In the dynamic semiconductor sector, GLOBALFOUNDRIES Inc. and Cirrus Logic, Inc. stand out as influential players, each with distinct market roles and innovation approaches. GLOBALFOUNDRIES focuses on large-scale wafer fabrication, while Cirrus Logic specializes in advanced mixed-signal processing solutions. Comparing these companies offers valuable insights into diverse strategies within the same industry. Join me as we explore which company presents the most compelling investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between GLOBALFOUNDRIES Inc. and Cirrus Logic, Inc. by providing an overview of these two companies and their main differences.

GLOBALFOUNDRIES Overview

GLOBALFOUNDRIES Inc. operates as a semiconductor foundry worldwide, manufacturing integrated circuits that enable numerous electronic devices. The company produces a variety of semiconductor devices, including microprocessors, mobile and baseband processors, network processors, and power management units. Founded in 2009 and based in Malta, New York, GLOBALFOUNDRIES holds a significant position in wafer fabrication services and semiconductor technologies.

Cirrus Logic Overview

Cirrus Logic, Inc. is a fabless semiconductor company focusing on low-power, high-precision mixed-signal processing solutions. Its products include codecs, amplifiers, digital signal processors, and SoundClear technology for enhanced audio experiences. The company’s audio and mixed-signal ICs are used across consumer electronics and industrial applications. Founded in 1984 and headquartered in Austin, Texas, Cirrus Logic serves a broad international market.

Key similarities and differences

Both companies operate in the semiconductor sector but differ in their business models: GLOBALFOUNDRIES is a foundry providing wafer fabrication services, while Cirrus Logic designs and markets fabless semiconductor products. GLOBALFOUNDRIES has a larger workforce and market capitalization, focusing on manufacturing, whereas Cirrus Logic emphasizes specialized mixed-signal audio and industrial IC solutions with a smaller employee base.

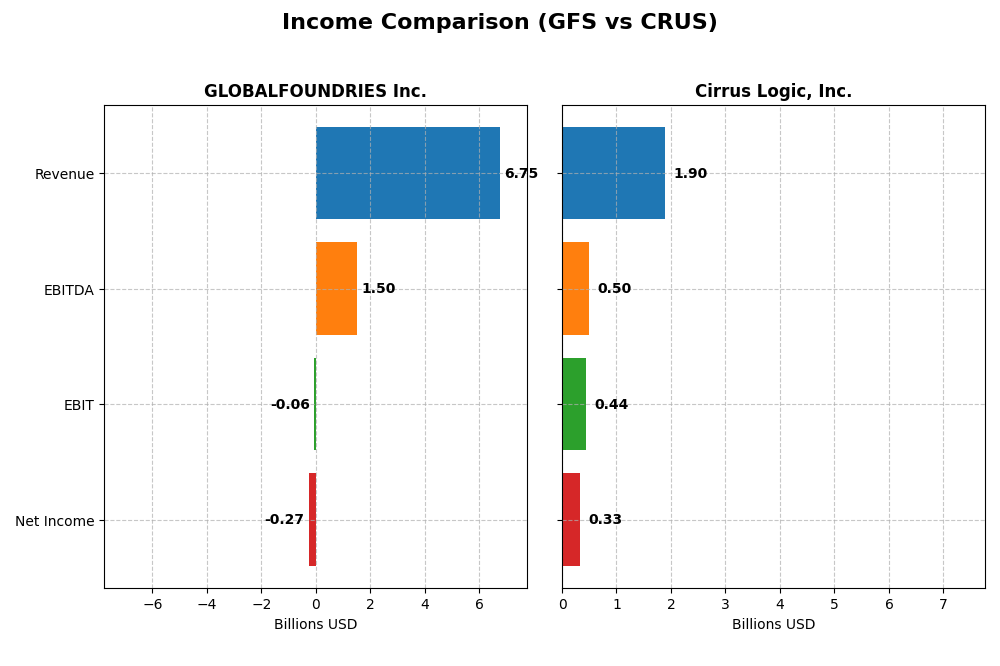

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for GLOBALFOUNDRIES Inc. and Cirrus Logic, Inc. for their most recent fiscal years.

| Metric | GLOBALFOUNDRIES Inc. (GFS) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Market Cap | 23B | 6.3B |

| Revenue | 6.75B | 1.9B |

| EBITDA | 1.5B | 497M |

| EBIT | -64M | 445M |

| Net Income | -265M | 332M |

| EPS | -0.48 | 6.24 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

GLOBALFOUNDRIES Inc.

GLOBALFOUNDRIES experienced a 39.15% revenue increase and 80.37% net income growth over 2020-2024, but faced a sharp 8.69% revenue decline and negative net income in 2024. Gross margin remains favorable at 24.46%, yet EBIT and net margins turned negative recently. The 2024 year showed deteriorating profitability with a -3.93% net margin and -0.95% EBIT margin.

Cirrus Logic, Inc.

Cirrus Logic showed steady revenue growth of 38.48% from 2021 to 2025, with net income increasing 52.53%. In 2025, revenue rose 5.99% and net margin improved to 17.48%. The company maintains solid gross (52.53%) and EBIT margins (23.46%), alongside favorable interest expense ratios, reflecting consistent profitability and margin expansion in the latest fiscal year.

Which one has the stronger fundamentals?

Cirrus Logic demonstrates stronger fundamentals, with favorable margins across gross, EBIT, and net income, plus consistent year-over-year growth and a positive global income statement evaluation of 92.86%. GLOBALFOUNDRIES shows mixed results, with declining recent profitability and a 57.14% unfavorable income statement rating, despite overall growth in revenue and net income over five years.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for GLOBALFOUNDRIES Inc. (GFS) and Cirrus Logic, Inc. (CRUS), reflecting their financial health and operational efficiency as of their latest fiscal periods.

| Ratios | GLOBALFOUNDRIES Inc. (GFS) FY 2024 | Cirrus Logic, Inc. (CRUS) FY 2025 |

|---|---|---|

| ROE | -2.46% | 17.01% |

| ROIC | -1.47% | 14.20% |

| P/E | -89.54 | 15.95 |

| P/B | 2.20 | 2.71 |

| Current Ratio | 2.11 | 6.35 |

| Quick Ratio | 1.57 | 4.82 |

| D/E | 0.22 | 0.07 |

| Debt-to-Assets | 13.81% | 6.18% |

| Interest Coverage | -1.48 | 457.0 |

| Asset Turnover | 0.40 | 0.81 |

| Fixed Asset Turnover | 0.82 | 6.62 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

GLOBALFOUNDRIES Inc.

GLOBALFOUNDRIES exhibits several unfavorable ratios, including negative net margin (-3.93%), ROE (-2.46%), and ROIC (-1.47%), indicating profitability challenges. However, liquidity ratios such as current ratio (2.11) and debt metrics appear favorable. The company does not pay dividends, likely due to ongoing reinvestment or restructuring needs as free cash flow coverage remains limited.

Cirrus Logic, Inc.

Cirrus Logic shows predominantly favorable financial ratios, with strong net margin (17.48%), ROE (17.01%), and ROIC (14.2%). The interest coverage ratio is exceptionally high at 495.45, confirming solid earnings to cover debt expenses. Despite no dividends paid, the firm likely prioritizes growth and R&D investments, supported by a low debt-to-assets ratio (6.18%).

Which one has the best ratios?

Cirrus Logic’s ratios are generally more favorable, highlighting profitability and strong debt management. GLOBALFOUNDRIES faces multiple unfavorable profitability metrics, though liquidity and leverage are adequate. Overall, Cirrus Logic demonstrates a healthier financial profile, whereas GLOBALFOUNDRIES presents risks tied to negative returns and earnings quality.

Strategic Positioning

This section compares the strategic positioning of GLOBALFOUNDRIES Inc. and Cirrus Logic, Inc. in terms of market position, key segments, and exposure to technological disruption:

GLOBALFOUNDRIES Inc.

- Operates as a large semiconductor foundry with significant scale and competitive pressure in wafer fabrication.

- Key segments include wafer fabrication and engineering services; business driven by integrated circuit manufacturing for diverse electronics.

- Exposure to disruption from evolving semiconductor manufacturing technologies impacting wafer fabrication and device integration.

Cirrus Logic, Inc.

- Fabless semiconductor company focused on mixed-signal audio and industrial applications with moderate competitive pressure.

- Key segments are portable audio products and high-performance mixed-signal products, driving revenue in consumer and industrial markets.

- Faces disruption risks in audio codec innovation and mixed-signal processing technologies, requiring continuous product development.

GLOBALFOUNDRIES Inc. vs Cirrus Logic, Inc. Positioning

GLOBALFOUNDRIES shows a concentrated focus on wafer fabrication and engineering services, leveraging scale but facing intense competition. Cirrus Logic diversifies across portable audio and industrial mixed-signal products, balancing consumer and industrial drivers with ongoing innovation demands.

Which has the best competitive advantage?

Cirrus Logic demonstrates a very favorable moat with ROIC exceeding WACC and growing profitability, indicating a durable competitive advantage. GLOBALFOUNDRIES shows a slightly unfavorable moat, shedding value despite improving ROIC trends.

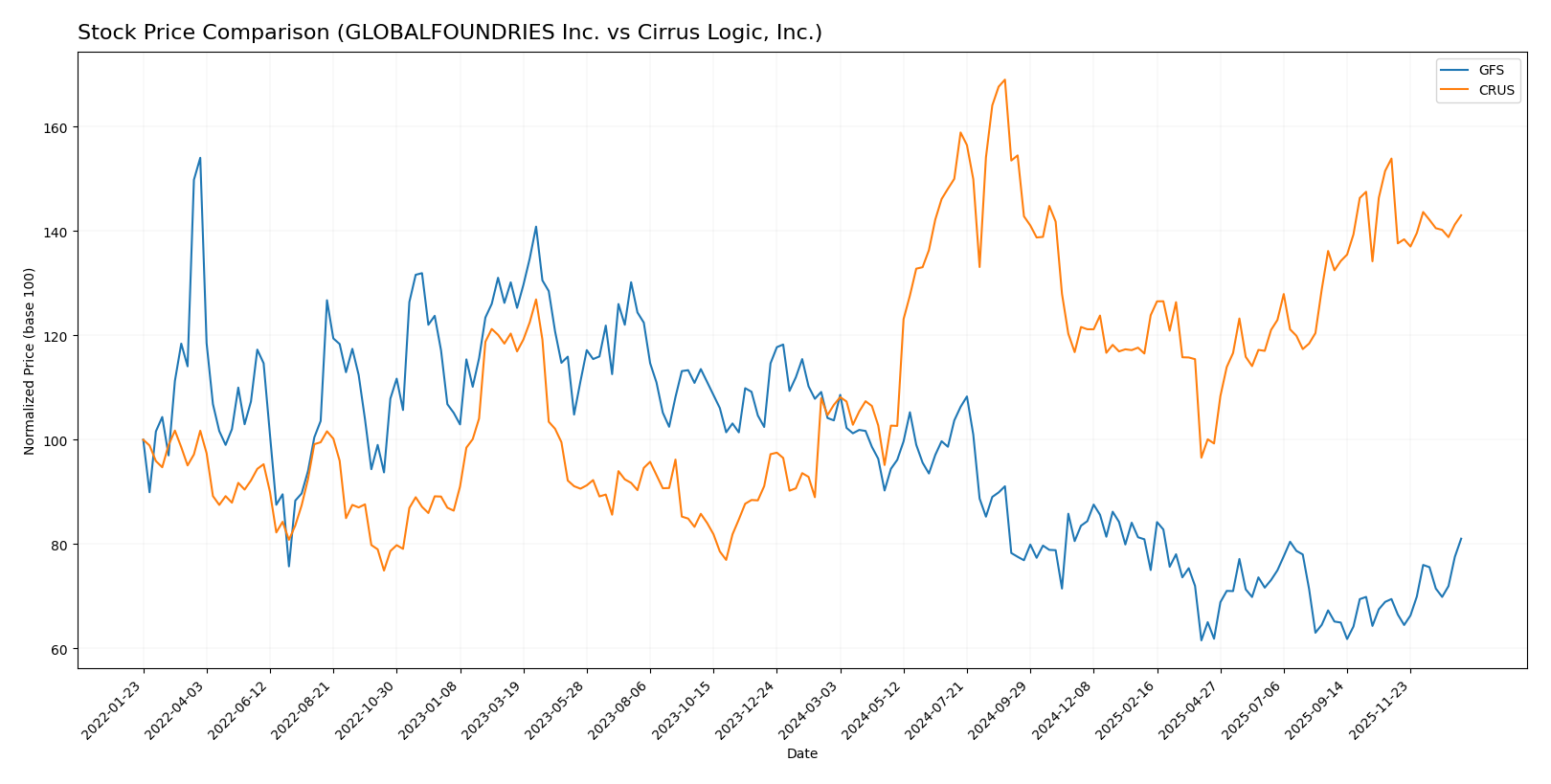

Stock Comparison

The past year’s stock performance reveals contrasting trends: GLOBALFOUNDRIES Inc. experienced a notable bearish trajectory with some recent recovery, while Cirrus Logic, Inc. showed a strong bullish trend that has recently softened.

Trend Analysis

GLOBALFOUNDRIES Inc. recorded a -21.86% price change over the past 12 months, reflecting a bearish trend with accelerating decline and a price range between 31.54 and 55.66. Recent months show a 16.66% rebound with moderate volatility.

Cirrus Logic, Inc. posted a 34.06% gain over the same period, indicating a bullish trend with decelerating momentum and higher volatility, fluctuating between 82.02 and 145.69. Recently, it experienced a -7.06% pullback.

Comparing both, Cirrus Logic outperformed GLOBALFOUNDRIES over the last year, delivering the highest market gains despite a recent short-term decline.

Target Prices

Here is the current consensus on target prices from verified analysts for these semiconductor companies:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| GLOBALFOUNDRIES Inc. | 40 | 37 | 38.5 |

| Cirrus Logic, Inc. | 155 | 100 | 138.75 |

Analysts expect GLOBALFOUNDRIES’ price to settle slightly below its current 41.53 USD, while Cirrus Logic’s consensus target of 138.75 USD suggests upside potential from the current 123.28 USD market price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for GLOBALFOUNDRIES Inc. and Cirrus Logic, Inc.:

Rating Comparison

GLOBALFOUNDRIES Inc. Rating

- Rating: C+, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate score of 3.

- ROE Score: Very unfavorable, low score of 1.

- ROA Score: Very unfavorable with a score of 1.

- Debt To Equity Score: Moderate score of 3.

- Overall Score: Moderate rating of 2 out of 5.

Cirrus Logic, Inc. Rating

- Rating: A-, viewed as very favorable.

- Discounted Cash Flow Score: Favorable score of 4.

- ROE Score: Favorable, solid score of 4.

- ROA Score: Very favorable, highest score of 5.

- Debt To Equity Score: Moderate score of 3.

- Overall Score: Favorable rating of 4 out of 5.

Which one is the best rated?

Based strictly on the provided data, Cirrus Logic, Inc. holds superior scores across most financial metrics including ROE, ROA, and discounted cash flow, resulting in a higher overall rating than GLOBALFOUNDRIES Inc.

Scores Comparison

The scores comparison between GLOBALFOUNDRIES Inc. and Cirrus Logic, Inc. is as follows:

GLOBALFOUNDRIES Inc. Scores

- Altman Z-Score: 2.61, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 6, representing average financial strength.

Cirrus Logic, Inc. Scores

- Altman Z-Score: 11.94, indicating very low bankruptcy risk in the safe zone.

- Piotroski Score: 7, representing strong financial strength.

Which company has the best scores?

Cirrus Logic, Inc. shows better financial health with a higher Altman Z-Score in the safe zone and a stronger Piotroski Score compared to GLOBALFOUNDRIES Inc., which remains in the grey zone with average financial strength.

Grades Comparison

The following presents the latest reliable grading data for GLOBALFOUNDRIES Inc. and Cirrus Logic, Inc.:

GLOBALFOUNDRIES Inc. Grades

This table summarizes recent analyst grades and rating actions for GLOBALFOUNDRIES Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | Downgrade | Neutral | 2025-12-31 |

| B of A Securities | Maintain | Underperform | 2025-12-04 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-13 |

| JP Morgan | Maintain | Neutral | 2025-11-13 |

| Citigroup | Maintain | Neutral | 2025-11-13 |

| Wedbush | Maintain | Outperform | 2025-11-13 |

| B of A Securities | Downgrade | Underperform | 2025-10-13 |

| Deutsche Bank | Maintain | Buy | 2025-08-06 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-06 |

| Wedbush | Maintain | Outperform | 2025-08-06 |

The overall grade trend for GLOBALFOUNDRIES shows a mixture of neutral to outperform ratings, with some downgrades to underperform, indicating a cautious analyst stance.

Cirrus Logic, Inc. Grades

This table provides a snapshot of analyst grades maintained for Cirrus Logic, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Benchmark | Maintain | Buy | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Stifel | Maintain | Buy | 2025-09-12 |

| Barclays | Maintain | Equal Weight | 2025-05-07 |

| Barclays | Maintain | Equal Weight | 2025-04-22 |

| Stifel | Maintain | Buy | 2025-04-17 |

The rating pattern for Cirrus Logic is predominantly positive, with multiple buy and overweight ratings maintained consistently over several months.

Which company has the best grades?

Cirrus Logic has received more consistent buy and overweight ratings compared to GLOBALFOUNDRIES, which exhibits mixed grades including neutral and underperform. This suggests that investors may perceive Cirrus Logic as having stronger analyst confidence, potentially impacting investment sentiment accordingly.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of GLOBALFOUNDRIES Inc. (GFS) and Cirrus Logic, Inc. (CRUS) based on recent financial and operational data.

| Criterion | GLOBALFOUNDRIES Inc. (GFS) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Diversification | Moderate: Focus on Water Fabrication (6.1B USD) with smaller Engineering services segment (652M USD) | High: Mixed signal and portable audio products with balanced revenue streams (~1.9B USD total) |

| Profitability | Weak: Negative net margin (-3.93%), ROIC (-1.47%), and ROE (-2.46%) | Strong: Net margin 17.48%, ROIC 14.2%, ROE 17.01% |

| Innovation | Improving ROIC trend but still value destroying; moderate innovation in fabrication processes | Durable competitive advantage with growing profitability and innovation in audio technology |

| Global presence | Large global fabrication capacity but facing profitability challenges | Niche global presence focused on audio semiconductors and mixed-signal products |

| Market Share | Significant in semiconductor fabrication but losing value | Growing market share in portable audio and mixed-signal segments |

Key takeaways: Cirrus Logic shows strong profitability, a durable competitive advantage, and well-diversified products, making it a favorable investment choice. GLOBALFOUNDRIES, while improving, currently struggles with profitability and value creation despite a solid market position.

Risk Analysis

Below is a comparative table of key risks for GLOBALFOUNDRIES Inc. (GFS) and Cirrus Logic, Inc. (CRUS) based on the most recent data.

| Metric | GLOBALFOUNDRIES Inc. (GFS) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Market Risk | High beta 1.485 indicates higher volatility | Moderate beta 1.084 suggests relatively lower volatility |

| Debt level | Low debt-to-equity 0.22, debt to assets 13.81% (favorable) | Very low debt-to-equity 0.07, debt to assets 6.18% (favorable) |

| Regulatory Risk | Moderate, semiconductor manufacturing faces compliance and export controls | Moderate, fabless semiconductor subject to IP and trade regulations |

| Operational Risk | Negative margins and returns, some operational inefficiencies | Strong margins, high ROE and ROIC reduce operational risk |

| Environmental Risk | Moderate, manufacturing plants have environmental compliance obligations | Lower risk, fabless model reduces direct environmental impact |

| Geopolitical Risk | Exposure to US-China tech tensions could impact supply chains | Moderate, relies on global electronics markets with some geopolitical sensitivity |

The most significant risk for GLOBALFOUNDRIES stems from operational challenges, reflected by its negative profit margins and weak returns on equity and assets, coupled with higher market volatility. Cirrus Logic shows stronger financial health and lower debt, minimizing its operational and financial risks. However, both companies face moderate regulatory and geopolitical risks typical of the semiconductor industry. Investors should weigh GFS’s operational vulnerabilities against CRUS’s more stable profile.

Which Stock to Choose?

GLOBALFOUNDRIES Inc. (GFS) shows a declining income trend with unfavorable profitability and financial ratios, including negative returns on equity and assets. Its debt levels appear manageable, but overall rating is moderate with a slightly unfavorable moat status.

Cirrus Logic, Inc. (CRUS) exhibits strong income growth, favorable profitability, and mostly positive financial ratios. The company maintains low debt, a very favorable moat, and a strong overall rating, indicating efficient capital use and durable competitive advantage.

Investors seeking growth and quality may find CRUS more aligned with their profile due to its favorable income and financial metrics, while those with higher risk tolerance might view GFS’s improving ROIC trend as a developing opportunity, despite current challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of GLOBALFOUNDRIES Inc. and Cirrus Logic, Inc. to enhance your investment decisions: