In the fast-evolving semiconductor industry, Tower Semiconductor Ltd. (TSEM) and Cirrus Logic, Inc. (CRUS) stand out as key players with distinct but overlapping market focuses. Tower specializes in analog intensive mixed-signal foundry services, while Cirrus delivers innovative low-power mixed-signal processing solutions, particularly for audio applications. This comparison explores their innovation strategies and market positions to help you decide which company may be the smarter addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Tower Semiconductor Ltd. and Cirrus Logic, Inc. by providing an overview of these two companies and their main differences.

Tower Semiconductor Ltd. Overview

Tower Semiconductor Ltd. is an independent semiconductor foundry specializing in analog intensive mixed-signal semiconductor devices. Founded in 1993 and headquartered in Israel, the company offers customizable process technologies, wafer fabrication, and design enablement services. It serves diverse markets including consumer electronics, automotive, aerospace, and medical devices, positioning itself as a versatile player in the semiconductor industry.

Cirrus Logic, Inc. Overview

Cirrus Logic, Inc. is a fabless semiconductor company focused on low-power, high-precision mixed-signal processing solutions. Established in 1984 and based in Austin, Texas, it provides audio and high-performance mixed-signal products used in smartphones, laptops, automotive entertainment, and industrial applications. Cirrus emphasizes advanced audio technologies like SoundClear to enhance user experience across multiple consumer and industrial markets.

Key similarities and differences

Both companies operate within the semiconductor sector but differ in business models: Tower Semiconductor is a foundry providing manufacturing and design services, while Cirrus Logic is fabless, focusing on product design and innovation in audio and mixed-signal ICs. They each target diverse end markets but with distinct technological specializations—Tower on fabrication and process technologies, Cirrus on integrated audio and signal processing solutions.

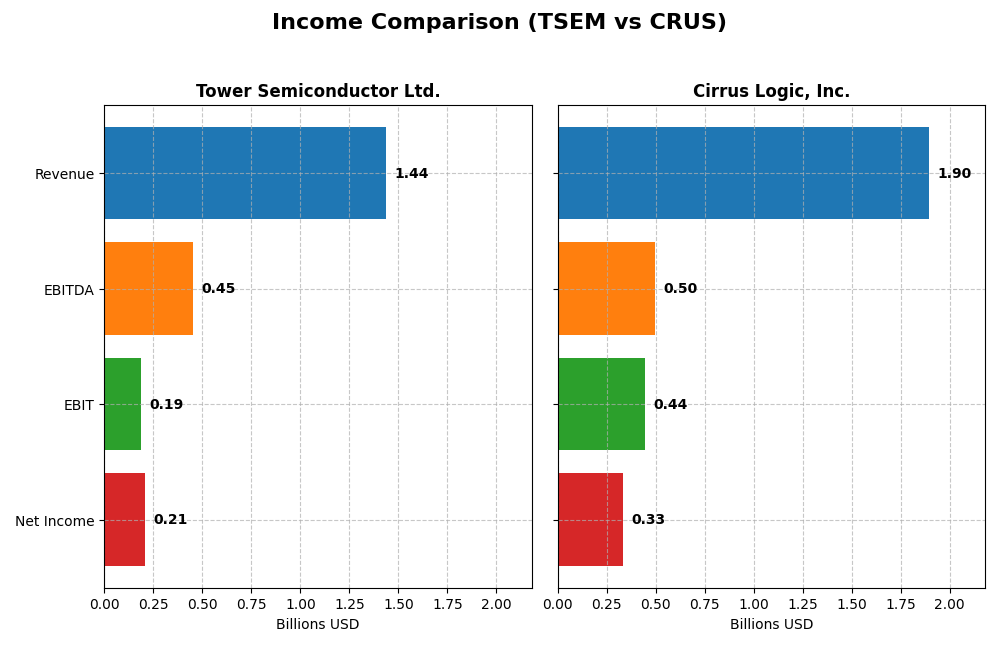

Income Statement Comparison

This table compares key income statement metrics for Tower Semiconductor Ltd. and Cirrus Logic, Inc. based on their most recent fiscal year data.

| Metric | Tower Semiconductor Ltd. (TSEM) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Market Cap | 13.9B | 6.3B |

| Revenue | 1.44B | 1.90B |

| EBITDA | 451M | 497M |

| EBIT | 185M | 445M |

| Net Income | 208M | 332M |

| EPS | 1.87 | 6.24 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Tower Semiconductor Ltd.

Tower Semiconductor’s revenue grew moderately by 13.5% from 2020 to 2024, while net income surged 153% over the same period, reflecting strong bottom-line improvement. Gross and EBIT margins remained favorable, near 23.6% and 12.9% respectively. However, in 2024, growth slowed with revenue up just 0.9%, and net income declined sharply by 60%, indicating recent margin compression and operational challenges.

Cirrus Logic, Inc.

Cirrus Logic reported solid revenue growth of 38.5% from 2021 to 2025, with net income rising 52.5%, supported by consistently robust margins—gross margin at 52.5% and EBIT margin at 23.5%. The latest year showed positive momentum as revenue increased 6%, earnings before tax grew 22%, and net margin expanded by nearly 14%, demonstrating improving profitability and operational efficiency.

Which one has the stronger fundamentals?

Cirrus Logic displays stronger fundamentals with higher and expanding margins, consistent revenue and net income growth, and a more favorable recent performance trend. Tower Semiconductor, while showing long-term income growth, experienced a significant earnings decline and margin deterioration in the latest year, suggesting more volatility and near-term headwinds compared to Cirrus Logic’s steadier progress.

Financial Ratios Comparison

This table presents a side-by-side comparison of key financial ratios for Tower Semiconductor Ltd. (TSEM) and Cirrus Logic, Inc. (CRUS) based on their most recent available fiscal year data.

| Ratios | Tower Semiconductor Ltd. (2024) | Cirrus Logic, Inc. (2025) |

|---|---|---|

| ROE | 7.8% | 17.0% |

| ROIC | 6.4% | 14.2% |

| P/E | 27.5 | 15.9 |

| P/B | 2.16 | 2.71 |

| Current Ratio | 6.18 | 6.35 |

| Quick Ratio | 5.23 | 4.82 |

| D/E (Debt-to-Equity) | 0.068 | 0.074 |

| Debt-to-Assets | 5.9% | 6.2% |

| Interest Coverage | 32.6 | 457.0 |

| Asset Turnover | 0.47 | 0.81 |

| Fixed Asset Turnover | 1.11 | 6.62 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Tower Semiconductor Ltd.

Tower Semiconductor shows a mixed ratio profile with favorable net margin and WACC but a weak ROE and an unfavorable P/E ratio indicating valuation concerns. Its very high current ratio may signal inefficient asset use. The company does not pay dividends, likely focusing on reinvestment or growth strategies, as reflected by its zero dividend yield and absence of payout data.

Cirrus Logic, Inc.

Cirrus Logic presents a stronger set of financial ratios, with favorable net margin, ROE, and ROIC, alongside an exceptional interest coverage ratio. The current ratio is high but unfavorable, similar to Tower. Like Tower, Cirrus Logic does not distribute dividends, suggesting a priority on reinvestment and innovation rather than shareholder payouts at this stage.

Which one has the best ratios?

Comparing both, Cirrus Logic displays a more favorable overall ratio profile with a higher proportion of strong metrics and fewer weaknesses. Tower Semiconductor’s ratios are more mixed, with notable concerns in profitability and valuation. Thus, Cirrus Logic holds a clearer edge in ratio strength based on this data.

Strategic Positioning

This section compares the strategic positioning of Tower Semiconductor Ltd. and Cirrus Logic, Inc., including market position, key segments, and exposure to technological disruption:

Tower Semiconductor Ltd.

- Independent foundry in semiconductors facing moderate competitive pressure in analog mixed-signal devices.

- Focuses on customizable process technologies across diverse sectors: consumer electronics, automotive, aerospace, medical, and industrial.

- Provides wafer fabrication and design enablement services, which may face disruption from evolving semiconductor manufacturing technologies.

Cirrus Logic, Inc.

- Fabless semiconductor company with competitive pressure in mixed-signal audio and industrial markets.

- Key segments are portable audio products and high-performance mixed-signal products, driving revenue growth.

- Develops integrated audio solutions with proprietary SoundClear technology, exposed to audio processing innovation.

Tower Semiconductor Ltd. vs Cirrus Logic, Inc. Positioning

Tower Semiconductor operates a diversified foundry model serving multiple industries, offering broad market exposure but facing fabrication technology risks. Cirrus Logic concentrates on audio and mixed-signal ICs, benefiting from specialized technology but narrower market focus.

Which has the best competitive advantage?

Cirrus Logic shows a very favorable moat with ROIC exceeding WACC and growing profitability, indicating a durable competitive advantage. Tower Semiconductor’s moat is slightly unfavorable, with value destruction despite improving ROIC trends.

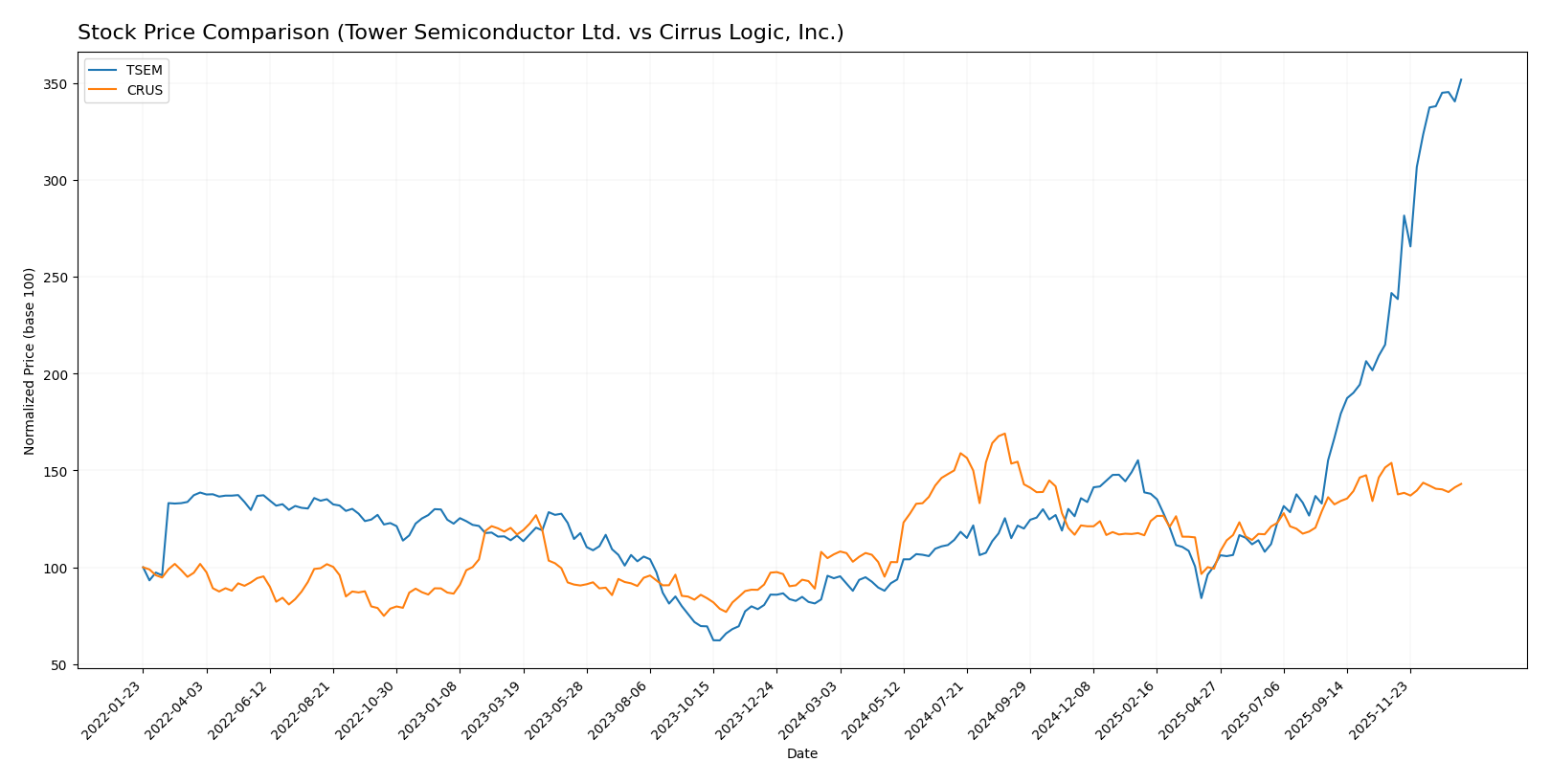

Stock Comparison

The stock price movements over the past year show Tower Semiconductor Ltd. (TSEM) with a strong bullish trend and accelerating gains, while Cirrus Logic, Inc. (CRUS) also experienced a bullish trend but with deceleration and recent mild decline.

Trend Analysis

Tower Semiconductor Ltd. (TSEM) recorded a 272.71% price increase over the past 12 months, signaling a strong bullish trend with acceleration. The stock ranged between 29.65 and 124.0, showing high volatility (std deviation 23.67).

Cirrus Logic, Inc. (CRUS) showed a 34.06% price increase over the same period, confirming a bullish trend but with deceleration. It traded between 82.02 and 145.69, with moderate volatility (std deviation 14.46), and a recent 7.06% decline.

Comparing both, TSEM delivered the highest market performance with a significantly larger price increase and accelerating momentum, while CRUS’s trend is positive but slowing down and recently negative.

Target Prices

Analysts present a mixed but generally positive price outlook for Tower Semiconductor Ltd. and Cirrus Logic, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Tower Semiconductor Ltd. | 125 | 66 | 96 |

| Cirrus Logic, Inc. | 155 | 100 | 138.75 |

Tower Semiconductor’s consensus target price of 96 is slightly below its current price of 124, suggesting limited upside. Cirrus Logic’s consensus target of 138.75 indicates a potential upside from its current price of 123.28, reflecting more bullish analyst sentiment.

Analyst Opinions Comparison

This section compares the analysts’ ratings and grades for Tower Semiconductor Ltd. and Cirrus Logic, Inc.:

Rating Comparison

TSEM Rating

- Rating: B+ with a very favorable status.

- Discounted Cash Flow Score: Moderate at 3, indicating average valuation based on cash flow.

- ROE Score: Moderate at 3, reflecting average efficiency in generating profit from equity.

- ROA Score: Favorable at 4, suggesting effective asset utilization.

- Debt To Equity Score: Favorable at 4, implying a stronger balance sheet with lower financial risk.

- Overall Score: Moderate at 3, reflecting an average overall financial standing.

CRUS Rating

- Rating: A- with a very favorable status.

- Discounted Cash Flow Score: Favorable at 4, showing better valuation prospects.

- ROE Score: Favorable at 4, indicating stronger profitability from shareholders’ equity.

- ROA Score: Very favorable at 5, demonstrating excellent asset efficiency.

- Debt To Equity Score: Moderate at 3, showing a higher financial risk relative to TSEM.

- Overall Score: Favorable at 4, indicating a stronger overall financial position.

Which one is the best rated?

Based strictly on the provided data, Cirrus Logic (CRUS) holds a better rating and higher scores across most key financial metrics than Tower Semiconductor (TSEM), suggesting a stronger financial profile in this comparison.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Tower Semiconductor Ltd. and Cirrus Logic, Inc.:

TSEM Scores

- Altman Z-Score: 21.06, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health based on key criteria.

CRUS Scores

- Altman Z-Score: 11.94, also in the safe zone with low bankruptcy risk.

- Piotroski Score: 7, showing strong financial health similarly.

Which company has the best scores?

Both TSEM and CRUS have Altman Z-Scores well within the safe zone, indicating low bankruptcy risk. Their Piotroski Scores are equal at 7, reflecting strong financial health for both companies based on the provided data.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Tower Semiconductor Ltd. and Cirrus Logic, Inc.:

Tower Semiconductor Ltd. Grades

The following table summarizes recent grades from major grading companies for Tower Semiconductor Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2026-01-09 |

| Wedbush | Downgrade | Neutral | 2025-12-31 |

| Benchmark | Maintain | Buy | 2025-11-11 |

| Susquehanna | Maintain | Positive | 2025-11-11 |

| Wedbush | Maintain | Outperform | 2025-11-11 |

| Barclays | Maintain | Equal Weight | 2025-11-11 |

| Benchmark | Maintain | Buy | 2025-09-08 |

| Susquehanna | Maintain | Positive | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-04 |

Tower Semiconductor’s grades show a predominance of Buy and Positive ratings, with a single Neutral downgrade, indicating a generally favorable outlook.

Cirrus Logic, Inc. Grades

Below is a summary of recent grades from recognized grading firms for Cirrus Logic, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Benchmark | Maintain | Buy | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Stifel | Maintain | Buy | 2025-09-12 |

| Barclays | Maintain | Equal Weight | 2025-05-07 |

| Barclays | Maintain | Equal Weight | 2025-04-22 |

| Stifel | Maintain | Buy | 2025-04-17 |

Cirrus Logic’s grades are predominantly Buy and Positive, complemented by Overweight ratings and multiple Equal Weight assessments, reflecting steady analyst confidence.

Which company has the best grades?

Both Tower Semiconductor Ltd. and Cirrus Logic, Inc. have received mostly Buy and Positive grades from reputable firms, indicating favorable analyst sentiment. Cirrus Logic shows a slightly higher number of Buy ratings and Overweight actions, potentially signaling stronger momentum. Investors might interpret these grades as a signal of relative analyst confidence, which could influence portfolio decisions.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Tower Semiconductor Ltd. (TSEM) and Cirrus Logic, Inc. (CRUS) based on the most recent financial and strategic data.

| Criterion | Tower Semiconductor Ltd. (TSEM) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Diversification | Limited product range, focused on specialty semiconductor manufacturing | More diversified with high-performance mixed signal and portable audio products |

| Profitability | Moderate net margin (14.47%), ROIC below WACC indicating value destruction | Strong net margin (17.48%) and ROIC well above WACC supporting value creation |

| Innovation | ROIC trend growing, suggesting improving efficiency but overall slightly unfavorable moat | Growing ROIC and innovation reflected in product mix and durable competitive advantage |

| Global presence | Moderate, primarily serving semiconductor markets | Strong presence in consumer electronics with global reach |

| Market Share | Niche markets with modest asset turnover (0.47) | Larger market share in audio and mixed signal segments with higher asset turnover (0.81) |

Key takeaways: Cirrus Logic demonstrates stronger profitability, innovation, and market presence, supported by a very favorable economic moat. Tower Semiconductor shows improving ROIC but still destroys value, requiring cautious consideration due to weaker profitability and market diversification.

Risk Analysis

Below is a comparative table of key risks for Tower Semiconductor Ltd. (TSEM) and Cirrus Logic, Inc. (CRUS) based on the most recent data available:

| Metric | Tower Semiconductor Ltd. (TSEM) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Market Risk | Moderate beta at 0.876; semiconductor cyclicality | Slightly higher beta at 1.084; sensitivity to consumer electronics demand |

| Debt level | Low debt-to-equity ratio at 0.07; favorable leverage | Low debt-to-equity ratio at 0.07; moderate financial risk |

| Regulatory Risk | Exposure to international trade policies, especially US, Asia, Europe | US-focused with some international exposure; regulatory changes in tech sector |

| Operational Risk | Complex manufacturing processes; supply chain constraints | Fabless model reduces manufacturing risk but depends on foundry partners |

| Environmental Risk | Moderate; semiconductor fabs consume significant energy and water | Moderate; fabless reduces direct impact but supply chain may be exposed |

| Geopolitical Risk | High; headquartered in Israel with operations in multiple regions | Moderate; US-based but with global supply chain dependencies |

Synthesizing these risks, geopolitical tensions and supply chain disruptions present the most impactful challenges for Tower Semiconductor given its manufacturing footprint in sensitive regions. Cirrus Logic’s main risks lie in market demand fluctuations and regulatory shifts in the US technology sector. Both companies maintain low debt levels, which supports financial resilience.

Which Stock to Choose?

Tower Semiconductor Ltd. (TSEM) shows overall favorable income statement metrics with a 14.47% net margin but recent declines in profitability growth. Its financial ratios are slightly favorable, with strong debt management and liquidity, yet some valuations like P/E remain unfavorable. The company has a slightly unfavorable MOAT rating due to ROIC below WACC but with improving profitability.

Cirrus Logic, Inc. (CRUS) exhibits a very favorable income profile with a 17.48% net margin and consistent positive growth across key metrics. Its financial ratios are favorable overall, highlighting strong returns and low debt risk. CRUS holds a very favorable MOAT rating, indicating value creation and a durable competitive advantage.

Considering ratings and financial performance, CRUS might appeal to investors seeking quality and consistent value creation, while TSEM could be more relevant for those who tolerate some risk and look for improving profitability. The choice could thus depend on an investor’s risk tolerance and preference for growth versus stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Tower Semiconductor Ltd. and Cirrus Logic, Inc. to enhance your investment decisions: