In the fast-evolving semiconductor industry, Cirrus Logic, Inc. (CRUS) and IPG Photonics Corporation (IPGP) stand out as innovators with distinct yet overlapping market focuses. Cirrus Logic excels in mixed-signal processing for audio and industrial applications, while IPG Photonics leads in high-performance fiber laser technologies. This comparison explores their innovation strategies and market positions to help you identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Cirrus Logic and IPG Photonics by providing an overview of these two companies and their main differences.

Cirrus Logic Overview

Cirrus Logic, Inc. is a fabless semiconductor company specializing in low-power, high-precision mixed-signal processing solutions. Its products include integrated codecs, digital signal processors, and audio technologies used in consumer electronics such as smartphones, AR/VR headsets, and automotive systems. Headquartered in Austin, Texas, Cirrus Logic serves both industrial and energy markets with high-performance mixed-signal products.

IPG Photonics Overview

IPG Photonics Corporation develops and manufactures high-performance fiber lasers, fiber amplifiers, and diode lasers primarily for materials processing applications worldwide. The company also provides advanced laser systems, optical components, and communication amplifiers for telecommunications and medical uses. Based in Marlborough, Massachusetts, IPG Photonics markets to OEMs, system integrators, and end users through direct and distributor sales channels.

Key similarities and differences

Both Cirrus Logic and IPG Photonics operate in the semiconductor sector, focusing on advanced technology solutions. Cirrus Logic emphasizes mixed-signal processing and audio-related applications, while IPG Photonics specializes in fiber laser and amplifier technologies for industrial and communications uses. Each relies on a combination of direct sales forces and distribution agreements to reach their target markets, yet their product portfolios and end markets differ notably.

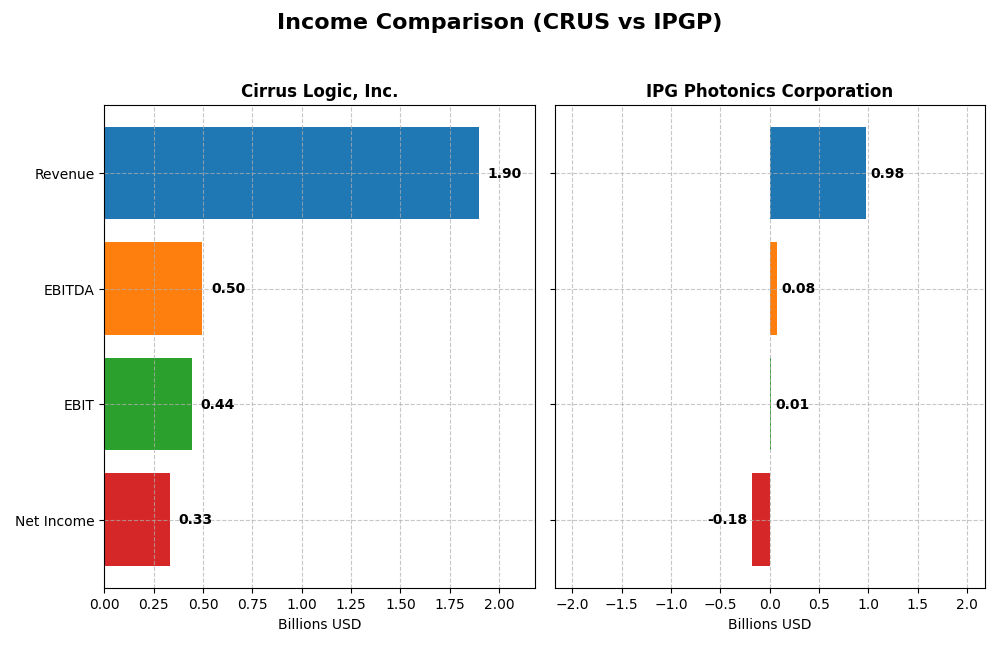

Income Statement Comparison

The following table presents a side-by-side comparison of key income statement metrics for Cirrus Logic, Inc. and IPG Photonics Corporation for their most recent fiscal years.

| Metric | Cirrus Logic, Inc. (CRUS) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Market Cap | 6.29B | 3.37B |

| Revenue | 1.90B | 977M |

| EBITDA | 497M | 76M |

| EBIT | 445M | 14M |

| Net Income | 332M | -182M |

| EPS | 6.24 | -4.09 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Cirrus Logic, Inc.

Cirrus Logic’s revenue grew steadily from 2021 to 2025, rising from $1.37B to $1.90B, with net income increasing from $217M to $332M. Margins showed consistent improvement, with a strong gross margin of 52.5% and net margin near 17.5% in 2025. The latest year saw favorable growth in earnings per share (+22%) and operating income (+22%), signaling solid margin expansion and operational efficiency.

IPG Photonics Corporation

IPG Photonics experienced declining revenue over 2020-2024, dropping from $1.46B to $977M, with net income turning negative at -$182M in 2024 from a positive $278M in 2021. Gross margin weakened but remained favorable at 34.6%, while net margin turned sharply unfavorable at -18.6%. The most recent year showed steep declines across revenue (-24%), net margin, and earnings per share, reflecting operational challenges.

Which one has the stronger fundamentals?

Cirrus Logic presents stronger fundamentals with significant growth in revenue and net income, consistent margin improvements, and a favorable income statement evaluation rating of 92.9%. In contrast, IPG Photonics shows deteriorating financials with negative profitability, shrinking revenue, and an unfavorable income statement evaluation of 78.6%, indicating weaker operational and financial health over the period.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Cirrus Logic, Inc. (CRUS) and IPG Photonics Corporation (IPGP) based on their most recent fiscal year data.

| Ratios | Cirrus Logic, Inc. (CRUS) FY 2025 | IPG Photonics Corporation (IPGP) FY 2024 |

|---|---|---|

| ROE | 17.0% | -8.97% |

| ROIC | 14.2% | -9.97% |

| P/E | 15.95 | -17.76 |

| P/B | 2.71 | 1.59 |

| Current Ratio | 6.35 | 6.98 |

| Quick Ratio | 4.82 | 5.59 |

| D/E (Debt-to-Equity) | 0.074 | 0.009 |

| Debt-to-Assets | 6.2% | 0.78% |

| Interest Coverage | 457 | 0 |

| Asset Turnover | 0.81 | 0.43 |

| Fixed Asset Turnover | 6.62 | 1.66 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Cirrus Logic, Inc.

Cirrus Logic shows strong profitability with favorable net margin (17.48%), ROE (17.01%), and ROIC (14.2%), indicating efficient capital use. However, its high current ratio (6.35) is seen as unfavorable, potentially signaling excess liquidity. The company does not pay dividends, likely focusing on reinvestment and R&D, as suggested by its substantial research and development expenses.

IPG Photonics Corporation

IPG Photonics exhibits weak profitability ratios, including negative net margin (-18.58%), ROE (-8.97%), and ROIC (-9.97%), reflecting operational challenges. Its current ratio (6.98) is also unfavorable, though the quick ratio (5.59) and low debt levels are positive. The lack of dividends aligns with negative earnings and possible prioritization of growth and capital allocation to operations.

Which one has the best ratios?

Cirrus Logic maintains a more favorable overall ratio profile, with a majority of key profitability and leverage metrics positive, supporting operational strength. In contrast, IPG Photonics faces significant profitability weaknesses and less favorable asset turnover, despite solid liquidity and debt metrics. Thus, Cirrus Logic’s ratios are generally superior in this comparison.

Strategic Positioning

This section compares the strategic positioning of Cirrus Logic, Inc. and IPG Photonics Corporation, focusing on market position, key segments, and exposure to technological disruption:

Cirrus Logic, Inc.

- Leading fabless semiconductor with moderate beta; faces competitive pressure in semiconductors.

- Key drivers are portable audio products ($1.14B) and high-performance mixed signal products ($759M).

- Exposed to disruption through evolving audio and industrial applications requiring integrated mixed-signal ICs.

IPG Photonics Corporation

- Mid-sized semiconductor firm specializing in fiber lasers; faces competitive pressure in niche laser markets.

- Diversified laser products with focus on high power CW lasers and amplifiers; materials processing is main segment.

- Exposure to disruption via advanced fiber laser technologies impacting materials processing and communications.

Cirrus Logic vs IPG Photonics Positioning

Cirrus Logic pursues a diversified portfolio emphasizing portable audio and mixed-signal ICs, leveraging innovation in consumer electronics. IPG Photonics concentrates on laser technologies with a focus on materials processing, reflecting a more specialized strategic approach with narrower market segments.

Which has the best competitive advantage?

Cirrus Logic demonstrates a very favorable economic moat with growing ROIC and value creation, indicating a durable competitive advantage. IPG Photonics shows very unfavorable moat characteristics with declining ROIC, signaling value destruction and weaker competitive positioning.

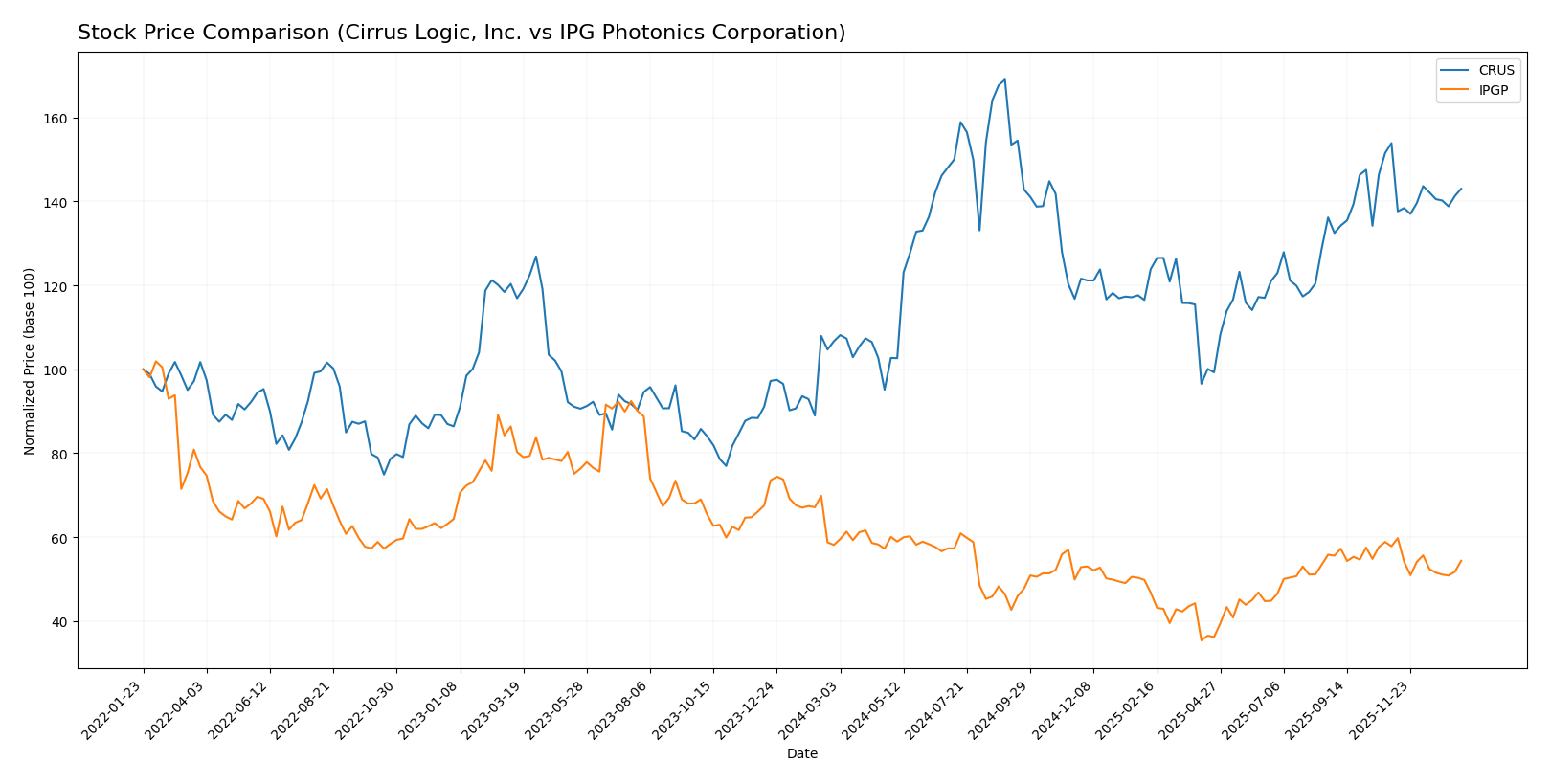

Stock Comparison

The stock price movements of Cirrus Logic, Inc. and IPG Photonics Corporation over the past 12 months reveal contrasting trends, with Cirrus Logic showing strong gains despite recent deceleration, while IPG Photonics experienced a consistent decline.

Trend Analysis

Cirrus Logic, Inc. exhibited a bullish trend over the past year with a 34.06% price increase, though the upward momentum slowed down. The stock ranged between 82.02 and 145.69, with volatility reflected by a 14.46 std deviation. IPG Photonics Corporation showed a bearish trend with a 6.49% price decrease over the same period, accompanied by decelerating downward momentum. The stock price fluctuated between 52.12 and 90.69, with a 9.27 std deviation. Comparing both stocks, Cirrus Logic delivered the highest market performance, outperforming IPG Photonics by a substantial margin in price appreciation over the past year.

Target Prices

The current analyst consensus presents optimistic price targets for Cirrus Logic, Inc. and IPG Photonics Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cirrus Logic, Inc. | 155 | 100 | 138.75 |

| IPG Photonics Corporation | 96 | 92 | 94 |

Analysts expect Cirrus Logic’s price to rise significantly above its current 123.28 USD, while IPG Photonics shows a narrower target range, suggesting moderate upside from its current 80.03 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cirrus Logic, Inc. (CRUS) and IPG Photonics Corporation (IPGP):

Rating Comparison

CRUS Rating

- Rating: A- indicating a very favorable overall rating.

- Discounted Cash Flow Score: 4, considered favorable.

- ROE Score: 4, showing favorable efficiency in generating profit from equity.

- ROA Score: 5, very favorable asset utilization to generate earnings.

- Debt To Equity Score: 3, moderate financial risk level.

- Overall Score: 4, reflecting a favorable overall financial standing.

IPGP Rating

- Rating: B+ also indicating a very favorable overall rating.

- Discounted Cash Flow Score: 4, considered favorable.

- ROE Score: 2, indicating moderate efficiency in profit generation.

- ROA Score: 3, showing moderate effectiveness in asset utilization.

- Debt To Equity Score: 4, indicating favorable lower financial risk.

- Overall Score: 3, showing a moderate overall financial standing.

Which one is the best rated?

Based strictly on the provided data, CRUS holds a higher overall rating (A-) and superior scores in ROE, ROA, and overall financial standing compared to IPGP’s B+ and moderate scores, making CRUS the better rated company in this comparison.

Scores Comparison

The comparison of the Altman Z-Score and Piotroski Score for Cirrus Logic and IPG Photonics is as follows:

CRUS Scores

- Altman Z-Score: 11.94, indicating a safe zone.

- Piotroski Score: 7, reflecting strong financial health.

IPGP Scores

- Altman Z-Score: 9.65, also indicating a safe zone.

- Piotroski Score: 7, reflecting strong financial health.

Which company has the best scores?

Both Cirrus Logic and IPG Photonics have Altman Z-Scores well within the safe zone and identical Piotroski Scores of 7, indicating similarly strong financial health based on the provided data.

Grades Comparison

Here is the grades comparison of Cirrus Logic, Inc. and IPG Photonics Corporation from verified grading companies:

Cirrus Logic, Inc. Grades

The following table summarizes recent grades and actions by reputable firms for Cirrus Logic, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Benchmark | Maintain | Buy | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Stifel | Maintain | Buy | 2025-09-12 |

| Barclays | Maintain | Equal Weight | 2025-05-07 |

| Barclays | Maintain | Equal Weight | 2025-04-22 |

| Stifel | Maintain | Buy | 2025-04-17 |

Cirrus Logic’s grades consistently trend toward Buy and Overweight, reflecting stable positive sentiment from multiple analysts.

IPG Photonics Corporation Grades

The following table presents recent verified grades and rating changes for IPG Photonics Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Stifel | Maintain | Buy | 2025-02-12 |

| Needham | Maintain | Hold | 2025-02-12 |

| Seaport Global | Downgrade | Neutral | 2024-08-01 |

| Stifel | Maintain | Buy | 2024-07-31 |

| Raymond James | Maintain | Strong Buy | 2024-07-31 |

IPG Photonics shows a mix of upgrades and strong buy ratings but includes some hold and sell opinions, indicating more varied analyst views.

Which company has the best grades?

Both companies hold a consensus “Buy” rating, but Cirrus Logic’s grades are more uniformly positive with repeated Buy and Overweight designations. IPG Photonics has stronger highs like Strong Buy and Outperform but also includes some Hold and Sell ratings, suggesting more analyst divergence. This contrast could influence investor perception of stability and risk.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Cirrus Logic, Inc. (CRUS) and IPG Photonics Corporation (IPGP) based on their recent financial and operational data.

| Criterion | Cirrus Logic, Inc. (CRUS) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Diversification | Moderate diversification with key segments in Portable Audio and High-Performance Mixed Signal Products | More diversified product portfolio across various laser types and systems |

| Profitability | Strong profitability with 17.48% net margin and growing ROIC at 14.2% (Very Favorable moat) | Negative profitability: net margin at -18.58%, declining ROIC at -9.97% (Very Unfavorable moat) |

| Innovation | Consistent innovation in mixed-signal and audio technology driving growing profitability | Innovation challenged by declining returns, despite a broad laser technology range |

| Global presence | Established global presence in consumer electronics market | Strong global footprint in industrial laser applications |

| Market Share | Solid market share in portable audio chips, growing revenue in core segments | Market share under pressure due to profitability issues and declining returns |

Cirrus Logic stands out with robust profitability, efficient capital use, and a durable competitive advantage, making it a favorable investment option. In contrast, IPG Photonics is currently facing profitability and return challenges despite its diversified product line and global reach, indicating higher risk.

Risk Analysis

The table below summarizes key risk factors for Cirrus Logic, Inc. (CRUS) and IPG Photonics Corporation (IPGP) based on the most recent data available in 2026.

| Metric | Cirrus Logic, Inc. (CRUS) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Market Risk | Moderate beta at 1.08; tech sector exposure | Moderate beta at 1.02; cyclical demand in materials processing |

| Debt level | Very low debt-to-equity at 0.07; strong interest coverage | Minimal debt at 0.01 D/E; excellent interest coverage (infinite) |

| Regulatory Risk | Moderate; semiconductor industry subject to export controls | Moderate; laser technology and exports may face regulations |

| Operational Risk | Dependence on innovation in mixed-signal ICs; supply chain sensitivity | Complex manufacturing of fiber lasers; supply chain and tech risks |

| Environmental Risk | Moderate; energy usage in semiconductor fabrication | Moderate; manufacturing impact and energy consumption |

| Geopolitical Risk | Exposure to global markets and trade tensions | Exposure to international markets and geopolitical tensions |

Cirrus Logic’s most impactful risk lies in operational challenges and market cyclicality, though its low debt and strong financial health mitigate financial risks. IPG Photonics faces notable profitability pressure with negative margins recently, increasing operational and market risks despite a strong balance sheet. Both companies are exposed to geopolitical and regulatory uncertainties that could affect supply chains and exports. Caution is advised due to market and operational volatility.

Which Stock to Choose?

Cirrus Logic, Inc. (CRUS) shows a favorable income evolution with a 38.5% revenue growth over 2021-2025 and strong profitability indicators, including a 17.5% net margin and 17.0% ROE. Its debt levels are low, reflected in a 6.2% debt-to-assets ratio, and financial ratios are globally favorable, supported by a very favorable A- rating and a very favorable moat status indicating durable competitive advantage.

IPG Photonics Corporation (IPGP) presents an unfavorable income evolution marked by a 18.6% revenue decline over 2020-2024 and negative profitability metrics, such as an -18.6% net margin and -9.0% ROE. Despite low debt ratios and a strong Altman Z-Score, its overall financial ratios are slightly unfavorable, with a B+ rating and a very unfavorable moat status highlighting value destruction and declining profitability.

For investors prioritizing financial stability, profitability, and a durable competitive advantage, CRUS might appear more favorable. Conversely, IPGP could be seen as more aligned with risk-tolerant profiles potentially seeking turnaround opportunities, given its moderate rating but unfavorable income and moat trends.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cirrus Logic, Inc. and IPG Photonics Corporation to enhance your investment decisions: