Home > Comparison > Consumer Cyclical > SBUX vs CMG

The strategic rivalry between Starbucks Corporation and Chipotle Mexican Grill defines the current trajectory of the consumer cyclical sector. Starbucks operates as a global specialty coffee roaster and retailer, boasting a vast footprint and diversified product lines. Chipotle, by contrast, runs a fast-casual restaurant model focused on fresh, customizable offerings. This analysis will assess which company delivers the superior risk-adjusted return for a diversified portfolio amid evolving consumer preferences.

Table of contents

Companies Overview

Starbucks and Chipotle both command significant presence in the global restaurant industry, shaping consumer tastes and dining trends.

Starbucks Corporation: Global Specialty Coffee Leader

Starbucks dominates as a specialty coffee roaster, marketer, and retailer with over 33K stores worldwide. Its core revenue comes from beverages, packaged coffees, and food items sold across company-operated and licensed locations. In 2026, Starbucks prioritizes expanding international footprints and innovating premium beverage experiences to reinforce its market leadership.

Chipotle Mexican Grill, Inc.: Fast-Casual Pioneer

Chipotle stands as a fast-casual Mexican grill operator with approximately 3,000 restaurants across North America and Europe. It generates revenue primarily through dine-in and takeout sales focused on customizable Mexican dishes. The company’s 2026 strategy centers on digital sales growth and operational efficiency to capture incremental market share in competitive fast-casual dining.

Strategic Collision: Similarities & Divergences

Both companies emphasize strong consumer engagement but diverge in execution; Starbucks invests in a broad global specialty beverage ecosystem, while Chipotle focuses on a lean menu and fast service. Their battle for customer loyalty unfolds mainly at the intersection of convenience and product quality. This sharp contrast defines their distinct investment profiles—Starbucks offers scale and diversification, Chipotle bets on growth agility and operational discipline.

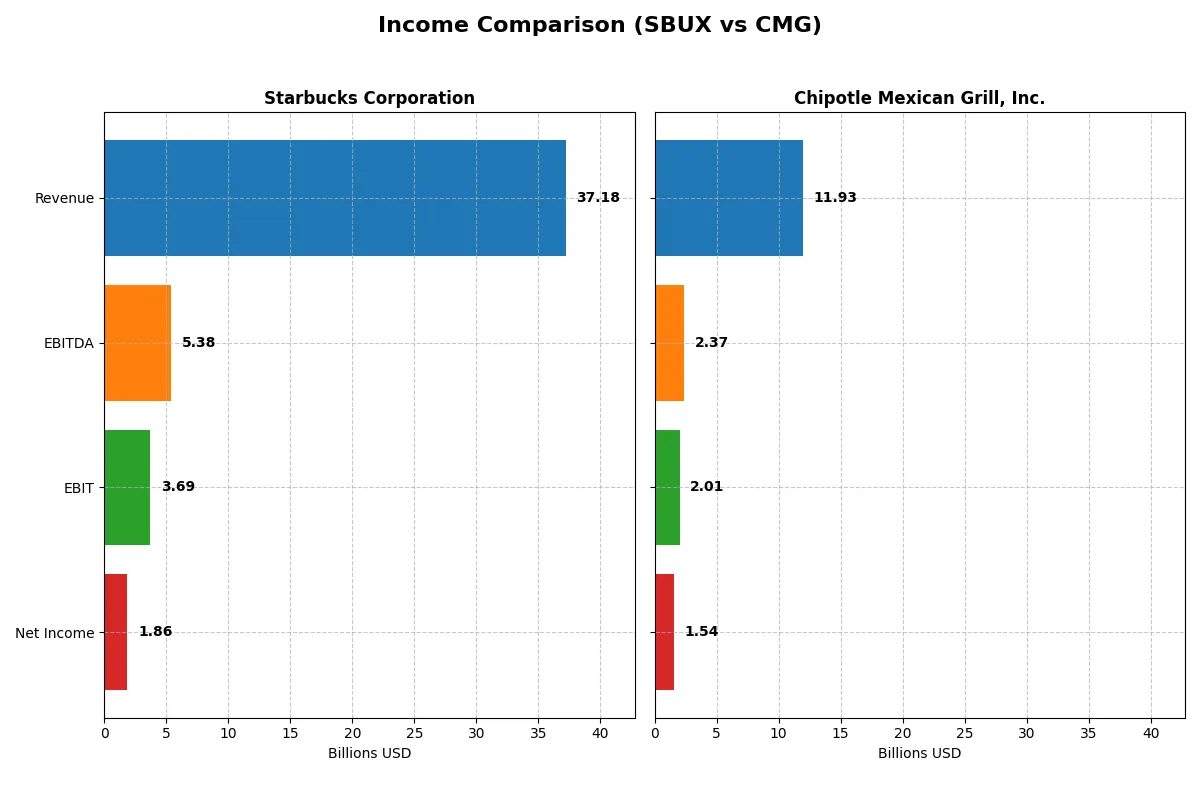

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Starbucks Corporation (SBUX) | Chipotle Mexican Grill, Inc. (CMG) |

|---|---|---|

| Revenue | 37.2B | 11.9B |

| Cost of Revenue | 28.2B | 9.3B |

| Operating Expenses | 5.4B | 656M |

| Gross Profit | 9.0B | 2.7B |

| EBITDA | 5.4B | 2.4B |

| EBIT | 3.7B | 2.0B |

| Interest Expense | 543M | 0 |

| Net Income | 1.9B | 1.5B |

| EPS | 1.63 | 1.15 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs its business more efficiently, spotlighting revenue growth and profitability dynamics.

Starbucks Corporation Analysis

Starbucks grew revenue steadily from 29B in 2021 to 37B in 2025 but saw net income decline sharply from 4.2B to 1.9B. Gross margin weakened slightly to 24.15%, indicating rising costs. The net margin halved to 4.99% in 2025, reflecting margin pressure and lower operational efficiency compared to prior years.

Chipotle Mexican Grill, Inc. Analysis

Chipotle expanded revenue from 7.5B in 2021 to 11.9B in 2025, with net income more than doubling from 653M to 1.54B. Gross margin held firm near 22.35%, while net margin improved to 12.88%, signaling strong cost control and operational momentum. Chipotle’s EPS rose by nearly 148% over five years, underscoring robust earnings growth.

Margin Resilience vs. Growth Execution

Chipotle outperforms Starbucks on key profitability metrics, delivering higher net margins and superior net income growth. Starbucks shows revenue scale but struggles with declining margins and earnings. For investors, Chipotle’s profile offers a more attractive blend of margin resilience and accelerating profit expansion.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Starbucks (SBUX) | Chipotle (CMG) |

|---|---|---|

| ROE | -22.9% (2025) | 54.3% (2025) |

| ROIC | 8.5% (2025) | 18.9% (2025) |

| P/E | 52.6 (2025) | 32.2 (2025) |

| P/B | -12.1 (2025) | 17.5 (2025) |

| Current Ratio | 0.72 (2025) | 1.23 (2025) |

| Quick Ratio | 0.51 (2025) | 1.19 (2025) |

| D/E | -3.29 (2025) | 3.48 (2025) |

| Debt-to-Assets | 83.1% (2025) | 109.5% (2025) |

| Interest Coverage | 6.6x (2025) | 0x (2025) |

| Asset Turnover | 1.16 (2025) | 1.33 (2025) |

| Fixed Asset Turnover | 2.09 (2025) | 1.67 (2025) |

| Payout ratio | 149.3% (2025) | 0% (2025) |

| Dividend yield | 2.84% (2025) | 0% (2025) |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence behind headline performance.

Starbucks Corporation

Starbucks shows weak profitability with a negative ROE of -23% and a low net margin of 5%, signaling operational challenges. Its valuation is stretched, trading at a P/E of 52.6 and a P/B of -12.1, reflecting mixed investor sentiment. The company rewards shareholders with a 2.84% dividend yield, suggesting stable cash returns despite reinvestment limits.

Chipotle Mexican Grill, Inc.

Chipotle delivers robust profitability with a 54.3% ROE and a 12.9% net margin, showcasing operational efficiency. The stock is expensive with a P/E of 32.2 and a high P/B of 17.5, indicating growth expectations priced in. It pays no dividend, instead focusing on growth and reinvestment to fuel future expansion.

Premium Valuation vs. Operational Safety

Chipotle offers superior profitability and a clearer growth trajectory but at a premium valuation. Starbucks presents a more moderate risk profile with dividends, despite operational headwinds. Growth-oriented investors may prefer Chipotle’s growth-centric profile, while income-focused investors might lean toward Starbucks’ yield and steadiness.

Which one offers the Superior Shareholder Reward?

I compare Starbucks (SBUX) and Chipotle (CMG) on dividends, buybacks, and sustainability. Starbucks pays a 2.8% yield with a high 149% payout ratio, risking dividend sustainability. Chipotle pays no dividends but reinvests heavily in growth, supported by robust free cash flow. Both run share buybacks, but Starbucks’ buyback intensity is moderate versus Chipotle’s aggressive reinvestment. Starbucks offers immediate income but with payout risks; Chipotle prioritizes growth and capital allocation efficiency. I judge Chipotle’s model more sustainable and superior for total return in 2026.

Comparative Score Analysis: The Strategic Profile

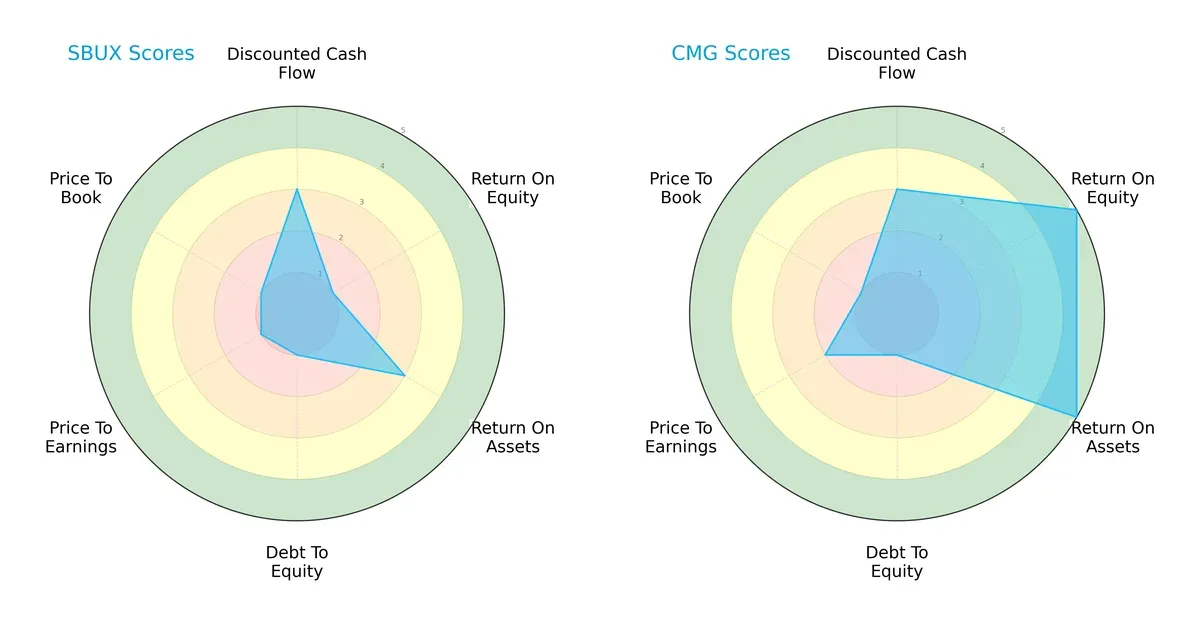

The radar chart reveals the fundamental DNA and strategic trade-offs shaping Starbucks and Chipotle’s financial profiles:

Chipotle commands superior efficiency, boasting very favorable ROE (5) and ROA (5) scores, reflecting optimal asset and equity utilization. Starbucks lags with unfavorable ROE (1) and moderate ROA (3), signaling weaker profitability. Both share a very unfavorable debt-to-equity score (1), indicating high leverage risk. Valuation metrics (PE/PB) are uniformly weak, but Chipotle’s overall score (3) edges out Starbucks (2), showing a more balanced financial position versus Starbucks’ reliance on moderate DCF (3) alone.

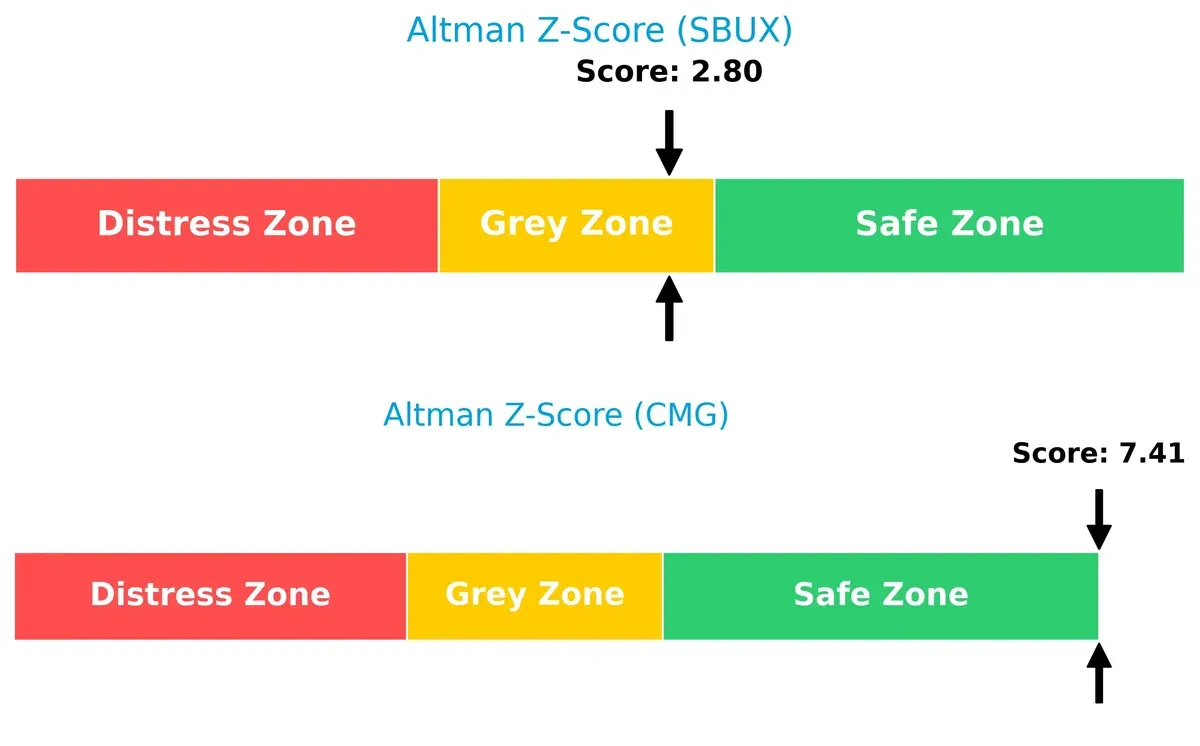

Bankruptcy Risk: Solvency Showdown

Chipotle’s Altman Z-Score (7.41) far exceeds Starbucks’ (2.80), placing Chipotle in the safe zone and Starbucks in the grey zone, signaling a moderate bankruptcy risk for Starbucks amid current market cycles:

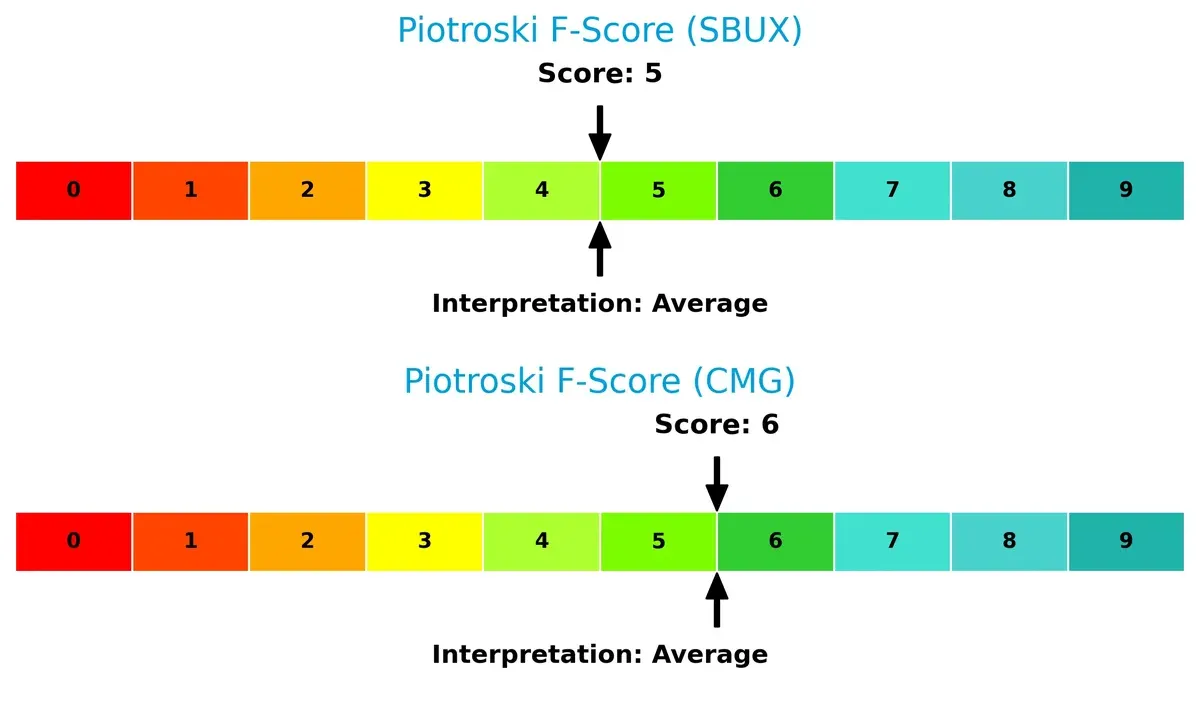

Financial Health: Quality of Operations

Chipotle’s Piotroski F-Score of 6 slightly outperforms Starbucks’ 5, both indicating average financial health. Neither firm raises immediate red flags, but Chipotle shows marginally stronger operational robustness:

How are the two companies positioned?

This section dissects Starbucks and Chipotle’s operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats and identify the more resilient competitive advantage today.

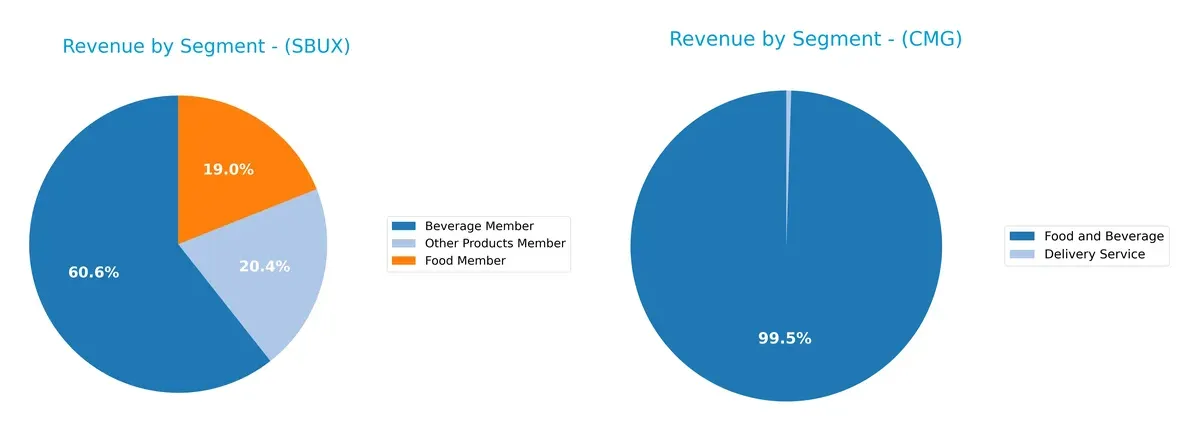

Revenue Segmentation: The Strategic Mix

This comparison dissects how Starbucks and Chipotle diversify their income streams and highlights their primary sector bets for 2025:

Starbucks anchors 2025 revenue with $22.5B from Beverage, complemented by $7.0B Food and $7.6B Other Products, showing a balanced portfolio. Chipotle, by contrast, pivots almost entirely on Food and Beverage at $11.9B, with a minimal $60M from Delivery Service. Starbucks’ mix reduces concentration risk and leverages ecosystem lock-in, while Chipotle’s reliance on one core segment signals potential vulnerability but also focus on operational excellence.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Starbucks Corporation and Chipotle Mexican Grill, Inc.:

Starbucks Corporation Strengths

- Strong global presence with significant US and international revenues

- Diverse product segments: beverages, food, and other products

- Favorable asset turnover and interest coverage ratios

- Dividend yield provides income to shareholders

Chipotle Mexican Grill, Inc. Strengths

- Higher profitability with strong net margin, ROE, and ROIC

- Favorable WACC and quick ratio indicate financial health

- Strong asset turnover and infinite interest coverage

- Focused US market presence with growing food and delivery segments

Starbucks Corporation Weaknesses

- Negative ROE and unfavorable net margin signal profitability challenges

- Low current and quick ratios raise liquidity concerns

- High debt-to-assets ratio (83.11%) implies financial risk

- High P/E ratio could indicate overvaluation

Chipotle Mexican Grill, Inc. Weaknesses

- Unfavorable P/E and price-to-book ratios suggest valuation concerns

- Higher debt-to-assets ratio (109.5%) signals leverage risk

- No dividend yield reduces income appeal

- Limited geographic diversification focused mainly on US

Despite Starbucks’ extensive product diversification and global footprint, its profitability and liquidity weaknesses pose risks. Chipotle excels in profitability and financial efficiency but faces valuation and leverage challenges along with less geographic diversification. These factors directly influence each company’s strategic focus on growth and risk management.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from relentless competition and market pressures. Here’s how Starbucks and Chipotle defend their turf:

Starbucks Corporation: Brand Power and Global Footprint

Starbucks relies on intangible assets and brand loyalty, sustaining premium pricing and stable margins despite recent profit declines. Expansion in China tests its moat’s resilience in 2026.

Chipotle Mexican Grill, Inc.: Operational Excellence and Growth Momentum

Chipotle’s cost advantage and efficient capital use drive superior ROIC and margin expansion. Unlike Starbucks, Chipotle’s growing profitability signals a widening moat, with U.S. market penetration fueling future gains.

Moat Battle: Brand Prestige vs. Operational Efficiency

Chipotle’s moat runs deeper, evidenced by ROIC well above WACC and a positive trend, unlike Starbucks’ declining returns. Chipotle is better positioned to defend and grow its market share amid evolving consumer tastes.

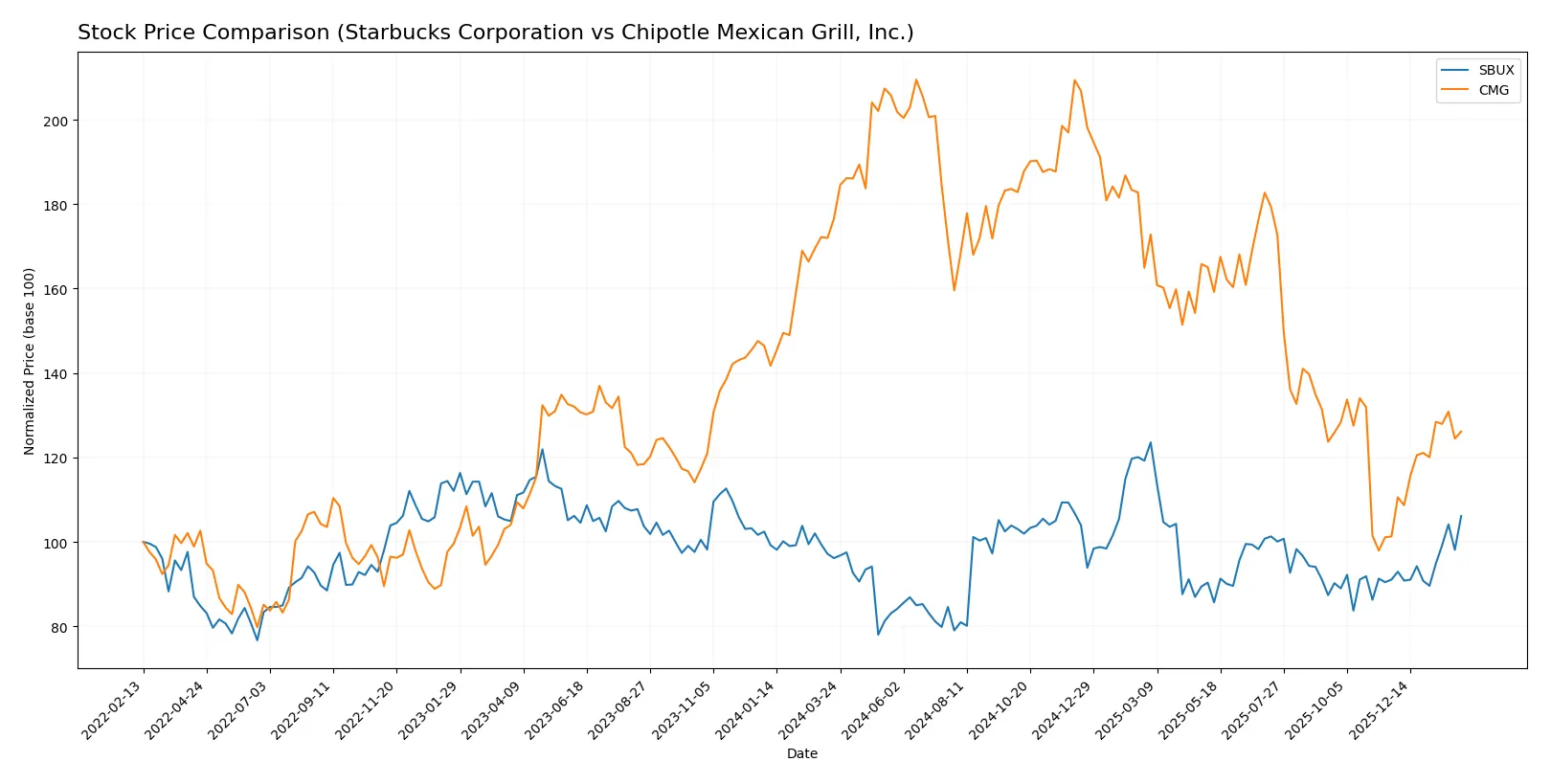

Which stock offers better returns?

The past year showed contrasting price trajectories for Starbucks and Chipotle, with Starbucks gaining steadily while Chipotle experienced a significant overall decline despite recent gains.

Trend Comparison

Starbucks stock rose 10.35% over the past 12 months, marking a bullish trend with accelerating gains and a high of 115.81. Volatility was moderate, with an 8.91% standard deviation.

Chipotle’s stock fell 28.55% over the same period, indicating a bearish trend despite recent acceleration and a 24.53% gain since November 2025. Volatility was slightly higher at 9.32%.

Starbucks delivered the highest market performance with a sustained bullish trend, contrasting sharply with Chipotle’s overall decline despite short-term recovery.

Target Prices

Analysts present a moderate target consensus for Starbucks and Chipotle, reflecting cautious optimism amid sector volatility.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Starbucks Corporation | 90 | 165 | 107.47 |

| Chipotle Mexican Grill, Inc. | 35 | 52 | 44.35 |

Starbucks’s consensus target sits slightly above its current price of 99.45, suggesting modest upside potential. Chipotle’s target consensus at 44.35 exceeds its 39.39 share price, indicating room for growth but tempered by a wide target range.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent grades assigned by major financial institutions for both companies:

Starbucks Corporation Grades

This table presents the latest grades from reputable grading companies for Starbucks Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-02-02 |

| Barclays | Maintain | Overweight | 2026-01-30 |

| Piper Sandler | Maintain | Overweight | 2026-01-30 |

| TD Cowen | Maintain | Hold | 2026-01-30 |

| BTIG | Maintain | Buy | 2026-01-30 |

| BTIG | Maintain | Buy | 2026-01-29 |

| Wells Fargo | Maintain | Overweight | 2026-01-29 |

| RBC Capital | Maintain | Outperform | 2026-01-29 |

| Wells Fargo | Maintain | Overweight | 2026-01-27 |

| Mizuho | Maintain | Neutral | 2026-01-26 |

Chipotle Mexican Grill, Inc. Grades

This table shows the latest grades from recognized grading companies for Chipotle Mexican Grill, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Maintain | Hold | 2026-02-05 |

| TD Cowen | Maintain | Buy | 2026-02-04 |

| Morgan Stanley | Maintain | Overweight | 2026-02-04 |

| Keybanc | Maintain | Overweight | 2026-02-04 |

| Piper Sandler | Maintain | Overweight | 2026-02-04 |

| Mizuho | Maintain | Neutral | 2026-02-04 |

| BTIG | Maintain | Buy | 2026-02-04 |

| Citigroup | Maintain | Buy | 2026-02-04 |

| Stifel | Maintain | Buy | 2026-02-04 |

| Barclays | Maintain | Equal Weight | 2026-02-04 |

Which company has the best grades?

Chipotle Mexican Grill has more consistent buy and overweight ratings from leading firms compared to Starbucks. This may suggest stronger institutional confidence, potentially influencing investor sentiment more favorably.

Risks specific to each company

The following categories pinpoint critical pressure points and systemic threats facing Starbucks Corporation and Chipotle Mexican Grill, Inc. in the challenging 2026 market environment:

1. Market & Competition

Starbucks Corporation

- Faces intense global competition with over 33,800 stores; brand differentiation is crucial.

Chipotle Mexican Grill, Inc.

- Operates ~3,000 restaurants with strong U.S. presence but faces fast-casual rivals expanding aggressively.

2. Capital Structure & Debt

Starbucks Corporation

- High debt-to-assets ratio at 83.1% signals financial leverage risk despite favorable interest coverage.

Chipotle Mexican Grill, Inc.

- Debt-to-assets ratio exceeds 100%, indicating heavy leverage and potential solvency concerns.

3. Stock Volatility

Starbucks Corporation

- Beta of 0.94 suggests slightly less volatility than the market; provides moderate risk exposure.

Chipotle Mexican Grill, Inc.

- Beta near 1.0 indicates volatility closely tracking the market, implying standard risk sensitivity.

4. Regulatory & Legal

Starbucks Corporation

- Global footprint exposes it to diverse regulatory regimes and compliance costs.

Chipotle Mexican Grill, Inc.

- Expansion in Europe adds complexity; food safety and labor laws remain critical risks.

5. Supply Chain & Operations

Starbucks Corporation

- Complex supply chain with coffee sourcing vulnerabilities amid climate change.

Chipotle Mexican Grill, Inc.

- Relies heavily on fresh ingredients; supply disruptions can significantly impact operations.

6. ESG & Climate Transition

Starbucks Corporation

- ESG initiatives are advanced, but climate risks to coffee crops pose strategic challenges.

Chipotle Mexican Grill, Inc.

- ESG efforts growing; sustainability in agriculture is vital but still developing.

7. Geopolitical Exposure

Starbucks Corporation

- Significant international presence exposes it to geopolitical instability and currency risks.

Chipotle Mexican Grill, Inc.

- Mostly U.S.-centric but expanding in Europe, which entails emerging geopolitical risks.

Which company shows a better risk-adjusted profile?

Starbucks’ most impactful risk is its high financial leverage contrasted by solid operational scale. Chipotle’s critical risk lies in its excessive debt load and tighter margins despite better profitability metrics. I see Chipotle offering a slightly better risk-adjusted profile, thanks to superior profitability and a safer Altman Z-Score of 7.4 versus Starbucks’ 2.8. However, Chipotle’s debt-to-assets ratio above 100% is a red flag warranting caution.

Final Verdict: Which stock to choose?

Starbucks Corporation’s superpower lies in its global brand recognition and efficient asset turnover. Despite recent margin pressures and liquidity concerns, it maintains solid operating returns. This stock suits investors seeking steady exposure to a mature consumer staple with moderate growth expectations but requires vigilance on its declining profitability.

Chipotle Mexican Grill, Inc. boasts a robust strategic moat through strong return on invested capital well above its cost of capital. It delivers superior profitability and a healthier liquidity profile relative to Starbucks. This stock fits well in a growth-at-a-reasonable-price portfolio that values operational excellence and expanding economic profit.

If you prioritize stable brand equity and global scale, Starbucks offers a compelling choice due to its operational efficiency and dividend yield. However, if you seek accelerating profitability and a proven value creator with expanding ROIC, Chipotle outshines as the better option despite its higher valuation and recent price volatility. Both present distinct risk-reward profiles aligned with different investor strategies.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Starbucks Corporation and Chipotle Mexican Grill, Inc. to enhance your investment decisions: