In the fast-evolving semiconductor industry, Cirrus Logic, Inc. (CRUS) and SkyWater Technology, Inc. (SKYT) stand out as key players with distinct approaches. Cirrus Logic focuses on high-precision mixed-signal processing solutions, while SkyWater specializes in semiconductor manufacturing and co-development services. Both companies target innovation and market relevance, making their comparison vital for investors seeking growth in technology. Let’s explore which company offers the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Cirrus Logic, Inc. and SkyWater Technology, Inc. by providing an overview of these two companies and their main differences.

Cirrus Logic Overview

Cirrus Logic, Inc. is a fabless semiconductor company focused on low-power and high-precision mixed-signal processing solutions. The company offers audio products like codecs, smart codecs, and amplifiers used in consumer electronics such as smartphones, AR/VR headsets, and automotive systems. Headquartered in Austin, Texas, Cirrus Logic emphasizes enhancing user experience through its SoundClear technology and serves both industrial and energy markets with high-performance mixed-signal products.

SkyWater Technology Overview

SkyWater Technology, Inc. specializes in semiconductor development and manufacturing services, providing engineering and process development support to co-create technologies with customers. The company manufactures silicon-based analog, mixed-signal, power discrete, MEMS, and rad-hard integrated circuits. Founded in 2017 and based in Bloomington, Minnesota, SkyWater serves diverse sectors including aerospace and defense, automotive, bio-health, consumer, and industrial IoT industries.

Key similarities and differences

Both companies operate in the semiconductor industry and focus on mixed-signal technologies, yet Cirrus Logic is fabless, concentrating on product design and audio processing solutions, while SkyWater combines semiconductor development with manufacturing services. Cirrus targets consumer electronics and energy applications, whereas SkyWater’s client base is broader, including aerospace, defense, and healthcare. The companies differ in size and market capitalization, reflecting their distinct business models and market segments.

Income Statement Comparison

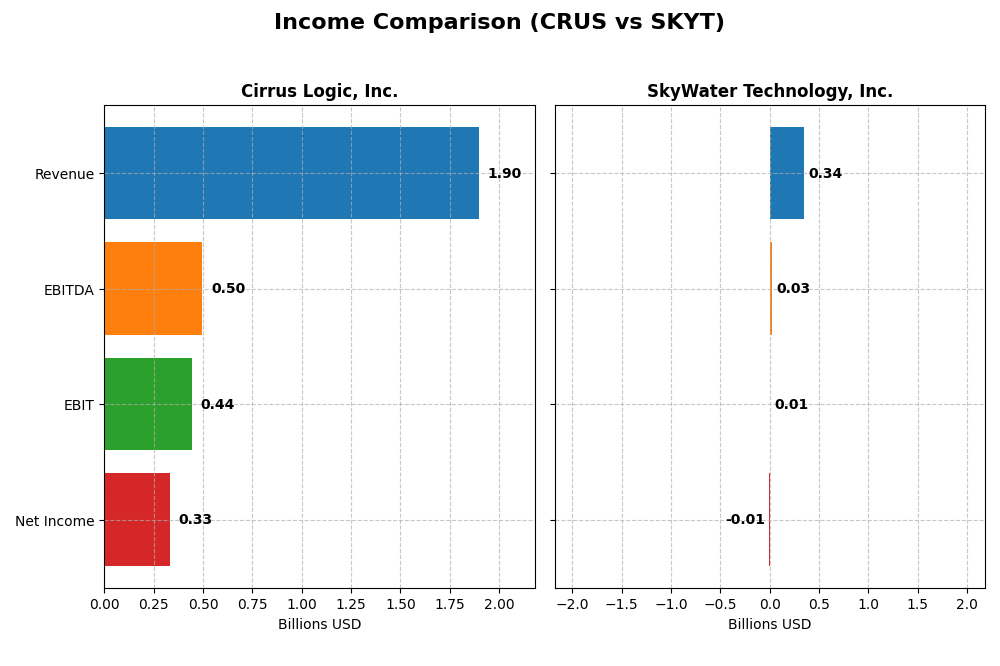

The table below compares the most recent fiscal year income statement metrics for Cirrus Logic, Inc. and SkyWater Technology, Inc., providing an overview of their financial performance.

| Metric | Cirrus Logic, Inc. | SkyWater Technology, Inc. |

|---|---|---|

| Market Cap | 6.3B | 1.5B |

| Revenue | 1.9B | 342M |

| EBITDA | 497M | 25M |

| EBIT | 445M | 7M |

| Net Income | 332M | -7M |

| EPS | 6.24 | -0.14 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Cirrus Logic, Inc.

Cirrus Logic’s revenue increased from $1.37B in 2021 to about $1.90B in 2025, reflecting a favorable overall growth of 38.5%. Net income rose sharply by 52.5% over the period, reaching $331.5M in 2025. Margins remained robust, with gross margin at 52.5% and net margin improving to 17.5%. The 2025 fiscal year showed solid margin improvements and a 6% revenue growth, indicating steady operational efficiency.

SkyWater Technology, Inc.

SkyWater Technology’s revenue grew from $140M in 2020 to $342M in 2024, a strong 143.7% increase. The net income, however, remained negative until 2024, when losses narrowed to -$6.8M. Gross margin improved to 20.3%, while net margin stayed unfavorable at -2.0%. Despite losses, 2024 marked significant progress with an 81.5% net margin growth and a 79.4% EPS increase, signaling improving fundamentals.

Which one has the stronger fundamentals?

Cirrus Logic demonstrates more consistent profitability with favorable margins and sustained net income growth, reflecting operational stability. SkyWater shows impressive revenue expansion and improving margins but still posts net losses, indicating higher risk. Cirrus Logic’s stronger earnings quality contrasts with SkyWater’s growth-driven but less mature financial profile.

Financial Ratios Comparison

This table presents the latest financial ratios for Cirrus Logic, Inc. and SkyWater Technology, Inc., enabling a side-by-side comparison of key metrics for fiscal year 2025 and 2024 respectively.

| Ratios | Cirrus Logic, Inc. (CRUS) FY 2025 | SkyWater Technology, Inc. (SKYT) FY 2024 |

|---|---|---|

| ROE | 17.0% | -11.8% |

| ROIC | 14.2% | 3.4% |

| P/E | 15.9 | -100.3 |

| P/B | 2.71 | 11.82 |

| Current Ratio | 6.35 | 0.86 |

| Quick Ratio | 4.82 | 0.76 |

| D/E (Debt-to-Equity) | 0.074 | 1.33 |

| Debt-to-Assets | 6.2% | 24.5% |

| Interest Coverage | 457 | 0.74 |

| Asset Turnover | 0.81 | 1.09 |

| Fixed Asset Turnover | 6.62 | 2.07 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Cirrus Logic, Inc.

Cirrus Logic shows predominantly favorable ratios with strong profitability metrics, including a net margin of 17.48% and ROE at 17.01%, indicating efficient profit generation. The company also has a robust interest coverage ratio of 495.45, reflecting low financial risk. However, the high current ratio of 6.35 may indicate excessive liquidity. Cirrus Logic does not pay dividends, likely focusing on reinvestment and innovation.

SkyWater Technology, Inc.

SkyWater Technology exhibits mostly unfavorable ratios, with a negative net margin of -1.98% and negative ROE at -11.79%, suggesting ongoing losses and inefficient equity use. The company’s high debt-to-equity ratio of 1.33 and weak interest coverage of 0.74 point to financial stress. It also does not pay dividends, probably due to negative earnings and a growth-focused strategy.

Which one has the best ratios?

Based on the ratio evaluations, Cirrus Logic has the best financial ratios with a favorable overall profile characterized by solid profitability, strong solvency, and liquidity, despite a caution on its high current ratio. In contrast, SkyWater displays significant financial weaknesses and an unfavorable ratio profile, reflecting challenges in profitability and financial stability.

Strategic Positioning

This section compares the strategic positioning of Cirrus Logic, Inc. and SkyWater Technology, Inc. across Market position, Key segments, and Exposure to technological disruption:

Cirrus Logic, Inc.

- Established fabless semiconductor with $6.3B market cap, moderate competitive pressure

- Focuses on portable audio products and high-performance mixed-signal ICs driving revenue

- Operates in mature mixed-signal and audio IC markets, limited direct exposure to disruptive tech

SkyWater Technology, Inc.

- Smaller foundry services provider with $1.5B market cap, high beta implies stronger competitive volatility

- Provides semiconductor development and manufacturing for diverse industries including aerospace and automotive

- Engages in advanced technology and wafer manufacturing, exposed to rapid industry innovation and evolving tech

Cirrus Logic vs SkyWater Technology Positioning

Cirrus Logic’s diversified focus on audio and mixed-signal ICs benefits from established markets, while SkyWater’s concentrated foundry services target emerging sectors. Cirrus has scale advantages; SkyWater faces higher volatility but potential innovation gains.

Which has the best competitive advantage?

Cirrus Logic exhibits a very favorable moat with consistent value creation and growing ROIC, indicating a durable competitive advantage. SkyWater’s moat is slightly unfavorable despite improving profitability, signaling weaker competitive positioning.

Stock Comparison

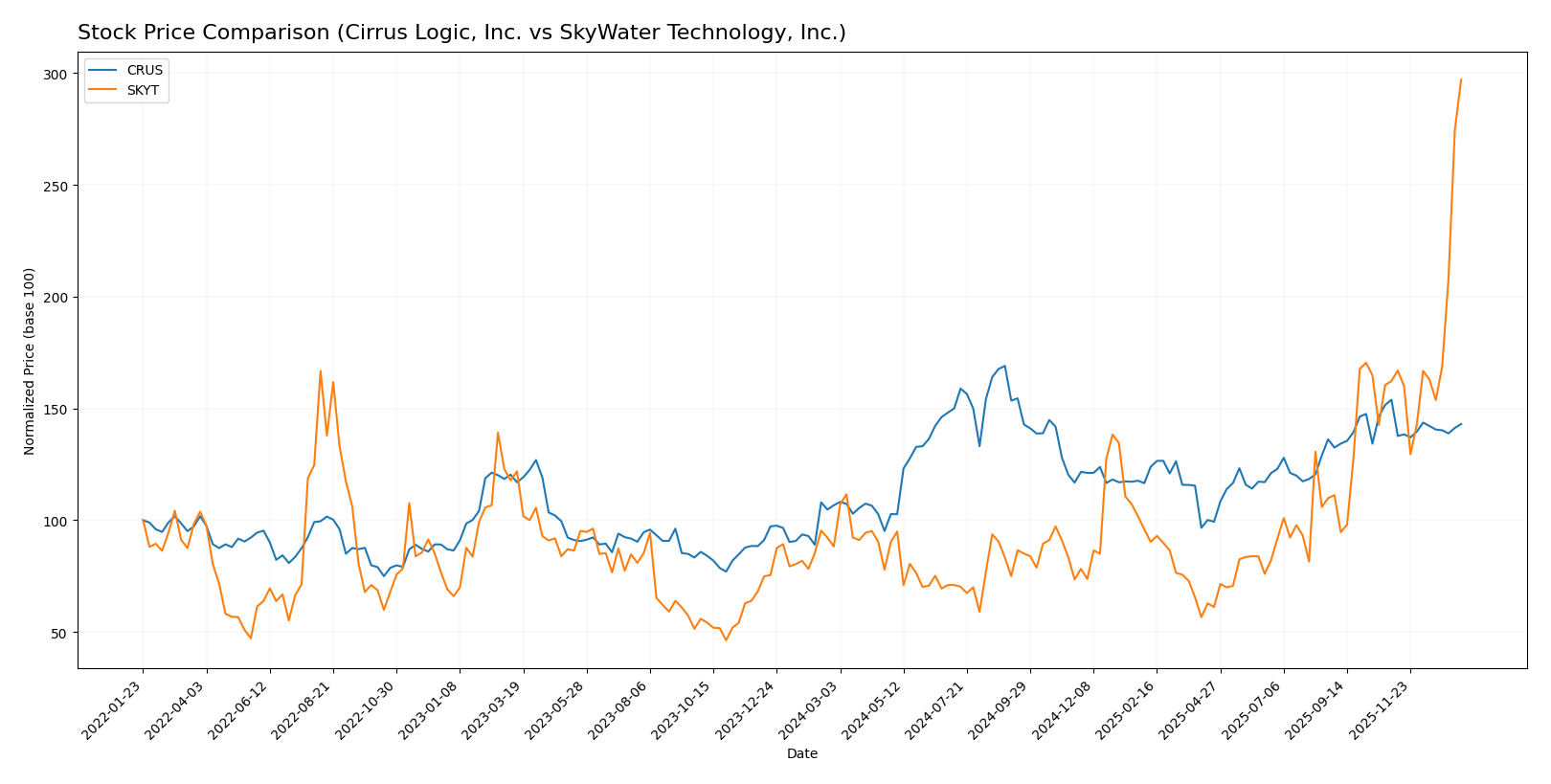

The past year has seen Cirrus Logic, Inc. (CRUS) and SkyWater Technology, Inc. (SKYT) experience significant price movements, with CRUS showing a strong initial gain followed by a recent pullback, while SKYT has demonstrated robust and accelerating growth.

Trend Analysis

Cirrus Logic, Inc. (CRUS) exhibited a bullish trend over the past 12 months, with a 34.06% price increase and decelerating momentum. The stock ranged between 82.02 and 145.69, showing recent weakness with a -7.06% drop since November 2025.

SkyWater Technology, Inc. (SKYT) delivered a pronounced bullish trend over the same period, surging 236.8% with accelerating momentum. It traded between 6.1 and 32.03, supported by an 83.13% gain in the recent two and a half months.

Comparing the two, SKYT has outperformed CRUS substantially, posting the highest market performance with strong acceleration and buyer dominance throughout the past year.

Target Prices

The current analyst consensus presents a mixed outlook for Cirrus Logic, Inc. and SkyWater Technology, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cirrus Logic, Inc. | 155 | 100 | 138.75 |

| SkyWater Technology, Inc. | 25 | 25 | 25 |

Analysts expect Cirrus Logic’s stock to appreciate from its current price of $123.28 toward a consensus target of $138.75, indicating moderate upside potential. SkyWater Technology’s consensus target of $25 is below its current price of $32.03, suggesting a bearish view by analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cirrus Logic, Inc. and SkyWater Technology, Inc.:

Rating Comparison

CRUS Rating

- Rating: A- indicating a very favorable overall assessment.

- Discounted Cash Flow Score: 4, considered favorable.

- ROE Score: 4, showing favorable efficiency in equity use.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 3, moderate financial risk level.

- Overall Score: 4, representing a favorable overall rating.

SKYT Rating

- Rating: B+ reflecting a very favorable overall assessment.

- Discounted Cash Flow Score: 1, rated very unfavorable.

- ROE Score: 5, indicating very favorable equity profitability.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 3, reflecting a moderate overall rating.

Which one is the best rated?

Based on the provided data, Cirrus Logic holds higher ratings in discounted cash flow and overall score, while SkyWater excels in return on equity and assets but scores poorly on debt to equity and discounted cash flow. Overall, Cirrus Logic is better rated.

Scores Comparison

The comparison of scores between Cirrus Logic, Inc. and SkyWater Technology, Inc. is as follows:

Cirrus Logic, Inc. Scores

- Altman Z-Score: 11.94, indicating a safe zone for bankruptcy

- Piotroski Score: 7, classified as strong financial health

SkyWater Technology, Inc. Scores

- Altman Z-Score: 2.20, placing it in the grey zone

- Piotroski Score: 5, considered average financial health

Which company has the best scores?

Based strictly on the provided data, Cirrus Logic has higher Altman Z-Score and Piotroski Score values, indicating stronger financial stability and health compared to SkyWater Technology.

Grades Comparison

The following presents the recent grades assigned to Cirrus Logic, Inc. and SkyWater Technology, Inc. by reputable grading firms:

Cirrus Logic, Inc. Grades

This table summarizes Cirrus Logic’s recent analyst grades from well-known financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Benchmark | Maintain | Buy | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Stifel | Maintain | Buy | 2025-09-12 |

| Barclays | Maintain | Equal Weight | 2025-05-07 |

| Barclays | Maintain | Equal Weight | 2025-04-22 |

| Stifel | Maintain | Buy | 2025-04-17 |

Cirrus Logic’s grades consistently indicate a positive outlook, with multiple “Buy” and “Overweight” ratings and no downgrades over the period.

SkyWater Technology, Inc. Grades

Below are the recent grades for SkyWater Technology from established financial analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology’s grades also show a strong buy-side consensus with repeated “Buy” and “Overweight” ratings maintained over time.

Which company has the best grades?

Both companies receive predominantly “Buy” and “Overweight” ratings from credible firms, reflecting positive analyst sentiment. Cirrus Logic shows a larger number of total ratings, while SkyWater maintains a steady buy consensus with fewer ratings. Investors may interpret the breadth and consistency of these favorable grades as indicative of strong market confidence for both stocks.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Cirrus Logic, Inc. (CRUS) and SkyWater Technology, Inc. (SKYT) based on the most recent financial and operational data.

| Criterion | Cirrus Logic, Inc. (CRUS) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | Moderate: Focused on audio and mixed-signal products, with steady revenue growth in Portable Audio (1.14B USD in 2025) and High-Performance Mixed Signal segments | Limited: Mainly advanced technology and wafer services, revenue around 150M USD in tech services, less diversified product base |

| Profitability | Strong: ROIC 14.2%, net margin 17.48%, favorable financial ratios overall, creating value with ROIC > WACC by 5.44% | Weak: Negative net margin (-1.98%), ROIC 3.4% below WACC (19.8%), shedding value despite growing ROIC trend |

| Innovation | Solid: Consistent growth in high-performance mixed-signal tech, supporting durable competitive advantage | Improving: ROIC trend shows growth, but profitability remains low; innovation impact yet to translate into profitability |

| Global presence | Established: Products serve global consumer electronics markets, especially portable audio | Niche: Focused on specialized technology services, smaller scale and narrower market reach |

| Market Share | Significant in audio semiconductor niche with steady revenue increases | Small player in semiconductor foundry services, growing but limited market share |

Key takeaways: Cirrus Logic demonstrates strong profitability and a durable competitive advantage driven by focused innovation in audio semiconductors, making it a value creator. SkyWater is still building profitability and market presence, showing potential but currently shedding value with riskier financials.

Risk Analysis

Below is a comparative table outlining key risk factors for Cirrus Logic, Inc. (CRUS) and SkyWater Technology, Inc. (SKYT) based on the most recent data available:

| Metric | Cirrus Logic, Inc. (CRUS) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Risk | Moderate (Beta: 1.08) | High (Beta: 3.49) |

| Debt level | Low (D/E: 0.07) | High (D/E: 1.33) |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Moderate |

Cirrus Logic shows a lower market volatility and minimal debt, reducing financial risk, but has a less favorable current ratio indicating liquidity concerns. SkyWater bears higher market risk and leverage, with financial distress signals from a low interest coverage ratio and a grey-zone bankruptcy risk score. The most impactful risks for SkyWater are its elevated debt and market volatility, while Cirrus Logic’s main caution is liquidity management.

Which Stock to Choose?

Cirrus Logic, Inc. (CRUS) shows a favorable income evolution with sustained revenue and net income growth over 2021-2025. Its profitability metrics like ROE (17.0%) and net margin (17.5%) are solid, debt levels are low with a debt-to-equity of 0.07, and it holds a very favorable overall rating (A-). The company exhibits a very favorable moat status, indicating durable competitive advantages and value creation.

SkyWater Technology, Inc. (SKYT) demonstrates strong revenue growth but negative net margin (-2.0%) and ROE (-11.8%) in 2024. Its financial ratios largely appear unfavorable, including a high debt-to-equity of 1.33 and low liquidity ratios. Although it has a very favorable rating (B+), its moat status is slightly unfavorable, reflecting value destruction despite improving profitability trends.

For risk-tolerant investors seeking growth potential, SKYT’s accelerating stock price and revenue growth might appear attractive despite financial challenges. Conversely, risk-averse or quality-focused investors might view CRUS’s stable profitability, strong financial position, and durable moat as more favorable. The choice could depend on the investor’s risk appetite and strategy emphasis.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cirrus Logic, Inc. and SkyWater Technology, Inc. to enhance your investment decisions: