In the fast-evolving semiconductor industry, Cirrus Logic, Inc. (CRUS) and indie Semiconductor, Inc. (INDI) stand out for their innovative approaches and market presence. Both companies focus on specialized semiconductor solutions, with Cirrus excelling in audio and mixed-signal processing, while indie targets automotive and advanced driver assistance technologies. This comparison will help investors identify which company offers the most compelling opportunity in this dynamic sector. Let’s explore which stock deserves a place in your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Cirrus Logic and indie Semiconductor by providing an overview of these two companies and their main differences.

Cirrus Logic Overview

Cirrus Logic, Inc. is a fabless semiconductor company specializing in low-power, high-precision mixed-signal processing solutions. Based in Austin, Texas, it offers audio products such as codecs, amplifiers, and digital signal processors used in smartphones, tablets, automotive entertainment, and professional audio systems. The company also supplies high-performance mixed-signal products for industrial and energy applications, emphasizing sound enhancement and energy control technologies.

indie Semiconductor Overview

indie Semiconductor, Inc., headquartered in Aliso Viejo, California, focuses on automotive semiconductors and software solutions. Its product portfolio targets advanced driver assistance systems, connected car features, and electrification, including ultrasound sensors, in-cabin wireless charging, infotainment, and telematics. The company also develops photonic components for optical sensing and communication markets, leveraging a range of innovative technology platforms.

Key similarities and differences

Both Cirrus Logic and indie Semiconductor operate in the semiconductor industry, targeting niche markets with specialized products. Cirrus Logic emphasizes consumer audio and industrial mixed-signal solutions, while indie focuses on automotive applications and photonics. Cirrus Logic is a more established player with a larger market cap and workforce, whereas indie is a younger company concentrating on emerging automotive and connectivity technologies with a higher beta, indicating greater volatility.

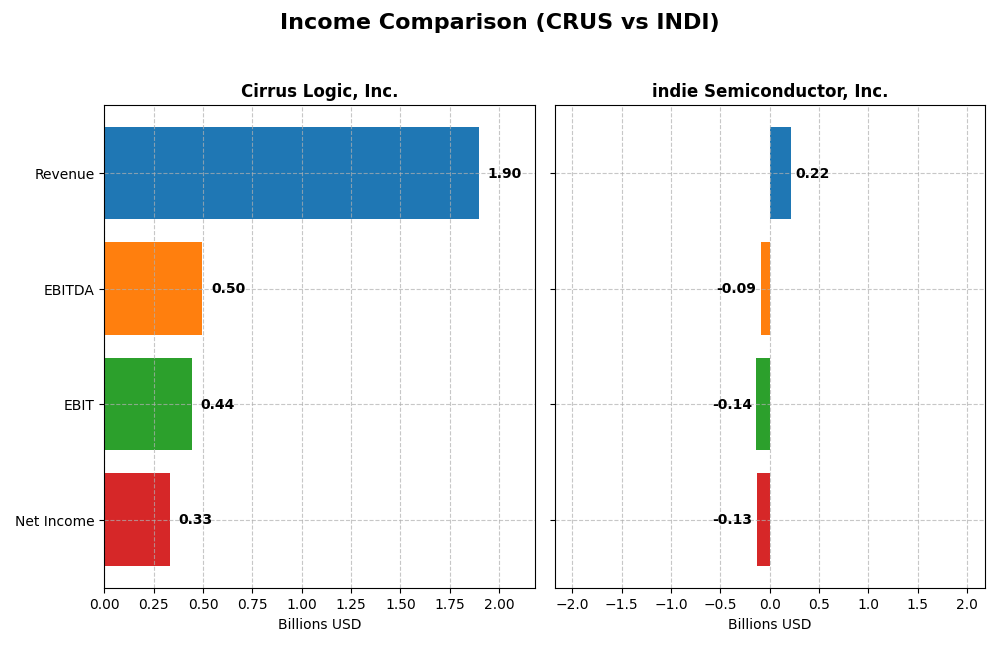

Income Statement Comparison

Below is the latest fiscal year income statement comparison for Cirrus Logic, Inc. and indie Semiconductor, Inc., highlighting key financial metrics.

| Metric | Cirrus Logic, Inc. (CRUS) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Cap | 6.3B | 857M |

| Revenue | 1.9B | 217M |

| EBITDA | 497M | -94M |

| EBIT | 445M | -137M |

| Net Income | 332M | -133M |

| EPS | 6.24 | -0.76 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Cirrus Logic, Inc.

Cirrus Logic’s revenue steadily increased from $1.37B in 2021 to $1.90B in 2025, reflecting a 38.48% growth over five years. Net income rose by 52.53%, reaching $332M in 2025, with net margins improving to 17.48%. The most recent year showed a 6% revenue growth and a strong 22.45% EPS increase, indicating solid margin expansion and profitability gains.

indie Semiconductor, Inc.

indie Semiconductor’s revenue expanded substantially from $23M in 2020 to $217M in 2024, an 858% increase. However, net income remained negative, worsening to a loss of $133M in 2024 despite some margin improvement. The latest year saw a 2.9% revenue decline and a 16.11% drop in net margin, reflecting ongoing challenges in achieving profitability despite growth in gross profit.

Which one has the stronger fundamentals?

Cirrus Logic demonstrates stronger fundamentals with consistent revenue and net income growth, favorable margins, and improving profitability metrics. indie Semiconductor shows impressive revenue expansion but struggles with persistent losses and unfavorable net margins. Overall, Cirrus Logic’s stability and profitability present a more favorable income statement profile compared to indie Semiconductor’s ongoing operational challenges.

Financial Ratios Comparison

This table presents a side-by-side comparison of key financial ratios for Cirrus Logic, Inc. (CRUS) and indie Semiconductor, Inc. (INDI) based on their most recent fiscal year data.

| Ratios | Cirrus Logic, Inc. (CRUS) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| ROE | 17.0% | -31.7% |

| ROIC | 14.2% | -19.3% |

| P/E | 15.9 | -5.35 |

| P/B | 2.71 | 1.70 |

| Current Ratio | 6.35 | 4.82 |

| Quick Ratio | 4.82 | 4.23 |

| D/E (Debt-to-Equity) | 0.07 | 0.95 |

| Debt-to-Assets | 6.18% | 42.3% |

| Interest Coverage | 457 | -18.4 |

| Asset Turnover | 0.81 | 0.23 |

| Fixed Asset Turnover | 6.62 | 4.30 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Cirrus Logic, Inc.

Cirrus Logic displays strong profitability with a net margin of 17.48% and a return on equity at 17.01%, both favorable. Its low debt-to-equity ratio of 0.07 and high interest coverage indicate solid financial health, though a high current ratio of 6.35 is seen as unfavorable, suggesting potential inefficiency in asset utilization. The company does not pay dividends, likely prioritizing reinvestment and growth.

indie Semiconductor, Inc.

indie Semiconductor shows weak profitability ratios, including a net margin of -61.2% and return on equity of -31.73%, both unfavorable. Its high debt levels and negative interest coverage contribute to financial risk, despite a favorable price-to-earnings ratio and strong quick ratio. The company pays no dividends, reflecting a reinvestment strategy amid ongoing losses and high R&D expenditure.

Which one has the best ratios?

Cirrus Logic has a more favorable ratio profile overall, with strong profitability, low leverage, and solid coverage ratios. indie Semiconductor faces significant challenges including negative profitability and coverage ratios, with a higher debt burden. Thus, Cirrus Logic’s financial ratios suggest a comparatively stronger position.

Strategic Positioning

This section compares the strategic positioning of Cirrus Logic, Inc. and indie Semiconductor, Inc., including Market position, Key segments, and disruption:

Cirrus Logic, Inc.

- Established player with $6.3B market cap, moderate beta 1.08.

- Focuses on portable audio ($1.14B) and high-performance mixed-signal products ($759M).

- Fabless semiconductor with advanced audio and mixed-signal tech; less disruption risk stated.

indie Semiconductor, Inc.

- Smaller with $857M market cap, higher beta 2.54, higher volatility.

- Concentrates on automotive semiconductors and software for ADAS and connected cars.

- Focus on automotive tech including photonics and software, subject to evolving automotive trends.

Cirrus Logic vs indie Semiconductor Positioning

Cirrus Logic has a diversified product base across audio and mixed-signal segments with a larger market presence. indie Semiconductor concentrates on automotive semiconductors and software, offering a niche but potentially more volatile exposure.

Which has the best competitive advantage?

Cirrus Logic demonstrates a very favorable moat with growing ROIC above WACC, indicating durable competitive advantage. indie Semiconductor shows a very unfavorable moat with declining ROIC, implying value destruction and weaker competitive positioning.

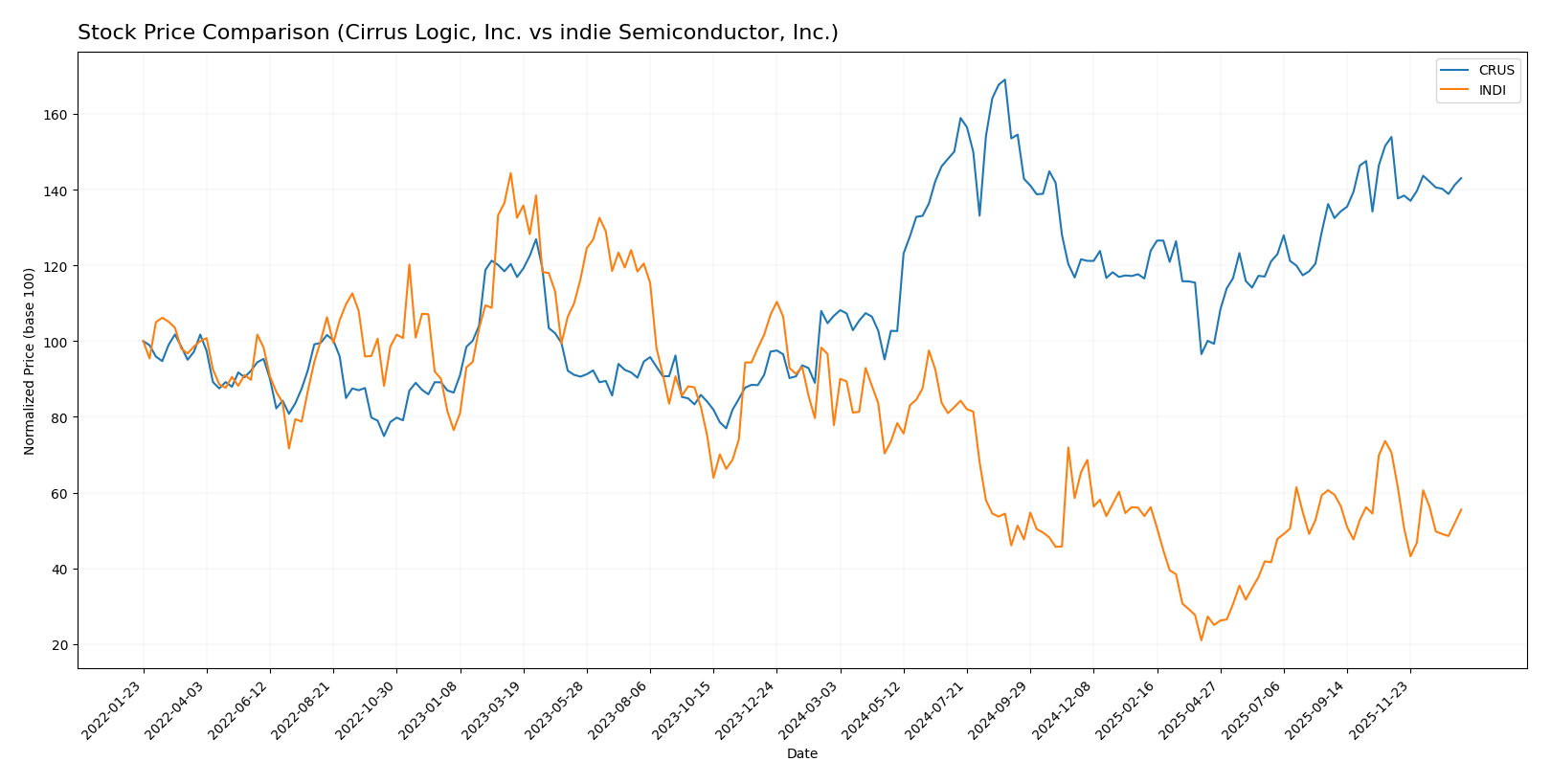

Stock Comparison

The stock price movements of Cirrus Logic, Inc. (CRUS) and indie Semiconductor, Inc. (INDI) over the past 12 months reveal contrasting trends, with CRUS showing strong overall gains despite recent pullbacks, while INDI has faced sustained declines amid increasing seller pressure.

Trend Analysis

Cirrus Logic, Inc. (CRUS) exhibited a bullish trend over the past 12 months with a 34.06% price increase, though the upward momentum has decelerated. The stock ranged from 82.02 to 145.69, with volatility reflected in a 14.46 std deviation.

indie Semiconductor, Inc. (INDI) showed a bearish trend, declining 28.67% over the same period with decelerating losses. Price fluctuated between 1.6 and 7.43, with lower volatility at a 1.35 std deviation.

Comparing both, CRUS delivered the highest market performance with significant gains, while INDI suffered notable declines, reflecting divergent investor sentiment and trading dynamics.

Target Prices

The current analyst consensus shows a positive outlook for Cirrus Logic, Inc. and indie Semiconductor, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cirrus Logic, Inc. | 155 | 100 | 138.75 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

Analysts expect Cirrus Logic’s stock to appreciate from its current price of 123.28 USD toward the consensus target near 139 USD, indicating moderate upside potential. indie Semiconductor’s target price consensus at 8 USD suggests significant potential growth from its current 4.23 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cirrus Logic, Inc. and indie Semiconductor, Inc.:

Rating Comparison

CRUS Rating

- Rating: A-, indicating a very favorable overall assessment of financial health.

- Discounted Cash Flow Score: 4, showing a favorable valuation based on cash flow projections.

- ROE Score: 4, indicating efficient profit generation from shareholders’ equity.

- ROA Score: 5, demonstrating very favorable asset utilization for earnings.

- Debt To Equity Score: 3, reflecting moderate financial risk with balanced debt.

- Overall Score: 4, representing a favorable summary of financial performance.

INDI Rating

- Rating: C-, reflecting a very unfavorable overall financial standing.

- Discounted Cash Flow Score: 1, signaling a very unfavorable cash flow outlook.

- ROE Score: 1, showing very unfavorable profit generation efficiency.

- ROA Score: 1, indicating very unfavorable asset utilization.

- Debt To Equity Score: 1, showing very unfavorable financial risk due to debt.

- Overall Score: 1, indicating a very unfavorable summary of financial health.

Which one is the best rated?

Based strictly on the data, Cirrus Logic, Inc. holds significantly higher ratings and scores across all key financial metrics compared to indie Semiconductor, Inc., indicating a stronger overall financial position.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score of Cirrus Logic, Inc. and indie Semiconductor, Inc.:

Cirrus Logic, Inc. Scores

- Altman Z-Score: 11.94, indicating a safe zone status.

- Piotroski Score: 7, classified as strong financial health.

indie Semiconductor, Inc. Scores

- Altman Z-Score: 0.12, indicating a distress zone.

- Piotroski Score: 2, classified as very weak financial health.

Which company has the best scores?

Cirrus Logic, Inc. has significantly better scores, with a safe zone Altman Z-Score and a strong Piotroski Score, unlike indie Semiconductor, which is in distress and has a very weak Piotroski Score.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Cirrus Logic, Inc. and indie Semiconductor, Inc.:

Cirrus Logic, Inc. Grades

The following table summarizes recent grades from recognized grading companies for Cirrus Logic, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Benchmark | Maintain | Buy | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Stifel | Maintain | Buy | 2025-09-12 |

| Barclays | Maintain | Equal Weight | 2025-05-07 |

| Barclays | Maintain | Equal Weight | 2025-04-22 |

| Stifel | Maintain | Buy | 2025-04-17 |

The overall trend for Cirrus Logic, Inc. shows consistent buy or overweight ratings, indicating stable positive sentiment among analysts.

indie Semiconductor, Inc. Grades

The following table summarizes recent grades from recognized grading companies for indie Semiconductor, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

indie Semiconductor, Inc. demonstrates a strong bias towards buy and overweight ratings, with a single neutral rating from UBS, reflecting generally favorable analyst opinions.

Which company has the best grades?

Both Cirrus Logic, Inc. and indie Semiconductor, Inc. have received mostly positive grades, but Cirrus Logic displays a greater number of consistent buy ratings across multiple firms. This may suggest a stronger analyst conviction, potentially influencing investor confidence and portfolio allocations.

Strengths and Weaknesses

The table below compares the key strengths and weaknesses of Cirrus Logic, Inc. (CRUS) and indie Semiconductor, Inc. (INDI) based on recent financial performance, innovation, market presence, and profitability.

| Criterion | Cirrus Logic, Inc. (CRUS) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Diversification | Moderate: Mainly focused on audio and mixed-signal products | Limited: Primarily product-driven with smaller service segment |

| Profitability | Strong: Net margin 17.5%, ROIC 14.2%, value creator with growing ROIC | Weak: Negative net margin -61.2%, ROIC -19.25%, value destroyer with declining ROIC |

| Innovation | Favorable: Consistent investment in high-performance audio tech | Challenged: Struggling to generate returns on capital, indicating innovation hurdles |

| Global presence | Established global supplier to portable audio markets | Smaller scale with limited global reach and market penetration |

| Market Share | Solid presence in portable audio electronics | Niche player with lower market share and slower growth |

Key takeaways: Cirrus Logic demonstrates a durable competitive advantage with strong profitability and efficient capital use, making it a safer investment choice. Indie Semiconductor faces significant financial and operational challenges, with declining profitability and limited diversification, posing higher risk for investors.

Risk Analysis

Below is a comparative table summarizing key risks for Cirrus Logic, Inc. (CRUS) and indie Semiconductor, Inc. (INDI) based on the most recent fiscal data:

| Metric | Cirrus Logic, Inc. (CRUS) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Risk | Moderate beta (1.08), stable market cap ~6.3B USD | High beta (2.54), smaller market cap ~857M USD |

| Debt level | Very low debt-to-equity (0.07), strong interest coverage (495x) | High debt-to-equity (~0.95), negative interest coverage (-14x) |

| Regulatory Risk | Moderate; semiconductor industry exposure to export controls | Elevated; automotive semiconductor market with stringent regulations |

| Operational Risk | Low; diversified product portfolio and strong operational metrics | High; negative net margin and ROE indicate operational inefficiencies |

| Environmental Risk | Moderate; industry-wide energy usage and material sourcing concerns | Moderate; automotive focus may increase exposure to evolving emissions standards |

| Geopolitical Risk | Moderate; global supply chain exposure in semiconductors | High; automotive supply chain and tech geopolitical tensions impact |

To synthesize, indie Semiconductor faces the most impactful risks: high financial leverage, operational losses, and greater market volatility. Cirrus Logic shows sound financial health with minimal debt and strong profitability, though exposure to semiconductor market cycles and geopolitical supply constraints remain relevant. Investors should weigh these risk factors carefully, prioritizing robust balance sheets and operational efficiency to manage downside exposure.

Which Stock to Choose?

Cirrus Logic, Inc. (CRUS) shows a favorable income evolution with 38.48% revenue growth over five years and strong profitability metrics, including a 17.48% net margin. Financial ratios are mostly favorable, reflecting efficient asset use and low debt levels, supported by a very favorable rating of A- and a strong moat with growing ROIC above WACC.

Indie Semiconductor, Inc. (INDI) presents a mixed income profile with high overall revenue growth but negative net income growth and unfavorable margins. Financial ratios indicate significant challenges, including negative returns and high debt measures, reflected in a very unfavorable rating of C- and a very unfavorable moat due to declining ROIC well below WACC.

For investors, CRUS might appear more suitable for those prioritizing financial stability and quality investing, given its strong profitability and value creation. Conversely, INDI could be seen as a higher-risk option possibly aligning with risk-tolerant profiles seeking growth potential despite current financial weakness.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cirrus Logic, Inc. and indie Semiconductor, Inc. to enhance your investment decisions: