In the evolving healthcare sector, Quest Diagnostics Incorporated (DGX) and Charles River Laboratories International, Inc. (CRL) stand out as key players within the medical diagnostics and research industry. Both companies leverage innovation to serve critical roles in diagnostic testing and drug development, addressing overlapping markets with distinct strategies. This article will explore their strengths and risks to help you decide which company offers the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Quest Diagnostics and Charles River Laboratories by providing an overview of these two companies and their main differences.

Quest Diagnostics Overview

Quest Diagnostics Incorporated focuses on providing diagnostic testing, information, and services both in the U.S. and globally. The company offers a broad range of diagnostic services including routine and advanced clinical testing, anatomic pathology, and risk assessment solutions. It serves patients, clinicians, hospitals, and healthcare organizations through multiple brands and a wide network of laboratories, patient service centers, and healthcare professionals, employing around 55K people.

Charles River Laboratories Overview

Charles River Laboratories International, Inc. operates as a non-clinical contract research organization specializing in drug discovery, non-clinical development, and safety testing services worldwide. Its operations span research models and services, discovery and safety assessment, and manufacturing solutions, supporting pharmaceutical and biotechnology clients. The company employs roughly 18.7K workers and is known for its extensive range of preclinical research and testing offerings that facilitate drug development processes.

Key similarities and differences

Both companies operate in the healthcare sector with a focus on medical diagnostics and research but differ in their core focus areas. Quest Diagnostics centers on diagnostic testing services for patients and healthcare providers, while Charles River Laboratories is primarily involved in preclinical research and safety testing for drug discovery. Quest Diagnostics has a larger workforce and market capitalization ($19.5B vs. $10.9B), whereas Charles River exhibits higher volatility with a beta of 1.62 compared to Quest’s 0.64.

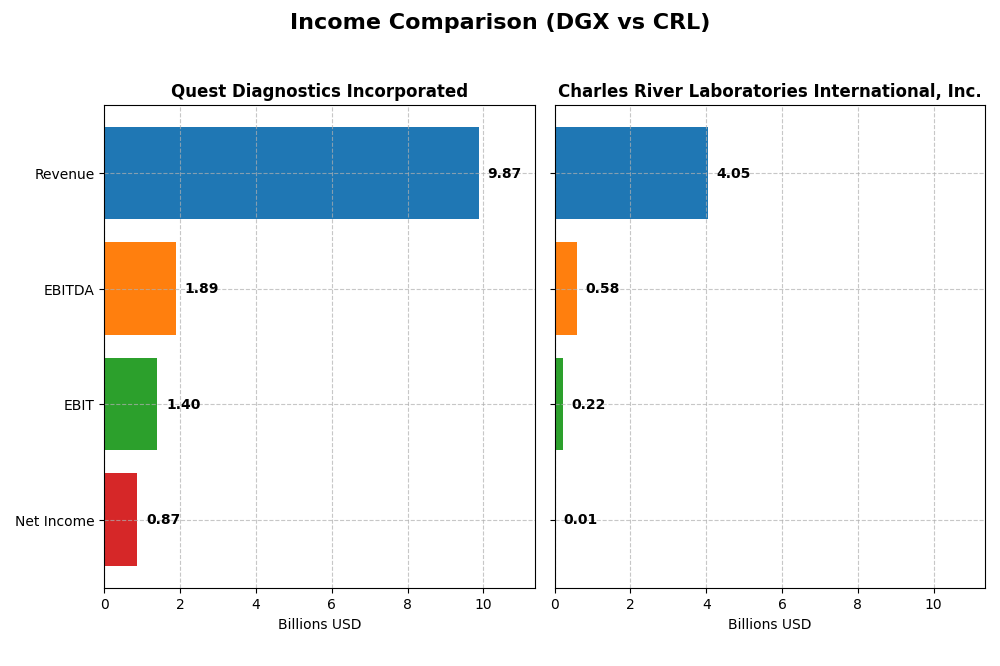

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Quest Diagnostics Incorporated (DGX) and Charles River Laboratories International, Inc. (CRL) for the fiscal year 2024.

| Metric | Quest Diagnostics Incorporated (DGX) | Charles River Laboratories International, Inc. (CRL) |

|---|---|---|

| Market Cap | 19.5B | 10.9B |

| Revenue | 9.87B | 4.05B |

| EBITDA | 1.89B | 581M |

| EBIT | 1.40B | 219M |

| Net Income | 871M | 10.3M |

| EPS | 7.8 | 0.20 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Quest Diagnostics Incorporated

Quest Diagnostics’ revenue showed moderate growth with a 6.7% increase in 2024, while net income declined by 4.41% that year. Despite this, its gross margin remained stable at 32.86%, and EBIT margin was favorable at 14.19%. The 2024 results highlight solid operational efficiency, with EBIT rising 8.35% and net margin slightly contracting over the period.

Charles River Laboratories International, Inc.

Charles River Laboratories experienced a slight revenue decline of 1.92% in 2024, with net income plunging by 97.79%. Its gross margin was steady at 32.88%, but EBIT margin weakened to 5.42%, reflecting operational challenges. The recent year showed significant deterioration in profitability metrics, with sharp drops in EBIT and net margin, indicating margin pressures.

Which one has the stronger fundamentals?

Quest Diagnostics exhibits stronger fundamentals, supported by stable and favorable margin profiles alongside moderate revenue growth and improved EBIT. In contrast, Charles River Laboratories faces significant earnings declines and margin erosion despite revenue growth over the long term. The overall income statement evaluation favors Quest Diagnostics due to its more consistent profitability and operational performance.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Quest Diagnostics Incorporated (DGX) and Charles River Laboratories International, Inc. (CRL) based on their most recent fiscal year 2024 data.

| Ratios | Quest Diagnostics Incorporated (DGX) | Charles River Laboratories International, Inc. (CRL) |

|---|---|---|

| ROE | 12.85% | 0.30% |

| ROIC | 6.96% | 0.95% |

| P/E | 19.23 | 921.12 |

| P/B | 2.47 | 2.74 |

| Current Ratio | 1.10 | 1.41 |

| Quick Ratio | 1.02 | 1.13 |

| D/E (Debt-to-Equity) | 1.05 | 0.79 |

| Debt-to-Assets | 43.87% | 36.18% |

| Interest Coverage | 5.96 | 1.80 |

| Asset Turnover | 0.61 | 0.54 |

| Fixed Asset Turnover | 3.57 | 2.01 |

| Payout ratio | 38.00% | 0% |

| Dividend yield | 1.98% | 0% |

Interpretation of the Ratios

Quest Diagnostics Incorporated

Quest Diagnostics shows mostly neutral to slightly favorable ratios, with a return on equity of 12.85% and a weighted average cost of capital (WACC) favorably low at 5.71%. The debt-to-equity ratio is unfavorable at 1.05, indicating higher leverage risk. The dividend yield is 1.98%, supported by a steady payout but requiring monitoring for sustainability given moderate free cash flow coverage.

Charles River Laboratories International, Inc.

Charles River Laboratories exhibits several unfavorable ratios, including a very low net margin of 0.25% and return on equity at 0.3%, reflecting weak profitability. Its price-to-earnings ratio is extremely high at 921.12, signaling potential overvaluation. The company does not pay dividends, likely due to reinvestment priorities and ongoing growth efforts, with a neutral debt-to-equity ratio of 0.79.

Which one has the best ratios?

Comparing both, Quest Diagnostics has a more balanced financial profile with more favorable and neutral ratios, while Charles River Laboratories faces significant profitability and valuation challenges. Quest Diagnostics’ dividend payments and stronger coverage metrics also contrast with Charles River’s absence of shareholder distributions and weaker returns.

Strategic Positioning

This section compares the strategic positioning of Quest Diagnostics (DGX) and Charles River Laboratories (CRL), including market position, key segments, and exposure to technological disruption:

Quest Diagnostics (DGX)

- Leading diagnostics provider with significant market cap and moderate competitive pressure.

- Focused on diagnostic information services, including routine, advanced clinical, and pathology testing.

- Exposure to disruption moderate; reliant on IT solutions but limited data on innovation impact.

Charles River Laboratories (CRL)

- Mid-sized contract research organization facing higher competitive volatility.

- Diversified across research models, discovery and safety assessment, and manufacturing support.

- Faces technological disruption risk in drug discovery and biologics testing sectors.

Quest Diagnostics vs Charles River Laboratories Positioning

Quest Diagnostics pursues a concentrated strategy centered on diagnostic services, benefiting from scale but potentially vulnerable to innovation shifts. Charles River adopts a more diversified approach across non-clinical research and manufacturing, spreading risk but facing complex operational demands.

Which has the best competitive advantage?

Both companies are shedding value with declining ROIC trends. Quest Diagnostics shows a slightly unfavorable moat, while Charles River’s moat is very unfavorable, indicating Quest Diagnostics currently maintains a comparatively stronger competitive advantage.

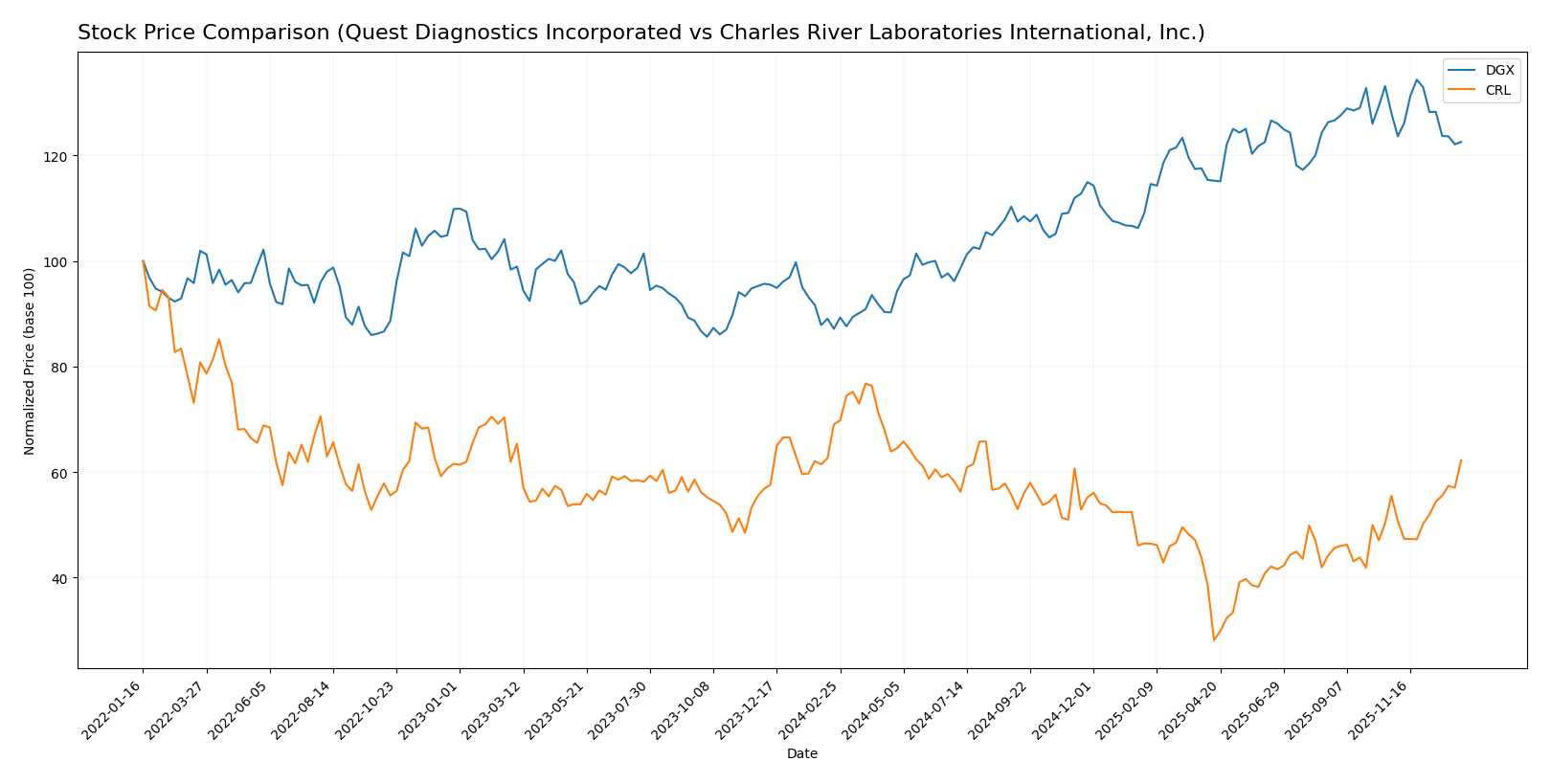

Stock Comparison

The stock price movements over the past year reveal contrasting dynamics, with Quest Diagnostics showing a strong overall gain despite recent weakness, while Charles River Laboratories faces a longer-term decline tempered by recent recovery.

Trend Analysis

Quest Diagnostics Incorporated (DGX) experienced a bullish trend over the past 12 months with a 40.68% price increase, though the pace of gains has decelerated. The stock reached a high of 191.25 and a low of 124.0, with notable volatility (std. dev. 18.03). Recent weeks show a slight bearish correction of -4.25%.

Charles River Laboratories International, Inc. (CRL) showed a bearish trend over the same period, declining 9.82% overall despite accelerating losses. The stock was more volatile (std. dev. 36.13) with prices ranging from 99.75 to 272.57. Recently, it gained 12.11%, indicating a short-term bullish reversal.

Comparing the two, Quest Diagnostics has delivered the highest market performance over the past year with a significant positive return, while Charles River Laboratories remains in a longer-term downtrend despite recent gains.

Target Prices

Analysts present a generally optimistic target consensus for both Quest Diagnostics Incorporated and Charles River Laboratories International, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Quest Diagnostics Incorporated | 215 | 190 | 201.6 |

| Charles River Laboratories International, Inc. | 224 | 185 | 204.86 |

The target prices suggest potential upside for Quest Diagnostics, with consensus (~201.6) well above the current price of 174.44. Similarly, Charles River’s consensus target (~204.86) is slightly below its current price of 220.91, indicating mixed expectations from analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Quest Diagnostics Incorporated and Charles River Laboratories International, Inc.:

Rating Comparison

DGX Rating

- Rated B, indicating a very favorable overall rating.

- Discounted Cash Flow Score is 4, reflecting favorable valuation prospects.

- Return on Equity Score is 4, showing strong profit generation from equity.

- Return on Assets Score is 4, demonstrating efficient asset utilization.

- Debt To Equity Score is 1, considered very unfavorable financial risk.

- Overall Score is 3, categorized as moderate financial standing.

CRL Rating

- Rated C, also marked as very favorable overall rating.

- Discounted Cash Flow Score is 4, indicating favorable valuation prospects.

- Return on Equity Score is 1, very unfavorable efficiency in generating profit.

- Return on Assets Score is 1, showing very unfavorable asset utilization.

- Debt To Equity Score is 1, also very unfavorable financial risk.

- Overall Score is 2, representing moderate financial standing.

Which one is the best rated?

Based strictly on the provided data, DGX is better rated overall with a B rating and higher scores in ROE, ROA, and overall financial standing compared to CRL’s C rating and lower scores in these areas.

Scores Comparison

Here is a comparison of the financial scores for Quest Diagnostics Incorporated (DGX) and Charles River Laboratories International, Inc. (CRL):

DGX Scores

- Altman Z-Score: 3.20, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, showing strong financial health and investment potential.

CRL Scores

- Altman Z-Score: 2.27, indicating a grey zone with moderate bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength and investment quality.

Which company has the best scores?

Based on the provided data, DGX has better scores than CRL. DGX is in the safe zone for bankruptcy risk and has a stronger Piotroski Score, while CRL remains in the grey zone with average financial strength.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Quest Diagnostics Incorporated and Charles River Laboratories International, Inc.:

Quest Diagnostics Incorporated Grades

This table presents recent grades from established grading companies for Quest Diagnostics Incorporated.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2025-10-27 |

| Truist Securities | Maintain | Hold | 2025-10-22 |

| Barclays | Maintain | Equal Weight | 2025-10-22 |

| Leerink Partners | Maintain | Outperform | 2025-10-21 |

| Jefferies | Maintain | Buy | 2025-10-21 |

| Mizuho | Maintain | Outperform | 2025-10-17 |

| UBS | Maintain | Neutral | 2025-10-17 |

| Evercore ISI Group | Maintain | In Line | 2025-10-08 |

| Barclays | Maintain | Equal Weight | 2025-10-02 |

| Baird | Downgrade | Neutral | 2025-08-25 |

Overall, Quest Diagnostics shows a mixed pattern with many hold/neutral ratings but also notable outperform and buy opinions, indicating a cautious yet somewhat positive consensus.

Charles River Laboratories International, Inc. Grades

Below are recent grades from recognized grading companies for Charles River Laboratories International, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Neutral | 2025-12-18 |

| JP Morgan | Maintain | Neutral | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-12-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-11 |

| TD Cowen | Maintain | Buy | 2025-11-10 |

| Baird | Upgrade | Outperform | 2025-11-06 |

| Barclays | Maintain | Overweight | 2025-11-06 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Mizuho | Maintain | Neutral | 2025-10-17 |

| William Blair | Upgrade | Outperform | 2025-10-06 |

Charles River Laboratories exhibits predominantly positive upgrades and overweight ratings, reflecting a generally favorable outlook from analysts.

Which company has the best grades?

Charles River Laboratories holds the stronger consensus with more buy and outperform ratings compared to Quest Diagnostics’ more neutral and hold-oriented grades. This difference may influence investors seeking growth potential or stability depending on their risk tolerance.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of Quest Diagnostics Incorporated (DGX) and Charles River Laboratories International, Inc. (CRL) based on their latest financial and operational metrics.

| Criterion | Quest Diagnostics Incorporated (DGX) | Charles River Laboratories International, Inc. (CRL) |

|---|---|---|

| Diversification | Moderate: Primarily Diagnostic Information Services (≈9.6B USD in 2024) with limited other segments | Moderate: Balanced revenue from Discovery and Safety Assessment (≈2.45B USD), Manufacturing Support, and Research Models |

| Profitability | Neutral: ROIC 6.96% slightly above WACC 5.71%, net margin 8.82%, stable but declining ROIC trend (-42%) | Unfavorable: ROIC 0.95% below WACC 9.78%, net margin 0.25%, ROIC sharply declining (-87%) |

| Innovation | Slightly Favorable: Strong fixed asset turnover (3.57), ongoing diagnostic service expansion | Neutral: Moderate asset turnover (0.54), innovation relies on research service growth |

| Global presence | Strong U.S. focus with some international reach through diagnostic services | Broad global footprint with diversified service offerings across multiple segments |

| Market Share | Leading position in diagnostic testing in the U.S. | Significant player in preclinical and safety assessment services globally |

Key takeaways: Quest Diagnostics shows stable profitability and strong U.S. market positioning but faces challenges with declining ROIC and limited diversification. Charles River Laboratories struggles with profitability and value creation despite a diversified and global service portfolio, signaling higher investment risk.

Risk Analysis

Below is a comparative overview of key risks for Quest Diagnostics Incorporated (DGX) and Charles River Laboratories International, Inc. (CRL) based on the most recent data from 2024.

| Metric | Quest Diagnostics (DGX) | Charles River Laboratories (CRL) |

|---|---|---|

| Market Risk | Low beta 0.64, indicating lower volatility | High beta 1.62, implying higher volatility |

| Debt level | Debt-to-equity 1.05 (unfavorable), debt-to-assets 43.87% (neutral) | Debt-to-equity 0.79 (neutral), debt-to-assets 36.18% (neutral) |

| Regulatory Risk | Moderate due to healthcare industry compliance | Moderate, with international operations subject to diverse regulations |

| Operational Risk | Medium, supported by a large network but complex logistics | Medium, reliance on specialized services and global supply chain |

| Environmental Risk | Low to moderate, standard healthcare sector exposure | Low to moderate, some exposure from manufacturing and testing services |

| Geopolitical Risk | Low, primarily US based | Moderate, with significant international presence |

In synthesis, Charles River Laboratories faces higher market risk and moderate geopolitical exposure due to its international footprint, whereas Quest Diagnostics shows slightly higher financial leverage risk. Market volatility and debt management are the most impactful risks to monitor for both companies, especially considering CRL’s higher beta and DGX’s elevated debt-to-equity ratio. Both companies operate in regulated healthcare sectors, so regulatory compliance remains a consistent risk factor.

Which Stock to Choose?

Quest Diagnostics Incorporated (DGX) shows a generally favorable income statement with stable gross and EBIT margins, though net margin has slightly decreased. Financial ratios are slightly favorable, with strong coverage but some debt concerns. The rating is very favorable with a moderate overall score. Its economic moat is slightly unfavorable, reflecting declining profitability and value shedding.

Charles River Laboratories International, Inc. (CRL) exhibits an unfavorable income statement trend, with declining margins and net income despite revenue growth. Financial ratios lean slightly unfavorable due to low returns and weak coverage. The rating remains very favorable but with lower scores overall. The company’s moat is very unfavorable, signaling significant value destruction and declining profitability.

For investors prioritizing financial stability and consistent profitability, DGX might appear more favorable given its stronger income metrics and financial ratios despite some debt challenges. Conversely, growth-oriented or risk-tolerant investors might see potential in CRL’s recent price rebound and revenue increase, though its financial health and value creation remain challenged. The choice could depend on an investor’s risk profile and focus on income quality versus potential turnaround.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Quest Diagnostics Incorporated and Charles River Laboratories International, Inc. to enhance your investment decisions: