Investors seeking growth in the communication equipment sector often weigh established giants against innovative newcomers. Cisco Systems, Inc. (CSCO) and Credo Technology Group Holding Ltd (CRDO) both operate in this dynamic industry, with Cisco offering a broad portfolio of networking solutions and Credo focusing on cutting-edge high-speed connectivity technologies. This comparison explores their market positions and innovation strategies to help you decide which company holds greater potential for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Cisco Systems, Inc. and Credo Technology Group Holding Ltd by providing an overview of these two companies and their main differences.

Cisco Systems, Inc. Overview

Cisco Systems, Inc., headquartered in San Jose, California, is a leading player in the communication equipment industry. Its mission centers on designing, manufacturing, and selling Internet Protocol-based networking products and related services globally. Cisco offers a broad portfolio including switching, routing, wireless, security, collaboration, and observability solutions, serving diverse customers such as businesses, governments, and service providers.

Credo Technology Group Holding Ltd Overview

Credo Technology Group Holding Ltd, also based in San Jose, focuses on providing high-speed connectivity solutions for optical and electrical Ethernet applications. Founded in 2008, Credo specializes in integrated circuits, active electrical cables, and SerDes chiplets, along with intellectual property licensing. The company operates internationally, supplying products designed to enhance data transmission performance in the technology sector.

Key similarities and differences

Both companies operate within the communication equipment industry and are headquartered in San Jose, specializing in technology solutions for network connectivity. Cisco offers a wider range of networking products and services, including security and collaboration tools, with a significantly larger workforce and market capitalization of about 298B USD. In contrast, Credo is more focused on niche high-speed connectivity components, with a market cap near 28B USD and a smaller employee base, reflecting a more specialized business model.

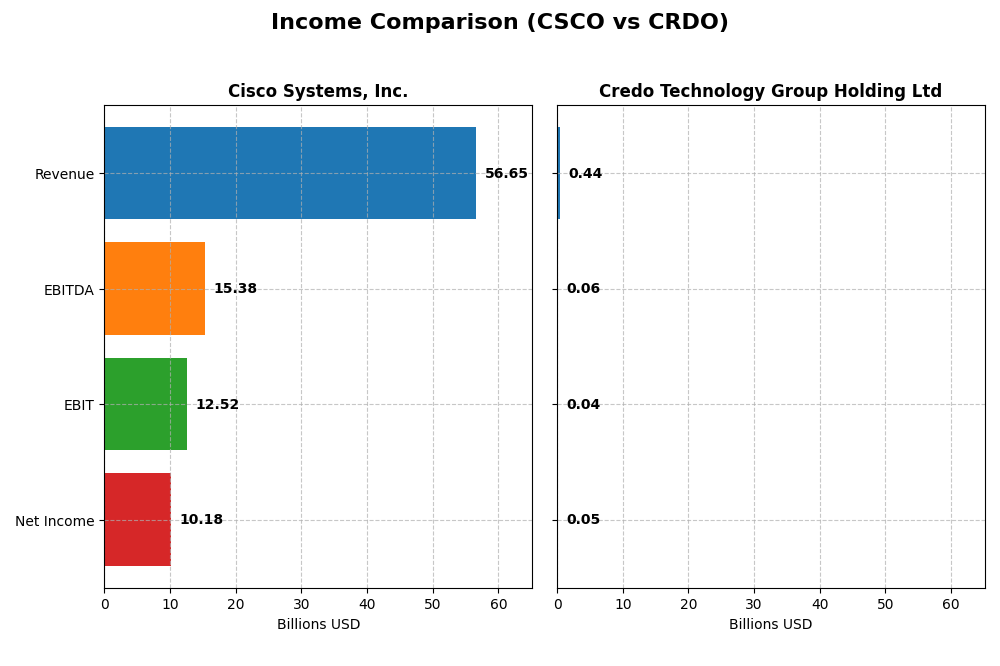

Income Statement Comparison

This table compares the most recent fiscal year income statement metrics for Cisco Systems, Inc. and Credo Technology Group Holding Ltd, highlighting their financial performance side by side.

| Metric | Cisco Systems, Inc. (CSCO) | Credo Technology Group Holding Ltd (CRDO) |

|---|---|---|

| Market Cap | 298.2B | 27.7B |

| Revenue | 56.7B | 437M |

| EBITDA | 15.4B | 60M |

| EBIT | 12.5B | 38M |

| Net Income | 10.2B | 52M |

| EPS | 2.56 | 0.31 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Cisco Systems, Inc.

Cisco’s revenue showed a steady increase from $49.8B in 2021 to $56.7B in 2025, yet net income declined from $10.6B to $10.2B over the same period. Gross margin remained strong at 64.9%, but net margin decreased to 18.0%. In 2025, revenue growth slowed to 5.3%, while net margin contracted by 6.3%, signaling margin pressures despite stable earnings per share.

Credo Technology Group Holding Ltd

Credo experienced rapid growth, with revenue jumping from $59M in 2021 to $437M in 2025, and net income turning positive to $52M after losses in previous years. Gross margin held steady at around 64.8%, while net margin improved to 12.0%. In the latest year, revenue and net income surged by over 120%, reflecting accelerated expansion and improved profitability.

Which one has the stronger fundamentals?

Cisco demonstrates solid profitability with favorable gross and net margins, but shows signs of margin compression and slower growth. Credo, while smaller, exhibits exceptional revenue and net income growth with improving margins and no interest expenses. The fundamental strength depends on preference for stable, established earnings versus high-growth potential with improving profitability.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Cisco Systems, Inc. and Credo Technology Group Holding Ltd, based on their fiscal year 2025 data. These ratios offer insight into profitability, liquidity, valuation, leverage, and operational efficiency.

| Ratios | Cisco Systems, Inc. (CSCO) | Credo Technology Group Holding Ltd (CRDO) |

|---|---|---|

| ROE | 21.73% | 7.66% |

| ROIC | 11.62% | 5.01% |

| P/E | 26.83 | 138.19 |

| P/B | 5.83 | 10.58 |

| Current Ratio | 1.00 | 6.62 |

| Quick Ratio | 0.91 | 5.79 |

| D/E | 0.63 | 0.02 |

| Debt-to-Assets | 24.24% | 1.98% |

| Interest Coverage | 7.38 | 0 |

| Asset Turnover | 0.46 | 0.54 |

| Fixed Asset Turnover | 16.59 | 5.54 |

| Payout ratio | 63.23% | 0% |

| Dividend yield | 2.36% | 0% |

Interpretation of the Ratios

Cisco Systems, Inc.

Cisco displays mostly favorable financial ratios, including a strong net margin of 17.97%, a robust return on equity at 21.73%, and a solid return on invested capital of 11.62%. Some concerns arise from its elevated PE ratio of 26.83 and a current ratio near 1.0, indicating tight short-term liquidity. Cisco pays dividends with a 2.36% yield; its payout is supported by free cash flow, reflecting a sustainable shareholder return policy.

Credo Technology Group Holding Ltd

Credo shows mixed ratio results: a favorable net margin of 11.95% but an unfavorable return on equity of 7.66% and a high weighted average cost of capital at 16.29%. The company maintains a high current ratio of 6.62, yet this is marked unfavorable, possibly indicating excess liquidity or inefficiency. Credo does not pay dividends, likely due to reinvestment in R&D and growth priorities, aligned with its high valuation multiples and no return to shareholders.

Which one has the best ratios?

Cisco Systems holds a more favorable overall ratio profile with 57.14% favorable metrics versus 42.86% for Credo, reflecting stronger profitability, capital returns, and a balanced risk profile. Credo’s neutral rating is affected by high valuation multiples, weaker returns, and no dividend yield, while Cisco combines solid operational performance with a steady dividend policy.

Strategic Positioning

This section compares the strategic positioning of Cisco Systems, Inc. and Credo Technology Group Holding Ltd, focusing on Market position, Key segments, and Exposure to technological disruption:

Cisco Systems, Inc.

- Leading global player in communication equipment with strong competitive pressure from peers.

- Diverse segments including networking, services, security, collaboration, and observability driving business.

- Positioned in established networking tech with ongoing innovation in cloud, security, and collaboration.

Credo Technology Group Holding Ltd

- Smaller market cap, niche player in high-speed connectivity solutions with intense competition.

- Focused on optical and electrical Ethernet products, IP licensing, and engineering services.

- Dependent on SerDes and DSP technologies, potentially vulnerable to rapid tech changes.

Cisco Systems, Inc. vs Credo Technology Group Holding Ltd Positioning

Cisco’s diversified portfolio spans multiple segments, reducing reliance on any single market, while Credo concentrates on specialized connectivity solutions, offering focused expertise but less segment diversity. Cisco’s scale offers broad market reach; Credo’s niche focus may limit scalability.

Which has the best competitive advantage?

Cisco holds a slightly favorable moat by creating value despite declining profitability, reflecting efficient capital use and scale advantages. Credo shows a slightly unfavorable moat, currently shedding value but improving profitability, indicating emerging competitive strength yet limited capital efficiency.

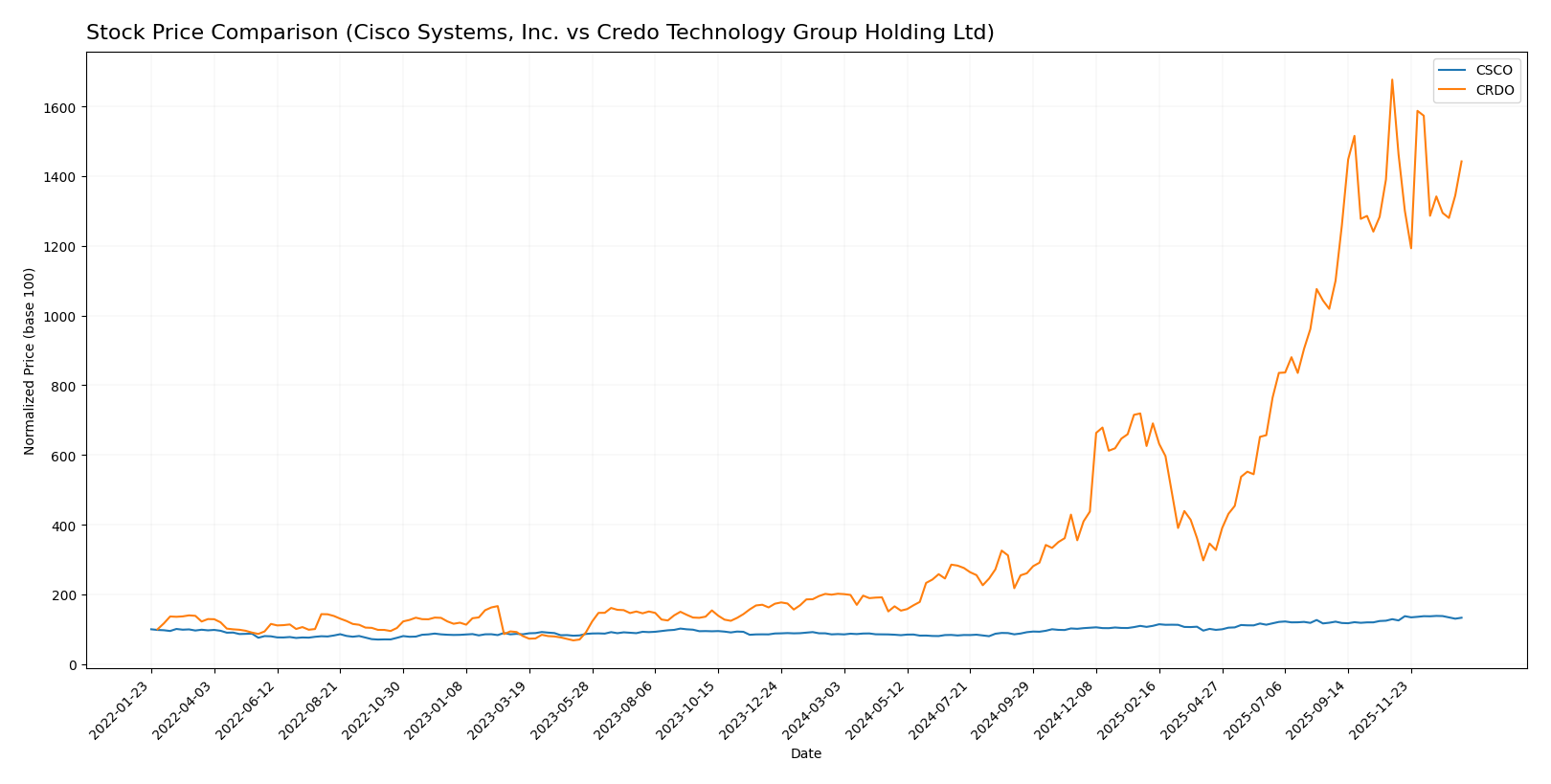

Stock Comparison

The stock price movements of Cisco Systems, Inc. and Credo Technology Group Holding Ltd over the past year reveal distinct bullish trends with varying degrees of acceleration and volume dynamics.

Trend Analysis

Cisco Systems, Inc. exhibited a 54.46% price increase over the past 12 months, indicating a bullish trend with deceleration. The stock showed a high of 78.42 and a low of 45.47, with moderate volatility (std dev 9.65).

Credo Technology Group Holding Ltd posted a 614.07% gain over the same period, also bullish but decelerating. This stock experienced higher volatility (std dev 48.96), with a high of 187.62 and a low of 16.92.

Comparing both, Credo Technology Group Holding Ltd delivered the highest market performance with a substantially greater price increase despite recent short-term weakness.

Target Prices

The analyst consensus suggests promising upside potential for both Cisco Systems, Inc. and Credo Technology Group Holding Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cisco Systems, Inc. | 91 | 69 | 82.67 |

| Credo Technology Group Holding Ltd | 250 | 160 | 217.5 |

For Cisco, the consensus target price of 82.67 USD is moderately above its current price of 75.47 USD, indicating cautious optimism. Credo’s consensus target of 217.5 USD exceeds its current 161.38 USD, reflecting stronger growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Cisco Systems, Inc. and Credo Technology Group Holding Ltd:

Rating Comparison

CSCO Rating

- Rating: Both companies have a “B” rating, considered very favorable.

- Discounted Cash Flow Score: CSCO scores 4, indicating favorable future cash flow projections.

- ROE Score: CSCO has a score of 4, reflecting favorable profit generation from equity.

- ROA Score: CSCO scores 4, showing favorable asset utilization.

- Debt To Equity Score: CSCO scores 1, reflecting very unfavorable financial risk with high debt.

- Overall Score: CSCO has a moderate score of 3.

CRDO Rating

- Rating: Both companies have a “B” rating, considered very favorable.

- Discounted Cash Flow Score: CRDO scores 1, indicating very unfavorable cash flow projections.

- ROE Score: CRDO also scores 4, showing favorable profit efficiency from equity.

- ROA Score: CRDO scores 5, indicating very favorable asset utilization.

- Debt To Equity Score: CRDO scores 4, indicating favorable financial stability with lower debt.

- Overall Score: CRDO also has a moderate score of 3.

Which one is the best rated?

Both companies share the same overall rating of “B” and an overall score of 3, indicating moderate standing. CSCO excels in discounted cash flow, while CRDO shows stronger asset utilization and better debt management. Neither is uniformly better rated across all metrics.

Scores Comparison

The comparison of Altman Z-Score and Piotroski Score for Cisco Systems and Credo Technology Group is as follows:

CSCO Scores

- Altman Z-Score: 3.19, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health and solid investment potential.

CRDO Scores

- Altman Z-Score: 100.37, well within the safe zone, indicating very low bankruptcy risk.

- Piotroski Score: 5, indicating average financial health and moderate investment quality.

Which company has the best scores?

Based strictly on the provided data, CRDO has a much higher Altman Z-Score, indicating stronger bankruptcy safety, but CSCO has a higher Piotroski Score, suggesting better overall financial strength. The scores show differing strengths.

Grades Comparison

The following tables summarize the recent grades assigned to Cisco Systems, Inc. and Credo Technology Group Holding Ltd by reputable grading companies:

Cisco Systems, Inc. Grades

This table lists the latest grades from established financial institutions for Cisco Systems, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Morgan Stanley | Maintain | Overweight | 2025-11-13 |

| B of A Securities | Maintain | Buy | 2025-11-13 |

| Evercore ISI Group | Maintain | In Line | 2025-11-13 |

| Barclays | Maintain | Equal Weight | 2025-11-13 |

| Piper Sandler | Maintain | Neutral | 2025-11-13 |

| UBS | Maintain | Buy | 2025-11-13 |

| Melius Research | Maintain | Buy | 2025-11-13 |

| JP Morgan | Maintain | Overweight | 2025-11-13 |

| Keybanc | Maintain | Overweight | 2025-11-13 |

Overall, Cisco’s grades predominantly indicate a positive outlook, with most firms maintaining “Buy” or “Overweight” ratings.

Credo Technology Group Holding Ltd Grades

This table presents the most recent grades from verified grading companies for Credo Technology Group Holding Ltd:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2025-12-02 |

| Needham | Maintain | Buy | 2025-12-02 |

| Mizuho | Maintain | Outperform | 2025-12-02 |

| Roth Capital | Maintain | Buy | 2025-12-02 |

| Barclays | Maintain | Overweight | 2025-12-02 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-07 |

| Barclays | Maintain | Overweight | 2025-09-04 |

| TD Cowen | Maintain | Buy | 2025-09-04 |

| Needham | Maintain | Buy | 2025-09-04 |

Credo’s grades consistently reflect strong confidence with multiple “Buy,” “Outperform,” and “Overweight” ratings maintained across recent months.

Which company has the best grades?

Both Cisco Systems and Credo Technology have strong consensus ratings of “Buy.” However, Credo Technology exhibits a higher concentration of “Buy,” “Outperform,” and “Overweight” grades, suggesting a more uniformly positive analyst perspective. This trend could signal potentially higher growth expectations or confidence from analysts, which investors might consider when assessing risk and reward profiles.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Cisco Systems, Inc. (CSCO) and Credo Technology Group Holding Ltd (CRDO) based on the most recent financial and market data.

| Criterion | Cisco Systems, Inc. (CSCO) | Credo Technology Group Holding Ltd (CRDO) |

|---|---|---|

| Diversification | Highly diversified with strong segments in Networking (28.3B), Security (8.1B), and Services (22.0B) | Less diversified; heavily reliant on Product segment (412M) with smaller License and Engineering Services |

| Profitability | Strong profitability: Net margin 18%, ROE 22%, ROIC 11.6%, with value creation above WACC | Moderate profitability: Net margin 12%, ROIC 5.0% below WACC (16.3%), indicating value destruction but improving |

| Innovation | Significant investment in security and collaboration technologies, maintaining competitive edge | Innovation growing with rising ROIC trend, but currently still shedding value overall |

| Global presence | Established global footprint with wide market reach in enterprise networking and security | Smaller scale, more niche market presence, focused on specialized technology licensing and services |

| Market Share | Leading market share in networking and enterprise IT infrastructure | Limited market share in niche segments, early growth phase |

Key takeaways: Cisco demonstrates strong value creation and market leadership supported by diversified revenue streams and solid profitability, though its profitability trend is slightly declining. Credo shows promising growth in profitability and innovation but currently struggles with value destruction and limited diversification, implying higher risk but potential for turnaround.

Risk Analysis

Below is a comparative risk assessment table for Cisco Systems, Inc. and Credo Technology Group Holding Ltd based on the most recent data from 2025–2026.

| Metric | Cisco Systems, Inc. (CSCO) | Credo Technology Group Holding Ltd (CRDO) |

|---|---|---|

| Market Risk | Moderate (Beta 0.86) | High (Beta 2.66) |

| Debt level | Moderate (D/E 0.63, Debt/assets 24%) | Very Low (D/E 0.02, Debt/assets 2%) |

| Regulatory Risk | Moderate (Global operations) | Moderate (Global operations, IP licensing) |

| Operational Risk | Low (Established, scale 90K employees) | Moderate (Small size, 500 employees) |

| Environmental Risk | Low (Technology sector) | Low (Technology sector) |

| Geopolitical Risk | Moderate (Global presence including China) | Moderate (US, China, Mexico operations) |

The most impactful risks differ: Cisco faces moderate market and geopolitical risks due to its large global footprint, while Credo’s higher market risk stems from its elevated beta and smaller scale. Cisco’s moderate debt level contrasts with Credo’s very low leverage, which reduces financial risk for Credo but its elevated valuation ratios suggest caution. Investors should weigh Cisco’s stable operations against Credo’s growth volatility and valuation risks.

Which Stock to Choose?

Cisco Systems, Inc. (CSCO) shows a generally favorable income evolution with stable net margins around 18%, moderate revenue growth, and solid profitability metrics including a 21.7% ROE. Its debt level is moderate, with some unfavorable liquidity ratios but a favorable interest coverage and a strong dividend yield. The company holds a very favorable overall rating and a slightly favorable moat rating despite a recent decline in ROIC.

Credo Technology Group Holding Ltd (CRDO) exhibits rapid revenue and net income growth, with a favorable income statement and improving profitability. However, its financial ratios are mixed, featuring high valuation multiples, very low debt, excellent liquidity, but a neutral overall financial ratio opinion. The company has a slightly unfavorable moat status due to ROIC below WACC but with a positive upward trend, and a moderate overall rating.

For investors prioritizing established profitability and financial stability, Cisco’s consistent value creation and favorable rating might appear more suitable. Conversely, those with a tolerance for higher risk and a focus on rapid growth could find Credo’s expanding income and improving profitability appealing, despite its current valuation and financial uncertainties.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cisco Systems, Inc. and Credo Technology Group Holding Ltd to enhance your investment decisions: