Home > Comparison > Consumer Defensive > CHD vs IPAR

The strategic rivalry between Church & Dwight Co., Inc. and Inter Parfums, Inc. shapes the competitive landscape of the consumer defensive sector. Church & Dwight operates as a diversified household products manufacturer with broad distribution, while Inter Parfums focuses on high-margin luxury fragrance brands. This head-to-head contrasts scale and diversification against niche premium positioning. This analysis aims to identify which corporate strategy offers the superior risk-adjusted return for a well-rounded portfolio in 2026.

Table of contents

Companies Overview

Church & Dwight and Inter Parfums hold distinct yet influential roles within the household and personal products market.

Church & Dwight Co., Inc.: Diversified Consumer Products Leader

Church & Dwight dominates the household and personal care space with a broad portfolio including ARM & HAMMER and Trojan brands. Its core revenue relies on mass-market consumer goods like cleaning products, personal care, and specialty animal nutrition. In 2026, it emphasizes expanding international reach while leveraging its strong brand equity and diversified product lines.

Inter Parfums, Inc.: Prestige Fragrance and Cosmetic Specialist

Inter Parfums commands a niche in luxury fragrances under prestigious names like Jimmy Choo and Lanvin. It generates revenue by designing, marketing, and distributing high-end perfumes through department stores and global wholesalers. Its 2026 strategy focuses on strengthening its brand portfolio and expanding e-commerce channels to capture premium consumer segments.

Strategic Collision: Similarities & Divergences

Church & Dwight pursues a broad-based product diversification, while Inter Parfums focuses on a selective luxury segment with exclusive brands. Their primary battleground is consumer personal care, but they target vastly different customer bases and price points. These strategic contrasts define their unique investment profiles: Church & Dwight offers stability through scale, whereas Inter Parfums provides growth potential through brand prestige.

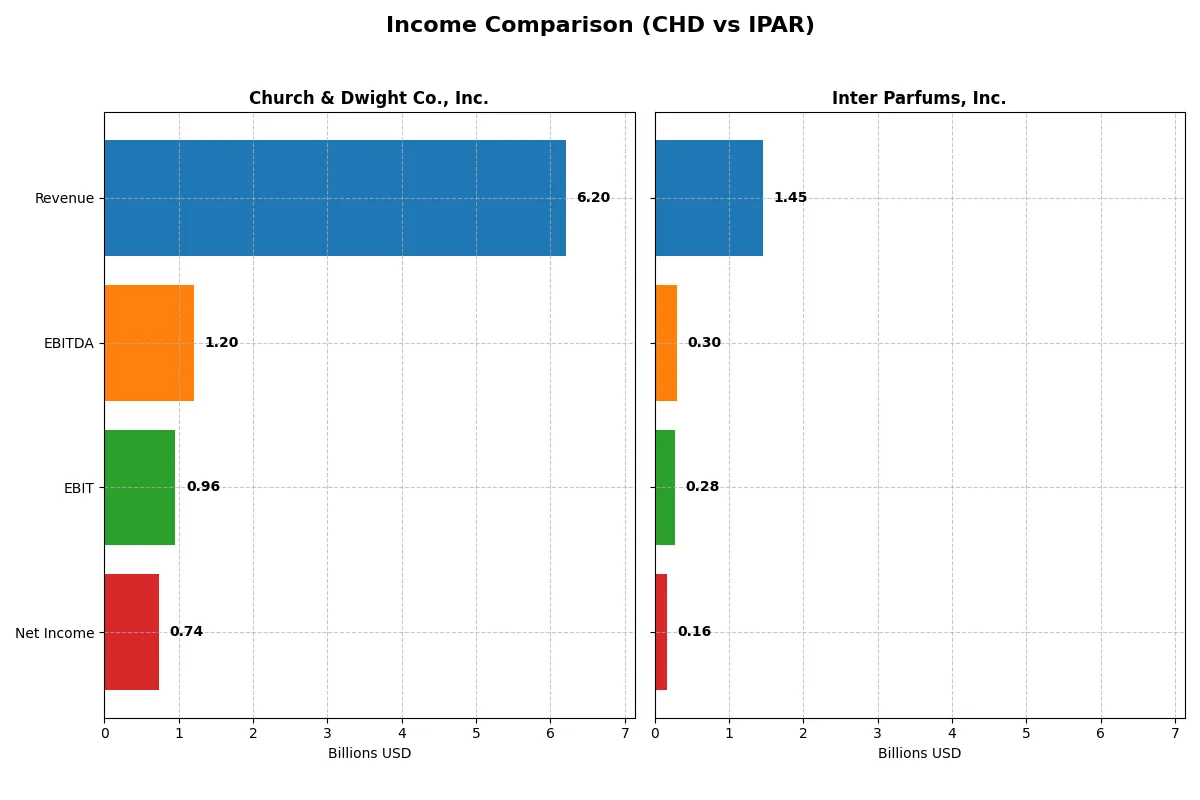

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Church & Dwight Co., Inc. (CHD) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| Revenue | 6.2B | 1.45B |

| Cost of Revenue | 3.43B | 525M |

| Operating Expenses | 1.7B | 653M |

| Gross Profit | 2.77B | 927M |

| EBITDA | 1.2B | 305M |

| EBIT | 957M | 276M |

| Interest Expense | 0 | 7.8M |

| Net Income | 737M | 164M |

| EPS | 3.04 | 5.13 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true operational efficiency and profitability momentum of two distinct corporate engines.

Church & Dwight Co., Inc. Analysis

Church & Dwight’s revenue steadily climbs to $6.2B in 2025, yet net income declines to $737M, reflecting margin pressure. Gross margin holds firm near 44.7%, while net margin improves to 11.9%, driven by disciplined operating expense control. The latest year shows improved EBIT growth (+12.4%) and net margin expansion (+23.9%), hinting at operational efficiency gains despite modest revenue growth (+1.6%).

Inter Parfums, Inc. Analysis

Inter Parfums boosts revenue sharply to $1.45B in 2024 with a strong 10.2% annual increase. Gross margin impresses at 63.9%, surpassing Church & Dwight by a wide margin, though net margin slightly contracts to 11.3%. EBIT grows 5.9%, supported by solid cost management, but net margin dips 2.3%. Overall, Inter Parfums exhibits robust top-line momentum and margin expansion over the medium term.

Margin Dominance vs. Revenue Scale

Inter Parfums excels in margin strength and explosive growth, with net income up 330% over five years, far outpacing Church & Dwight’s 11.9% net margin and slower income declines. Conversely, Church & Dwight commands scale with $6.2B revenue but faces margin compression and slower revenue gains. For investors prioritizing margin expansion and rapid growth, Inter Parfums offers a more dynamic profile, while Church & Dwight’s scale suits those focused on steady, large-cap consistency.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose underlying fiscal health, valuation premiums, and capital efficiency for the companies compared below:

| Ratios | Church & Dwight Co., Inc. (CHD) | Inter Parfums, Inc. (IPAR) |

|---|---|---|

| ROE | 18.4% | 22.1% |

| ROIC | 11.2% | 18.4% |

| P/E | 27.6 | 25.6 |

| P/B | 5.08 | 5.66 |

| Current Ratio | 1.07 | 2.75 |

| Quick Ratio | 0.71 | 1.63 |

| D/E | 0.55 | 0.26 |

| Debt-to-Assets | 24.7% | 13.6% |

| Interest Coverage | 0 (not reported) | 35.1 |

| Asset Turnover | 0.70 | 1.03 |

| Fixed Asset Turnover | 7.54 | 8.14 |

| Payout Ratio | 39.0% | 58.4% |

| Dividend Yield | 1.41% | 2.28% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, revealing hidden risks and operational excellence crucial for investors’ strategic decisions.

Church & Dwight Co., Inc.

Church & Dwight posts a robust 18.4% ROE and 11.9% net margin, demonstrating solid profitability. However, its P/E of 27.6 and P/B of 5.1 mark the stock as relatively expensive. The 1.4% dividend yield offers steady returns, balancing moderate reinvestment with shareholder payouts.

Inter Parfums, Inc.

Inter Parfums shines with a higher 22.1% ROE and 11.3% net margin, signaling efficient operations. Its P/E ratio at 25.6 is slightly lower but still elevated. A 2.3% dividend yield complements strong cash flow metrics, highlighting a shareholder-friendly approach amid disciplined capital allocation.

Premium Valuation vs. Operational Safety

Inter Parfums delivers superior profitability and more favorable liquidity ratios, suggesting better operational efficiency. Church & Dwight’s higher valuation ratios imply stretched pricing. Risk-averse investors might favor Inter Parfums’ balanced financial health, while those accepting premium valuations might consider Church & Dwight’s steady dividend profile.

Which one offers the Superior Shareholder Reward?

Church & Dwight (CHD) pays a 1.41% dividend yield with a moderate 39% payout, supported by strong free cash flow (4.5/share). It also executes consistent buybacks, enhancing shareholder returns sustainably. Inter Parfums (IPAR) offers a higher 2.28% yield but a riskier 58% payout, with uneven free cash flow and less reliable buybacks. CHD’s balanced dividend and buyback strategy delivers a more attractive and sustainable total return for 2026 investors.

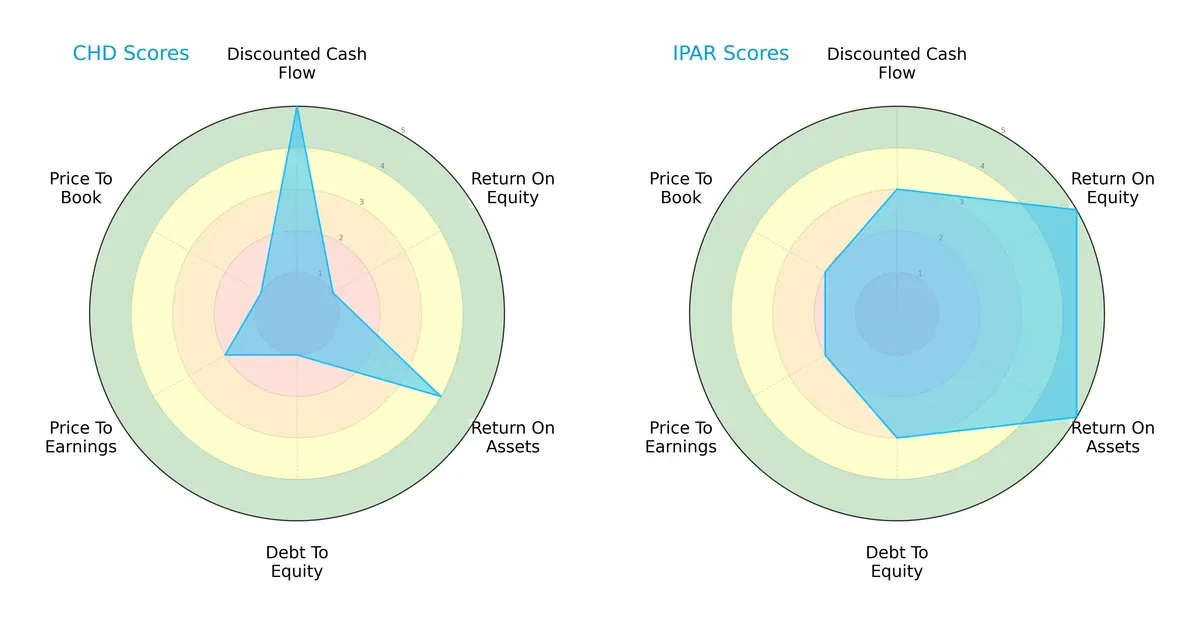

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Church & Dwight and Inter Parfums, showcasing each firm’s core financial strengths and vulnerabilities:

Inter Parfums displays a more balanced profile with strong scores in ROE (5) and ROA (5), reflecting efficient asset use and shareholder returns. Church & Dwight excels in discounted cash flow (5), signaling undervaluation potential, but struggles with debt-to-equity (1) and ROE (1), indicating financial leverage risks and weak equity returns. Inter Parfums relies less on a single edge, presenting a healthier overall financial footprint.

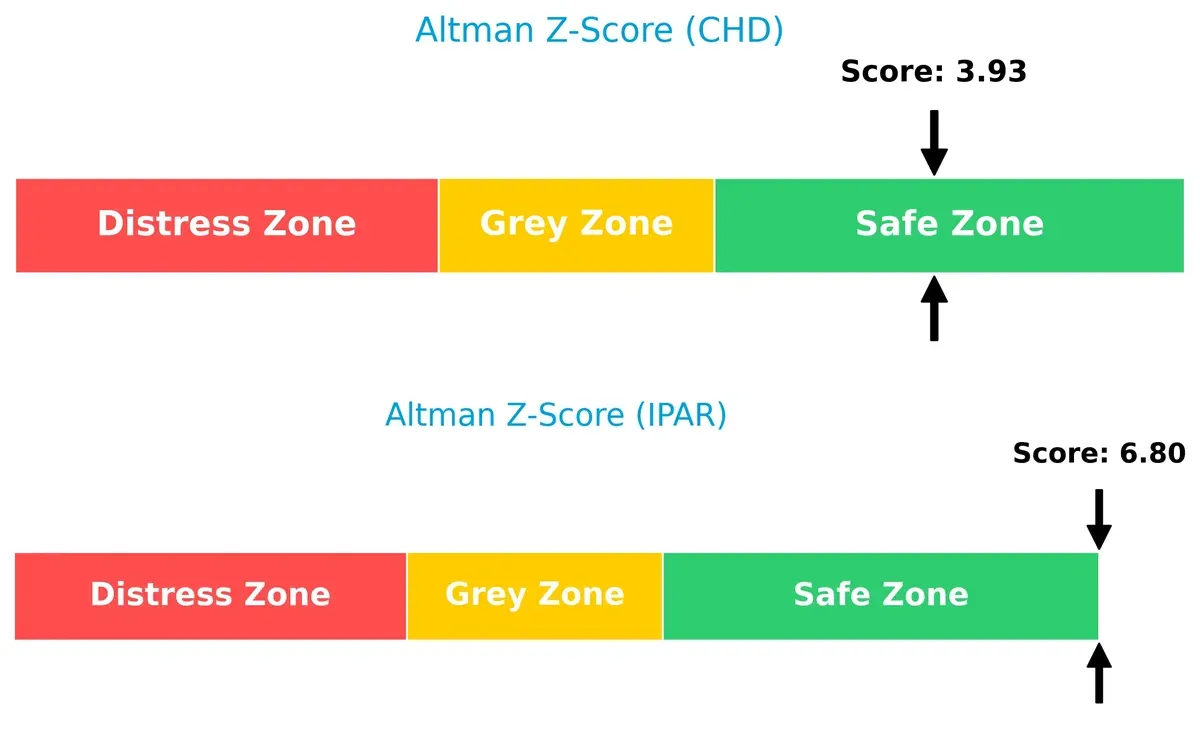

Bankruptcy Risk: Solvency Showdown

Inter Parfums posts a superior Altman Z-Score (6.8) versus Church & Dwight (3.9), signaling stronger solvency and a safer position against bankruptcy in this cycle:

Financial Health: Quality of Operations

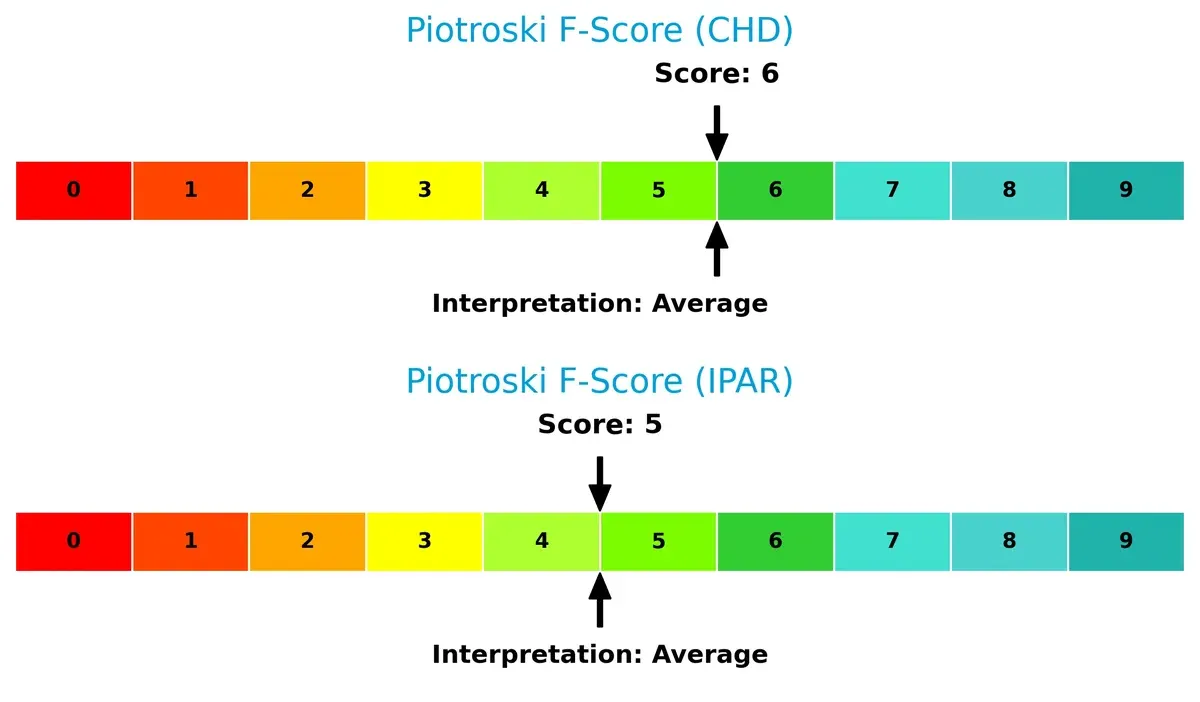

Church & Dwight and Inter Parfums both have average Piotroski F-Scores—6 and 5 respectively—indicating moderate financial health without glaring red flags but room for operational improvements:

How are the two companies positioned?

This section dissects the operational DNA of CHD and IPAR by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which offers the most resilient competitive advantage.

Revenue Segmentation: The Strategic Mix

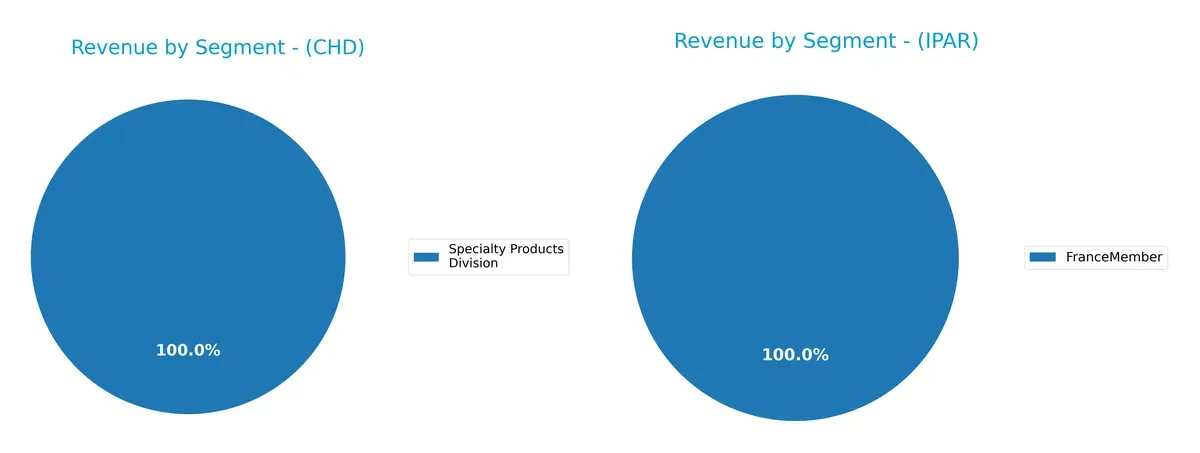

The following visual comparison dissects how Church & Dwight Co., Inc. and Inter Parfums, Inc. diversify their income streams and where their primary sector bets lie:

Church & Dwight anchors its revenue in the Specialty Products Division, consistently generating around 300M annually, indicating a focused but stable segment. Inter Parfums relies solely on its FranceMember segment at 37.6M, showing extreme concentration. Church & Dwight’s single-segment dominance suggests less diversification risk but higher dependency on one market, while Inter Parfums’ narrow base implies vulnerability but potential niche strength.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Church & Dwight Co., Inc. (CHD) and Inter Parfums, Inc. (IPAR):

CHD Strengths

- Favorable net margin and ROIC indicating strong profitability

- Moderate debt with favorable debt-to-assets and infinite interest coverage

- Established global presence with significant domestic and international revenue

- Specialty Products Division revenue shows consistent contribution

IPAR Strengths

- Higher ROE and ROIC reflect superior capital efficiency

- Strong liquidity ratios and low debt enhance financial stability

- Diverse global footprint across multiple regions

- Higher dividend yield supports income investors

CHD Weaknesses

- Unfavorable PE and PB ratios suggest valuation concerns

- Quick ratio below 1 signals potential liquidity risk

- Moderate asset turnover compared to sector averages

- Relatively lower dividend yield

IPAR Weaknesses

- PE and PB ratios also elevated, signaling valuation premium

- WACC relatively higher, affecting capital cost efficiency

- Smaller revenue scale and narrower product segmentation

- Limited specialty product disclosure

Both companies exhibit solid profitability and global presence, but CHD’s liquidity and valuation metrics warrant caution. IPAR excels in capital efficiency and financial stability but faces a higher cost of capital and valuation premium, influencing strategic priorities.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true defense against profit erosion from competition over the long term. Let’s dissect the moats of two industry players:

Church & Dwight Co., Inc.: Diversified Brand Portfolio with Stable Margins

Church & Dwight leverages intangible assets and brand strength, reflected in a consistent 44.7% gross margin and stable 15.4% EBIT margin. However, ROIC shows a declining trend in 2026, signaling pressure on capital efficiency despite value creation. Expansion into specialty and international segments could bolster its moat if managed carefully.

Inter Parfums, Inc.: High-Margin Luxury Fragrance Specialist

Inter Parfums relies on brand exclusivity and pricing power, evident in a superior 63.9% gross margin and 19.0% EBIT margin. Unlike Church & Dwight, IPAR’s ROIC has surged, indicating a widening moat supported by strong revenue growth and expanding global reach in luxury markets. Continued innovation in fragrance lines may deepen its competitive advantage.

Brand Diversification vs. Luxury Pricing Power: The Moat Face-Off

Inter Parfums shows a deeper, more durable moat with accelerating ROIC and robust margin expansion. Church & Dwight’s broader portfolio creates value but faces margin and ROIC pressure. IPAR is better positioned to defend and extend its market share amid evolving consumer preferences.

Which stock offers better returns?

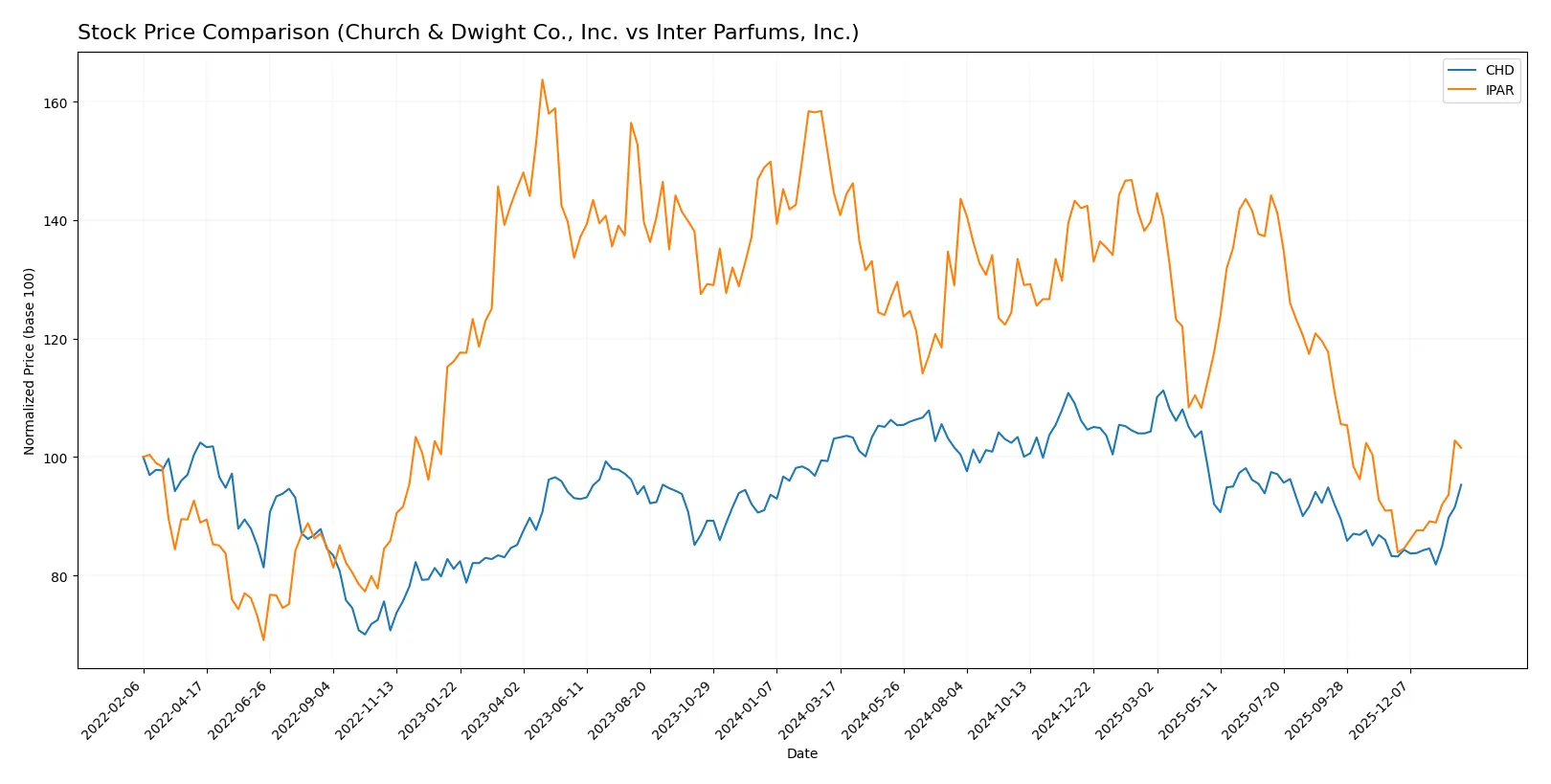

Over the past year, both Church & Dwight Co., Inc. and Inter Parfums, Inc. experienced bearish trends with recent price recoveries showing bullish momentum since late 2025.

Trend Comparison

Church & Dwight’s stock declined 7.56% over the past year, marking a bearish trend with accelerating downside. The price ranged from 82.64 to 112.33, showing recent recovery of 14.45% since November 2025.

Inter Parfums’ stock fell 29.78% over the same period, also bearish with accelerating losses. Volatility was higher, with a range between 80.61 and 141.02. The recent 11.6% rebound reflects some recovery momentum.

Comparing both, Church & Dwight outperformed Inter Parfums with a smaller overall loss and stronger recent buyer dominance, delivering the highest market performance in this timeframe.

Target Prices

Analysts present a clear consensus for target prices of Church & Dwight Co., Inc. and Inter Parfums, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Church & Dwight Co., Inc. | 82 | 102 | 96.25 |

| Inter Parfums, Inc. | 103 | 112 | 107.5 |

Church & Dwight’s target consensus matches its current price, indicating a balanced risk-reward profile. Inter Parfums’ consensus price stands roughly 10% above current levels, signaling moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Church & Dwight Co., Inc. Grades

The following table summarizes recent grades from leading financial institutions for Church & Dwight Co., Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Maintain | Buy | 2026-01-28 |

| UBS | Maintain | Neutral | 2026-01-14 |

| TD Cowen | Maintain | Hold | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Raymond James | Upgrade | Outperform | 2026-01-05 |

| Jefferies | Upgrade | Buy | 2025-12-17 |

| Citigroup | Upgrade | Neutral | 2025-12-17 |

| Deutsche Bank | Maintain | Buy | 2025-12-10 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Barclays | Maintain | Underweight | 2025-11-04 |

Inter Parfums, Inc. Grades

Below is a summary of recent institutional grades for Inter Parfums, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BWS Financial | Maintain | Neutral | 2026-01-29 |

| BWS Financial | Downgrade | Neutral | 2025-11-21 |

| Canaccord Genuity | Maintain | Buy | 2025-11-19 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Jefferies | Maintain | Buy | 2025-10-28 |

| BWS Financial | Maintain | Buy | 2025-10-22 |

| Canaccord Genuity | Maintain | Buy | 2025-10-21 |

| BWS Financial | Maintain | Buy | 2025-05-07 |

| Piper Sandler | Maintain | Overweight | 2025-04-24 |

| DA Davidson | Maintain | Buy | 2025-03-25 |

Which company has the best grades?

Church & Dwight consistently holds high grades, including multiple “Buy” and “Outperform” ratings. Inter Parfums mostly receives “Buy” and “Neutral” grades, with some recent downgrades. Investors may view Church & Dwight as favored by analysts, potentially indicating stronger confidence in its outlook.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Church & Dwight Co., Inc.

- Faces intense competition in household products with moderate growth prospects and a strong brand portfolio.

Inter Parfums, Inc.

- Competes in the luxury fragrance segment with higher volatility but benefits from premium brand positioning.

2. Capital Structure & Debt

Church & Dwight Co., Inc.

- Moderate leverage with a debt-to-equity of 0.55, neutral risk profile, and strong interest coverage.

Inter Parfums, Inc.

- Lower leverage at 0.26 debt-to-equity, favorable balance sheet, and robust interest coverage of 35.3.

3. Stock Volatility

Church & Dwight Co., Inc.

- Low beta of 0.46 indicates defensive stock with less price fluctuation.

Inter Parfums, Inc.

- Higher beta of 1.24 shows elevated volatility and greater market sensitivity.

4. Regulatory & Legal

Church & Dwight Co., Inc.

- Subject to consumer product safety regulations with moderate compliance risk.

Inter Parfums, Inc.

- Faces stricter regulations on fragrance ingredients and international trade compliance risks.

5. Supply Chain & Operations

Church & Dwight Co., Inc.

- Established, diversified supply chain though quick ratio of 0.71 signals potential liquidity constraints.

Inter Parfums, Inc.

- More agile supply chain with favorable quick ratio of 1.63 supporting operational flexibility.

6. ESG & Climate Transition

Church & Dwight Co., Inc.

- Under pressure to reduce environmental footprint in consumer staples production.

Inter Parfums, Inc.

- Faces challenges adapting luxury packaging and sourcing to ESG standards but benefits from niche market appeal.

7. Geopolitical Exposure

Church & Dwight Co., Inc.

- Moderate exposure to international markets with risks from trade tensions and supply disruptions.

Inter Parfums, Inc.

- Higher exposure to European and global luxury markets, vulnerable to geopolitical instability.

Which company shows a better risk-adjusted profile?

Inter Parfums faces higher market volatility but shows superior financial strength with lower leverage, stronger liquidity, and better profitability metrics. Church & Dwight offers defensive stability but carries some liquidity and valuation risks. The standout risk for Church & Dwight is its tight liquidity position, while Inter Parfums must manage market and geopolitical volatility. Given these factors, I find Inter Parfums’ risk-adjusted profile more favorable, supported by a strong Altman Z-score of 6.8 and a solid balance sheet that mitigate its higher beta risk.

Final Verdict: Which stock to choose?

Church & Dwight stands out as a resilient cash generator with solid value creation despite a slight decline in profitability. Its modest liquidity calls for vigilance, but its defensive qualities suit an income-focused or conservative growth portfolio.

Inter Parfums boasts a robust and expanding economic moat, underpinned by impressive returns on invested capital and strong balance sheet health. Its higher stability and efficient capital use make it attractive for investors seeking quality growth with a margin of safety.

If you prioritize steady cash flow and defensive positioning, Church & Dwight might be the compelling choice due to its proven value creation and moderate risk profile. However, if you seek accelerating profitability and a durable competitive edge, Inter Parfums offers better stability and growth potential, albeit at a premium valuation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Church & Dwight Co., Inc. and Inter Parfums, Inc. to enhance your investment decisions: