In the fast-evolving semiconductor industry, Nova Ltd. (NVMI) and Cirrus Logic, Inc. (CRUS) stand out for their innovative approaches and market presence. Nova focuses on process control systems for semiconductor manufacturing, while Cirrus Logic excels in mixed-signal processing solutions for audio and industrial applications. This comparison explores their strategies and market positions to help you identify the most promising investment opportunity in this competitive sector.

Table of contents

Companies Overview

I will begin the comparison between Nova Ltd. and Cirrus Logic, Inc. by providing an overview of these two companies and their main differences.

Nova Ltd. Overview

Nova Ltd. focuses on designing, developing, producing, and selling process control systems for semiconductor manufacturing. Headquartered in Rehovot, Israel, it serves global markets including the US, Taiwan, China, and Korea. Its product portfolio comprises metrology platforms for dimensional, films, materials, and chemical measurements, supporting various semiconductor processes like lithography and etch. The company operates primarily in the semiconductor industry and employs 1,177 people.

Cirrus Logic, Inc. Overview

Cirrus Logic, Inc. is a fabless semiconductor company based in Austin, Texas, specializing in low-power, high-precision mixed-signal processing solutions. Its products include audio codecs, digital signal processors, and power management ICs used in consumer electronics like smartphones and AR/VR headsets, as well as industrial applications. Founded in 1984, Cirrus employs 1,609 people and serves both US and international markets in the technology sector.

Key similarities and differences

Both Nova Ltd. and Cirrus Logic operate in the semiconductor industry and serve international markets with specialized technology products. Nova focuses on process control and metrology systems for semiconductor manufacturing, while Cirrus Logic develops mixed-signal processing and audio-related ICs for consumer and industrial applications. Their business models differ as Nova produces hardware platforms for semiconductor fabrication, whereas Cirrus is fabless, emphasizing design and licensing of integrated circuits.

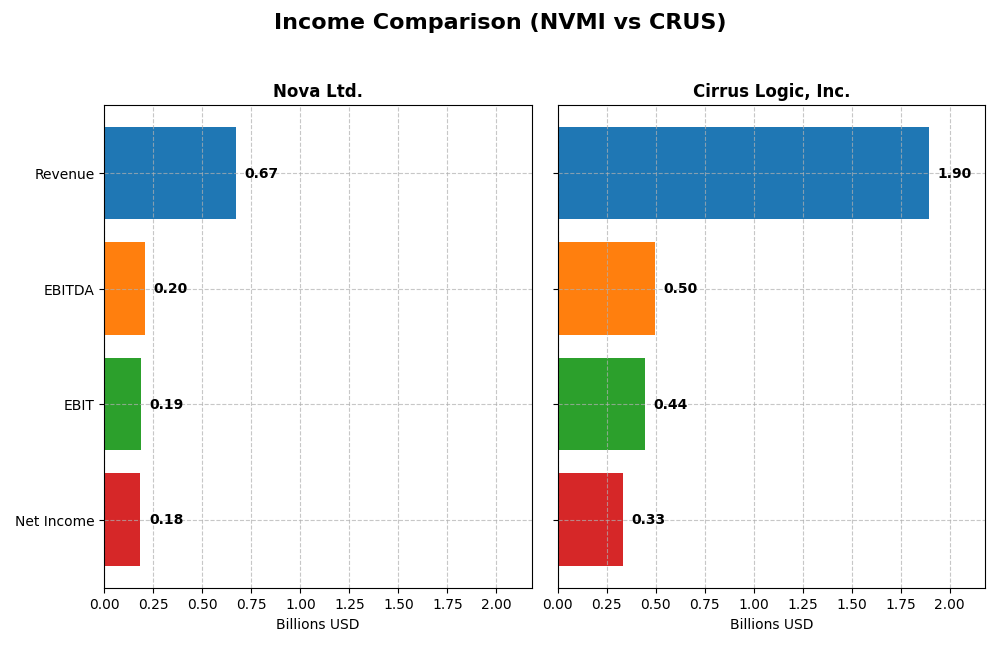

Income Statement Comparison

The following table compares key income statement metrics for Nova Ltd. and Cirrus Logic, Inc. based on their most recent fiscal year financial reports.

| Metric | Nova Ltd. (NVMI) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Market Cap | 12.9B | 6.3B |

| Revenue | 672M | 1.9B |

| EBITDA | 205M | 497M |

| EBIT | 188M | 445M |

| Net Income | 184.9M | 332M |

| EPS | 6.31 | 6.24 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Nova Ltd.

Nova Ltd. exhibited strong revenue growth, increasing from $269M in 2020 to $672M in 2024, with net income rising sharply from $48M to $185M. Margins improved notably, with a gross margin of 57.57% and a net margin of 27.33% in 2024. The latest year showed a favorable 29.83% revenue growth and a 34.35% increase in EPS, reflecting robust operating performance.

Cirrus Logic, Inc.

Cirrus Logic’s revenue grew more moderately, from $1.37B in 2021 to $1.90B in 2025, while net income increased from $217M to $332M. Margins remained stable, with a gross margin of 52.53% and net margin at 17.48% in 2025. Recent growth was neutral in revenue (5.99%) but favorable in EBIT (+21.94%) and EPS (+22.45%), indicating operational efficiency gains.

Which one has the stronger fundamentals?

Both companies demonstrate favorable income statement evaluations, with Nova Ltd. showing higher margin expansion and stronger overall revenue and net income growth. Cirrus Logic, while exhibiting steadier revenue growth and solid margin stability, posted lower net margins and slower top-line gains. Nova’s higher growth rates and margin improvements suggest stronger income fundamentals in this comparison.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Nova Ltd. (NVMI) and Cirrus Logic, Inc. (CRUS) based on the most recent fiscal year data available.

| Ratios | Nova Ltd. (NVMI) 2024 | Cirrus Logic, Inc. (CRUS) 2025 |

|---|---|---|

| ROE | 19.81% | 17.01% |

| ROIC | 13.39% | 14.20% |

| P/E | 31.20 | 15.95 |

| P/B | 6.18 | 2.71 |

| Current Ratio | 2.32 | 6.35 |

| Quick Ratio | 1.92 | 4.82 |

| D/E (Debt-to-Equity) | 0.25 | 0.07 |

| Debt-to-Assets | 17.0% | 6.18% |

| Interest Coverage | 116.20 | 457.0 |

| Asset Turnover | 0.48 | 0.81 |

| Fixed Asset Turnover | 5.06 | 6.62 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Nova Ltd.

Nova Ltd. shows generally strong financial ratios, with favorable net margin (27.33%), ROE (19.81%), and ROIC (13.39%), indicating efficient profitability and capital use. However, its valuation metrics such as P/E (31.2) and P/B (6.18) appear stretched, and WACC is unfavorable at 12.26%. The company does not pay dividends, likely prioritizing reinvestment and growth.

Cirrus Logic, Inc.

Cirrus Logic exhibits solid profitability metrics, including a 17.48% net margin and a 17.01% ROE, supported by favorable debt ratios and interest coverage. Valuation multiples and WACC are neutral, reflecting balanced market expectations. Like Nova Ltd., Cirrus Logic does not pay dividends, possibly focusing on R&D and share buybacks to enhance shareholder returns.

Which one has the best ratios?

Both companies present a favorable overall ratio profile, with Nova Ltd. holding a slight edge in profitability but facing higher valuation pressures and WACC concerns. Cirrus Logic benefits from lower leverage and stable valuations, though its current ratio is less favorable. The choice depends on weighting profitability against valuation and capital structure.

Strategic Positioning

This section compares the strategic positioning of Nova Ltd. and Cirrus Logic, Inc. regarding market position, key segments, and exposure to technological disruption:

Nova Ltd.

- Leading semiconductor process control system provider facing competition in global markets including Taiwan and the US.

- Key segments include semiconductor metrology platforms serving logic, foundries, memory sectors, and process equipment manufacturers.

- Exposure to disruption from evolving semiconductor manufacturing technologies requiring advanced metrology for process control.

Cirrus Logic, Inc.

- Fabless semiconductor company focused on mixed-signal audio and industrial applications with moderate competitive pressure.

- Main business drivers are portable audio products and high-performance mixed-signal products for consumer and industrial markets.

- Faces disruption risks tied to rapid innovation in audio processing and industrial mixed-signal ICs.

Nova Ltd. vs Cirrus Logic, Inc. Positioning

Nova Ltd. has a focused strategy centered on semiconductor manufacturing metrology, serving diverse IC sectors. Cirrus Logic pursues a more diversified approach, targeting portable audio and industrial mixed-signal applications. Nova’s specialization may limit market breadth but deepens expertise, while Cirrus benefits from broader market exposure but faces varied competitive dynamics.

Which has the best competitive advantage?

Cirrus Logic demonstrates a very favorable economic moat with ROIC well above WACC and consistent profitability growth, indicating a durable competitive advantage. Nova Ltd. shows slightly favorable positioning with growing ROIC but currently sheds value relative to its cost of capital.

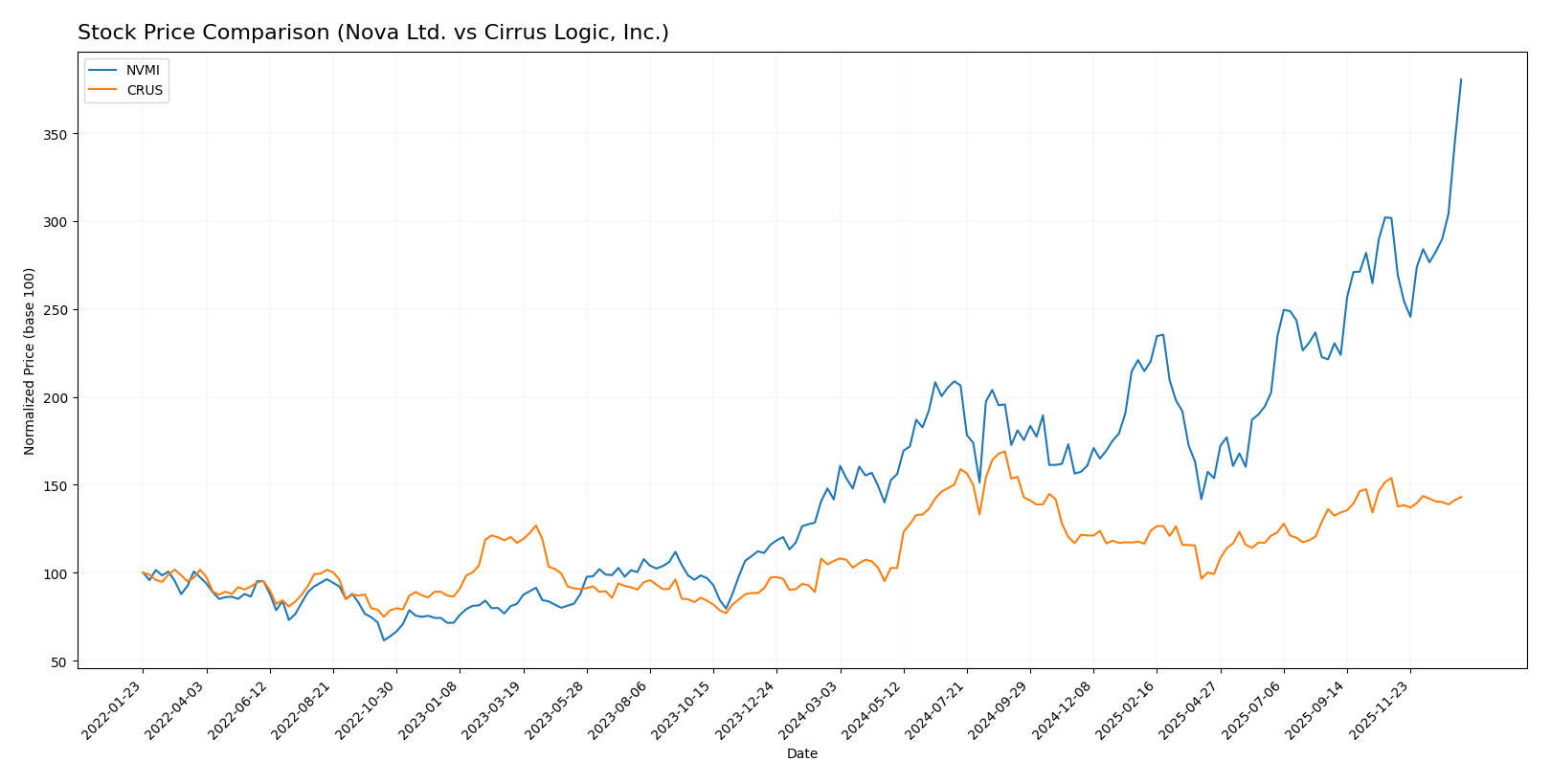

Stock Comparison

The stock price movements of Nova Ltd. and Cirrus Logic, Inc. over the past 12 months reveal distinct bullish trends, with Nova Ltd. showing strong acceleration and higher volatility compared to Cirrus Logic’s more moderate gains and recent deceleration.

Trend Analysis

Nova Ltd. (NVMI) experienced a 168.54% price increase over the last year, indicating a strong bullish trend with accelerating momentum and high volatility, reaching a peak at 434.55.

Cirrus Logic, Inc. (CRUS) posted a 34.06% gain over the same period, reflecting a bullish but decelerating trend with lower volatility and a high of 145.69.

Comparing the two, Nova Ltd. delivered significantly higher market performance with accelerated gains, while Cirrus Logic showed more modest growth and recent negative price movement.

Target Prices

The consensus target prices from recognized analysts indicate potential valuation ranges for these semiconductor companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Nova Ltd. | 390 | 335 | 362.5 |

| Cirrus Logic, Inc. | 155 | 100 | 138.75 |

Analysts expect Nova Ltd.’s stock to trade below its current price of 434.55 USD, suggesting potential downside. Cirrus Logic’s consensus target of 138.75 USD is above its current 123.28 USD, indicating modest upside potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Nova Ltd. and Cirrus Logic, Inc.:

Rating Comparison

Nova Ltd. Rating

- Rating: B-, classified as Very Favorable

- Discounted Cash Flow Score: 3 (Moderate)

- Return on Equity Score: 4 (Favorable)

- Return on Assets Score: 5 (Very Favorable)

- Debt To Equity Score: 1 (Very Unfavorable)

- Overall Score: 3 (Moderate)

Cirrus Logic, Inc. Rating

- Rating: A-, classified as Very Favorable

- Discounted Cash Flow Score: 4 (Favorable)

- Return on Equity Score: 4 (Favorable)

- Return on Assets Score: 5 (Very Favorable)

- Debt To Equity Score: 3 (Moderate)

- Overall Score: 4 (Favorable)

Which one is the best rated?

Cirrus Logic, Inc. holds a higher overall rating of A- versus Nova Ltd.’s B-, with superior scores in discounted cash flow and debt-to-equity metrics, making it better rated based on the provided data.

Scores Comparison

This table compares the Altman Z-Score and Piotroski Score for Nova Ltd. and Cirrus Logic, Inc.:

NVMI Scores

- Altman Z-Score: 7.76, indicating a safe zone status

- Piotroski Score: 7, classified as strong

CRUS Scores

- Altman Z-Score: 11.94, indicating a safe zone status

- Piotroski Score: 7, classified as strong

Which company has the best scores?

Both Nova Ltd. and Cirrus Logic, Inc. have Altman Z-Scores in the safe zone and identical Piotroski Scores classified as strong. Cirrus Logic’s higher Altman Z-Score suggests comparatively stronger financial stability.

Grades Comparison

Here is a comparison of the recent grades assigned to Nova Ltd. and Cirrus Logic, Inc.:

Nova Ltd. Grades

The following table summarizes Nova Ltd.’s recent grades from verified grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2026-01-13 |

| Jefferies | Maintain | Buy | 2025-12-15 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-07 |

| Benchmark | Maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-06-24 |

| B of A Securities | Maintain | Buy | 2025-06-24 |

| Benchmark | Maintain | Buy | 2025-05-09 |

| Citigroup | Maintain | Buy | 2025-05-09 |

| B of A Securities | Maintain | Buy | 2025-04-16 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-03-14 |

Nova Ltd. consistently receives Buy and Outperform ratings, indicating a positive overall sentiment from analysts.

Cirrus Logic, Inc. Grades

The following table summarizes Cirrus Logic, Inc.’s recent grades from verified grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Benchmark | Maintain | Buy | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Stifel | Maintain | Buy | 2025-09-12 |

| Barclays | Maintain | Equal Weight | 2025-05-07 |

| Barclays | Maintain | Equal Weight | 2025-04-22 |

| Stifel | Maintain | Buy | 2025-04-17 |

Cirrus Logic shows a mix of Buy, Overweight, and Equal Weight ratings, with some variation in analyst sentiment.

Which company has the best grades?

Both Nova Ltd. and Cirrus Logic, Inc. have a consensus of “Buy,” but Nova Ltd. demonstrates a more uniform pattern of strong Buy and Outperform ratings. This consistency might suggest steadier analyst confidence, potentially impacting investor perception of stability and growth prospects.

Strengths and Weaknesses

Below is a table summarizing the key strengths and weaknesses of Nova Ltd. (NVMI) and Cirrus Logic, Inc. (CRUS) based on the latest financial data and competitive analysis.

| Criterion | Nova Ltd. (NVMI) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Diversification | Low – single main product line (~538M USD in 2024) | Moderate – two main segments with balanced revenues (1.14B & 759M USD in 2025) |

| Profitability | High net margin (27.33%), ROIC 13.39%, but ROIC barely above WACC | Solid net margin (17.48%), ROIC 14.2%, comfortably above WACC |

| Innovation | Growing ROIC trend but currently shedding value, indicating potential but no strong moat yet | Very favorable moat with durable competitive advantage and increasing profitability |

| Global presence | Moderate – growing but limited scale | Strong global footprint with diversified product lines and steady revenue growth |

| Market Share | Smaller scale with niche exposure | Larger scale with dominant positions in mixed signal and portable audio products |

Key takeaways: Cirrus Logic shows a stronger competitive moat and more diversified revenue streams, supporting sustained profitability and growth. Nova Ltd. is improving profitability but remains more vulnerable with less diversification and a weaker moat. Investors should weigh risk tolerance accordingly.

Risk Analysis

Below is a comparative overview of key risks for Nova Ltd. (NVMI) and Cirrus Logic, Inc. (CRUS) based on the most recent data from 2025-2026:

| Metric | Nova Ltd. (NVMI) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Market Risk | High beta at 1.83 indicates higher volatility and sensitivity to market swings. | Moderate beta at 1.08 suggests average market volatility exposure. |

| Debt Level | Low debt-to-equity ratio at 0.25, indicating manageable leverage. | Very low debt-to-equity ratio at 0.07, signaling strong balance sheet. |

| Regulatory Risk | Exposure to multiple international markets (Israel, US, Taiwan, China) increases regulatory complexity. | Primarily US-based but with international sales; moderate regulatory risk. |

| Operational Risk | Specialized semiconductor process control systems could face supply chain or tech disruption risks. | Fabless semiconductor model may reduce manufacturing risks but depends on third parties. |

| Environmental Risk | Moderate, with semiconductor manufacturing processes potentially subject to environmental regulations. | Moderate, given industry environmental standards and energy-related product lines. |

| Geopolitical Risk | Higher, given operations in geopolitically sensitive regions including Israel and China. | Lower, mainly US-based operations with less exposure to tense geopolitical areas. |

The most significant risks for Nova Ltd. involve its higher market volatility and geopolitical exposure, which could impact operational continuity. Cirrus Logic’s main challenge lies in market fluctuations and maintaining supply chain efficiency in a fabless model. Both companies maintain low debt levels, reducing financial risk.

Which Stock to Choose?

Nova Ltd. (NVMI) has shown strong income growth with revenue up 149.59% and net income rising 283.58% over 2020-2024. Its profitability metrics like net margin (27.33%) and ROE (19.81%) are favorable, supported by low debt ratios and a very high interest coverage, though valuation multiples appear stretched. The company’s slight competitive advantage signals increasing profitability but limited moat durability.

Cirrus Logic, Inc. (CRUS) presents steady income growth—38.48% revenue and 52.53% net income increases over 2021-2025—with favorable profitability indicators including a 17.48% net margin and solid ROIC. It benefits from a very favorable moat with durable competitive advantages, lower debt ratios, and moderate valuation multiples, despite a decelerating recent stock trend.

For investors prioritizing growth potential and accelerating income trends, Nova Ltd. might appear attractive given its rapid expansion and improving profitability. Conversely, those valuing durable competitive advantages and financial stability may find Cirrus Logic’s strong moat and balanced ratios more aligned with risk-averse or quality-focused strategies. The choice could thus depend on the investor’s risk tolerance and investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Nova Ltd. and Cirrus Logic, Inc. to enhance your investment decisions: