Investors often seek companies that blend innovation with market resilience, making Cintas Corporation and Global Payments Inc. compelling subjects for comparison. Both operate within the specialty business services sector, yet they target distinct niches—Cintas with uniform rental and facility services, and Global Payments with cutting-edge payment technology solutions. This article will explore their strategies and growth prospects to help you decide which company deserves a place in your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Cintas Corporation and Global Payments Inc. by providing an overview of these two companies and their main differences.

Cintas Corporation Overview

Cintas Corporation focuses on providing corporate identity uniforms and related business services primarily in the US, Canada, and Latin America. Operating through segments like Uniform Rental and Facility Services, it supplies uniforms, safety products, and cleaning services to a broad range of clients, from small businesses to major corporations. Founded in 1968 and headquartered in Cincinnati, Ohio, Cintas is a leading player in specialty business services.

Global Payments Inc. Overview

Global Payments Inc. delivers payment technology and software solutions for card, electronic, and digital payments across the Americas, Europe, and Asia-Pacific. Its operations include Merchant Solutions, Issuer Solutions, and Business and Consumer Solutions, serving financial institutions, retailers, and underbanked consumers. Established in 1967 and based in Atlanta, Georgia, Global Payments is a significant provider in the specialty business services sector.

Key similarities and differences

Both companies operate in the specialty business services industry and are headquartered in the US, but they serve different market needs. Cintas is focused on uniform rental, facility services, and safety products, whereas Global Payments specializes in payment processing technology and software solutions. Employee counts differ significantly, with Cintas employing about 46,500 and Global Payments around 27,000, reflecting their distinct operational scales and business models.

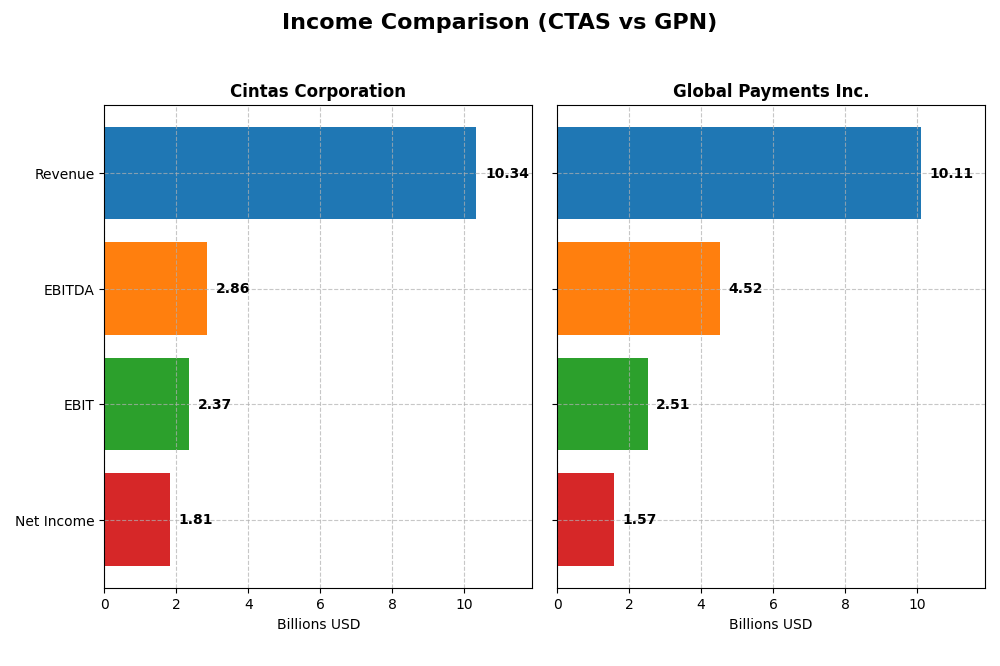

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Cintas Corporation and Global Payments Inc. for their most recent fiscal years.

| Metric | Cintas Corporation (CTAS) | Global Payments Inc. (GPN) |

|---|---|---|

| Market Cap | 77.8B | 19.5B |

| Revenue | 10.34B | 10.11B |

| EBITDA | 2.86B | 4.52B |

| EBIT | 2.37B | 2.51B |

| Net Income | 1.81B | 1.57B |

| EPS | 4.48 | 6.18 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Cintas Corporation

Cintas has demonstrated consistent revenue and net income growth from 2021 to 2025, with revenue rising from $7.1B to $10.3B and net income increasing from $1.1B to $1.8B. Gross and net margins remained stable and favorable, with the latest year showing a 7.75% revenue growth and a 7.02% net margin increase, indicating solid margin improvements alongside expanding earnings.

Global Payments Inc.

Global Payments experienced revenue growth from $7.4B in 2020 to $10.1B in 2024, with net income increasing significantly from $585M to $1.57B. Margins were favorable overall, though operating expenses grew faster than revenue in the last year. The 2024 performance showed a moderate 4.7% revenue increase but a strong 52% net margin growth, driven by substantial EBIT and EPS improvements.

Which one has the stronger fundamentals?

Both companies display favorable income statement trends, with Cintas showing more consistent margin stability and steady earnings growth. Global Payments reports higher overall growth rates but with more volatile margins and a less favorable expense-to-revenue ratio recently. Cintas’s balance of steady margin expansion and solid profitability contrasts with Global Payments’ rapid growth coupled with some margin pressures.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Cintas Corporation (CTAS) and Global Payments Inc. (GPN) based on the most recent fiscal year data available.

| Ratios | Cintas Corporation (CTAS) 2025 | Global Payments Inc. (GPN) 2024 |

|---|---|---|

| ROE | 38.7% | 7.0% |

| ROIC | 22.8% | 4.7% |

| P/E | 50.4 | 18.2 |

| P/B | 19.5 | 1.28 |

| Current Ratio | 2.09 | 0.97 |

| Quick Ratio | 1.82 | 0.97 |

| D/E (Debt-to-Equity) | 0.57 | 0.75 |

| Debt-to-Assets | 27.0% | 35.9% |

| Interest Coverage | 23.3 | 3.68 |

| Asset Turnover | 1.05 | 0.22 |

| Fixed Asset Turnover | 5.51 | 4.44 |

| Payout ratio | 34% | 16.1% |

| Dividend yield | 0.67% | 0.89% |

Interpretation of the Ratios

Cintas Corporation

Cintas shows strong profitability with a net margin of 17.53% and a high return on equity at 38.69%, both favorable indicators. Liquidity ratios are solid, with a current ratio of 2.09, supporting short-term financial health. However, valuation multiples like a P/E of 50.43 and P/B of 19.51 are unfavorable. The company pays dividends, though the yield is low at 0.67%, indicating modest shareholder returns with no apparent risks from payout sustainability.

Global Payments Inc.

Global Payments displays a decent net margin of 15.54%, yet struggles with low returns on equity (7.05%) and invested capital (4.68%), flagged as unfavorable. Liquidity concerns arise with a current ratio below 1. The P/E ratio is neutral at 18.19, while the P/B ratio is favorable at 1.28. The firm provides dividends with a 0.89% yield, but overall ratio evaluations lean slightly unfavorable, suggesting cautious appraisal of shareholder returns.

Which one has the best ratios?

Cintas Corporation exhibits a more favorable ratio profile overall, with stronger profitability, better liquidity, and higher returns despite some valuation concerns. Global Payments’ lower returns and liquidity ratios, combined with a slightly unfavorable global opinion, place it behind Cintas in this comparison based strictly on the provided ratio evaluations.

Strategic Positioning

This section compares the strategic positioning of Cintas Corporation and Global Payments Inc., covering Market position, Key segments, and Exposure to technological disruption:

Cintas Corporation

- Leading uniform rental and facility services provider with strong market presence in North America.

- Diverse segments including Uniform Rental, First Aid, Fire Protection, and Direct Sales driving revenues.

- Operates mainly through physical distribution and local delivery, limited direct mention of tech disruption.

Global Payments Inc.

- Payment technology provider with significant presence in Americas, Europe, and Asia-Pacific.

- Focus on Merchant, Issuer, and Business & Consumer payment solutions as main revenue drivers.

- Faces technological disruption with evolving payment software and digital solutions markets.

Cintas Corporation vs Global Payments Inc. Positioning

Cintas follows a diversified business model across service lines in uniform and safety products, offering stable revenue streams. Global Payments concentrates on payment technology and software solutions, exposing it more to fast-evolving digital markets. Each approach reflects different operational scopes and market dependencies.

Which has the best competitive advantage?

Cintas shows a very favorable moat with strong value creation and growing ROIC, indicating durable competitive advantage. Global Payments has a slightly unfavorable moat, currently shedding value despite improving profitability, suggesting weaker competitive defensibility.

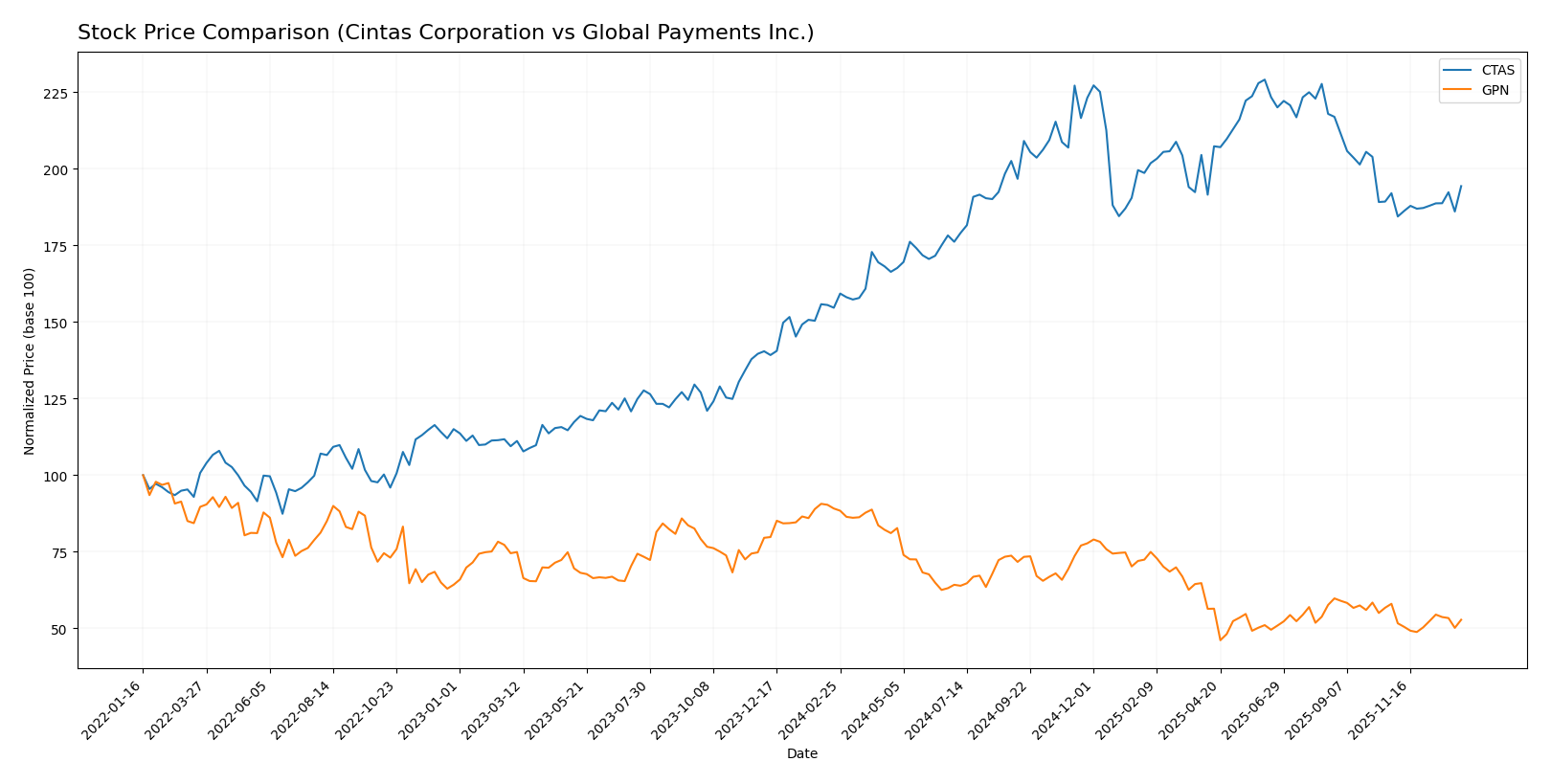

Stock Comparison

The past year has seen contrasting movements between Cintas Corporation and Global Payments Inc., with Cintas exhibiting a strong upward trend despite deceleration, while Global Payments faced a significant decline with accelerating bearish momentum.

Trend Analysis

Cintas Corporation’s stock showed a bullish trend over the past 12 months with a 25.67% price increase, though the upward momentum is decelerating. The stock traded between 153.67 and 227.66, with high volatility indicated by a 19.2 std deviation.

Global Payments Inc. experienced a bearish trend over the same period, with a 40.74% price drop and accelerating downward momentum. The stock ranged from 134.19 to 69.46, showing notable volatility with a 17.04 std deviation.

Comparing their performance, Cintas delivered the highest market gains, while Global Payments showed significant losses and weaker recent buyer interest.

Target Prices

Analysts present a positive target price consensus for both Cintas Corporation and Global Payments Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cintas Corporation | 235 | 184 | 210.83 |

| Global Payments Inc. | 105 | 93 | 100.33 |

The target consensus for Cintas at 210.83 is above the current price of 193.12, indicating potential upside. Similarly, Global Payments shows a consensus target of 100.33, well above its current price of 79.52, suggesting room for growth according to analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cintas Corporation and Global Payments Inc.:

Rating Comparison

Cintas Corporation Rating

- Rating: B, categorized as Very Favorable.

- Discounted Cash Flow Score: 3, Moderate level.

- ROE Score: 5, indicating a Very Favorable rating.

- ROA Score: 5, Very Favorable rating.

- Debt To Equity Score: 2, Moderate rating.

- Overall Score: 3, Moderate rating.

Global Payments Inc. Rating

- Rating: A-, categorized as Very Favorable.

- Discounted Cash Flow Score: 5, Very Favorable level.

- ROE Score: 3, Moderate rating.

- ROA Score: 3, Moderate rating.

- Debt To Equity Score: 2, Moderate rating.

- Overall Score: 4, Favorable rating.

Which one is the best rated?

Global Payments Inc. holds a higher overall score (4 vs. 3) and a superior discounted cash flow score compared to Cintas Corporation. Conversely, Cintas excels in ROE and ROA scores. Both have the same debt to equity score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

Cintas Corporation Scores

- Altman Z-Score: 11.77 indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 8 denoting very strong financial health.

Global Payments Inc. Scores

- Altman Z-Score: 0.98 indicating distress zone, high bankruptcy risk.

- Piotroski Score: 8 denoting very strong financial health.

Which company has the best scores?

Cintas Corporation shows significantly better financial stability with a safe zone Altman Z-Score compared to Global Payments’ distress zone score. Both have equally strong Piotroski Scores of 8, indicating solid financial health.

Grades Comparison

The following sections present a factual summary of recent grades assigned by recognized financial institutions for both companies:

Cintas Corporation Grades

The table below shows the latest grades for Cintas Corporation from reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Sell | 2025-12-22 |

| RBC Capital | Maintain | Sector Perform | 2025-12-19 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-19 |

| Baird | Maintain | Neutral | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-19 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-17 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-25 |

| Citigroup | Maintain | Sell | 2025-09-26 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-25 |

| JP Morgan | Maintain | Overweight | 2025-09-25 |

Cintas Corporation’s grades predominantly show a neutral to cautious stance, with several “Sell” and “Equal Weight” ratings, balanced by a few “Buy” and “Overweight” opinions.

Global Payments Inc. Grades

The table below presents recent grades from recognized financial institutions for Global Payments Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2025-11-13 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| RBC Capital | Maintain | Sector Perform | 2025-11-05 |

| Keybanc | Downgrade | Sector Weight | 2025-10-22 |

| Evercore ISI Group | Maintain | In Line | 2025-08-08 |

| Keybanc | Maintain | Overweight | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-08-07 |

| RBC Capital | Maintain | Sector Perform | 2025-08-07 |

| Mizuho | Upgrade | Outperform | 2025-07-25 |

Global Payments Inc. shows a mix of stable and slightly optimistic ratings, with several “Hold” and “Sector Perform” grades, and some upgrades to “Outperform” and “Overweight.”

Which company has the best grades?

Global Payments Inc. has received a stronger consensus with a “Buy” consensus and multiple positive upgrades, whereas Cintas Corporation’s consensus is “Hold” with more cautious or neutral ratings. This difference may influence investors’ outlooks regarding growth potential and risk exposure.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Cintas Corporation (CTAS) and Global Payments Inc. (GPN), based on the most recent financial and strategic data available.

| Criterion | Cintas Corporation (CTAS) | Global Payments Inc. (GPN) |

|---|---|---|

| Diversification | Strong diversification across uniform rental, safety, fire protection, and direct sales; steady revenue growth in multiple segments | Concentrated revenues mainly in Merchant and Issuer Solutions; less diversified product base |

| Profitability | High profitability with ROIC 22.8%, net margin 17.53%, and favorable ROE of 38.69% | Lower profitability; ROIC at 4.68%, net margin 15.54%, and weak ROE at 7.05% |

| Innovation | Demonstrates durable competitive advantage with growing ROIC (+45%) indicating operational efficiency | Improving ROIC trend (+146%) but still shedding value; innovation improving profitability |

| Global presence | Primarily North American focus with strong domestic market penetration | Global footprint with significant international merchant services, expanding global reach |

| Market Share | Leading position in uniform rental and facility services with revenues of $7.98B in 2025 | Market leader in payment solutions with $7.69B in Merchant Solutions revenues in 2024 |

Key takeaways: Cintas shows strong diversification, excellent profitability, and a durable competitive moat, making it a more stable investment. Global Payments is improving profitability and expanding globally but still faces challenges in value creation and operational efficiency.

Risk Analysis

Below is a comparison table outlining key risks for Cintas Corporation (CTAS) and Global Payments Inc. (GPN) based on the most recent financial and operational data:

| Metric | Cintas Corporation (CTAS) | Global Payments Inc. (GPN) |

|---|---|---|

| Market Risk | Moderate (Beta 0.97) | Moderate-Low (Beta 0.80) |

| Debt level | Moderate (Debt/Equity 0.57, favorable debt-to-assets 27%) | Moderate (Debt/Equity 0.75, neutral debt-to-assets 36%) |

| Regulatory Risk | Moderate (Service industry, US-centric) | Elevated (Financial tech with global regulatory exposure) |

| Operational Risk | Low (Strong asset turnover 1.05, high interest coverage 23.4) | Moderate (Lower asset turnover 0.22, interest coverage 4) |

| Environmental Risk | Low (Service industry, limited direct impact) | Low (Payment processing, limited direct environmental footprint) |

| Geopolitical Risk | Moderate (Operations mainly North America, some Latin America) | Elevated (Global presence including Europe, Asia-Pacific) |

Cintas shows solid financial stability with favorable liquidity and coverage ratios, reducing bankruptcy risk (Altman Z-score 11.77, safe zone). Global Payments faces higher operational and geopolitical risks due to its international scope and weaker leverage metrics; its Altman Z-score (0.98) signals financial distress risk despite a strong Piotroski score. Investors should weigh Global Payments’ regulatory and geopolitical uncertainties more cautiously.

Which Stock to Choose?

Cintas Corporation (CTAS) shows a strong income evolution with a 45.3% revenue growth over 2021-2025 and favorable profitability metrics including a 17.53% net margin and 38.69% ROE. Its financial ratios are mostly favorable, with a low debt level (net debt to EBITDA 0.84) and a very favorable rating of B. The company demonstrates a durable competitive advantage with a very favorable moat rating, reflecting efficient capital use and growing ROIC.

Global Payments Inc. (GPN) exhibits positive income growth with a 36.13% revenue increase over 2020-2024 and a 15.54% net margin. However, its profitability ratios such as ROE (7.05%) and ROIC (4.68%) are less favorable, coupled with higher leverage (net debt to EBITDA 3.27). The rating is very favorable at A-, but the moat assessment is slightly unfavorable, indicating value destruction despite improving profitability.

Investors prioritizing financial strength and a durable competitive advantage might find Cintas’s profile more favorable due to its strong profitability, stable debt situation, and very favorable ratings. Conversely, those seeking potential growth opportunities with improving profitability but accepting higher leverage and risk could see merit in Global Payments. The choice may depend on the investor’s risk tolerance and strategy focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cintas Corporation and Global Payments Inc. to enhance your investment decisions: