Home > Comparison > Consumer Defensive > CL vs CHD

The strategic rivalry between Colgate-Palmolive Company and Church & Dwight Co., Inc. shapes the competitive landscape of the Consumer Defensive sector. Colgate-Palmolive operates as a diversified household and personal products giant with a strong pet nutrition segment. In contrast, Church & Dwight emphasizes innovation in specialty and consumer products with a leaner operational footprint. This analysis aims to identify which company offers the superior risk-adjusted return potential for a balanced investment portfolio.

Table of contents

Companies Overview

Colgate-Palmolive and Church & Dwight hold pivotal roles in the global household and personal products market.

Colgate-Palmolive Company: Global Consumer Products Leader

Colgate-Palmolive dominates household and personal care with its diversified product portfolio, including oral care, skin health, and pet nutrition. It primarily generates revenue through branded consumer goods sold worldwide. In 2026, it focuses on expanding eCommerce channels and innovating health-oriented products to reinforce its market leadership.

Church & Dwight Co., Inc.: Specialty Consumer Products Innovator

Church & Dwight specializes in consumer and specialty products, leveraging strong brands like ARM & HAMMER and TROJAN. Its revenue stems from diverse categories, including baking soda products, personal care, and animal productivity supplements. The company’s 2026 strategy emphasizes growing its specialty segment and expanding international footprints to capture niche markets.

Strategic Collision: Similarities & Divergences

Both companies compete in household and personal care but differ in approach. Colgate-Palmolive pursues a broad global consumer goods strategy, while Church & Dwight focuses on specialized, brand-centric niches. The primary battleground is product innovation and channel expansion. Their distinct profiles reflect Colgate’s scale advantage versus Church & Dwight’s targeted brand strength, shaping unique investment appeals.

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Colgate-Palmolive Company (CL) | Church & Dwight Co., Inc. (CHD) |

|---|---|---|

| Revenue | 20.4B | 6.20B |

| Cost of Revenue | 8.13B | 3.43B |

| Operating Expenses | 7.90B | 1.70B |

| Gross Profit | 12.3B | 2.77B |

| EBITDA | 3.96B | 1.20B |

| EBIT | 3.33B | 957M |

| Interest Expense | 267M | 0 |

| Net Income | 2.13B | 737M |

| EPS | 2.64 | 3.04 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company converts sales into profits more efficiently and sustains financial momentum.

Colgate-Palmolive Company Analysis

Colgate’s revenue grew steadily from 17.4B in 2021 to 20.4B in 2025, showing a 17% increase over five years. Its net income, however, declined slightly, falling to 2.1B in 2025 from 2.9B in 2024. Gross and net margins remain strong at 60.1% and 10.5%, respectively, but recent margin compression and a 21.7% drop in EBIT suggest weakening operational efficiency.

Church & Dwight Co., Inc. Analysis

Church & Dwight’s revenue rose from 5.2B in 2021 to 6.2B in 2025, a 19.5% increase over five years. Net income peaked at 828M in 2021 but dropped to 737M in 2025. Its gross margin at 44.7% is lower than Colgate’s but EBIT margin of 15.4% and net margin of 11.9% show solid profitability. Notably, the company improved EBIT by 12.4% and net margin by 23.9% in the last year, indicating recent operational momentum.

Margin Strength vs. Growth Resilience

Colgate’s higher gross margin reflects strong pricing power, but its recent profit erosion signals margin pressures and efficiency challenges. Church & Dwight delivers lower revenue but better recent profit growth and margin expansion. For investors, Church & Dwight’s improving margins and earnings growth profile may offer a more attractive risk-reward balance amid evolving market conditions.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Colgate-Palmolive Company (CL) | Church & Dwight Co., Inc. (CHD) |

|---|---|---|

| ROE | 13.63% | 18.41% |

| ROIC | 30.56% | 11.19% |

| P/E | 25.73 | 27.62 |

| P/B | 350.65 | 5.08 |

| Current Ratio | 0.92 | 1.07 |

| Quick Ratio | 0.58 | 0.71 |

| D/E (Debt-to-Equity) | 40.15 | 0.55 |

| Debt-to-Assets | 53.05% | 24.74% |

| Interest Coverage | 15.01 | 0 (not reported) |

| Asset Turnover | 1.25 | 0.70 |

| Fixed Asset Turnover | 4.55 | 7.54 |

| Payout ratio | 61.92% | 38.98% |

| Dividend yield | 2.41% | 1.41% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence essential for informed investment decisions.

Colgate-Palmolive Company

Colgate exhibits strong profitability with a 13.63% ROE and a 14.37% net margin, signaling operational efficiency. However, its P/E of 25.73 and P/B of 350.65 suggest an expensive valuation. The company supports shareholder returns with a 2.41% dividend yield, reflecting steady cash flow distribution rather than aggressive growth reinvestment.

Church & Dwight Co., Inc.

Church & Dwight posts a solid 18.41% ROE and an 11.88% net margin, indicating efficient capital use. The P/E ratio of 27.62 and P/B of 5.08 mark a stretched valuation, though less extreme than Colgate’s. Dividend yield stands at 1.41%, showing moderate shareholder returns balanced with reinvestment for growth.

Premium Valuation vs. Operational Safety

Colgate offers higher profitability and a more generous dividend but trades at a notably stretched P/B ratio, raising valuation concerns. Church & Dwight delivers a slightly leaner margin profile with a more moderate valuation and balanced shareholder returns. Investors seeking stable income may prefer Colgate; those favoring moderate risk might lean toward Church & Dwight.

Which one offers the Superior Shareholder Reward?

I see Colgate-Palmolive (CL) prioritizes a robust dividend yield of 2.41% with a high payout ratio near 62%, signaling strong shareholder income but limited cash reinvestment. CL’s buyback intensity remains moderate, enhancing total returns sustainably given its solid free cash flow at 4.34/share. Church & Dwight (CHD) yields less at 1.41% with a conservative 39% payout, favoring reinvestment and modest buybacks. CHD’s free cash flow per share at 4.50 supports growth and buybacks, but lower yield and payout dampen immediate income. I conclude CL offers a superior total return profile in 2026 through balanced dividends and buybacks, combining income with sustainability better than CHD’s growth-tilted model.

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Colgate-Palmolive Company and Church & Dwight Co., Inc., highlighting their core financial strengths and weaknesses:

Colgate-Palmolive shows strength in Return on Equity (5) and Return on Assets (5), signaling efficient profit generation and asset use. Church & Dwight leads in Discounted Cash Flow (5), indicating better valuation on future cash flows. Both struggle with Debt-to-Equity (1) and Price-to-Book (1), reflecting high leverage and premium market pricing. Overall, Colgate-Palmolive offers a more balanced profile, while Church & Dwight relies heavily on its cash flow valuation edge.

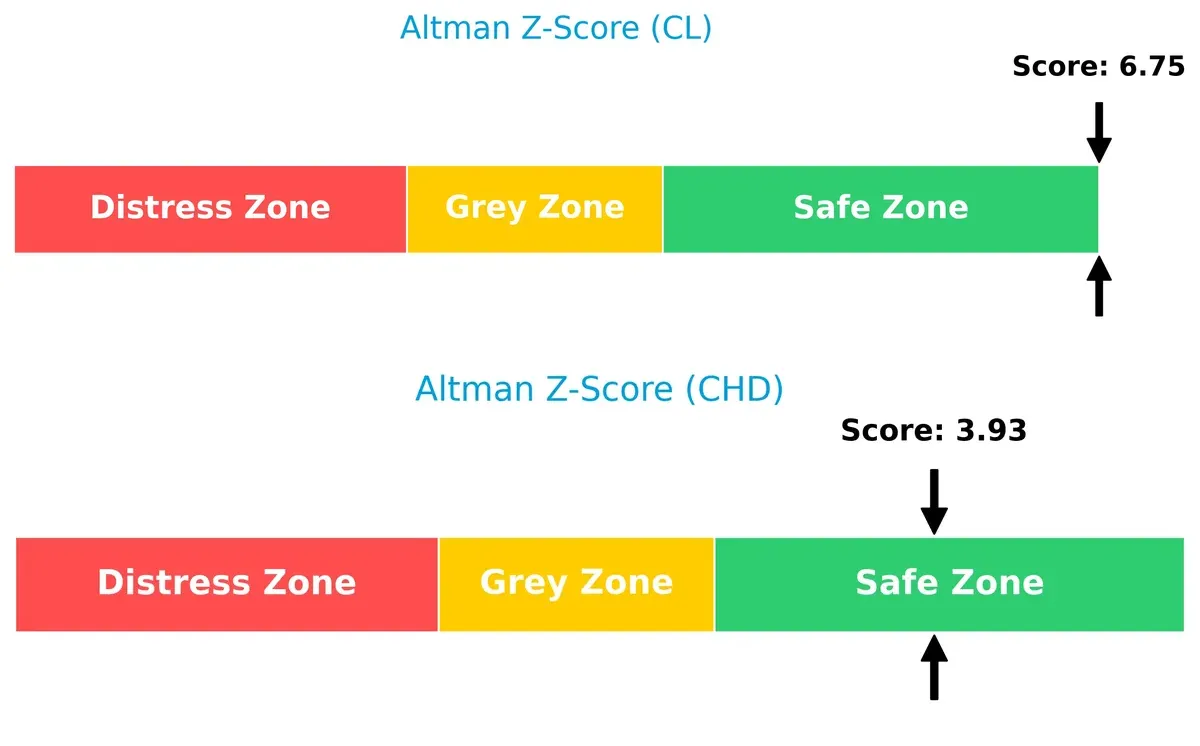

Bankruptcy Risk: Solvency Showdown

Colgate-Palmolive’s Altman Z-Score of 6.75 significantly outpaces Church & Dwight’s 3.93, indicating a stronger buffer against bankruptcy risks in this economic cycle:

Financial Health: Quality of Operations

Both firms share a Piotroski F-Score of 6, placing them in average financial health territory. Neither shows acute red flags, but neither stands out as exceptionally strong:

How are the two companies positioned?

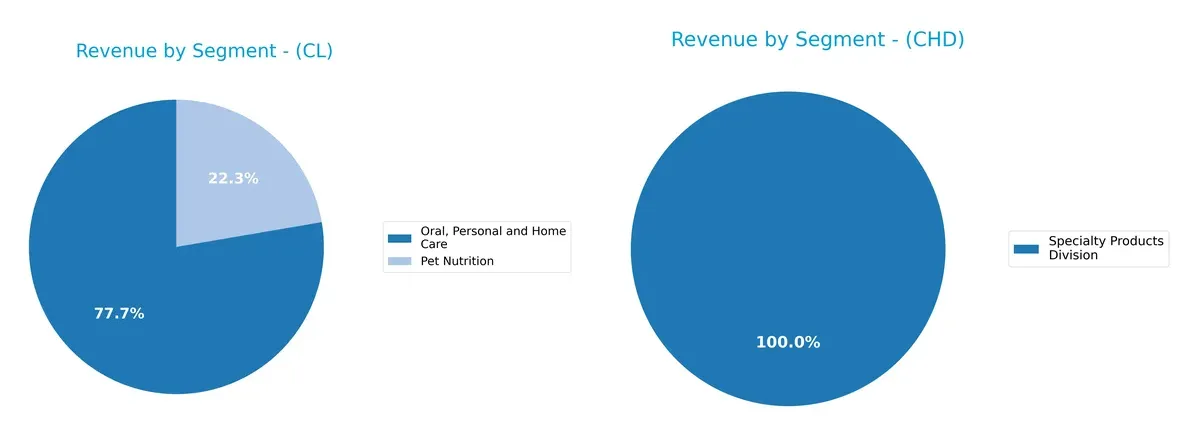

This section dissects the operational DNA of Colgate-Palmolive and Church & Dwight by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Colgate-Palmolive and Church & Dwight diversify their income streams and reveals the sectors that anchor their revenue bases:

Colgate-Palmolive dominates with a bifurcated revenue mix: $15.6B from Oral, Personal and Home Care and $4.5B from Pet Nutrition, showing solid diversification. Church & Dwight relies almost entirely on its Specialty Products Division, with revenues around $300M, reflecting concentration risk. Colgate’s dual-segment strategy anchors resilience and ecosystem lock-in, while Church & Dwight’s narrow base demands vigilance on market shifts.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Colgate-Palmolive Company and Church & Dwight Co., Inc.:

Colgate-Palmolive Company Strengths

- Strong profitability with 14.37% net margin and 30.56% ROIC

- High asset turnover of 1.25 and fixed asset turnover of 4.55

- Robust dividend yield at 2.41%

- Diverse revenue streams in oral care and pet nutrition totaling over 20B USD

Church & Dwight Co., Inc. Strengths

- Favorable profitability with 11.88% net margin and 11.19% ROIC

- Strong fixed asset turnover at 7.54

- Lower debt-to-assets ratio at 24.74%

- Significant domestic and international consumer revenue totaling about 5.8B USD

Colgate-Palmolive Company Weaknesses

- High leverage with 53.05% debt-to-assets and 40.15 D/E ratio

- Weak liquidity indicated by current ratio 0.92 and quick ratio 0.58

- Overvalued valuation metrics: PE 25.73 and PB 350.65

Church & Dwight Co., Inc. Weaknesses

- Moderate valuation concerns with PE 27.62 and PB 5.08

- Suboptimal liquidity with quick ratio 0.71

- Lower asset turnover of 0.7

- Dividend yield at a modest 1.41%

Both companies show favorable profitability and operational efficiency but face valuation and liquidity challenges. Colgate’s larger scale and diversification contrast with Church & Dwight’s stronger balance sheet and asset utilization. These factors influence their strategic priorities in managing growth and financial risk.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only defense that shields long-term profits from relentless competitive pressure and market disruption:

Colgate-Palmolive Company: Intangible Assets Powerhouse

Colgate’s moat stems from strong brand equity and global distribution. Its high ROIC of 25.6% versus WACC reflects efficient capital use and margin stability. New product innovations and pet nutrition expansion could deepen this moat in 2026.

Church & Dwight Co., Inc.: Cost Advantage and Niche Innovation

Church & Dwight’s moat relies on cost-efficient operations and unique specialty products, contrasting with Colgate’s brand strength. Despite a lower ROIC, 5.5% above WACC, it sustains value but faces declining profitability. Growth in consumer international markets could bolster its moat.

Brand Equity vs. Cost Efficiency: The Competitive Moat Face-Off

Colgate’s wider moat, marked by rising ROIC and durable brand power, outmatches Church & Dwight’s narrower, eroding profitability moat. Colgate is better positioned to defend market share amid intensifying competition.

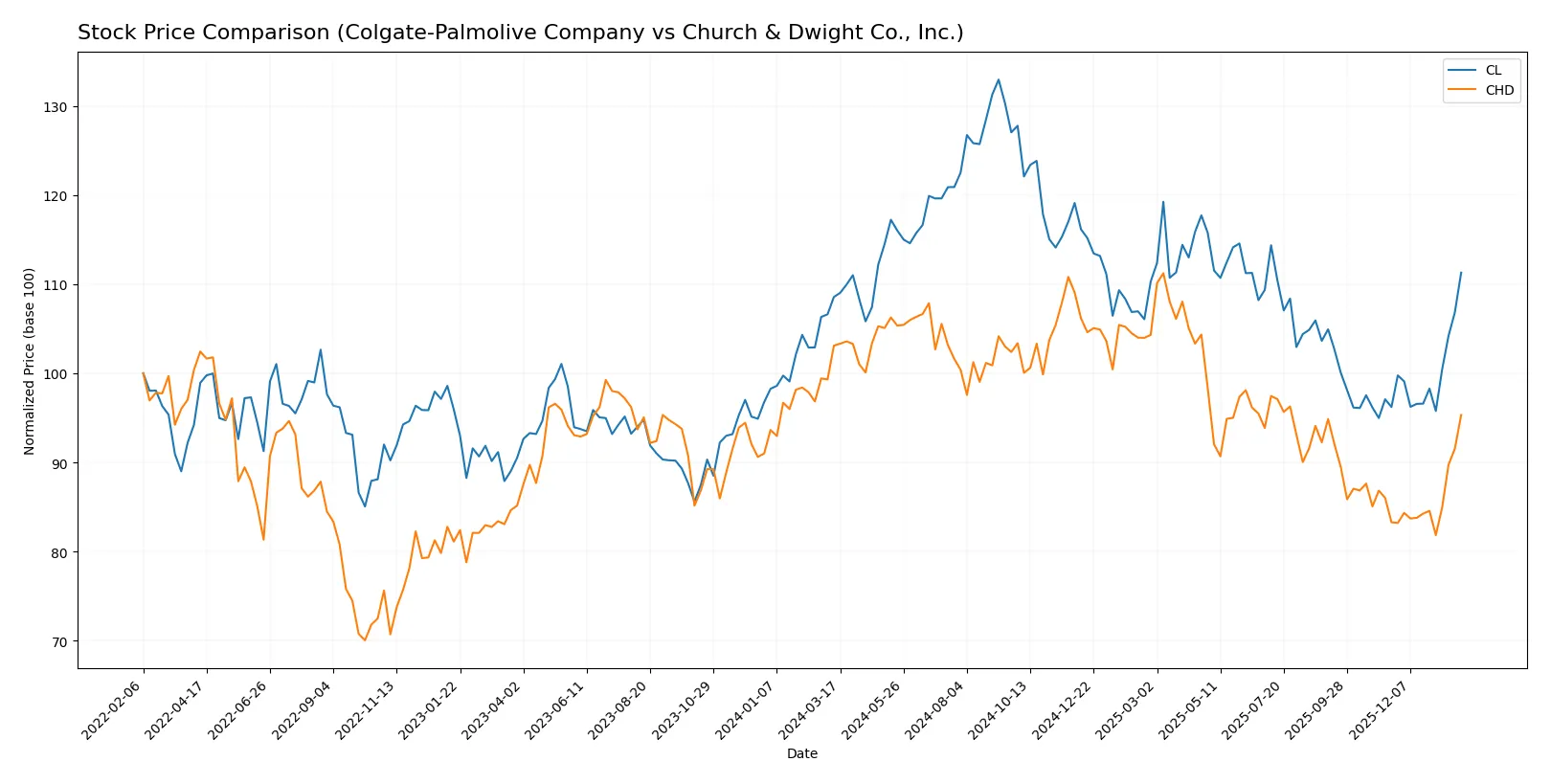

Which stock offers better returns?

Over the past year, Colgate-Palmolive’s stock gained 2.52%, showing accelerating bullish momentum, while Church & Dwight’s shares declined 7.56%, despite recent positive price shifts.

Trend Comparison

Colgate-Palmolive’s stock rose 2.52% over the last 12 months, marking a bullish trend with accelerating momentum and a 7.34 standard deviation. The price ranged from 77.05 to 107.86.

Church & Dwight’s stock fell 7.56% over the same period, reflecting a bearish trend but with recent acceleration. Volatility measured at 7.84, and prices fluctuated between 82.64 and 112.33.

Colgate-Palmolive outperformed Church & Dwight overall, delivering positive returns while Church & Dwight faced a negative yearly trend despite recent gains.

Target Prices

Analysts show a moderately bullish consensus with solid upside potential for both Colgate-Palmolive and Church & Dwight.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Colgate-Palmolive Company | 83 | 96 | 89.2 |

| Church & Dwight Co., Inc. | 82 | 102 | 96.25 |

Colgate-Palmolive’s consensus target of 89.2 sits just below its current price of 90.29, indicating limited near-term upside. Church & Dwight’s target matches its current price, signaling a balanced risk-reward profile from analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The institutional grades for Colgate-Palmolive Company and Church & Dwight Co., Inc. are as follows:

Colgate-Palmolive Company Grades

The latest grades from major financial institutions on Colgate-Palmolive Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2026-01-16 |

| UBS | Maintain | Buy | 2026-01-14 |

| Wells Fargo | Upgrade | Equal Weight | 2026-01-13 |

| TD Cowen | Maintain | Buy | 2026-01-08 |

| Piper Sandler | Upgrade | Overweight | 2026-01-07 |

| JP Morgan | Maintain | Overweight | 2025-12-18 |

| Argus Research | Downgrade | Hold | 2025-12-11 |

| RBC Capital | Upgrade | Outperform | 2025-12-09 |

| Barclays | Maintain | Equal Weight | 2025-11-04 |

| Citigroup | Maintain | Buy | 2025-11-03 |

Church & Dwight Co., Inc. Grades

Recent institutional grades for Church & Dwight Co., Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Maintain | Buy | 2026-01-28 |

| UBS | Maintain | Neutral | 2026-01-14 |

| TD Cowen | Maintain | Hold | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Raymond James | Upgrade | Outperform | 2026-01-05 |

| Citigroup | Upgrade | Neutral | 2025-12-17 |

| Jefferies | Upgrade | Buy | 2025-12-17 |

| Deutsche Bank | Maintain | Buy | 2025-12-10 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Barclays | Maintain | Underweight | 2025-11-04 |

Which company has the best grades?

Colgate-Palmolive generally holds stronger grades, with multiple Buy and Overweight ratings. Church & Dwight shows more Neutral and Hold grades, though some upgrades to Outperform and Buy appear. Investors may view Colgate-Palmolive as favored by analysts, potentially reflecting higher confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Colgate-Palmolive Company

- Dominates through diversified oral and pet care brands but faces intense FMCG competition.

Church & Dwight Co., Inc.

- Strong niche brands like ARM & HAMMER but limited scale versus larger rivals.

2. Capital Structure & Debt

Colgate-Palmolive Company

- High debt-to-assets ratio at 53%, raising financial risk.

Church & Dwight Co., Inc.

- Low debt-to-assets at 25%, indicating conservative leverage.

3. Stock Volatility

Colgate-Palmolive Company

- Very low beta (0.30) suggests stable stock with low volatility.

Church & Dwight Co., Inc.

- Moderate beta (0.46) indicates higher price swings.

4. Regulatory & Legal

Colgate-Palmolive Company

- Operates globally with exposure to consumer safety regulations and labeling standards.

Church & Dwight Co., Inc.

- Faces regulatory risks in specialty and health product segments, especially OTC and medical claims.

5. Supply Chain & Operations

Colgate-Palmolive Company

- Large global supply network vulnerable to raw material inflation and logistics disruptions.

Church & Dwight Co., Inc.

- Smaller scale but diverse supply chain with potential exposure to specialty ingredient sourcing risks.

6. ESG & Climate Transition

Colgate-Palmolive Company

- Increasing pressure to meet sustainability goals in packaging and carbon footprint.

Church & Dwight Co., Inc.

- Emerging ESG initiatives but less mature sustainability programs compared to peers.

7. Geopolitical Exposure

Colgate-Palmolive Company

- Significant global footprint exposes it to currency fluctuations and trade tensions.

Church & Dwight Co., Inc.

- Primarily US-based, limiting geopolitical risks but less international growth opportunity.

Which company shows a better risk-adjusted profile?

Colgate-Palmolive’s biggest risk is its high leverage, which could strain finances during economic downturns. Church & Dwight faces competitive pressure from smaller scale and higher stock volatility. Colgate’s stable stock and superior Altman Z-score (6.75 vs. 3.93) indicate a safer financial position despite debt concerns. Recent data show Colgate’s debt-to-assets at 53% is a red flag, but its robust operating metrics and dividend yield strengthen its risk-adjusted profile. I conclude Colgate-Palmolive holds a better risk-adjusted stance for 2026 investors.

Final Verdict: Which stock to choose?

Colgate-Palmolive’s superpower lies in its durable competitive advantage, demonstrated by a strong, growing ROIC well above its cost of capital. This cash-generating machine commands premium valuation but carries liquidity risks with a weak current ratio. It suits investors seeking steady, long-term value and income with moderate growth.

Church & Dwight boasts a strategic moat rooted in operational efficiency and a solid balance sheet with lower leverage. Its reliable free cash flow and safer liquidity profile make it a more conservative choice. It fits portfolios aiming for GARP—growth at a reasonable price—with less exposure to valuation extremes.

If you prioritize durable profitability and a proven value creator, Colgate outshines with stronger economic moat and higher returns. However, if you seek better financial stability and a margin of safety at a reasonable price, Church & Dwight offers a compelling defensive growth scenario.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Colgate-Palmolive Company and Church & Dwight Co., Inc. to enhance your investment decisions: