Home > Comparison > Technology > CRUS vs SLAB

The strategic rivalry between Cirrus Logic, Inc. and Silicon Laboratories Inc. shapes the semiconductor sector’s competitive landscape. Cirrus Logic excels in low-power, high-precision mixed-signal audio solutions, while Silicon Labs focuses on analog-intensive mixed-signal products for IoT applications. This contrast highlights a battle between specialized audio innovation and broad IoT integration. This analysis will determine which business model presents a superior risk-adjusted opportunity for a diversified technology portfolio.

Table of contents

Companies Overview

Cirrus Logic and Silicon Laboratories stand as key players in the semiconductor space, each shaping distinct market segments.

Cirrus Logic, Inc.: Precision Audio and Mixed-Signal Innovator

Cirrus Logic specializes in low-power, high-precision mixed-signal processing. Its revenue derives mainly from audio codecs and signal processors embedded in smartphones, AR/VR headsets, and automotive entertainment. In 2026, the company sharpened its focus on enhancing user experience with proprietary SoundClear technology, driving differentiation through louder, high-fidelity sound and active noise cancellation.

Silicon Laboratories Inc.: IoT and Analog Mixed-Signal Specialist

Silicon Labs commands a strong position in analog-intensive mixed-signal solutions powering IoT applications. It generates revenue from wireless microcontrollers and sensors used in smart home, industrial automation, and medical devices. In 2026, the firm prioritized expanding its footprint in connected home and industrial automation markets, capitalizing on the growing demand for intelligent, networked devices.

Strategic Collision: Similarities & Divergences

Both companies operate as fabless semiconductor innovators but diverge sharply in focus: Cirrus Logic targets audio-centric mixed-signal chips, while Silicon Labs leads in IoT and analog sensor integration. Their primary battleground lies in mixed-signal semiconductor solutions, addressing different end markets. Investors face contrasting profiles—Cirrus Logic’s niche in audio tech versus Silicon Labs’ broad IoT ecosystem exposure.

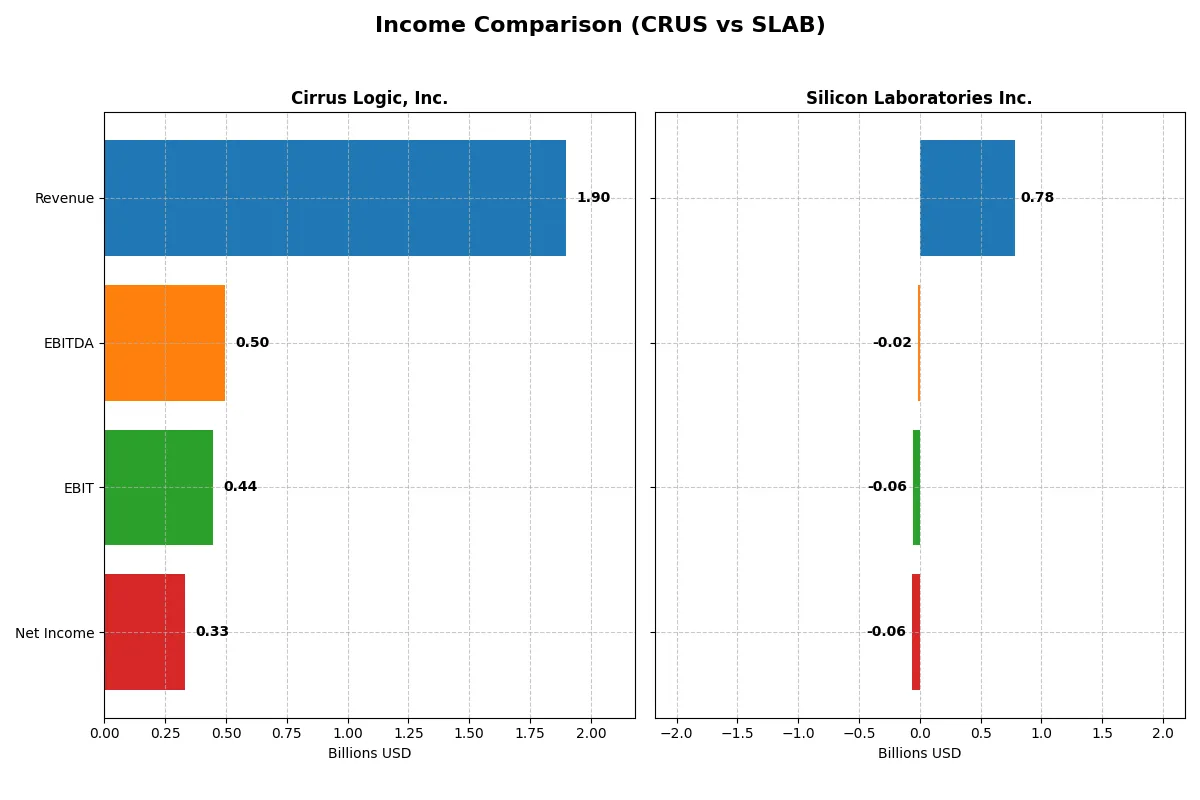

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Cirrus Logic, Inc. (CRUS) | Silicon Laboratories Inc. (SLAB) |

|---|---|---|

| Revenue | 1.90B | 785M |

| Cost of Revenue | 900M | 328M |

| Operating Expenses | 586M | 528M |

| Gross Profit | 996M | 457M |

| EBITDA | 497M | -19M |

| EBIT | 445M | -57M |

| Interest Expense | 0.9M | 1.0M |

| Net Income | 332M | -65M |

| EPS | 6.24 | -1.98 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability dynamics driving each company’s financial engine.

Cirrus Logic, Inc. Analysis

Cirrus Logic’s revenue rose steadily from $1.37B in 2021 to $1.90B in 2025, with net income climbing from $217M to $331M. The company sustains strong gross margins around 52.5% and net margins near 17.5%, reflecting disciplined cost control. In 2025, EBIT surged 22%, signaling robust operational momentum and improving profitability.

Silicon Laboratories Inc. Analysis

Silicon Labs’ revenue expanded sharply by 34% in 2025 to $785M, up from $584M in 2024. However, it posted a net loss of $65M despite a favorable gross margin of 58.2%. EBIT remains negative at -7.3%, though improving from prior years. The company shows growth momentum but struggles to translate sales into profits efficiently.

Margin Strength vs. Growth Struggles

Cirrus Logic delivers consistent profitability with favorable margins and solid earnings growth, demonstrating operational efficiency. Silicon Labs exhibits strong top-line growth but continues to face losses and negative net margins. For investors prioritizing profitability and margin health, Cirrus Logic’s profile stands out as the fundamentally stronger and more reliable performer.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Cirrus Logic, Inc. (CRUS) | Silicon Laboratories Inc. (SLAB) |

|---|---|---|

| ROE | 17.01% | -5.93% |

| ROIC | 14.20% | -6.27% |

| P/E | 15.95 | -65.89 |

| P/B | 2.71 | 3.91 |

| Current Ratio | 6.35 | 4.69 |

| Quick Ratio | 4.82 | 4.02 |

| D/E | 0.07 | 0.00 |

| Debt-to-Assets | 6.18% | 0.00% |

| Interest Coverage | 457.0 | -72.35 |

| Asset Turnover | 0.81 | 0.62 |

| Fixed Asset Turnover | 6.62 | 6.10 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and operational strengths crucial for investor insight.

Cirrus Logic, Inc.

Cirrus Logic posts a strong 17.01% ROE and a healthy 17.48% net margin, signaling robust profitability. Its P/E of 15.95 and P/B of 2.71 suggest a fairly valued stock, neither stretched nor cheap. The firm retains earnings for aggressive R&D, as it pays no dividends, fueling future growth potential.

Silicon Laboratories Inc.

Silicon Labs struggles with negative profitability metrics: -5.93% ROE and -8.27% net margin indicate operational challenges. Its P/E ratio is negative, reflecting losses, while a P/B of 3.91 appears high. With zero dividends and a focus on R&D, the company reinvests heavily but faces significant financial headwinds.

Profitability Stability vs. Growth Risk

Cirrus Logic delivers stable profitability and balanced valuation, blending operational efficiency with prudent capital allocation. Silicon Labs, despite aggressive R&D spending, shows weak returns and elevated risk. Investors favoring steady income and valuation discipline may lean toward Cirrus, while growth seekers must weigh Silicon Labs’ riskier profile.

Which one offers the Superior Shareholder Reward?

Cirrus Logic (CRUS) and Silicon Laboratories (SLAB) both forgo dividends, favoring reinvestment and buybacks. I observe CRUS delivers robust free cash flow (7.8/share in 2025) funding stable buybacks, while SLAB struggles with negative net margins and weaker free cash flow (2.0/share in 2025). CRUS’s payout ratio is zero but its buyback program is intense and sustainable, supported by strong operating margins (~23%) and cash ratios (~2.8). SLAB’s ongoing losses and negative operating cash flow suggest a risky reinvestment strategy despite a higher gross margin (58%). I conclude CRUS offers a superior total return profile in 2026 due to disciplined capital allocation and sustainable shareholder rewards.

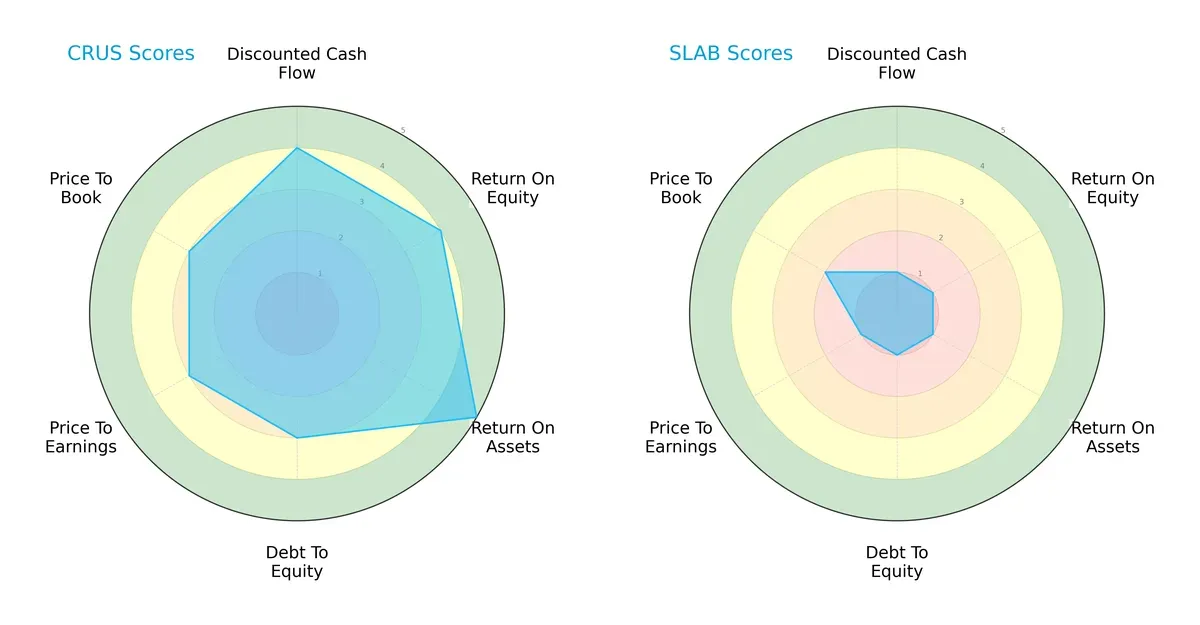

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Cirrus Logic, Inc. and Silicon Laboratories Inc., highlighting their financial strengths and weaknesses:

Cirrus Logic dominates with a balanced profile, excelling in ROA (5) and maintaining favorable scores in DCF (4) and ROE (4). Its moderate debt-to-equity (3) and valuation metrics (PE 3, PB 3) show prudent leverage and reasonable pricing. Silicon Laboratories lags significantly, scoring very low (1) across most metrics except a slightly better P/B score (2), indicating reliance on weak fundamentals and valuation challenges.

Bankruptcy Risk: Solvency Showdown

Cirrus Logic and Silicon Laboratories both sit comfortably in the safe zone, but Silicon Laboratories’ higher Altman Z-Score (25.18 vs. 15.74) signals even stronger solvency and a lower bankruptcy risk in this cycle:

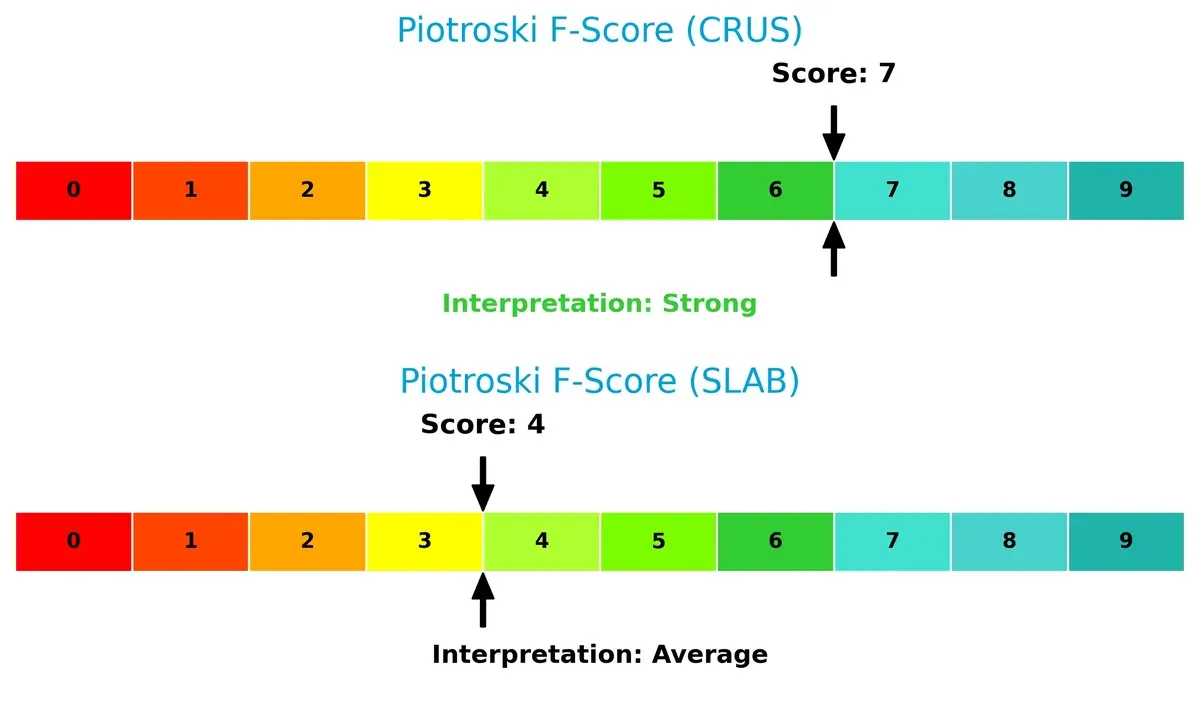

Financial Health: Quality of Operations

Cirrus Logic scores a robust 7 on the Piotroski F-Score, reflecting strong operational health and financial quality. Silicon Laboratories’ 4 signals caution, exposing weaknesses in profitability and efficiency that pose red flags for long-term investors:

How are the two companies positioned?

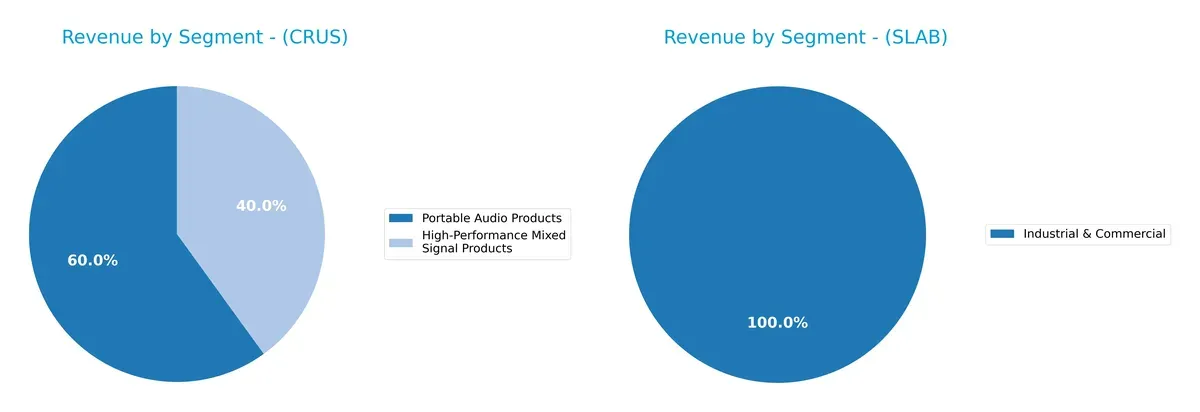

This section dissects the operational DNA of Cirrus Logic and Silicon Laboratories by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to identify which business model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Cirrus Logic, Inc. and Silicon Laboratories Inc. diversify their income streams and where their primary sector bets lie:

Cirrus Logic anchors its revenue in Portable Audio Products, generating $1.14B in 2025, with High-Performance Mixed Signal Products at $759M. This concentration signals strong audio sector dominance but exposes concentration risk. Silicon Laboratories relies solely on its Industrial & Commercial segment at $339M in 2024, revealing a narrower focus. Cirrus exhibits moderate diversification; Silicon Labs pivots on a single segment, reflecting distinct strategic bets and ecosystem positioning.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Cirrus Logic and Silicon Laboratories:

CRUS Strengths

- Strong profitability with 17.48% net margin

- High ROE at 17.01%

- Favorable ROIC at 14.2% above WACC

- Low debt levels and strong interest coverage

- Solid quick ratio at 4.82 supports liquidity

- Diverse product segments with focus on audio and mixed signal

SLAB Strengths

- Favorable quick ratio at 4.02 indicates liquidity

- Zero debt enhances financial flexibility

- Favorable fixed asset turnover at 6.1 shows asset efficiency

- Diverse industrial and commercial product base

- Global revenue spread with presence in China, Taiwan, US

- PE ratio marked favorable despite negative earnings

CRUS Weaknesses

- Unfavorable current ratio at 6.35 may signal working capital imbalance

- No dividend yield limits income returns

- Neutral asset turnover at 0.81 could constrain growth

- Moderate PB at 2.71 does not reflect strong market premium

SLAB Weaknesses

- Negative net margin and ROE indicate ongoing losses

- Unfavorable WACC at 11.01% raises capital costs

- Negative interest coverage signals financial distress

- Elevated PB at 3.91 may imply valuation risk

- Unfavorable current ratio at 4.69 limits liquidity

- No dividend yield reduces shareholder income

Cirrus Logic exhibits strong profitability and conservative leverage, supporting a robust financial base. Silicon Labs faces profitability and capital cost challenges despite liquidity and zero debt. These differences highlight distinct strategic and operational profiles for each company.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield protecting long-term profits from relentless competition erosion. Let’s dissect the moats of two semiconductor peers:

Cirrus Logic, Inc.: Precision Audio Innovator with High ROIC Moat

Cirrus Logic’s moat stems from its intangible assets in advanced audio processing technology. This moat shows in a strong ROIC 5.2% above WACC and stable 23% EBIT margins. In 2026, expanding into AR/VR and automotive sectors could deepen its competitive edge.

Silicon Laboratories Inc.: IoT Mixed-Signal Specialist Facing Margin Pressure

Silicon Labs relies on a specialized product portfolio for IoT applications, a narrower moat than Cirrus. Its declining ROIC and negative net margins reveal value erosion, but 2026’s IoT market growth offers potential for a strategic turnaround.

Moat Strength Faceoff: Intangible Asset Dominance vs. IoT Niche Vulnerability

Cirrus Logic’s wider, more sustainable moat outperforms Silicon Labs’ shrinking competitive advantage. Cirrus is better equipped to defend and grow market share amid intensifying semiconductor competition.

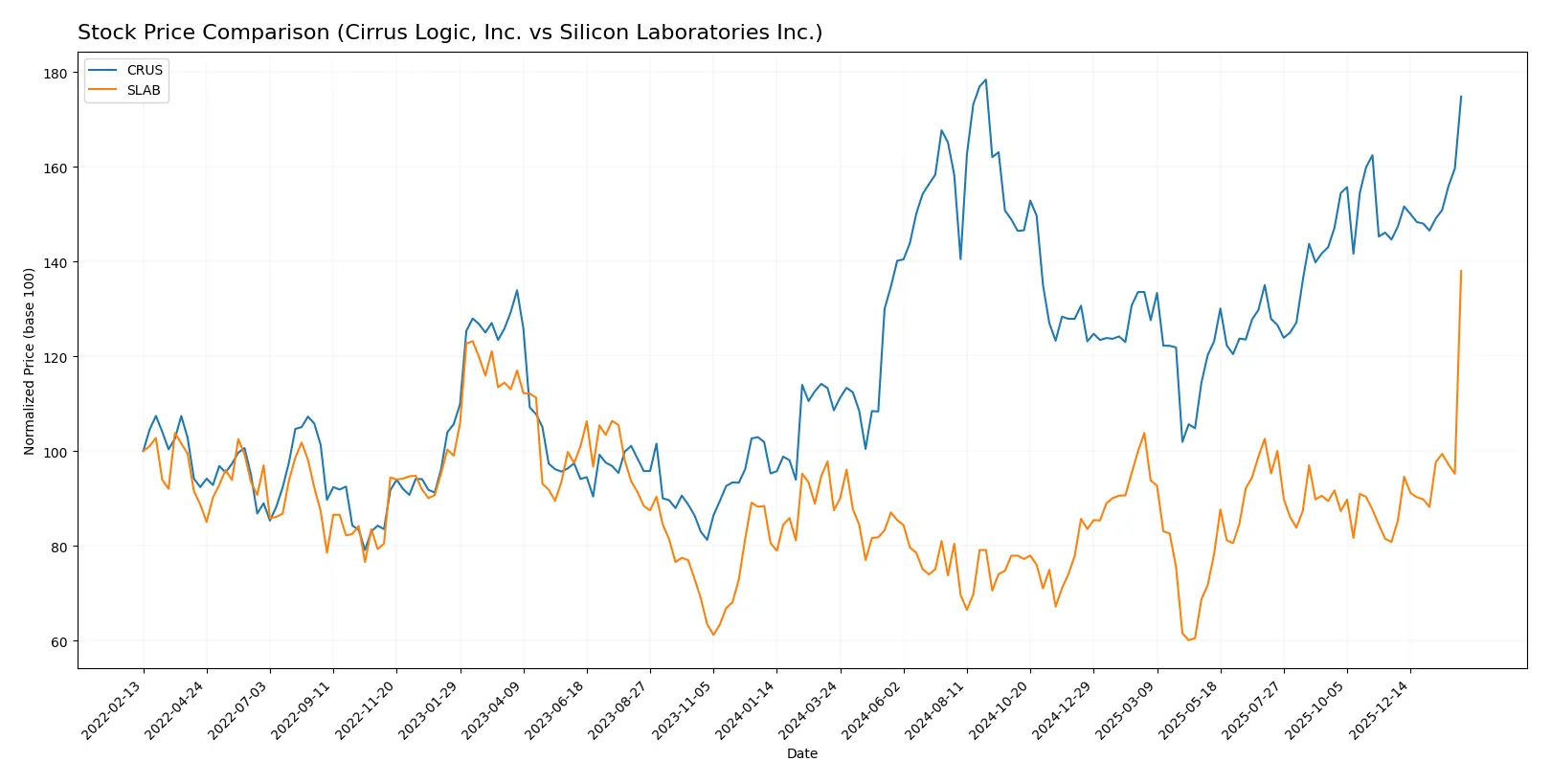

Which stock offers better returns?

Over the past year, Cirrus Logic and Silicon Laboratories have both shown strong upward price momentum, with notable acceleration and dominant buyer activity shaping their trading dynamics.

Trend Comparison

Cirrus Logic’s stock rose 61.02% over the last 12 months, marking a bullish trend with accelerating momentum and moderate volatility (std dev 14.64). The price swung between $82.02 and $145.69, confirming upward strength.

Silicon Laboratories gained 57.75% during the same period, also bullish with accelerating gains but higher volatility (std dev 16.2). It recorded a range from $89.82 to $206.5, indicating sizeable price swings.

Both stocks are accelerating upward, yet Cirrus Logic delivered a slightly higher total return, outperforming Silicon Laboratories over the last year.

Target Prices

Analysts show a positive outlook with clear upside potential for both Cirrus Logic and Silicon Laboratories.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Cirrus Logic, Inc. | 110 | 163 | 144.5 |

| Silicon Laboratories Inc. | 160 | 231 | 211.6 |

The consensus target prices for Cirrus Logic and Silicon Laboratories sit above current prices, indicating analyst confidence in future growth. This suggests attractive entry points for investors seeking semiconductor exposure.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a summary of the latest institutional grades for Cirrus Logic, Inc. and Silicon Laboratories Inc.:

Cirrus Logic, Inc. Grades

The table below presents Cirrus Logic’s recent grades from reputable institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-02-04 |

| Benchmark | Maintain | Buy | 2026-02-04 |

| Barclays | Maintain | Equal Weight | 2026-02-04 |

Silicon Laboratories Inc. Grades

The table below shows the latest grades for Silicon Laboratories from established grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-02-06 |

| RBC Capital | Maintain | Sector Perform | 2026-02-05 |

| Keybanc | Downgrade | Sector Weight | 2026-02-04 |

Which company has the best grades?

Cirrus Logic holds generally stronger grades, with multiple “Buy” ratings maintained recently. Silicon Labs faces downgrades and more neutral assessments. This difference signals higher institutional confidence in Cirrus Logic’s near-term prospects.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Cirrus Logic, Inc. (CRUS)

- Operates in highly competitive semiconductor sector with steady net margin (17.48%) and positive ROE, supporting market resilience.

Silicon Laboratories Inc. (SLAB)

- Faces intense competition with negative net margin (-8.27%) and ROE, signaling operational challenges and market share risks.

2. Capital Structure & Debt

Cirrus Logic, Inc. (CRUS)

- Maintains very low debt-to-equity (0.07) and strong interest coverage (495x), reflecting prudent capital management.

Silicon Laboratories Inc. (SLAB)

- Zero debt but negative interest coverage (-58x) suggests operational losses overshadow any capital structure benefits.

3. Stock Volatility

Cirrus Logic, Inc. (CRUS)

- Beta of 1.136 indicates moderate stock volatility, in line with semiconductor sector norms.

Silicon Laboratories Inc. (SLAB)

- Higher beta at 1.536 signals elevated stock price volatility, increasing investment risk.

4. Regulatory & Legal

Cirrus Logic, Inc. (CRUS)

- No significant regulatory/legal flags; operates primarily in US with standard compliance demands.

Silicon Laboratories Inc. (SLAB)

- Similarly no major regulatory concerns but exposure to global IoT markets heightens risk from evolving standards.

5. Supply Chain & Operations

Cirrus Logic, Inc. (CRUS)

- Relies on fabless semiconductor model; strong asset turnover (0.81) indicates operational efficiency.

Silicon Laboratories Inc. (SLAB)

- Also fabless but lower asset turnover (0.62) and negative profitability suggest supply chain or operational execution risks.

6. ESG & Climate Transition

Cirrus Logic, Inc. (CRUS)

- Limited explicit ESG data, but strong financial health suggests capacity to invest in climate transition initiatives.

Silicon Laboratories Inc. (SLAB)

- Financial stress may constrain ability to invest in ESG improvements, a growing investor focus in 2026.

7. Geopolitical Exposure

Cirrus Logic, Inc. (CRUS)

- US-based with international sales; exposed to trade tensions but diversified product applications mitigate risk.

Silicon Laboratories Inc. (SLAB)

- Similar US base with China exposure; IoT market reliance increases vulnerability to geopolitical supply chain disruptions.

Which company shows a better risk-adjusted profile?

Cirrus Logic’s most impactful risk is an unusually high current ratio (6.35), indicating potential capital inefficiency despite strong profitability. Silicon Laboratories faces critical operational losses and negative returns, posing severe financial risks. Cirrus Logic exhibits a superior risk-adjusted profile, supported by very favorable Altman Z-Score (15.7) and Piotroski score (7). Silicon Labs’ financial distress signals caution despite its zero debt. Recent fiscal 2025 results confirm Cirrus Logic’s robust profitability and balance sheet strength, justifying greater investor confidence.

Final Verdict: Which stock to choose?

Cirrus Logic, Inc. (CRUS) excels as a cash-generating engine with a strong, sustainable moat evidenced by its growing ROIC well above WACC. Its main point of vigilance lies in an unusually high current ratio, which may indicate inefficient asset management. This stock suits investors seeking steady growth in a portfolio focused on quality and profitability.

Silicon Laboratories Inc. (SLAB) leverages a strategic moat built on rapid innovation and high R&D investment, fueling impressive revenue growth despite current profitability challenges. Relative to CRUS, SLAB carries higher operational risks but offers a compelling option for investors with a tolerance for volatility who prioritize potential turnaround stories and market share expansion.

If you prioritize consistent value creation and financial stability, CRUS is the compelling choice due to its very favorable moat and strong income statement performance. However, if you seek aggressive growth with a focus on innovation and are willing to accept elevated risk, SLAB offers superior growth momentum, albeit with a more uncertain profitability outlook. Both present distinct analytical scenarios aligned with different investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cirrus Logic, Inc. and Silicon Laboratories Inc. to enhance your investment decisions: