Home > Comparison > Technology > LRCX vs CRUS

The strategic rivalry between Lam Research Corporation and Cirrus Logic, Inc. shapes the semiconductor industry’s competitive landscape. Lam Research operates as a capital-intensive manufacturer of advanced semiconductor processing equipment. Cirrus Logic, by contrast, focuses on high-precision, low-power mixed-signal solutions with a fabless model. This analysis explores their contrasting growth and value propositions, aiming to identify the superior risk-adjusted opportunity for a diversified technology portfolio in 2026.

Table of contents

Companies Overview

Lam Research Corporation and Cirrus Logic, Inc. stand as pivotal players in the semiconductor industry, each commanding distinct niches with significant market influence.

Lam Research Corporation: Semiconductor Equipment Powerhouse

Lam Research dominates as a leading supplier of semiconductor processing equipment critical for integrated circuit fabrication. Its revenue stems primarily from advanced systems like ALTUS and SABRE that enable film deposition and copper interconnect manufacturing. In 2026, Lam emphasizes innovation in plasma-enhanced CVD and atomic layer deposition technologies to maintain its competitive edge globally.

Cirrus Logic, Inc.: Fabless Audio and Mixed-Signal Innovator

Cirrus Logic operates as a fabless semiconductor company specializing in low-power, high-precision mixed-signal processing solutions. Its core revenue driver is audio products integrating ADCs, DACs, and proprietary SoundClear technology for enhanced sound and active noise cancellation. The company’s 2026 strategy focuses on expanding applications across mobile, automotive, and industrial sectors with high-performance mixed-signal ICs.

Strategic Collision: Similarities & Divergences

Both companies thrive in the semiconductor field but diverge sharply in approach—Lam invests heavily in capital equipment manufacturing, while Cirrus leverages a fabless model focused on audio and mixed-signal ICs. Their primary battleground lies in supplying semiconductor innovation but at different ecosystem levels. Investors face contrasting profiles: Lam’s capital-intensive growth contrasts with Cirrus’s nimble product specialization.

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Lam Research (LRCX) | Cirrus Logic (CRUS) |

|---|---|---|

| Revenue | 18.4B | 1.9B |

| Cost of Revenue | 9.5B | 900M |

| Operating Expenses | 3.1B | 586M |

| Gross Profit | 9.0B | 996M |

| EBITDA | 6.3B | 497M |

| EBIT | 6.0B | 445M |

| Interest Expense | 178M | 898K |

| Net Income | 5.4B | 332M |

| EPS | 4.17 | 6.24 |

| Fiscal Year | 2025 | 2025 |

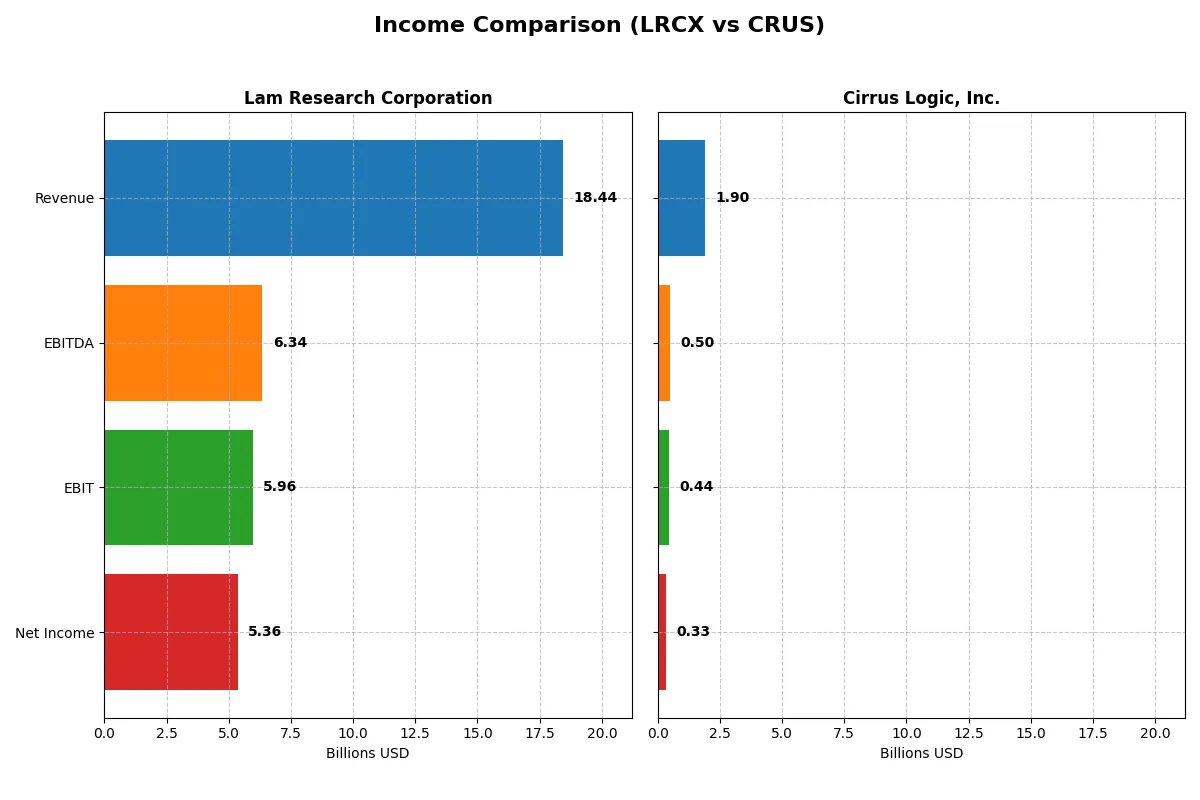

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how efficiently Lam Research Corporation and Cirrus Logic, Inc. convert revenue into profit and growth.

Lam Research Corporation Analysis

Lam Research’s revenue rose sharply to $18.4B in 2025, driving net income to $5.36B. Its gross margin stands robust at 48.7%, while the net margin reaches an impressive 29.1%. The latest year shows strong momentum, with operating expenses growing proportionally and EPS surging 43%, signaling excellent cost control and profitability expansion.

Cirrus Logic, Inc. Analysis

Cirrus Logic’s revenue grew modestly to $1.9B in 2025, with net income at $332M. The company maintains a higher gross margin of 52.5%, but a thinner net margin of 17.5%. Although revenue growth is slower, EBIT and net margin showed solid improvement, alongside a 22% EPS increase, reflecting steady operational gains despite scale limitations.

Margin Power vs. Revenue Scale

Lam Research outperforms with significantly higher revenue and net income, paired with strong margin expansion and EPS growth. Cirrus Logic excels in gross margin but lags in scale and net profitability. For investors, Lam Research’s profile offers superior earnings power and efficiency, while Cirrus Logic presents a smaller, steady growth story.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Lam Research Corporation (LRCX) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| ROE | 54.3% | 17.0% |

| ROIC | 34.0% | 14.2% |

| P/E | 23.4 | 15.9 |

| P/B | 12.7 | 2.7 |

| Current Ratio | 2.21 | 6.35 |

| Quick Ratio | 1.55 | 4.82 |

| D/E (Debt-to-Equity) | 0.48 | 0.07 |

| Debt-to-Assets | 22.3% | 6.2% |

| Interest Coverage | 33.1 | 457.0 |

| Asset Turnover | 0.86 | 0.81 |

| Fixed Asset Turnover | 7.59 | 6.62 |

| Payout Ratio | 21.5% | 0.0% |

| Dividend Yield | 0.92% | 0.0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden operational strengths and risks critical for investors’ strategic decisions.

Lam Research Corporation

Lam Research demonstrates exceptional profitability with a 54.33% ROE and a strong 29.06% net margin, signaling operational excellence. Its valuation appears fairly priced with a neutral P/E of 23.36 but a stretched P/B at 12.69. Despite a low 0.92% dividend yield, Lam reinvests heavily in R&D, fueling sustained growth and shareholder value.

Cirrus Logic, Inc.

Cirrus Logic posts solid but modest profitability, with a 17.01% ROE and 17.48% net margin, reflecting efficient operations at lower scale. The stock trades at a neutral P/E of 15.95 and a reasonable P/B of 2.71, suggesting fair valuation. It offers no dividend, instead channeling resources into robust R&D, supporting future innovation and market positioning.

Premium Valuation vs. Operational Safety

Lam Research commands a premium valuation justified by superior returns and reinvestment discipline, balancing risk with growth potential. Cirrus Logic offers a more conservative risk profile with fair valuation and steady profitability. Lam suits growth-oriented investors; Cirrus Logic fits those prioritizing operational stability and value.

Which one offers the Superior Shareholder Reward?

I compare Lam Research (LRCX) and Cirrus Logic (CRUS) on their shareholder distribution strategies. LRCX delivers a modest dividend yield around 0.9%, with a sustainable payout ratio near 21%, backed by strong free cash flow coverage (3.2x). It also runs steady buybacks, boosting total returns. CRUS pays no dividend but reinvests heavily in growth, showing robust free cash flow yield and ultra-low debt. Its buyback activity is less visible but cash-rich balance sheets and high operating cash flow indicate strong capital allocation potential. Historically, I’ve observed that dividend payers like LRCX offer steadier income in cyclical tech. However, CRUS’s reinvestment and low leverage favor capital gains during growth phases. For 2026, I favor Lam Research for total shareholder reward due to its balanced income-plus-buyback approach and proven payout sustainability.

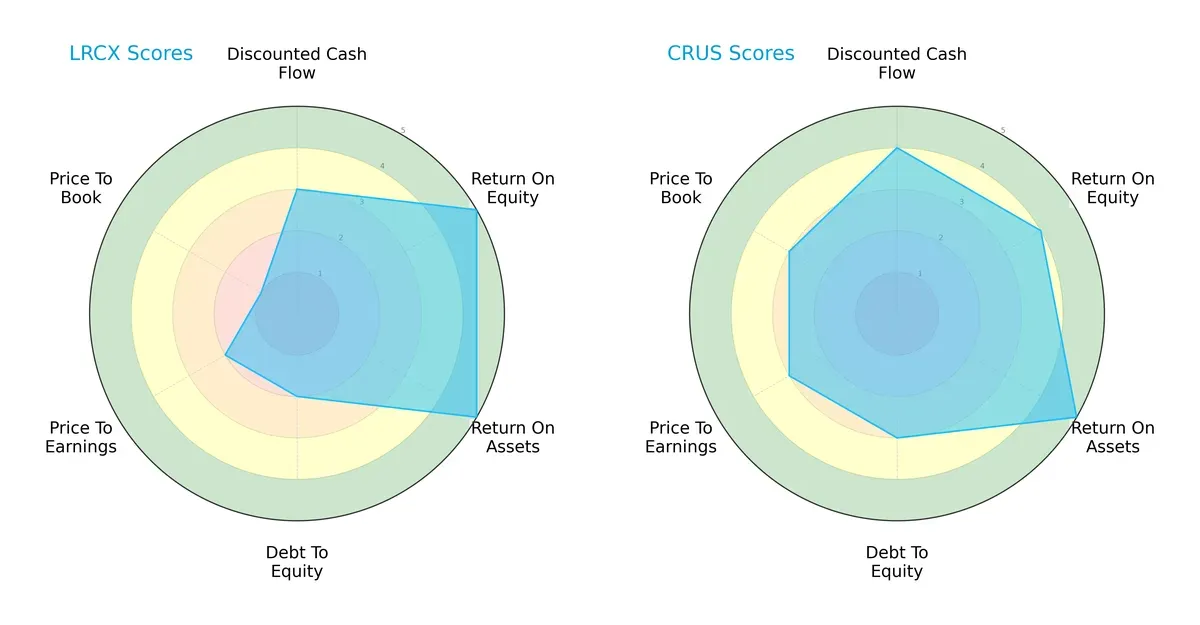

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Lam Research and Cirrus Logic, highlighting their financial strengths and valuation nuances:

Lam Research excels in return metrics, scoring 5 in both ROE and ROA, demonstrating superior profitability and asset utilization. Cirrus Logic offers a more balanced profile with solid scores across DCF (4), ROE (4), and valuation metrics (PE 3, PB 3). Lam Research’s weakness lies in valuation, notably a very unfavorable P/B score of 1, suggesting potential overvaluation or asset base concerns. Cirrus Logic relies less on a single strength and maintains moderate debt levels, reflecting prudent capital structure management. Overall, Cirrus Logic presents a more balanced risk-return profile, while Lam Research depends heavily on operational efficiency amid valuation challenges.

Bankruptcy Risk: Solvency Showdown

Lam Research’s Altman Z-Score at 21.2 significantly outpaces Cirrus Logic’s 12.4, both firmly in the safe zone. This gap signals Lam Research’s stronger buffer against financial distress in volatile cycles:

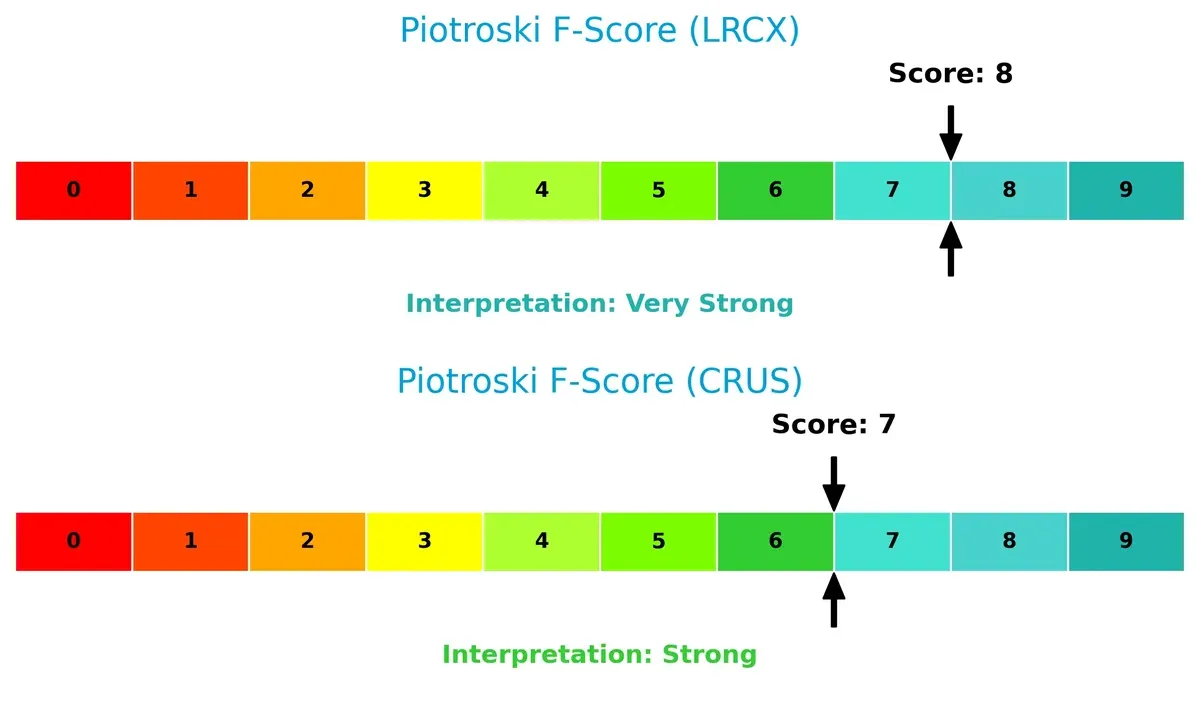

Financial Health: Quality of Operations

Lam Research achieves a Piotroski F-Score of 8, indicating very strong financial health, narrowly surpassing Cirrus Logic’s strong 7. Both companies display robust internal metrics, but Lam Research’s edge suggests slightly better profitability and operational efficiency:

How are the two companies positioned?

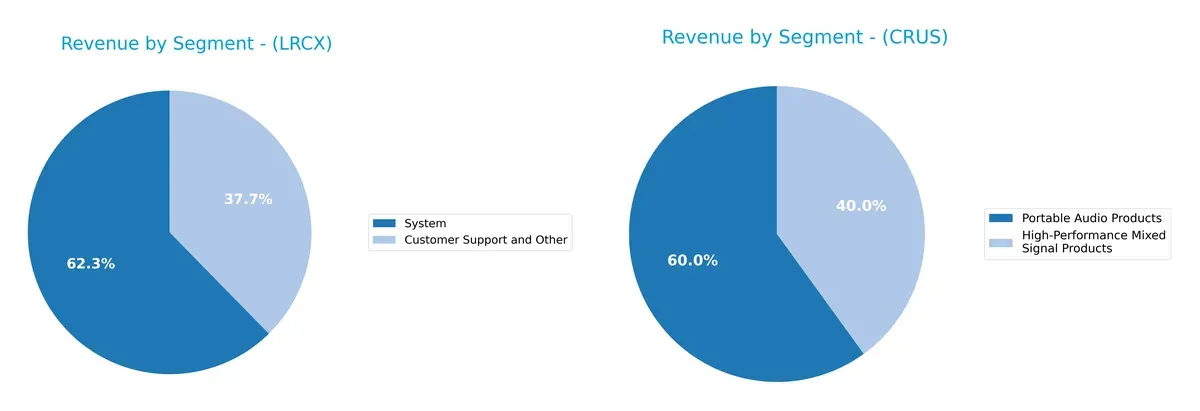

This section dissects the operational DNA of Lam Research and Cirrus Logic by comparing their revenue distribution by segment and internal dynamics. The goal is to confront their economic moats to identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Lam Research and Cirrus Logic diversify their income streams and reveals where their primary sector bets lie:

Lam Research anchors revenue in its System segment with $11.5B in 2025, complemented by $6.9B from Customer Support. This mix shows strong ecosystem lock-in balancing product sales and service. Cirrus Logic pivots between Portable Audio ($1.14B) and High-Performance Mixed Signal Products ($759M), reflecting a more balanced but narrower tech focus. Lam’s broader base reduces concentration risk; Cirrus leans on specialized audio innovation, which may limit scalability.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Lam Research Corporation and Cirrus Logic, Inc.:

LRCX Strengths

- High net margin at 29.06%

- ROE strong at 54.33%

- ROIC of 34.0% well above WACC

- Solid liquidity with current ratio 2.21

- Diversified geographic revenue including China and Korea

- Significant system segment revenue at $11.5B

CRUS Strengths

- Positive net margin at 17.48%

- ROE of 17.01% supports profitability

- ROIC at 14.2% above WACC

- Very high interest coverage at 495.45

- Low debt-to-assets at 6.18%

- Balanced product mix with mixed signal and portable audio

LRCX Weaknesses

- WACC at 12.05% above ROIC indicates capital cost pressure

- High price-to-book at 12.69 signals potential overvaluation

- Dividend yield low at 0.92%

- Asset turnover neutral at 0.86

- Heavy reliance on system segment revenue

- Limited US revenue proportion

CRUS Weaknesses

- Current ratio very high at 6.35, may indicate inefficient asset use

- Dividend yield nil, no income return

- Price-to-book neutral at 2.71

- Asset turnover neutral at 0.81

- Revenue concentration in China over US and other regions

- Lower ROE relative to sector leaders

Both companies demonstrate solid profitability with distinct capital structures and product focus. LRCX leverages high returns but faces valuation and capital cost challenges. CRUS maintains conservative leverage and strong interest coverage but shows potential inefficiency in asset management and revenue concentration risks. These factors shape each firm’s strategic positioning and risk profile.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield protecting a company’s long-term profits from relentless competitive erosion:

Lam Research Corporation: Capital-Intensive Precision Moat

I see Lam’s moat rooted in its high capital requirements and specialized semiconductor equipment. This drives a robust ROIC of nearly 22%, reflecting efficient capital use and margin stability. Expansion into advanced wafer processing deepens this moat amid evolving chip fabrication demands in 2026.

Cirrus Logic, Inc.: Niche Innovation and Integration Moat

Cirrus Logic’s moat centers on its proprietary mixed-signal audio solutions and integration capabilities, distinct from Lam’s capital intensity. It delivers value with a healthy 5.4% ROIC premium over WACC and rising profitability. Growth in smart audio and haptics markets offers fresh expansion avenues in 2026.

Capital Rigor vs. Innovation Edge: The Moat Showdown

Lam Research’s broader and deeper moat stems from high barriers to entry and consistent value creation, outperforming Cirrus’s narrower niche advantage. Lam is better positioned to defend and grow its market share amid semiconductor complexity and scale demands.

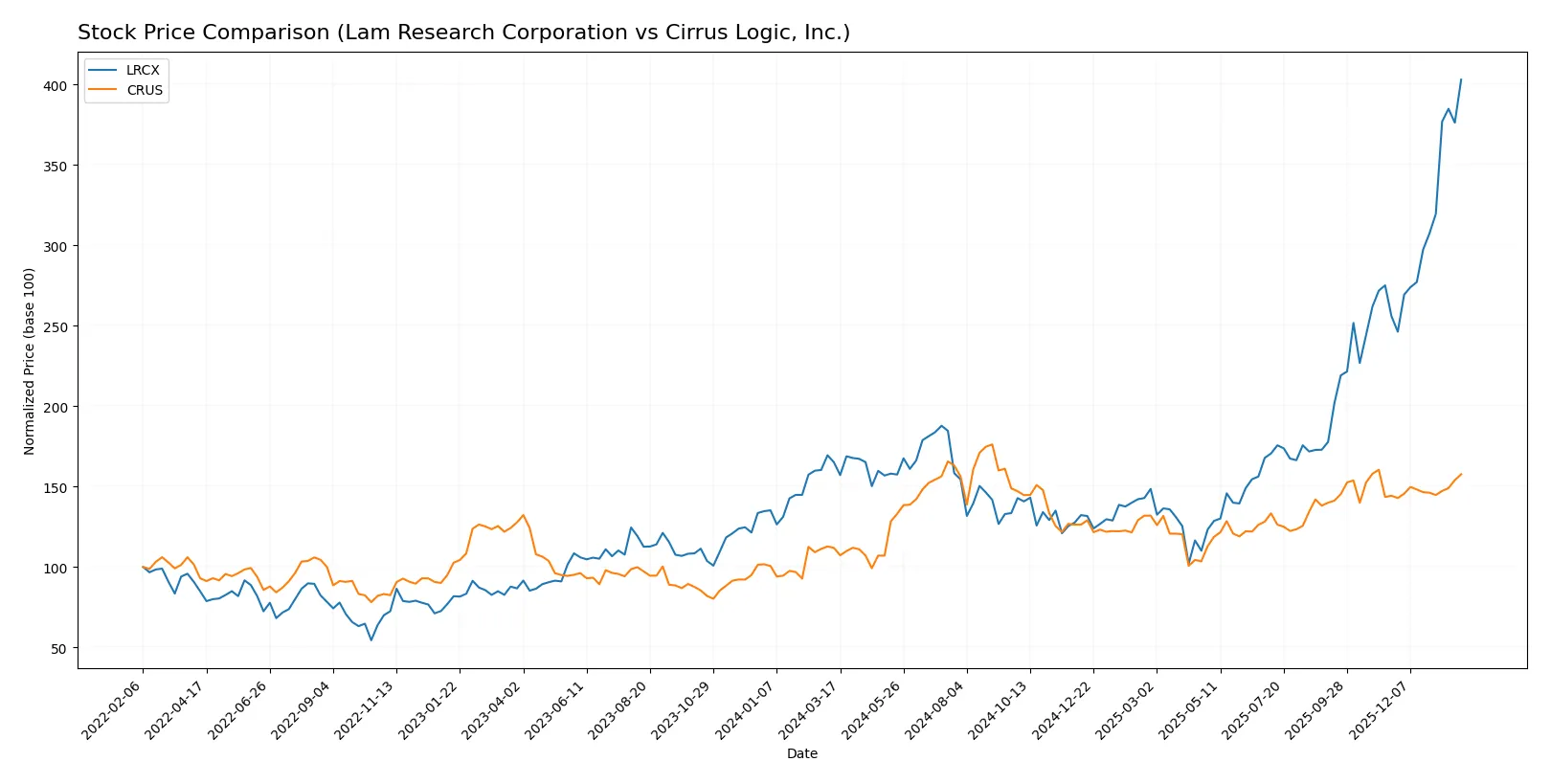

Which stock offers better returns?

Both Lam Research Corporation and Cirrus Logic, Inc. show strong price gains over the past year, with Lam Research demonstrating more pronounced growth and trading activity.

Trend Comparison

Lam Research’s stock rose 144.03% over the past year, showing a bullish trend with accelerating momentum. Its price ranged from 59.09 to 233.46, reflecting high volatility (std. dev. 36.82).

Cirrus Logic’s stock increased 40.89% over the past year, also bullish but less volatile (std. dev. 14.44). The trend accelerated moderately, with prices moving between 82.02 and 145.69.

Lam Research outperformed Cirrus Logic, delivering a significantly higher return and stronger acceleration in price growth during the analyzed period.

Target Prices

Analysts present a broad but optimistic target consensus for Lam Research and Cirrus Logic.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Lam Research Corporation | 127 | 325 | 267 |

| Cirrus Logic, Inc. | 100 | 155 | 139 |

Lam Research’s consensus target of 267 sits well above its current 233 price, signaling upside potential. Cirrus Logic’s consensus at 139 also exceeds its current 130, reflecting moderate bullish sentiment.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Institutional grades for Lam Research Corporation and Cirrus Logic, Inc. are detailed below:

Lam Research Corporation Grades

The following table summarizes recent institutional grades for Lam Research Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2026-01-29 |

| Citigroup | Maintain | Buy | 2026-01-29 |

| RBC Capital | Maintain | Outperform | 2026-01-29 |

| Needham | Maintain | Buy | 2026-01-29 |

| UBS | Maintain | Buy | 2026-01-29 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-29 |

| Goldman Sachs | Maintain | Buy | 2026-01-29 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-29 |

| Wells Fargo | Maintain | Overweight | 2026-01-29 |

| Stifel | Maintain | Buy | 2026-01-29 |

Cirrus Logic, Inc. Grades

The following table summarizes recent institutional grades for Cirrus Logic, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Benchmark | Maintain | Buy | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Stifel | Maintain | Buy | 2025-09-12 |

| Barclays | Maintain | Equal Weight | 2025-05-07 |

| Barclays | Maintain | Equal Weight | 2025-04-22 |

| Stifel | Maintain | Buy | 2025-04-17 |

Which company has the best grades?

Lam Research Corporation consistently receives strong buy and outperform ratings from a broad spectrum of firms. Cirrus Logic, Inc. also has positive grades but with more equal weight and fewer outperform ratings. Investors may view Lam Research’s broader consensus as indicative of greater confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both Lam Research Corporation and Cirrus Logic, Inc. in the 2026 market environment:

1. Market & Competition

Lam Research Corporation

- Faces intense competition in semiconductor equipment with rapid innovation cycles. Market leadership depends on continuous R&D.

Cirrus Logic, Inc.

- Operates in a niche of mixed-signal processing, facing competition from larger integrated device manufacturers and evolving consumer demands.

2. Capital Structure & Debt

Lam Research Corporation

- Maintains moderate leverage (D/E 0.48) with strong interest coverage (33.43x), indicating healthy debt management.

Cirrus Logic, Inc.

- Features very low leverage (D/E 0.07) and extremely high interest coverage (495.45x), reducing financial risk significantly.

3. Stock Volatility

Lam Research Corporation

- Exhibits high beta (1.779), reflecting above-market volatility and sensitivity to sector cycles.

Cirrus Logic, Inc.

- Displays lower beta (1.084), indicating more stable stock price behavior relative to the market.

4. Regulatory & Legal

Lam Research Corporation

- Exposed to complex international trade regulations, especially U.S.-China tensions impacting semiconductor supply chains.

Cirrus Logic, Inc.

- Faces fewer regulatory burdens but must navigate intellectual property risks and export controls in tech components.

5. Supply Chain & Operations

Lam Research Corporation

- Supply chain disruptions could impact wafer fabrication equipment delivery; global footprint adds complexity.

Cirrus Logic, Inc.

- Relies on external foundries; supply chain volatility in semiconductor materials poses operational risks.

6. ESG & Climate Transition

Lam Research Corporation

- Increasing pressure to reduce carbon footprint in manufacturing processes; ESG compliance critical for investor appeal.

Cirrus Logic, Inc.

- Smaller scale may limit ESG impact but must address energy efficiency in product design and manufacturing partners.

7. Geopolitical Exposure

Lam Research Corporation

- Significant exposure to geopolitical risks due to global sales, especially tensions in Asia-Pacific markets.

Cirrus Logic, Inc.

- Moderate geopolitical risks with a focus on U.S. and international markets; less direct exposure to China tensions.

Which company shows a better risk-adjusted profile?

Lam Research faces higher market and geopolitical risks amplified by its global footprint and stock volatility. Cirrus Logic benefits from a conservative capital structure and lower stock beta, signaling lower financial and market risk. However, its smaller scale increases dependency on external foundries. Overall, Cirrus Logic shows a better risk-adjusted profile, supported by stronger financial stability and lower leverage. The stark contrast in beta—1.779 for Lam versus 1.084 for Cirrus—underscores my concern about Lam’s vulnerability to market swings.

Final Verdict: Which stock to choose?

Lam Research Corporation’s superpower lies in its exceptional capital efficiency and robust profitability, reflected in a return on invested capital far exceeding its cost of capital. Its point of vigilance is the relatively elevated price-to-book ratio, suggesting valuation risk in turbulent markets. It fits well in aggressive growth portfolios seeking durable economic moats.

Cirrus Logic, Inc. offers a strategic moat through strong recurring revenue streams supported by its niche in audio semiconductor solutions. Compared to Lam, it presents a more conservative risk profile with lower leverage and a healthier current ratio. This stock suits investors focused on growth at a reasonable price with steady cash flow stability.

If you prioritize maximizing capital returns and are comfortable with valuation premiums, Lam Research outshines thanks to its scalable profitability and market leadership. However, if you seek better stability with moderate growth and a lower risk envelope, Cirrus Logic offers a compelling alternative with a solid financial footing and strategic niche. Both present viable analytical scenarios depending on your risk tolerance and portfolio goals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Lam Research Corporation and Cirrus Logic, Inc. to enhance your investment decisions: