Home > Comparison > Financial Services > FITB vs CFG

The competitive dynamic between Fifth Third Bancorp and Citizens Financial Group shapes the regional banking landscape. Fifth Third operates a diversified financial services model with strong commercial and consumer lending focus. Citizens Financial emphasizes a broad retail and commercial banking platform with extensive digital delivery. This head-to-head pits diversified growth against digital-driven scale. This analysis will reveal which trajectory offers the superior risk-adjusted return for a balanced portfolio in financial services.

Table of contents

Companies Overview

Fifth Third Bancorp and Citizens Financial Group both play pivotal roles in regional banking across key U.S. markets.

Fifth Third Bancorp: Diversified Regional Banking Powerhouse

Fifth Third Bancorp stands as a diversified financial services company focused on commercial and consumer banking. It generates revenue through credit intermediation, lending, cash management, and wealth management services. In 2021, it emphasized expanding its branch network across the Midwest and Southeast to deepen customer relationships and enhance service offerings.

Citizens Financial Group, Inc.: Comprehensive Retail and Commercial Bank

Citizens Financial Group commands a strong presence in retail and commercial banking with a broad portfolio of deposit, lending, and wealth services. Its income derives from consumer deposits, mortgage lending, commercial loans, and treasury management solutions. In 2021, Citizens prioritized digital platform growth alongside extending its branch footprint across 14 states and the District of Columbia.

Strategic Collision: Similarities & Divergences

Both banks operate in regional markets with a focus on diversified banking and wealth management. Fifth Third leans into a multi-segment approach with extensive branch networks, while Citizens integrates digital innovation with a larger geographic reach. They primarily compete for middle-market and consumer segments. The distinct strategies reflect differing risk profiles and growth trajectories within the regional banking sector.

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Fifth Third Bancorp (FITB) | Citizens Financial Group (CFG) |

|---|---|---|

| Revenue | 12.87B | 11.15B |

| Cost of Revenue | 4.47B | 3.37B |

| Operating Expenses | 5.19B | 5.45B |

| Gross Profit | 8.40B | 7.78B |

| EBITDA | 3.62B | 2.69B |

| EBIT | 3.21B | 2.33B |

| Interest Expense | 3.92B | 3.81B |

| Net Income | 2.52B | 1.83B |

| EPS | 3.55 | 3.90 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable financial engine in 2025.

Fifth Third Bancorp Analysis

Fifth Third Bancorp’s revenue slightly declined by 1.4% in 2025 to $12.9B, yet net income rose 10.6% to $2.52B. Gross margin holds strong at 65.3%, reflecting solid cost control, while net margin improved to 19.6%. The bank’s efficiency gains manifest in a 10.1% EBIT growth, signaling robust momentum despite revenue softness.

Citizens Financial Group Analysis

Citizens Financial Group’s revenue dropped 9.7% to $11.1B in 2025, but net income surged 34.4% to $1.83B. Its gross margin is higher at 69.8%, though net margin trails at 16.4%. EBIT expanded 23.3%, reflecting operational leverage. However, steeper revenue declines temper the strong profitability gains, indicating mixed efficiency signals.

Margin Strength vs. Revenue Resilience

Both firms demonstrate favorable income statement profiles with growing EBIT and net margins despite revenue headwinds. Fifth Third shows superior net margins and steadier revenue, delivering consistent bottom-line growth. Citizens excels in gross margin and net income growth rate but suffers from sharper top-line contraction. Fifth Third’s profile appeals to investors seeking balanced profitability and revenue stability.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Fifth Third Bancorp (FITB) | Citizens Financial Group (CFG) |

|---|---|---|

| ROE | 11.6% | 7.0% |

| ROIC | 8.9% | 4.3% |

| P/E | 12.3 | 13.8 |

| P/B | 1.43 | 0.96 |

| Current Ratio | 0.82 | 1.04 |

| Quick Ratio | 0.82 | 1.04 |

| D/E | 0.67 | 0.43 |

| Debt-to-Assets | 6.8% | 5.0% |

| Interest Coverage | 0.82 | 0.61 |

| Asset Turnover | 0.06 | 0.05 |

| Fixed Asset Turnover | 4.14 | 12.18 |

| Payout Ratio | 39.8% | 40.5% |

| Dividend Yield | 3.23% | 2.94% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, unveiling operational strengths and hidden risks that shape investor confidence and valuation.

Fifth Third Bancorp

Fifth Third shows solid profitability with an 11.6% ROE and a strong 19.6% net margin, indicating efficient core operations. Its P/E of 12.33 and P/B of 1.43 suggest the stock is attractively valued. A 3.23% dividend yield rewards shareholders, balancing growth with steady returns.

Citizens Financial Group, Inc.

Citizens Financial posts a weaker 7.0% ROE and a 16.4% net margin, showing lower profitability efficiency. It trades at a slightly higher P/E of 13.76 but a lower P/B of 0.96, reflecting market skepticism. The 2.94% dividend yield supports income-focused investors amid moderate operational challenges.

Balanced Profitability Meets Valuation Discipline

Fifth Third balances profitability and valuation with a slightly favorable overall ratio profile. Citizens shows more favorable ratios overall but suffers from weaker returns. Investors seeking a blend of steady income and operational efficiency may lean toward Fifth Third’s profile, while those prioritizing valuation metrics might consider Citizens.

Which one offers the Superior Shareholder Reward?

I compare Fifth Third Bancorp (FITB) and Citizens Financial Group, Inc. (CFG) on dividend yield, payout ratio, and buybacks for 2026. FITB yields 3.23% with a 40% payout ratio, balancing dividends and buybacks sustainably. CFG offers a lower 2.94% yield but maintains a similar payout while likely emphasizing reinvestment. Both execute buybacks, yet FITB’s consistent cash flow coverage signals a more durable distribution. I find FITB offers a superior total shareholder return profile in 2026, blending yield, buybacks, and financial prudence better than CFG.

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Fifth Third Bancorp and Citizens Financial Group, Inc., highlighting their strategic strengths and weaknesses:

Fifth Third Bancorp shows a stronger return on equity (4 vs. 3) and a slight edge in discounted cash flow (both 4). Citizens Financial Group edges in price-to-book valuation (3 vs. 2), suggesting better market value relative to book assets. Both firms share moderate debt-to-equity and price-to-earnings scores, but Fifth Third Bancorp presents a more balanced profile with consistent returns, while Citizens relies more on valuation metrics.

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores place both firms deep in the distress zone, signaling heightened bankruptcy risk and vulnerability in this economic cycle:

Financial Health: Quality of Operations

Fifth Third Bancorp holds a very strong Piotroski F-Score of 8, surpassing Citizens Financial Group’s strong 7, indicating superior internal financial health and operational quality:

How are the two companies positioned?

This section dissects the operational DNA of FITB and CFG by comparing their revenue distribution by segment and internal dynamics. The goal is to confront their economic moats to identify which business model offers the most resilient and sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Fifth Third Bancorp and Citizens Financial Group diversify their income streams and where their primary sector bets lie:

Fifth Third Bancorp anchors its revenue in interest income at $10.4B for 2024, but diversifies across commercial banking ($377M), wealth management ($647M), and payments ($608M). Citizens Financial Group shows a narrower focus, relying heavily on service charges and fees ($417M) and card fees ($362M) in 2024. Fifth Third’s broad mix reduces concentration risk, whereas Citizens leans on fee-based income, implying stronger dependence on consumer transactional activity.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Fifth Third Bancorp and Citizens Financial Group, Inc.:

Fifth Third Bancorp Strengths

- Higher net margin at 19.61%

- Favorable P/E at 12.33

- Favorable dividend yield of 3.23%

- Low debt-to-assets at 6.77%

- Strong fixed asset turnover at 4.14

- Diversified revenue streams across banking and wealth management

Citizens Financial Group, Inc. Strengths

- Higher total favorable ratios at 57.14%

- Favorable P/E at 13.76

- Lower debt-to-equity at 0.43

- Favorable quick ratio of 1.04

- Strong fixed asset turnover at 12.18

- Consistent service and card fees revenue

Fifth Third Bancorp Weaknesses

- Current ratio below 1.0 at 0.82, indicating liquidity risk

- WACC at 12.33% exceeds ROIC at 8.9%

- Unfavorable interest coverage at 0.82

- Asset turnover low at 0.06

- Neutral ROE at 11.61% limits profitability growth

Citizens Financial Group, Inc. Weaknesses

- Lower net margin at 16.42%

- Unfavorable ROE at 6.96% and ROIC at 4.25%

- Higher WACC at 14.07%

- Unfavorable interest coverage at 0.61

- Asset turnover low at 0.05

Fifth Third Bancorp shows strengths in profitability margins, dividend yield, and moderate leverage but faces liquidity and capital cost challenges. Citizens Financial has a stronger balance sheet and operational efficiency but struggles with profitability and capital returns. Both banks display opportunities to improve asset utilization and interest coverage ratios.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from relentless competition erosion. Without it, sustainable value evaporates quickly. Let’s dissect the moat dynamics of two regional banks:

Fifth Third Bancorp: Emerging Profitability from Operational Efficiency

Fifth Third’s moat centers on cost advantage and operational improvements, reflected in a growing ROIC despite currently shedding value versus WACC. Margin stability and improving profitability signal potential moat deepening through efficiency gains in 2026.

Citizens Financial Group: Struggling Moat with Declining Returns

Citizens relies on scale and diversified services but faces a shrinking moat, evidenced by a sharply declining ROIC well below WACC. Its competitive position weakens amid margin pressure, risking further erosion unless strategic pivots reverse this trend.

Efficiency Edge vs. Scale Strain: Who Defends Market Share Better?

Fifth Third’s improving ROIC trend grants it a slightly wider and more durable moat than Citizens, whose value destruction and profitability decline signal a vulnerable competitive stance. I see Fifth Third better equipped to defend and potentially expand its market share in 2026.

Which stock offers better returns?

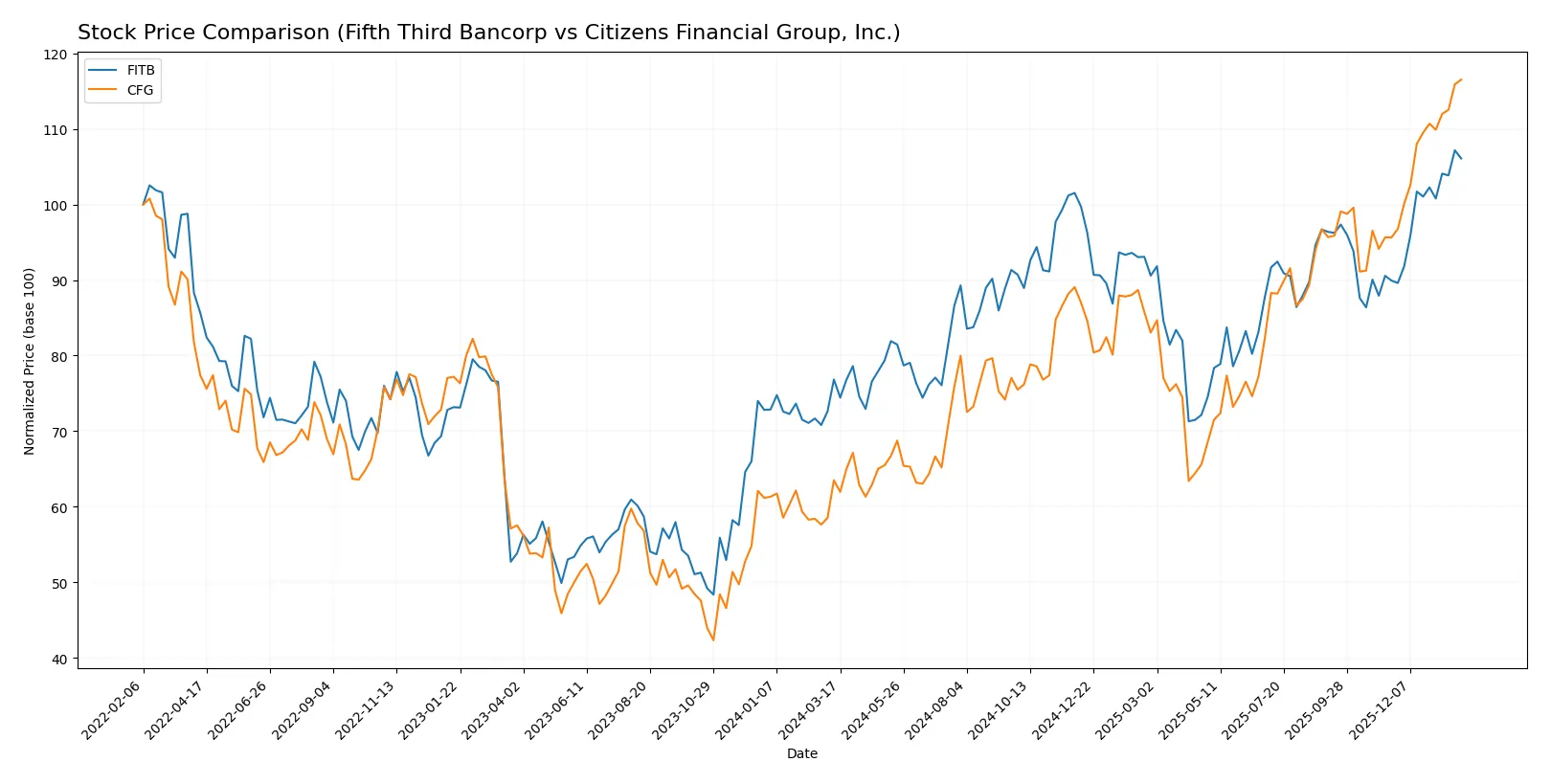

Over the past year, Fifth Third Bancorp and Citizens Financial Group, Inc. both exhibited strong price appreciation with accelerating bullish trends, marked by significant gains and distinct trading volume dynamics.

Trend Comparison

Fifth Third Bancorp’s stock price rose 38.08% over the past 12 months, showing an accelerating bullish trend with a standard deviation of 4.08 and a high of 50.74. Recent momentum remains positive.

Citizens Financial Group’s stock surged 83.51% in the same period, also accelerating bullishly with higher volatility at 7.49 standard deviation and a peak price of 62.98. Recent gains outpace FITB’s.

CFG outperformed FITB, delivering the highest market performance with stronger acceleration and greater price appreciation over the past year.

Target Prices

Analysts project a favorable outlook for Fifth Third Bancorp and Citizens Financial Group with solid upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Fifth Third Bancorp | 50 | 61 | 56.2 |

| Citizens Financial Group, Inc. | 60 | 80 | 69.46 |

Fifth Third Bancorp’s consensus target sits about 12% above its current price of $50.22, signaling moderate upside. Citizens Financial Group’s target consensus exceeds its $62.98 price by nearly 10%, reflecting strong analyst confidence.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is the comparison of recent institutional grades for Fifth Third Bancorp and Citizens Financial Group, Inc.:

Fifth Third Bancorp Grades

The following table summarizes recent grades from established grading companies for Fifth Third Bancorp.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-01-26 |

| DA Davidson | Maintain | Buy | 2026-01-26 |

| Citigroup | Maintain | Neutral | 2026-01-23 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2026-01-21 |

| RBC Capital | Maintain | Outperform | 2026-01-21 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Barclays | Maintain | Overweight | 2026-01-05 |

| Truist Securities | Maintain | Buy | 2025-12-22 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-12-17 |

| Piper Sandler | Maintain | Overweight | 2025-12-10 |

Citizens Financial Group, Inc. Grades

The following table summarizes recent grades from established grading companies for Citizens Financial Group, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2026-01-26 |

| Citigroup | Maintain | Buy | 2026-01-26 |

| Argus Research | Maintain | Buy | 2026-01-23 |

| RBC Capital | Maintain | Outperform | 2026-01-22 |

| B of A Securities | Maintain | Buy | 2026-01-22 |

| Morgan Stanley | Maintain | Overweight | 2026-01-22 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-22 |

| DA Davidson | Maintain | Buy | 2026-01-22 |

| TD Cowen | Maintain | Buy | 2026-01-22 |

| Raymond James | Downgrade | Outperform | 2026-01-07 |

Which company has the best grades?

Citizens Financial Group, Inc. generally receives stronger grades than Fifth Third Bancorp, with more Buy and Outperform ratings. This may attract investors seeking higher confidence from analysts.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Fifth Third Bancorp

- Faces intense regional banking competition with pressure on margins amid digital disruption.

Citizens Financial Group, Inc.

- Also competes heavily in regional banking, balancing physical branches and digital growth demands.

2. Capital Structure & Debt

Fifth Third Bancorp

- Moderate debt-to-equity (0.67) with favorable debt-to-assets (6.77%) but weak interest coverage (0.82).

Citizens Financial Group, Inc.

- Lower debt-to-equity (0.43) and debt-to-assets (4.98%), yet interest coverage is weaker (0.61), raising refinancing risks.

3. Stock Volatility

Fifth Third Bancorp

- Beta near 1 (0.988) indicates market-level volatility exposure.

Citizens Financial Group, Inc.

- Higher beta (1.086) suggests above-market volatility, increasing investor risk during downturns.

4. Regulatory & Legal

Fifth Third Bancorp

- Subject to stringent US banking regulations, with potential compliance costs impacting profitability.

Citizens Financial Group, Inc.

- Similar regulatory environment with added scrutiny due to a more complex commercial banking segment.

5. Supply Chain & Operations

Fifth Third Bancorp

- Operations face risks from technology integration and branch network efficiency.

Citizens Financial Group, Inc.

- Also exposed to operational risks tied to digital transformation and branch management costs.

6. ESG & Climate Transition

Fifth Third Bancorp

- ESG initiatives increasingly important; transition risks could affect loan portfolios in carbon-intensive sectors.

Citizens Financial Group, Inc.

- Faces ESG pressures with a need to align financing practices with climate goals to avoid reputational damage.

7. Geopolitical Exposure

Fifth Third Bancorp

- Primarily US-focused, limiting direct geopolitical risk but vulnerable to domestic economic policy shifts.

Citizens Financial Group, Inc.

- Also US-centric but with some exposure to national markets, adding modest geopolitical complexity.

Which company shows a better risk-adjusted profile?

Fifth Third Bancorp’s most impactful risk is its weak interest coverage, signaling potential refinancing challenges despite moderate leverage. Citizens Financial faces greater stock volatility and even weaker interest coverage, increasing financial risk. However, CFG’s stronger capital structure and higher Piotroski score suggest a more resilient risk-adjusted profile. Notably, FITB’s Altman Z-Score in the distress zone alarms on potential financial distress despite a very strong Piotroski Score, underscoring caution. Overall, CFG offers a slightly better risk-adjusted profile amid 2026’s banking pressures.

Final Verdict: Which stock to choose?

Fifth Third Bancorp’s superpower lies in its improving profitability and efficient capital management despite facing value destruction. Its aggressive growth is fueled by strong operational momentum but watch its liquidity tightness as a point of vigilance. It suits investors comfortable with moderate risk and seeking growth potential.

Citizens Financial Group offers a strategic moat through a solid balance sheet and favorable valuation metrics. Its stronger financial stability relative to Fifth Third makes it appealing for investors prioritizing safety. It fits well in GARP portfolios aiming for steady growth at a reasonable price.

If you prioritize growth backed by improving operational returns, Fifth Third Bancorp is the compelling choice due to its accelerating profitability trend. However, if you seek greater financial stability and value discipline, Citizens Financial Group offers better stability despite slower profitability momentum. Both present distinct analytical scenarios depending on your risk appetite.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Fifth Third Bancorp and Citizens Financial Group, Inc. to enhance your investment decisions: