Home > Comparison > Financial Services > CFG vs RF

The strategic rivalry between Citizens Financial Group, Inc. and Regions Financial Corporation shapes the regional banking landscape in the U.S. Citizens operates with a strong dual focus on consumer and commercial banking, leveraging diversified financial solutions. Regions emphasizes corporate, consumer, and wealth management services, maintaining a broad footprint across the South and Midwest. This analysis explores which business model delivers superior risk-adjusted returns, guiding investors seeking durable exposure in regional financial services.

Table of contents

Companies Overview

Citizens Financial Group and Regions Financial Corporation are major players in the US regional banking sector, each commanding substantial market presence.

Citizens Financial Group, Inc.: Established Regional Powerhouse

Citizens Financial Group operates as a bank holding company serving individuals and businesses across 14 states and DC. Its revenue flows from diversified retail and commercial banking products, including mortgages, credit cards, business loans, and treasury services. In 2026, Citizens emphasizes digital delivery and expanding its commercial banking footprint to deepen client relationships and capture emerging market segments.

Regions Financial Corporation: Southern and Midwestern Banking Staple

Regions Financial Corporation delivers banking and wealth management services primarily in the South, Midwest, and Texas. It generates revenue via commercial banking, consumer loans, and investment services, carving out a stronghold in commercial real estate and corporate advisory. In 2026, Regions prioritizes expanding its corporate banking and wealth management capabilities to enhance cross-selling and client retention.

Strategic Collision: Similarities & Divergences

Both banks focus on regional dominance and multi-segment banking, but Citizens leans more on digital innovation while Regions exploits its stronghold in commercial real estate and wealth management. Their competition centers on winning middle-market and commercial clients through tailored financial solutions. Investors face distinct profiles: Citizens bets on tech-enabled growth, whereas Regions anchors on relationship-driven expansion.

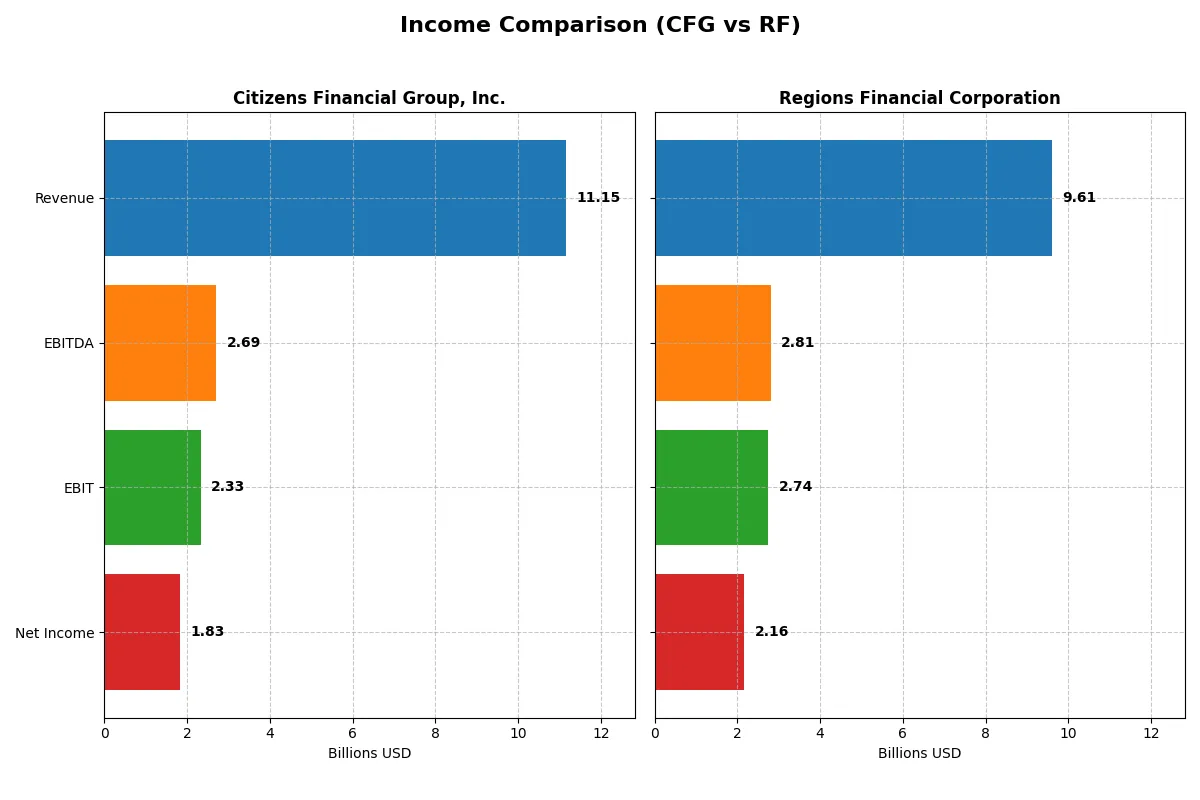

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Citizens Financial Group, Inc. (CFG) | Regions Financial Corporation (RF) |

|---|---|---|

| Revenue | 11.1B | 9.6B |

| Cost of Revenue | 3.37B | 2.44B |

| Operating Expenses | 5.45B | 4.43B |

| Gross Profit | 7.78B | 7.17B |

| EBITDA | 2.69B | 2.81B |

| EBIT | 2.33B | 2.74B |

| Interest Expense | 3.81B | 2.08B |

| Net Income | 1.83B | 2.16B |

| EPS | 3.9 | 2.31 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company drives superior efficiency and profitability through its core operations and cost management.

Citizens Financial Group, Inc. Analysis

Citizens Financial shows a mixed revenue trend, declining 9.7% last year but growing 59.6% over five years. Gross margin stands strong at 69.8%, and net margin improved sharply to 16.4%. The 2025 net income rose to $1.83B with a 27.4% EPS jump, signaling efficiency gains despite revenue softness.

Regions Financial Corporation Analysis

Regions Financial posts steady revenue growth with a 2.5% rise last year and 45.5% over five years. It boasts a higher gross margin of 74.6% and a robust net margin of 22.4%. Its 2025 net income reached $2.16B, with 18.7% EPS growth, reflecting solid operational momentum and margin expansion.

Margin Strength vs. Revenue Resilience

Regions Financial leads with superior gross and net margins, translating into stronger profitability on a smaller revenue base than Citizens. Citizens shows sharper EPS and net margin improvements recently but struggles with revenue contraction. Regions’ profile suits investors prioritizing stable margins and steady income growth.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | Citizens Financial Group (CFG) | Regions Financial Corporation (RF) |

|---|---|---|

| ROE | 6.96% | 11.32% |

| ROIC | 4.25% | 13.79% |

| P/E | 13.76 | 10.99 |

| P/B | 0.96 | 1.25 |

| Current Ratio | 1.04 | 0.30 |

| Quick Ratio | 1.04 | 0.30 |

| D/E | 0.43 | 0.26 |

| Debt-to-Assets | 5.0% | 3.1% |

| Interest Coverage | 0.61 | 1.32 |

| Asset Turnover | 0.049 | 0.060 |

| Fixed Asset Turnover | 12.18 | 5.79 |

| Payout Ratio | 40.5% | 41.8% |

| Dividend Yield | 2.94% | 3.80% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, unveiling hidden risks and operational strengths that shape investor confidence and valuation.

Citizens Financial Group, Inc. (CFG)

CFG posts a modest ROE of 6.96% and a strong net margin of 16.42%, indicating moderate profitability but some operational challenges. The P/E of 13.76 and P/B below 1 suggest the stock is attractively valued. CFG supports shareholders with a 2.94% dividend yield, reflecting steady income alongside cautious capital allocation.

Regions Financial Corporation (RF)

RF outperforms with an ROE of 11.32% and a higher net margin of 22.44%, signaling superior efficiency. Its P/E ratio of 11.0 and P/B of 1.25 imply a reasonable valuation with slight premium. RF offers a 3.8% dividend yield, reinforcing its commitment to shareholder returns through steady cash distributions.

Balanced Profitability Meets Valuation Discipline

Both CFG and RF exhibit favorable overall ratio profiles with roughly 57% favorable metrics. RF delivers higher profitability and dividends but trades at a slightly premium valuation. CFG offers value appeal with lower multiples and a solid dividend. RF suits investors prioritizing operational strength; CFG appeals to those seeking value with income.

Which one offers the Superior Shareholder Reward?

I see Citizens Financial Group (CFG) pays a higher dividend yield near 2.9%, with a payout ratio around 40%, showing balanced income distribution. Regions Financial (RF) offers a 3.8% yield and a similar payout near 42%. CFG’s dividend is well covered by free cash flow, unlike RF, which lacks clear free cash flow metrics. CFG also runs a more aggressive share buyback program, enhancing total shareholder return. RF’s conservative leverage and decent buybacks support stability but limit upside. I judge CFG’s distribution model more sustainable and rewarding in 2026, making it the superior choice for total return investors.

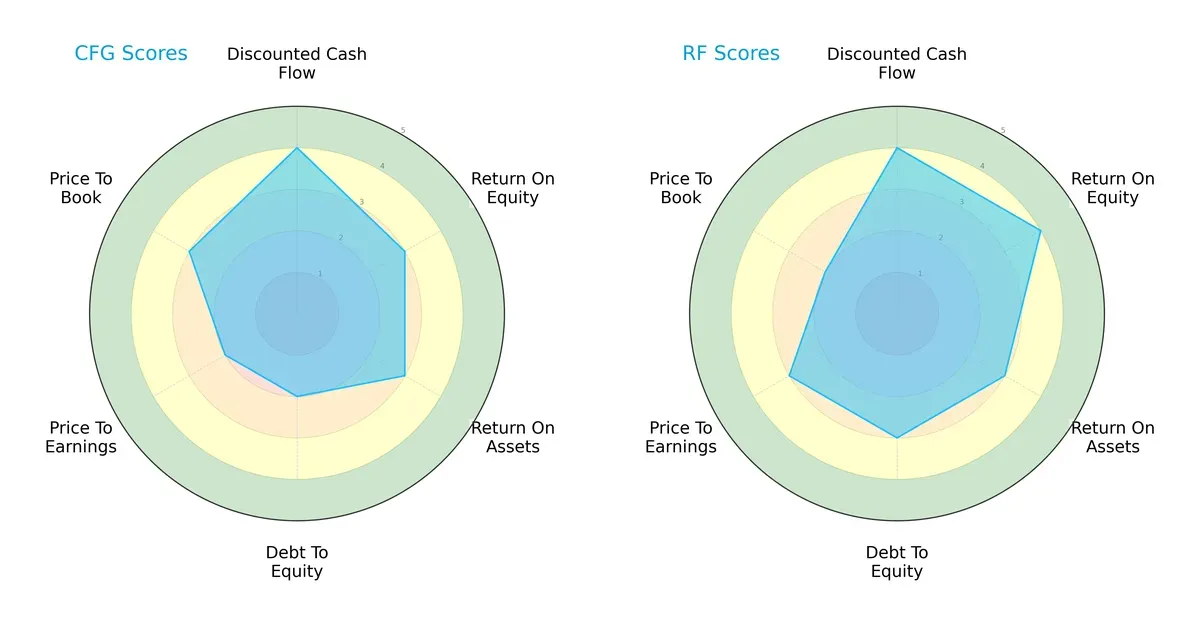

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Citizens Financial Group and Regions Financial Corporation:

Both firms share a balanced overall score of 3. They tie on DCF (4) and ROA (3), but Regions excels with a superior ROE (4 vs. 3) and stronger debt management (Debt/Equity score 3 vs. 2). Citizens shows a slight edge in Price-to-Book valuation (3 vs. 2). Regions leans on profitability and leverage control, while Citizens depends more on valuation metrics. Regions offers a more balanced profile.

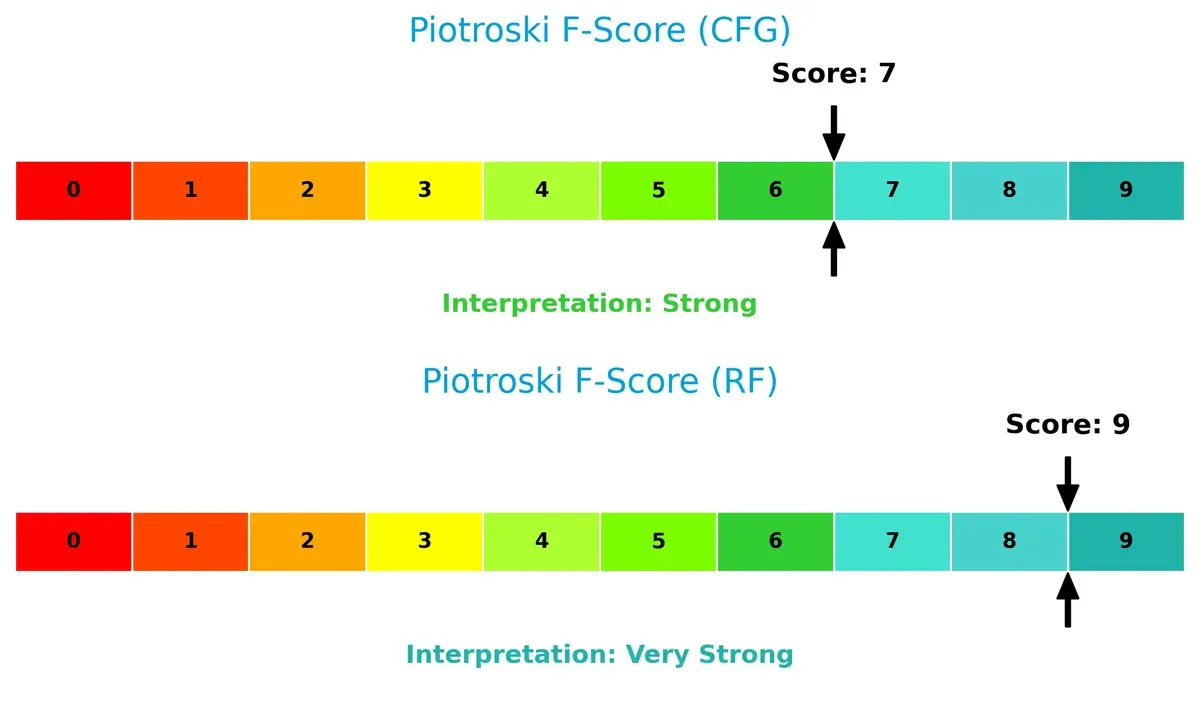

Bankruptcy Risk: Solvency Showdown

Regions Financial’s Altman Z-Score is -0.38, trailing Citizens Financial’s 0.28; both scores fall into the distress zone, signaling elevated bankruptcy risk in this cycle:

Financial Health: Quality of Operations

Regions Financial’s Piotroski F-Score of 9 outperforms Citizens Financial’s 7, indicating stronger operational health and fewer red flags in internal metrics:

How are the two companies positioned?

This section dissects the operational DNA of CFG and RF by comparing their revenue distribution and internal dynamics—strengths and weaknesses. The final goal is to confront their economic moats to identify the more resilient and sustainable competitive advantage in today’s market.

Revenue Segmentation: The Strategic Mix

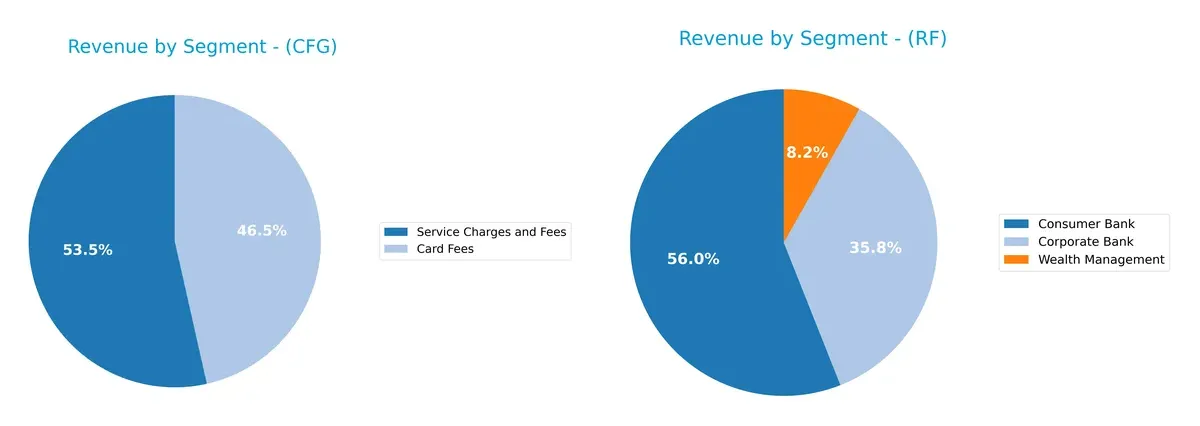

This visual comparison dissects how Citizens Financial Group and Regions Financial diversify income streams and reveals their primary sector bets:

Citizens Financial anchors revenue in Consumer Banking with $3.56B and Commercial Banking at $1.95B (2017 data), showing moderate diversification. Regions Financial balances Consumer Bank ($3.13B), Corporate Bank ($2B), and Wealth Management ($457M) in 2023, reflecting a broader mix. Regions’ segment spread reduces concentration risk, while Citizens relies more heavily on core banking, emphasizing infrastructure dominance but higher exposure to economic cycles.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Citizens Financial Group (CFG) and Regions Financial Corporation (RF):

CFG Strengths

- Diverse revenue streams from commercial and consumer banking

- Favorable net margin at 16.42%

- Low debt-to-assets ratio at 4.98%

- Strong fixed asset turnover at 12.18

- Favorable dividend yield of 2.94%

- Favorable PE and PB ratios indicating market valuation support

RF Strengths

- Higher net margin at 22.44%

- Favorable ROIC of 13.79% above WACC

- Lower debt-to-assets at 3.06%

- Favorable fixed asset turnover at 5.79

- Strong dividend yield at 3.8%

- Favorable PE and PB ratios reflecting investor confidence

CFG Weaknesses

- Unfavorable ROE at 6.96% below cost of capital

- WACC at 14.07% exceeding ROIC

- Low interest coverage ratio of 0.61

- Low asset turnover at 0.05

- Neutral current ratio at 1.04 indicating moderate liquidity

RF Weaknesses

- Unfavorable current and quick ratios at 0.3 signaling liquidity risk

- Interest coverage at 1.32 still weak

- WACC at 12.77% above cost of debt

- Slightly unfavorable asset turnover at 0.06

Both companies show favorable profitability and valuation metrics but face liquidity and efficiency challenges. CFG’s higher fixed asset turnover contrasts with RF’s stronger ROIC and net margin. These factors may influence their strategic focus on improving asset utilization and liquidity management.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion in banking. Let’s examine two regional banks’ moats:

Citizens Financial Group, Inc. (CFG): Struggling Capital Efficiency

CFG’s moat hinges on scale and regional footprint, but its ROIC trails WACC by nearly 10%, signaling value destruction. Declining ROIC over five years warns of weakening capital allocation. New digital offerings may boost revenue, but pressure on margins persists.

Regions Financial Corporation (RF): Emerging Profitability Edge

RF leverages operational efficiency and expanding market presence, with ROIC slightly above WACC and a rising trend. This signals improving capital use and modest competitive resilience. Growth in wealth management and commercial banking could deepen its moat in 2026.

Verdict: Capital Allocation vs. Operational Momentum

CFG’s shrinking ROIC exposes a fragile moat, while RF’s improving returns suggest a widening moat. I see Regions better positioned to defend and grow market share through operational gains and disciplined investing.

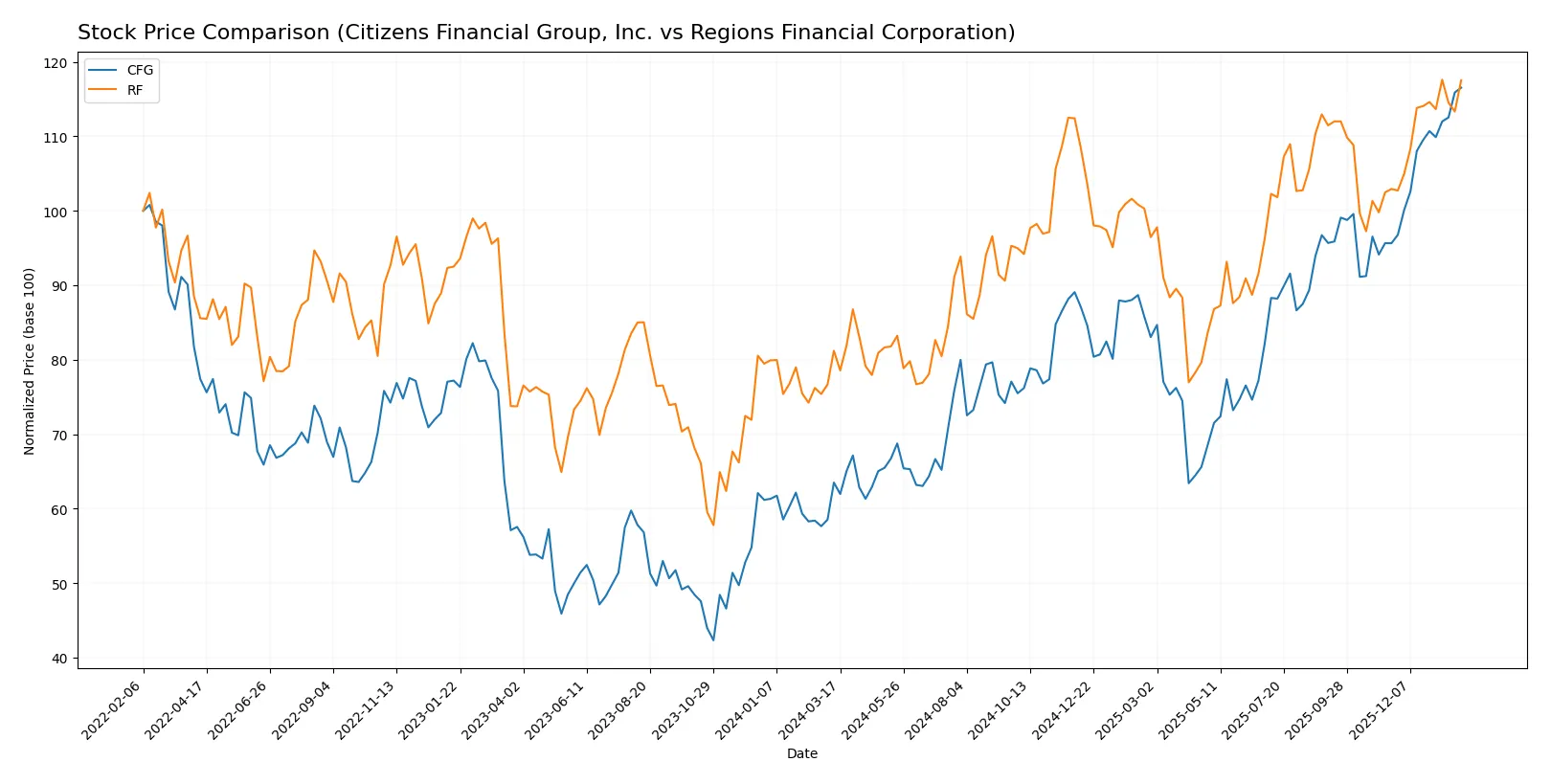

Which stock offers better returns?

The past year reveals strong price rallies for both stocks, with Citizens Financial Group accelerating sharply, while Regions Financial shows steady bullish momentum.

Trend Comparison

Citizens Financial Group’s stock surged 83.51% over the past 12 months, showing bullish acceleration and higher volatility with a 7.49 std deviation. The price ranged from 33.14 to 62.98.

Regions Financial’s stock increased 44.74% over the same period, also bullish with acceleration but lower volatility at 2.78 std deviation. Its range was 18.6 to 28.52.

Citizens Financial Group outperformed Regions Financial, delivering nearly double the market gain and stronger price momentum in the last year.

Target Prices

Analysts present a moderate upside for Citizens Financial Group and Regions Financial Corporation based on current consensus estimates.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Citizens Financial Group, Inc. | 60 | 80 | 69.46 |

| Regions Financial Corporation | 27 | 32 | 29.89 |

The consensus target for Citizens Financial Group sits about 10% above its current price of 62.98, indicating cautious optimism. Regions Financial’s target suggests a slight upside from its 28.5 price, reflecting steady but limited growth expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Citizens Financial Group, Inc. Grades

Below is a summary of recent grades issued by reputable institutions for CFG:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | maintain | Hold | 2026-01-26 |

| Citigroup | maintain | Buy | 2026-01-26 |

| Argus Research | maintain | Buy | 2026-01-23 |

| RBC Capital | maintain | Outperform | 2026-01-22 |

| B of A Securities | maintain | Buy | 2026-01-22 |

| Morgan Stanley | maintain | Overweight | 2026-01-22 |

| Keefe, Bruyette & Woods | maintain | Outperform | 2026-01-22 |

| DA Davidson | maintain | Buy | 2026-01-22 |

| TD Cowen | maintain | Buy | 2026-01-22 |

| Raymond James | downgrade | Outperform | 2026-01-07 |

Regions Financial Corporation Grades

Recent grades from credible sources for RF are shown below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keefe, Bruyette & Woods | downgrade | Market Perform | 2026-01-20 |

| Wells Fargo | maintain | Underweight | 2026-01-20 |

| Piper Sandler | maintain | Neutral | 2026-01-20 |

| Wells Fargo | downgrade | Underweight | 2026-01-16 |

| Evercore ISI Group | downgrade | Underperform | 2026-01-06 |

| Barclays | maintain | Underweight | 2026-01-05 |

| Truist Securities | maintain | Hold | 2025-12-22 |

| Keefe, Bruyette & Woods | maintain | Outperform | 2025-12-17 |

| Truist Securities | maintain | Hold | 2025-10-20 |

| Stephens & Co. | downgrade | Equal Weight | 2025-10-14 |

Which company has the best grades?

Citizens Financial Group holds consistently positive grades, mostly Buy or Outperform. Regions Financial shows several downgrades and Underweight ratings. CFG’s stronger grades suggest better institutional confidence, potentially impacting investor sentiment more favorably.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Citizens Financial Group, Inc. (CFG) and Regions Financial Corporation (RF) in the 2026 market environment:

1. Market & Competition

Citizens Financial Group, Inc. (CFG)

- Operates 1,200 branches in 14 states, strong regional presence but faces intense banking sector competition.

Regions Financial Corporation (RF)

- Larger network with 1,300 offices mainly in South, Midwest, and Texas; faces competitive regional banking pressures.

2. Capital Structure & Debt

Citizens Financial Group, Inc. (CFG)

- Debt-to-equity ratio of 0.43 with favorable debt management; interest coverage at 0.61 is a red flag.

Regions Financial Corporation (RF)

- Lower debt-to-equity ratio of 0.26; better interest coverage at 1.32 but still below ideal safety levels.

3. Stock Volatility

Citizens Financial Group, Inc. (CFG)

- Beta at 1.086 indicates slightly higher volatility than market average.

Regions Financial Corporation (RF)

- Beta at 1.039 reflects moderate volatility, closer to market norm, signaling steadier price moves.

4. Regulatory & Legal

Citizens Financial Group, Inc. (CFG)

- Subject to extensive banking regulations; historical compliance track record but regulatory scrutiny remains high.

Regions Financial Corporation (RF)

- Similar regulatory environment; potential exposure due to regional banking policies and evolving financial rules.

5. Supply Chain & Operations

Citizens Financial Group, Inc. (CFG)

- Operates 3,300 ATMs and digital platforms; operational risks from tech disruptions and branch optimization.

Regions Financial Corporation (RF)

- Operates 2,000 ATMs and heavy branch network; faces operational risks linked to digital transformation and physical footprint.

6. ESG & Climate Transition

Citizens Financial Group, Inc. (CFG)

- ESG initiatives in nascent stages; climate transition risks may impact loan portfolios and regulatory costs.

Regions Financial Corporation (RF)

- Stronger ESG focus evident; climate-related financial risks remain significant but better managed.

7. Geopolitical Exposure

Citizens Financial Group, Inc. (CFG)

- Primarily US-focused with limited international exposure; domestic policy shifts pose main geopolitical risk.

Regions Financial Corporation (RF)

- Similar domestic concentration; regional economic disparities could create uneven risk profiles.

Which company shows a better risk-adjusted profile?

Regions Financial Corporation shows a better risk-adjusted profile. Its lower debt-to-equity ratio and stronger interest coverage reduce financial risk. Despite both firms being in the distress zone for Altman Z-Score, Regions’ higher Piotroski score (9 vs. 7) signals superior financial health. Citizens’ interest coverage below 1 is worrying, highlighting vulnerability to rising interest costs. This disparity in debt service capability underpins my caution toward Citizens despite similar overall ratings.

Final Verdict: Which stock to choose?

Citizens Financial Group (CFG) stands out for its operational resilience and efficient asset utilization, driving solid cash flow generation. However, its declining ROIC relative to cost of capital signals a cautionary tale on value destruction. CFG suits investors seeking aggressive growth with a tolerance for strategic risk.

Regions Financial Corporation (RF) boasts a strategic moat through improving profitability and disciplined capital allocation, reflected in its growing ROIC exceeding WACC. Its stronger return metrics and safer balance sheet make RF a more stable choice. This profile aligns well with investors favoring GARP strategies that balance growth and value.

If you prioritize dynamic growth and can absorb volatility, CFG’s operational efficiency and bullish momentum might appeal despite its value challenges. However, if you seek better stability and a gradually strengthening moat, RF outshines as a more prudent option offering superior risk-adjusted returns. Both present analytical scenarios worth considering within diversified portfolios.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Citizens Financial Group, Inc. and Regions Financial Corporation to enhance your investment decisions: