

- Provides cloud infrastructure optimized for GenAI, including GPU/CPU compute and AI model services.

- Positioned in emerging GenAI infrastructure disruption, concentrating on specialized compute and AI workloads.

Cloudflare, Inc. vs CoreWeave, Inc. Positioning

Cloudflare pursues a diversified approach with broad cloud security and performance offerings across industries, while CoreWeave concentrates on GenAI compute infrastructure. Cloudflare’s scale and diverse segments contrast with CoreWeave’s niche focus and smaller workforce.

Which has the best competitive advantage?

Both companies are currently shedding value relative to their cost of capital. Cloudflare shows a slightly unfavorable moat with growing profitability, whereas CoreWeave has an unfavorable moat with stable but negative value creation, indicating limited competitive advantage for both.

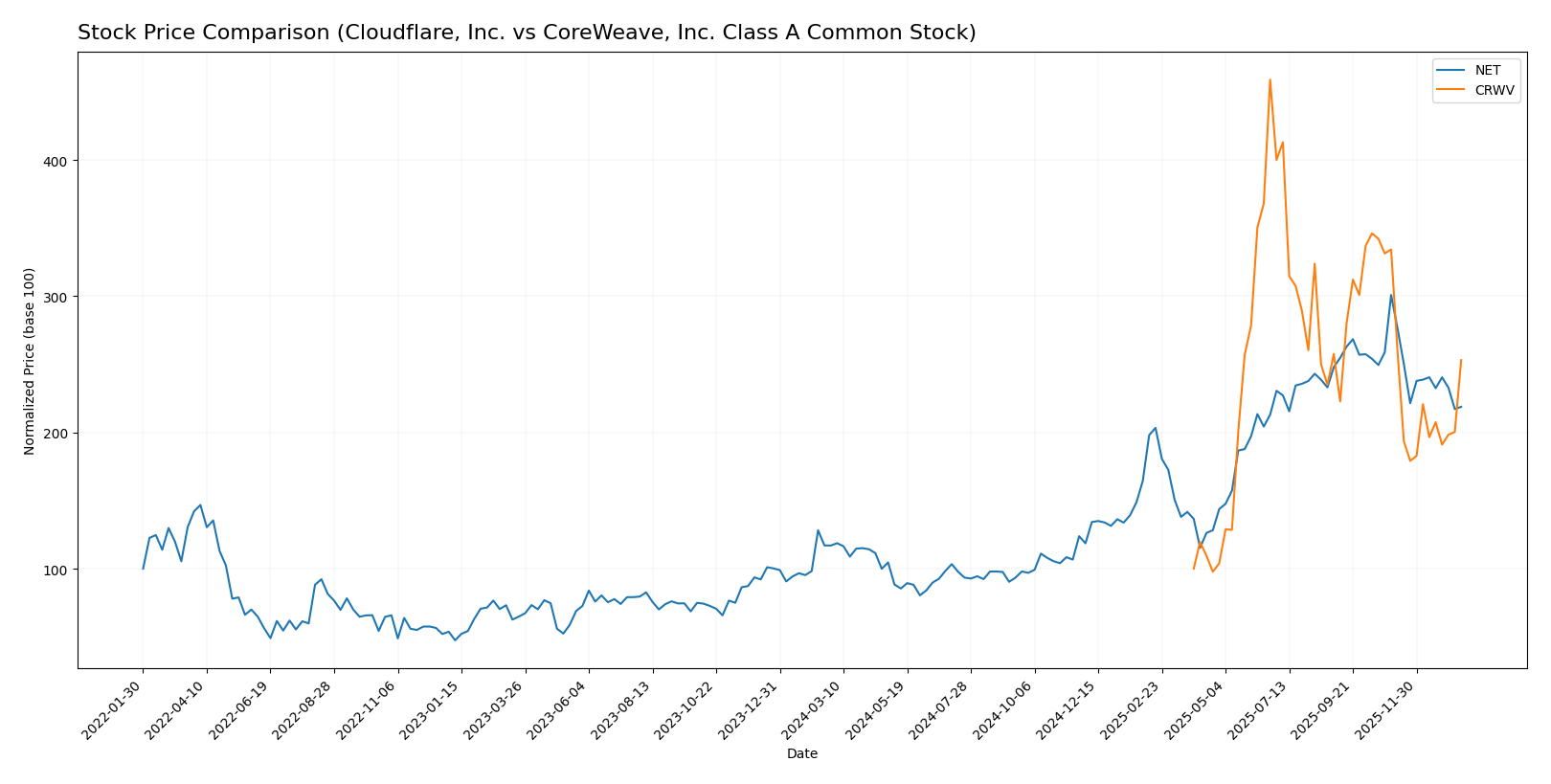

Stock Comparison

The stock prices of Cloudflare, Inc. (NET) and CoreWeave, Inc. Class A (CRWV) have shown significant growth over the past 12 months, with both exhibiting bullish trends but recent downward corrections in early 2026.

Trend Analysis

Cloudflare, Inc. (NET) recorded an 87.07% price increase over the past year, indicating a bullish trend with deceleration. The stock reached a high of 253.3 and a low of 67.69, showing strong volatility with a standard deviation of 52.73. Recent months show a 27.29% decline, signaling short-term bearish pressure.

CoreWeave, Inc. (CRWV) experienced a 153.08% gain over the same period, also bullish with deceleration. Its price fluctuated between 39.09 and 183.58, with a lower volatility level of 35.67. Recent trading reflects a 24.29% drop, suggesting a mild bearish trend in the short term.

Comparing both, CoreWeave delivered the highest market performance over the past year with a 153.08% rise, outperforming Cloudflare’s 87.07% gain despite recent declines in both stocks.

Target Prices

Analysts present a cautiously optimistic consensus on target prices for Cloudflare, Inc. and CoreWeave, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 300 | 210 | 248.86 |

| CoreWeave, Inc. Class A Common Stock | 175 | 68 | 115.79 |

The consensus targets for both stocks exceed their current prices, suggesting moderate upside potential for investors. Cloudflare’s target consensus of 248.86 is notably above its 184.17 market price, while CoreWeave’s 115.79 consensus surpasses its 101.23 price, indicating positive analyst sentiment relative to current valuations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cloudflare, Inc. and CoreWeave, Inc. Class A Common Stock:

Rating Comparison

Cloudflare, Inc. Rating

- Rating: D+ with a “Very Favorable” status

- Discounted Cash Flow Score: 1 (Very Unfavorable)

- ROE Score: 1 (Very Unfavorable)

- ROA Score: 1 (Very Unfavorable)

- Debt To Equity Score: 1 (Very Unfavorable)

- Overall Score: 1 (Very Unfavorable)

CoreWeave, Inc. Rating

- Rating: D+ with a “Very Favorable” status

- Discounted Cash Flow Score: 1 (Very Unfavorable)

- ROE Score: 1 (Very Unfavorable)

- ROA Score: 1 (Very Unfavorable)

- Debt To Equity Score: 1 (Very Unfavorable)

- Overall Score: 1 (Very Unfavorable)

Which one is the best rated?

Both Cloudflare and CoreWeave hold identical ratings of D+ with similarly unfavorable scores across all financial metrics. Neither company is rated better based on the provided data.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Cloudflare, Inc. and CoreWeave, Inc. Class A Common Stock:

Cloudflare Scores

- Altman Z-Score: 9.47, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 2, classified as very weak financial strength.

CoreWeave Scores

- Altman Z-Score: 0.80, indicating distress zone, high bankruptcy risk.

- Piotroski Score: 3, also classified as very weak financial strength.

Which company has the best scores?

Cloudflare has a substantially higher Altman Z-Score, placing it in the safe zone, whereas CoreWeave is in the distress zone. Both companies have very weak Piotroski Scores, but CoreWeave’s is slightly higher at 3 versus 2 for Cloudflare.

Grades Comparison

The following sections present a detailed comparison of the latest grades assigned to Cloudflare, Inc. and CoreWeave, Inc. Class A Common Stock by reputable grading companies:

Cloudflare, Inc. Grades

This table summarizes recent analyst grades for Cloudflare, Inc. from established financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-11-10 |

| Susquehanna | Maintain | Neutral | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Cloudflare’s grades predominantly indicate a buy or neutral stance, with multiple buy ratings maintained consistently over recent months.

CoreWeave, Inc. Class A Common Stock Grades

Below is a summary of recent grades for CoreWeave, Inc. Class A Common Stock from recognized grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| DA Davidson | Upgrade | Neutral | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-11-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| Barclays | Maintain | Equal Weight | 2025-11-12 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| B of A Securities | Maintain | Neutral | 2025-11-11 |

CoreWeave’s grades show a mix of buy, overweight, and neutral ratings, reflecting a generally positive but somewhat cautious analyst outlook.

Which company has the best grades?

Both Cloudflare and CoreWeave hold an overall consensus of “Buy,” but Cloudflare has a larger number of buy ratings and fewer neutral opinions compared to CoreWeave. This suggests Cloudflare is viewed more favorably by analysts, which could influence investor confidence and portfolio decisions in terms of perceived stability and growth potential.

Strengths and Weaknesses

Below is a comparative overview of the key strengths and weaknesses of Cloudflare, Inc. (NET) and CoreWeave, Inc. Class A Common Stock (CRWV) based on the latest financial and strategic data.

| Criterion | Cloudflare, Inc. (NET) | CoreWeave, Inc. Class A Common Stock (CRWV) |

|---|---|---|

| Diversification | Moderate revenue concentration; primarily in cloud services | Limited data; appears more specialized in niche markets |

| Profitability | Negative net margin (-4.72%) and ROIC (-6.06%), shedding value but with improving ROIC trend | Negative net margin (-45.08%), ROIC slightly positive but below WACC, destroying value |

| Innovation | Growing ROIC suggests increasing operational efficiency and innovation efforts | Neutral ROIC trend; no significant improvement in profitability |

| Global presence | Strong global infrastructure supporting cloud services | Limited global footprint; more regional or specialized presence |

| Market Share | Significant presence in cloud security and CDN markets | Smaller, emerging player with niche market focus |

In summary, Cloudflare shows signs of improving profitability and operational efficiency despite current losses, supported by global reach and innovation. CoreWeave, while promising in ROE, faces steep profitability challenges and a less diversified business, which increases investment risk. Investors should weigh Cloudflare’s growth trajectory against CoreWeave’s niche potential and financial instability.

Risk Analysis

Below is a comparative risk assessment table for Cloudflare, Inc. (NET) and CoreWeave, Inc. Class A Common Stock (CRWV) based on the most recent financial data from 2024.

| Metric | Cloudflare, Inc. (NET) | CoreWeave, Inc. (CRWV) |

|---|---|---|

| Market Risk | Beta 1.97, moderate volatility | Beta 21.65, extremely high volatility |

| Debt Level | Debt-to-Equity 1.4 (unfavorable) | Negative Debt-to-Equity (-25.68, favorable but unusual) |

| Regulatory Risk | Moderate, operates globally with cloud security regulations | Moderate, emerging market with GenAI infrastructure focus |

| Operational Risk | Medium, reliant on cloud infrastructure and cybersecurity | High, early-stage with scaling challenges |

| Environmental Risk | Low, software infrastructure sector | Low, software infrastructure sector |

| Geopolitical Risk | Moderate, US-based with global clients | Moderate, US-based with global clientele |

Synthesizing the risks, CoreWeave faces the most significant market risk due to extremely high beta, indicating high price volatility and potential instability. Its Altman Z-Score places it in the distress zone, signaling a higher bankruptcy risk. Cloudflare, while also showing unfavorable profitability ratios and debt levels, is in a safer financial zone with a more stable market risk profile. Investors should weigh CoreWeave’s growth potential against its financial fragility and volatility, while Cloudflare presents moderate risk with stronger financial stability.

Which Stock to Choose?

Cloudflare, Inc. (NET) shows strong revenue growth of 28.76% in 2024 with favorable income statement trends but suffers from negative profitability ratios, a high debt-to-equity ratio of 1.4, and an overall unfavorable financial ratio profile. Its slightly unfavorable moat rating reflects value destruction despite improving profitability. The company’s Altman Z-Score of 9.47 indicates low bankruptcy risk, though its Piotroski score is very weak.

CoreWeave, Inc. Class A Common Stock (CRWV) exhibits exceptional revenue growth of 736.64% in 2024 but faces significant profitability challenges with a negative net margin of -45.08% and a weak current ratio of 0.39. Its financial ratios are largely unfavorable, and the company’s moat rating is unfavorable, indicating value destruction and stable but weak profitability. The Altman Z-Score of 0.80 places it in distress zone, signaling financial risk.

Investors prioritizing financial stability and improving profitability might find Cloudflare’s fundamentals more reassuring due to its favorable income trends and strong Altman Z-Score, despite its challenges. Conversely, those seeking high growth potential with tolerance for elevated risk could consider CoreWeave’s rapid revenue expansion, albeit with caution given its financial distress signals and unfavorable ratios.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cloudflare, Inc. and CoreWeave, Inc. Class A Common Stock to enhance your investment decisions: