In the dynamic semiconductor industry, Onto Innovation Inc. and Cirrus Logic, Inc. stand out as key players driving technological progress. Onto Innovation focuses on process control and inspection tools, while Cirrus Logic specializes in mixed-signal processing solutions for audio and power applications. Both companies share a commitment to innovation and serve overlapping markets. This article will help you decide which of these promising companies is the better fit for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Onto Innovation Inc. and Cirrus Logic, Inc. by providing an overview of these two companies and their main differences.

Onto Innovation Inc. Overview

Onto Innovation Inc. focuses on designing, developing, and manufacturing process control tools, including macro defect inspection, 2D/3D optical metrology, and lithography systems. The company offers yield management solutions and device packaging services to semiconductor and advanced packaging device manufacturers globally. Founded in 1940 and headquartered in Wilmington, Massachusetts, Onto serves diverse industries such as silicon wafer, LEDs, and MEMS with a workforce of 1,551 employees.

Cirrus Logic, Inc. Overview

Cirrus Logic, Inc. is a fabless semiconductor company specializing in low-power, high-precision mixed-signal processing solutions. Its product portfolio includes codecs, amplifiers, digital signal processors, and SoundClear technology aimed at enhancing audio experiences in consumer electronics and industrial applications. Founded in 1984 and based in Austin, Texas, Cirrus Logic employs 1,609 people and operates globally in markets such as smartphones, automotive entertainment, and energy control systems.

Key similarities and differences

Both Onto and Cirrus Logic operate within the semiconductor industry and serve global markets with advanced technology solutions. Onto focuses on hardware tools for process control and yield management in semiconductor manufacturing, while Cirrus Logic concentrates on mixed-signal processing and audio-related integrated circuits for consumer and industrial devices. Their business models differ in that Onto offers both hardware and software solutions for production lines, whereas Cirrus Logic primarily develops chipsets and software for audio and energy applications.

Income Statement Comparison

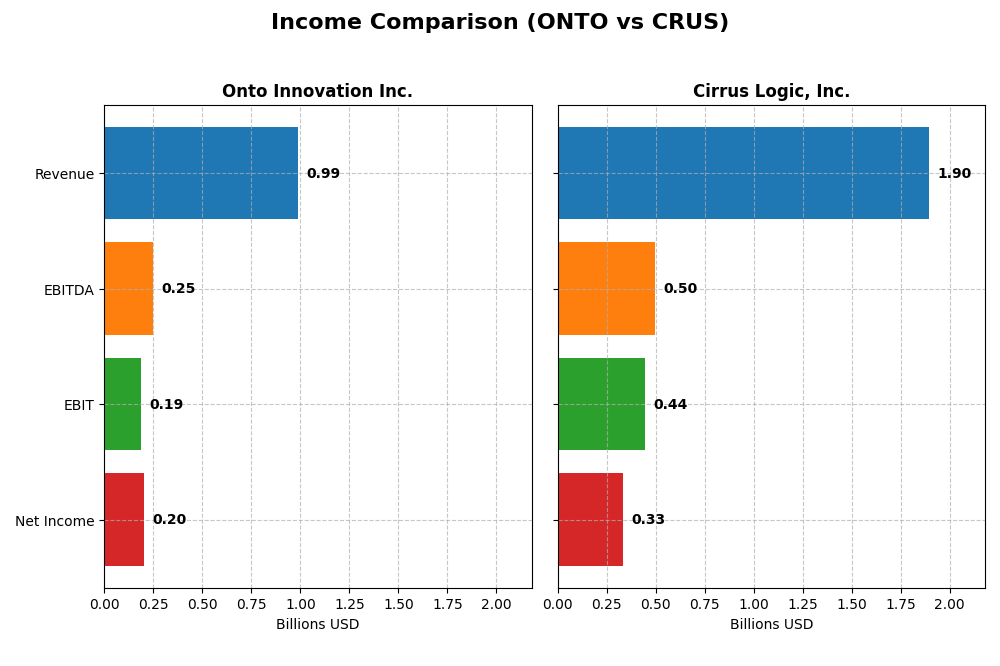

This table presents a side-by-side comparison of the key income statement metrics for Onto Innovation Inc. and Cirrus Logic, Inc. based on their most recent fiscal year data.

| Metric | Onto Innovation Inc. | Cirrus Logic, Inc. |

|---|---|---|

| Market Cap | 10.7B | 6.3B |

| Revenue | 987M | 1.9B |

| EBITDA | 249M | 497M |

| EBIT | 187M | 445M |

| Net Income | 202M | 332M |

| EPS | 4.09 | 6.24 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Onto Innovation Inc.

Onto Innovation Inc. demonstrated strong revenue growth from 2020 to 2024, rising from $556M to $987M, with net income surging from $31M to $202M. Margins remained healthy and improved, with a gross margin of 52.19% and net margin of 20.43% in 2024. The latest year showed significant growth acceleration, with net income up 37.55% and EPS rising 65.04%.

Cirrus Logic, Inc.

Cirrus Logic’s revenue trended upward from $1.37B in 2021 to $1.90B in 2025, while net income increased from $217M to $332M over the same period. Margins remained stable, with a gross margin near 52.53% and a net margin of 17.48% in 2025. The most recent year reflected moderate revenue growth of 6%, with favorable improvements in EBIT and net margin growth.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement dynamics, but Onto Innovation shows more robust net income and EPS growth over the period, coupled with higher net margin expansion. Cirrus Logic maintains steady revenue and margin stability with moderate growth. Onto’s accelerated profitability gains contrast with Cirrus’s more gradual improvements, highlighting Onto’s stronger momentum in fundamentals.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Onto Innovation Inc. (ONTO) and Cirrus Logic, Inc. (CRUS) based on the most recent fiscal data available. These ratios provide insight into profitability, liquidity, leverage, efficiency, and shareholder returns.

| Ratios | Onto Innovation Inc. (2024) | Cirrus Logic, Inc. (2025) |

|---|---|---|

| ROE | 10.5% | 17.0% |

| ROIC | 8.8% | 14.2% |

| P/E | 41.8 | 15.9 |

| P/B | 4.37 | 2.71 |

| Current Ratio | 8.69 | 6.35 |

| Quick Ratio | 7.00 | 4.82 |

| D/E (Debt-to-Equity Ratio) | 0.008 | 0.074 |

| Debt-to-Assets | 0.7% | 6.2% |

| Interest Coverage | 0 | 457 |

| Asset Turnover | 0.47 | 0.81 |

| Fixed Asset Turnover | 7.16 | 6.62 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Onto Innovation Inc.

Onto Innovation shows a mix of strong and weak ratios, with a favorable net margin of 20.43% but unfavorable valuation metrics like a PE of 41.76 and PB of 4.37. Its liquidity is uneven, with a high current ratio of 8.69 marked unfavorable, yet a quick ratio of 7.0 is favorable. Onto does not pay dividends, reflecting a focus on reinvestment and growth rather than shareholder payouts.

Cirrus Logic, Inc.

Cirrus Logic displays mostly favorable ratios, including a solid net margin of 17.48%, ROE of 17.01%, and ROIC of 14.2%. Its valuation is more reasonable, with a PE of 15.95 and PB of 2.71, both neutral. Liquidity ratios show a favorable quick ratio of 4.82 but an unfavorable current ratio of 6.35. Cirrus also does not pay dividends, likely prioritizing R&D and acquisitions over distributions.

Which one has the best ratios?

Cirrus Logic holds a more favorable overall ratio profile, with 57.14% favorable ratios compared to Onto Innovation’s 42.86%. Cirrus exhibits stronger profitability and valuation metrics alongside solid liquidity, while Onto faces challenges in valuation and asset turnover. Both companies currently do not distribute dividends, focusing on growth and reinvestment.

Strategic Positioning

This section compares the strategic positioning of Onto Innovation Inc. and Cirrus Logic, Inc., focusing on market position, key segments, and exposure to technological disruption:

Onto Innovation Inc.

- Mid-sized semiconductor player with some competitive pressure on NYSE

- Focus on process control tools, software, and packaging for semiconductors

- Exposure to disruption linked to semiconductor manufacturing technologies

Cirrus Logic, Inc.

- Fabless semiconductor firm with strong market presence on NASDAQ

- Offers mixed-signal audio and high-performance products for multiple markets

- Faces disruption from evolving audio and mixed-signal processing technologies

Onto Innovation Inc. vs Cirrus Logic, Inc. Positioning

Onto Innovation has a concentrated focus on semiconductor process control and metrology, while Cirrus Logic is diversified across portable audio and mixed-signal products. Onto’s positioning is specialized, whereas Cirrus targets broader applications in consumer and industrial electronics.

Which has the best competitive advantage?

Cirrus Logic shows a very favorable moat with ROIC above WACC and growing profitability, indicating a durable competitive advantage. Onto Innovation has a slightly unfavorable moat, shedding value despite improving ROIC trends.

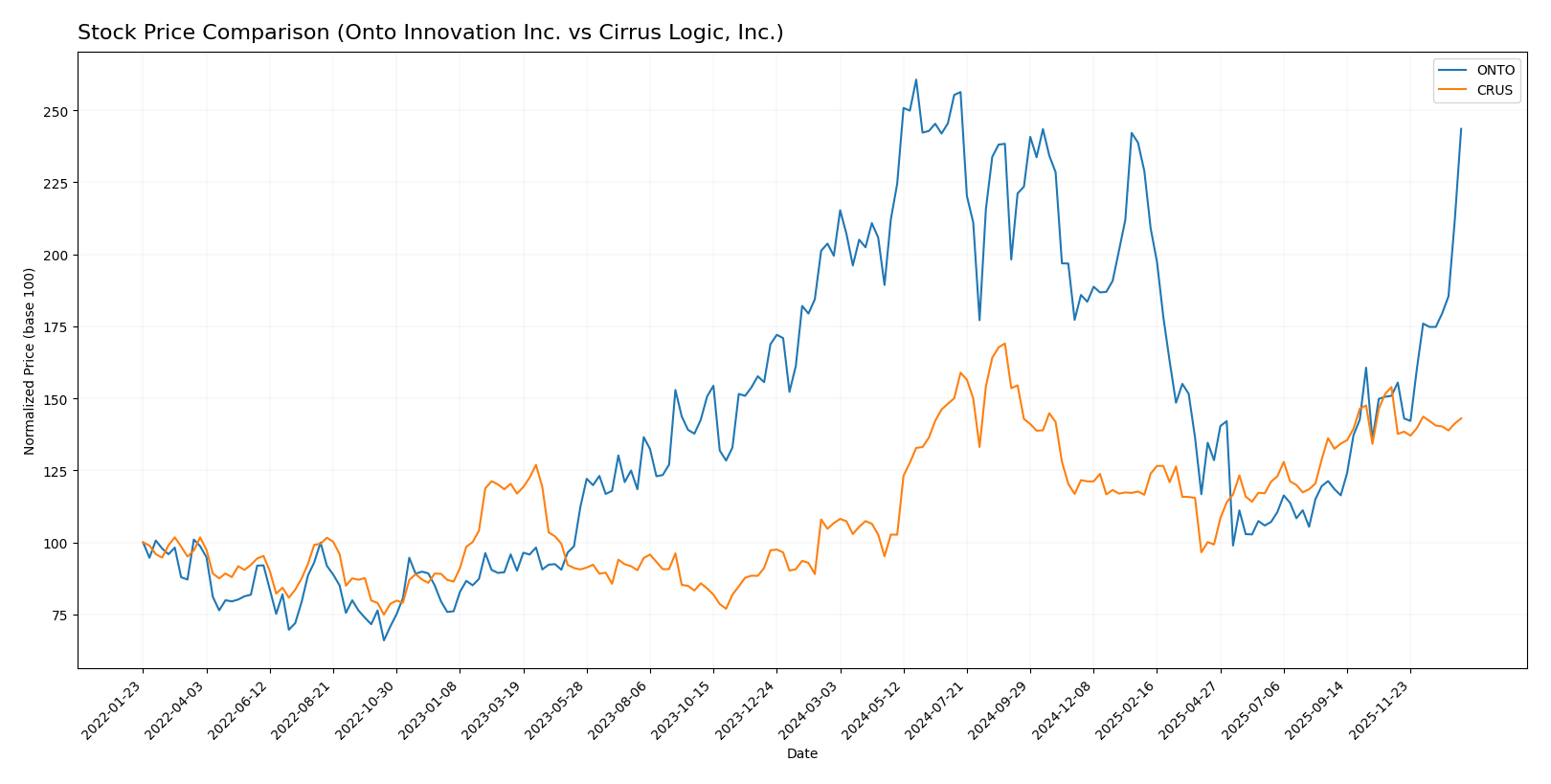

Stock Comparison

The stock price movements of Onto Innovation Inc. and Cirrus Logic, Inc. over the past 12 months reveal distinct trading dynamics, with Onto showing strong bullish momentum and Cirrus experiencing a decelerating bullish trend.

Trend Analysis

Onto Innovation Inc. demonstrated a 22.07% price increase over the past year, confirming a bullish trend with accelerating momentum, high volatility (42.61 std deviation), and a peak price of 233.14. Recent months show an even stronger 61.42% rise.

Cirrus Logic, Inc. recorded a 34.06% gain in the same period, maintaining a bullish trend but with decelerating momentum and lower volatility (14.46 std deviation). Recently, the stock declined by 7.06%, reflecting a short-term bearish movement.

Comparing both, Cirrus Logic achieved a higher annual price increase (34.06% vs. 22.07%), though Onto Innovation’s recent acceleration and stronger buyer dominance highlight contrasting performance phases.

Target Prices

The current analyst consensus presents a mixed outlook with defined target ranges for both Onto Innovation Inc. and Cirrus Logic, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Onto Innovation Inc. | 200 | 160 | 178 |

| Cirrus Logic, Inc. | 155 | 100 | 138.75 |

Analysts expect Onto Innovation’s stock to trade below its current price of 217.85, indicating potential downside risk. Cirrus Logic’s consensus target of 138.75 is moderately above its current 123.28, suggesting potential upside.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Onto Innovation Inc. and Cirrus Logic, Inc.:

Rating Comparison

ONTO Rating

- Rating: B+, assessed as Very Favorable.

- Discounted Cash Flow Score: Moderate, value 3.

- ROE Score: Moderate, value 3.

- ROA Score: Favorable, value 4.

- Debt To Equity Score: Favorable, value 4.

- Overall Score: Moderate, value 3.

CRUS Rating

- Rating: A-, assessed as Very Favorable.

- Discounted Cash Flow Score: Favorable, value 4.

- ROE Score: Favorable, value 4.

- ROA Score: Very Favorable, value 5.

- Debt To Equity Score: Moderate, value 3.

- Overall Score: Favorable, value 4.

Which one is the best rated?

Based strictly on the provided data, Cirrus Logic, Inc. has higher overall financial scores and a better rating (A-) compared to Onto Innovation Inc. (B+), indicating a stronger analyst assessment for Cirrus Logic.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Onto Innovation Inc. and Cirrus Logic, Inc.:

ONTO Scores

- Altman Z-Score: 34.16, indicating a safe financial position with very low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength and moderate investment quality.

CRUS Scores

- Altman Z-Score: 11.94, also in the safe zone, showing low bankruptcy risk.

- Piotroski Score: 7, indicating strong financial health and good investment potential.

Which company has the best scores?

Cirrus Logic has a lower but still safe Altman Z-Score and a higher Piotroski Score compared to Onto Innovation. Based strictly on these scores, Cirrus Logic shows stronger financial health and investment potential.

Grades Comparison

Here is a comparison of the recent grades assigned to Onto Innovation Inc. and Cirrus Logic, Inc.:

Onto Innovation Inc. Grades

The following table summarizes recent grades from reputable grading companies for Onto Innovation Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Hold | 2026-01-14 |

| Needham | Maintain | Buy | 2026-01-06 |

| Jefferies | Maintain | Buy | 2025-12-15 |

| B. Riley Securities | Maintain | Buy | 2025-11-18 |

| Needham | Maintain | Buy | 2025-11-18 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| Oppenheimer | Maintain | Outperform | 2025-10-14 |

| Stifel | Maintain | Hold | 2025-10-13 |

| B. Riley Securities | Maintain | Buy | 2025-10-10 |

| Jefferies | Upgrade | Buy | 2025-09-23 |

Overall, Onto Innovation Inc. has predominantly maintained Buy and Outperform grades, with few Hold ratings, reflecting a generally positive analyst sentiment.

Cirrus Logic, Inc. Grades

The following table summarizes recent grades from reputable grading companies for Cirrus Logic, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Benchmark | Maintain | Buy | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Stifel | Maintain | Buy | 2025-09-12 |

| Barclays | Maintain | Equal Weight | 2025-05-07 |

| Barclays | Maintain | Equal Weight | 2025-04-22 |

| Stifel | Maintain | Buy | 2025-04-17 |

Cirrus Logic, Inc. shows a mix of Buy and Overweight ratings alongside several Equal Weight grades, indicating a moderately positive but somewhat cautious analyst outlook.

Which company has the best grades?

Both Onto Innovation Inc. and Cirrus Logic, Inc. share a consensus Buy rating. However, Onto Innovation Inc. has a higher proportion of Buy and Outperform grades with fewer Hold ratings, suggesting a stronger analyst conviction. This could imply greater confidence in Onto’s growth prospects compared to Cirrus Logic’s more mixed evaluations.

Strengths and Weaknesses

Below is a comparative table highlighting the strengths and weaknesses of Onto Innovation Inc. (ONTO) and Cirrus Logic, Inc. (CRUS) based on recent financial and operational data.

| Criterion | Onto Innovation Inc. (ONTO) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Diversification | Moderate: Revenue primarily from Systems & Software (850M in 2024), Parts and Services smaller but growing | Moderate: Two main segments, Portable Audio (1.14B) and High-Performance Mixed Signal Products (759M) |

| Profitability | Neutral: Net margin 20.43%, ROIC 8.77% below WACC (10.66%), value shedding but improving ROIC trend | Favorable: Net margin 17.48%, ROIC 14.2% above WACC (8.76%), strong value creation with growing ROIC |

| Innovation | Slightly Unfavorable: Higher P/E (41.76) and P/B (4.37) may reflect market concerns on growth sustainability | Very Favorable: Reasonable valuation with P/E 15.95 and P/B 2.71, strong investment in product innovation |

| Global presence | Neutral: Solid asset turnover (fixed asset turnover 7.16), but low overall asset turnover (0.47) suggests room for efficiency | Favorable: Better asset turnover (0.81), reflecting efficient use of assets in global markets |

| Market Share | Growing revenue trend in Systems and Software segment signals expanding market presence | Stable and dominant in Portable Audio segment with consistent revenue growth |

Key takeaways: Cirrus Logic demonstrates a stronger economic moat with consistent value creation, efficient asset use, and a favorable profitability profile. Onto Innovation shows improving profitability but still faces challenges in efficiently converting capital into value, suggesting careful monitoring before investment.

Risk Analysis

Below is a comparative table of key risks for Onto Innovation Inc. (ONTO) and Cirrus Logic, Inc. (CRUS) based on the latest available data from 2025-2026:

| Metric | Onto Innovation Inc. (ONTO) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Market Risk | High beta (1.46) indicates higher volatility | Moderate beta (1.08), lower volatility than ONTO |

| Debt level | Very low debt-to-equity (0.01), minimal leverage | Low debt-to-equity (0.07), manageable leverage |

| Regulatory Risk | Moderate, semiconductor industry sensitive to export controls and IP regulations | Moderate, fabless model reduces some regulatory exposure |

| Operational Risk | Medium, with complex process control tools manufacturing | Medium, reliance on product innovation in audio semiconductors |

| Environmental Risk | Low to moderate, typical for semiconductor equipment manufacturing | Low, primarily fabless semiconductor design with less direct manufacturing impact |

| Geopolitical Risk | Moderate, supply chain and global trade tensions could impact | Moderate, global supply chains and trade policies influence operations |

In synthesis, ONTO carries higher market risk due to its elevated beta and some unfavorable financial ratios, though its very low debt mitigates financial distress risk. CRUS shows a more balanced risk profile with favorable profitability and financial stability scores. Both face moderate regulatory and geopolitical risks inherent to the semiconductor sector, but neither shows immediate distress signals. Investors should weigh ONTO’s volatility against CRUS’s steadier fundamentals.

Which Stock to Choose?

Onto Innovation Inc. (ONTO) has shown strong income growth with a 77% rise in revenue and over 550% net income growth from 2020 to 2024. Its profitability is favorable, marked by a 20.43% net margin and balanced debt levels. However, its financial ratios present a neutral overall profile, with some unfavorable metrics such as a high P/E ratio and current ratio. The company’s rating is very favorable at B+, supported by moderate to favorable component scores. The MOAT evaluation signals a slightly unfavorable status, indicating value destruction despite a growing ROIC trend.

Cirrus Logic, Inc. (CRUS) exhibits moderate income growth, with revenue rising 38% and net income by 53% over 2021-2025. It maintains favorable profitability with a 17.48% net margin and strong financial ratios, achieving 57% favorable metrics and only 14% unfavorable, with a very favorable rating of A-. The company shows a very favorable MOAT status, with ROIC exceeding WACC and a growing ROIC trend, implying durable competitive advantage. Its bankruptcy risk is low with a safe Altman Z-Score and a strong Piotroski score.

For investors prioritizing strong financial ratios and a durable competitive advantage, Cirrus Logic might appear more favorable given its very favorable MOAT and rating, alongside stable profitability. Conversely, those focused on robust income growth and improving profitability may find Onto Innovation’s accelerating financial performance appealing, despite its slightly unfavorable MOAT and mixed ratio profile. Thus, the choice could depend on whether one values growth momentum or established financial strength and stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Onto Innovation Inc. and Cirrus Logic, Inc. to enhance your investment decisions: