Investors seeking strong opportunities in specialty business services often consider Cintas Corporation and Thomson Reuters Corporation, two industry leaders with distinct yet overlapping market footprints. Cintas excels in uniform rental and facility services, while Thomson Reuters innovates in business information and workflow solutions. Both emphasize innovation to serve corporate clients globally. This article will help you decide which company presents the most compelling investment prospect in 2026.

Table of contents

Companies Overview

I will begin the comparison between Cintas Corporation and Thomson Reuters Corporation by providing an overview of these two companies and their main differences.

Cintas Corporation Overview

Cintas Corporation specializes in providing corporate identity uniforms and related business services across the United States, Canada, and Latin America. Its core operations include uniform rental and facility services, first aid and safety services, and ancillary products such as mats and cleaning supplies. Founded in 1968 and headquartered in Cincinnati, Ohio, Cintas serves a broad customer base from small businesses to major corporations.

Thomson Reuters Corporation Overview

Thomson Reuters Corporation delivers business information services globally, including legal, tax, accounting, and news content. It operates through segments such as Legal Professionals, Corporates, Tax & Accounting Professionals, Reuters News, and Global Print. Founded in 1851 and based in Toronto, Canada, the company supports professionals and organizations with research, workflow solutions, and media services worldwide.

Key similarities and differences

Both companies operate within the specialty business services sector but serve different market needs. Cintas focuses on physical products like uniforms and facility supplies, whereas Thomson Reuters provides digital and print information services. While Cintas operates mainly in North America, Thomson Reuters has a more global reach with diverse professional service segments. Each employs distinct business models tailored to their respective industries and client bases.

Income Statement Comparison

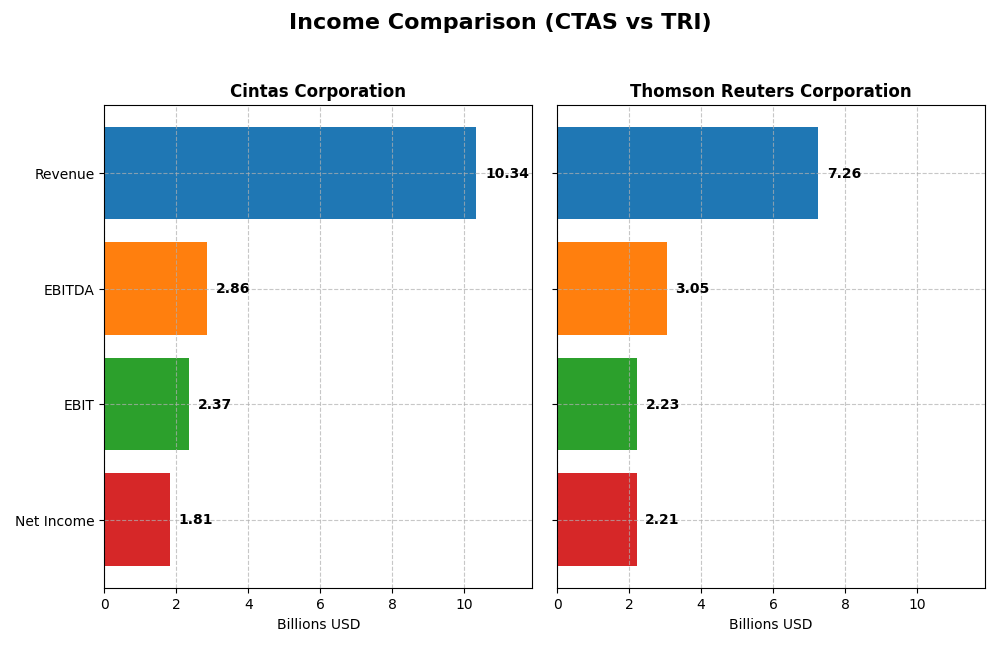

This table compares the key income statement metrics of Cintas Corporation and Thomson Reuters Corporation for their most recent fiscal years, providing a clear view of their financial performance.

| Metric | Cintas Corporation (CTAS) | Thomson Reuters Corporation (TRI) |

|---|---|---|

| Market Cap | 77.8B | 58.2B |

| Revenue | 10.34B | 7.26B |

| EBITDA | 2.86B | 3.05B |

| EBIT | 2.37B | 2.23B |

| Net Income | 1.81B | 2.21B |

| EPS | 4.48 | 4.89 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Cintas Corporation

From 2021 to 2025, Cintas Corporation showed a steady increase in revenue from 7.1B to 10.3B, alongside net income growth from 1.1B to 1.8B. Margins improved consistently, with a favorable gross margin above 50% and net margin reaching 17.5% in 2025. The latest year saw revenue growth moderate to 7.75%, but earnings and margins expanded favorably, underscoring operational efficiency.

Thomson Reuters Corporation

Between 2020 and 2024, Thomson Reuters experienced revenue growth from 6.0B to 7.3B and a net income rise from 1.1B to 2.2B. Margins remained strong, with a gross margin over 75% and net margin above 30% in 2024. However, the most recent year showed slower EBIT growth (0.22%) and declines in net margin and EPS, reflecting some pressure on profitability despite solid overall fundamentals.

Which one has the stronger fundamentals?

Cintas demonstrates more consistent and broad-based margin improvements and earnings growth, with nearly 93% of income statement metrics favorable. Thomson Reuters maintains higher margins but faces recent margin compression and EPS declines, with about 57% favorable and 21% unfavorable metrics. Cintas’s steady margin expansion and earnings growth suggest comparatively stronger operational fundamentals.

Financial Ratios Comparison

This table presents a side-by-side comparison of key financial ratios for Cintas Corporation (CTAS) and Thomson Reuters Corporation (TRI) based on their most recent fiscal year data.

| Ratios | Cintas Corporation (CTAS) FY 2025 | Thomson Reuters Corporation (TRI) FY 2024 |

|---|---|---|

| ROE | 38.7% | 18.4% |

| ROIC | 22.8% | 13.9% |

| P/E | 50.4 | 32.7 |

| P/B | 19.5 | 6.0 |

| Current Ratio | 2.09 | 1.02 |

| Quick Ratio | 1.82 | 1.01 |

| D/E (Debt-to-Equity) | 0.57 | 0.26 |

| Debt-to-Assets | 27.0% | 16.7% |

| Interest Coverage | 23.3 | 12.5 |

| Asset Turnover | 1.05 | 0.39 |

| Fixed Asset Turnover | 5.51 | 18.8 |

| Payout Ratio | 33.7% | 40.9% |

| Dividend Yield | 0.67% | 1.25% |

Interpretation of the Ratios

Cintas Corporation

Cintas shows strong profitability with a 17.53% net margin and an impressive 38.69% return on equity, supported by solid returns on invested capital. Its liquidity ratios are favorable, reflecting good short-term financial health. However, valuation metrics like P/E at 50.43 and P/B at 19.51 are high, which could indicate overvaluation risk. The company pays dividends, but its dividend yield is low at 0.67%, suggesting modest shareholder returns.

Thomson Reuters Corporation

Thomson Reuters benefits from a robust 30.45% net margin and decent return on equity at 18.41%, though its return on invested capital is more moderate. Liquidity and leverage ratios are predominantly favorable, with a low debt-to-equity ratio of 0.26 and strong interest coverage. The dividend yield stands at 1.25%, reflecting a balanced approach to shareholder returns, with no significant risks noted in payout sustainability.

Which one has the best ratios?

Both companies have an equal proportion of favorable ratios (64.29%), yet Cintas excels in profitability metrics like ROE and asset turnover, while Thomson Reuters has a stronger net margin and healthier leverage ratios. Cintas faces higher valuation multiples, whereas Thomson Reuters shows a more moderate valuation and slightly higher dividend yield, making the comparison nuanced depending on investor priorities.

Strategic Positioning

This section compares the strategic positioning of Cintas Corporation and Thomson Reuters Corporation including Market position, Key segments, and disruption:

Cintas Corporation

- Leading uniform rental and facility services provider with moderate competitive pressure in specialty business services.

- Key segments: Uniform Rental & Facility Services, First Aid & Safety, Fire Protection, and Uniform Direct Sales driving growth.

- Limited exposure to technological disruption, relying on distribution networks and local delivery with ancillary product services.

Thomson Reuters Corporation

- Major global business information services provider facing competition in legal, tax, and news segments.

- Key segments: Legal Professionals, Corporates, Tax & Accounting, Reuters News, and Global Print focus on software and information services.

- Moderate exposure to tech disruption, focusing on electronic software and digital workflow automation solutions globally.

Cintas Corporation vs Thomson Reuters Corporation Positioning

Cintas has a diversified service portfolio centered on physical products and facility services, offering stable demand but limited digital exposure. Thomson Reuters concentrates on electronic software and information services, leveraging technology but facing evolving industry disruption risks.

Which has the best competitive advantage?

Both companies demonstrate a very favorable moat with growing ROIC above WACC, indicating durable competitive advantages. Cintas shows stronger ROIC growth, suggesting a potentially more robust value creation over recent years compared to Thomson Reuters.

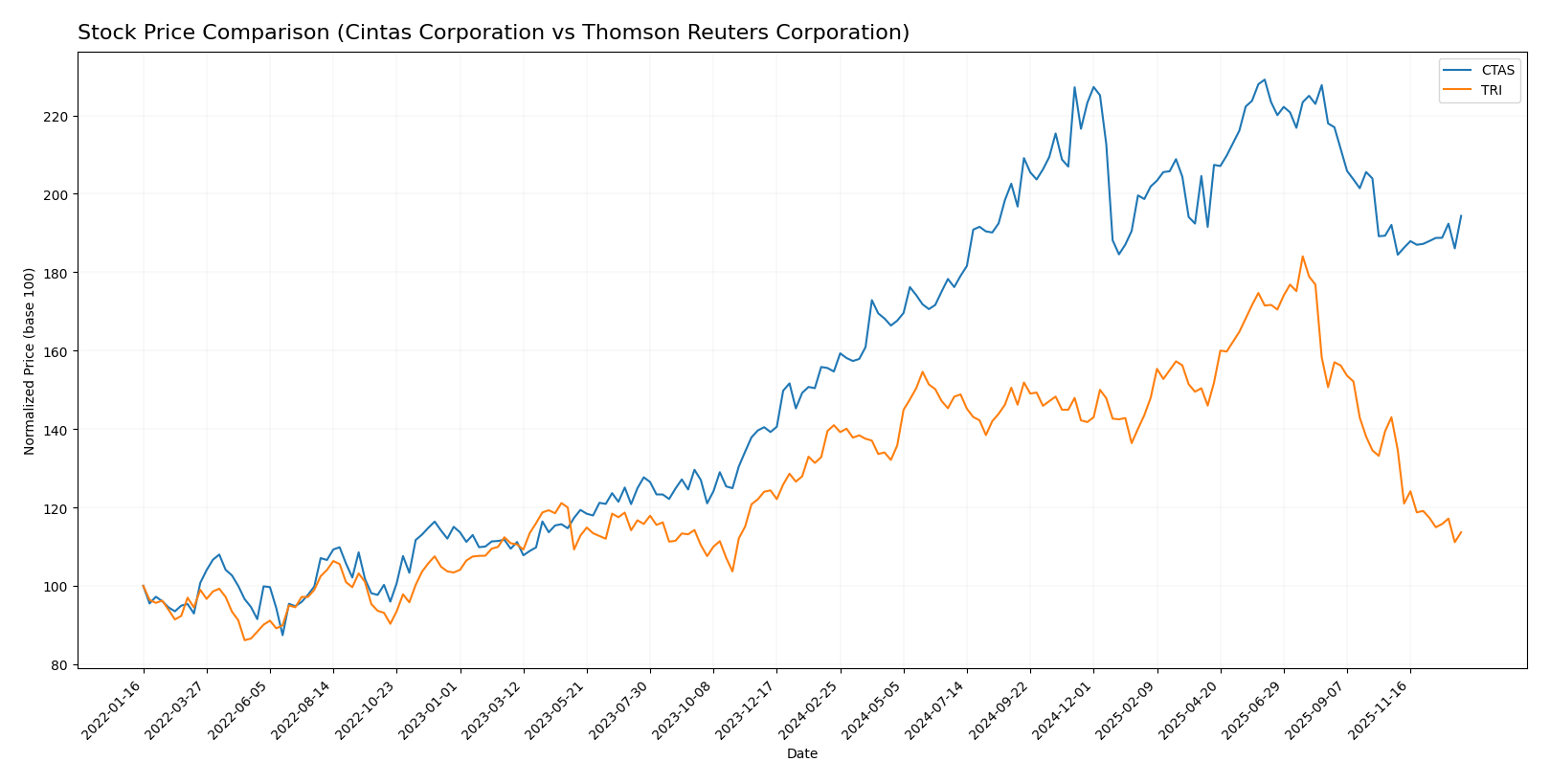

Stock Comparison

The stock price movements of Cintas Corporation (CTAS) and Thomson Reuters Corporation (TRI) over the past year reveal contrasting trajectories, with CTAS showing a strong bullish trend and TRI experiencing sustained bearish pressure.

Trend Analysis

Cintas Corporation’s stock price increased by 25.67% over the past 12 months, indicating a bullish trend with deceleration in momentum. The price ranged from a low of 153.67 to a high of 227.66, supported by high volatility (19.2 std deviation).

Thomson Reuters Corporation’s stock declined by 19.38% over the same period, reflecting a bearish trend with decelerating downward momentum. The stock fluctuated between 126.36 and 209.29, with notable volatility (17.02 std deviation).

Comparing these trends, Cintas has delivered the highest market performance, outperforming Thomson Reuters with a positive price change versus a significant loss.

Target Prices

The current analyst consensus presents a positive outlook for both Cintas Corporation and Thomson Reuters Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cintas Corporation | 235 | 184 | 210.83 |

| Thomson Reuters Corporation | 212 | 165 | 187.33 |

Analysts expect Cintas Corporation’s stock to appreciate moderately above its current price of $193.12, while Thomson Reuters shows potential upside from $129.23 to a consensus near $187.33. Both targets suggest attractive growth opportunities.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cintas Corporation and Thomson Reuters Corporation:

Rating Comparison

Cintas Corporation Rating

- Rating: B, considered Very Favorable overall.

- Discounted Cash Flow Score: 3, Moderate valuation assessment.

- ROE Score: 5, Very Favorable efficiency in generating profit from equity.

- ROA Score: 5, Very Favorable asset utilization.

- Debt To Equity Score: 2, Moderate financial risk due to debt levels.

Thomson Reuters Corporation Rating

- Rating: B+, also considered Very Favorable overall.

- Discounted Cash Flow Score: 4, Favorable valuation assessment.

- ROE Score: 4, Favorable efficiency in generating profit from equity.

- ROA Score: 5, Very Favorable asset utilization.

- Debt To Equity Score: 3, Moderate financial risk with slightly higher score.

Which one is the best rated?

Thomson Reuters holds a slightly better rating with B+ versus Cintas’s B, supported by a higher discounted cash flow score and a stronger debt-to-equity rating. Both show strong asset utilization, but Cintas leads marginally on return on equity.

Scores Comparison

This section compares the Altman Z-Score and Piotroski Score of both companies:

Cintas Scores

- Altman Z-Score: 11.77, indicating a safe financial zone with very low bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health for value investing.

Thomson Reuters Scores

- Altman Z-Score: 7.99, also in the safe zone, indicating low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health but slightly lower.

Which company has the best scores?

Cintas shows higher scores in both Altman Z-Score and Piotroski Score compared to Thomson Reuters, indicating a stronger financial position based on these metrics.

Grades Comparison

I present below a detailed comparison of the grades assigned to Cintas Corporation and Thomson Reuters Corporation by various reputable grading companies:

Cintas Corporation Grades

The table below summarizes recent grades from established financial institutions for Cintas Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Sell | 2025-12-22 |

| RBC Capital | Maintain | Sector Perform | 2025-12-19 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-19 |

| Baird | Maintain | Neutral | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-19 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-17 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-25 |

| Citigroup | Maintain | Sell | 2025-09-26 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-25 |

| JP Morgan | Maintain | Overweight | 2025-09-25 |

Overall, Cintas Corporation’s grades predominantly indicate a neutral to slightly negative outlook, with multiple “Sell,” “Hold,” and “Equal Weight” ratings alongside fewer “Buy” and “Overweight” ratings.

Thomson Reuters Corporation Grades

The following table shows the grading data for Thomson Reuters Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2025-12-17 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-05 |

| JP Morgan | Maintain | Neutral | 2025-11-05 |

| Canaccord Genuity | Upgrade | Buy | 2025-11-05 |

| CIBC | Maintain | Outperform | 2025-10-29 |

| Goldman Sachs | Upgrade | Buy | 2025-10-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-11 |

| Wells Fargo | Upgrade | Overweight | 2025-09-09 |

| TD Securities | Upgrade | Buy | 2025-08-28 |

| CIBC | Upgrade | Outperform | 2025-08-19 |

Thomson Reuters Corporation’s grades reflect a generally positive trend, with numerous upgrades and several “Buy,” “Outperform,” and “Overweight” ratings, indicating growing confidence.

Which company has the best grades?

Thomson Reuters Corporation has received consistently stronger and more positive grades compared to Cintas Corporation, which shows a more cautious or neutral stance. For investors, Thomson Reuters’ better grades may signal greater analyst confidence and potential for upside, while Cintas’ mixed ratings suggest a more guarded outlook.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Cintas Corporation (CTAS) and Thomson Reuters Corporation (TRI) based on the most recent data.

| Criterion | Cintas Corporation (CTAS) | Thomson Reuters Corporation (TRI) |

|---|---|---|

| Diversification | Diverse service portfolio: uniform rental, safety, fire protection, direct sales | Less diversified, focused mainly on electronic software and services |

| Profitability | High net margin (17.53%) and ROIC (22.8%), strong profitability | Higher net margin (30.45%) but lower ROIC (13.94%) compared to CTAS |

| Innovation | Moderate innovation with steady expansion in service offerings | Strong innovation focus in electronic software and analytics |

| Global presence | Strong North American presence with growing global footprint | Global presence with emphasis on digital and print media worldwide |

| Market Share | Leading market position in uniform rental and facility services | Leading player in legal, financial, and media information sectors |

Cintas demonstrates robust profitability and diversification with a strong, growing economic moat, while Thomson Reuters excels in profitability and innovation but with less diversification. Both firms offer durable competitive advantages, yet investors should weigh CTAS’s broader service mix against TRI’s focused digital leadership.

Risk Analysis

Below is a comparative table summarizing key risks for Cintas Corporation (CTAS) and Thomson Reuters Corporation (TRI) as of the most recent fiscal years:

| Metric | Cintas Corporation (CTAS) | Thomson Reuters Corporation (TRI) |

|---|---|---|

| Market Risk | Moderate (Beta 0.97; sensitive to US industrial demand fluctuations) | Low (Beta 0.31; more stable, diversified globally) |

| Debt level | Moderate (Debt/Equity 0.57; Debt/Assets 27%) | Low (Debt/Equity 0.26; Debt/Assets 17%) |

| Regulatory Risk | Moderate (US-centric, subject to labor and safety regulations) | Moderate to High (Global operations with complex regulatory environments) |

| Operational Risk | Moderate (Relies on logistics and on-time delivery for uniforms and services) | Moderate (Dependent on data accuracy and cybersecurity) |

| Environmental Risk | Moderate (Involves waste from uniform rental and cleaning processes) | Low to Moderate (Primarily information services; limited direct environmental impact) |

| Geopolitical Risk | Low to Moderate (Primarily North America focused) | Moderate to High (Global exposure including emerging markets) |

Synthesis: The most impactful risks for CTAS involve operational and market fluctuations in the industrial services sector, while TRI faces higher geopolitical and regulatory risks due to its global presence. Both companies maintain moderate debt levels, but TRI’s diversified footprint may expose it to greater regulatory uncertainty. Investors should monitor geopolitical tensions and regulatory changes closely.

Which Stock to Choose?

Cintas Corporation (CTAS) shows a favorable income evolution with strong growth in revenue and net income over 2021-2025. Its financial ratios are largely positive, highlighting high profitability, moderate debt, and a very favorable rating of B. The company demonstrates a durable competitive advantage with a very favorable moat rating.

Thomson Reuters Corporation (TRI) presents favorable income metrics but mixed recent growth, with some unfavorable trends in net margin and EPS growth over one year. Its financial ratios are also favorable overall, supported by a very favorable rating of B+. TRI exhibits a durable competitive advantage with a very favorable moat, though recent stock trends have been bearish.

Investors focused on growth and strong profitability might find CTAS appealing given its robust income growth and high returns on equity and invested capital. Conversely, those prioritizing stability and a solid competitive moat with somewhat steadier financial ratios could see TRI as favorable despite recent challenges. The choice could depend on whether an investor favors growth momentum or seeks established quality with moderate risk.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cintas Corporation and Thomson Reuters Corporation to enhance your investment decisions: